Companies that are left for dead sometimes contain valuable legal claims.

Once investors discover such claims, results can be quick and stunning.

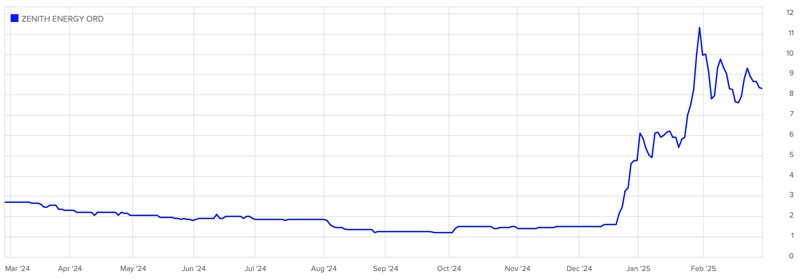

E.g., London-listed Zenith Energy had been written off by its shareholders. In December 2024, the market learned that the firm had three solid legal claims against Tunisia. An international court could soon award shareholders hundreds of millions in damages. In a matter of weeks, the stock rose 7x, from 1.5 pence to 12 pence.

Such instances have become more frequent in recent years.

Today's Weekly Dispatch explains the sector based around a specific case.

The company analysed in this article is bound to create waves in the time leading up to a specific date – 16 May 2025!

Outlier profits from unusual investment cases

The biggest profits are often made where the least people expect them.

Oftentimes, this requires picking up assets that are viewed as too toxic or too complex for other investors to bother.

Quite possibly the best-known such case is that of a specialised British finance firm investing in a legal claim against the Republic of Argentina.

When Burford Capital (ISIN GG00BMGYLN96, UK:BUR) purchased an expropriation claim involving the South American country, no one believed it would ever go anywhere. The expropriation claim seemed complex, and who would ever manage to collect money from the serial defaulter that is Argentina?

The claim was for billions of dollars of damages, but Burford Capital managed to secure it for the paltry sum of USD 18m. That was in 2015.

The company did have to shell out over USD 100m to pay for lawyers. However, it also resold parts of the claim along the way at a much higher valuation. Precise figures aren't known, but the British litigation finance specialist might have recouped more than its legal costs from the partial sale. In effect, it would have funded the legal costs out of the claim's partial re-sale and owned the remainder for free.

Fast-forward eight years, and the court awarded damages of USD 16.5bn. Burford Capital currently owns 38% of the overall claim. With (effectively) zero capital at risk, the firm won a claim (pro-rata) of USD 6.27bn. It's as close to generating billions out of thin air as you can get.

In this particular case, collecting the award is proving a challenge, because Argentina continues to drag its feet. However, while the issue drags on, the damages awarded gather additional interest. Besides, Argentina has a long history of eventually settling such international claims. Since the court case was won in early 2023, even sceptics admit that collecting some settlement amount has become a matter of when rather than if, even if it'll involve agreeing a haircut deal. Chances are, Burford Capital will recover about a third of the funds owed or USD 2bn. That'll have been over 100x the initial investment.

Nice work, if you can get it!

All of this was predicted in detail in a report sent to Undervalued-Shares.com Members in March 2022. Thanks to the Argentinean claim, Burford Capital has proven a good investment already, and probably with a lot more to come. That said, owning this claim through Burford Capital only ever gives you so much upside since this is just one claim in a big portfolio of legal cases.

Burford Capital.

As it were, outlier investments of this type are available for direct purchase by ordinary investors. If you know where to look, you can skip around middlemen such as Burford Capital and make multiple times your money out of such claims.

Undervalued-Shares.com has long had a passion for digging out such obscure cases:

- In a Weekly Dispatch in August 2022, readers learned about Rusoro Mining (ISIN CA7822271028, OTC:RMLFF and CA:RUS), which then was trading at 7 US cent. Its legal claim against the Republic of Venezuela subsequently propelled the stock as high as USD 1.11. More than one of my readers bought into it as a kind of smart lottery ticket, and then rode the stock to a multi-bagger profit.

Rusoro Mining.

- In a Weekly Dispatch in February 2023, I pointed towards the tremendously liquid pool of defaulted Lebanese bonds that is trading on international exchanges. The price for Lebanese bonds has since recovered nearly 300%. This was so liquid and easy to access that you could have invested in the tens of millions without any effort.

- Undervalued-Shares.com Lifetime Members learned about Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH) when it was primarily a legal claim against Italy. They were able to load up at prices between 9-14 pence, and the stock is now trading around 40 pence. The British firm had sued Italy for EUR 275m and was awarded EUR 190m. Here, too, did Italy drag its feet with paying. However, Rockhopper Exploration accelerated the payout by selling the court-verified claim to a specialised investor (which enabled it to invest the cash in its core business).

Rockhopper Exploration.

How can private companies possibly sue countries?

Can't sovereign nation states simply refuse to pay these awards?

How can you find such opportunities before they become more widely known?

All of the above was already covered in the April 2023 Weekly Dispatch "9 opportunities in litigation finance, defaulted debt and expropriation claims". I also published a slew of in-depth research reports about such cases, including the now-famous case of Gold Reserve (ISIN BMG4R86G1074, US OTC:GDRZF) with its claim against Venezuela.

Last but not least, I once summarised the entire case of long-forgotten Cuban debt from the pre-Castro era. This dated back to the 1930s. Speak of digging deep to find dormant legal claims!

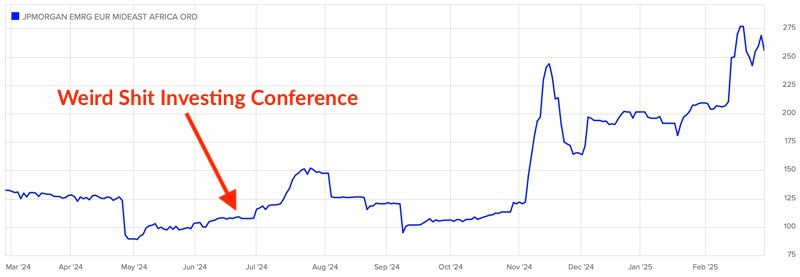

Similar cases were also a focus of last year's Weird Shit Investing conference, hosted in London and New York. E.g., one London participant presented an easy way to buy into frozen Russia-related claims by investing in a London-listed entity, JPMorgan Emerging Europe, Middle East & Africa Securities (ISIN GB0032164732, UK:JEMA). This was an opportunity to buy claims on Russian assets at 14% of their underlying value. Given recent news, this particular investment is now up 2.5x and suddenly getting a lot more attention. However, the easiest money has already been made. This included Undervalued-Shares.com Lifetime Members, who had received an in-depth report about this case in July 2024.

JPMorgan Emerging Europe, Middle East & Africa Securities.

Just how to get in on such opportunities early on?

London-listed Panthera Resources (ISIN GB00BD2B4L05, UK:PAT) provides a real learning opportunity. Aside from being a good case to educate yourself, it could also start to pay off handsomely between now and 16 May 2025.

The next litigation opportunity?

On 25 February 2025, Panthera Resources disclosed that it had just raised GBP 2.7m from investors. The placement was heavily oversubscribed, even though it had not been heavily publicised. Reportedly, investors only got about 35% of the amounts they subscribed for.

Panthera Resources is a company with a market cap of just GBP 24m and two nascent gold exploration projects in the less desirable parts of West Africa. Were investors eager to throw their money at early-stage gold projects in Mali? As far as mining is concerned, that country had recently made headlines for terrorists killing 25 gold mining employees in an ambush, as well as issuing an arrest warrant for an international gold mining CEO. It's hardly a tempting investment destination, at least for now.

What got investors excited wasn't Panthera Resources' gold prospects in West Africa, but an old legal claim against the Republic of India.

Aspects of this claim date back over 20 years, which is why the market had long forgotten about it.

In 2004, Panthera Resources and India signed an agreement for the company to prospect for gold in Bhukia in the Rajasthan region. Following its initial work, Panthera Resources located a potential 1.7m ounces – a remarkable find in its own right, and all the more remarkable given that the company had only prospected on 10% of the area. There were concrete indications to suspect that this could be a world-class gold mining district that extended far beyond the initial find.

Subsequently, the potential gold reserve turned out to be nearer to 7m ounces, putting Bhukia into the big league globally. However, Panthera Resources never got to develop and exploit the resource. The State of Rajasthan and the Republic of India didn't allow the company to follow through on the agreement they had signed – in effect, expropriating the company.

Disputes between mining companies and governments are common. In the past, might commonly beat right when a junior miner had an issue with the government of a host country. However, the playing field has changed lately, primarily because of the rise of litigation finance.

Specialised firms like Burford Capital have discovered that they can often buy a stake in legal claims at low valuations. Companies and investors that have run into issues with a government usually don't have the expertise or the cash to take on a sovereign nation and fight their corner. The likes of Burford Capital then come in with a tempting offer. They fund the entire legal case, provided they get a share of the proceeds if the case is won.

A firm like Burford Capital can provide the financial muscle and the legal expertise to take such cases through the legal system. Interestingly, this often doesn't have to involve the court system of the country where the issue arose.

The system for "investor-state dispute settlement" (ISDS) is not something that many members of the public would take an active interest in or even have heard about. It's a set of rules through which foreign investors can sue sovereign nations if they have been wronged in the context of their foreign direct investment. Crucially, this arbitration system bypasses the host nation's court system.

For shareholders of Panthera Resources, the ISDS could produce hundreds of millions in damages. If successful, this money will be awarded under a mechanism where the money can be collected quite easily, unless India wants to risk having its state-owned assets confiscated in Britain or elsewhere.

About bilaterial investment treaties

What Panthera Resources recently started to make use of is a little known but important arbitration mechanism that exists within so-called bilaterial investment treaties.

The world's 195 nation states have signed nearly 3,000 bilateral investment treaties with each other. In short, most foreign direct investment is protected under this type of treaties. Crucially, these treaties allow for a foreign investor to resort to international arbitration bodies to hold a country to account if a legal dispute arises.

An investor in developing or corrupt countries wouldn't want to rely on the court system of the country that they have an issue with, and they don't have to. Instead, they go the route of international arbitration. This protects them against local politicians influencing court decisions, or outright corrupt judges.

Major parts of the current ISDS system used around the world were implemented in the 1980s, with heavy involvement of the World Bank and other multilateral organisations. At the time, many developing or underdeveloped nations would not have had the court system to handle a case brought by a large foreign investor. In the absence of a reliable mechanism for resolving legal conflicts, large investors would have shied away from investing in the first place.

Most international treaties on investment provide considerable legal protection to foreign investors. The obvious right established in such treaties is the right to not be expropriated. This was an all too frequent issue during the 1960-1980s, when less developed countries often saw confiscating assets owned by foreign investors as a legitimate means to an end.

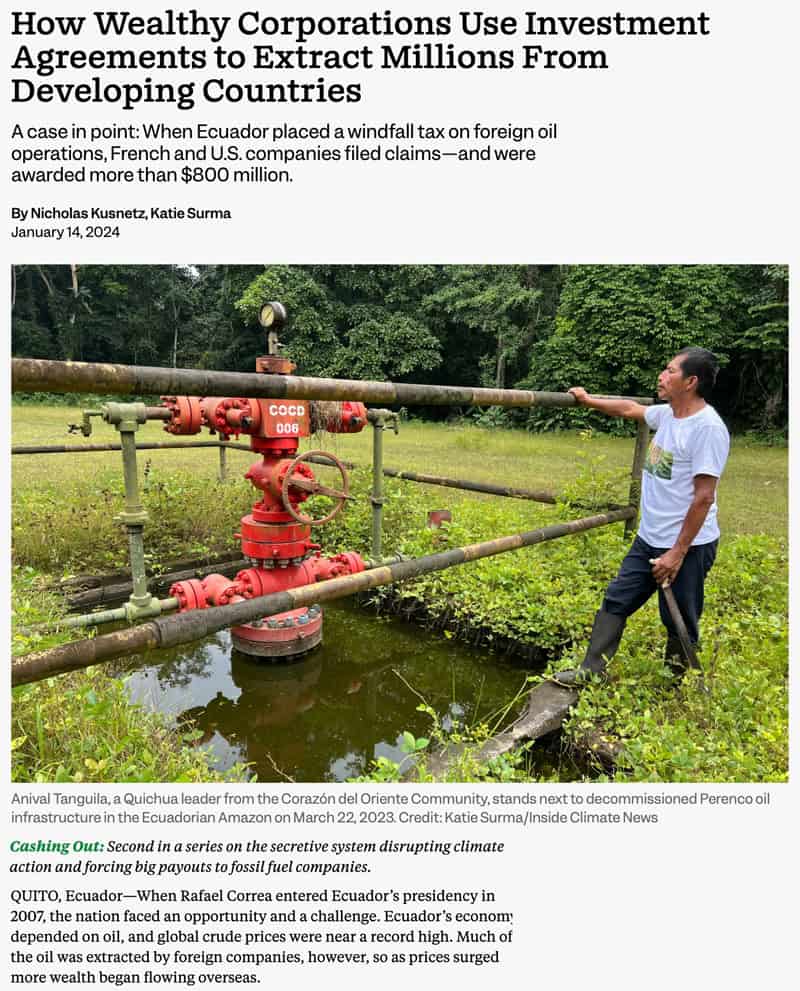

In today's world, outright expropriation is less of an issue, and maltreatment of foreign investors tends to be more complex. It often involves a government trying to retroactively change the economics of a project or not following through on legal obligations. This has better optics overall and gets you less criticism from the media because the intricacies are far more difficult to explain. It has the same effect on investors, though.

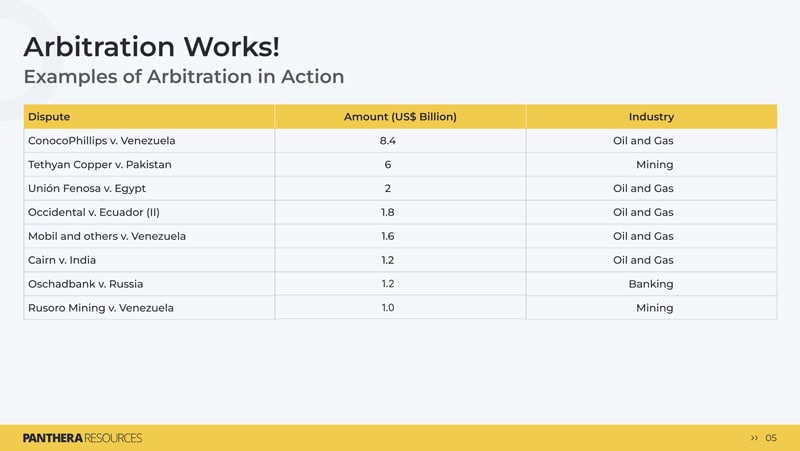

Given that there is no public register of such cases, it's difficult to assess how many of them prevail. One often-cited study from 2012 concluded that out of 244 cases analysed, 42% were decided in favour of the host state, 31% in favour of the investor, and 27% settled out of court. Given that a settlement out of court more often than not means the investor got paid a percentage of the damages claimed, it suggests that about half of these cases end with at least a partial win for the investor. In total, international investors have won over USD 100bn in compensation from nation states since the year 2000.

Over the past 15 years, so-called litigation funders have discovered ISDS claims as a highly profitable niche.

Source: Inside Climate News, 14 January 2024.

The biggest such litigation funder is Burford Capital, which claims to have delivered a win or partial win for 92% of its cases. The Guernsey-based firm can fund lawsuits of any size, and it probably controls about a third of the fast-growing global market for litigation finance.

However, Burford Capital is no longer the only sophisticated player. There is also Litigation Capital Management (ISIN AU000000LCA6, UK:LIT), a much smaller firm but with an equally impressive track record. Throughout its existence, LCM has scored a win in around 85% of its cases. It recently had to concede defeat in two high-profile cases and had its share price clobbered as a result, which goes to show that even the best litigation funders don't always get it right. Still, winning over 250 out of 300 cases across 25 years shows that the firm knows what it's doing. It manages a pool of USD 650m to fund cases, including bigger ones.

LCM's track record is undoubtedly due to the fact that it funds just 3% of the cases it gets offered (15 out of 500 cases presented every year). Being successful in litigation finance is all about having the expertise to analyse cases before taking them onboard.

Interestingly, there is no other case where LCM is known to be putting up as large an amount of capital to fight a case as for Panthera Resources.

The claim for damages could reach a billion US dollars even in a base case scenario. In one scenario that is less likely but still has a likelihood of more than zero, the claim could even reach multi-billions.

It's this legal claim that got investors excited about Panthera Resources' private placement earlier this week.

Staking the claim

In February 2023, Panthera Resources and LCM signed the following agreement:

- LCM will provide up to USD 13.6m to fight the legal case against the Republic of India (upped from an initial USD 10.5m agreed in February 2023).

- If the case is won or voluntarily settled, LCM gets a share of the damages based on a formula that considers the cost incurred, the absolute amount won, and the time it took to win the case.

- If the case is lost, LCM does not get anything, and its investment in the case is written off.

Following Panthera Resources' previous exhaustive efforts to resolve the case amicably and legally in India, it decided that pursuing the case through international arbitration mechanisms was the best way forward.

LCM took the case on after spending nearly a year working through 1,900 pieces of evidence that Panthera Resources had provided for its due diligence. Once LCM's funding had been secured, Panthera Resources formally filed its notice for arbitration in July 2024.

Such arbitration panels operate based on a fixed procedure, which among other early steps involves determining the legal seat of the arbitration case. On 10 January 2025, Panthera Resources reported that the legal seat of the case was going to be England and Wales (i.e., London). The United Kingdom is an arbitration location widely regarded as politically neutral and highly professional. Quite possibly, it's the best arbitration jurisdiction in the world.

The case will be heard in the context of the Australia-India bilateral investment treaty of 1999. Even though Panthera Resources is listed in London, the subsidiary that the claim is attached to, Indo Gold Pty Limited, is Australian-registered. Panthera Resources owns 97% of Indo Gold. The 1999 treaty is no longer in effect, but Australia and India had agreed that older cases would continue to be treated as having arisen under this treaty.

What LCM is not going to provide to Panthera Resources is the cash needed to operate the holding company, which includes annual costs for the board, accounting and auditing, and the listing in London. Panthera Resources also has to pay some upkeep for the gold prospecting licenses that it owns in West Africa (at least for now, until they are spun off with separate financing or handed back to the host country). It's for these expenses that the company has just raised GBP 2.7m.

Given the clearly defined procedure of arbitration cases, a decision in this case is due within three to five years. Panthera Resources is now fully funded until the end of the arbitration claim, which provides certainty about the share capital that any damages awarded will be split among. There won't be any further dilution until the case is decided.

Following the placement, Panthera Resources has a fully diluted share capital of 250m shares. The company is debt-free and at a price of 9.5 pence has a market cap of just under GBP 24m (USD 30m).

What's the claim going to be?

That's the million billion-dollar question that shareholders are now certain to learn the answer to no later than 16 May 2025.

How the case will unfold

Arbitration courts are geared towards being transparent and efficient.

One of their advantages is that they set out a clear timeline. In the case of Panthera Resources, it's now known that the company will have to provide its so-called Memorial no later than 16 May 2025.

The Memorial describes the entire history of the dispute. It includes all evidence, such as witness statements. It also includes the so-called statement of claim ("SoC"), which is the calculations that support the amount of the claim. It is an extremely extensive document, time-consuming and expensive to prepare.

As a publicly listed company, Panthera Resources will have to let its shareholders know what it actually claims as damages. It can do so once it has filed its SoC.

Internet fora that follow the company have long speculated that the claim will be in the region of USD 800m-1.2bn. In principle, USD 1bn should be the right ballpark figure for an analysis but there is reason to expect that Panthera Resources will actually pursue a slightly different course of action than what the market has been expecting so far.

As Undervalued-Shares.com has learned during its extensive research of Panthera Resources, something that is specific to this claim are several dates and events on which to base the calculation of damages. For this reason, there might not going to be one definitive SoC but a series of such claims, which then creates a range of possible outcomes.

For the sake of illustration, the two ends of the extremes would include:

- Panthera Resources being able to claim just its sunk costs, which would amount to a claim of about USD 30m plus interest.

- Panthera Resources claiming the royalties that India is now set to earn from the new owner of the mine, which could be a sum surpassing USD 10bn.

As ever, neither end of the two extremes are likely to happen.

What is certain, though, is that India has yanked a valuable asset from underneath the Australian entity. India has recently progressed to publicly auction the mine to a new owner, in a process that is still ongoing. Based on the information that is publicly available about the auction process, the Bhukia mining area is now recognised as one of the world's largest newly discovered gold fields, and several medium-sized mining corporations are vying to become its owner.

Based on one calculation, the Indian government could receive over USD 10bn in royalties from the mine. Had the Indian government not expropriated Panthera Resources, that's money that would be due to the company – and not including the money that the mine's new owner will earn for themselves. The recent increase in gold price only ups this figure further. Relative to the current size of Panthera Resources, the sums involved (at least in theory) are staggering.

With its auction of the Bhukia gold mining area and the documents created for the purpose of the auction process, India may have done the equivalent of delivering the smoking gun to the prosecutor of a murder case. It's an extraordinary set of circumstances!

What chance does the company stand to win its case?

The involvement of LCM is an indicator in itself, but even more interesting are the terms based on which the Australians are providing litigation finance.

As Panthera Resources disclosed in February 2023, LCM stands to receive 2-4.25x the money provided by LCM, OR (if higher) between 5-15% of the damages awarded.

Based on the market rates for litigation finance, these terms are quite advantageous for Panthera Resources. As one highly experienced investor in the field – who is a reader and friend of Undervalued-Shares.com – interpreted the agreement when I ran it past him: "I would say this reflects mostly the quality of the claim."

Anyone interested in Panthera Resources should keep the old German saying "On high seas and in courts of law, you are in God's hands" in mind.

Still, this case seems to be much better than a mere 50/50 coin toss:

- Even before 2012, around 50% of such arbitration cases ended with a win for the claimant. Litigation funding has only become more widely available since 2010. For cases since 2010, the overall likelihood of the claimant winning will have gone up.

- Once a few filters are applied, the likelihood increases further. E.g., LCM has won over 250 of its 300 cases ("winning" = getting out more than invested in a case).

- India made a few cardinal mistakes along the way. By putting the Bhukia gold field up for auction, it effectively demonstrated the tremendous economic value of the gold district. If India wanted to show to the world that it expropriated Panthera Resources because it wanted to pocket the gold district's billions itself, it could not have done so in a more effective way. This will even give Panthera Resources' lawyers many figures to base their case on. India's arrogance in this matter could cost the country dearly.

Sleuth investors willing to put in the time to research the Internet will be able to find other nuggets of information – pun intended!

E.g., the (neutral) chairman of the three-member arbitration panel appointed for the case of Panthera Resources has been involved in 46 such disputes, 17 of which ended in favour of the investor, 6 in favour of the state, 6 were settled through a compromise, and 1 found violations but without compensation. The remaining cases are still ongoing. Interestingly, he was the one who decided the now famous case of Rusoro Mining against Venezuela (and did so to the company's favour).

Investors with experience in this field know that arbitration cases will always carry a "smell". The case of Panthera Resources smells like it has a likelihood of succeeding that is far above 50%.

After all, the case fought by Panthera Resources will have had to convince a board and a management team to work on it, a highly sophisticated litigation funder to provide USD 13.6m of non-recourse fundingm an international arbitration body to accept the case, and three arbitration experts to agree to sit on the panel.

The company's CEO, Mark Bolton, has a history of getting involved in such cases. His track record stands at resolving 100% of all cases. He is incentivised through stock options.

These are many filters, and they all indicate that Panthera Resources has a case that's worth fighting for.

Soon, the market should start to recognise that, too.

Ride the litigation journey

It would be easy to fall for the misconception that such litigation claims are an entirely binary investment.

Of course, the final outcome will see the company either get compensation, or not.

However, the price of the stock is not a static value that will then experience a sudden change once a decision comes in. The market is going to bring forward the likely outcome of the case, based on a broader set of investors following the progress of the case. The share price of such cases goes through a revaluation curve.

Much as every case is different, there are some guidelines as to how such cases tend to be valued at different stages of the journey.

A claim that is left for dead and not actively pursued would typically trade at 1-2% of its value.

During the first half of a claim being actively pursued, the market would usually grant a valuation of 5-10% of the claim.

In the later stage and assuming the case is going well, the valuation would usually hover around 20%.

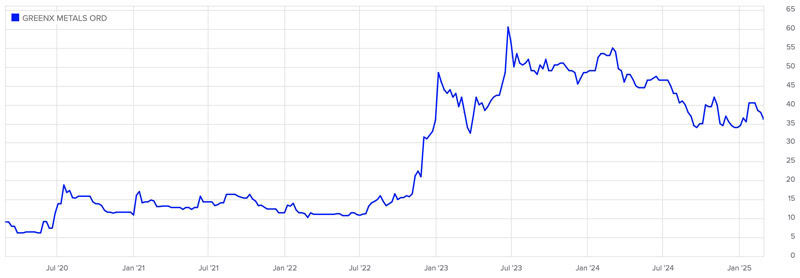

Once a positive decision has been achieved, the value would gradually approach the likely payout. E.g., the now famous case of GreenX Metals (ISIN AU0000198939, UK:GRX), formerly known as Prairie Mining, involved a London-listed Australian company taking the Polish government to arbitration. In 2020, the company demanded GBP 737m in damages under the Polish-Australian bilateral investment treaty. After the company got awarded GBP 252m (= 34% of its SoC), the claim traded as high as 80% of the damages awarded. Its share price rose from 11 pence to 60 pence when the decision came in (and after trading as low as 6 pence when the company was not yet actively pursuing the case, giving early investors a 10x return). It has now petered off to 38 pence because the Polish government is dragging out the collection of the payment. This may in itself be a good opportunity to get in now and treat it as an arbitrage case. Thanks to the bilateral investment treaty, GreenX Metals is entitled to interest accumulating while the issue of collection is worked out – but that's a story for another day. In the meantime, GreenX Metals has become a benchmark for such cases, also thanks to the amount of attention that the case had received in investor fora while it was ongoing. Besides, guess who funded the case of GreenX Metals? That was LCM, too. LCM does have a track record of working on mining-related cases.

GreenX Metals.

Delays to the collection of damages can hold back the valuation, but that's usually not more than a delay. Arbitration courts don't have an appeals process. Annulments of claims are possible, but they are only granted in the case of procedural errors such as an arbitration panelist turning out to have been bribed. Annulments are rarely awarded – at less than 3% of annulment applications, this risk is a non-event. The reason why Burford Capital struggles to collect funds from Argentina is because it won its claim in a US court rather than an international arbitration one. Cases that go through arbitration mechanisms agreed in bilateral investment treaties are vastly superior from the perspective of investors, because the nation states involved cannot wiggle their way out of it.

Remarkably, were India to lose the case, Panthera Resources could go ahead and confiscate state-owned assets.

In a past case (Cairn Energy – see further down), the winning claimant seized planes operated by state-owned Air India. This wouldn't happen anymore nowadays because Air India has since been privatised. However, trading nations can't operate without assets in foreign jurisdictions. There are always assets to seize, particularly when large economies like India are involved. E.g., most banks in India are government-owned, and India has foreign reserves internationally.

Source: BBC, 8 July 2021.

The sharp teeth of these international investment treaties have already made India pay up multiple times in other, even expensive cases:

- In 2011, Australia's White Industries won USD 4m compensation because it had suffered financially owing to unfair delays in Indian courts.

- In 2020, a British firm then known as Cairn Energy won USD 1.2bn in damages from India over retrospective tax claims. The company that today is known as Capricorn Energy did seize Indian assets abroad, which made India pay up.

- In 2020, Vodafone won a USD 2bn arbitration award relating to retrospective tax claims that India had thrust upon it without legal basis.

Source: Financial Times, 25 September 2020.

Were Panthera Resources to win its case, collecting the funds should not involve more than a delay, and with interest payable for each day of waiting. In fact, if you bought into the claim at a fraction of its value, receiving interest on the actual claim amount can be a lucrative profit on top of it all.

For the company's shareholders, any kind of win or settlement would most likely lead to their investment multiplying in value.

Panthera Resources currently is worth just USD 30m. The realistic SoC will likely be USD 1bn. Settlements and awards typically range between 20-60% of the claim's value. For Panthera Resources shareholders, once you factor in the pay-off for LCM, this would be akin to 5-18x the current share price.

Besides, there are two possible outlier scenarios:

- Panthera Resources winning a full USD 1bn, or nearly 30x the current share price once LCM has been paid its share.

- Panthera Resources being awarded compensation based on the royalties that India now stands to receive from a new owner of the mine. This could be equivalent to 100-200x the current share price.

I'd assign a low likelihood for the latter scenario, but the probability isn't zero either. Just as much, there is a small risk that Panthera Resources will only be awarded its sunk cost of USD 30m. This would then mean shareholders who buy on the current level get their money back. In a way, Panthera Resources is a lottery ticket where one bad scenario means investors coming out without a loss.

However, my base case would be Panthera winning USD 400-600m in damages, compared to its current market cap of USD 30m.

The stock is currently trading at 3% of the base case claim value. This leaves aside the money due to the litigation funder, but it also assumes the West African assets are worth zero, which they aren't. Much as Mali and Burkina Faso are currently not in vogue, some initial work of Panthera Resources in Mali yielded promising results. According to some observers, these West African assets may even be worth as much as the current share price. The company has made clear indications that it was preparing to spin them off in the foreseeable future – basically, as soon as possible within the constraints posed by Mali's current situation. Once it goes ahead, the spin-off will turn Panthera Resources into a 100% focused litigation play.

There are further nuances. Experience shows that the bigger the claim in absolute numbers, the higher the likelihood that the plaintiff will try to settle the case before the judgment. The entire case may come to a conclusion sooner than anyone thinks possible now. In fact, besides the figure stated above, this scenario is part of my base case. India will know that it kicked a veritable own goal, and the longer the country waits with a settlement, the more expensive it will get. Never mind the issues this case throws up in terms of India screwing a foreign investor, which can put off other cases of foreign direct investment.

Other pieces of the puzzle are now also starting to become clear. Upon contacting Panthera Resources, its CEO confirmed to Undervalued-Shares.com that "the company intends to distribute funds to shareholders" if or when it wins its case. This is an important statement, as it alleviates any fears that the damages won could end up anywhere but shareholders' pockets. Clarity over the special dividend is a major factor that the market will not have yet fully grasped yet as it was not previously a part of the conversation.

Once all of the above is taken together, it does make Panthera Resources one of the most promising cases in the niche sector of publicly listed litigation cases.

How much longer might the stock be available at such prices?

You be the judge, but typically such a stock would now gravitate towards 5-10% of its claim value. Provided, of course, you believe that the SoC will come out nearer to USD 1bn. There is no guarantee, but percentage likelihoods are heavily tilted towards this order of magnitude.

Also, a LOT of American money is currently eyeing up litigation finance. As the funding flooding into this sector increases, so do the valuations at the different case stages. This could be further aided by the hot-off-the-press news that a Chinese firm has just won a billion-dollar arbitration case against the government of the Philippines.

With all that in mind, you will probably read about Panthera Resources in other publications before too long. Its CEO takes pride in being easily contactable by investors and engaging with interested audiences (to the point of listing his mobile phone number in company presentations). The company has published his incentivisation scheme, and Bolton stands to gain a lot once the share price gets moving.

The stock has become an entirely different animal over the past few months. With the arbitration case filed, the seat of the arbitration hearing determined as London, and the general funding of the company secured until the end of the case, this has now become a focused, attractive case to latch onto.

Just like defaulted Lebanese bonds, old Venezuelan claims and the recent case of Zenith Energy (ISIN CA98936C8584, UK:ZEN), it's likely that the stock is going to revalue over the coming months. E.g., when Zenith Energy announced in December 2024 that the smallest of its three claims against the country of Tunisia and its state-owned oil company had been decided in its favour, the stock reacted with a 700% gain in a matter of weeks, even though the larger of the two claims is still going through the arbitration mechanism. The massive trading volume of the stock at the time and the subsequent GBP 2.9m placement that the company carried out illustrate the growing number of investors following these cases. Within just a few weeks, this case went from trading at 1% of its claim value to about 8% (before settling back at 5-6%).

Some even go as far as saying that publicly listed litigation cases are now worthy of being called an emerging asset class in its own right. If that was to happen, Undervalued-Shares.com would love to claim that it helped put this type of opportunity onto the radar of a larger number of investors.

Zenith Energy.

How is the case journey likely going to be for Panthera Resources?

For Panthera Resources shareholders, 16 May 2025 is now providing a clear focal point. The announcement of the all-important SoC will happen on that date, or earlier – after all, the company has had ample time to prepare. Its legal case has been prepared by King & Spalding, who in 2024 had been ranked leading international arbitration practice for the fourth year in a row. Along the way, Panthera Resources had its financier, LCM, sit on its shoulder as a wise owl.

Source: King & Spalding, 22 March 2024.

With all that in mind, the time to consider getting involved in this case is now. Luckily, there might even be a decent amount of stock available in the market.

A micro-cap stock with old shareholders switching out

How on Earth can such a situation even be available to invest into?

Panthera Resources' claim is now so old that many investors have never heard of it. Other investors – including some large holders of Panthera Resources stock – will have grown tired of it. E.g., Singapore's Republic Investment Management (RIM) recently reduced its stake in Panthera Resources from 6.24% to 4.79%. As far as Undervalued-Shares.com was able to ascertain, RIM is a portfolio manager that just follows instructions from clients. These clients invested in a mining story at the time, and they have now been electing to take the opportunity to exit. As ever in public markets, there are buyers and sellers. Who makes the better decisions will become clear later.

Litigation cases involving junior mining companies often see the original mining investors bail out because litigation finance is not their area of interest (just as much as litigation funders don't invest in mines). This is where the opportunity arises for other investors to step in and benefit from irrationally low valuations. In turn, this creates a window of opportunity to buy larger number of shares than what you might expect to be available in the case of a micro-cap. At Panthera Resources, ongoing shifts in its ownership structure could occur over the coming months.

Case in point, during the three days leading up to the publication of this Weekly Dispatch, a total of about 12.5m shares changed hands. Within less than a week, that'll have been about 5% of the entire share capital. It is a small amount in absolute numbers, but a large enough trading volume to allow individual private investors to put GBP 5,000 or GBP 10,000 into the stock. If it succeeds beyond expectations, such a small amount will have grown to the equivalent of a luxury car or maybe even a house somewhere affordable. Panthera Resources is the type of investment that private investors will look at with regards to potentially giving their entire portfolio a considerable boost, without having to put a large amount of money at risk.

A growing number of observers seem to have realised that in the days leading up to 16 May 2025, the stock is not likely to still be trading at its current valuation.

Panthera Resources last tried to settle with India in 2020/21. Within just three months, the prospect of a potential settlement made the stock rise 6x from 6 pence to 37 pence. These negotiations came to nothing in the end, but it shows how violent the market can react once there are news about the possibility of something happening.

Panthera Resources.

Given what's at stake now and based on a clear timeline backed by a top-notch litigation financier, who'd bet against a similar development over the coming months? Any share price that is less than 5% of the expected SoC is probably "undervalued", to stick to the spirit of this website.

How to discover more such ideas

In case you wonder how Undervalued-Shares.com digs up cases like this, I can't claim credit quite to the degree that you may think.

Oftentimes, I have readers bring me interesting ideas. In particular, my group of Lifetime Members has turned out to be a highly knowledgeable, engaged group of investors who occasionally send me brilliant ideas. Such was the case with Panthera Resources, which an unnamed reader sent my way. You know who you are – thank you!

Inspirations from other private investors aside, there is a surprising scope of information resources even about the most arcane subjects and investments.

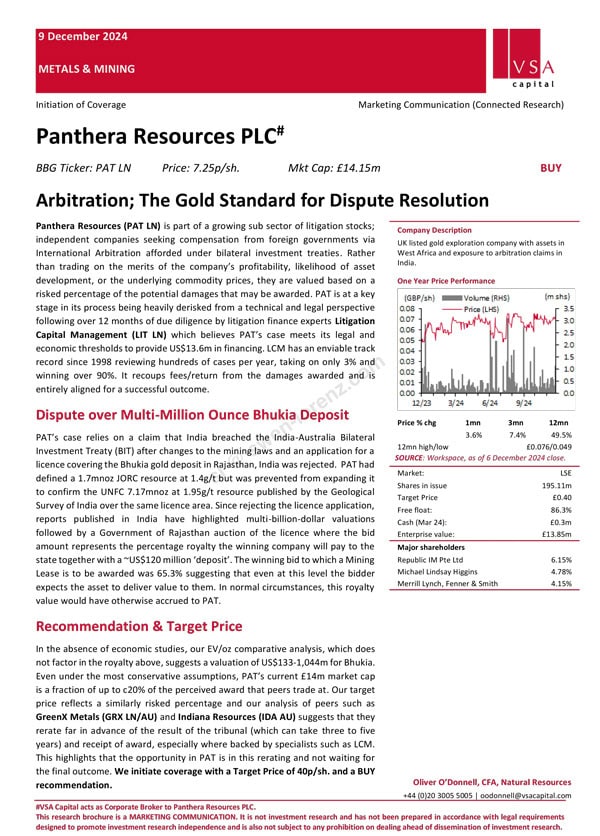

In the case of Panthera Resources, it's VSA Capital, a niche brokerage firm in London. Its technical research report on Panthera Resources, which also sets out comparative data and suggests an initial price target of 40 pence per share for the upcoming part of the journey, is free to access on www.research-tree.com (registration required).

Source: VSA Capital, 9 December 2024 (available via Research Tree).

Panthera Resources' CEO has also given several interviews, the most relevant one being a nine-minute update about the Bukia case.

Source: VSA Capital, December 2024.

Besides, there are some excellent resources on the Internet that are company-independent. One that is worth highlighting is the Twitter account of Marcin Michalek, a Polish private investor who has built up a following for his highly knowledgeable commentary about litigation opportunities. Marcin is a MUST-follow for anyone with an interest in the subject. He occasionally tweets about Panthera Resources, too, and arranged a Zoom meeting with the company's CEO earlier this year.

Join me in learning about other "weird shit"

More such opportunities are waiting to be discovered, and I have every intention to help other investors tag along for the journey.

To this end, I will once again be hosting the Weird Shit Investing conference. Today's Weekly Dispatch is my long-winded way of starting to officially advertise the upcoming second edition of this conference, which will take place in:

- Hong Kong (19 June 2025)

- London (24 June 2025)

- New York (26 June 2025)

The format is simple:

- In each city, 16 participants each present their outlier idea.

- In each city, 6 HNWIs and family offices can sit in as voyeurs.

- A one-page summary of each idea will be added to the Weird Shit Investing manual, which is distributed entirely for free to all subscribers of the Weekly Dispatches.

Last year's inaugural edition went well, but it also provided insights on how to improve the event further.

Notable changes this year will include:

- Smaller group size in each city, as it helps everyone make genuine, deep new connections with like-minded people they would have never met otherwise. As one participant put it in 2024, "meeting people was 50% of the experience".

- Strict vetting of participants. If you think a conventional "value investment" will get you admitted, think again. Some participants of the inaugural edition thought they could ignore the instructions and present a run-off-the-mill value investment. None of them will be invited back.

- Upscaling both venues and hospitality. We got to live a little, after all.

If you feel that cases like Panthera Resources are up your alley, and that you could come up with an unusual investment idea listed on a recognised stock exchange, I'd like to hear from you.

I have already locked in venues and next week will proceed with signing up speakers and voyeurs for the spaces that are still available. Now is the time to get in touch and indicate your interest! (If you already emailed me in the past, I have your records on file and will reach out in the next week.)

Undervalued-Shares.com will continue to bring you investment ideas that you cannot find anywhere else – backed up by the source material so that you can make up your own mind.

Out now: Buy Florida land – where it's still cheap!

Over the next 5, 10 and 20 years, Florida is bound to do well.

The latest report from Undervalued Shares – out today – deals with a region that could be the state's most exciting part for the next 20 years.

There is one stock that allows you to easily get exposure to this investment theme.

You can currently invest at a massive discount to its asset value and future potential – and could bag a 5x upside over 7-10 years.

Out now: Buy Florida land – where it's still cheap!

Over the next 5, 10 and 20 years, Florida is bound to do well.

The latest report from Undervalued Shares – out today – deals with a region that could be the state's most exciting part for the next 20 years.

There is one stock that allows you to easily get exposure to this investment theme.

You can currently invest at a massive discount to its asset value and future potential – and could bag a 5x upside over 7-10 years.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: