A week ago, a group of 15 intrepid Undervalued-Shares.com readers visited Istanbul.

The trip was designed to:

- Have Turkish companies present their investment case to us.

- Learn about Turkey in general – economy, politics, and people.

- Meet like-minded individuals.

How did it all go, and what were our key learnings?

Undervalued-Shares.com readers in the boardroom of Sabancı Holding.

Medical tourism turned cash cow

Turkey has become well known as a place to travel to for medical treatments, cosmetic surgery, or hair transplants. Sometimes it comes with a negative touch – just think of the media highlighting cases where someone travelled to Turkey and it all went wrong.

We visited MLP Care / MLP Saglik Hizmetleri (ISIN TREMLPC00021, IS:MPARK), Turkey's largest private hospital group. It operates 26 hospitals with over 5,000 beds in 15 cities under the Liv Hospital and Medical Park brands.

Our visit was an eye-opening experience.

As one participant put it, the hospital we've been shown was nicer than a Mayo Clinic in the US, the high-end private hospital chain. It even had a former Mayo Clinic doctor working there.

Admittedly, we visited the highest-end hospital of the group, one that had been built very recently and specifically for wealthier Turks and foreign visitors, many of whom come from the Gulf region. Still, it was a useful example to see what is possible in Turkey:

- West European visitors get treated at one third the typical cost.

- US visitors only have to spend one sixth of their usual cost.

- A new hospital built by MLP Care can break even after six months.

- Thanks to its asset-light model, the company can open a new hospital with a cash outlay of just USD 8m.

Originally backed by Carlyle Group, MLP Care has grown out of nowhere to lead the Turkish hospital market with a 12% market share overall. It's bigger than the market's #2 and #3 combined.

Some of the market's aspects are not without controversy. E.g., one of the reasons why costs are so low is that Turkish hospitals are difficult to sue. Is that a bad thing, given how excessive malpractice claims can be in the US? You be the judge. MLP Care has turned it into a selling point: for about USD 50, patients get insured in case they need follow-up treatments after their return home.

MLP Care gets clients not just from Western Europe, but from parts of the world where governments haven't built their own healthcare infrastructure. E.g., the governments of Bahrain and Bosnia-Herzegovina signed contracts with the company to send patients to Turkey at the expense of the treasury. It's cheaper than to build a national healthcare system from scratch. Consider that Turkish Airlines (ISIN TRATHYAO91M5, IS:THYAO) flies to more destinations than any other airline in the world, and it all starts to make sense.

Presently, foreigners make up 20% of MLP Care's revenue, and the target is to get them to 30%. Another important segment are so-called top-up services, which are services that go above and beyond what is covered by the government. MLP Care has found that the primary target group for these services are newlyweds with young children looking for better options than what is provided by the government. This is a good demographic to be in as these customers can stay around for decades.

Half of MLP Care's growth stems from buying distressed hospitals and turning them around using the company's proven model, which includes its advanced digital infrastructure. MLP Care tries to run an asset-light model overall, and the real estate necessary for the hospitals is held by external investors.

Did the election change anything for the firm's long-term outlook? Both ends of the political spectrum in Turkey were in favour of private healthcare, and private care has only penetrated 25% of Turkey's healthcare sector so far. It does seem like there is plenty of room to grow. MLP Care currently has no financial leverage worth mentioning and should be able to plan its future from a position of strength.

Our group felt that longer term, Turkey might switch from competing on price to competing on expertise. The rate at which MLP Care is able to acquire expertise is probably significantly faster than, for example, much of Western Europe's.

Leaving aside stock market gyrations and valuations, this visit and the presentation by MLP Care's CFO, Burcu Öztürk, left everyone just a little impressed and with a crack in our matrix of preconceived ideas.

Liv Hospital in Vadistanbul.

Operating a bank during inflationary times

With a recent inflation rate of 44% p.a., Turkey is in a league of its own – in a bad way.

How can anyone operate a bank in such an environment, and what does it mean for shareholders of such institutions?

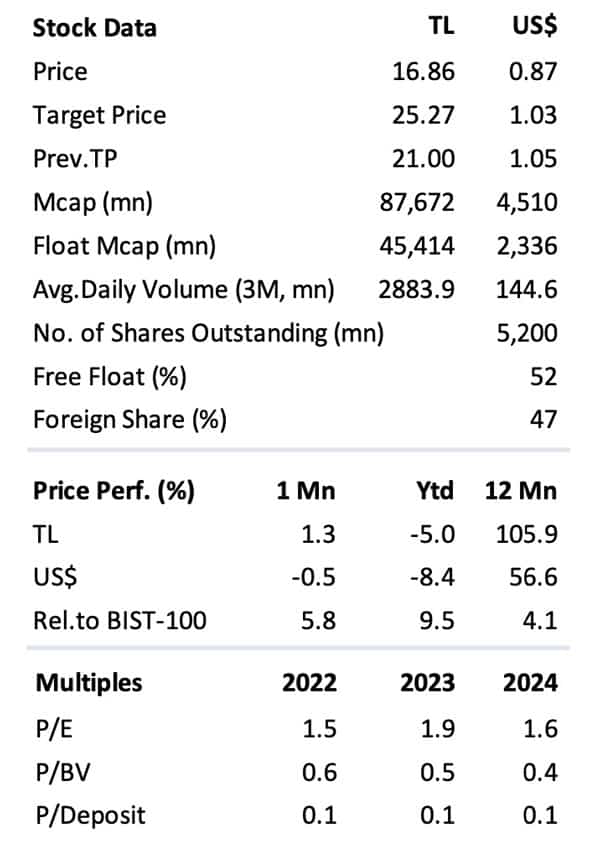

We tried to get to the bottom of this during our visit to Akbank (ISIN TRAAKBNK91N6, IS:AKBNK), one of Turkey's largest banks.

"It's an extremely demanding environment", was the reply of the management team.

Somewhat counter-intuitively, Akbank seems to not just survive, but actually thrive. Inflation-adjusted, it recently achieved a return on equity in the high single digits.

How did it pull that off?

Our group concluded that this sort of environment requires the management to constantly focus on short-term issues and changes. As the bank's team told us, they are often enough informed about a policy change on Friday evening and then have to work throughout the weekend to be prepared for business reopening on Monday. One of the group's members summed it up as "so much of it sounds ultra-short-term".

It's not all what it seems, though. E.g., Akbank generates 36% of its revenue from payment systems. The bank could close down all lending and would still be left with two thirds of its revenue.

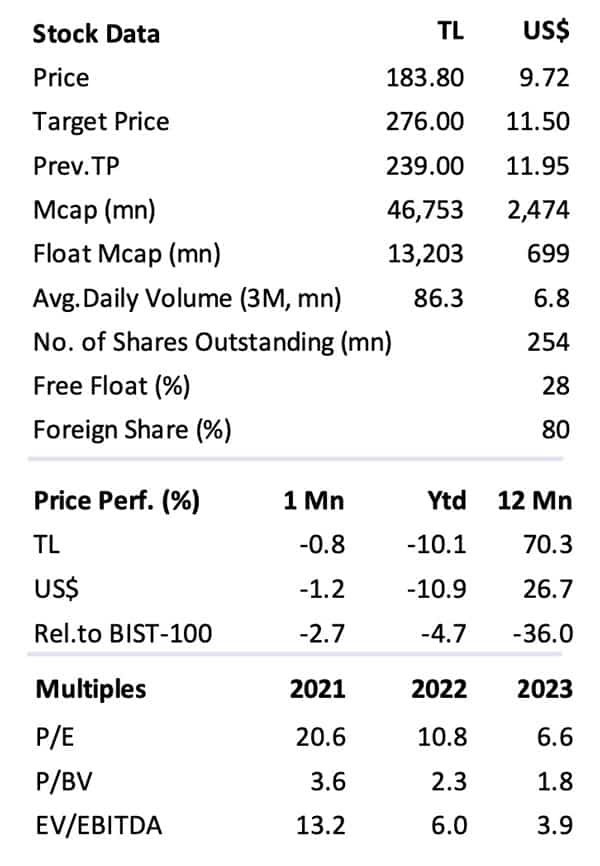

Depending on which estimates you choose to believe and how you treat inflation, Akbank stock is trading for a p/e of either 1-2 (see table below) or 3-4 (a more conservative estimate). The young Turkish consumer base is hungry for new services, and Akbank is strong in customer acquisition. One does need to wonder whether operating in an underpenetrated, high-growth market makes up for the troubles caused by inflation.

To study this case in more detail, please download Akbank's extensive presentation of its Q1/2023 results.

Source: İş Investment, 27 April 2023.

From manufacturing to branding

Turkey is a hub for textile production, and Mavi Giyim Sanayi Ve Ticaret (ISIN TREMAVI00037, IS:MAVI) seems to be the stand-out company of the sector.

Founded in 1991, Mavi used to be a manufacturer of jeans, primarily selling under Western brand names such as Calvin Klein.

Today, Mavi (Turkish for "blue") is a major brand in its own right – and one that you can purchase not just in its 340 stores across Turkey. Over the past 13 years, the company has gone from producing 900,000 jeans mostly on behalf of other brands, to selling 10m jeans under its own brand.

In 2008, America private equity bought into Mavi and had it change direction. At the time, the company didn't even have a system to reliably figure out how many of its jeans it sold to its branded clients and how many it sold itself.

Today, Mavi is a successful, modern retailer that impressed even the retail entrepreneur who was part of our group.

Turkey has an extensive ecosystem for denim, which Mavi continues to use in order to produce its goods. The company's focus, however, is its brand and the customer experience that it offers through its omni-channel strategy. Mavi is the #1 jeans brand in Turkey and seems to have captured both the hearts and minds of Turkish consumers. Its CEO, the energetic Cüneyt Yavuz, wanted to see us for 20 minutes of our scheduled one-hour stay, but he ended up speaking with us for 90 minutes. He was the most memorable person we met on this trip. Yavuz explained how he turned what is ultimately a me-too product (jeans) into a superior product that lives off its relationship with consumers. As a a self-confessed "psycho on inventory management", he also seems to run a swish operation.

The transition from manufacturing to branding helped Mavi to significantly increase its margins. "Made in Turkey" is now appreciated by Turkish consumers and preferred to "Made in Bangladesh" or "Made in China", which is what cheaper brands use.

Turkish jeans aren't Italian jeans, but they are not trying to and they don't need to be. Given the vast size of the Turkish market – 85m consumers – Mavi is an interesting company even if you disregard the international expansion that it has begun, including in the US.

On the way out, more than one member of our group purchased Mavi jeans at one of the brand's countless shops in Istanbul.

Source: İş Investment, 30 March 2023.

Turkey's leading IPO bank

Were we the only investors currently mad enough to take a curious look at the Turkish market just ahead of the country's major elections?

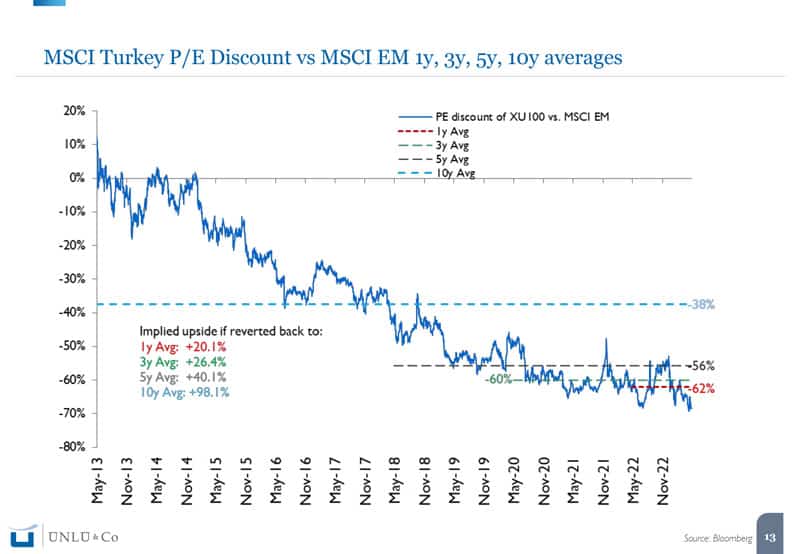

Not at all. The management team of ÜNLÜ & Co. (ISIN TREUNCO00023, IS:UNLU) just recently met with investors in London, New York and Boston. The reason why they have been getting attention abroad might be the potential of ÜNLÜ's stock as a high-leverage play on the Turkish market.

ÜNLÜ is Turkey's leading provider of investment advisory and asset management products – "Turkey's local version of Goldman Sachs", as we joked, though this description may not be far off.

With a 22% market share, the company is the top player in the Turkish IPO market.

It has a 20% market share in M&A advisory services.

Its CEO, chairman and major shareholder, Mahmut L. Ünlü, explained to us how Turkey was getting a lot of attention: "China is too risky. South Africa is a basket case. This leads to foreign companies looking at Turkey, where they find a strong industrial base." As he sees is, there is a lot of foreign money potentially looking to come to Turkey. Valuations are low, with banks trading at a p/e of 4 (previously 15) and retail trading at 6-7x earnings.

Turkey currently has a high negative interest rate, and almost every executive that we met agreed that the country needed to get back to some kind of economic orthodoxy. In the meantime, however, there is also opportunity in crisis. Many defaulted borrowers are now much more willing to settle their outstanding debt, prompting ÜNLÜ to buy up portfolios of non-performing loans from banks. "It used to be difficult to collect 50%. Now, people pay up the full amount." Higher inflation as an incentive for debtors to settle their outstanding obligations – who knew?

As highlighted in "Turkey – taking stock in times of change", between 2018 and 2021, the share of foreign ownership in Turkey's stock market had dropped from 65% to less than 30%. ÜNLÜ could benefit significantly if or when foreign money returns to Turkey in force, growing its income by a multiple.

In the meantime, ÜNLÜ is scaling up a new product that could single-handedly change the company's perception: Piapiri, a trading app for Turkish investors. If the app takes hold, it could put the stock of its owner into the spotlight.

All the while, ÜNLÜ educates investors on what it sees as the strengths of the Turkish market, including:

- Turkey's national debt is just 36% of GDP.

- Turkey recently made up with Saudi Arabia, which is a notable change set within the current geopolitical developments.

- Investors from countries such as the United Arab Emirates have started to look at a broader range of Turkish assets rather than just trophy assets (which feeds into the previous point).

For a detailed overview of the Turkish stock market, please download ÜNLÜ's May 2023 "Turkey Strategy".

Cars as cash cow

Carmakers are not exactly an investors' darling right now. Nevertheless, meeting the management of Turkish automobile manufacturer TOFAŞ (ISIN TRATOASO91H3, IS:TOASO), left our group surprisingly impressed.

TOFAŞ was established in 1968 as Türk Otomobil Fabrikası A.Ş., with the help of what was then Fiat. Following the merger between Fiat Chrysler Automobiles and Peugeot S.A. to form what is now Stellantis (ISIN NL00150001Q9, Euronext:STLA), TOFAŞ became the joint venture partner of Koç Holding (ISIN TRAKCHOL91Q8, IS:KCHOL), the world's fourth largest car manufacturer behind Toyota, Volkswagen, and Hyundai Motor. The giant Turkish family holding that controls 5% of the country's entire GDP, owns 37.85% of the company, as does Stellantis. Of the remaining 24.3% of outstanding shares that are in free float, about 35% are in foreign ownership.

Many still think of Turkey as primarily a cheap manufacturing hub, but the country is more than that. TOFAŞ is one of the largest research and development centres of Stellantis in Europe. The company has a strong presence in the region, and a domestic market-leading share of 21% in light vehicles.

According to an agreement between Stellantis and Koç Holding, Stellantis is to consolidate all of its commercial activities in Turkey under TOFAŞ. This consolidation will have a notable effect on TOFAŞ, leading to a 50/50 split of its car production for the export and domestic markets (so far: 75/25). The export component provides stability, whereas the domestic component provides growth. So far, Turkey has just 200 cars per 1,000 residents. In Bulgaria, it's 500 cars per 1,000 residents while in the US, it's 831 cars.

As a highly profitable, balanced business with a strong market position and plenty of room to grow, TOFAŞ could attract new investors once its new structure is in place.

Source: İş Investment, 3 February 2023.

Hungry Thirsty consumers

Turkey and the entire surrounding region have their issues and risks, but a lack of growth potential is not among them. It's quite possible that Coca-Cola İçecek (ISIN TRECOLA00011, IS:CCOLA) is the right way to play this trend, provided you are lucky enough to pick up some shares on the cheap during the occasional sell-off.

CCI is a beverages company that produces the world's best-known beverage, Coca-Cola, for sale in 11 countries: Turkey, Kazakhstan, Uzbekistan, Kyrgyzstan, Tajikistan, Turkmenistan, Azerbaijan, Pakistan, Syria, Jordan, and Iraq.

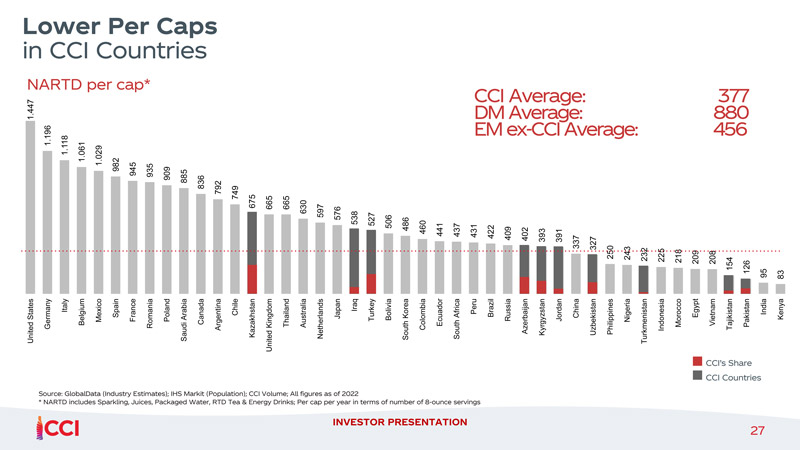

It's a region of 430m consumers where the per capita consumption of canned and bottled drinks is still way below the rest of the world: the so-called NARTD per capita (sparkling water, soft drinks, juices, energy drinks and similar beverages) is 880 in the developed world, 456 in other emerging markets, and just 356 in the countries that CCI operates in.

If you believe in consumers in these regions gradually catching up with their peers (and the rest of the world), then CCI stock is one of the ways to latch onto it with relatively low operational risk and a significant leverage effect.

From 2005 to 2022, CCI has grown as follows:

- Volume: fivefold with 10% compound annual growth.

- Sales: 45-fold with 25% compound annual growth.

- EBITDA: 52-fold with 26% compound annual growth.

The company won't continue quite at that rate. In 2005, it was a single-country bottler; going forward, it will not be able to add further countries at the same rate – even though it's currently "working on one market with very high potential", as our group learned.

CCI has a different set of challenges and opportunities than other companies in the beverage industry. Pepsi is actually quite dominant in the Middle East, and in some of these countries Coca-Cola is only a weak #2.

Given the company's quality, the stock does not often come up for sale at a cheap valuation. Still, events in the region can lead to the occasional bargain. E.g., in March 2022, the stock of Coca-Cola Hellenic Bottling Company (ISIN CH0198251305) had come under pressure due to the nearby Ukraine war, falling from EUR 30 to EUR 20. It is now back up at EUR 28. Come hell or high water, the world is thirsty for Coke.

CCI will suit investors who want exposure to this region's growth markets in a way that also gives them the safety of the Coca-Cola brand. The stock is worth keeping an eye on.

Source: İş Investment, 28 February 2023.

Supermarkets with a twist

Cooperative-based Migros is the leading supermarket chain Switzerland, but there is also a market-leading public company of the same name in Turkey – who knew?

Migros Ticaret (ISIN TREMGTI00012, IS:MGROS) is the #3 player in the Turkish retail sector overall, and the leading supermarket chain. It has had an interesting history in capital market terms.

In 2008, private equity company BC Partners purchased 51% of Migros from Koç Holding, and subsequently upped its stake to 98%. In 2011, it sold 20% of the company back to public markets. In 2015, it revealed that it would sell 40.25% to the Turkish conglomerate Anadolu Group for around USD 2.7bn – in essence, a management buyout.

The company has repaid the debt that stemmed from the MBO, and it's now entering the post-MBO phase. For the first time in 14 years, it started paying a dividend. Migros has a net cash position, no hard currency debt, and it will now find a balance between investing in growth and paying out dividends.

There are some surprising, non-obvious aspects to Migros, such as the recent provision of consumer loans which give consumers access to 60-day, interest-free loans to fund purchases at Migros, without any risk to the company. How is that possible? Migros has partnered with a fintech company that provides this risk-free, interest-free capital, in exchange for access to Migros' customer base to whom it then tries to upsell further financial services. This was a clever move on the side of Migros to provide an additional service to its customers, increase its own sales, and do so without putting any of its capital at risk.

Migros may just be the right way to play the rise of the Turkish consumer.

Family holding as de facto ETF

The name Koç Holding has already popped up several times, but the Koç family is not the only mega-clan in Turkey's economy. There is also the Sabancı family, which has built Sabancı Holding (ISIN TRASAHOL91Q5, IS:SAHOL) into one of the leading Turkish holding companies.

Sabancı is akin to buying a Turkey ETF: more than 80% of its portfolio is invested in ten publicly listed Turkish companies. The largest of these companies is Akbank, which makes up a third of the entire portfolio. Enerjisa Enerji (ISIN TREENSA00014, IS:ENJSA), Turkey's leading company in electricity distribution, is the second largest investment, representing 16% of the portfolio.

Sabancı is currently investing into renewable energy projects in the US, and its strategy of doubling capital expenditure will see 76% of all investments focussed on the "New Economy". Sabancı is making a visible effort to present itself as a modern, shareholder-friendly company.

Despite growing its US dollar-based net asset value over the past years, the stock is currently trading at a material discount to its historical p/e multiples – and a valuation at a p/e of 2 seems cheap indeed.

Source: CCI Investor Presentation, May 2023.

Our conclusions

This was a rapid-fire summary of sum of the trip's findings.

How does it all stack up from the perspective of foreign investors?

For once, Turkish stocks are very difficult to access. With the exception of some foreign-listed Turkish stocks, investors need to open a local brokerage account, which makes it difficult but also potentially interesting. Once it becomes easier to trade Turkish stocks – which it will at some point, e.g. thanks to trading apps such as Piapiri eventually opening to foreign users – the market could see additional investment flow into some of these names.

Valuations are an issue, though. Some Turkish stocks are cheap, but are they cheap enough?

At a time when many stocks listed on Western exchanges are trading for p/e ratios of 3-6 (banks, energy, and other Old Economy sectors), is it worth going the extra mile to invest in Turkey?

Paraphrasing some of the feedback from our group:

- "Wait for another steep devaluation of the Turkish Lira, and then prepare to strike."

- "Some individual stocks could do really well. ÜNLÜ could perform very strongly when foreign investment flows into Turkey again."

- "Turkey is interesting to learn how banks and other companies can navigate inflationary times. Maybe we all need to learn from them given what's happening in Europe and the US right now."

- "Strong growth from eager consumers makes up for a lot of the other sins."

- "The strong interest from domestic investors has led to Turkish stocks currently being not as cheap as you'd think." (See also the 30 December 2022 Financial Times article "Turkish stocks soar as local investors seek refuge from blistering inflation".)

- "Because of the high inflation rate, it is VERY difficult to make any sense of the figures published by Turkish companies."

- "It's remarkable that despite the well-known difficult situation of the Turkish economy, these companies just accept the externalities for what they are and deal with them."

- "Turkey is a place for diversifying some of your wealth away from Western welfare states."

Outside of the immediate investing aspects, the trip also gave some illuminating insights into the changing economic landscape of the planet. The expensive parts of Istanbul oftentimes felt more vibrant – and pleasant – than some cities in the Western part of the Mediterranean. Personally, I decided that if ever I were to get a hair transplant, I'd do so in the Liv luxury hospital. As one participant put it: "It never felt like we were in a hospital. It felt like a 4-star hotel with a lot of office space."

All of this also needs to be seen in light of the recent political developments. Turkey's election ended with a 52% win for president Erdoğan, and it remains to be seen how the country's finances and surrounding policies may change now that its long-running ruler is firmly in the saddle for another five years. The Turkish lira has lost 80% of its value against the US dollar in the past five years, largely a result of Erdoğan pressuring his central bank into cutting interest rates despite high inflation. On the day after the election, the stock market jumped 4% but the lira continued to decline in value. Does Erdoğan intend to return to a more orthodox policy now that he has secured power, and could he even change course? Sceptics will assume that he will continue to run the value of the lira into the ground, but a more optimistic outlook has him appoint some economic advisors who are respected by financial markets, at least initiating a partial return to more widely accepted policies. There is a huge range of potential outcomes, whose background was yet again widely reported in the media recently, such in the Wall Street Journal and the Financial Times.

Turkey is certainly a complex investment case – which is challenging, but it may also be where the opportunity lies, as complexity often creates pockets of overlooked value.

Also, any provision of more than an initial commentary on any of the companies above would require a proper deep-dive first. Attending personal presentations by C-suite executives of public companies is a hugely informative affair, but it only gets you the management narrative. All of us enjoyed getting to hear (and see) a different set of narratives than what you'd usually get in much of the mainstream media.

It certainly was a mind-expanding trip, and fun as well!

Future trips – feedback please

Trips such as the one to Turkey have benefits that go beyond the obvious.

"The group is outstanding. I haven't had such quality conversations in months."

Indeed, one of the aspects that has come up consistently in the two decades of my organising get-togethers is that readers appreciate meeting like-minded people.

In fact, my motley crew of participants got along so well that some of them talked of wanting to get back together in Istanbul later this year to catch up again. As one group member put it: "If someone had told me before I left to come here that being in the company of such an amazing group of people with such impressive and inspiring individual stories would've been an even bigger enjoyment than all the company meetings, I would not have believed them - but it absolutely was."

Everyone made valuable new professional contacts, and new friends.

"When do you do another such trip? Where to?", was one of the questions that came up.

Well, with a bit of luck, I might pull together another such trip before year-end. The list of potential countries to visit currently includes Israel, Saudi-Arabia, Slovenia, Serbia, Argentina, Denmark, Austria, and Hungary.

If you are among those interested in joining another trip, what would you like to see, and what would be the biggest added value for you from such an event?

As ever, your feedback is much appreciated and will help to map out next steps. Looking forward to it – just drop me an email.

Can't get enough of Undervalued Shares?

Head over to LinkedIn, and read even more from your favourite investment blog!

It's the youngest member of the Undervalued-Shares.com social family, and still growing.

Watch it evolve, and enjoy short summaries of the Weekly Dispatches, updates on the latest research reports and other news while you do.

Can't get enough of Undervalued Shares?

Head over to LinkedIn, and read even more from your favourite investment blog!

It's the youngest member of the Undervalued-Shares.com social family, and still growing.

Watch it evolve, and enjoy short summaries of the Weekly Dispatches, updates on the latest research reports and other news while you do.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: