Since the war in Ukraine broke out in February 2022, anyone holding ADRs or GDRs of Russian companies will have had to deal with a complex set of problems.

In the meantime, their securities were valued at zero – even though they were clearly worth more.

Will a possible peace deal for Ukraine include a solution for frozen Russian securities?

Is the potential return of Western investors one of the reasons why Russian stocks have been performing so strong lately?

Complex knock-on effects

The freezing of Russian securities held by Western investors was one of the tragic side effects of the war in Ukraine.

Because of their high dividends, Russian stocks had been widely held by private investors who relied on income from their investments. In Germany alone, an estimated 70,000 private investors are affected, including many elderly investors in particular

Some Western pension funds also had chunks of their portfolios in Russian securities. After all, the Russian market was part of emerging market indices, and many Russian securities offered double-digit dividend yields. Some of these funds will have subsequently sold for pennies on the dollar, often because of the political pressure or for the sake of virtue signalling.

The damage done is much broader than the losses in individual portfolios. ADRs and GDRs had been established for decades as a tool for easily investing internationally. The market's trust in this system was broken, and it may take a decade or two to recover.

As ever in a crisis, there have also been winners.

As far back as March 2022, Bloomberg reported that "Goldman Sachs Group Inc. and JPMorgan Chase & Co. have been purchasing beaten-down company bonds tied to Russia in recent days, as hedge funds that specialize in buying cheap credit look to load up on the assets, according to people with knowledge of the private transactions."

Goldman Sachs jumping in head first when there is an asset available at fire-sale prices – who would have thought?

Source: Bloomberg, 4 March 2022.

Some private investors, too, took advantage of the market distortions created by Russia sanctions. Bloomberg reported in 2024 how private investors had used so-called Russian "S accounts" (= accounts available to foreigners who can even open them remotely) and "forced conversions" of ADRs (= conversions where the consent of the Western brokerage firm was not required) to turn themselves into millionaires. In essence, they bought cheap Russian ADRs held in Western brokerage accounts and turned them into stock holdings in Russian S accounts. This brought along the complication of getting the money out of Russia, but there were always backdoor routes to achieve that. Getting roubles out of Russia could usually be achieved by going via countries like Kazakhstan or China. Russia is, after all, the country where roundabout solutions to circumvent restrictions have been the normal modus operandus for longer than anyone can remember.

Source: Bloomberg, 4 October 2024.

Yet other opportunities arose out of the corporate restructurings that were forced by the Russia sanctions.

E.g., Russian's Google equivalent, Yandex, was legally domiciled in the Netherlands and listed on Nasdaq. The company eventually sold its Russian assets for USD 5bn and decided to use the cash to embark on a new future in AI. Now re-named Nebius Group (ISIN NL0009805522, Nasdaq:NBIS), the stock reopened for trading in October 2024. Analysts at Crossroads Capital published a seminal research piece on the newly constituted company, and the share price doubled within eight weeks.

Nebius Group.

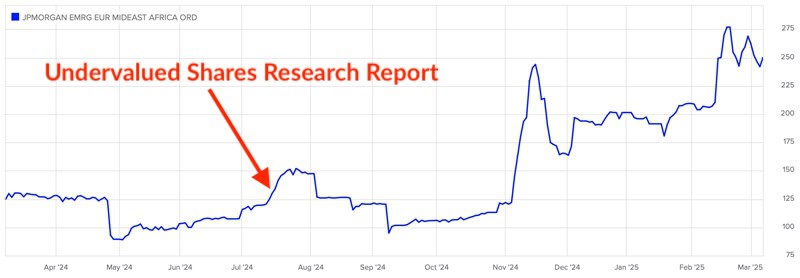

Undervalued-Shares.com Lifetime Members, too, were able to capitalise on these distortions, as they were pointed to the Central and Eastern Europe Fund (ISIN US1534361001, NYSE:CEE) and JPMorgan Emerging Europe, Middle East & Africa Securities (ISIN GB0032164732, UK:JEMA). Both own a basket of Russian securities and continued to trade in New York and London, respectively. Both traded at a huge discount. The shares are up 23% and 86%, respectively, since the publishing of the initial research reports.

JPMorgan Emerging Europe, Middle East & Africa Securities.

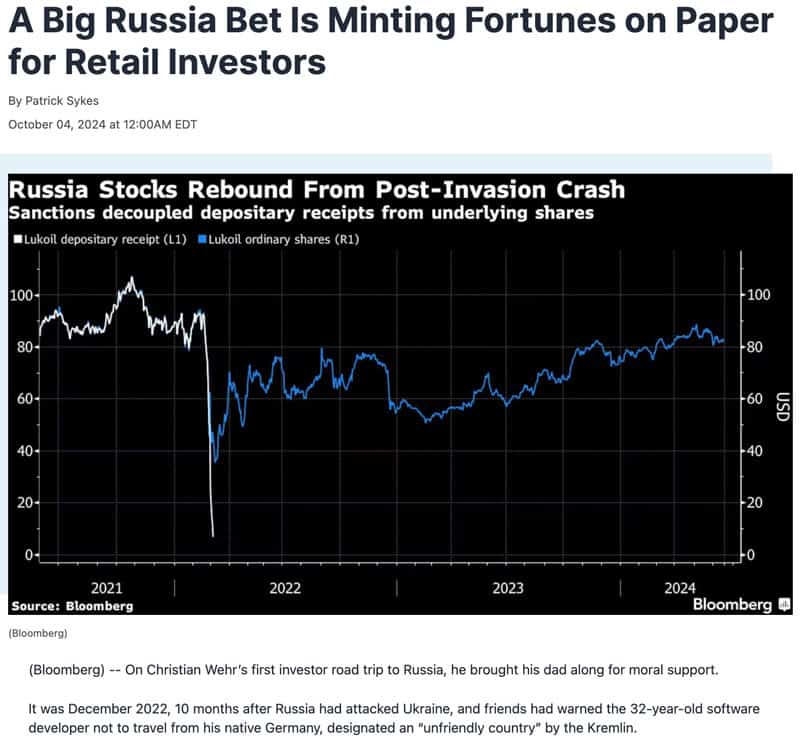

Besides, there were indirect plays on the theme. Undervalued-Shares.com Lifetime Members were pointed towards Raiffeisen Bank International (ISIN AT0000606306, VIE:RBI) when it was down and out. The Austrian bank has a large Russian subsidiary, which continued operating. Having bought into one of the cheapest European banks, Lifetime Members now have an indirect Russia recovery play in their portfolio, which is already up 95%. However, it's still below its pre-war level and continues to rank among the cheapest European banks altogether.

Source: UBS, 30 January 2025. Metrics based on a share price of EUR 21.70 (click on image to enlarge).

These examples show the variety that exists within the sector.

It's no different with Russian securities that remain stuck and the specific situation of their owners.

The maddening factor within all this? Every case is different.

I had last reported about this in detail in my 23 June 2023 Weekly Dispatch "Russian ADRs and GDRs – what's next?". Remarkably, this article subsequently became one of the most widely read articles this website has ever published!

As I put it back then:

"The entire subject surrounding Russian ADRs and GDRs is almost impossible to cover, not because it's complex and intransparent, but because banks and brokerage firms do not always treat their customers according to the rules

I've come across numerous cases where banks and brokerage firms:

- Treated individual customers differently, for no apparent reason.

- Refused to deal with the subject at all, because…. Russia!

- Misinterpreted rules or simply weren't aware of finer details and new developments.

In fairness, from the perspective of banks and brokerage firms, the matter must almost be impossible to deal with. The treatment of ADRs and GDRs of Russian firms is:

- Influenced by countless individual factors on a company level, which makes it insanely complex to deal with.

- Subject to repeated rule changes, many of which were difficult to keep on top of in a timely fashion.

- Hindered by practical factors such as language barriers and the general level of bureaucracy that the entire financial sector is caught up in nowadays.

It's simply an administrative nightmare for all parties involved. Banks and brokerage firms have to bear huge costs to help their clients, which will disincentivise some to even dedicate time to it. Hence, many customers feel stranded and left alone."

Up to now, the situation remains the same.

However, there do seem to be some initial signs of positive developments.

American investors gearing up for a return

Developments on the political front have been happening at a frantic pace of late. Things have literally been changing by the hour, and sometimes in dramatic 180-degree turns.

At this stage, no one knows for sure what will happen in Ukraine. Some will say that anyone who is expecting peace of some kind is merely getting played by Putin. This may be the case, but markets are currently clearly pricing in a distinct possibility of another phase for the conflict – maybe even peace, of sorts. The strong recovery of the rouble versus the US dollar indicates as much.

RUB to USD.

On 28 February 2025, Bloomberg reported that "investors are rushing to buy assets with any link to Moscow."

Source: Bloomberg, 28 February 2025.

Indeed, US institutions are now gearing up for a return to the Russian market. Goldman Sachs allegedly created a team to focus on the task.

Will these developments also lead to a solution for the holders of frozen Russian ADRs and GDRs?

Maybe.

Undervalued-Shares.com believes that the following has to be taken into consideration:

- Some ADRs and GDRs have been officially cancelled by their issuers. It's unlikely that they can be brought back. A lot of technical damage has been done to the system, which will be difficult and time-consuming to reverse, even if there was appetite to do so.

- Based on events of the past few days, the US could treat the matter entirely different than the EU (and UK). Going forward, a US investor may experience this problem in a different way than an EU-based investor. That's before we even take into account further variations. E.g., for a US investor based in the EU but holding ADRs in a Swiss account, this could yet again be different. There will be a significant need for individual advice, which some financial institutions will be able (and willing) to give, while others may be unable (or unwilling).

- A tremendous administrative backlog mess likely needs cleaning up first. E.g., as a result of the so-called forced conversions of ADRs, investors now seemingly own Russian stocks in their Russian S account, without a full reconciliation with their previous Russian ADR holdings in Western brokerage accounts. As one expert I rang ahead of publishing this article put it, a lot of these solutions really only took matters to a halfway point where they then got stuck.

- In a piece of good news, it seems quite likely that everyone would receive their accumulated Russian dividends for the past three years if an overall resolution was found. A "lookback" of three years was established at the outset of the war and seems manageable in practical terms. Such a lookback is also the international standard for such situations. For some Russian stocks, receiving dividends for the past three years could add up to a significant amount of money!

- How high or low this matter ranks among political decisionmakers remains to be seen. There is also the division between the US and the UK. The US might want to clear this up as soon as possible and get back to doing business. The EU tends to act more slowly in general, and all the more so relative to the recent speed of the Trump administration.

Source: Reuters, 3 March 2025.

One firm that has kept reporting about this entire matter throughout the past three years, is Roemer Capital in Cyprus. Their Head of Distribution, Luis Saenz, publishes a daily client letter that also covers developments in Russian capital markets and related areas.

I managed to catch up with Luis in London last week, and he provided the following input:

"When we think about the Russian market the first thing to say is- tread carefully. We are currently in an upside-down situation. From a technical regulatory standpoint, US sanctions are more severe and tighter than in Europe even if the will to enforce or sustain them has changed. This might put investors in a tough situation and on the wrong footing."

There is also the separate but related question how the Russian market overall will fare. Luis says:

"From an asset value standpoint we see value almost everywhere we look in Russia. Especially in good quality companies servicing the Russian consumer which has been hammered over the term of the conflict. In the end of 2021, before the full scale war broke, Central Bank of Russia (CBR) rates were standing at a modest 7.5% and from 5% back in 214. When the war broke the CBR hiked to a crippling 20% and rates are now standing at 21%. The impact on consumption and availability of credit have been pronounced. From a Russia proxy stand point names like Raiffeisen Bank (Austria) and OTP Bank (Hungary) should continue to revalue. Any sanction relief will push rates lower, boost capital flows and drive consumer confidence."

If you'd like to keep abreast about these developments, I recommend you sign up to Luis' newsletter (email [email protected]).

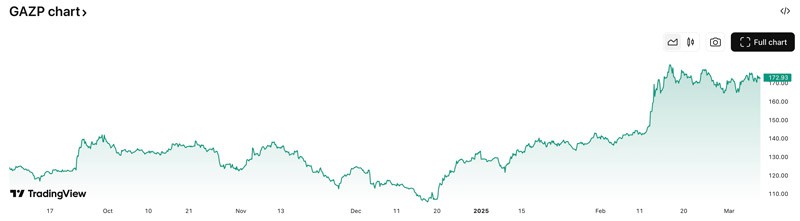

The stock of Gazprom is up 60% (!) since December 2024. It is still way below its pre-war price, and there are many reasons to argue that Gazprom will never return to its former state. However, it's also noteworthy that the EU's gas reserves showed real signs of exhaustion of late. It will be difficult for the EU to refill its gas storage facilities this summer and prepare for winter. Who knows, maybe we will yet see what the Financial Times already speculated about in a headline on 30 January 2025: "EU debates return to Russian gas as part of Ukraine peace deal".

Source: TradingView.

Meanwhile, the price of Sberbank is approaching its pre-war level when based in roubles. It's up 3x since the record-lows of mid-2022. Sberbank is sanctioned by the West, which is why you won't find any brokerage firm publishing any information. Come to think, Western compliance departments are prohibiting even mentioning Sberbank's stocks ticker symbol, as this could be interpreted as promoting a sanctioned investment. Sberbank is known to have done relatively well. For 2024, the bank reported a 24% return on equity.

Source: TradingView.

Most Western Internet providers have blocked Russian websites, and Bloomberg has stopped transmitting Russian share prices. In a potential sign of things to come, anyone curious about Russian share prices can use an American website: TradingView features many Russian stocks.

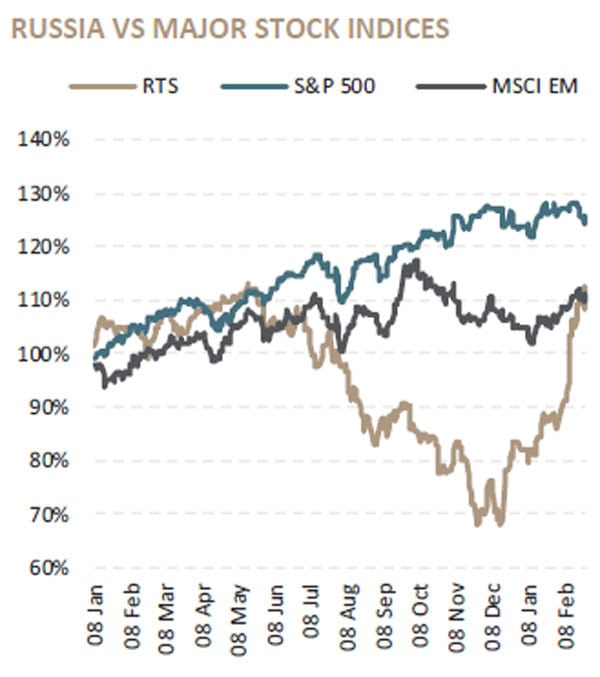

Source: Roemer Capital, 8 February 2025.

Where do we go from here?

All in all, these are probably the most substantive developments for holders of Russian ADRs and GDRs of the past two years.

However, any progress does still depend on politics.

Also, Russia will remain a difficult place to do business.

The likes of Goldman Sachs may be salivating at the idea of Russian stocks getting reintroduced into indices and large funds having to buy back into the market for that reason.

However, the interest of a firm like Goldman Sachs does not necessarily equal that of a broad selection of American businesses. Before anyone gets carried away by the improved prospects, it's recommended they read the following assessments:

"Russia's Withering Economy Is Tricky Place to Do Deals – Even for Trump"

The Wall Street Journal, 25 February 2025

"Why American Businesses Aren't Raring to Get Back Into Russia"

The New York Times, 24 February 2025

"Gazprom, once a mighty tool of Russia, stumbles toward more modest future"

The Washington Post, 23 February 2025

No one knows for certain what the next weeks days are going to bring – but there is undoubtedly some movement. For owners of Russian ADRs and GDRs, 2025 could continue to be an interesting year.

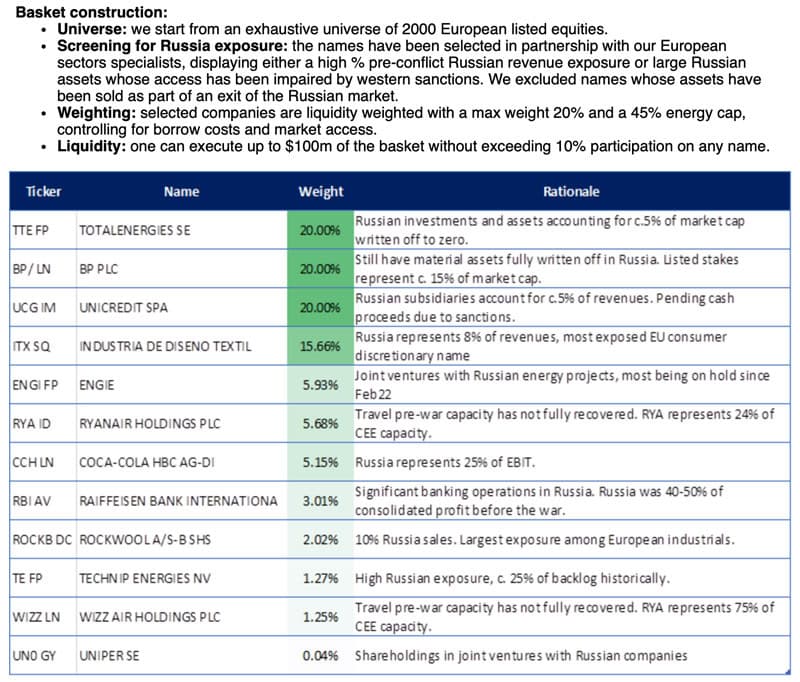

In the meantime, investors can also check out which European stocks offer exposure to Russia.

Just before putting the finishing touches to this article, a research note "European companies with Russia exposure" from Bank of America hit my desk:

"As talks continue between President Trump, Ukraine and Russia, the potential implications of a deal begin to take hold. Several European businesses saw their Russian operations be put on hold, or written off to zero, in the immediate aftermath of the conflict's outbreak… 3 years later, Trump's willingness to reach a deal could pave the way towards easing Russian sanctions as a following step towards a peace agreement. Such a scenario could see a material re-rating of assets and earnings for the 12 Russia exposed stocks we have identified below."

Source: Bank of America, 4 March 2025.

Clearly, a spreading desire exists to get exposure to Russia – through (almost) any means.

These stocks have MEGA price potential – Swen Lorenz on defence, AI, quantum computing & Bayer (German-language video)

What's happening in the German market right now? What are the prospects for German defence stocks, carmakers and other blue-chips? And what about tech stocks, gold and bitcoin?

Some fascinating insights into current affairs, explored with Luis Ropero of Finanzexperten im Interview - biallo.

These stocks have MEGA price potential – Swen Lorenz on defence, AI, quantum computing & Bayer (German-language video)

What's happening in the German market right now? What are the prospects for German defence stocks, carmakers and other blue-chips? And what about tech stocks, gold and bitcoin?

Some fascinating insights into current affairs, explored with Luis Ropero of Finanzexperten im Interview - biallo.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: