Image by Below the Sky / Shutterstock.com

Many mistakenly believe that Guyana is located in Africa – when it's actually nestled right next to Venezuela.

The country has seen some of the world's largest offshore oil discoveries, and its economy is on steroids.

Are there any investible assets?

Could a locally listed farm be the most interesting Guyana investment there is?

Today's Weekly Dispatch explores these questions.

It also features an exclusive video interview with Cody Shirk, my American colleague and friend, who researched Guyana using his well-known boots-on-the-ground approach.

The incredible growth of a tiny country

In 2015, ExxonMobil discovered oil off the coast of Guyana.

The discovery changed the course of the country. Long one of the poorest nations of the Western hemisphere, Guyana has since become the world's fastest growing economy.

Since 2015, its GDP per capita has more than quintupled. In 2022 and 2023, its economy grew by 67% and 33%, respectively. Another stunner of a year is forecast for 2024, with 34% GDP growth.

The former British colony benefits from a large amount of oil wealth spread around a relatively small population of 800,000 people. Per head, there is twice as much oil as in Saudi Arabia. To put things in perspective, Guyana's landmass is nearly as big as the UK, but it only has 1.2% of the UK's population.

Georgetown – Guyana's capital.

The Financial Times summarised the situation in a feature on 25 June 2024:

"The giant Exxon project that could create the world's last petrostate

The US energy giant and its partners, Hess and Chinese group Cnooc, have already discovered about 11bn barrels of oil in the Stabroek Block, a vast oil reservoir about 120 miles off the coast of the South American country.

More than $55bn of investment has been sanctioned to extract just under half of those reserves, but after making more discoveries, the consortium is scaling up production.

'The way in which we've been able to progress so quickly from discovery to development and production, that is of huge value to Guyana,' says Alistair Routledge, ExxonMobil's Guyana president. 'It could deliver well over $100bn to the country.'"

Just a week ago, ExxonMobil reported that it had reached 500m barrels of oil produced in Guyana since output began in 2019. The goal is to lift production to 1.3m barrels per day by 2027, up from currently 650,000 barrels. In comparison, the UK's North Sea produces just 1m barrels per day.

With quick resource wealth come social problems. Prices in Guyana have skyrocketed, prompting the BBC to ask "Will Guyana's oil bonanza benefit its poorest people?"

Supporters of the country's energy projects claim that they will bring untold riches to the population. Indeed, Guyana recently started to hand out cheques to its citizens, including the Guyanese diaspora of 400,000 people, who the government encourages to come back as it needs more labour to support the strong economic growth.

Source: Business Insider, 17 October 2024.

Guyana makes for a fascinating case study of a country, and it will only continue to rise in prominence.

Someone else who also caught onto the Guyana story early on is Cody Shirk, the American entrepreneur, investor, and writer. Cody has visited Guyana repeatedly, and even met the country's president (see his website and YouTube channel for travel notes).

When I visited Cody in West Palm Beach last week, I had a chance to pick his brain about investing in Guyana. While walking along the beach, we recorded a 29-minute conversation covering a wide range of issues concerning Guyana.

Listen to Swen and Cody discuss Guyana investment opportunities.

As we touch upon in the video, investing in Guyana is possible through a range of options.

Energy stocks with Guyana exposure

Guyana is bound to be an oil- and gas-based economy, which makes stocks from this sector the most obvious option.

Canada-listed ECO (Atlantic) Oil & Gas (ISIN CA27887W1005, CA:EOG) owns exploration areas in Guyana, but also in Namibia and South Africa. Its stock briefly spiked tenfold in the late 2010s but has since drifted down. It's now 93% off its former high and has a market capitalisation of just CAD 66m.

It's similar in the case of CGX Energy (ISIN CA1254055066 , CA:OYL), a Canadian exploration company that is also developing the Berbice Deep-Water Port in Guyana. The company currently has a market cap of CAD 66m after losing 95% of its value since a brief 2019 spike. CGX is part-owned by Frontera Energy (ISIN CA35905B1076, CA:FEC), a Canadian company with oil projects in several Latin American countries, and currently valued at CAD 660m.

London-listed Tullow Oil (ISIN GB0001500809, UK:TLW) had a presence in Guyana when I first reported about the country, but it has since sold its Guyanese activities.

The large players in Guyana are ExxonMobil (ISIN US30231G1022, NYSE:XOM), Hess Corporation (ISIN US42809H1077, NYSE:HES), and China National Offshore Oil Corporation (ISIN HK0883013259, HK:0883) – all of whom own stakes in the same project, Stabroek. ExxonMobil owns 45%, Hess holds 30%, and the Chinese own 25% of the project that covers 6.6m acres. Chevron (ISIN US1667641005, NYSE:CVX) made a bid for Hess a year ago, and ExxonMobil has since been trying to block the merger on the basis of claiming a right of first refusal for Hess' Guyana stake. The stock of Hess is currently more of a merger arbitrage play, and the legal situation is expected to drag into 2025.

For anyone looking to get quality exposure to the Guyana opportunity, ExxonMobil is the stock to look at. Somewhat surprisingly, this single project in tiny Guyana makes up a significant part of the oil giant's business. Alongside the Permian Basin in the United States, the offshore oil fields in Guyana represent one of ExxonMobil's most crucial growth assets and an increasingly vital part of its global portfolio, as analysed by OilPrice.com in August 2024: "ExxonMobil's Guyana Oil: A Trillion-Dollar Opportunity?"

ExxonMobil.

Oil-related plays also exist for the other Guianas. TotalEnergies (ISIN FR0000120271, FR:TTE) and APA (ISIN US0374111054, Nasdaq:APA) have been drilling in neighbouring Suriname, which used to be called Dutch Guyana.

As oil and gas plays go, these stocks are also always set within the dynamics of global energy markets and the overall valuation of that sector.

Is any of them a screaming buy right now? Much depends on your view of the oil and gas markets. As a country that is firmly in the sphere of influence of the US and NOT located in the Middle East, investing in Guyana could be an interesting way for investors looking for income-generating investments in the energy sector.

As ever, there are also the inevitable junior mining plays:

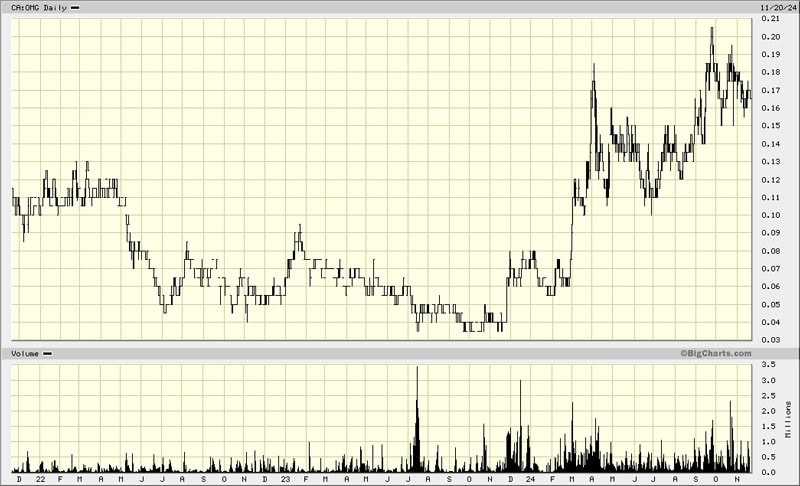

- Canada-listed Omai Gold Mines (ISIN CA6820431048, CA:OMG) is working to breathe new life into the old Omai gold mine in Guyana, which between 1993 and 2005 profitably produced 300,000 ounces of gold a year even though gold was trading at just USD 400 per ounce then. The company's stock has quadrupled over the past year and now has a market cap of CAD 90m.

Omai Gold Mines.

- Gold Port Corporation (ISIN CA38068W1086, CA:GPO) is working to develop a historic gold resource in Guyana, but it only has a market cap of CAD 1.2m.

- Guyana Gold Corporation (ISIN US4035281025, OTC:GYGC) has a market cap that doesn't even reach the seven digits anymore.

To the best of my knowledge, there are no other internationally listed Guyana-related plays.

In Guyana itself, though, the universe of public companies is surprisingly diverse.

Going local – the Guyana Stock Exchange

Guyana does have a stock exchange, and it is home to no less than 18 companies. For a country of less than a million people, that's good going.

As you'd expect to find in a frontier market, it's mostly a mix of companies from basic industries:

- Caribbean Container Incorporated

- Citizens Bank Guyana Incorporated

- City Jewelers and Pawnbrokers Limited

- Demerara Bank Limited

- Demerara Distillers Limited

- Demerara Tobacco Company Limited

- Global Trust & Investment Company Limited

- Guyana Bank for Trade and Industry Limited

- Guyana National Cooperative Bank

- Guyana Stockfeeds Incorporated

- Humphrey & Company Limited

- P. Santos & Company Limited

- National Bank of Industry & Commerce Ltd

- Property Holdings Incorporated

- Republic Bank (Guyana) Limited

- Rupununi Development Company Limited

- Sterling Products Limited

- Trinidad Cement Limited.

Can anyone actually buy and sell these stocks?

As Cody told me during our conversation:

"I have a good friend who invested in the Guyanese Stock Exchange. In 2019, he told them to give him the six most liquid stocks. He put in a meaningful amount. He sold out of all of them a couple of years ago and doubled his money on all of them.

If you want exposure, you go to the Guyana Stock Exchange website. They have several brokers. You do not have to go there, instead you can register everything online. Of course, there is a ton of paperwork."

Is any one of these stocks interesting enough to bother?

One might just be.

Guyana's mystery farm

To give credit where credit is due, it was Cody who first pointed me towards this company – and my ears perked when he revealed details.

At this year's Weird Shit Investing conference in New York, he told the assembled audience of fund managers and investors about "the largest ranch in the world". The Dadanawa Ranch started out as a trading post about 1865, and in 1919 it turned into the Rupununi Development Company (Guyana:RDL).

Information is difficult to find, but it appears that the ranch comprises about 1,700 square miles (4,400 square kilometres, or 1,100,000 acres), which would make it the largest ranch in the Americas. While there are companies in South America with larger acreage, such as Argentina's CRESUD (ISIN US2264061068, NYSE:CRESY) with 2m acres, these are operations with multiple farms and spread around several countries.

One obvious problem with the Dadanawa Ranch is that it's extremely remote, even by the standards of the more adventurous traveller. There are no well-kept roads, and you'll probably have to charter a bush plane to get there. The value of such remote land will be limited, at least for now. Also, much of it is savannah and may not have much use at all. Apparently, even during its heydays, the ranch never had more than a few tens of thousands of cattle.

The Dadanawa savannah.

The massive land ownership does make you wonder, though: is there an undervalued land play waiting to be discovered?

It's a question that desktop researchers can find at least some clues about.

Based on the information available online, the Rupununi Development Company has just 367,784 shares outstanding. The stock last traded at GYD 500 (Guyanese dollar), which converts into USD 2.40. Could a company that owns one of the largest farms in the world have a market cap of less than USD 1m?

Given how opaque and impenetrable the Guyanese stock market is right now, this wouldn't entirely surprise me. It's not clear, though, if these figures are correct and up-to-date. In any case, the stock is trading.

There are a couple of snags, though.

The Rupununi Development Company doesn't seem to have published an annual report since 2021 (or at least, it's not available online). There is no corporate website either.

The company does appear to be alive, though: this year alone has seen 47 trades in the stock.

There is also a question mark as to the actual size of the farm, and its legal ownership status.

According to historical records, the land was granted by the government as a lease for 99 years. Signed in 1919, the leasehold would have expired in 2018. Indeed, the company's 2021 annual report states that it handed in "the application to the Guyana Lands and Survey Department for renewal of the Manari and Dadawana leases now totalling 112,640 acres."

Were the leases ever renewed?

Had the farm somehow shrunk by 90%?

Might the land have been returned to the indigenous community?

Spending an evening scouring the Internet for information, yours truly wasn't able to find any definitive answers. Even the information about the possibility of visiting Dadanawa as a tourist is thin on the ground.

It did emerge, though, that the ranch had hit real financial trouble in the early 2010s. Back then, Guyana's largest insurance company, Hand-in-Hand, bought a controlling stake in the Rupununi Development Company. The Guyanese Stock Exchange website does list an address for the company, which is the same as the insurance company's.

The more enterprising sleuths among you may now set off to research this in more detail. Cody is planning another trip to Guyana; email him to check if you could tag along.

Alternatively – join the Weird Shit Investing conference

If you are into finding truly original investment ideas, then hit me up for the upcoming Weird Shit Investing conference.

In 2025, I will once again organise the event in London and New York – and quite possible, in Hong Kong, too.

Get more information or register your interest on the Weird Shit Investing conference website. I am looking for more potential participants for Hong Kong, in particular.

A more investible, immediate opportunity than Dadanawa Ranch...

... is this AIM-listed small-cap whose outright liquidation will happen before too long.

The return of all capital to shareholders should yield 2-2.5x over the coming 12-24 months, with low downside risk.

It's an opportunity that shouldn't even exist – but it does, because hardly anyone is even following AIM stocks anymore.

The AIM market's suffering is your opportunity, if you know where to look!

A more investible, immediate opportunity than Dadanawa Ranch...

... is this AIM-listed small-cap whose outright liquidation will happen before too long.

The return of all capital to shareholders should yield 2-2.5x over the coming 12-24 months, with low downside risk.

It's an opportunity that shouldn't even exist – but it does, because hardly anyone is even following AIM stocks anymore.

The AIM market's suffering is your opportunity, if you know where to look!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: