Does a stock with a p/e of 1.5 interest you?

Picking up Thungela (ISIN ZAE000296554) stock following its spin-off from Anglo American (ISIN GB00B1XZS820) in early June 2021 was an absolute no-brainer. Each holder of Anglo American stock received stock of the mining giant's thermal coal division, and the new stock started trading on the exchanges in London and Johannesburg.

As a fund manager friend told me before the listing: "Huge forced selling coming. Keep an eye on this."

Indeed, it was obvious that many freshly minted shareholders were going to dump the stock, no matter how low the price.

As Bloomberg wrote on 1 June 2021:

"Some of London's biggest investors will become involuntary owners of a pure-play coal miner next week, potentially triggering a substantial sell-off."

Needless to say, Bloomberg referred to the kind of investment funds that have signed up to corporate virtue signalling and so-called "green" investing, and which couldn't be seen holding coal-related investments. They did indeed dump the stock, and anyone who took the opposite position profited handsomely. Thungela stock stood at ≈GBP 1.10 on the first day of trading, and the first week as a listed company saw MASSIVE trading volume at prices below GBP 1.50.

The stock reached GBP 4.98 a few days ago, up more than three times in a matter of months.

Forced selling by virtue-signalling fund managers was an opportunity to invest in a highly cash-generative company at an insanely undervalued price. Just wait until you learn more about the valuation metrics at which these fund managers dumped their clients' investment!

When highly-paid fund managers make decisions based on questionable ideology and fluffy marketing guff, those who still have a sense of realism and a knack for crunching numbers can make easy money.

Will we see more cases like Thungela?

You bet!

The current wave of group think and outright madness that is rippling through executive suites and boardrooms is bound to continue, given how many special interest groups have a financial incentive to keep the trend going. Other companies will go ahead and spin off "dirty" divisions, creating what could be an entire wave of Thungela-type listings across industries not favoured by the anointed. (We might even need a good name for the phenomenon – any suggestions?)

If you want to be there when the next such opportunity presents itself, you need to hone your skills for spotting them.

Today's Weekly Dispatch will give you some pointers on how to find them yourself. You'll also learn why you shouldn't hesitate a split second to exploit what's currently happening in the world. Quite the opposite, you should proudly invest your money where the self-proclaimed saviours of the world don't want to invest.

The Thungela case in a nutshell

Thungela is just one example of what's currently happening in markets, but it's simply too good a case study not to use it for demonstrating an important trend.

A broad set of special interest groups (political parties, NGOs, academia) has worked together to define what investors should (and shouldn't) put their money into.

They give a thumbs up to:

- Generating as much energy as possible from wind and solar.

- Selling "undesirable" energy assets.

- Complying with standards that are created by global organisations, i.e. organisations that are one additional step removed from being accountable to the voters of democratic, sovereign nations.

They don't want investors to back:

- Minimising risks to the energy supply by securing the baseload using proven sources.

- Investing in additional capacity of proven energy sources while new energy sources are still being ramped up and tested for their actual reliability.

- Sovereign nation states ensuring their citizens remain energy independent instead of falling under the mercy of other nations.

