Across European markets, stocks of real estate companies are currently down 50%, 70% or even more.

The share price of the Société des Bains de Mer (SBM), on the other hand, is trading at an all-time high.

What has been driving this outlier performance, and could there be further gains to come?

Today's article squares the circle with my Weekly Dispatch from 16 September 2022, where I promised an update once an important development had taken place.

SBM.

SBM delivers – yet again!

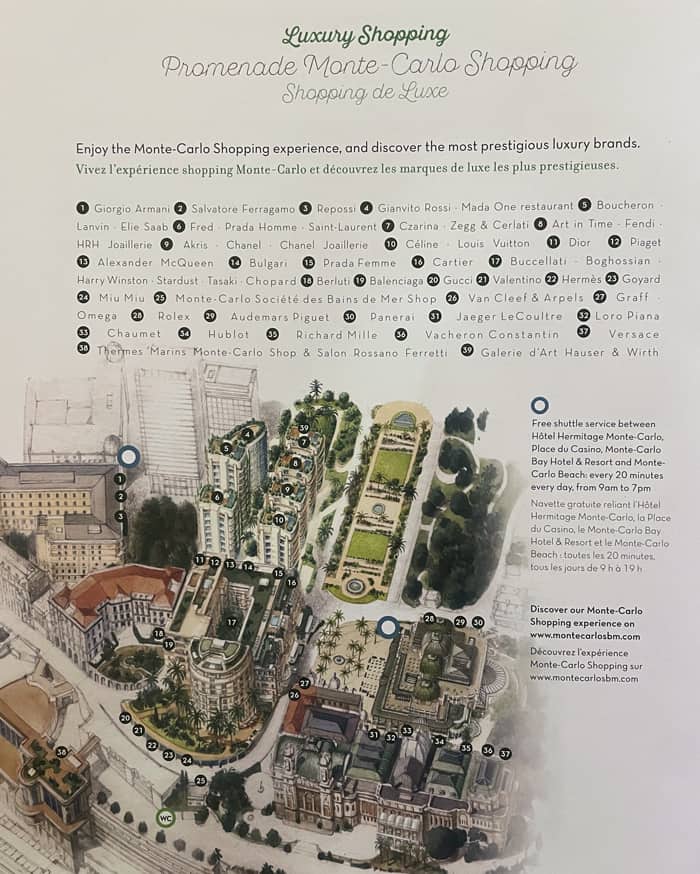

SBM (ISIN MC0000031187, Euronext:BAIN) owns a property portfolio in Monaco that comprises the Hôtel de Paris and the Hôtel Hermitage, the world-famous Casino de Monte-Carlo, the Café de Paris in Casino Square, and even the opera building. The company operates 20 restaurants, the spa Les Thermes Marins, and Jimmy'z nightclub. It also owns several hundred apartments, among them the uber-expensive One Monte-Carlo residences in a brand new development right on Casino Square.

SBM owns everything around the famous Casino Square (image credit: Drozdin Vladimir / Shutterstock.com).

It all started in 1863, when SBM purchased 100,000 square metres (about 25 acres) of prime land in Monaco for the proverbial song. At the time, Monaco had just lost 80% of its territory and was nearly bankrupt. Much of the remaining land consisted of farmland, and many residents lived in subsistence. There was no road connection to Nice, and visitors had to come by boat or take a treacherous path through the mountains. So dire was Monaco's situation during this era that a piece of land famously changed hands in exchange for a dinner for 12.

Monaco's recognisable coastline in the 1850s.

Earlier this week, I gave SBM's products and services a thorough test run. Over four days in the Principality, I put myself through arduous tasks such as using the garden bar of the Hôtel Hermitage for meetings, attending a gala dinner in the Salle Empire at the Hôtel de Paris, and enjoying a local produce lunch at the group's Monte-Carlo Beach Hotel. I tried to get myself up to speed by speaking to residents, journalists, taxi drivers and business owners – to the degree that anyone can get a real handle of the situation in the space of just four days.

My visit coincided with a pivotal moment in time for SBM's further development. During the past years, the company had spent much focus on renovating the Hôtel de Paris and building the One Monte-Carlo neighbourhood. These large projects are now completed, leaving SBM's management team with the necessary headspace to think about the next big moves.

SBM also just bagged a stunning one-off profit from a development that I had pointed out in my September 2022 Weekly Dispatch. Since 2009, SBM had held a minority stake in Betclic, an online betting company. On SBM's balance sheet, the stake was valued at probably EUR 115m – no one knows for sure, because SBM's accounts were never quite clear in this regard. In spring 2022, Betclic went public through a merger with a SPAC, which gave SBM an opportunity to sell half of its stake for EUR 425m. For the other half of its stake, the company was under a lock-up until July 2023. As soon as the lock-up expired, SBM sold these shares, too. In total, SBM cashed out a cool EUR 800m from a non-core financial investment that it had purchased for a fraction of the price. This was a major windfall even when compared to SBM's market cap of currently EUR 2.7bn.

Combine all that with the appointment of a new CEO in January 2023, and you get a potentially potent mix for shareholders that should perk up your ears.

SBM stock has reached a new all-time high of EUR 111 recently, delivering on my September 2022 prediction that "it does look like the stock price has further to run over the coming 12-18 months. It's likely going to breach the EUR 100 threshold soon."

If you look at the long-term chart of the stock (which I first reported on in 2004), you'll see how the old saying holds true that the rich always get richer.

SBM.

A new era beckons

Stéphane Valeri became CEO of SBM only in January 2023, but he has a long-standing history with the company as well as Monaco politics, having held the most powerful political position in the Principality from 2018 to 2022. What's more, Valeri's father had spent his entire career working for SBM, and his great-grandfather had worked for the company during its early days in the late 19th century. Speak of having SBM in your DNA!

The Monaco insider has just expanded the company's management team from six to nine. Notably, the new appointments included a senior executive dedicated to the idea of expanding SBM internationally.

Source: Hello Monaco, 27 May 2023.

Monaco is limited in space, but previous attempts at expanding outside of its borders were not exactly successful. An SBM-branded beach establishment that opened in Abu Dhabi in 2011 had to close three years later. The attempt to establish the brand "Monte Carlo Casino" for online gambling didn't get very far either. Expanding beyond your home market is never an easy task, and SBM will have to find a way to make its very Monaco-specific brand and heritage relevant in other places.

Based on an extensive interview that Valeri gave to the local media, SBM is now going to make another push not just on carefully considered international expansion, but in other areas as well. The July 2023 edition of the Monaco Hebdo magazine has Valeri on its cover page, and copies of it are proudly displayed in the lobby of SBM's headquarter, a surprisingly non-descript building in the Principality's "cheaper" Fontvieille neighbourhood, located next to one of the Bentley and Ferrari dealerships that litter the entire Principality.

The interview is only available through the hardcopy of the free magazine; you can download a scan here. It's best to read this interview alongside another article about SBM's new leadership, which Monaco Hebdo had published on 18 May 2023.

Highlights of the potential future plans under SBM's new leadership include the following:

- A full takeover of the site of Le Méridien Beach Plaza in Monaco, which SBM holds a long-term leasehold of that expires in 2026. The state of Monaco is the property's freeholder, and passing the redevelopment of the site to SBM may be on the cards. Valeri has already stated that the hotel, which started as a Holiday Inn in the 1970s, should be knocked down entirely and replaced with something new altogether: "To avoid doing something massive, we can imagine the construction of two airy buildings, with green spaces, swimming pools in the middle. We are not obliged to build a tower in place of this hotel. But it's not me who will decide. Architects will work on it." The Le Méridien Beach Plaza has the only private beach of Monaco, which – at a time when Monaco's public beaches are on the cusp of overcrowding (see my snapshot below) – makes it a potentially uniquely valuable site.

Monaco's public beach in July 2023.

- A potential relocation of the coastal road between the Monte-Carlo Bay Resort and the Monte-Carlo Beach Hotel. It has just emerged that SBM actually owns both the road and the small forest that is located right behind the road, and considerations are underway to make use of the forest site. This would be on French national territory, but immediately adjacent to Monaco. Operating assets just outside the Principality's border is not new for SBM, mostly famously with the Monte-Carlo Beach Hotel.

Another overlooked SBM asset – now being looked at!

- A rethink of the Monte-Carlo Sporting building complex (also known as Sporting d'été), which is owned by SBM and mostly used for entertainment and events. Originally built in the 1970s and renovated in 1999, this site seems ripe for such a rethink, given that a part of it is used as a car park! As ever so often with assets that SBM has in its back pocket, real estate doesn't come any more prime than this.

A super prime site now awaiting redevelopment.

- The pending purchase of a hotel in Courchevel, the elite French skiing resort. Its international expansion strategy is still under development, but SBM has made it clear that it wants to invest in locations that Monaco residents would typically like to frequent. This includes locations such as St. Barts, Miami, Dubai, and London. The Courchevel opportunity was reportedly too good not to leap at it.

Source: Monaco News, 14 July 2023.

