Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

European bank stocks – yet another stellar year ahead?

"European bank stocks could be in for a few good years", my Weekly Dispatch of 14 October 2022 predicted.

"The idea that a permanent goodbye to zero interest rates could lead to multiple expansion for European banks is a powerful one."

This was not a subject that many readers were interested in at the time, but it worked well.

European bank stocks have since been in a multi-year bull run.

Do they have yet further to run?

The story up to now

Last month, UBS published an extensive research note: "European Banks – The last leg of a five year bull run:

It's been another great year for European banks. This year the European bank sector has delivered 31% total return vs the market at 10%. ...

Despite a strong YTD run – helped by increasing bank rate hedging, better fee income, improving loan growth and higher equity markets – we think the European banks are still attractive at 7.4x FY25 and 6.9x FY26 EPS, yielding 6.7% and 4% more in buybacks.

… Banks trade at a 22% discount to their long run P/E multiple and 47% discount to the market, a 20% larger discount than usual."

Within the different subsets of European banks, UK banks have delivered the highest returns. Indeed, since that Weekly Dispatch from October 2022, the following UK stocks are up:

- NatWest: +81%

- Barclays: +76%

- HSBC: +63%

That's without taking into consideration the dividends paid in the meantime. For 2025, the expected dividend yields for these banks are 7.2% (HSBC), 5.7% (NatWest), and 4.2% (Barclays).

On top of dividend yields come share buybacks. Due to the changed interest rate environment, banks are producing a lot of cash. NatWest and HSBC are trading on a 9% free cash flow yield, while Barclays comes with 13%.

What else has the outperformance been driven by?

Outside of higher income from interest, European banks have generally exceeded expectations on non-interest income, and they benefited from their strong capital reserve ratios.

There is probably more to come

As UBS analysed, European bank stocks are still trading at a 47% discount to their historical P/E ratios, which is 20% higher than usual. If these stocks got back to their historical valuation multiples, that'd deliver a 20% return. Add the sector's average expected dividend yield, and you get to an expected return of 25-30% for the coming 12 months.

But how do you choose the right bank to invest in?

Many different sub-markets exist within Europe, never mind the different characteristics of individual banks.

Depending on an investor's preferences and goals, various themes could be played:

1. Interest rates

Depending on where you believe interest rates will go, there are some banks that are more aggressively geared towards playing interest rate changes than others.

E.g., banks in Italy, Spain, Ireland, and the Nordics are generally more sensitive to these changes than banks in the UK, France, Belgium, Netherlands, and Germany.

2. Emerging market allocation

With a stronger US dollar and potentially increasing tariffs, emerging markets are facing a risk of importing inflation. This is another complex subject, but some European banks (most notably, HSBC and Standard Chartered) have more emerging market exposure than others.

3. Capital market exposure and US exposure

Soaring equity markets in the US make for a brighter outlook for investment banking divisions and equity trading income.

Barclays generates about half of its group revenues in US dollars, thanks to its strong investment banking division and its US consumer credit operation. Barclays also happens to trade at a discount to other European bank stocks.

The winners overall?

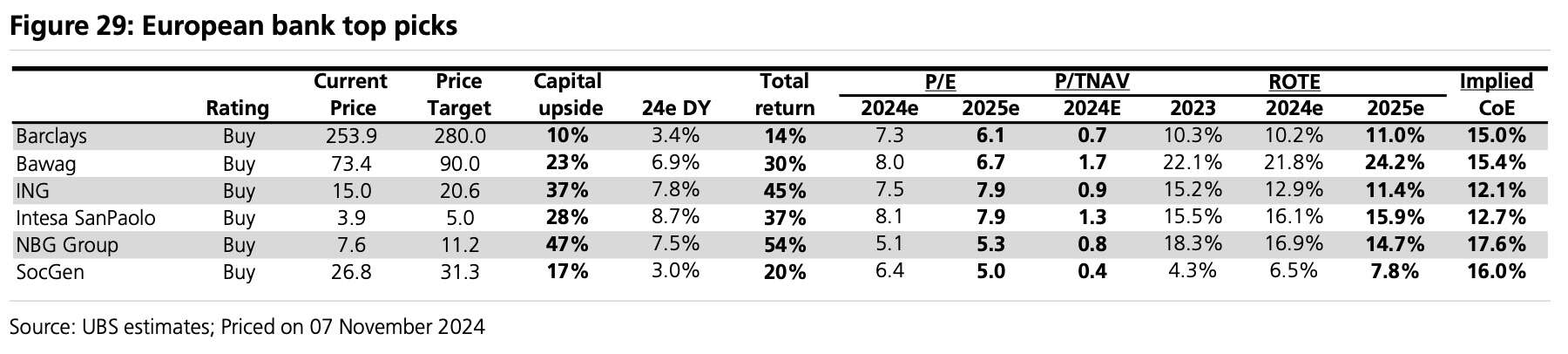

This is a vast sector, and large banks are complex to analyse. The top picks of UBS' research team include:

- Intesa

- ING

- National Bank of Greece

- Barclays

- Bawag

- SocGen.

The following table shows some of the key valuation metrics for these top picks.

Source: UBS, 11 November 2024 (click on image to enlarge).

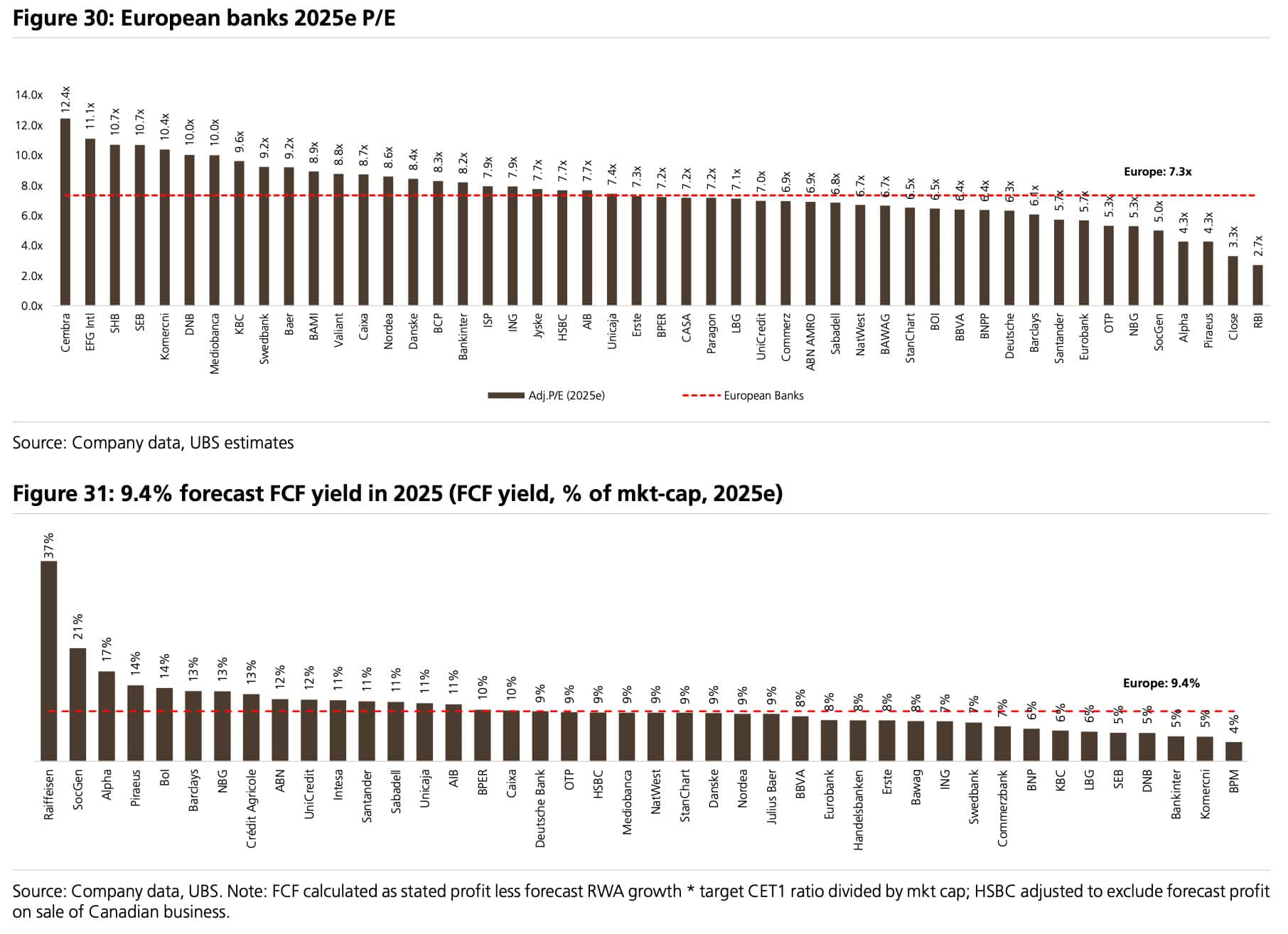

If you already own other banks and would like to check out how their stocks compare based on P/E ratios and free cash flow yield, check out the following two graphs.

Source: UBS, 11 November 2024 (click on image to enlarge).

The full, 30-page UBS research report includes all underlying data, including a a separate 25-page document packed with reams of valuation data. Get in touch if you'd like to receive a copy.

Hot off the press: new in-depth research report

Looking to buy a fast-growing, world-class tech company at a fraction of US valuations?

The company featured in my latest research report – out just now– hails from a small and exotic country, but it does not need to hide behind US tech firms such as Google, Apple or Amazon.

With a #1 market share in several sectors, off-the-charts financial metrics, and continuous high-paced growth, it offers 5x upside potential over the next 3-5 years.

Hot off the press: new in-depth research report

Looking to buy a fast-growing, world-class tech company at a fraction of US valuations?

The company featured in my latest research report – out just now– hails from a small and exotic country, but it does not need to hide behind US tech firms such as Google, Apple or Amazon.

With a #1 market share in several sectors, off-the-charts financial metrics, and continuous high-paced growth, it offers 5x upside potential over the next 3-5 years.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: