Little-known, Euronext-listed Reinet offers a backdoor route to investing into Britain’s Pension Corporation.

Will Georgia’s EU membership candidate status bring further investment gains?

Georgia is a country known for being surrounded by military conflict and political risks.

20% of its territory is occupied by Russia, the surrounding region includes Turkey and Iran, and the country clearly serves as a pathway for sanctioned Russian business.

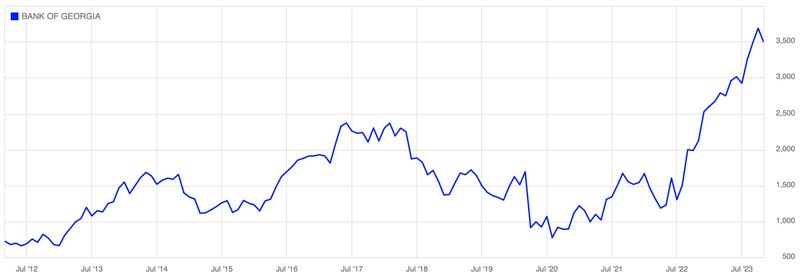

Surprisingly, its London-listed bellwether stocks have recently gone from strength to strength. Since spring 2020, Bank of Georgia is up 350%, and TBC Bank has gained 313%. The stock of Georgia Capital is up 273%, and the investment holding significantly increased its net asset value.

Over the next three months, a decision is expected as to whether Georgia will become an official candidate for membership of the European Union.

During a trip to the country to attend a friend's wedding, I had a closer look at its unique and complicated circumstances.

Georgia's location in the region (image credit: Kachor Valentyna / Shutterstock.com).

Economic success in a difficult neighbourhood

Even though it has just 4m people, Georgia is a country that gets a lot of attention. Due to its location where Europe meets Asia, it sits at the crossroads of countries that have a combined population of 3bn.

Over the centuries, its strategic location made Georgia the object of rivalry between Persia, Turkey, and Russia. More recently, it had to deal with a wide range of political issues both inside the country and in the nearby region.

In 2008, Georgia lost the regions of Abkhazia and South Ossetia to Russian occupation. Lying just to the north of Georgia, Russia is an omnipresent factor in Georgia.

To the south, Georgia is neighbours with Armenia and Azerbaijan, two countries that have recently been battling over control of the Nagorno-Karabakh region.

Southwest of Georgia lies Turkey, which is also (in)famous for its own set of political and economic issues.

Just a bit further south, there is Iran.

It's quite the neighbourhood!

The complex ethnic set-up of the region.

Despite the region's polycrisis, Georgia has thrived economically. Between 2010-2019, the country had been the second-fastest growing economy in Europe and Central Asia with a 5.2% annual growth rate, and its poverty rate had almost halved.

Recent world events did not stand in the way of continued growth. In 2022, Georgia's GDP was up 10.1%. The important tourism industry reached a new record high, as did investment. Foreign direct investment into Georgia reached USD 2bn in 2022, equivalent to 8% of GDP. The country managed to get its government debt from 60% of GDP back down to a pre-pandemic level of 39%.

Source: bne IntelliNews, 22 March 2023.

All the while, Georgia managed to turn itself into a highly successful tourist destination. Famed for its unique and ancient cultural heritage, the country receives about three times as many tourists per year as it has residents. It's also popular with "banking tourists", i.e. private investors and entrepreneurs who appreciate that opening a Georgian bank account is an easy way to open a full-fledged offshore account with just a few thousand dollars deposit and not having to show anything but your passport (described in more detail in this in-depth article).

On-the-ground research in the Alazani Valley, in front of the mighty Caucasus Mountains.

Georgia also managed to turn itself into a beneficiary – of sorts – of the sanctions against Russia. As one of the few countries Russians don't need a visa to enter, Georgia has seen a huge influx of new residents and tourists from Russia, many of whom brought along significant purchasing power or work in valuable sectors such as IT.

Clearly, this is a country that has managed to turn a difficult set of circumstances into quite some success.

Similarly, the three Georgian companies that are listed on the London Stock Exchange have rallied. Anyone who invested into Georgia at a time when others doubted the country's prospects will currently be sitting on tidy profits.

The London-listed trio of Georgian companies

Without a doubt, Bank of Georgia (ISIN GB00BF4HYT85, UK:BGEO) is the country's flagship company. While its main competitor, TBC Bank (ISIN GB00BYT18307, UK:TBCG), may have an equal market cap of GBP 1.6bn (USD 2bn), Bank of Georgia's brand is omnipresent at home and widely known among foreign investors, which makes it THE Georgian stock that public market investors know about. Thanks to Georgia's general economic growth, the bank's loan book has grown 18% p.a. over the past decade.

Both Bank of Georgia and TBC Bank have been a great proxy for the success of the Georgian economy. In effect, Georgia's banking market is a duopoly, where the two leading players simply don't have to compete against each other on price. Competition from fintech companies is not an issue either, because the country is too small to attract serious interest from this sector. Not only do Bank of Georgia and TBC Bank benefit from the ongoing economic growth, but they are also gradually winning market share from the remaining marginal banks. As a result, margins have been very attractive, and Bank of Georgia plans its growth around the key notion of delivering return on equity of 20% p.a.

Both Bank of Georgia and TBC Bank are great examples that being based out of a small, somewhat overlooked market can be a great advantage and lead to consistent above-average returns for shareholders.

Bank of Georgia.

Georgia Capital (ISIN GB00BF4HYV08, UK:CGEO) hasn't reached a new record for its stock price yet, but it set a new record for the net asset value of its shares. The company was founded by a former CEO of Bank of Georgia who wanted to spin off the bank's investment activities and create a dedicated investment vehicle. Georgia Capital's strategy is to invest locally based on the lower local valuation multiples, bring in better management, consolidate and grow the businesses, and eventually sell the investment to international strategic buyers who pay international multiples.

With a market cap of GBP 400m (USD 500m), it's the smaller one of the foreign-listed Georgian companies. A quarter of the investment company's portfolio consists of a stake in Bank of Georgia, with the remainder of the portfolio split between a water utility, hospitals, insurance, retail, and education.

The overall success of these companies and potential further gains for their stocks do depend on the overall state of the Georgia's economy and the country's standing in the world.

Which is why an important looming deadline is worth noting: the EU's decision to grant Georgia the status of candidate country by the end of this year. If the decision were favourable, considerable additional interest from abroad could carry these stocks higher.

Will Georgia get EU candidate status?

Wherever you go in Georgia, it's notable that the flag of the EU is flying right next to that of Georgia – even though the country is not officially a candidate for EU membership yet.

Around 85% of Georgia's population are reportedly in favour of joining the political block. It's safe to say that much of the Western mainstream media and many European-focused investment funds would also welcome such a development.

Not long ago, EU candidate status for Georgia would have been seen as a shoe-in. The country scored higher on many technical criteria than the nearby candidates of Moldova and Ukraine. Yet, Moldova and Ukraine were granted the status last year, whereas Georgia was merely given a "European Union perspective". The EU didn't grant the status just yet and instead asked Georgia to improve its performance on a rather long list of 12 critical issues.

Whether Georgia will – or should – be granted the status of EU membership candidate is a question that has become much more controversial over the past years. Some say that the policies of the country's ruling party mirror the strategies of Viktor Orbán of Hungary or Recep Tayyip Erdoğan of Turkey. They see Georgia at risk of descending into authoritarianism.

It also didn't help that Georgia refused to fully play along with Western sanctions against Russia. When the war in Ukraine broke out, Georgia allowed tens of thousands of Russians to enter the country but reportedly refused entry to high-profile critics of Vladimir Putin. The recent relaunch of flights from Georgia to Russia is seen as Georgia providing support for Russians to reach Western destinations such as Nice, and these direct flight connections are generally seen as quite symbolic for Georgia's entanglement with Russia. Yet others see the country as openly playing by the rules of Russian business – or the Russian mafia even – rather than those of the EU.

The combination of difficult internal politics and obvious sanctions-evasion makes it anything but guaranteed that Georgia will be granted the status of EU membership candidate.

Which way will it go – and does it even matter?

Reading through a broad cross-section of recent media reports and political statements, it looks like the decision could go either way.

Irakli Garibashvili, the prime minister of Georgia, claims that his country has implemented and met most of the EU's 12 criteria set last year. He points out that 20% of Georgia's territory is occupied by Russia, which creates certain political and economic realities that Georgia needs to deal with in a pragmatic way. Indeed, if the EU continued to complicate Georgia's path to membership, the country could be pushed even further towards Russia. After 20 years of investing in its relationship with Georgia, it would be difficult for the EU to now walk away from the project.

Source: AA, 8 September 2023.

Following these arguments, there is a real chance that the status will be granted soon – which could well lead to growing interest in Georgian stocks, and even make it a potential short-term trade.

Equally, the status could be denied, which may prove a serious damper for Georgian stocks.

However, there is also a third scenario. Is EU membership actually something that Georgia (or investors) should be too fussed about? After all, the country has achieved its past economic growth without such a membership. Georgia lies at the crossroads of markets with 3bn people, of which the EU market makes up just 400m people. Of the three countries that provide half of the foreign direct investment in Georgia, two are not EU members (the UK and the US).

Could the question of EU candidate status be more important to Western mainstream media than to the outlook of local investments?

Georgian stocks will be of interest to some

Georgia and its surrounding political issues are caught up in today's polarising political issues.

Following my visit and a decent amount of reading, it looks to me like there is a lot of grey, rather than the black and white portrayed by those who have a horse in the race of Georgian politics.

The Georgian government could simply be engaged in a game where it cleverly plays both Russia and the West – a potential hedging strategy to emerge as winner whether or not the EU greenlights Georgia's candidacy, and whether or not Russia achieves victory in Ukraine.

Notably, Russia has recently been as important a trading partner for Georgia as the entire EU. That's a remarkable economic fact, given that Russia and Georgia haven't had diplomatic relations since the eight-day war of 2008. Equally, there will be some value in cosying up to a certain extent with Brussels.

Investors may want to ask themselves, what's not to like about a government that recognises the complexity of its own situation and simply aspires to a diversified portfolio of international relationships?

In any case, the sustained rally of Georgian stocks and the influx of foreign direct investment should tell us something. If this was a country in crisis or at risk of descending into oligarchic authoritarianism, investors don't seem to view it as a problem. Georgian stocks may have simply priced in all of these facts already, and they may continue to benefit from the considerable growth of the underlying economy.

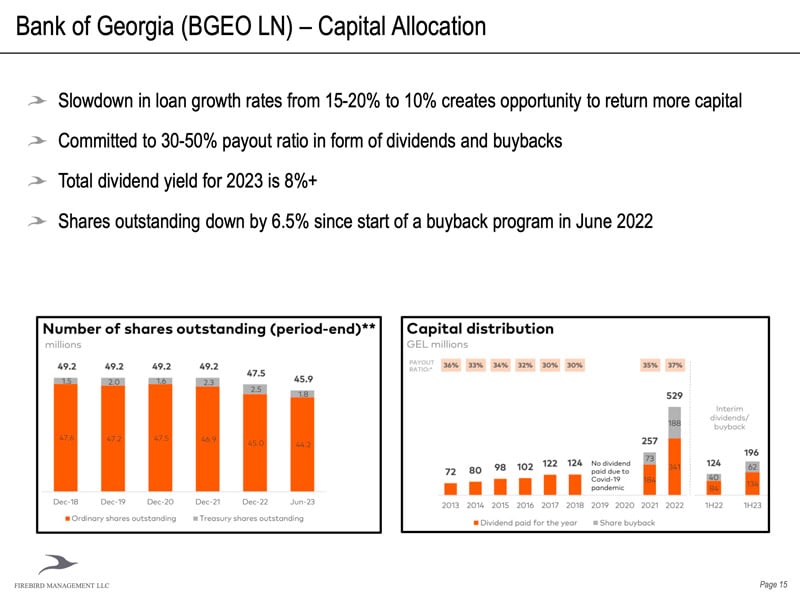

Even though it has nearly quadrupled in price, the stock of Bank of Georgia continues to trade at a significant discount to its already cheap historical multiples. Following its rapid growth, the bank will now experience a slowdown in its loan growth, which in turn will increase the chance of capital returns to shareholders.

The stock of Georgia Capital is trading at a 60% discount to its net asset value, despite growing its net asset value per share at 13% p.a. for the last three years. In January 2023, Good Investing published an in-depth interview with Irakli Gilauri, the company's CEO.

Georgia undoubtedly has governance issues, bank stocks are cheap the world over, holding companies such as Georgia Capital almost always trade at a conglomerate discount, and the market cap of all Georgian stocks is so small that most investment funds wouldn't even consider the country.

Still, these stocks do attract their own set of followers. Some investors believe that it makes sense to invest in economies that grow well above the pace of Western Europe, and where you can buy into companies that combine P/Es in mid-single digits, high single-digit dividend yields, and room for further growth. One such investor is Steven Gorelik of Firebird Management, who recently presented the case of Bank of Georgia at the Cyprus Value Investor Conference.

Source: Steven Gorelik, Firebird Management, September 2023.

Others will take the surrounding politics as a reason to stay away from it all.

One of the world's best (and cheapest) oil and gas stocks

My latest research report features one of the cheapest large-cap stocks in the world.

The company has a globally known brand and a highly liquid stock, some of the best metrics in the oil and gas industry, and a management which is returning its focus on the firm's core business.

It is set to benefit from what could soon be a violent rally of undervalued oil and gas stocks.

One of the world's best (and cheapest) oil and gas stocks

My latest research report features one of the cheapest large-cap stocks in the world.

The company has a globally known brand and a highly liquid stock, some of the best metrics in the oil and gas industry, and a management which is returning its focus on the firm's core business.

It is set to benefit from what could soon be a violent rally of undervalued oil and gas stocks.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: