In May 2024, a dozen Undervalued Shares readers visited Copenhagen.

Thanks to a local friend, we managed to get meetings with world-class companies, ranging in market cap from EUR 900m-25bn.

What were some of our key findings?

Which companies did we like most?

Our intrepid group of readers in Copenhagen.

Market leader for e-governance

Our meetings kicked off with cBrain (ISIN DK0060030286, CPH:CBRAIN), a 22-year-old software company focused on providing solutions to governments.

Government is a huge sector, and possibly the largest in the world even.

Many governments are eager to digitise services. In Denmark, residents can now get divorced online. The process involves a mandatory cooling-off period of three days, but besides that, the process to offload your spouse can be done online.

This is possible thanks to cBrain working with various Danish government entities to provide solutions that are specifically aimed at turning bureaucracy into software solutions and online services.

cBrain claims that there is no other company quite like it anywhere in the world. Large software firms like SAP or Salesforce can, of course, provide software solutions to governments. However, cBrain claims that its know-how in process templates for government functions is the key for its success. An impressive 19 out of 22 Danish government ministries use cBrain software.

cBrain already has customers in other parts of the world. In Germany, the Deutsche Rentenversicherung (German Pension Insurance) is a client, an entity with 60,000 employees. In California, cBrain has won over government entities that were looking for a software solution for environmental permitting processes. Denmark's reputation as a country with outstanding governance standards helps, of course. In fact, Danish embassies and consulates often act as a quasi sales rep for cBrain's software, e.g. by hosting events where a representative of cBrain is present. It does makes you wonder, does cBrain have the long-term potential to become another global Danish champion?

For now, it's a hidden one. The company has flown under the radar because it went public through a mere listing rather than a conventional IPO with a placement. It has provided English-language reporting only during the past 12 months. Analysts from Danish banks have recently started to cover the company.

Its market cap of EUR 650m is high compared to its earnings, but low if cBrain manages to turn itself into the kind of global champion that its founder aims for. Aged 64, Per Tejs Knudsen remains firmly in the saddle.

As cBrain says in its 2024 investor presentation:

"Transforming government through digitization represents a huge opportunity. Industry analysts estimate that by digitizing processes, based on best practices and aligning the organization, governments can enhance services, improve citizens' quality of life, while generating savings of over $1 trillion annually worldwide."

Everyone in our group felt that cBrain was a company to keep an eye on. Timing a purchase is difficult, because the stock is unlikely to ever be conventionally cheap. And potential new competition from existing large software firms needs close monitoring. That all said, though, this was an inspiring and exciting company visit.

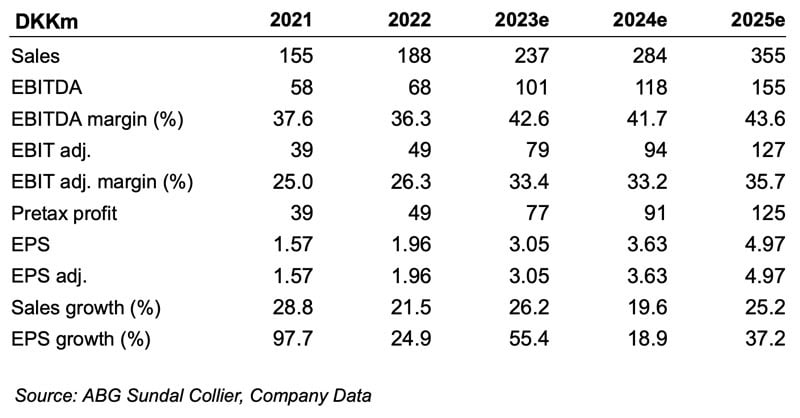

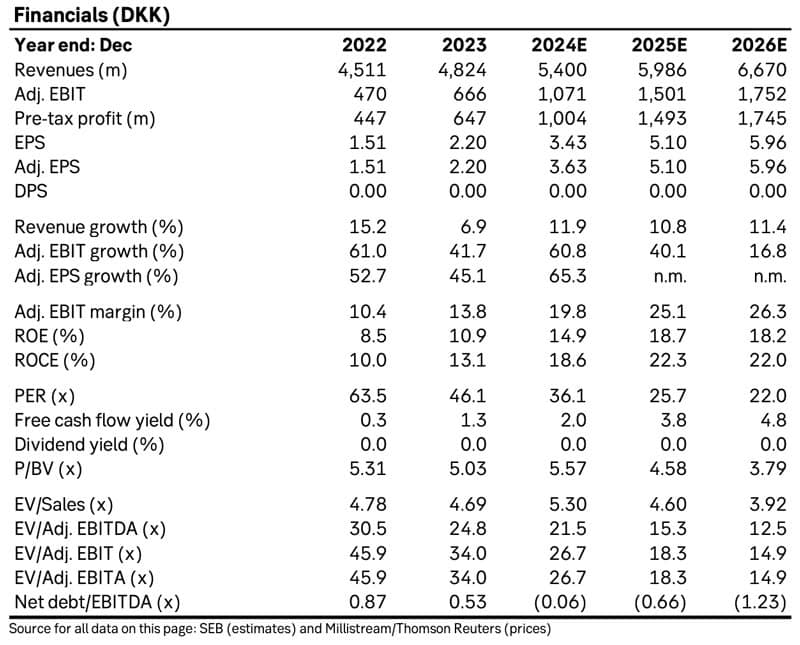

Source: ABG Sundal Collier, 8 February 2024 (metrics based on price of DKK 264).

Source: ABG Sundal Collier, 8 February 2024 (metrics based on price of DKK 264).

Market leader for cigars

A company that our group loved visiting was Scandinavian Tobacco (ISIN DK0060696300, CO:STG).

Who would expect a world-leading cigar manufacturer to be based out of a Nordic country?

I already wrote about Scandinavian Tobacco on 17 November 2023.

We visited the company in its non-descript office building on the outskirts of Denmark's capital. Not unexpectedly, we heard that cigars were a highly cash-generative business. In the first instance, Scandinavian Tobacco sends its entire excess cash flow back to shareholders. Since it went public in 2016, the company has bought back stock worth DKK 8.5bn, which is equivalent to its entire current market cap. Its dividend yield is in the range of 10% p.a. The stock got slammed recently when the company reported its figures for Q1/2024. Sales were down 1%, and profits halved. However, Scandinavian Tobacco believes it can improve margins in the second quarter, and is sticking to its full-year guidance.

Scandinavian Tobacco.

Does a firm like Scandinavian Tobacco have any prospects to achieve growth?

The company is the de facto consolidator of the global cigar industry. There are many smaller cigar brands in the world, and few who would (or could) buy them. As our group was told: "There are still enough decent sized cigar companies in the world." The Danes are not going to run out of viable acquisition targets anytime soon, and these acquisitions usually face very limited competition from other bidders – if any!

Scandinavia Tobacco also succeeds with outcompeting its rivals in retail. The company operates lifestyle stores and superstores for cigars – which take market share from mom-and-pop retail stores.

If investing in cigar-related companies interests you, then Scandinavian Tobacco is worth following because it occupies a unique position within that industry.

Tackling the allergy epidemic

If you think that Denmark only has Novo Nordisk to show as world-leading company in healthcare, think again.

ALK-Abelló (ISIN DK0061802139, CPH:ALKB) is a world market leader in allergy immunotherapies, commanding a 35% market share. I had already reported about the company on 15 December 2023.

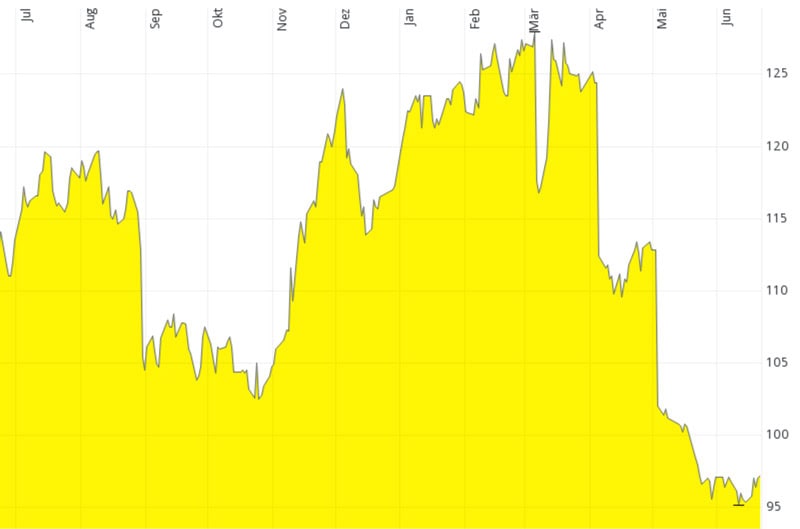

The stock has since reached DKK 145, up from DKK 95.

ALK-Abelló.

Our group visited ALK-Abelló just before its Capital Markets Day. The company's long-standing investor relations representative, Per Plotnikof, was brimming with excitement.

ALK-Abelló likes to describe itself as a specialist for "reprogramming the immune system" and using "products that are derived from nature". Its products work on the basis of continuous exposure.

While the entire subject of allergies is fraud with controversy, allergies are undoubtedly a global epidemic. ALK-Abelló views increasing urbanisation as one of the key reasons for the spiralling number of allergy cases around the world. Given lifestyle changes that are taking place globally, the company's addressable market is probably only going to grow. However, it's also up against powerful incumbents. E.g., in the US, doctors make huge amounts of money from giving shots against allergies. They want no alternatives to stand in the way of their existing revenue streams.

ALK-Abelló is still very much a European company, with 70% of its sales deriving from the continent. The combination of rising allergy rates, growing interest in alternative treatments and ALK-Abelló having been around for decades could lead to an eventual take-off of the company, and the generation of more sales in Asia and North America.

Once again, our group felt this was an impressive company that they had never heard of before, but which they were now keen to follow.

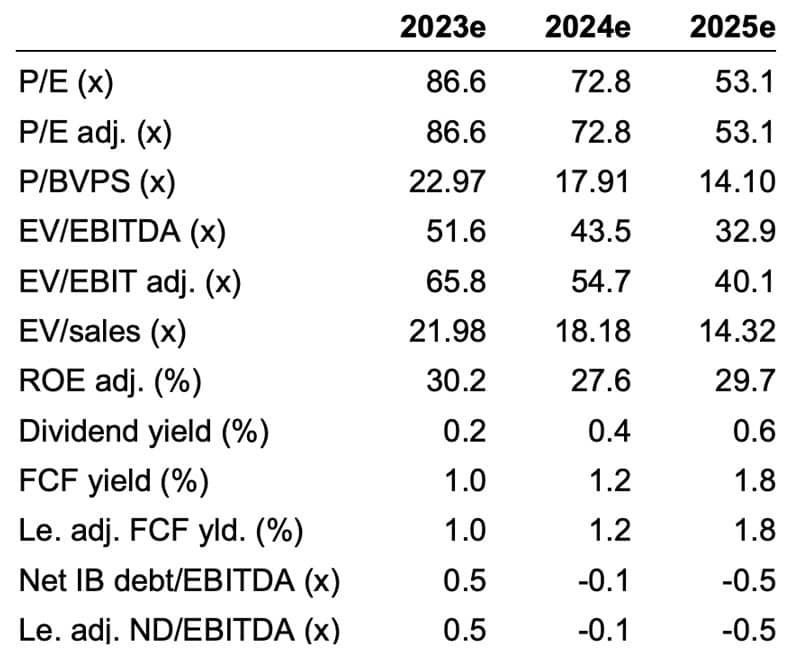

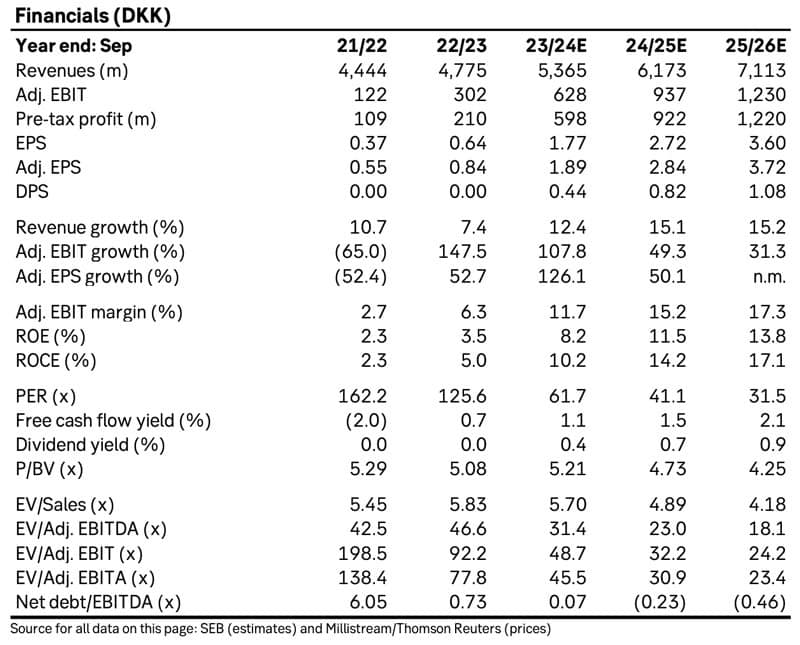

Source: SEB, 3 May 2024 (metrics based on price of DKK 131).

Another hiden healthcare champion

While cBrain and ALK-Abelló are stocks that have recently recovered a lot from a previous sell-off, the stock of Ambu A/S (ISIN DK0060946788, CPH: AMBU-B) is currently still stuck in a rut.

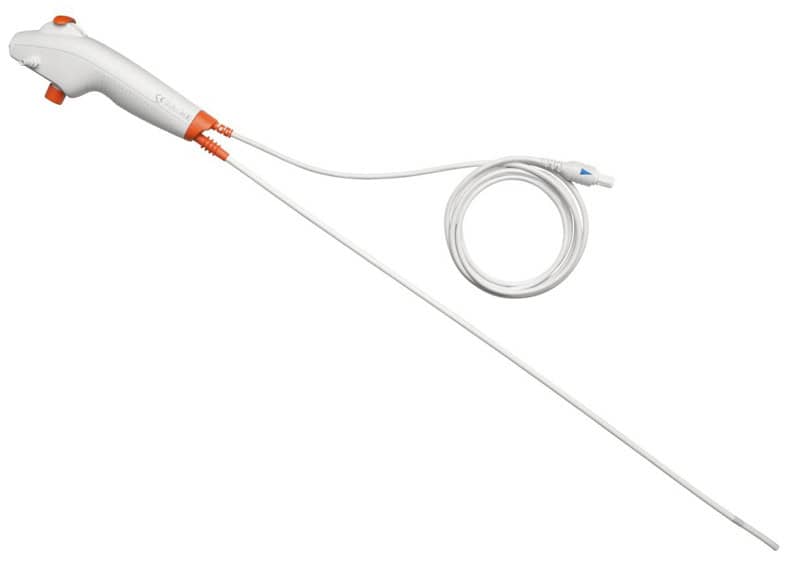

The 85-year-old company develops and produces single-use endoscopy solutions for use in anesthesia, cardiology, neurology, pulmonology, urology, and gastroenterology.

Source: Ambu A/S.

The case for single-use products versus multi-use products plays heavily into this investment case. It would seem counter-intuitive to use such sophisticated products just once and then dispose of them. However, factors such as the enormous cost for professionally cleaning these instruments or the lack of available facilities for such cleaning in less-developed countries give Ambu an interesting edge.

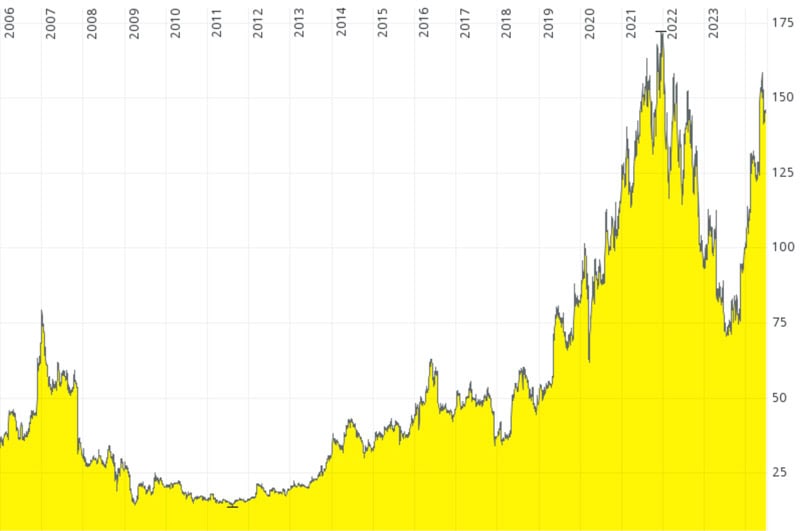

Between 2011 and 2021, the stock went from DKK 5 to DKK 350. It then crashed to as low as DKK 73 in November 2023. Now trading at DKK 135, it's still way off its former high.

Ambu went through a difficult period when it had to replace management, redevelop products, and tackle its high debt load.

It did carry out a capital raise in 2023, and can now look forward again, which even includes a tentative plan to eventually pay out a dividend to shareholders.

Danish bank SEB looked at the stock in a 3 May 2024 research note:

"On track to beat and raise: We now forecast 15.5% y/y group organic sales growth (previously 9.6%), to align with the company's preliminary result. On the divisional level, we now assume 22% y/y organic sales growth for Endoscopy Solutions (increased from 19.2%), 11% for Anaesthesia (previously 3%) and 5% for PM&D (previously -7%)."

Contact me if you'd like a copy of the report.

To fully understand this highly specialised sector and Ambu's prospects, a deep dive would be needed, rather than just a one-hour company visit. However, it does appear like the company is gaining positive momentum again, which could also drive its stock.

Source: SEB, 3 May 2024 (metrics based on price of DKK 117).

Many learnings, and many new connections

When I organise these trips, I try to squeeze as many company visits into the schedule as possible.

The other companies who were so kind to host us were:

Bavarian Nordic (ISIN DK0015998017, CPH:BAVA)

Vaccines against infectious diseases and cancer

Ørsted (ISIN DK0060094928, CPH:ORSTED)

#1 worldwide for offshore wind farms

Lundbeck (ISIN DK0061804697, CPH:HLUN-B)

Pharma for brain disease

Vestas (ISIN DK0061539921, CPH:VWS)

Wind turbine manufacturer

Royal Unibrew (ISIN DK0060634707, CPH:RBREW)

Danish beer brands and strong presence in the Baltics

Naturally, a two-day field trip is limited in both scope and depth, and it won't turn you into an expert for that country's public companies. Still, with the right line-up of meetings and an open-minded approach, you'll be able to develop a sense if an opportunity is worth keeping on your radar. Our group felt that Denmark offered a surprising number of world-leading companies with great long-term prospects. Given that this is a country with less than six million people, it really does punch above its weight.

As ever with these trips, we also had great fun as a group, and all made new friends. Participants had flown in from the US, Israel, Germany, Singapore, and the UK.

Keep your eyes out for a potential third and final trip this year. I have tentatively scheduled to lead a group of fund managers and accredited investors to Saudi Arabia during w/b 21 October 2024. Get in touch if you'd like to join; I'm now going to make a final evaluation as to whether the trip will go ahead.

Weird Shit Investing 2024 – The Manual

26 "weird shit" investing ideas from the Weird Shit Investing 2024 conference.

Crisis investing?

Banned investments?

Unusual financing structures?

Niche alternative assets?

Niche, exotic markets?

Very complex investment cases?

The misfits and iconoclasts of the investment industry have given it their all, and produced a two-page summary of their favourite investment case.

What is is about, what makes it interesting and weird, and what is the valuation and return profile?

The Weird Shit Investing manual has you covered.

It's available entirely for free – exclusively for subscribers of the (equally free) Weekly Dispatches.

Weird Shit Investing 2024 – The Manual

26 "weird shit" investing ideas from the Weird Shit Investing 2024 conference.

- Crisis investing?

- Banned investments?

- Unusual financing structures?

- Niche alternative assets?

- Niche, exotic markets?

- Very complex investment cases?

The misfits and iconoclasts of the investment industry have given it their all, and produced a two-page summary of their favourite investment case.

What is is about, what makes it interesting and weird, and what is the valuation and return profile?

The Weird Shit Investing manual has you covered.

It's available entirely for free – exclusively for subscribers of the (equally free) Weekly Dispatches.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: