Image by SERGIO V S RANGEL / Shutterstock.com

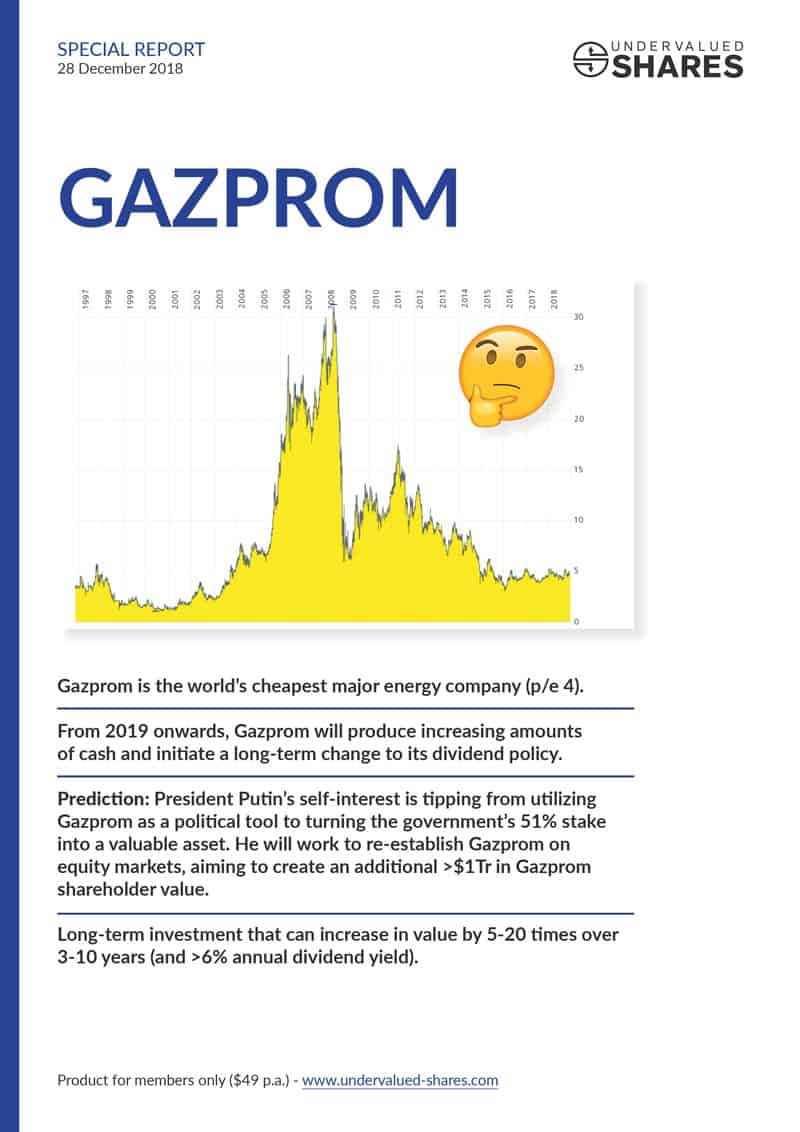

On 28 December 2018, when I relaunched Undervalued-Shares.com, I dedicated my first research report to Russia's former gas monopolist, Gazprom.

Not only has the stock since more than doubled in price, it also pays a monster dividend.

Today's featured stock should go a very similar route.

Between 2022 and 2025, Brazil's national oil producer Petrobras is expected to pay out dividends totalling >100% of the current share price.

How is that even possible?

Among other reasons, it's courtesy of 'woke' Western leaders.

Europe and the US are pushing oil companies to decrease their capital investments. However, the West's dream of relying on so-called renewable energy simply isn't ready yet. The US has already begged OPEC to produce more oil, Germany sends record amounts to Russia, and the rest of the EU relies on countries such as Algeria to keep houses warm.

The West's approach to energy markets has led to an extraordinary opportunity for investors who remain cool and analyse the evidence.

Here is what you need to know.

Oil will be around a lot longer

Oil, gas and coal are the workhorses of the global energy sector and contribute 83% to the world's energy consumption. Even based on the stated carbon reduction policies of the world's governments, oil consumption is going to increase from ≈90m barrel per day in 2020 to ≈102m barrel per day in 2030. Oil demand is RISING, rather than decreasing.

To keep production rising, the non-OPEC oil industry would have to invest approximately USD 600bn per year in exploration and drilling. However, in 2020, it only invested USD 328bn. After the price of crude oil crashed in 2014, the industry reduced investment – also driven by the political developments in Europe and the US. The Western oil majors are now going to let their oil production decline. E.g., for Shell (ISIN GB00B03MLX29), the current outlook is a 3% p.a. decline compared to 1-2% previously projected, which was already a striking number. The situation is similar with most of the large Western oil companies.

As a result of this lack of investment, the world is heading towards an interesting situation. Oil demand keeps going up, but oil supply doesn't because of the dearth of investment.

We have never before experienced a phase where oil was clearly needed but the Western world was not willing to invest in producing it. As a result, over the next few years, oil prices are at least going to stay on an elevated level. Energy shortages are a possibility, too. Energy investments have an extremely long lead time. There are few other markets where it's possible to predict such a development with such accuracy.

The difference between the need for more oil and the West's unwillingness to invest in it is where the opportunity lies for investors.

Here is a striking figure that the team at Goldman Sachs has worked out. So-called renewable energy projects can currently raise investment if they offer an annual return as low as 3%. For an energy project involving fossil fuel to raise money, investors need to be offered an annual return of ≈20%.

With returns like these, someone is going to invest in producing the additional oil.

However, oil isn't the same the world around. This is something that even I didn't fully realise, until I researched Brazil's so-called "pre-salt" oil fields.

Good oil and bad oil

Some oil wells are better than others. Ideally, you are looking for oil fields that are i) large in size (to achieve economies of scale); ii) under a lot of pressure (so that the oil is easier to pump up); and iii) produce oil of a certain quality (such as lower sulphur content). Oil that ticks all these boxes can even score with investors who have signed up to the climate change theme, as it is relatively lower in carbon emission.

In 2006/07, Brazilian oil company Petrobras discovered "pre-salt" oil fields. These are offshore oil fields that contain oil below the thick layer of salt which formed under the ocean 160m years ago when the continental superstructure Gondwana separated into the American and African continents ("post-salt" oil fields sit above this salt layer).

At the time, Brazil had an estimated 14bn barrels of oil reserves left. The pre-salt discoveries were estimated to add 50bn barrels of new reserves, which meant that both Brazil and Petrobras no longer had to fear running out of oil.

The crux was that these oil fields are at great depth and located within geological structures that the oil industry had less experience with. Still, they were so attractive financially that they already make up >50% of the country's total oil production.

And Brazil is no minnow. The country produces 3% of the world's oil demand and ranks as the world's #9 producer. By 2024, it could already be #5.

One of the driving forces behind all this continues to be Petrobras, which has decided to embark on a large-scale investment programme. Between 2022 and 2026, the company is set to invest USD 68bn to explore new oil fields and start additional oil production. Among non-OPEC oil companies, this is one of the largest investment programmes in the world. Petrobras has sensed a unique opportunity, and it's entirely unapologetic about using it. Thanks to Europe and the US winding down their investments in fossil fuels, it becomes all the more lucrative to make up the shortfall.

And lucrative it will be, as the following figures show.

The numbers are staggering

Between 2016 and 2020, Petrobras produced USD 140bn (!) in free cash flow - 2.5 times that of Exxon Mobil (ISIN US30231G1022) during the same five-year period.

At the time, Petrobras was still struggling to shake off its exposure to the "Car Wash" corruption scandal of 2014. This unpleasant chapter ended in February 2021, and Petrobras is now embarking on a new era.

A few weeks ago, the company's management implemented a new dividend policy which from 2022 should generate dividend payments for shareholders that few other companies in the world can offer. Just like Russia's government in the case of Gazprom, Brazil's government decided it's best to utilise its stake in Petrobras to generate dividend income and increasing capital values. And just like Gazprom, Petrobras has now done the revolutionary thing of tying executive pay to the company's value creation.

Petrobras is such an extraordinary opportunity that I made it the focus of my latest research report. Comprising 46 pages in total, the report covers a LOT of other aspects of this investment, such as:

- Why has Goldman Sachs just raised its expectation for the 2022 and 2023 dividends to 30% each?

- What's the potential political surprise that could lead to Brazilian equities going through the roof in 2022?

- How secure are the dividend payments in times of fluctuating oil prices and currency exchange rates?

- How does Petrobras' valuation stack up against its international peers, especially Russian energy stocks?

My report on Petrobras gives the answers to all those questions, and more.

It comes almost to the day on the third anniversary of relaunching Undervalued-Shares.com with my report on Gazprom. This investment has done rather well for my readers, and I view Petrobras as a quasi "Gazprom #2".

Given how the West has already started to suffer under its energy policies, the stock is even an insurance-type protection. Are you worried about inflation or paying more at the petrol station? Not owning fossil fuel energy stocks in 2022/23 could turn out to be the biggest drag on your portfolio. In addition to Gazprom, Petrobras should be one of the pillars of every portfolio.

The report is now available on Undervalued-Shares.com (Members only).

Gazprom showed how it's done

Gazprom's stock price is up 114% since my first report in late 2018 - and this doesn't even include the 30% in dividend payments. Quite a healthy return!

The parallels between Gazprom three years ago and Petrobras today are really quite startling.

If you want a sneak preview of how the Petrobras story is going to unfold, it's worth getting out those Gazprom reports again (if you haven't already).

Gazprom showed how it's done

Gazprom's stock price is up 114% since my first report in late 2018 - and this doesn't even include the 30% in dividend payments. Quite a healthy return!

The parallels between Gazprom three years ago and Petrobras today are really quite startling.

If you want a sneak preview of how the Petrobras story is going to unfold, it's worth getting out those Gazprom reports again (if you haven't already).

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: