I turn 50 today. What have I learned about investing so far?

An asymmetric opportunity – and it's a bank!

(Full access for Lifetime Members only)

An asymmetric opportunity – and it's a bank!

1 November 2023

What readers said about this report

Buying an asset on the cheap is one thing.

Being given an asset FOR FREE is another thing altogether.

Especially if there is a very real prospect of that free asset being sold for a nine-digit (!) cash sum in the foreseeable future. To round it all off, the sales proceeds (or a significant part thereof) could come to shareholders as a special dividend.

One particular bank stock piqued my interest because it combines:

- Dirt-cheap valuation both in absolute and relative terms.

- A "bonus asset" valued at zero but potentially worth nine digits.

- Lots of cash probably making its way back to shareholders.

- A short-term catalyst due on 3 November 2023.

- Medium-term catalysts to provide further fuel for the stock price.

If it all plays out, investors will get about half of their cash back and then own a stock that will yield 15% p.a. initially, and rise closer to 25% p.a. over the following years.

The company in question is in a market leading position, and its stock has daily trading volume in the millions.

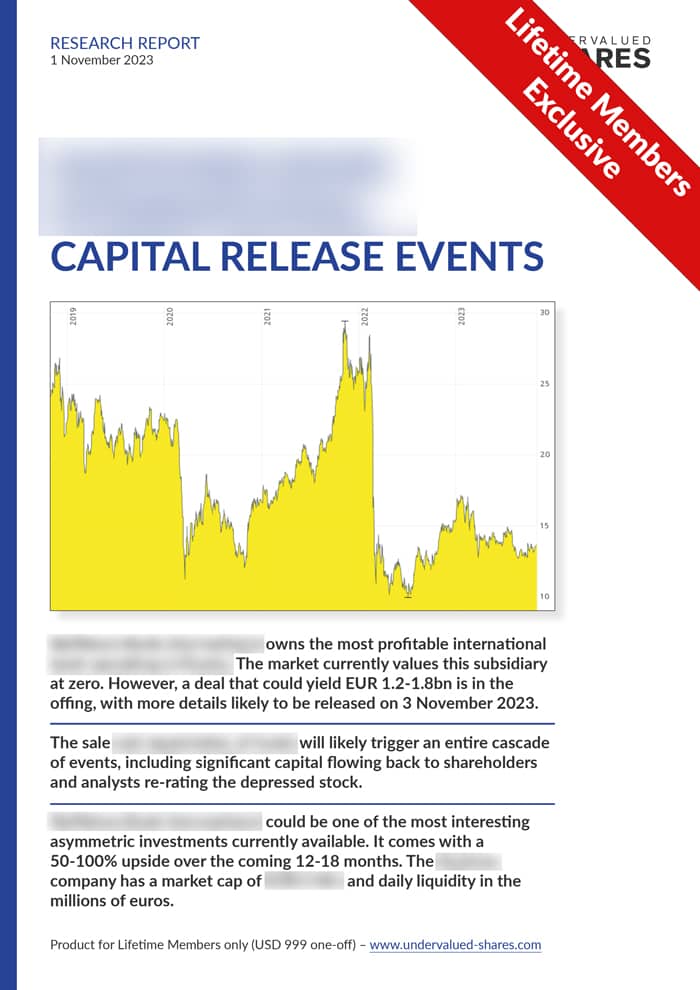

I believe it has a realistic chance of rising 50-100% over the coming 12-18 months.

This opportunity is exclusively available to Undervalued-Shares.com Lifetime Members.

Not a Lifetime Member yet? Sign up for a Membership - just USD 999/one-off.

Already a Lifetime Member? Log into your account to download the report.

What readers said about this report

David M.

January 2024

I loved your (company name hidden by Undervalued-Shares.com) write up. That position is working out brilliantly for me, thank you for another brilliant research report there.