Industry roll-ups are not something you'd usually talk about at a dinner party, but it's a way for building a lucrative company that is worth highlighting.

In an industry roll-up, you acquire and merge multiple smaller companies into a large company. If you have chosen the right industry and the right acquisition targets, a roll-up allows you to:

- Cut costs by pooling resources.

- Become more competitive.

- Benefit from so-called "multiple arbitrage". Smaller firms tend to be offered for a cheaper valuation, whereas the stock market values larger, growing firms at higher multiples. In theory, with each acquisition, the valuation of a publicly-listed consolidator should leap forward.

It's a neat strategy if you can find the right industry to apply it to. Most industries already have a significant degree of concentration, and there are simply not enough smaller targets to acquire.

That's why it's so interesting to have one viable, highly scalable roll-up company go public soon. The IPO is done via a SPAC (Special Purpose Acquisition Company), and it hasn't attracted any hype yet – though it should!

Here is the case of a US-based industry roll-up that is likely to turn into a lucrative investment over the years to come.

Decade-long strong growth with a successful roll-up strategy

The story of Vintage Wine Estates (VWE) began in 2000 when Pat Roney acquired the Girard Winery in California. The former grocery retailing executive (Dean & DeLuca) and wine expert needed an initial seven years to get the company into shape for an industry roll-up. Since then, there has been no end to his thirst for acquisitions.

Over the past 14 years, the company that was renamed VWE in 2009 has gobbled up 20 other wine producers in deals totalling USD 250m. Through the acquisitions, Roney has built a group producing over 50 brands of wine.

His playbook has been a classic industry roll-up:

- Lower the costs of goods by combining production, e.g. share a high-speed bottling line between all the smaller estates.

- Cut down on administrative and marketing costs by having a central management team.

- Use the company's size to get the products into national retailers, which smaller brands would either struggle to do by themselves or not achieve good margins.

As time progressed, Roney was able to add a few features, such as an in-house email list of 850,000 wine consumers. Needless to say, a newly acquired wine brand is always a good story to put in front of the existing client and fan base, and it usually creates an immediate uplift in sales.

The financial aspect of this strategy is compelling. During the 2010s, VWE has increased its revenue and EBITDA by an average of 20% and 24% p.a., respectively.

This caught the eye of another player in the drinks industry: Paul Walsh, former CEO of Diageo (ISIN GB0002374006). During Walsh's tenure from 2000 to 2013, the international drinks giant's market cap had grown from USD 29bn to 108bn. Nowadays, Walsh operates an investment company, Bespoke Capital Partners (BCP).

BCP had listed a blank cheque company on the Canadian market, the Bespoke Capital Acquisition Corporation (ISIN CA0863441089). Walsh aimed to use the shell company to acquire a cannabis company. When he didn't find a suitable acquisition target, he shifted the listing to the Nasdaq market in the US (where it has the ticker symbol "BSPE") and went on the lookout for a drinks company.

Along came VWE and its ongoing drive for consolidating smaller players. The SPAC has lots of cash that its investors want to deploy, and VWE needs more financing to speed up and scale up its industry roll-up.

It could be a match made in heaven, as the following figures show.

The hyper-fragmented US wineries market

The US has over 10,000 wineries, most of which are too small to achieve compelling metrics.

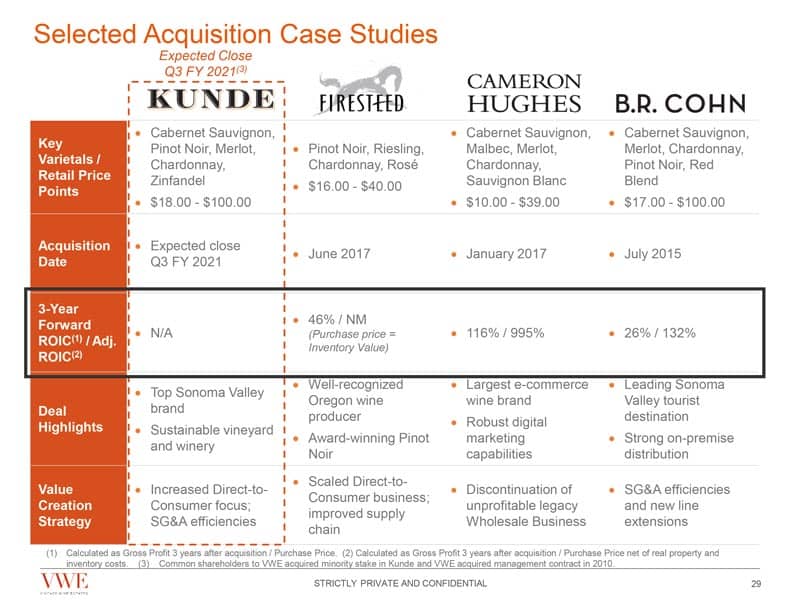

Deploying capital into acquiring these companies proved extremely lucrative for Roney. The Return on Invested Capital (ROIC) achieved by some of these transactions was so high that I don't even dare to spell out these numbers. Check the following slide from a VWE presentation for details.

Source: VWE investor presentation, February 2021.

More acquisitions are waiting to be done in the US, and VWE is now likely to emerge as one of the serious dealmakers in the space.

In the past, the usual target company would have been worth USD 20m to USD 40m. Thanks in no small measure to its upcoming merger with a SPAC with USD 365m of cash waiting to be put to good use, the newly-merged entity will have financial firepower for acquisitions totalling USD 1bn once its unused financing potential is used.

Once the merger of the two entities is complete, VWE will be able to increase its deal size to include individual transactions of up to USD 100m. There are fewer buyers in that part of the wineries M&A market, so VWE may end up striking even more advantageous deals.

VWE has barely scratched the surface of the highly fragmented US wineries market. It expects to keep growing its revenue at a rate above 20% p.a. Roney believes he will also manage to improve margins further, thanks to increasing economies of scale now that VWE is getting to a serious size.

Indeed, he is not going to part from any shares in the venture he created but roll over his entire stake to the new company. As part of the deal, the company's existing investors will get options that vest at a share price of USD 15 and USD 20, respectively. It compares to a current share price of USD 10.15. The terms were chosen to signal to the market that management and key investors are convinced of the company's long-term prospects.

You can learn more about how such industry roll-ups work (and the lingo used to describe them) by reading the company's investor presentation. It's a rare example of clarity, compelling figures, and a realistic valuation for investors to jump aboard.

As an investor friend put it in a WhatsApp message to me: "A must-own for any self-respecting oenophile."

To which I have nothing to add.

The details of another lucrative roll-up – revealed in an exclusive report

Coincidentally, I have just published a 34-page research report about another US-based industry roll-up. It's an investment opportunity that I feel strongly about.

I have personally used the product multiple times, I wrote about the stock before anyone else did, and I have met its founder and several C-suite executives in real life and over the course of a decade.

After lying in waiting for years, now was the time to strike. The company's investor conference last week (which I attended) yielded vital clues for me to get writing.

Undervalued-Shares.com Members who have already read the report seem to share my enthusiasm for this opportunity:

"I had never heard about them but I think it's one of your best reports so far."

"Just wanted to say that was a great read."

"I am amazed at the level of detail of both factual information and interpretation."

If you haven't read it yet, I recommend you make it part of your plans for this weekend!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

A compounder gem for the "Experience Economy"

Who would possibly want to invest in a cruise ship operator at this particular time?

Even worse, who would want to do so after the stock has increased six times (!) in 12 months?

Hear me out!

I've found one company which is bound to benefit from the post-pandemic Zeitgeist, and the new trend of "revenge travel".

If you are looking to profit from the world reopening for business, this could be a clever investment for the remainder of 2021 (at least!).

Intrigued? My latest report, out this week, has the full investment case.