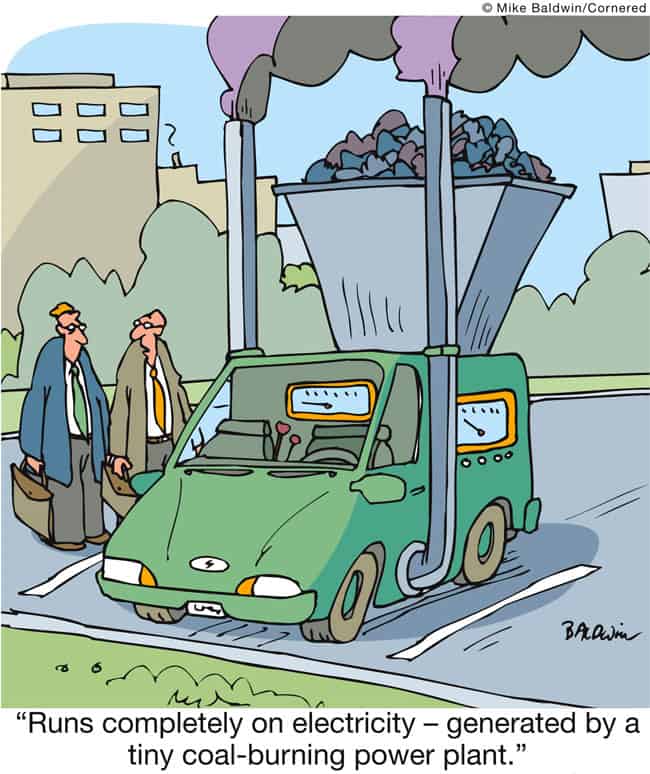

Something this has arguably led to is the demonisation of coal as a source of energy. If you argued in favour of using coal for anything – least of all, generating energy ("thermal coal") – you effectively ejected yourself from polite society.

As a result, many of the world's largest asset managers and investment funds have stopped investing in thermal coal, either by divesting investments in the sector, or actively pushing their portfolio companies to get rid of their interests in coal. They started doing so at a time when available evidence should already have rung all alarm bells. For YEARS, it has been evident that energy transitions were never going to go as quickly as projected. They take decades – plural! An interview with Rob West of Thunder Said Energy ("The third major energy transformation") from May 2019 gives you the most eloquent, solid explanation why energy transitions can't be done quickly.

Even the Germans are coming to this realisation. In May 2011, Angela Merkel decreed that nuclear power in Germany was to be phased out by 2022. Fast-forward 12 years, and Germany is about to switch off nuclear plants while lacking the necessary capacity to replace them. If even the economically mighty and ideologically fired-up Germany can't pull off a fast-tracked energy transition, what are the odds for other countries?

Anglo American was one of the many large, Western corporations where executives and board members didn't have the spine to stand up to aggressive pressure groups. The South African company became another case of corporate virtue signalling when it agreed to spin off Thungela.

Had those investment funds eager to show off their "green" credentials put their clients' financial interest first, they wouldn't have sold so cheaply. Even before the recent run-up of the coal price, it was already clear that Thungela stock was trading at 1.5 times earnings, 1.2 times cash flow, 0.3 times 2021 EBITDA, and a 25% dividend yield.

With such insane valuation figures, Thungela stock was a no-brainer investment that everyone should have held onto. It has just made clever investors an absolute fortune. At the end of the day, a highly cash-generative business with a 25% dividend yield will always attract buyers.

It's all part of a bigger trend, and one that I predicted a while back already.

Insanity never lasts – and cash is king

In March 2020, I published a follow-up report about Gazprom (ISIN US3682872078), the Russian energy giant that I have long described as one of the must-own investments for the 2020s.

The report included a separate chapter that is worth another look. While the full report is only available to Undervalued-Shares.com Members, you can download this three-page chapter with a single click.

Here are the key passages of what I wrote back then:

"Replacing so-called "green energy" with "rational energy"

We have all seen recent headlines such as:

- "World must stop using any fossil fuels."

- "Oil and gas are killing the planet."

- "Fossil fuel producers will become a stranded, worthless asset."

Whenever I hear these absolutes and end-of-days statements from the so-called environmental movement, I become sceptical. My memories of the so-called "Green movement" go back to the early 1980s, when I was 6 or 7 years old. Our teacher gave each of us a free sticker with green slogans to put onto our school satchel – an early version of what is now virtue-signalling on social media! I remember exactly the one I got: "Don't buy colourful toilet paper, because it damages the groundwater." In German, it rhymed: "Kauf's Klopapier nicht farbig-bunt, dem Wasser schadet's bis zum Grund."

Later on, I learned that I had fallen for green fallacies. At the time, white toilet paper was often more damaging to the environment because it had been produced using bleach. It all sounded nice, but it missed the target.

For nearly four decades, I have seen ever-new themes and alleged emergencies being propagated from the Greens. I even once worked as CEO of a conservation NGO, a job that had fallen into my lap because of some philanthropic work I had done and which exposed me to the inside of this sector for nearly four years. By now, I have seen enough earth-ending hysterias that I should have died from some environmental disaster five times over. I am still here, though.

What I have learned in these years is this:

- The picture is never as black and white as they want to make you believe.

- Much of what they preach is outright wrong, as in it goes against the hard facts.

- To figure out what's going on, follow the money to NGOs, think tanks, special interest groups and the like. That usually tells you all that you need to know.

I have done a lot of reading on the subject lately. Much as I am not yet finished with my research, I am already at a stage where I am willing to stick my neck out for the following thesis:

- Fossil fuels will be with us for much longer than currently anticipated. At the earliest, we'll see other energy forms take over sometime between 2040 and 2050. Possibly, much later even.

…

- To get to a cleaner environment, the main question to ask is not what fuel to use, but how to use it. Developing better technologies will more likely yield good results for our planet than banning specific energy forms.

…

Until anyone convinces me of the opposite, I expect a new investment trend emerging that roughly looks like this:

- Instead of a black and white approach based on "Coal = bad" and "Wind = good", we'll gradually see a more balanced approach to picking energy investments. How can a country reliably cover its baseload? Which sources make energy available to everyone, not just the wealthy? Which companies are actively advancing the development and deployment of new technologies to make existing energy infrastructure more efficient and less polluting? These are essential questions to ask, without which all so-called "green" investing will remain a naïve pipedream and a scheme to make money off new financial products and services.

…

- Whereas so-called "renewable energy" has recently been valued at a premium by capital markets, and fossil energy has been valued at a discount, we'll see a gradual convergence. One will come down, the other one will go up. Sanity and rationality will return to the energy market. The divisions sown by the Green movement for financial gains and as a path to power will gradually be replaced with a more rational approach."

Fast-forward 1 1/2 years, and here we are!

The radicals who wanted the Western world to switch off traditional fuel sources asap and switch to wind, solar and unicorn poop no matter what, are now reaping the consequences:

- Western Europe, the ideological Mecca of "green" energy, has spiralling energy costs because it is short of energy. The price for spot delivery of gas in Europe recently reached the equivalent of USD 400 per barrel oil. Families on lower incomes, in particular, are going to be hit hard by the ill-conceived policies of the so-called environmental movement.

- Blackouts during the coming winter have become a real possibility, even in highly-developed countries like Germany, the UK, and France.

- Countries that could have been the master of their own fate in terms of energy, are suddenly at the mercy of Russia, Saudi Arabia, and the other paragons of good governance.

Suddenly, investors realise that fossil fuel-based energy assets aren't nearly as out-of-fashion as some would have made you believe. The market has started to realise as much, as a look at this year's best performers shows. Fossil fuel-related energy stocks are up across the board, many of them by several hundred percent. This only goes to show that oil, gas and coal will not be replaced by so-called "renewable" energy sources all that quickly, and those companies and fund managers that recognised as much are reaping the benefits.

Just as I was writing this Weekly Dispatch, the Financial Times came out with some stunning figures about the fund managers who dared to disagree with the approved view:

"Hedge funds cash in as green investors dump energy stocks

Hedge funds have been quietly scooping up the shares of unloved oil and gas stocks discarded by environmentally-minded institutional investors, and are now reaping big gains as energy prices surge.

Hedge fund managers in the US and UK have been betting that the eagerness of many big institutions to be seen to embrace environmental, social and governance (ESG) standards means they are selling wholesale out of fossil fuel stocks, even though demand for some of these products remains high.

'It's such a great and easy idea,' Crispin Odey, founder of London-based Odey Asset Management, told the Financial Times.

'They [big institutional investors] are all so keen to get rid of oil assets, they're leaving fantastic returns on the table,' added Odey, whose European fund is up more than 100 per cent so far this year.'

Will any of these developments change what's happening?

I doubt they will. The broader, underlying trends are not going to turn around anytime soon. Academia, politics and other key decision-making nodes of Western society are too invested in their ideology.

There'll be more spin-offs of "bad" divisions, and Thungela won't have been the last opportunity to buy on the cheap when "green" funds sell at any price just to be seen as doing the right thing.

There'll even be help from a new form of activist investors – a new phenomenon, and one that will play into the hands of investors who want to exploit these developments. Let's take a look.

Keep an eye on these activist investors

Those who created the current energy supply issues with the energy supply will keep pushing for more of the same, no matter the amount of contradicting evidence. It's their raison d'être and source of income, which is why they won't let go of it. Among their next targets will be:

- Divest plastic.

- Ban arms.

- Outlaw gambling.

These are just examples. There are all sorts of variation to the theme, stretching from environmental issues (real or perceived) to even fluffier goals such as "diversity". I believe there'll be a long list of Western corporations who give in to pressure groups. Unforgotten is the incidence of a SINGLE customer criticising sandwich and coffee chain Pret A Manger for daring to sell a "gingerbread man" called "Godfrey". To avoid being seen as lacking gender balance, Pret fell on its knees immediately and created gender-neutral "gingerbread biscuits", one of which was named "Annie". With a generation of CEOs such as the one running Pret, more silly decisions are guaranteed.

Such decisions will find additional support from a new class of activist investors, such as Engine No. 1. The activist hedge fund wants to force companies to make changes along the lines of what I described above. E.g., it took a stake in ExxonMobil (ISIN US30231G1022) and succeeded in winning three board seats. The company has agreed to prepare itself for a future free of fossil fuels. Engine No. 1 achieved all this with a tiny stake, similar to that one disgruntled Pret A Manger customer managing to push through change.

Following the success of Engine No. 1, more activist funds of this kind are bound to be launched. Without a doubt, there IS demand for it out there, and there'll be ways to monetise these trends – some actually make real financial sense. However, there is also bound to be a lot of dumbfuckery coming out of it, such as the forced selling of Thungela by "green" funds. These are the cases that I want to take advantage of.

Here is how you can prepare yourself for it, including ONE specific opportunity to potentially make 100 times your money.

3 tips for getting in on this trend

If you want to be among the first who spot the next Thungela, you should probably stick to the following three rules.

1. Hone your mind to controversial ideas

Without a doubt, to pursue an investment like Thungela, you'll need both a thick skin and a solid background for dealing with the inevitable accusations that you are a terrible, bad person.

- Your friends could disinvite you if you speak about your successful coal investments at their big-city cocktail parties.

- Virtue-signalling corporations might put your job application aside if they see that you have posted impure views online.

- Your partner could withhold sex if they find out you are investing in perceived bad stuff. (I am not even joking.)

All of this requires you to develop not just analytical skills, but also a worldview that makes you feel confident in your choice and enables you to argue your case.

To develop the suitable analytical skills isn't all that difficult. Recognising that a 25% dividend yield and a p/e of 1.5 are attractive isn't rocket science.

To obtain a different worldview might be a bit more difficult. I recommend you start by reading "The Vision of the Anointed" by Thomas Sowell. The book brands the "anointed" as promoters of a worldview that is based on fantasy and feelings, and impervious to real-world considerations. It's a perfect description of the class of people who are driving many of the current societal, political and economic agendas – and who got us into the current energy market mess.

Change your reading habits to sharpen your mind, and ideas such as Thungela are more likely to appear on your radar.

2. Read finance blogs and investment newsletters

A couple of months ago, when I sensed the first signs of potential energy shortages, I decided to fill up my oil tank to the max and recommended my friends to do the same asap. My life on Sark is largely autarkic, and I even operate my kitchen oven using oil. With my new energy reserves, I can now comfortably sit out three years of supplies getting cut off.

Did any of the publications you read recommend you invest in fossil fuel stocks or secure your personal energy supply against possible supply disruptions, black-outs and spiralling prices?

If the answer is "No", you should probably reconsider your reading list.

A big shout out goes out to Stock Spin-off Investing, a subscription-based newsletter that had both the guts and the foresight to feature Thungela in July 2021. Its author proclaimed Thungela his single biggest personal investment, and his analysis of the Thungela opportunity was first class, and exemplary of the kind of valuable, contrarian reporting you are more likely to find on blogs and investment newsletters rather than the mainstream media. Use this link to get a free preview of Stock Spin-off Investing's analysis on Thungela, or sign up to a 7-day free trial and a USD 44/month membership.

3. Prioritise analysing anything that's considered "dirty"

It's really as simple as that.

Set up a (free) Google News alert, to learn about upcoming spin-offs of businesses that are likely to see forced selling by "green" funds once the listing goes ahead.

Alternatively, check the buyers of such spun-off divisions. E.g., American oil companies are currently scheduled to offload fossil fuel assets worth USD 140bn. They are selling because they are under pressure, and they are in a hurry to sell to be seen as good guys. Selling under pressure is never good for negotiating the best price, which makes it highly likely the buyers of these businesses will strike a good deal. Companies like Saudi Aramco (ISIN SA14TG012N13) and other government-owned entities outside of the Western industrialised nations will be buyers, and the returns of their shareholders will go up as a result.

As yet another alternative, check out the private equity funds that take advantage of this situation. As described in my recent analysis of woke CEOs, private equity firms are not necessarily under the same kind of public pressure as publicly-listed companies. They will have a field day buying undervalued assets for their investors.

There are plenty of variations to play this theme, and you are lucky enough to live at a time when all the necessary information resources are available virtually for free.

As to that potential 100-bagger I mentioned earlier…

Yours truly and his rag-tag of likeminded analysts hunting for "guzzolene" in off-the-beaten path locations.

A highly speculative coal opportunity

Coal is something that I have had an interest in for a long time.

In spring 2020, I pointed my Lifetime Members to an interesting coal-related investment opportunity. It hasn't worked out yet, but it could be worth another look given how the world has changed recently. It focusses on a tiny company listed in London, which controls one of Asia's largest coal resources, located in a country that is desperately short of affordable energy for its large population.

For full disclosure, this company is not for the faint-hearted:

- It is politically highly controversial. E.g., its shareholder meeting in London regularly sees demonstrators harass shareholders.

- It's far from guaranteed that this coal resource will ever be developed. For the past 15 years, development plans have not yet led to actual coal production.

- The company's stock is not very liquid, and it's extremely volatile.

When I first wrote about it, the stock was trading at 11 pence. It subsequently rose as high as 25 pence, but recently dropped to just 5 pence because of China's proclamation to stop funding coal projects abroad.

I had always described this opportunity as a highly speculative investment, which could either make 100 times investors' money, or go bust altogether. Hundreds of millions of Asians are still without electricity – and that leaves aside the question how affordable the energy provided to those connected to the grid is. My baseline assumption is that when push comes to shove, Asian politicians and Asian consumers alike will prioritise keeping the lights on and at affordable prices, over sanctimonious rhetoric.

Right now, the stock is about as down and out as they come (down >99% from its 2005 peak). This could make it all the more interesting, though. It's certainly one of the most extreme investments of the coal sector that I am aware of – and an interesting story in its own right.

If you aren't a Lifetime Member yet, you can join for USD 999. It's a one-off payment, and you'll get access to all my future as well as past reports. This will also include the report on Pampa Energía (ISIN US6976602077), a publicly-listed Argentinean energy company that owns a significant part of Argentina's largest shale oil field – yet another investment case of this nature. Just as the Americans are throttling investments in shale resources following Joe Biden's executive order, the Argentineans ramp up their efforts – and using cheap, discarded American equipment!

There are MANY variations to play this theme. Today's Weekly Dispatch primarily aimed to make you aware of the scope of opportunities that exist.

I am already working to present one or the other Thungela-style investment to Undervalued-Shares.com Members. As long as the self-proclaimed environmental movement continues to screech that all fossil fuels are bad, there'll be opportunities to invest and make money. The valuation gap between "green" energy companies and fossil fuel-based energy companies remains wide, and it'll continue to narrow as the fantasies of the so-called environmental movement gradually get exposed for what they are.

Bayer: A unique opportunity? (German-language video)

My report on Bayer AG continues to make waves!

Join me and Paul Petzelberger of SdK Schutzgemeinschaft der Kapitalanleger e.V. as we dig deep into the life science company.

Will it manage to stage a turnaround? What are the potential triggers for a rise in Bayer's share price? What are the risks for shareholders?

Bayer: A unique opportunity? (German-language video)

My report on Bayer AG continues to make waves!

Join me and Paul Petzelberger of SdK Schutzgemeinschaft der Kapitalanleger e.V. as we dig deep into the life science company.

Will it manage to stage a turnaround? What are the potential triggers for a rise in Bayer's share price? What are the risks for shareholders?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: