Can you name an event that hardly any investor is currently betting on?

A peace deal between Russia and Ukraine must be one of it. It has long been akin to treason to mention as much as the possibility of peace negotiations. As a result, hardly anyone has positioned their portfolio to benefit from such a development.

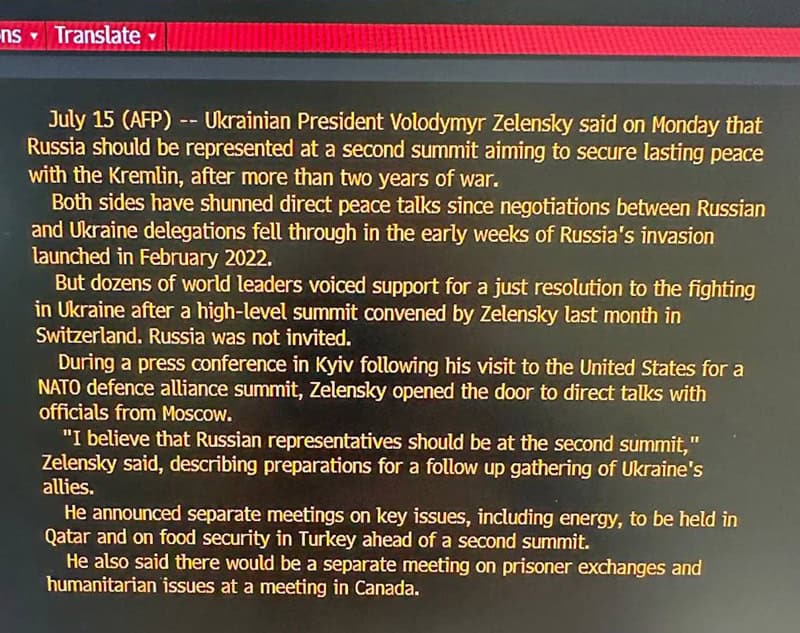

However, on 15 July 2024, AFP reported that "Ukrainian President Volodymyr Zelensky said Russia should be represented at a second summit aiming to secure lasting peace with the Kremlin. … During a press conference in Kyiv following his visit to the United States for a NATO defence alliance summit, Zelensky opened the door to direct talks with officials from Moscow."

Add to it a potential Trump presidency, and there could indeed be a chance of a peace deal with Russia.

Could it really happen? No one knows for sure.

But it's an interesting intellectual exercise to ask which stocks would benefit.

Source: AFP, 15 July 2024.

The value of being outside of the consensus

All wars come to an end eventually. When the shooting is over, the rebuilding begins.

The reconstruction of Ukraine has been a subject of conversation since the early phase of the war. As far back as July 2022, Zelensky stated that the eventual reconstruction of his country would become the “common task of the entire democratic world” after the war with Russia ends.

Two years later, the question of when this war will end continues to be a divisive issue. While Undervalued-Shares.com doesn't hold a particularly strong view, it's worth highlighting once again that investors need to bet on developments that markets have not yet priced in.

As pointed out in the 20 December 2019 Weekly Dispatch on "Non-consensus viewpoints":

"To succeed in investing, it's not enough to be right. You have to be right AND outside the consensus.

This is a little-understood quirk of the stock market. Imagine a group of one dozen analysts who follow a particular company. If they all expect earnings to increase next year, then the stock price will usually already reflect that. There is hardly ever a pay-off if you are right but merely within the existing consensus. The consensus will almost always be priced in already.

To significantly outperform the market, you will have to come up with a prediction that you are not only proven right on but which others do not yet believe in."

The possibility of seeing a negotiated end to this war in the foreseeable future certainly remains outside of the consensus.

Is it a zero-likelihood event, though?

Hardly.

Even avid followers of Zelensky will have to admit as much, following his statement of 15 July 2024.

So what's at stake, and why should investors care?

A new Marshall Plan

When the shooting stops, an intense discussion about Ukraine's reconstruction is guaranteed to happen, for all the obvious reasons:

- The native population that remained in Ukraine will want to rebuild their country.

- For many Western leaders, securing Ukraine's future is a high-priority item, supported by at least a significant part of the electorate.

- A reconstruction would be a financial bonanza unlike few before. It represents an opportunity for a massive wealth redistribution from Western taxpayers to those involved with the reconstruction. Corporate lobbyists in Brussels and elsewhere will go into overdrive mode to make it happen.

The numbers are going to be staggering.

When Zelensky spoke about reconstruction in July 2022, he mentioned that a USD 750bn reconstruction plan was required.

Ever since, various experts and organisations have published varying figures about what's required. No one can really know for sure, and the costs for reconstructing a country usually exceed the initial estimates. After all, which government budget for a mega-project ever turned out too low?

Source: Hudson Institute, 16 June 2024.

In any case, it will be in the hundreds of billions. The most-commonly used figure in public conversation seems to centre around the USD 500bn mark. Actual physical damage to Ukrainian infrastructure is estimated to be well into the triple-digit billions, e.g. an estimated 10% of the country's housing stock got destroyed in fighting. There'll be additional costs for aspects such as:

- Rebuilding civil society and governance.

- Making Ukraine a potential showcase country, e.g. for so-called green energy.

- Administering everything.

Who is going to pay for it?

The European Union has very much tied its flag to the mast when it comes to supporting Ukraine. Even if the US under a potentially different government decided to reduce or even stop support for Ukraine, Brussels will likely pick up the tab.

There is also always the possibility of mobilising private capital. In fact, on 16 July 2024, the EU stated that rebuilding Ukraine could not happen without private sector capital:

"European governments must step up efforts to incentivise the private sector to invest in Ukraine to fund the war-torn country's significant recovery and reconstruction needs, a senior EU offcial said on Tuesday (16 July).

Pierre-Arnaud Proux, deputy head of the inter-institutional unit coordinating Ukraine's relief and reconstruction at the European Commission, noted that the €50 billion in funds pledged by the EU under the bloc's Ukraine Facility to support Kyiv's reconstruction falls well short of the country's estimated investment needs, which hover right below the $500 billion mark.

'What is important is to [...] try to leverage and make sure that we can get the private sector on board because public resources alone will never make it,' Proux said during an online event organised by the European Policy Centre (EPC).

'[Ukraine's] needs are enormous,' the EU official said."

Outside of the EU, international funding organisations such as the EBRD, EIB, World Bank, EBRD and IFC have all stated that they would help out. The EU aims to set up a coordinating platform for these different efforts.

It begs the question, who is going to benefit from all this reconstruction work – and how can you get in on the act?

Ukraine's needs for reconstruction are undoubtedly gigantic.

Which companies to bet on

Following a hot war, the immediate tasks at hand include rebuilding residential real estate, roads, bridges, and energy infrastructure. There is an obvious opportunity for construction and civil engineering companies.

Enterprises that take on such jobs will more likely be from the same region, and more likely from the territory of EU member states.

This brings Austrian Strabag (ISIN AT000000STR1, VIE:STR) to the fore. Strabag is the largest construction company in Austria and one of the largest construction companies in Europe. Given Austria's location far to the East – Vienna is further East than Prague – it seems likely that Austrian companies are going to be well positioned for taking part in Ukraine's reconstruction.

Strabag specialises not just in construction in general, but specifically in civil engineering and transportation infrastructure. The company takes care of railway construction, sewer engineering, pipe and sewer construction, town planning, paving large surfaces, road construction, traffic engineering, waterway construction and similar areas, and it already has a strong presence in the Central and Eastern Europe (CEE) region.

Austria's Porr (ISIN AT0000609607, VIE:POS) is another Austrian construction company specialised in civil engineering. With a market cap of just EUR 550m, it's a fraction of the size of Strabag. Notably, a decade ago, Porr was already involved in the construction of Ukraine's "Beskyd" tunnel.

Last but not least, Austria's Wienerberger (ISIN AT0000831706, VIE:WIB) might have a role to play, albeit a different one. Its specialty is the construction of residential real estate. It also covers ancillary areas such as plastic pipes, pavers, façade, ceramic pipes, and roof work. With significant exposure in Poland, the Czech Republic, Hungary and Romania, Wienerberger already has experience in the region.

Several million Ukrainians are currently in Poland, and Polish companies could position themselves for Ukraine's reconstruction simply by way of having many Ukrainian staff members. Polish equivalents to the Austrian companies mentioned above would include:

- Budimex (ISIN PLBUDMX00013, WSE:BDX), Poland's largest construction company.

- Polimex Mostostal (ISIN PLMSTSD00019, WSE:PXM), one of the largest Polish engineering and construction companies and a general contractor in the field of industrial construction.

- Śnieżka (ISIN PLSNZKA00033, WSE:SKA), a manufacturer of paints used in construction. The company previously generated 10% of its revenue in Ukraine.

Outside of these obvious candidates, some lateral thinking helps to find the less-obvious stocks.

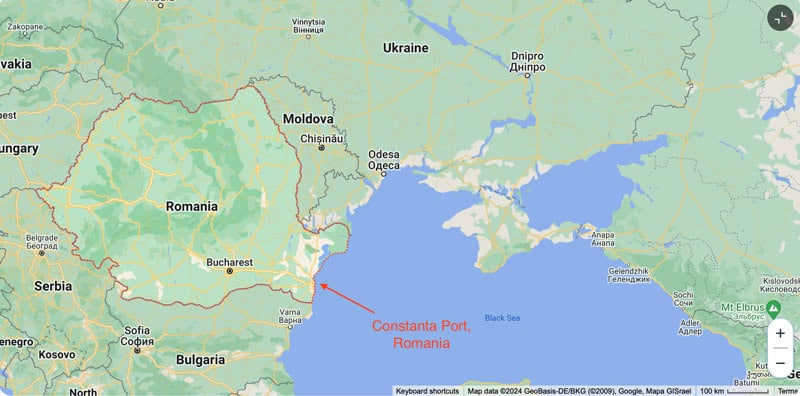

Worth mentioning is TTS Transport Trade Services (ISIN ROYCRRK66RD8, BX:TTS), a Romanian-listed company that provides river transport services on the Danube, and port services in Romania's Port of Constanța on the Black Sea. The closure of Ukrainian ports created additional demand for alternative routes, e.g. for grain exports, which means that major reconstruction efforts could lead to rising demand for transport services (although they would also go along with an eventual reopening of repaired Ukrainian ports). Notably, TTS stock is up 150% since the war broke out.

Romania's Port of Constanța.

Polish specialty retailers also deserve a closer look. The majority have some kind of presence in the Ukrainian market, and they enjoy a degree of customer loyalty in the country. As a result, it will be much easier for these companies to scale up their operations.

Names to keep an eye on include:

- LPP (ISIN PLLPP0000011, WSE:LPP), a Polish multinational clothing company.

- CCC (ISIN PLCCC0000016, WSE:CCC), one of the largest European companies in the footwear sector.

- Wittchen (ISIN PLWTCHN00030, WSE:WTN), a Polish company in the area of luxury purses and suitcases.

- Answear (ISIN PLANSWR00019, WSE:ANR), a digital sales platform for branded clothing, footwear, and accessories.

Ukraine has long had a large diaspora, and since the outbreak of the war several million more Ukrainians have either relocated or registered abroad. Precise figures are difficult to obtain, given the overall chaos and the inconvenient issue of probable large-scale refugee benefit fraud. In any case, the number of Ukrainians that are either based abroad or regularly travel abroad is massive. Travelling to and from Ukraine would likely increase once peace returns. Travellers could rely on the services of Wizz Air (ISIN JE00BN574F90, UK:WIZZ), the Hungary-based but London-listed low-cost airline specialised in the CEE region. To a lesser extent, the same could be true for Ryanair (ISIN IE00BYTBXV33, ISE:RYA).

These are just some of the potential winners of a reconstruction boom in Ukraine.

No doubt, there'll be many more. How about companies specialised in mine-clearing, or construction? Are any of them publicly listed? I found none, but if you know of a suitable play (or have further ideas), please get in touch.

The investment industry is forever looking for themes. Once topics like "ESG", renewable energy and climate change ran out of steam, the industry suddenly rediscovered defence stocks – which previously had been considered impossible. What's the next hot trend that no one is expecting right now?

Could we see a "Ukraine Reconstruction ETF"?

I wouldn't be surprised.

The risks and challenges

Needless to say, none of this may ever happen. Peace in Ukraine and a beginning of reconstruction could be years away. Just look at what happened to Afghanistan, where the conflict had dragged on for no less than two decades.

Also, it may simply be that Ukraine cannot be rebuilt. It was an absolute basket case of a country even before the invasion, and had never managed to get back to its pre-1990s level of GDP per capita – unlike Russia, which already reached this level in 2006. Since the war broke out, what little Ukraine had in terms of a functioning economy has been decimated. In 2022 alone, Ukraine's GDP fell by 29.9%.

Will the Ukrainians who have now been given a chance to live abroad ever want to return? Many might want to stay well clear of their home country's corruption, which many believe will never go away (and may even be fostered by Western interests).

Ukraine's well-known massive problem with corruption may, indeed, be the #1 factor standing in the way of rebuilding. In 2015, The Guardian highlighted this issue with its article "Welcome to Ukraine, the most corrupt nation in Europe". According to Transparency International’s 2021 Corruption Perceptions Index, Ukraine ranked #122 out of 180 countries, placing it alongside countries such as Zambia, Gabon, and Mexico.

A former Strabag CEO once said that in Russia, it was somehow possible to do business, but in Ukraine, it was always impossible, due to the high degree of corruption. Given that Russia hasn't exactly been a beacon of good governance either, that's a damning assessment and should give food for thought. Will any of the companies mentioned above even be interested in getting involved?

Throw in labour shortages, and what will likely be a fairly strong resistance among remaining Ukraine-based Ukrainians to bring in large numbers of workers from the global South.

It all begs the question, can Ukraine actually be rebuilt – even if there is peace within the foreseeable future?

Barely any debate about all this is currently going on among investors. It's a classic non-consensus view to take a look at.

It's also a subject where you can find interesting niche plays, if you know where to look for them.

A niche play on a deal with Ukraine

A stock with more immediate upside if peace comes to Ukraine?

The latest report for Undervalued-Shares.com Lifetime Members – out this week – features a stock that has 4x upside if a deal with Ukraine were made.

This investment depends on Russian equities becoming tradeable again in some shape or form – but if they do, this stock could move quite quickly.

In fact, it has already started to do so – but it's not too late yet to take a closer look.

A niche play on a deal with Ukraine

A stock with more immediate upside if peace comes to Ukraine?

The latest report for Undervalued-Shares.com Lifetime Members – out this week – features a stock that has 4x upside if a deal with Ukraine were made.

This investment depends on Russian equities becoming tradeable again in some shape or form – but if they do, this stock could move quite quickly.

In fact, it has already started to do so – but it's not too late yet to take a closer look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: