Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

San Francisco real estate – a proxy for the death of woke?

The signs have been everywhere for at least a year. The wave of woke policies is receding, even in uber-woke Silicon Valley circles.

No other city had suffered more under such policies than San Francisco.

Is real estate in the Bay Area a proxy for changes in the political landscape? Could the city's upcoming mayoral election in November accelerate the trend? And the key question for investors: how to best play this theme?

The problem child of American cities

Amid the noise about the US presidential election, few outside of California follow San Francisco's upcoming mayoral election. In 2019, the city's mayoral election cycle was aligned with the US' presidential election cycle, which makes the election get drowned out in the much bigger noise from Washington. No traditional March primary is held; instead, all the contenders appear on the November ballot. Right now, no fewer than 13 candidates are vying to be ranked as favourite by the electorate.

San Francisco's current mayor is London Breed. She was initially appointed interim mayor when the previous mayor died in office in July 2018, and got re-elected for a full term in 2019. Even though Breed will have inherited many problems from her predecessor(s), it was during her time in office that San Francisco went from a city with merely serious problems to one that became the global posterchild of failed "progressive" policies.

Who could forget "Snapcrap", the free app that invited its users to take photographs of faeces on San Francisco's streets and sidewalks. When yours truly last visited in October 2018, San Francisco's issues with homeless and drug addicts already looked like a dystopian nightmare. I am reliably informed that it all became a lot worse thereafter.

Source: GovTech, 19 November 2018.

The formerly elegant city has become a byword for homelessness, drug use, mental illness, and street crime. As tech billionaire and San Francisco resident David Sacks describes it: "In my home town of San Francisco, Democrat rule has turned the streets of our beautiful city into a cesspool of crime, homeless encampments and open drug use."

San Francisco's Tenderloin district.

Crime has become so bad that major retailers have exited the city. Famous downtown retail stores such as Macy's, Nordstrom and Westfield have closed their Union Square locations. While the general crisis of retail and company-specific issues will always have had an impact on these decisions, the knock-on effects of rampant crime in a city where police has stopped responding to shoplifting incidents under USD 950 will also have played a significant role.

Tourism has been way down as a result of all these developments. Infamously, San Francisco became the only negative outlier in the post-pandemic recovery of the US hotel industry across major US cities, with 23% lower average hotel prices.

All of this caused a serious quality-of-life challenge for residents. In October 2023, the US Census Bureau highlighted that 8% of San Francisco's population had plans to move away in the next year – the highest percentage by far for any US city (Chicago and New York stood at 5% and 3%, respectively).

It's a remarkable fall from grace for a city that was long known as one of the most desirable places in the US – and it also left a mark on the real estate market.

Office buildings took the brunt

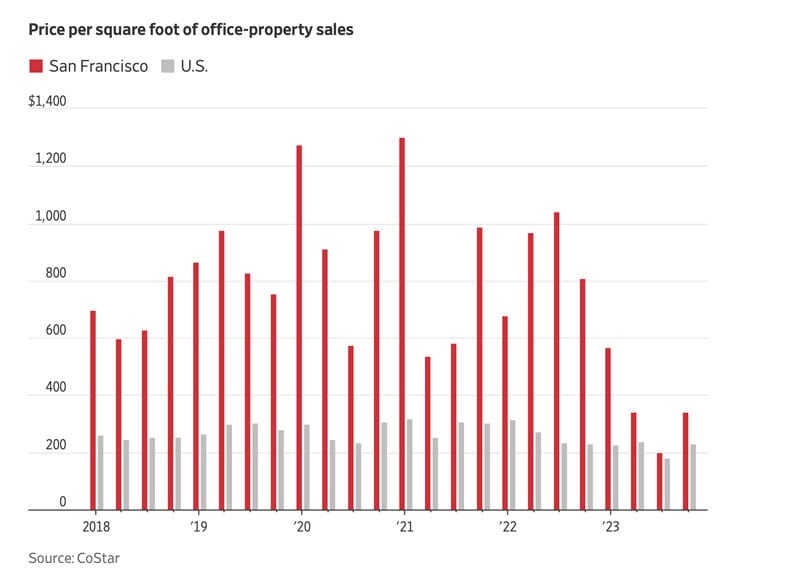

In 2020, 10% of San Francisco's office space was vacant. Most recently, this figure was an almost unbelievably high 37.5%. New York has been in the news lately because of its issues with vacant office space, but the Big Apple's rate of 23.5% pales in comparison to San Francisco. To have over a third of its office real estate lay empty is an unprecedented move even for a market with a well-established "boom and bust" history.

As ever, a confluence of factors are at work. During the pandemic lockdowns, San Francisco's tech workers were ideally suited for working remotely. Then again, many had already grown tired of having to avoid stepping into human faeces when leaving the office to go for a coffee – provided they could even still go to their favourite café or restaurant, as many had closed their doors. Just as any city is a complex fabric of factors and circumstances, so does a city's decline make for a complex subject to analyse.

A wave of foreclosures and firesales has undoubtedly set San Francisco's decline.

Recent examples include the iconic office buildings Market Center and 111 Sutter. While these were purchased in 2019 at prices of USD 722m and USD 227m, respectively, New York real estate firm Paramount Group recently marked them down to zero.

Some of these buildings are now valued at ZERO.

As The Wall Street Journal noted on 30 April 2024: "The exodus of workers and businesses during the pandemic left San Francisco a shell of its former self."

When entire office buildings are marked down to zero, you just have to ask the question: is the market approaching the bottom?

The US is a country where cities do go through pronounced boom-and-bust periods, only to come out stronger. Yours truly experienced as much in the early 1990s when visiting New York City, which at the time was considered a no-go zone with an incredibly high murder rate. Following Rudy Giuliani's election as mayor and the subsequent clean-up, Manhattan recovered, and prices for some office buildings increased tenfold from their crisis lows.

Could San Francisco's upcoming mayoral election prove a similar catalyst?

Mayoral candidates pushing for change

It's remarkable how the city's incumbent mayor, London Breed, retains a lot of support. Even though 71% of Bay Area residents disapprove of her work, she is currently widely seen as one of the most likely candidates to win the election.

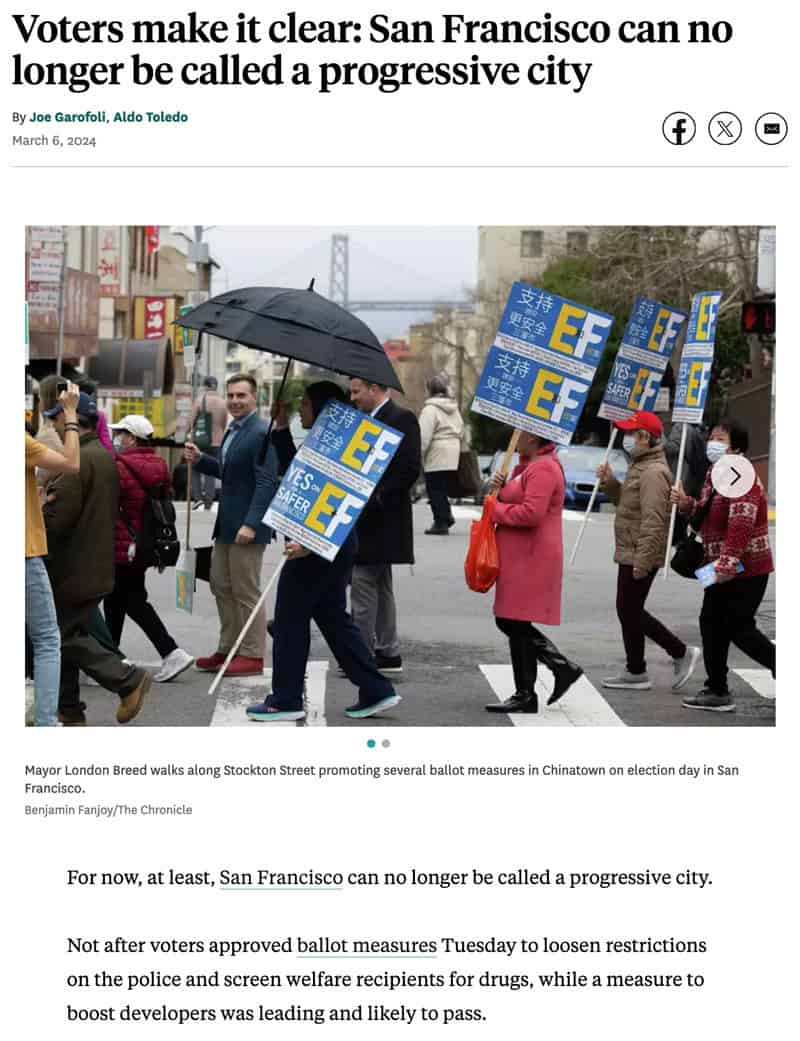

Reportedly, the rates of retail theft and auto smash-ins have been on the decline recently, thanks also to enhanced operations by the city policy. Breed is also campaigning for decisions that would grant the police more crime-fighting powers, including an increased use of drones and surveillance cameras. She also wants single adults on welfare to be screened and treated for illegal drug addiction, as a prerequisite for continuing cash assistance.

Empty promises by a politician willing to promise anything to cling on to power?

Breed's track record is not in her favour, but she also had to operate in a truly unique environment. In San Francisco, a large part of the electorate have long favoured existing policies so as to be seen as virtuous and "progressive".

Given how San Francisco has potentially reached a doom-loop-scenario, to what extent may voters now be ready to back significant change?

Right now, the upcoming election is too close to call. All of the leading mayoral candidates are Democrats. However, candidates also include Mark Farrell, former interim mayor of San Francisco whose programme makes him sound almost like a Californian version of Rudy Giuliani.

As Farrell told CNBC: "Unfortunately, our city now ranks dead last in economic recovery post-Covid. And that, to me, is an embarrassment and it needs to change."

If elected, Farrell promises to be aggressive in beefing up police staffing and clearing all large tent encampments. He also wants to create policies and incentives to bring downtown workers back to the office. His proposal is to create a 20-year vision to revitalise the city's downtown area, starting with tax incentives for businesses if they agree to make their staff come to the office four days a week.

Farrell also promises to clean up the famous park outside of the Ferry Building on the Embarcadero, and to increase options for more housing by changing building height regulations and bringing in aggressive incentives, including for the potential conversion of some office space into residential property. By the end of his first term, Farrell wants to have cut San Francisco's office vacancy rate by half.

If Farrell or any of the other candidates deliver, how could investors benefit from San Francisco's reversal of fortune?

Office properties at record-lows

There are a couple of listed office real estate investment trusts (REITs) with heavy exposure to San Francisco. Unsurprisingly, their stocks are down 60-70% compared to their pre-pandemic prices.

One that stands out is Paramount Group (ISIN US69924R1086, NYSE:PGRE), whose real estate portfolio is focused on San Francisco and New York. Given how New York has many of the same issues as San Francisco – albeit to a much lesser extent – you could view it as a double-play on the same theme. Paramount's stock was trading at USD 15 before the pandemic, and is currently still down two-thirds.

Paramount Group.

Other examples of REITs with strong exposure to San Francisco include Hudson Pacific Properties (ISIN US4440971095; NYSE:HPP), and Kilroy Realty (ISIN US49427F1084; NYSE:KRC). These two stocks are down 87% and 62%, respectively.

Such REITs are probably the next best option compared to joining more specialised investment entities on private markets. One such focused effort was recently started by Ian Jacobs, a value investing disciple and heir of the Toronto-based Reichmann real-estate dynasty. The Reichmanns had made a fortune buying properties in nearly bankrupt New York City during the 1970s, and Jacobs is now attempting to do something similar.

On 11 February 2024, The Wall Street Journal reported:

"Most investors are running away from San Francisco's downtown real-estate market, but Ian Jacobs is heading in. … The 47-year-old spent much of the past year getting financial commitments from relatives and other wealthy families to snap up San Francisco office buildings, people familiar with the matter said. Now Jacobs has to prove wrong the prevailing wisdom that downtown offices, especially those in San Francisco, will never fill up again

Ultimately, he hopes to buy 3 million square feet of office space for prices about 70% below what it would cost to build the properties, according to marketing materials for the project viewed by The Wall Street Journal."

When office buildings sell at two-thirds less than replacement costs, value should be had.

Could San Francisco become a revival story indeed, or even the posterchild for a city that was beholden to woke policies but eventually broke free? Could it yet "do a Giuliani" and enter a new era altogether?

Is right-leaning the new progressive?

"Was this the year of peak woke?", the Financial Times already asked on 29 December 2023.

Surprisingly, female voters could turn the tables. San Francisco has a famously left-leaning population and that won't change – just as much as there isn't a single right-leaning candidate among the leading candidates for mayor, if one wanted to stick to the old-fashioned (and possibly outdated) left-right terminology. However, woke female voters had been a major force in San Francisco's past politics, and they could now also be the ones who trigger change. In a choice between feeling virtuous and feeling safe, women are more likely to vote for a candidate who promises safety. Safety from harassment, theft and worse is now a major concern for anyone who lives in San Francisco. Most woke women I know don’t actually hold particularly strong political believes, but instead merely parrot talking points they picked up somewhere and/or which they believe will make them look virtuous. Faced with real-life dangers, they could turn on a dime when it comes to their voting. This wouldn’t necessarily show up in polls ahead of voting day, given how charged the political environment is.

Interestingly, a closer look at the candidates of the upcoming mayoral election shows that even the leading Democrat candidates are now favouring what would have formerly been the reserve of the Conservative spectrum. More policing, cracking down on welfare abuse, and physically clearing away homeless encampments would not normally be associated with the typical San Francisco voter or politician. Yet, it's now entered the city's political mainstream. In March 2024, Breed was publicly attacked for her new policies, which some claim have put an end to San Francisco being a progressive city and represent a "rightward shift". San Francisco's politicians shifting to the "right", the horror!

Throw in other emerging factors, such as the investment boom in AI and how that is bringing a new start-up scene back to San Francisco. The city may yet turn around – it's not like there weren't at least some promising signs.

On the other hand, the oversupply of office space in San Francisco is so stark that no landlord will regain any real pricing power anytime soon. Working from home is not going to go away. The US now has other powerful centres for venture capital and tech, such as Texas and Florida. Elon Musk has moved X (formerly Twitter) out of San Francisco, and plenty of other companies have also moved away. Then again, given how bombed-out the market is, it wouldn't take much for a first wave of speculative money to trigger an initial recovery.

During my 30+ years in markets, there haven't been many cases where you can buy real estate in a world-famous, Western city for 70% less than replacement value.

Being about as far away from the West Coast as you can be (geographically speaking), I'd love to hear from local readers and anyone who has already taken a closer look at the subject. Are there other San Francisco-related investment ideas that I should look at? Where am I off, and what did I miss?

A niche play on a deal with Ukraine

The latest report for Undervalued-Shares.com Lifetime Members features a stock that has 4x upside if peace came to Ukraine.

This investment depends on Russian equities becoming tradeable again in some shape or form – but if they do, this stock could move quite quickly.

In fact, it has already started to do so – but it's not too late yet to take a closer look.

A niche play on a deal with Ukraine

The latest report for Undervalued-Shares.com Lifetime Members features a stock that has 4x upside if peace came to Ukraine.

This investment depends on Russian equities becoming tradeable again in some shape or form – but if they do, this stock could move quite quickly.

In fact, it has already started to do so – but it's not too late yet to take a closer look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: