Is there a better signal for a good investment than company owners spending millions on buying more of their own shares?

Weekly dispatches

One Israeli gas company just doubled in value – and another one will probably follow suit

Stocks of an Israeli “outsider” gas company would have doubled your money over the last 12 months. Which begs the question, how best to make money off the Israeli gas opportunity during the next 12 months?

The day I outed the Rothschilds (and my readers made up to 461%)

Buy-backs by family shareholders are always an interesting activity to research. In the case of Banque Privée Edmond de Rothschild my readers made staggering profits of up to 461%.

The Porsche family’s 400 million Euro insider transaction that you should take note of

Porsche SE has just increased its stake in Volkswagen by EUR 400m from 52.2% to 53.1%. For Porsche/VW shares, it could well be “Now or never”.

Eurotunnel: The ‘Brexit share’ is rallying – do markets know more?

Despite the ongoing Brexit chaos in Westminster, shares in Paris-listed Getlink SA have risen 19% since October. How is that even possible, given the uncertainty Britain faces?

What the Galapagos Islands tell us about automobile company valuations

The government of the world-famous Galapagos Islands has banned the importation of additional electric cars. What does this mean for the car industry’s prospects and how stocks of car manufacturers are valued?

Hunting for investment bargains on the Silk Road (part 3)

Uzbekistan is still a ground-floor opportunity for pioneer investors. Nonetheless, it offers some investment opportunities already, and more will arise in the coming years.

Hunting for investment bargains on the Silk Road (part 2)

Why Uzbekistan (and other “frontier markets”) should be on your radar if you want to achieve superior investment returns.

Hunting for investment bargains on the Silk Road (part 1)

Meet Uzbekistan, one of the more unusual – but all the more interesting – markets to emerge as an investment destination.

Time Out plc: A good idea in principle but investors still lost out big time

Shares of Time Out plc have lost over 50% since the company’s IPO in June 2016 – what went wrong and are shareholders in for even more pain?

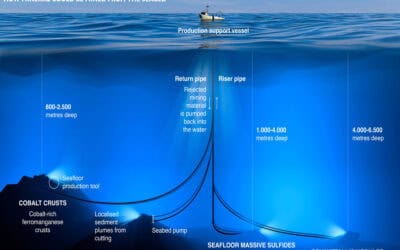

Where others see boycotts of fossil fuels, I see opportunities

Boycotts and divestiture campaigns can make for great investment bargains – is now the time to invest in high-dividend yielding and cash flow rich energy companies?

Putting the Vroom back into Porsche and Volkswagen (Research Report #2)

My latest report investigates Porsche SE, probably THE best equity opportunity you can currently find on the German market. And that’s not because they’d be producing cars (they don’t!).