Cuban creditors recently achieved a partial win in a court case in London, when a judge confirmed that defaulted debt issued in the 1980s in deutschmarks had to be repaid.

Then came Burford Capital's high-profile win over Argentina, which will unlock billions in decade-old claims from an expropriation case involving American investors.

Progress in cases like these has made a growing number of investors aware of litigation finance, as well as its closely related cousins of investing in defaulted debt and legal claims from expropriation. These are niche areas of the financial market, but they can be highly lucrative – sometimes growing an investment by a high multiple!

Today's Weekly Dispatch takes you on a quick spin through the sector, and briefly introduces two new, little-known stocks from this realm.

Cuban creditor with partial win

In early April 2023, a Cayman Islands-based investment fund achieved a partial win in a London court. CRF I had acquired old claims against Cuba totalling over a billion dollars, and the fund's investors then paid for litigation to force Cuba to repay the debt.

The court ruled that London was not the right venue for the claim, but it did confirm that the debt is legally owned by the investment fund and has to be repaid despite its age – two items that Cuba had previously refuted.

The decision is a partial win for both sides, as this 4 April 2023 article from Deutsche Welle summarises.

The landmark decision will have reverberations across the entire spectrum of remaining Cuban claims, and set the stage for the next round of speculation in Cuban debt.

I've repeatedly written about ancient financial claims against the Cuban government, most notably in a report that is probably the single most extensive piece of research that anyone has ever published about the subject. Nowadays, claims against Cuba are notoriously difficult to get hold of. It used to be possible to buy old Cuban bonds on the New York Stock Exchange, or invest into US-traded stocks like Cuban Electric to participate in restitution claims of companies that lost their assets to the country's expropriation policies. However, almost all of these Cuba-related securities got delisted in the 1990s and 2000s, respectively.

One of the few remaining ways to buy into such claims is to acquire stock of New Jersey-based Francisco Sugar Company (OTCPK:FRAZ), which owns a USD 53m claim relating to a shipment of sugar from the Republic of Cuba to the United Kingdom. It also has a claim to a sugar mill and land on the island, and when it's all added up, the company is one of the biggest remaining Cuba claimants overall. The stock is very difficult to trade, though, because it's part of the "Expert" section of the US OTC market (which few brokers trade in) and also quite simply entirely illiquid. Still, it illustrates that there are quirky options hiding among little-known publicly traded companies.

Cuba is an evocative and illustrative case that has long captivated investors, but even I have now run out of ideas on how to get any significant exposure to this particular sector. The good news: there are other, more liquid options for getting exposure to legal claims and litigation investing.

One of the best options right now is one that was decided in a New York court just two weeks ago, and which is very liquid to trade both in London and New York.

Burford Capital hits the litigation finance jackpot

The stock of Burford Capital (ISIN GG00BMGYLN96, UK:BUR) has been covered by quite a few blogs, such as Andrew Walker's outstandingly good Yet Another Value Blog. Overall, though, it isn't widely known in the investment mainstream.

The Guernsey-based company is generally regarded as the world's largest financier of litigation, with a massive book of claims both on its own behalf and for funds that it manages for third parties. Despite its success as the undisputed king of its industry, Burford Capital has had a sketchy reputation. In 2019, short sellers attacked the company, claiming it had misrepresented its finances and was "technically insolvent".

The claims were never proven, but Burford Capital's reputation suffered lasting damage – speak of mud always sticking! It didn't help that its business is inherently complex and prone to widely differing opinions; the latter being the nature of legal claims. In fact, so complex is its business that even people who know a fair bit about the industry at times struggle to see the big picture.

My research report on Burford Capital, published in March 2022, tried not just to explain the company in comprehensible terms but also provide a fresh perspective on the investment case.

As one reader subsequently commented:

"Having worked with the litigation funding sector previously… your report has been the first that has allowed me to look past my own bias/agenda and see the company 2 to 3 years on, rather than the perception as it is still publicly held."

My report explained the significant potential from a lawsuit that Burford Capital was waging against the government of Argentina. In 2012, Argentina expropriated the US shareholders of Argentinean oil company YPF (ISIN US9842451000, NYSE:YPF). In 2015, Burford Capital paid USD 18m to purchase compensation claims from investors who had been affected and then sued for billions in damages. This was always a moonshot in the true sense of the word. For its USD 18m investment, Burford Capital had acquired compensation claims that could total up to USD 20bn – but also needed a triple-digit amount of investments in legal fees. It is a gigantic case, with high stakes for both sides.

At the end of March 2023, Burford Capital won this lawsuit, and its stock price leaped up to 80% in a matter of two trading days.

Burford Capital.

Amazingly, even after its stock price rose so quickly, Burford Capital remains an outstandingly interesting investment case. In fact, the stock might be even more undervalued on its higher level now that the case has been decided. The company will likely be awarded USD 3.7-7.6bn, compared to its current market cap of USD 2.2bn. Argentina can (and probably will) appeal against the verdict, and being awarded damages does not yet equal getting a payment out of a nation that has become the world's most notorious serial-bankrupt. However, Burford Capital is an expert in collecting financial claims and seizing foreign assets, and it also has the option to sell its claims in whole or part to other investors. My estimate is that it will eventually collect USD 2-2.5bn in cold, hard cash through a combination of selling some of the claim and carrying out some tough-as-nails debt collection measures against Argentina. If my sense is right, then the stock price currently doesn't even reflect the full upside of this single case, and the remainder of the company's portfolio of claims as well as its profitable fund management business are thrown in for free. Burford Capital stock could be trading at double its current price before too long.

Given recent developments, I can't recommend highly enough that you take a look at the research report on Burford Capital (if you haven't done so already).

Some among you will want to use this sector to earn a much higher multiple on their investment, though. How about making potentially 2-10 times your money from a combination of expropriation claims and defaulted debt? If you are looking for opportunities with a bigger upside, you will find those in another crisis-ridden South American nation.

Venezuela – a plethora of claims

Venezuela has been a basket case of a country for many years, thanks to socialist policies that ruined what used to be one of the richest countries on Earth.

For investors who are interested in getting involved, there is a USD 150bn pool of defaulted Venezuelan debt to tap into (though US investors are banned from buying most of it). There are also plenty of expropriation cases that involve foreign companies which lost their Venezuelan assets and are entitled to compensation under international rules.

My 26 August 2022 Weekly Dispatch "Venezuela – a multi-bagger recovery play?" briefly featured the interesting case of Rusoro Mining (ISIN CA7822271028, CA:RML), a Canadian company that used to operate a gold mine in Venezuela, but which is now effectively dormant, except its ongoing lawsuit against the Republic of Venezuela. Because it's a Canadian company, US investors can buy into it, too.

Between 2006 and 2008, Rusoro Mining had acquired Venezuelan mining licences that gave it gold reserves of 5.6m ounces, as well as further possible 6.8m ounces subject to additional exploration work. In 2009, the company produced 126,000 ounces from its core gold field, and a further 25,000 ounces from a co-owned project. In 2011/12, Venezuela nationalised all mining assets without paying suitable compensation.

Rusoro Mining didn't just take this laying down, but teamed up with a litigation financier (a competitor of Burford Capital) to provide millions of upfront costs for a lawsuit that was going to claim USD 3.3bn in compensation from Venezuela. Four years later, the arbiters made an unanimous decision in favour of Rusoro Mining, granting USD 967m in damages plus interest. Additional interest has since accumulated at a rate of over USD 80m p.a. and will keep accumulating until the debt is repaid or a different kind of agreement is made between the parties. In comparison, Rusoro Mining's current market cap based on its fully diluted share capital of 585.6m shares is a mere USD 35m. You can buy into this claim at about 3% of its nominal value, compared to an expected eventual pay-off from Venezuela of somewhere between 25-30%. By distressed debt standards, this is a cheap claim to buy into with an attractive multiple. Where's the catch? Trading liquidity in the stock is fairly limited – though may be large enough for private investors who want to have a fun, intellectually interesting investment that fits into the far-end corner of their stock portfolio.

Another superbly attractive Venezuelan claim, and one with a decent amount of trading liquidity, was featured in my latest research report for Undervalued-Shares.com Lifetime Members. Details are strictly reserved for buyers of this report, not the least because it contains proprietary, exclusive information that no one else has published in this shape and form before. If the investment thesis works out, investors can make 2-10 times their money. In a worst case, they would probably still get half their money back – an asymmetric investment case that is the gold standard of investment research.

Anyone who prefers to let others do all the hard work could simply invest in one of the handful of investment funds that provide exposure to this area – such as the Altana Credit Opportunities Fund (professional, high-net-worth investors can try to get more information on this fund from Altana Wealth).

If you are looking for something a little closer to home that involves a government which is not insolvent, how about a compensation case against the government of Italy?

The curious case of a Falkland Islands oil company

It's not immediately apparent why a London-listed company that operates in the remote Falkland Islands should have a legal claim against the government of Italy.

Let me explain….

As my 7 October 2022 Weekly Dispatch "A new oil boom in the Falkland Islands" outlined, most of the publicly listed companies involved in the late 2000s oil exploration in the British Overseas Territory subsequently went bust when the oil price collapsed following the Great Financial Crisis.

One of the early pioneers in the Falklands oil basin, however, survived the general bust and ended up investing in oil exploration in Italy, only to get expropriated by the Italian government. The subsequent lawsuit resulted in a win for the company, which was awarded EUR 190m in damages. The Italian government appealed against the case and will likely drag its feet for as long as possible, but the odds are heavily stacked in favour of the oil company – which has always kept a toehold in the Falklands and could make a comeback on the back of the Falkland projects.

This, too, is an interesting investment case that I analysed in more detail in "Falkland Islands oil boom 2.0", a report for Undervalued-Shares.com Lifetime Members.

How does the investment case stack up in terms of risk/reward ratio? The Italian claim is probably worth more than the entire market cap of the company in question, and the potential pay-off from the oil assets in the Falkland Islands gets thrown in for free.

An American case to blow your mind

Not every litigation finance case has to involve exotic countries.

Pinelawn Cemetery (ISIN US7231041051, OTC:PLWN) in the US doesn't really fit into a particular category. It's not strictly speaking a litigation claim as such, but it has a strong semblance of one.

Summarising this case in a few words is not easy. It involves dormant financial claims, massive land reserves that were forest in the late 19th century but have since become part of the New York metropolitan area, and the most unusual legal backstory that anyone could have ever dreamt up.

"Pinelawn Cemetery – making a fortune from 'land share certificates'" is a real howler of a story. Be warned, though. This is a notoriously illiquid investment and I know very few people who managed to buy into it. Most brokers can't even trade this security.

When you are interested in litigation finance and legal claims, cases like Pinelawn Cemetery are useful to hone your skills and sharpen your senses for finding such outlier cases.

Defaulted debt from Lebanon

Like Venezuela, Lebanon has one of the world's largest pools of defaulted capital – and for once, buying into one of these opportunities is really easy. Lebanese bonds trade on major Western exchanges and are actually very liquid. They are currently trading at 6% of their nominal value and should eventually be settled between 25-30%.

Two new stocks for you to research further

One of the great advantages of publishing an investment blog is that readers come back to you with valuable feedback and interesting ideas.

When I first reported about Burford Capital, I wrote that it's one of just three listed companies in the space (and discarded the other two as not particularly interesting).

As a reader then pointed out to me, in addition to Burford Capital, there are another two litigation funders that you can invest into through the stock market. Both of them were hiding on London's AIM sector, a notoriously opaque market where diligent researchers often make surprising finds.

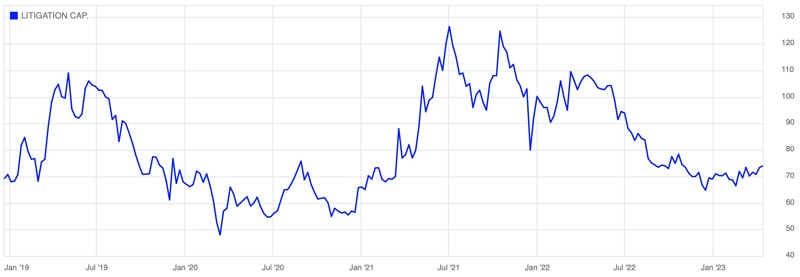

Australia-based Litigation Capital Management (ISIN AU000000LCA6, UK:LIT) listed in December 2018. It is much smaller than Burford Capital, but has some significant claims, most notably in the insolvency market where it got involved with the cases of Carillion and Comet (two infamous British insolvency cases). The company has also started to adopt the asset manager model, in a similar fashion to Burford Capital, which could help smooth out long-term returns. Notably, Litigation Capital Management still uses a traditional cash accounting style model. That's a more conservative way of accounting for these claims, and even though the company proudly explains its conservative accounting approach on its corporate website, this policy may have held the stock back.

The stock is down 40% compared to its spring 2021 high, but seems to have bottomed out.

Litigation Capital Management.

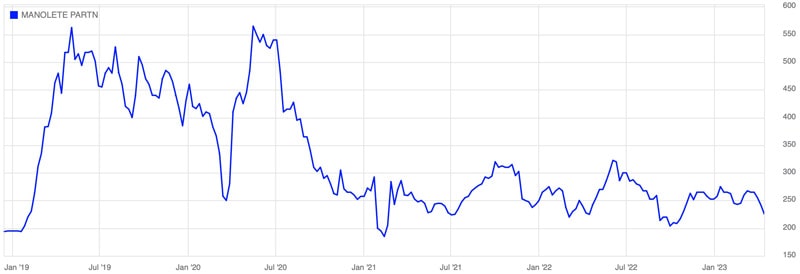

Besides, there is Manolete Partners (ISIN GB00BYWQCY12, UK:MANO), which has carved out a niche in insolvency claims. During its lifetime, the company has invested into over 1,000 insolvency cases – basically, doing on a small scale what distressed debt investors do with bonds of defaulted countries.

The temporary suppression of insolvency cases during the pandemic lockdowns wasn't helpful for the company, and it has also faced criticism over its accounting. Interestingly, Burford Capital had once invested in Manolete Partners, but later sold its stake.

One would think that with a potential recession in the wings, a firm focussed on insolvency cases should do well. However, compared to pre-pandemic times, Manolete Partners stock is still down 50%.

Manolete Partners.

Is either one of these companies undervalued?

I haven't done any deep research on them yet, but their charts look promising. In any case, these are two unusual companies that operate in a field with a lot of growth potential but relatively few experienced operators with access to outside growth capital. This overall constellation could make these companies worth a closer look.

Burford Capital: more undervalued than ever?

Given recent developments, I can't recommend highly enough to take another look at Burford Capital (if you haven't done so already).

The company remains an outstandingly interesting investment case, and its stock could be trading at double its current price before too long.

Dig out my research report (again) for a fresh perspective on the investment opportunity.

Burford Capital: more undervalued than ever?

Given recent developments, I can't recommend highly enough to take another look at Burford Capital (if you haven't done so already).

The company remains an outstandingly interesting investment case, and its stock could be trading at double its current price before too long.

Dig out my research report (again) for a fresh perspective on the investment opportunity.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: