Some of the world's best finance blogs aren't written by bloggers but fund managers.

How come?

Quite a few fund managers find it useful to test their investment theses on a public audience, or they write to extend their network and increase their fund's visibility.

One such example is Chris Mayer. Chris is a book author, former newsletter writer, and now manager of Woodlock House Family Capital.

Each time a new article appears on Chris' blog, I devour it with interest and joy. Chris is quite similar to Lyall Taylor of LT3000, who I know many of my readers adore.

Here are a few reasons why you should check out Chris Mayer's musings.

1. Specific stock ideas

Chris regularly writes extensively about individual stocks.

His investment strategy can best be described through the acronym "CODE":

C is for cheap: undervalued assets.

O is for owners: managers with skin in the game.

D is for disclosure: businesses with transparency and understandable business models.

E is for excellent financial condition: companies with low financial risks.

Does the approach ring familiar?

I regularly scour Chris' website for investment ideas. Occasionally, I go through some of his older articles to see if an old idea has become current again.

His ideas are so well presented that you could probably stop reading my website and move over to Chris instead. Just kidding. Sort of. It's simply really good material.

2. Depth and diversity of thought

Chris seems to have oodles of time to read and think. He appears to have an extraordinarily broad set of interests, akin to a true Renaissance man.

Besides stock ideas, Chris also covers investment strategy, current events, and what you could best describe as life philosophy.

I have a thing for finance people whose horizon extends well beyond the world of money. A well-rounded understanding of the world is crucial for investing. Chris ticks that box.

FREE eBook: The world's best investing blogs

What are the best blogs to help you become a better investor and improve your returns?

Check out “The world’s best investing blogs” for my very own top 30.

3. Books that help to get to know him better

Chris has published four books, all of which I have read.

Invest like a Dealmaker – Secrets from a Former Banking Insider explains why stock investors should analyse investments as if they were about to buy the entire company. A classic!

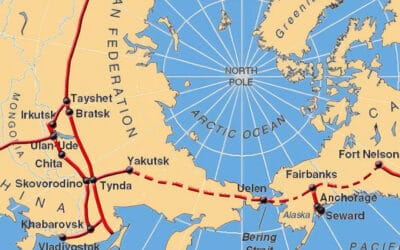

World Right Side Up: Investing Across Six Continents is very similar to my own musings about investment ideas from around the world. The book is now quite dated, but I thoroughly enjoyed reading it at the time.

100 Baggers is a book many of my readers will know. It deals with finding stocks that can go up in value by a factor of 100. Back in spring 2019, I gave away 100 copies of the book to new Undervalued Shares.com Members. The feedback I received was enthusiastic. Coincidentally, on the day I published this column I had lunch with a reader in Frankfurt who told me out of his own initiative: "100 Baggers was one of the best investment books I have ever read." That's from a finance professional with over 20 years experience!

How Do You Know?: A Guide to Clear Thinking about Wall Street, Investing & Life explores the limits of our knowledge and our ability to express it. In all honesty, I found this one challenging to read and probably have to re-read it to properly understand its content. As Chris describes on his website: "It provides a set of thinking tools we can use to help clarify our thinking. Builds on the work of Alfred Korzybski and his meta-discipline general semantics."

I have never met Chris, but because of his varied writing, I do feel like I know him fairly well.

Hopefully, he'll find the time to write another book one day. I'd pre-order it without knowing anything about it.

4. Twitter feed

I don't have a Twitter account, but I do regularly check out the Twitter feeds of a small number of people whose views interest me.

Chris' Twitter feed has 14,000 followers, and it's the bite-sized version of his more extensive writing.

It allows you to see the world through Chris' eyes, and helps me come across content that is useful but which I otherwise would not have been aware of.

If Twitter stopped allowing people to read Twitter feeds without having an account, I would even consider to hold my nose and open one.

5. Videos

You can occasionally catch an interesting video interview with Chris.

A few months back, he appeared on valueDACH, a website that curates and publishes high-quality content about value investing.

The 1h+ conversation was titled: "How to hunt 100 bagger stocks? And how to kill bad ideas?"

If you check YouTube, you can find a few other videos with him.

Chris Mayer speaking to Tilman Versch of valueDach.

Go and judge for yourself

It's quite straightforward.

If you enjoy my blog, then you'll probably also enjoy following Chris Mayer.

His website doubles up as that of his investment fund and his writings: www.woodlockhousefamilycapital.com

Check him out!

Blog series: Blogs to watch

There's more to "Blogs to watch" than this Weekly Dispatch. Check out my other articles of this 30-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just USD 49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports