Undervalued-Shares.com had the opportunity to speak with David Halpert, the founder and Chief Investment Officer of Prince Street Capital Management. David has popularised the term "Digital Decolonisation", which might become one of the most exciting investment themes of the 2020s.

Undervalued-Shares.com doesn't usually publish interviews. However, following a lengthy phone conversation with David a few weeks ago, his insights were too valuable not to share.

The interview is also the result of the growing network among Undervalued-Shares.com readers, and an introduction to David by a Lifetime Member.

Swen Lorenz: David, your fund management company is named after a well-known street in New York's Soho district. Yet, you personally are based out of Singapore, and your firm pursues investments in frontier and emerging markets around the world. Tell us how that all came about?

David Halpert: I started the firm in 2001 when I was living in New York. It was before September 11th, and my loft in New York was at the corner of Prince Street and another street. That's why I chose the name.

However, I always wanted to see the world. When I was ten years old, my mom put maps on the wall, and I kept looking at these wonderful place names and wondering what they were like.

As a result of all this, in 2007, I moved to Singapore, and my kids were born here. I have been in Singapore for 13 years, but the company kept the name that describes its origin.

Swen Lorenz: Over the past two weeks, I've introduced my readers to the concept of Digital Decolonisation or "DigDec". Today, this trend may seem obvious. Five years ago, it would not have been obvious at all. What made you realise that this new, secular trend was in the making?

David Halpert: Gojek, the Indonesian company that is the equivalent of Uber, was very important in my intellectual development around the formation of the Digital Decolonisation thematic. I have always had a fondness for the underdog. You might not know it when you look at Gojek today, but it was very much the underdog in the beginning. In talking with the founder of Gojek, Nadiem Makarim, about how he was thinking about his company, I learned about his relationship with Uber and how the American company could use its vast resources to challenge his local start-up. I felt for him and came up with this framework or narrative of how a local tech company could become a sort of insurgent competing against the global multinational hegemon.

Again and again, I saw how local businesses, local entrepreneurs, local customers, and local governments all said they don't like how these cross-border multinationals are interacting with their domestic economies. In essence, they were uncomfortable with Digital Colonisation of their countries by global tech titans. This was true for China's Alibaba (ISIN US01609W1027) going into India, the US' Amazon (ISIN US0231351067) expanding into South America, or Russia's Yandex (ISIN NL0009805522) getting into Central Asia.

This is most important in the context of small and medium enterprises as well as e-commerce. Take Lazada, the privately-held Singaporean multinational technology company that focusses mainly on e-commerce and which was funded by Germany's Rocket Internet (ISIN DE000A12UKK6). For years, its core business model was flooding the Indonesian market with Chinese imported goods. Tokopedia, Bukalapak and some of the other local Indonesian e-commerce companies were frustrated because they were losing business if they tried to promote their local brands. This became an issue for the government of Indonesia. Over time, helped by support of the local Indonesian government, Tokopedia was able to successfully curate local products which appealed to local consumers and ended up taking a dominant position back from Lazada (although they are not technically #1).

In 2020, you saw the tensions between the US government and Huawei. Those had really started in 2018 and 2019 already.

The tech sector has become politicised, and the issues of technology nationalism and technology sovereignty are now resonating with investors, voters, leaders, managers, and coders!

I got involved with a start-up in Bangladesh. The country is a huge tech and programming export centre. Many Chief Technology Officers and programmers working for tech companies traded in New York are from Bangladesh. We had programmers in that company saying that they had spent their entire careers working for foreign companies where they had absolutely no visibility into who their customers were and how their code was going to be used. They were unsure if they would ever get any part of the Employee Stock Option Plan. They were behind the curtain – employees that did not feel part of their companies.

The DigDec movement completely transforms that dynamic and turns the local entrepreneur, the local programmer, and the local innovator into the hero. It gives not only the CEO of these start-ups but also the staff a vision of what is possible and what it could mean to both their country and their families.

It's nice when such a company goes public, but they are not all going to be as successful as Fawry (ISIN EGS745L1C014), the Egyptian e-commerce company. However, I think I'm honestly making the world a better place by promoting this movement, which enhances self-determination leading to higher self-worth and a more sustainable economic growth model.

There are problems with it, of course. You have venal oligarchs in the developing world creating their own e-commerce ventures, and leaders such as Vladimir Putin who puts his thumb on the scales for Yandex to keep Google (ISIN US02079K3059) out of Russia. There are complexities to this, but imagine what the world would look like if Masayoshi Son of SoftBank Group (ISIN JP3436100006) were accurate with his prediction that we will only have ten companies left in the world. Amazon buys all the retailers, Google buys the advertising companies, Facebook buys all the media companies, WeWork buys all the property companies, Uber buys Tesla and Mercedes, and so forth. I think it is not going to be as much fun or as inclusive.

Life actually isn't that simple, and people aren't that simple. People want to work in a company where they feel its values and culture are vaguely understandable to them. For example, Gojek has this issue that 80% to 90% of their four million drivers are Muslim. At least half of them intend to go on Haj. Uber doesn't have a Haj programme, but at Gojek this is the kind of local issue that they can focus on. This localisation of management has huge social, economic, cultural, and political benefits.

Swen Lorenz: The last time we spoke, I was fascinated by listening to your view on how these developments compare to long-ago history. Can you tell us a few more historical parallels that are relevant for the DigDec topic?

David Halpert: If you wanted to speak about historical parallels that are relevant for DigDec, then I would look at Alexandria Arachosia, which was the original name of Kandahar in Afghanistan. It was one of the 70 cities that was founded or renamed by Alexander the Great.

When his army left that place and marched south into India, for 300 years the residents of Alexandria Arachosia continued drinking wine out of amphorae, acting out the plays of Sophocles, Euripides, and Aeschylus, and sacrificing to the 12 Olympian gods. Then slowly, over time, Buddhism took over, and then Islam took hold. As time passed, they kind of forgot that they were Greeks.

Geopolitical forces influence culture, trade, business and politics, but there is a time lag between geopolitical change and the cultural and economic change.

It has now been four years since the US started to turn away from globalisation, which started with Trump pulling out of the Trans-Pacific Partnership (TPP). This was the most important event in terms of catalysing the end of Silicon Valley's dominance in global technology.

Silicon Valley has been very strong for a very long time. But think back to what Siemens meant in your native Germany when you grew up. Siemens was a big thing. It produced telephones and computers. Is there a Siemens computer today? There isn't.

Swen Lorenz: Your firm had an early investment in MercadoLibre (ISIN US58733R1023), which gave Jeff Bezos' Amazon a run for its money in South America. At its February 2021 peak, it created nearly USD 100bn in shareholder wealth. Please tell us how you experienced finding this investment before most others did and riding it all the way up.

David Halpert: I found them in 2016 when my analyst based in Hong Kong drew my attention to it. As soon as I walked in through the door at MercadoLibre in Buenos Aires, I knew this was the real deal. It smelled like Gojek when you walked in there, and they just had exactly the same attitude that I like. It is a local company that is inspired by the new economy, and it is run by local people who care about Latin America. I believe they could all get jobs at Amazon if they wanted. However, they have done better for themselves, and they have done better for me as a shareholder than either of us would have done had we just stayed with Amazon.

So MercadoLibre has continued to outperform sell-side forecasts and my forecasts in terms of how fast they grow, how quickly they roll out new verticals, how many customers they get, and how effectively they capture their total addressable market, which is a very compelling total addressable market. It's now one of the most respected companies in emerging markets.

When I talk to people at other companies in emerging markets, they say we really want to be like MercadoLibre.

You can define that in stock market terms, but also in terms of customer satisfaction, the total number of users, and the total number of people's lives they have changed. MercadoLibre has served 91m people, and Gojek claims 185m people as customers. These are big numbers.

Swen Lorenz: I discovered in a newspaper article that you were among the seed funders (!) of Gojek, which is now a privately-held unicorn with a >USD 10bn valuation and plans to go public. My readers would be more likely to invest in something already listed on a public market because they wouldn't generally have access to seed funding opportunities in emerging markets (though some do!). Either way, for someone looking at riding the next wave of national tech champions in emerging markets, what advice can you offer?

David Halpert: Anyone who wants to do what I did, which is to get in at the seed stage, needs to be incredibly lucky. You have to take a lot of risks, and that means you probably want to spread your bets around.

I have done some unicorn hunting over the years. It has been quite a risky sport, but also a very satisfying sport.

Among things that I think are important in the unicorn hunt are the following factors:

- Total addressable market (should be BIG)

- Population (should be big, too)

- A good tech team

- A good CEO

- A CFO who is good enough

- The government should like the CEO

In defining what I consider to be a DigDec company, these are all necessary conditions.

Speaking of the last point, what happened between Jack Ma and the government of China a couple of months ago is very significant. Maybe it's the most important thing that happened in China last year. It might be the most important thing that happened in Asia last year. In many emerging markets, there is an unwritten contract between the government and tech entrepreneurs. If the entrepreneurs cross a line, it can be to the detriment of their investors.

Swen Lorenz: Seeing the success of Gojek and the sky-high valuation of firms like Fawry in Egypt (see my most recent Weekly Dispatches), sceptics will wonder if this trend has already run its course. Are we now in the tail end of a hype? Can you give us a few indications why, in your view, DigDec is still at its beginning and has the rest of the decade to run its course?

David Halpert: It's very simple.

There is no "DigDec" market cap in Ethiopia.

The second, third, and fourth-generation e-commerce business models, such as e-health and food delivery, have no market cap in Egypt.

The second, third, and fourth-generation e-commerce business models have no market cap in Indonesia.

The same is true for the Philippines.

And for Vietnam.

There is still a ton of opportunity that is not monetized.

Fawry is already monetized. It was a USD 1bn company, and then it became a USD 2bn company. The company grew during that time, but it was mostly just the stock finally getting recognised by fund managers. Today, it is not an undiscovered jewel anymore.

I would guess that many of your readers probably had never heard of it, or traded it, or researched it. But there are a lot of Saudis who have bought Fawry by now. If everybody in Saudi Arabia decided to put 1% of their portfolio into Fawry, it would be worth more than Siemens and Volkswagen.

I believe there will be Nigerians, there will be Ethiopians, there will be Filipinos, there will be Vietnamese, there will be Turks who will do the same with their local and regional champions.

Ethiopia has a 112m population but as yet zero DigDec market cap.

Technology investing is always risky, and technology stocks are always volatile. Some of these stocks have gone up too much, but some have just come down 40% and are now quite interesting, including MercadoLibre. A lot of them are somewhere in between. But I have no concerns about the entire story being over. It is nowhere near over! If ever we are talking about the stock of a search engine for Moldova, then it will be over. But at the moment, it is still really early days.

There are small countries that have no tech market cap, and there are big countries that have no tech market cap. That is going to create a lot of opportunity for investors, funds, and family offices that are interested in this space.

What really mattered was the withdrawal from the Trans-Pacific Partnership. The e-commerce provisions of the TPP – which I read in full – were structured to reflect the agenda of Silicon Valley. The RCEP trade agreement that effectively replaced it in Asia did not include the kind of provisions aimed at pleasing Silicon Valley.

Swen Lorenz: There must be some countries you view as more favourable for landing winners in DigDec investing than others. Can you give us your top candidate(s) among investable countries?

David Halpert: India is an excellent candidate for Digital Decolonisation investing. Mukesh Ambani, the billionaire businessman, chairman, and largest shareholder of Reliance Industries (ISIN INE002A01018), has personally used the words Digital Decolonisation. There was a forum in Gujarat where Ambani said that Mahatma Gandhi led India to political decolonisation, and Narendra Modi should lead India to Digital Decolonisation. India is absolutely ground zero for all of this.

But Indonesia is also ground zero for all this stuff. China is still ground zero. Then you get into all the others that are smaller but also interesting.

Argentina has three really good tech companies. They are all listed in New York, and my funds own two of them.

Brazil has a deep market, including digital banks but also all sorts of other cool companies.

Then you get into places where you have to look a little harder because there is currently less choice available in public markets. Think Vietnam, the Philippines, Thailand, Bangladesh, Pakistan, Egypt, Nigeria, Turkey, and Mexico.

They're all perfectly valid ecosystems for this kind of investment because they all have enough potential customers, enough economic activity, enough smart people, and enough access to capital to build real companies. I think they are all going to have digital banks, health tech, edutech, cybersecurity, distributed power, and all this cool new stuff.

If you want to make 100 times your money, then you have to take some risk. I am sorry about that. It would be much more fun if you could make 100 times your money without taking risk.

Swen Lorenz: Since May 2020, your firm is managing a DigDec Fund. Tell us everything my readers need to know about the fund.

David Halpert: I have been running an emerging markets equity business for 20 years, and I realised that this thematic subset of emerging markets companies who embrace innovation was more exciting to me. They were also more profitable to invest in compared to companies with a more traditional, established 20th-century business models such as Petrobras (ISIN BRPETRACNOR9) or Gazprom (ISIN US3682872078).

So, I rewrote the documents on one of my existing funds to make it the Prince Street DigDec Fund. Most of the people I spoke to about it initially thought I was crazy, but it went up more than 50% last year, and the current year is looking pretty good, too.

I don't see any sign of this reversing because I believe the trend is just so obvious. I can't believe that local governments are going to let Alibaba, Amazon, Uber, WeWork or whatever other foreign companies write the rules for these countries the way they used to.

Eventually, we will see USD 20bn to 50bn of DigDec market cap in the Philippines.

There will be USD 20bn to 50bn of DigDec market cap in Vietnam.

There will be USD 20bn to 50bn of DigDec market cap in Thailand.

There will be USD 5bn to 10bn of DigDec market cap in Bangladesh.

For Pakistan, it will be USD 5bn to 10bn.

In Sri Lanka, make it USD 3bn to 5bn.

Ethiopia will take a while, but it will be USD 5bn to 10bn in DigDec market cap.

In Nigeria, there will be USD 5bn to 10bn – maybe even USD 20bn.

Egypt has such a deep ecosystem that, eventually, there will be USD 20bn to 30bn in DigDec market cap.

Turkey could have USD 20bn to 30bn, but it will take a while because Turkey's financial market is underdeveloped.

And then, Germany! My god, your compatriots could create trillions of DigDec market cap if they only got going. It's so frustrating, given there are so many smart people in Germany. The country has the best engineers in the history of the world, and they invented the car, but today they can't build a computer. This makes me so frustrated. Your neighbours in Poland have two great tech companies already, Allegro (ISIN LU2237380790) and CD Projekt (ISIN PLOPTTC00011).

Greece is on it! There's a great e-commerce company in Greece, which is not public yet, but it's going to come public. It's fantastic, and it's run by actual Greek people.

Kazakhstan has a tech listing!

This is going to happen.

David (second from left) and his colleagues take an Asian sovereign wealth fund to visit Fawry.

Swen Lorenz: I participated in your firm's Investor Day last autumn and learned that you used to publish your "Top 5 DigDec picks" each year. I haven't seen your Top 5 for 2021 anywhere yet. Can you tease one top pick that is publicly-traded?

David Halpert: I generally create that list at the end of March, but Ping An Good Doctor (ISIN KYG711391022) is very likely to be on it for 2021.

The Chinese company is the largest telemedicine company in the world, with over 370m registered users and over 900k digital consultations per day. Digital consultations are much more efficient in terms of cost than face-to-face visits to a clinic. The data that PAGD has managed to assemble makes a very compelling base for developing next-generation AI-enabled consultations and, eventually, AI diagnostics.

It was on last year's list already, and it will probably be on this year's list again.

Swen Lorenz: Last but not least, which books about history, financial markets or investing would you recommend my readers get a copy of to educate themselves about all of these developments?

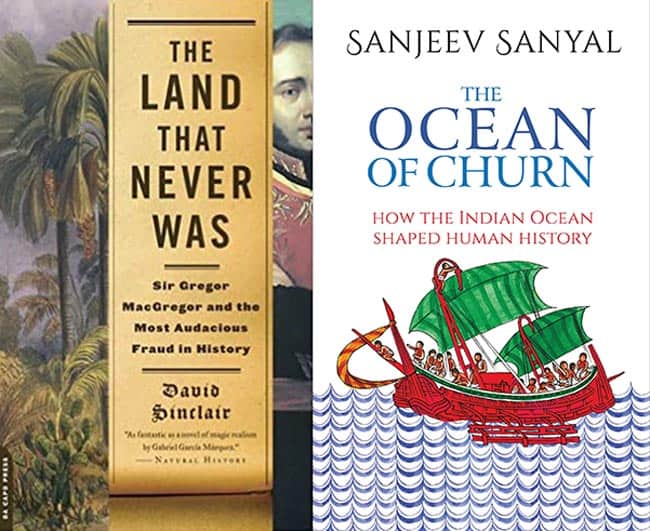

David Halpert: There is a wonderful book by David Sinclair called The Land That Never Was. It is essential reading for anyone who wants to play in emerging markets. It's about the greatest fraud of the 19th century, where a nation-state that didn't exist issued bonds.

Must-reads for all emerging market investors.

If you want something a little meatier, look up Sanjeev Sanyal. He is an advisor to the Indian government and has written a great history of the Indian Ocean, called The Ocean of Churn. It is essential viewing Asian history from an Indian perspective.

I wish we had the story of Gojek out as a book, but we don't have that yet. It certainly would make a good book. The story of MercadoLibre also would make a good book. One day!

Swen Lorenz: David, thank you for sharing your insights so generously with us! Your firm primarily deals with institutional investors and family offices but may accept larger ticket sizes from accredited private investors. If one of my readers wants to contact your office, the email address is [email protected].

Blog series: Digital Decolonisation

There's more to "Digital Decolonisation" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

The next Visa or Mastercard?

Chances are you’ve probably missed investing into Visa or Mastercard at the right time. Visa is up 62 times since 2001, while Mastercard is up 82 times since 2006.

There’s always another chance, though - and this time, it’s hiding in Israel of all places.

I have found an electronic payment provider that is in an earlier phase of its lifecycle, and its stock could go up by a factor of 2-4 over the coming 12-24 months.

My latest research report - exclusively available for Undervalued-Shares.com Lifetime Members - has all the details.