- A repurposing of the unique "Monte Carlo Casino" brand. When people think of gambling, they will usually think of Las Vegas, Macau, and Monte Carlo. Yet, in terms of global market share of the gambling market and annual revenue, the Monte Carlo Casino brand is almost negligible. How to take this brand abroad and grow its revenue? It's not an easy task given the past experience of trying to do so in the online space and failing at it. Still, SBM is now considering to do something about adding a casino in London. With its combination of heritage, wealth and global connectivity, London may just be the place where something like that could fly.

- A EUR 55m refurbishment of the Café de Paris site in Monaco's Casino Square. The famous café will be expanded to two floors, another new floor will house an outdoor restaurant operated by the international Amazónico brand, and new retail spaces will be occupied by top luxury brands from the watch and jewellery sector.

The area around Casino Square is AAA+ retail space.

There is much ado in the Principality and at SBM. The welcome sign at SBM's office says "Monte Carlo – Société des Bains de Mer", arranged in such a way that everyone immediately gets how Monte Carlo is SBM and SBM is Monte Carlo. What's good for one, is also good for the other!

Which is where Monaco's unique role in Europe – and the world – increasingly comes into play.

A European lifestyle like in the olden days

Monaco has long been the world's most expensive place for residential real estate, and the gap between prices in the Principality and the rest of the world will probably only widen further.

It barely needs spelling out that much of the Western world is potentially facing a mix of problems. Structural issues that had been known for decades but were never addressed appropriately have now started to create measurable and visible real-world consequences.

Look no further than this 17 July 2023 long-read piece by the Wall Street Journal: "Europeans Are Becoming Poorer. 'Yes, We're All Worse Off.'"

Source: Wall Street Journal, 17 July 2023.

Tax rates across Western Europe are at or near their highest point since the end of the Second World War, and with spiralling costs for welfare systems, they will probably rise yet higher. A raft of other issues that make many people reconsider where they live include rising crime, failing immigration policies, and a loss of personal liberty. Places like Malta, Cyprus and Portugal are seeing record numbers of new residents. As one recent headline summarised it: "More millionaires leaving UK than Russia." The underlying issues and motivations are complex and varied, but the growing demand for alternative jurisdictions is beyond doubt.

Needless to say, Monaco is not to everyone's taste. It's dense, with an aged population (average age 55 years), and many say that the social life in the Principality can be very "transactional". The cost of living in the Principality is eye-watering, and simply out of reach for most. In terms of value for money, Dubai is the winning alternative for many, as its rapid growth in residents shows.

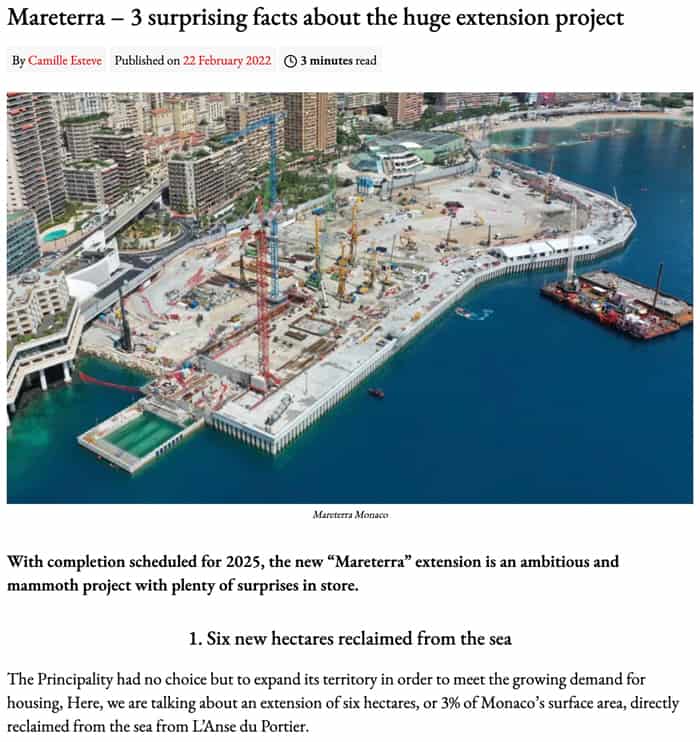

Yet, among those who can afford it, Monaco continues to be seen as an attractive option. In 1990, Monaco had 29,000 residents. Today, it's 37,000. The new Anse du Portier district, built on reclaimed land and floating platforms, will provide space for several thousand new residents when completed in 2025. Real estate prices in Anse du Portier are going well beyond EUR 100,000 per square metre, but demand is reported to be strong.

Source: Monaco Tribune, 22 February 2022.

Even in its current unfinished look, this new living quarter makes for an impressive addition to the Principality.

The new Anse du Portier district, due to be completed in 2025.

As I discussed with one Monaco resident, in some ways the Principality today feels like the Germany that I grew up in during the 1980s. Back then, Germany was a safe, sane place that left you optimistic for the future. Policemen were seen as being there to help and protect you – as expressed by the German word "Schutzmann", literally "protection man". Politics had its flaws, but there wasn't a sense that government acted outright against the interests of its people and country. Homelessness was a very limited issue, and not one that affected your experience in cities. Crime was not something that you worried about.

This European way of life is disappearing rapidly. You nowadays have to move to a place like Monaco.

Seeing Prince Albert in real life only adds to this impression. Unlike the set of politicians now in charge of much of Western Europe and the EU, the 65-year-old hereditary heir of the ruling Grimaldi clan commands genuine respect when entering the room. Soft-spoken, likeable and surprisingly charismatic, he instils confidence that his family's reign will continue to protect what makes Monaco special. I'd place a bet that life in Monaco will remain a rather pleasant experience for those who choose the Principality as their home, no matter how crazy politics and overall circumstances get in other parts of Europe.

It's this confidence in the future that I believe will drive SBM's business forward, and it will continue to rub off on the company's stock price.

Where to next?

I believe the share price will now head towards EUR 150.

Hard assets combined with scarcity

Real estate stocks are difficult animals. Most of the time, they trade at a massive discount to net asset value. It'd be naïve to say, though, that simply because the stock trades below the value of underlying assets, SBM stock will continue to rise.

SBM also isn't a real estate stock in the pure sense of the word. The company operates casinos and hotels as well, and it is 60% state-owned. By virtue of its unique role, it has to operate some facilities that would normally be expected to be paid for by the government, such as public gardens and the opera.

However, this quirky mix and uniqueness also adds to the attraction. France's richest man, Bernard Arnault, has purchased 5% of SBM through LVMH (ISIN FR0000121014, FR:LVMH). Aaron Frenkel, an Israeli businessman and philanthropist who lives in Monaco and presides over the Monaco Jewish community, holds 7%. A further 5% stake lies with Galaxy Entertainment (ISIN HK0027032686, HK:27), a gaming group operating in Macau. This leaves 77% of the shares in the hands of just four parties.

Given its glamour and seemingly never-ending economic success, SBM is a stock that attracts long-term investors who want to buy into both the asset and the company's heritage. I wouldn't be surprised if the supply of this share increasingly got scarce over the years and decades, simply because of a certain type of shareholder frittering away stock. Playing into this is an increasing recognition that smaller jurisdictions and microstates can make for an outstanding investment proposition. Credit Suisse's recent report "Small countries: The way to resilience" concluded that "small states worldwide thrive even in hostile environments".

The growing interest among investors in SBM stock may not be purely driven by the stock's undervaluation relative to its underlying assets, but it certainly helps. To be clear, it's not possible to value assets such as the public gardens in Monaco's Casino Square or the opera building, but for other assets held by SBM, it's perfectly feasible to hone in on a realistic valuation.

SBM does not get covered by bank analysts, but there is one recent, outstanding piece of research that looked at the company's underlying numbers in great detail: the March 2023 quarterly report from East 72 Dynasty Trust, an Australian investment trust.

The conclusion of the analysis?

SBM stock is probably "worth" at least EUR 150.

The research report didn't include any of the possibilities listed above, such as turning a worthless road into a development site to make living in the Principality even more attractive. Never mind the fact that in Monaco, prices for real estate do tend to rise almost every year – and sometimes all the more so when elsewhere in the world, the proverbial shit hits the fan.

As real estate in Monaco increases in value and SBM spreads its wings both domestically and potentially internationally, I'd say EUR 150 is indeed the logical next stop for this stock.

In the meantime, if you have any doubts, just test the product yourself. As ever, Monaco is worth a trip – with eye-watering costs, but true uniqueness never comes cheap!

How to own a (tiny) piece of Monaco

Monaco continues to be the world's most expensive real estate location.

Over the past ten years, prices have risen 75%; the rich and famous now have to fork out between EUR 40,000-115,000 per square metre for residential real estate.

If you ever wanted to buy yourself a tiny slice in the Principality, SBM remains the only publicly listed vehicle to do so.

It's also one of Europe's most mysterious (and fascinating) companies – and it's never been analysed in as much detail as in this in-depth report.

How to own a (tiny) piece of Monaco

Monaco continues to be the world's most expensive real estate location.

Over the past ten years, prices have risen 75%; the rich and famous now have to fork out between EUR 40,000-115,000 per square metre for residential real estate.

If you ever wanted to buy yourself a tiny slice in the Principality, SBM remains the only publicly listed vehicle to do so.

It's also one of Europe's most mysterious (and fascinating) companies – and it's never been analysed in as much detail as in this in-depth report.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: