During the first half of the year, doom-mongers predicting the demise of Europe were in high demand.

Their books, YouTube videos, and seminars experienced unprecedented public interest. Some even hit the bestseller lists of their respective countries.

According to those crash prophets, 2020 should finally be the year when:

- The eurozone banking sector collapses, starting in Italy.

- Other countries follow the lead of Britain and progress towards exiting the EU.

- Unprecedented social and economic mayhem breaks out.

The precise scenarios and timings vary, and there is also a lot of complexity and nuance around what constitutes "Europe". Some view the entire European continent as one and the same, while others differentiate between EU and non-EU (Britain, Switzerland, Norway), and yet others primarily look at those 19 of 27 EU countries that have adopted the euro.

The general themes, though, are pretty similar. We are supposed to soon see the end of the world as we know it.

We are now halfway through the year that many predicted was going to bring pivotal developments.

It's been a volatile year indeed, and the coronavirus crisis did throw the world a serious curveball. A lot of what has started to happen since March has yet to play out in full.

A collapse, though?

As of right now:

- European savers seem less worried about their bank deposits than during the Great Financial Crisis of 2008 – not the slightest sign of a run on the banks.

- The anti-EU political movements of Continental Europe remain on the fringe, overall.

- Eurozone stock markets have recovered significantly. The Euro Stoxx 50 index is just 15% below its 2019 high.

For the crash prophets to be proven right about 2020, a lot needs to happen during the remaining 181 days.

Could it be possible that things were never quite as bad as some made them appear?

Might it be this very environment that will provide plenty of investment opportunities for those who know how to approach the situation?

I set out to investigate. Specifically, I wanted to see if the opposite argument could be made. Nota bene, politically I am a Eurosceptic – but perfectly able to put that aside and look at the objective facts of the investment circumstances.

I've spent a few days reading up on the subject and making up my mind, to check if I can identify investment opportunities for us. My findings may surprise you.

First, an admission: my liking of crash prophets

Just for the avoidance of doubt, I actually side with a lot of what the doom-mongers say, if only in spirit. For example, I watch with fear and trepidation how national governments are racking up debt like never before. Also, I simply enjoy hearing from some of these crash prophets, and I have massive respect for how they present their arguments.

Yet, I have been around for long enough to have noticed two important patterns.

Most of the doom-mongers are wrong most of the time, only to enjoy very brief moments of glory when things temporarily get out of kilter. When they do shine, it's usually an indicator that the worst is already behind us (just like April 2020 was a great time to buy stocks!).

Also, throughout my entire lifetime, the world belonged to optimists and doers. If you allowed someone to scare you into hiding from the world, you've missed out on most of the good stuff.

One particular crash prophet I follow and admire started his career in the late 1970s. At the time, he published his first book about the imminent collapse of the US economy. The book was all about how the 1980s were going to be a disaster decade for equity investors.

We all know how that turned out. The 1980s brought the greatest bull market the world had experienced until that time, and the Dow gained 234%. Many were surprised. After all, the period had begun with a toxic presidential campaign that was shadowed by the "Misery Index", a number comprising the inflation and unemployment rates. Somehow, despite the initially challenging circumstances, the decade turned out pretty well.

Said author has since repackaged and republished the same book several times over and turned himself into a globally recognised doomster. The end of the economic system of America as we know it was always lurking just around the corner. It's been a veritable four decade-year career of predicting imminent collapse. During the same period, the Dow Jones has gone up by a factor of 30, and American companies such as Apple and Google have created TRILLIONS in new wealth for shareholders.

None of which is to say there hasn't been a lot of volatility during this period. Multiple crashes along the way brought temporary difficulties for investors and wiped out those who didn't have proper risk management for their portfolio (e.g., excessive leverage).

What never materialised, though, was the total financial, economic and social collapse and mayhem that we were warned about.

Could it simply be a bad idea *ever* to listen to those crash prophets?

Do I like to listen to them primarily because I have a secret lust for fear porn and sensationalism?

Is my dislike of the EU as a political institution getting in the way of my judgment of investments?

I had long wanted to compile my thoughts in an article and recently told a friend in New York about it. He is a world-travelling fund manager at a global firm and is someone with skin in the game. His work involves making real-world, large-sized investment decisions instead of selling books. He belongs to the money men of the world's #1 financial centre whose capital allocations move markets.

"What do you think of eurozone crash fears?", I asked.

His thoughts set me off to an interesting start.

A contrarian view of Europe

With his permission, I publish our WhatsApp chat:

"I think European equities – primarily, the eurozone – are a no-brainer.

The dollar is shitting itself. Most of the anti-US world, like Russia and Iran, are switching to the euro after all – not the Chinese renminbi or the Japanese yen. Think of the euro what you like, but the practicalities are that there are simply very few credible alternatives to it.

Here is the one point that I view as a game-changer for European markets, and one that has only recently started to emerge.

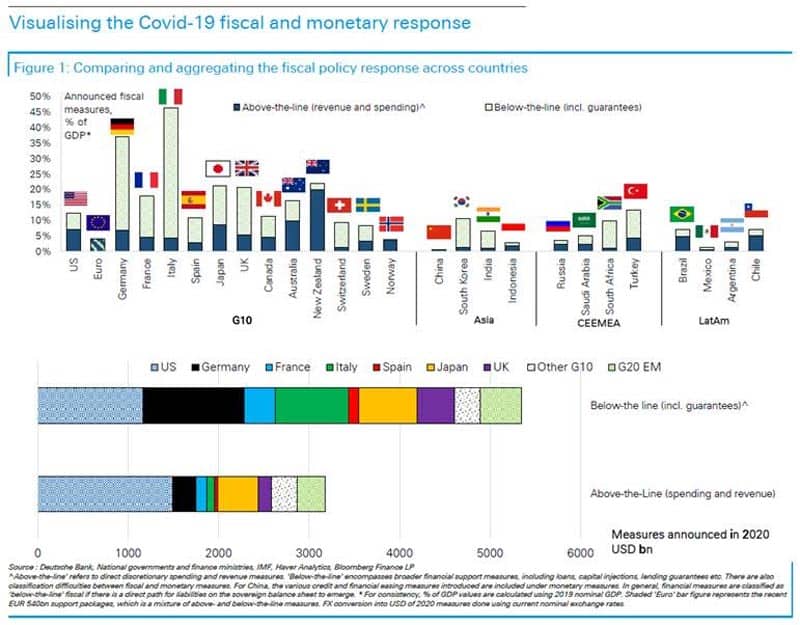

There has been a lot of confusion in the market about the different kinds of stimulus provided by governments around the world. During the last decade, we saw large asset purchases by central banks. Over the past ten years, most people have forgotten that other forms of stimulus even exist. The past decade of quantitative easing didn't see private banks do more lending, which was a major hindrance to economic activity. That is now changing. With their newly issued loan guarantees, European governments are getting their private banks to lend again. That's what I am REALLY excited about.

I tend to think of markets based on who the potential buyers could be and what their narratives may be.

For dollar-based investors, this is the first time in a decade that European stocks look attractive and are also priced as such relative to the domestic opportunity in the US. European stocks are extremely cheap stocks, certainly relative to the US. The slightest positive news can lead to these stocks re-rating meaningfully.

For European investors, too, it’s attractive to go into stocks. European stocks offer a more attractive risk/reward ratio as European bonds. There'll be an ongoing switching from bonds to equities, which will drive European markets up across the board.

The only investors I can’t see wanting to buy in Europe (whether the eurozone or other European countries, such as Great Britain) is Asians, because there’s so much exciting stuff happening within the region and its markets are deep enough to accommodate their money.

You can look at it the following way:

- China is the only area in the world that has a genuine V-shaped recovery. However, these markets are already flush with local money.

- The US is highly valued and is not doing the same kind of stimulus as Europe. Relatively speaking, it has become less attractive.

- That leaves Europe as the only large, investible market with low valuations and clear triggers for valuations moving up.

My argument is that if US-based investors reallocated just a 1% to 2% of their assets away from their domestic market and into European ones, it would be massive!"

Hmm.

Could European equity markets be the ultimate opportunity in a world where it's difficult to find good investment value?

You might think I was already signed up to the idea. After all, Undervalued-Shares.com has proven to be quite Eurocentric with its investment research.

However, there is a LOT about "Europe" – primarily, the eurozone – that I don't like:

- Of the world's 100 largest technology firms, 45 are in the US. Taiwan and Japan have 13 each. The EU's single largest economy, Germany, has two. The count across the entire 27 countries of the EU comes in lower than that of Taiwan and Japan. No one can see how that would ever change.

- I've grown up in a world when Europe was at the top of its game. If, as a European, you travelled to Asia in the 1980s or 1990s, you were in demand – professionally and personally. Today, many Asians deride Europeans. They visit Europe for a holiday among ancient ruins and to buy luxury goods that represent European heritage. Europe is all about the past. Post-Brexit, not a single university in the EU is in the world's top 20. In terms of education, the next generation of young Asians will be beating the crap out of their EU contemporaries. How is one to stay optimistic for Europe's overall future?

- The per capita GDP of the US now stands at USD 62,000. For the EU, the figure comes in at just USD 38,000 (that's a factor of 1.63). Compared to Americans, Europeans are paupers by many measures. The US has a genuinely unified market that benefits from unrivalled economies of scale and network effects while the EU has not even established a hierarchy of identification among its citizens. Never mind practicalities, such as the different languages spoken across its countries. For as long as Italians speak Italian and Germans speak German, the EU will never be able to emulate the vastness and easy internal accessibility of the US market. Even in the 21st-century, it's still mostly a continent made up of city walls – plus ça change. Never mind aspects such as demographics and immigration policies. Europe accounts for around 10% of the global population, but it pays out more than 50% of the world's welfare benefits. Combined with de facto open borders towards Africa and the Middle East, one can see problems appear on the horizon. There are SO many problems!

- Following Brexit, the EU has lost its ONE major voice to speak out in favour of free markets and competition. Indeed, competition is what the eurozone seems to fear the most. As part of the current Brexit deal negotiations, the EU wants to prevent the UK from becoming a Singapore-on-Thames. In best Newspeak fashion, the EU wants to "level the playing field". Some parts of the world revel in competition and the strengths that it brings out in everyone, others fear it. In a seminal 1987 scientific study, Paul Kennedy concluded that the meteoric rise of Europe from 1500 onwards was a product of political fragmentation, which spurred countries to compete against another. An overwhelming amount of historical evidence shows that centralism never breeds economic success. The EU seems to have made it its mission to prove all prior experiences wrong – good luck with that.

The list goes on and on.

A collapse, though?

I can't help but wonder if the next 181 days will yet again teach us that a more nuanced view is called for.

Note the huge difference in stimulus involving loan guarantees.

A poorer, stagnating region – but with opportunities *because* of just that!

The eurozone's Achille's heel is the euro.

Even before its birth, the common currency project has always been akin to a religion. Questioning it was akin to heresy, and it remains so. The obvious flaw is the lack of a fiscal union. Decision-makers in Brussels will be painfully aware that throughout history, monetary unions without an underlying fiscal union have turned into disasters.

By now, it's blatantly obvious that the EU will ignore ANY rule if needed to advance its cause. It established as much right from the outset:

- The Maastricht Treaty of 1992 demanded a debt-to-GDP limit of 60%. Yet, Italy had 122% debt-to-GDP, and there was not even a trend of decline. Still, the country was allowed in even during the first round.

- Greece had failed all five Maastricht criteria by a wide margin. With a delay of two years to save face, the country was allowed to enter regardless.

- Even Germany used "creative accounting to massage their fiscal deficits to less than the limit. Knowledge that this manipulation of the key figures was taking place had no real influence on the evaluation of countries' readiness to join the euro." These words are a summary by Jens Nordvig, an outspoken supporter of the euro, in his 2014 book about reinventing the eurozone.

Right from its start, the euro project was based on political lies and financial mischief.

Common sense was enough to see right through it. Trying to squeeze a broad range of hugely diverse country under a single currency was never going to become an economic success for all parties involved – certainly not for as long as there wasn't even a fiscal union to back up the monetary policy with a coherent financial strategy.

The idea that you could easily melt German and Italian fiscal habits, or Greek and German bookkeeping, has made for many good jokes. Research by J.P. Morgan once concluded that you'd have a more coherent economic region if you united all countries of the world that start with an "M". J.P. Morgan did actually publish such a report!

The results are just as expected. Instead of the economic convergence that the EU said it was aiming for, the continent has experienced a shocking amount of economic divergence.

Germany benefitted massively because its export-based economy benefitted from the euro being weaker (= cheaper) than the deutschmark would have been.

Italy, Greece and Spain were on the other end of the spectrum. The euro was stronger than the lira, drachma and peseta would have been on their own. These economies suddenly found themselves with substantial competitive disadvantages due to the exchange rates. As a result, entire swathes of these countries are now economic wastelands with tens of millions of young people bereft of job prospects. The economies of Italy and Spain have shrunk by 10%, and that of Greece by 40% even. All the while, other parts of the world economy were growing. If you shrink while others are growing, you fall behind at twice the speed. The World Bank had once called the EU a "convergence machine", which young unemployed Spaniards, Greeks and Italians may not agree with.

Here is where things are standing right now:

- More than two decades into the euro experiment, the anti-euro parties and movements of continental Europe remain on the fringe. I say this with dread, as I sympathise with them and wish they would succeed.

- Britain's electorate succeeded in escaping the EU primarily because it managed to take Brussels by surprise (and the tiny role I played in the campaign will remain one of the high points of my life). No other country will ever again be allowed to get anywhere near holding a referendum on EU membership.

- Politicians are aptest at using crises to advance their goals. The coronavirus crisis serves the EU to progress towards its aspired model of European federalism. Maggie Thatcher sensed as much as far back as 1990: "The European Monetary Union is really the backdoor to a federal Europe, and we totally and utterly reject that." (Watch the inimitable Iron Lady foresee it all in this epic two-minute clip).

The eurozone's people aren't rallying en masse in the streets yet, despite everything we have witnessed over the past months, years and decades. It's hard to see what would make them come out – and why should they? Not every child is destined to become a lawyer or rocket scientist. Just as much, not every region needs to heave with economic dynamism or strive for innovative leaps forward. Let the French drink their wine in peace and accept that most continental Europeans currently don't have much of a will to fight for (or against) something. The continent just traipses along, and it's rich enough to do so.

Despite all the problems, Europe's GDP (whether you look at the entire continent or just the EU) still puts it among the world's three largest economic blocks, alongside the US and China. Even if it simply stuck to its legacy industries and ancient tourist destinations, substantial amounts of money will be earned by European economies.

With that in mind, some of the more likely developments of the next months and years seem to be:

- Significantly higher taxes to keep the system afloat at ALL cost. The EU is heaving under massive financial pressure, and there are countless economic problems and pressure points throughout the region. However, there are also massive amounts of private wealth across the continent. It's probably just a matter of time before some kind of one-off tax is heaved upon residents of the EU, whether it's called bail-in, wealth tax, or "burden-sharing" (a repeat of the famous German "Lastenausgleich" after the Second World War). Check back to last week's issue of the Weekly Dispatches, where I briefly mentioned the possibility of using negative interest rates as a means for hidden taxation. That has been going on for years already. One study concluded that in Germany alone, the artificially depressed interest rates have cost savers a total of EUR 500bn (!) since 2009. That's my mum not getting any interest on her savings, which makes this personal for me.

- A continued loss of economic freedoms. Brussels is home to 25,000 corporate lobbyists. During the 2015 to 2019 term of Elżbieta Bieńkowska as European Commissioner responsible for the single market, a staggering 87% (!) of her time was spent on meeting with representatives of corporations. That's all you need to know about the lobbocracy that sits on top of EU legislation. There will be ever-more concentration of economic power in large corporations, combined with suppression of entrepreneurship through excessive regulation (justified with "safety for consumers", etc.). The future residents of the EU will be less of a citizenry with an impactful vote and economic self-determination, and more of an economic unit that exists for the benefit of large companies that own everything and bureaucracies that control everything.

- Stringent barriers to prevent anyone from challenging the status quo. It's probably a matter of time before undue criticism of EU federalism is deemed "hate speech" and banned off the eurozone splinternet (sic). The EU's General Data Protection Regulation (GDPR) has already led to >90% of American newspapers not being available to EU Internet users anymore. A fool who thinks these were unintended consequences. That's just one of many steps towards ensuring that EU residents are primarily exposed to approved narratives. I know countless Germans who feel they need to read Swiss newspapers to get a realistic view of the world. They joke that Swiss newspapers are today what "West-TV" was for residents of East Germany. Living within the EU will increasingly have similarities to living in communist China.

That's bad for those trapped inside (and I am glad that I am not!).

But it also means that the current system will be held together by the forces to be. As Mario Draghi, then president of the European Central Bank, said in his famous 2012 speech: "Whatever it takes."

Without a doubt, a lot of wealth will be destroyed (or confiscated) along the way, and new wealth creation will continue to be subdued compared to other regions of the world. But it's not going to lead to outright collapse. Using the power that they already have, the EU's politicians will simply usurp any and all resources that are necessary to keep their show on the road.

As a result, large parts of the EU will see a gradual erosion of their economic situation, as well as a continued falling behind other, more dynamic parts of the world. That's much more likely than a sudden crash.

I have been around for long enough to have a solid grasp of just how much Europe can fall behind in 25 years. For the next 25 years, I expect more of the same. Gradually and slowly, but steadily. 25 years is both a long time and a short time. It seems far away from today's perspective, but most of us will get to see the end of these next 25 years.

Much as it appears to be counter-intuitive, but this very environment could indeed prove to be fertile ground for investors.

Here are just some ideas on how this can benefit investors:

- Less competition for finding good ideas. The EU currently drives smaller fund management firms out of business through excessive regulations, and the same rules prevent new fund managers from being set up. The remaining large capital pools mostly pursue index investing or invest in stocks of other mega-corporations. As a result, less investment capital is looking for opportunities among small and mid-sized European companies. Rummaging through small and mid-sized European companies will likely remain a sweet spot for fund managers with the right research capabilities and local market knowledge.

- Many more takeover bids. When politicians are signed up to the idea of concentrating economic power under the helm of large corporations, it inevitably means consolidation among smaller players. The European situation smells of upcoming takeover bids for small and mid-sized companies. Also, the resulting large corporations could earn above-average margins once competition has been eliminated.

- Special situations that benefit from individual aspects of the overall trend. What happens if wealthy eurozone citizens get squeezed for taxes like never before? The number of tax exiles seeking shelter elsewhere will increase. Undervalued-Shares.com Members are already familiar with the publicly-listed company that owns swathes of real estate in Monaco. There'll be ever more people who are willing to pay almost any price to live in the principality, even though its real estate prices are already the highest in the world. Where else in Europe would they have to go to? If you are the company that owns the juiciest bits of the Monegasque real estate market, bad news for eurozone taxpayers means good news for your portfolio's value.

These are just examples, but they prove an important point.

There are ALWAYS ways to benefit financially from what's going on in the world, even if overall circumstances are challenging.

Coming up – a new series looking for hidden value in Europe

The US has a more dynamic economy, but it's also a tougher market for investors to make money in. The US stock exchange is much more transparent, it has more fund managers pouring all over it, and it's also very accessible for investors from abroad.

In Europe, it is still much easier to find hidden value and opportunities:

- Given the plethora of languages and cultures, there is no such thing as an analyst who could easily sift through the markets of the entire eurozone. Research across the EU takes a lot more effort, and it requires local expertise to judge the finer aspects.

- Some sectors simply lack local expertise. Just as the EU has fewer tech companies, there are fewer European analysts who understand the tech sector. The eurozone does have its bright spots for tech, though. For example, my Members already benefitted from a German software company that could become a global player, and which we caught right on the cusp of being discovered by others. In the US, such an opportunity would not have remained undiscovered for so long.

- The 27 countries that make up the EU still have vastly different legal systems and regulations. As they slowly move towards some common ground, investors can profit from regulatory arbitrage. For example, my Lifetime Members recently learned about a European life science company that has turned itself into a stunning success on the back of an industry that the EU mandates to be legal everywhere – but which only some EU countries permit and which is de facto banned in others! As this industry emerges from the EU's regulatory chaos, the company I featured could multiply its shareholders' money.

These are the kind of opportunities I am looking for, and which Undervalued-Shares.com Members get to read about in my in-depth research reports.

I don't know where the DAX or the CAC40 are going to be at in three months – in between pandemics, elections, and the usual market fluctuations. Market movements are something I consider to be mostly an unknowable.

However, if you pick the right regions and know how to utilise their advantages, you'll eventually come out ahead regardless.

Provided, of course, we don't experience the mother of all economic meltdowns.

To read up about that, however, you'll have to go elsewhere.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

5 reasons to invest – Volkswagen and Porsche SE

Volkswagen is probably about to take a giant leap forward as a company. Few people realise that they can buy Volkswagen stock with a 32% discount, by investing in publicly-listed Porsche SE.

A slightly convoluted but fascinating story – one which I'm sharing with my Members only!

My latest report looks at the 5 reasons to invest in the world's largest carmaker.

Interested?

Sign up for an Annual Membership (just USD 49) and you'll get instant access!