Statistically, you make your best financial decisions when you are 53-54.

As The Wall Street Journal once reported, "At around that age, people have accumulated knowledge and experience about money, spending and saving, but haven't begun losing key analytic cognitive skills."

Having just turned 50, I still have to wait a few years before I reach peak financial wisdom.

However, my round birthday today is too good a milestone not to write an article about what I have learned up to this point.

What are the 50 things that I would have loved to learn earlier?

#1: Don't believe that speaking to CEOs puts you at an advantage

I very consciously put this first.

Nothing else has cost me more money than speaking to CEOs.

CEOs cannot legally tell you anything that wouldn't already be available in print somewhere. They will woo and hypnotise you with their well-rehearsed spiel. Your objective judgment of the investment will suffer as a result.

It's much more effective to form your opinion based on your own, independent analysis of the publicly available material.

If anything, contact a company to fill in a few missing bits once you have finished your analysis.

#2: Portfolio concentration is important

Diversify, hedge your bets, spread your portfolio across many stocks. It must be the finance industry's most frequently dished-out advice. And who would disagree with "not putting all your eggs into one basket" since even your grandmother will have told you about that.

This advice is not wrong per se, but it won't apply to everyone and not at all times.

Everything depends on what you aim to achieve and where in life you are.

For some, diversifying could indeed be the wrong strategy. One of the inconvenient truths of the stock market is that very few people get rich through investing. You have a much higher likelihood of getting rich from starting and building a business. Trying to get rich on the stock market is tempting for all sorts of reasons, but it's insanely difficult.

Some say that spreading your bets and aiming to gradually get rich on the back of the economy's long-term growth is the only way the stock market could ever work in your favour. They aren't wrong, but their theory is up against some serious competition.

If you study the world's greatest investors, you will find that many of them completely ignored all advice about diversification. Going the opposite way led to immense riches, and for quite a few of them, rather quickly.

"When I've looked at all the investors (that) have very large reputations – Warren Buffett, Carl Icahn, George Soros – they all only have one thing in common. And it's the exact opposite of what they teach in a business school. It is to make large concentrated bets where they have a lot of conviction. They're not buying 35 or 40 names and diversifying. I don't know whether you remember that Icahn a few years ago put $5B into Apple. I don't think he was worth more than $10B when he did that. [In 1992] when I went in to tell Soros that I was going to short a 100% of the fund in the British pound against the Deutschmark, he looked at me with great disdain. He thought the story was good enough that I should be doing 200%, because it was sort of a once-in-a-generation opportunity. So, [these investors] concentrate their holdings. This is very counterintuitive."

Pretty clear words from someone who has been around for a long time, and who has walked the talk (see also my Weekly Dispatch "Concentrated bets – How the world's best value investors got rich").

And thanks to my broad readership and regular events with readers, I know many real-life examples of people who have made it on that basis:

- One of my readers put EUR 10k into a single investment and achieved a relatively quick 10x. He then traded his way up to several million within a few years. Without that first all-in bet, he would not have gotten there that quick – or at all.

- Another reader held a high-potential investment for years even when it didn't perform, which made him trail the market's overall performance for several years in a row because he had placed an outsized bet. Eventually, his thesis worked out. He achieved a 100-bagger ,and it had a transformative effect on his life.

- One reader has made over 30x his money over the past nine years, starting with a significant amount. One factor that played a role was that he occasionally used a degree of portfolio concentration that was higher than what you would have ever been allowed in a UCITS fund (where no portfolio position can be more than 10%).

Incidentally, some of these people turn up at the Weird Shit Investing conference that I organise once a year in London, New York and Hong Kong.

Further down, you'll read more about the value of meeting such people.

#3: Don't worry about being an amateur – revel in it!

Tying in with the list at the end of the previous point, I know a fair number of people who made some of their biggest gains when they were still relative novices.

Being an "amateur" does not need to stand in your way. It will make you question everything and not be held back by conventions (such as the financial industry's obsession with diversification, see point #2).

#4: Alpha is earned where no one else is looking

It's easy to say you have to be contrarian, but hard to do so.

I see as much in the metrics of my Weekly Dispatches.

E.g., in spring 2022 I published "Ukrainian agriculture stocks – land for 15 dollars an acre?"

At the time, Ukrainian agriculture stocks could be bought for the proverbial pennies on the dollar.

However, I can tell from speaking to many readers that hardly anyone took advantage of it. The war that was raging on at the time was the obvious reason.

Fast-forward to late 2024/early 2025, and anything I published about investing in Ukraine had metrics that were off the charts. Everyone and their brother suddenly was interested in investing in Ukraine.

However, by that time the prices of these agriculture stocks had already risen by 2-5x.

You have to invest when no one else dares to – simple as!

It's worth repeating this point over and over again, because it's so easy to speak about this yet so difficult to actually do it.

If placing a buy order doesn't make you break out in cold sweat, it's probably not a real contrarian investment.

#5: Don't get distracted from managing your money

The costliest period of my investing career was the 2008/09 Great Financial Crisis. Why did I get caught up in the crisis? Because I had taken my eyes off the ball.

My portfolio had done spectacularly well after the 2001-2003 dotcom crash when I bought into bombed-out equities. As a result of all the new money I had, I got operationally involved with a few private equity investments – more for fun and ego than anything else. I also enjoyed travelling the world in a more touristy way. I was extremely distracted AND complacent.

When the crisis started to unfold in earnest, I was on the back of a horse in South Africa's Cape region and didn't even have a mobile phone signal for most of that week. When I did hear about how bad things were getting, I didn't spend enough time to think about the consequences but went on enjoying my trip.

It all became rather expensive in the end.

I can directly trace back quite a few of my bad decisions to my lack of focus at the time.

If you want to properly look after your investments, there is no such thing as a day off.

Managing your investments and being serious about it requires a commitment. You need to be able to dedicate at least some time to it on an ongoing basis, and at times make it your temporary focus until things have blown over.

If you don't, you run the risk of Mr Market serving you a can of whoop-ass.

#6: Make sure you have investment buddies to swap notes with

Let's face it, we all live in our bubbles, and we all have our blind spots. If I could go back in time, I'd make sure that throughout my investment career, I'd always have a few buddies that I can share notes with.

You need a few friends who:

- Are well-informed and hold their own views.

- You can trust with the intimate details of your finances, and who do not hold back when calling out your BS.

- Are fun to talk to.

Call them buddies, colleagues, mentors, or whatever you like. Your investing skills invariably get better if you regularly discuss your investments, strategies, the market and other aspects with people who you can have a frank and informed conversation with.

If you don't have the right set of friends just yet, start by reading regularly about the experiences of other investors.

#7: Don't overpay on fees (for decades)

Here is an easy, quick win for you. It's one that to this day, too many people underestimate.

Financial services companies are really good at siphoning off excessive fees. Like, REALLY good. Often, you don't even notice what they are doing. Or you are too busy to care and too distracted by seemingly more important things.

Have you heard of the "no-fees" stock trading app, Robin Hood? Well, "no-fees" doesn't mean "free". These free brokers sell their order flow to market makers who charge investors excessive prices for the shares they are buying. In essence, their service amounts to charging you hidden fees.

There are pitfalls everywhere – the finance industry is a pool of sharks!

If you want to maximise your investment returns, you need to understand what fees you are paying and how they compare to the fees that other financial services providers charge for the same (or comparable) services. Over the years, it adds up mightily if you overpay on fees.

A penny saved is a penny earned.

We live in the day and age of quick, easy price comparisons. Anything you need to know is available on the web. Do yourself a favour and make use of this incredible resource.

#8: In the quest for minimising fees, don't fall for false economies

This may seem like a contradiction to the previous point.

Being too tight when it comes to paying fees can also work against you.

E.g., I have long believed in having ONE account with a private bank, no matter how high their charges. Every now and again, your investing career will throw you a challenge that the call centre staff at a discount broker could not resolve, or an opportunity that will require trading at more obscure markets.

Paying a good chunk of money to higher-end banks or brokerage firms has saved (and made) me a ton of money, because I was able to resolve unexpected problems that required someone with experience and decision-making power to help me.

#9: Learn early about shorting and hedging

I am an optimist by nature. Thinking about things going downhill – and making money off it – does not come naturally to me.

Shorting is about making money off falling prices.

Hedging is about securing an investment against losses.

The boundaries where one stops and the other starts are blurry. E.g., you can do hedging by shorting. There are many variations and strategies.

Looking back, I wish that I had spent more time early in my life to learn about shorting and hedging. It could have saved me a lot of money.

#10: Read OLD books

It will seem counter-intuitive, but old books are often helpful in predicting the future for investments.

Why?

- Plenty of books predicted the right ideas, but they were published ten, twenty or more years too early. You have to dust them off just as they become relevant again!

- History doesn't repeat itself, but it does rhyme. Knowing about stuff from the past long gone by will enable you to get a better understanding of the present and make more accurate predictions for the future. It will help you to at least get the overall direction of travel right, and that's as much as you need to do better than most other people.

I have generated outstanding investment ideas (and, sometimes at least, made heaps of money) by reading out-of-print books that others had long forgotten about. You could even go as far as calling this approach one of my secret weapons – not just with regard to investing, but life generally.

I have benefited repeatedly and strongly from this approach.

#11: Develop the ability to hang on to your long-term investments for really long

I bought my first Apple laptop in 2003. At the time, purchasing an Apple computer made you an outlier. Just 4% of computer sales were Apple, nearly everyone else used PCs with Microsoft's operating system. Only nerds had an Apple.

Right from the beginning, it was clear to me that Apple had vastly superior products. Not that many would have shared the assessment at the time. CNN Money reported in January 2003: "Sad as it may seem to the Mac enthusiasts, it's a Windows world. Wall Street doesn't seem to care too much about Apple, either. Only two of the 14 sell-side analysts that follow the company have it rated a 'buy'."

In retrospect, this was a valuable lesson about how the corporate media often trail behind emerging trends. I had seen all my friends struggle with their inferior Windows computers, but those with an Apple were extremely happy. All the clues were there.

I did buy Apple stock at the time because it was always clear to me that a growing number of people around the world were going to like these products. If only I had had the discipline to stick to my long-term view of the company. Apple stock was trading around USD 0.30 when I first invested in the company. It's now trading at USD 200. I can't remember when I sold, but it was way too early.

(Ditto for Bitcoin, where I dipped my toes in at USD 31 and sold at USD 6,000.)

Being a successful investor is a lot about simply not doing anything.

#12: Be hyperalert to the constant threat of "Black Swan" risks

What truly matters for your investment success, in the long run, is not to be wiped out somewhere along the way by a crash or a Black Swan event.

I repeat: don't get wiped out by a freak event!

In 2020, The Wall Street Journal published an article about people who lost everything during the coronavirus crash. "Bankrupt in just two weeks – individual investors get burned by collapse of complex securities" described one investor who had put his life savings of USD 800,000 into complex securities that were supposed to earn him a safe (and unusually high) income. This investment turned out to be a fair-weather one. Within two weeks, his portfolio got wiped out. He was 67 and retired, making it unlikely that he'll ever manage to get back on his feet financially.

That's the potential nightmare you need to avoid.

I once knew a self-made billionaire who lost everything during the 2008/09 crash. He, too, had previously thought "This sort of thing will never happen to me." He eventually threw himself in front of a train.

Make it a priority to secure your investment portfolio against the risk of being wiped out altogether. It's worth spending a bit of separate time on this question every month.

#13: Never forget about the need for humility

The stock market may well be the world's largest agglomeration of clever people. You must never underestimate what others know and how far ahead they are.

There'll also be plenty of people who have already experienced stuff that you can't even imagine exists.

As the old saying goes, "Pride will have a fall."

I made some of my costliest investment mistakes when I got cocky. Put a post-it on your freezer that it's vital to show humility in your investing. Or make your investment buddies (see point #6) remind you occasionally.

Being humble, and keeping in mind that you don't know about 99% of all things, will save you a lot of money over the course of your investing career.

#14: Learn about investment processes

The following is an inconvenient truth for me. If you pursue a structured process to identify, analyse, and manage investments, you almost inevitably become more successful.

What do I mean by "investment processes"?

An investment process is a series of repeatable steps that guide you through finding, analysing, and managing investments. Within each step, you have a set of rules you must follow before moving on to the next step. At the end of the process, you will have a complete and coherent basis on which to make a decision, and manage investments on an ongoing basis.

It's a rule book or a system.

I didn't spot the value of this until later in life.

"I've got my own way of doing things."

"I sense a good investment when I see one."

"Because of my experience, I don't need any rules."

These are all sentences you could have heard me say when I was younger. Today, I recognise the tremendous value created by building and following your own investment process.

For a start, it forces you to add to your skills. Creating a robust investment process invariably involves a variety of analytical steps that you are not yet familiar with – because there are so many of them!

To make a start, you can improve the process of analysing companies. My colleague Simon Kold from Denmark has published a book that I cannot recommend highly enough: "On the Hunt for Great Companies: An Investor's Guide to Evaluating Business Quality and Durability".

A process forces you not to cut corners but to look under every stone. It also prevents you from making impulse decisions, thus reducing your number of bad decisions.

#15: You only truly learn to trade and invest if you use your own money

I once helped a fund management firm in their search for a top-notch equity analyst.

What was the single-most difficult-to-find, highly-priced skill we were looking for?

It wasn't the ability to create financial models in Excel, or pull reams of data out of a Bloomberg terminal.

There was one magic, must-have factor: the winning candidate had to have the kind of experience that would enable them to not just look at investments analytically, but also with a gut instinct.

I am entirely serious about it.

Some of the best investment analysts and fund managers I know concur that:

- You do need to exert tremendous energy to analyse a stock using conventional methods because that provides the baseline for a decision (refer back to point #14).

- However, at the end of the day, the decision to invest (or not) is down to your gut feeling. And it's on that level where a significant part of the outperformance is created.

Nine out of ten candidates we looked at would have easily scored on the first point. But just one out of ten would even remotely qualify for the last point.

It's THAT rare a skillset in the investment industry.

It isn't difficult to figure out why this particular skill is in such short supply. You will only get this particular gut sense for separating the wheat from the chaff if you have been active in the markets yourself – for years and, crucially, with your own money.

Only when you put your hard-earned dough on the line will you start to think about your investments and watch their intricate movements on a daily (if not hourly) basis. The experience that you will gather from obsessively watching your wealth go up and down will be invaluable.

Don't do fantasy accounts or stock market games. If you only have EUR 500 (or USD 500) to start with, use a trading app to get started. Invest with REAL money, however little it may be.

#16: Seek an autodidactic education in personal finance

There is hardly an area in life that isn't affected by money and finances:

- Should you buy or rent?

- How best to plan for your retirement?

- What do you need to understand about insurances?

- Prenuptial agreement – yes or no?

If you get one of these questions entirely wrong, it could damage your life in a way that will take you years or decades to overcome.

Yet, how much do they teach you about these things in school, or even at home?

Your parents themselves were probably never taught by anyone. It's a persistent problem.

The good news is, you live in the golden age of digital information. No generation before you had access to so much (and often free) information, and you can fairly easily create a system of continually educating yourself about personal finance matters.

You'll have to create it yourself, though. No one else can determine your priorities at different stages in your life. If you don't make time for it, you will probably still get through life okay, but you'll have a lot of money snatched off you by prying hands along the way.

Amid your likely fascination with stocks, don't forget about all the other personal finance areas that will affect how you live, what you can afford, and how safe you (and your loved ones) will be throughout your life.

#17: A job in the corporate world will help your investing

Parents will probably love me for this one, and it's one of the questions I get asked about a lot. When I was young, I refused to pursue conventional employment. Because of that, I never saw a large organisation from the inside during my formative years. That only changed when I was 36 and became the CEO of an operation with 150 employees, 200 freelancers, and partner organisations around the world. It was the first time I was ever conventionally employed and had to work within a complex, sprawling organisational structure. The subsequent 3.5 years in this position have taught me a LOT about the workings of large entities.

Crucially, I've acquired skills that help me analyse publicly listed companies, and look at them from an inside perspective. This very different perspective is crucial to help you understand how these companies function (or, most of the time, *don't* function) – and you won't get it from reading books.

In retrospect, my investing career would have benefited significantly had I had ANY experience of working in an organisation earlier in life.

It's not so much about which position you have (even an internship will give you a glimpse of corporate life), but merely about being in the belly of the beast.

#18: Build a unique talent stack

The moment I became a university drop-out was when I sat down in a lecture hall and took in the sight of 700 (!) other students who had all started their first semester at the same time. I could not have formulated it in words back then, but I knew instinctively: "If they all study the same stuff that I study, how will I ever manage to distinguish myself from them?"

Becoming a university drop-out as someone with a German middle-class background in the mid-1990s was no picnic. Just about everyone told me I was throwing my life away. However, I did something that turned out to be much more valuable, even if at the time, I wasn't consciously aware of what I was doing.

I assembled a unique set of skills, which would set me apart from most other people. Dropping out of university didn't mean I didn't want to study. I simply decided that I needed to explore other things than everyone else. And study I did!

During my 20s, in particular, I was a complete readaholic and devoured what must have been hundreds of books about investing!

Today, I know that I was pursuing Scott Adam's theory about so-called talent stacks. Know as much as you can about a very diverse set of areas, and (crucially!) combined in such a way that you stand out.

That's what my studies of investing were all about.

However you go about building your knowledge of investing, try to do it in such a way that your collected skills and experiences are different from everyone else.

The question what sets you apart from everyone else is an inconvenient one because it does take real effort and the courage to get off your designated lane and do things your way. Also, it is not a question that you will find a definitive answer to. You'll have to develop your talent stack over the years, with lots of failure along the way. It never ends, at least not until you decide to call it quits on your career.

There is good news, though.

Now that you have made a start (by reading outlier media such as Undervalued-Shares.com), nothing will be able to stop you!

#19: You only need one or two good ideas per year

Experience does show that you really only need one or two good ideas per year to beat the market or achieve a transformative effect on your wealth.

Of course, you have to filter through a lot of noise to find these few outlier ideas.

But it's also entirely achievable.

You guessed it already, at this point I also refer you back to point #2 about portfolio concentration.

#20: Left-for-dead stocks are worth looking at

If you want to achieve a 10, 50 or 100-bagger, you have a higher chance of finding it among stocks that have been left for dead.

Check back to my three-part Weekly Dispatches series "Riches among ruins" to learn more.

The way Adolf Lundin picked up beaten-up mining ventures and depressed Russian assets to make up to 500x his money is a masterclass in investing (part 1 of the series).

#21: Don't underestimate how common and severe volatility is

A friend of mine who has been around even longer than me once said "Market crashs get ever faster and steeper."

There is a long debate as to why that is, but drawdowns seem to have gotten nastier during the past quarter century.

Besides, they happen more often than you'd think. A severe drawdown every five years means you'll likely experience ten such periods during your investing career.

Don't be afraid of them. Instead, build an investing strategy that allows you to make use of it. E.g., see the following point.

#22: Keep a shopping list of stocks you'd love to own for the right price

Every now and again, markets get completely dislocated.

When that happens, you will usually be busy with other things.

Keep a list ready of stocks you'd love to own if only you were able to buy them at the right price. Having such a list will help you to be ready to strike when these (usually short) periods of panics and sell-offs happen.

#23: Develop a network of peers to do due diligence

I already mentioned under point #6 the value of having some investing buddies.

It's worth making it a separate point that you should build your own due diligence circle. Get acquainted with some people who can help you with asking tough questions about an investment.

Need help with finding such people?

Join one of Undervalues-Shares.com's dinners for readers. They are worth attending if you want to form your own circle of peer review buddies. It's a (free!) service, organised in different parts of the world, and particularly popular with Lifetime Members, who always get first pickings at the (increasingly in-demand) spaces for these events.

A reader dinner hosted with my friends Cody Shirk and Keith Blackborg.

#24: Be aware of the concept of zeitgeist

Following, analysing, and capturing the zeitgeist, or "spirit of the age", should be one of the most important priorities for investors.

Once the zeitgeist changes, so do investment fads and valuations.

The combination of an investment theme getting back in fashion and its valuation multiples expanding can have a powerful double-effect on your investments (and the other way around). It's these major turning points in dominant narratives that can make for the biggest investment opportunities.

Few doubt that the 2020s have many critical turning points – economically, financially, and politically. However, can the zeitgeist be measured and predicted? Can you build this concept into your investment strategy?

If this point interests you, check back to my Weekly Dispatch "Zeitgeist, turning points, and the value of forgotten truths".

#25: Portfolio weighting is more important than being an incredible stock picker

Some of the world's best fund managers achieve a profit on just 30% of their investments, yet they still make billions for their backers.

In a seven-year study involving 45 of the world's best fund managers, their batting average was just 49% – meaning they lost money on 51% of their trades. Despite this, almost all of them made money overall.

How is this possible?

Stock picking is a skill. Managing a portfolio is an entirely different skill, and a vital one. As the statistic above shows, you could pick the wrong stock 70% of the time and still be a world-class investor with an enviable performance. So-called position sizing matters.

Stanley Druckenmiller, renowned as one of the world's best investors, once said "Sizing is 70% to 80% of the equation. … It's not whether you're right or wrong, it's how much you make when you're right and how much you lose when you're wrong."

Among the skills that anyone can acquire quite quickly and then utilise as a private investor are the lessons taught by "The Art of Execution". It's a relatively little-known, pleasantly short book by Lee Freeman-Shor that teaches important lessons about portfolio management.

If you want to read what it teaches in a nutshell, check back to my Weekly Dispatch about the book.

#26: Learn about moats

Incredibly, there are still people out there who invest but are not fully tuned in to the subject of moats.

It's an important concept to be aware of if you want to succeed with points #11 (hanging on to investments in successful companies) and #14 (developing a framework for evaluating companies).

For a quick overview, check out my Weekly Dispatch "Moats – a short introduction".

The article also links to excellent resources that drill into the subject in more depth.

#27: Private investors have some unbeatable advantages

There is one overlooked difference between professional investors like fund managers and individual investors: individual investors don't have to look at their portfolios every day. If you look at your portfolio too often, the temptation grows to sell your winners and stick to your losers. Exactly the opposite of what you should do from a performance perspective.

Charlie Munger dubbed this approach "SOYA", i.e. "Sit On Your Ass" investing.

Some of you might also remember the conversation between Queen Elizabeth II and Queen Mary in "The Crown":

Queen Elizabeth II: "But surely doing nothing is no job at all?"

Queen Mary: "To do nothing is the hardest job of all. And it will take every ounce of the energy you have."

Also, being able to occasionally go all-in is an advantage that private investors have over institutional investors. All roads lead back to portfolio concentration, see point #2.

#28: Complexity is a gift to behold

In complexity lies opportunity.

Does an investment case require reading a 700-page legal document? That's great, because it offers you the opportunity to gain an edge.

For a real-life example, check back to my recent story about litigation cases in general and that of Panthera Resources (ISIN GB00BD2B4L05, UK:PAT) in particular. It's a masterclass in complexity, and in finding alpha by looking where no one else is looking (see point #4).

#29: Read more footnotes in financial statements

I have seen wild stuff happen that could have been foreseen had investors made the effort to read up on details.

The small print and footnotes do matter.

If you want to check out some excellent courses that teach you how to do this, visit the website "Behind the Balance Sheet", operated by Steve Clapham.

#30: See the market like a tourist

When the facts change, move on.

Never get too attached to a theme or idea.

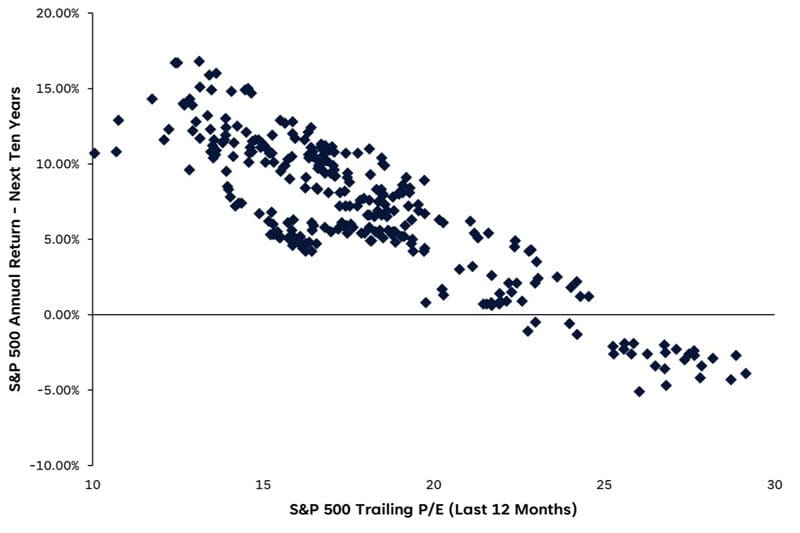

#31: Valuation is almost all that matters for long-term stock returns

Over a ten-year period, stock returns tend to be lower if the starting point for valuations is high (and vice versa).

In the short run, the market is a voting machine. In the long run, it's a weighing machine.

It's one of those eternal truths, which is why I have named my website "Undervalued-Shares.com".

Valuation matters (source: Goldman Sachs).

#32: Do latch onto the USA

Betting against the USA is a bad idea.

In the long run, this always holds true.

If you want to rise above day-to-day politics and get the necessary broad perspective on this question, read my Weekly Dispatch "USA – the unstoppable juggernaut?".

Given the recent hysteria, this point seemed worth including.

#33: Archive for life

Keeping an archive about your research, your investments and anything you've learned is invaluable.

I wish that I had developed a proper archive system earlier in life and then stuck with it.

#34: Some investment cases are too good to be true

Every now and again, you will stumble across an investment case that is too good to be true.

When you do, don't be fearful to place an outsized bet.

These no-brainers do come along every now and again. Markets are inefficient, especially if you look into areas mentioned in points #20 and #28.

#35: Don't rule out unlisted companies

If you are able to dedicate time and research to it, there is still a surprisingly broad sector of securities that are not listed on a recognised exchange.

For most of them, there will be some form of organised market on the world's various OTC platforms.

I once dedicated an entire article on "Finding opportunities (and adventure) among unlisted companies".

As a concrete example, I wrote about the Wimbledon Debentures in April 2020, when the pandemic lockdowns had led to these securities trading at fire-sale prices. They have since recovered strong. As the Financial Times reported on 9 April 2025, their prices jumped 59% last year alone.

Source: Financial Times, 9 April 2025.

#36: Financial markets are about cycles, and history teaches you about cycles

People who invest want to know what's going to happen tomorrow. They want to make investment decisions that are informed and forward-looking. For that, knowledge and understanding of the past is one of the most valuable tools available to you.

Financial markets are cyclical, and there isn't anything under the sun that hasn't been observed previously.

History teaches you how to spot these cycles.

You can use lessons from the past to more accurately predict the future. In fact, you cannot possibly overstate the value of knowing and understanding history to minimise the number of occasions when your expectations of the future prove to be off the mark.

There is also a plethora of books available from other authors who have taken up subjects relating to financial market history. Ignore these resources at your own peril.

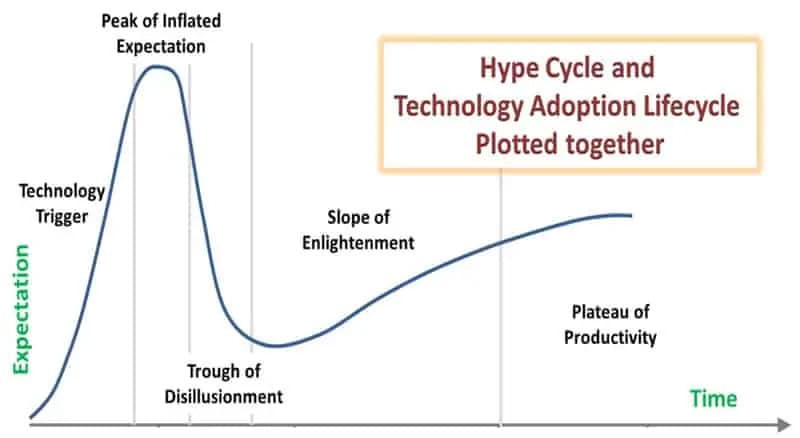

For a quick glimpse at one particularly valuable (and often-occurring) cycle in tech investing, check out my Weekly Dispatch about the Gartner Hype Cycle.

The Gartner Hype Cycle.

#37: Industry hypes come and go

Each time there is a new hype involving an industry, you think this one is serious and it will last.

Each time, the hype abates.

The difference between a newbie and an experienced investor is one knows this to be true.

However, these hyped industries sometimes do make a comeback. Check point #36 about cycles.

#38: You have to understand the concept of "non-consensus viewpoints"

To succeed in investing, it's not enough to be right. You have to be right AND outside the consensus.

This is a little-understood quirk of the stock market.

Imagine a group of one dozen analysts who follow a particular company. If they all expect earnings to increase next year, then the stock price will usually already reflect that. There is hardly ever a pay-off if you are right but merely within the existing consensus. The consensus will almost always be priced in already. To significantly outperform the market, you will have to come up with a prediction that you are not only proven right on but which others do not yet believe in.

You can educate yourself about this using my Weekly Dispatch on this subject.

#39: The most interesting reading is found outside of the mainstream media

At the risk of talking up my own book blog, your investments can benefit from engaging in heretic thinking.

Given that you have found your way to my website, you are probably well in tune already with the idea of hunting for unconventional, controversial viewpoints to advance your investment success.

My reading routine also includes a broad selection of entirely conventional publications, but it's often in the more obscure sources that I find the most interesting thoughts and ideas.

#40: Don't invest if they don't call you crazy

If your investment thesis isn't being ridiculed to a good degree, then you aren't trying hard enough to be ahead of the crowd!

I wrote about this in a May 2019 Weekly Dispatch.

I will keep using my Weekly Dispatches to occasionally test outrageous theses – such as "US-Russia tunnel – a non-consensus investment idea?", which asked whether we will see a Hyperloop train across the Bering Strait.

It's fun exploring such ideas, and often using old books (see point #10).

#41: Never miss a chance to learn from the world's best investors

Today, it is so easy to get "access" to the world's best investors and learn from their experience.

Thank you, Internet!

One interview I did with such a character is worth highlighting once again: Karl Ehlerding, the German equity investor who looks back at over 60 years of stock market experience and is truly unique among investors.

In July 2022, he granted me an exclusive look-back at his life in investing.

I published the long-form interview in both English and German.

#42: Don't say no to researching subjects that are a bit of fun

Not every investment research project has to be about finding a specific investment.

Educate yourself broadly about subjects and people that help you shape your framework.

There is nothing wrong with doing research that is even about fun in the first instance.

E.g., one article that readers keep telling me really fascinated them was "God's fund manager – how the Vatican made billions from stocks".

As point #18 set out, you have to create a unique talent stack. And as point #4 added, alpha is found when you go down paths that others have not recently explored. This also helps create serendipity.

#43: Many paths lead to investment success

Everyone will have to find their own path. There are no fixed recipes or one-size-fits-all solutions.

#44: Boring as interest rates are, they HAVE to be on your radar

Interest rates is not really a subject that would blow any normal person's socks of. I've always found it mind-bogglingly boring. However, interest rates are the most important price in capital markets. The prevailing rate of interest determines how capital gets allocated. Interest rates are the mechanism that guides all other investment decisions.

Are you sure you know enough about the subject?

I am 50 now, and I still don't.

Central banks determine what happens in financial markets, and everyone should spend more time learning about how they operate. (Which might, eventually, lead to a revolution.)

#45: Make your work in investing about systems, not goals

One of the most surefire ways to become more successful in investing is to take a look at a LOT of investment cases.

Everyone will have a different way to best go about that.

In my case, it's publishing a weekly column. I force myself to continuously look for new opportunities. Because of the (weekly) pressure to produce something that my readers will find interesting and useful, I continuously have to learn about new subjects and look at ideas that I would never have looked at otherwise.

It goes back to the old saying "Don't pursue goals; instead, set up a system."

A system is something you do regularly. If you are doing something weekly or monthly, it's a system. If you are waiting to achieve something at some point in the future, it's a goal. If my New Year's resolution was to look at 52 new ideas and subjects, I'd never get there, or I would end up cutting corners. Goals are easily forgotten, postponed, or altered. Statistically speaking, by 17 January of each new year, most resolutions/goals have already gone out the window.

Once you have set up a system, it becomes much easier to succeed.

My system is straightforward:

- Every week, I need to deliver some valuable investment-related content to the readers of my Weekly Dispatches.

- 10 times a year, I need to deliver a truly compelling and exciting investment thesis to Undervalued-Shares.com Members.

It's not difficult to find a bit of time each week to research one idea or subject. Unlike myself, you only need to read, rather than write about it! You just need to prioritise it. Over the course of the year, it adds up to a considerable body of knowledge.

By turning goals into an ongoing routine, you can set yourself up for success. This is true in investing, but also in other areas of life.

#46: If you can, write about investing

This won't be for everyone, but for some.

Putting your thoughts on paper and publishing them is incredibly valuable and can support your investing.

Writing forces you to structure your thoughts, and publishing will get you feedback from a knowledgeable audience.

I (modestly) lay claim to having inspired a bunch of people to start their own investment publication.

If I have just one additional reader start his or her own publication because of adding this point to today's list, it will have been worth it.

You can begin by reading my Weekly Dispatch "Everything you need to know about investment newsletters".

Making writing and publishing a part of your investment journey is helpful even if you only have a small number of readers.

#47: The more you know, the more you can know

I have a theory about compounding knowledge.

It's a subject I wrote about on the occasion of my 44th birthday, in an article called "44 things I know because I am now 44" (a highly worthwhile read!).

Financial capital compounds over the years, and it eventually produces exponential returns.

Have you ever considered that the very same thing happens with knowledge?

As I put it in my article, "learning years" aren't linear; instead, they compound. Most people base their perception of age on linear counting. I have started to base it on learning years, i.e., you should account for the fact that as we get older, we accumulate knowledge ever faster. As the saying goes, the more you know, the faster you learn.

Our knowledge accumulating exponentially (unless you vegetate in front of Netflix) makes for some powerful arithmetic as you get older.

As you will have gathered by now, I use Undervalued-Shares.com to force myself to continually learn about new stuff.

Adopting some form of this approach – which you can also do by reading regularly and widely – pays off tremendously.

#48: Choose your jurisdiction wisely

I cannot not mention this one, even if it's a seemingly tangential subject and difficult to turn into practice for most people.

What if I told you that there is one easy, risk-free step that will double your investment returns?

There actually is such a step.

Just minimise the amount of taxes you pay. Throughout their lives, people give away between 30% and 70% of their income in taxes. For argument's sake, say it's usually about 50% if you live in one of the large Western economies. If you reduced that down to 20%, you'd end up with a lot more money in your pockets.

If you cut it down to virtually zero (which is what I have done, and entirely legally, by moving to a suitable jurisdiction), you double your income without taking any risks.

There are numerous examples of why this plays directly into your investment success: tax-free compounding. One of the reasons behind Berkshire Hathaway's success was its ability to postpone capital gains taxes by sitting on investments for decades.

By pushing out capital gains taxes, Warren Buffett was able to compound his money faster than anyone else. Even if there is tax due at the end, a good tax strategy will have accelerated the investment success.

Taxes often distort investment decisions. I can't even begin to tell you how many cases I know where investors put off decisions because there were tax implications – and in the end, the distorted investment decision was worse than it would have been to pay taxes. If you live anywhere that has capital gains taxes of any kind, then you'll have tax issues distort the clarity of your thinking about the buying, holding, and selling of investments.

Even if you "only" have the salary of a big-city professional, you'll probably end up paying several million in taxes over your lifetime.

What if instead, you could at least keep one of these millions? How would it affect your financial situation? Can you imagine your quality of life if you were able to create true financial freedom a great deal sooner than your fifties or sixties?

I rest my case.

#49: Go to conferences where you meet fund managers

Much as I am against meeting with CEOs (see point #1), I am fervently in favour of attending events where you meet others who are managing money.

It doesn't matter whether it's professional fund managers or other private investors.

You can learn a lot from them, and benefit from both their experience and their latest investment ideas.

I never pass an opportunity to meet with other people who manage money. I recommend Nordic Value, FatAlpha Value (Cyprus) (formerly Cyprus Value Investor Conference), and Value Spain. They are run by friends who are outstanding at organising such events.

This point is one of the reasons why I keep organising my own dinners, conferences and other events for readers. They should always be about having a bit of fun along the way, which is why I have also organised another Galapagos Islands cruise for November 2025 (last four spaces available if you are interested).

You can't ever spend too much time with people who are working on similar challenges. Attending events to meet them is a great use of your time.

#50: Don't be afraid of failure

No matter how much you study, plan, and work in order for your investing to become a success, there'll be plenty of failure along the way.

For you, too.

Don't let the fear of failure stop you from doing what you think you should be doing.

Look at Warren Buffett, whose initial investment in Berkshire Hathaway was a disaster. He refused to let this monumental mistake stop him, though. When Berkshire Hathaway's textile business didn't work out, he used the company as an acquisition vehicle for insurance business. The rest is history.

Knowledge – and that includes failure – compounds. Check back to point #47.

If you play your cards right, all the failure you suffer during your investment will eventually become an asset.

Just stay in the game.

Don't ever quit.

Here's to the next 50 years.

"50 for 50" – My 50% off birthday present

On today's special occasion, I will do something I've never done before.

For the first time ever, you can get my Lifetime Membership at a discount.

Today, 50 of you can have it at 50% off.

Usually, it's USD 999.

If you are quick, you can get it for USD 499.

Simply use discount code "HALFWAYTO100" signing up here (the code will work until the first 50 codes are gone):

"50 for 50" – My 50% off birthday present

On today's special occasion, I will do something I've never done before.

For the first time ever, you can get my Lifetime Membership at a discount.

Today, 50 of you can have it at 50% off.

Usually, it's USD 999.

If you are quick, you can get it for USD 499.

Simply use discount code "HALFWAYTO100" signing up here (the code will work until the first 50 codes are gone):

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: