Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

3 British small-cap stocks worth digging into

I'll disclose the names of three small-cap stocks that I'd be tempted to cover in a research report – of the type that only paying Undervalued-Shares.com Members have access to.

You'll get these names for free, plus a few pointers to guide your own research.

Why the giveaway from my treasure trove of investment ideas?

I have more ideas than I can possibly write research reports about.

Following years of British small-caps losing ground, the London Stock Exchange is a target-rich environment for finding undervalued investments. It's like shooting fish in a barrel.

This abundance is set within the City of London's struggle to define its role and place in the world.

To assess these stocks, it's vital to look at the overall context. All of it taken together makes for a fascinating bigger picture.

One of the world's truly unique places

Outside of the finance industry, most people think that "City of London" refers to the whole of London, i.e. what is commonly called Greater London.

Even those who do understand that it is a separate, distinct part of London don't usually realise just how much of a special status the City enjoys.

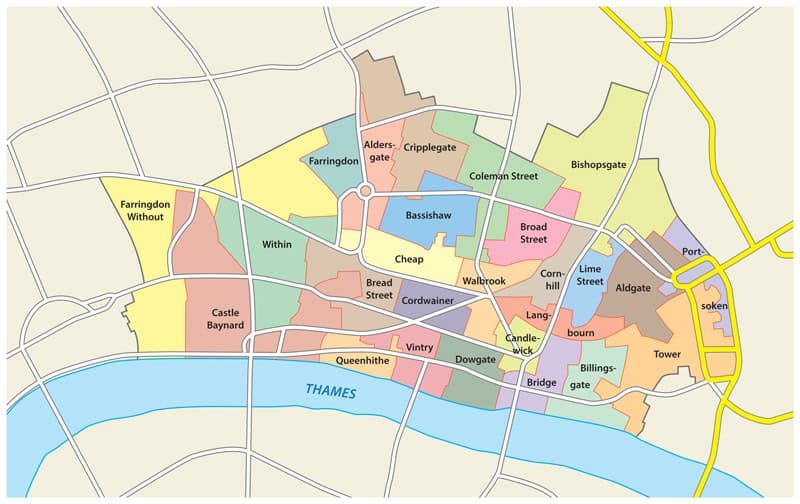

The City of London is a 1.12 square mile part of London – hence it's other name, "the Square Mile". To put it in perspective, Greater London is 600 square miles.

The City of London within Greater London.

The City is where much of the financial services industry is based, for reasons that go back two thousand years.

Under the Romans, "Londinium" became an important, walled trading outpost. After the Romans left, trade continued within the city walls for almost a thousand years. By the time William the Conqueror invaded England in 1066, the City had already become so powerful that he stayed clear of invading it. Instead, the City was allowed to govern itself provided it accepted him as King.

This tiny part of London has now been a corporate city since Roman times, with its own special kind of legal status. It is governed by the City of London Corporation, and its government pre-dates Britain's parliament. Incredibly, Britain's parliament has no authority over the City of London. The City of London is both part of and separate from Greater London, which is really difficult to get your head around.

One of the more visible aspects of the City is its own police force. The City of London Police has different uniforms from London's Metropolitan Police.

Image by John Gomez / Shutterstock.com.

Famously, on the odd occasion when the King wants to visit the City, he first has to request the permission of the City's Lord Mayor to enter.

Another fun – and useful – aspect of the City are its many ancient establishments. If you live in London, it's difficult to not come across the so-called livery companies. These are ancient trade bodies – in effect, guilds – whose names continue to represent the economic sectors of the Middle Ages. There are livery companies for haberdashers, salters, leathersellers, pewterers, waxchandlers, saddlers, woolmen, and goldsmiths. In total, there are 111 livery companies and they even publish an annual Pan-Livery Report. Why join them? You meet like-minded people and make useful contacts, just like in medieval times when these guilds had a lot of influence over the economy.

These are just some examples of the quirky, almost incredible aspects that make up the City of London until today.

If you wanted to dig deeper into the history of the City, there is an excellent three-part article Secrets of the City of London available behind a paywall on Substack.

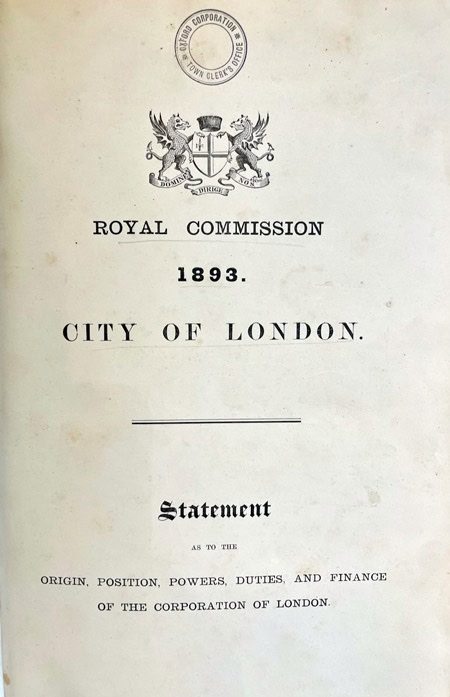

Real afficionados of the subject can also easily find many books about it, including interesting out-of-print ones. E.g., yours truly has in his library a rare 1893 copy of a report by a Royal Commission, which issued a 400-page tome on "the origin, position, powers, duties and finances of the Corporation of London". As the book states in its introduction: "The origin of the Corporation of the City of London goes back beyond legal memory." It all lends itself to veritable detective work about a history that is unlike any other legal entity in the world.

Ultimately, though, the City is about business and finance. It's where the Bank of England and the London Stock Exchange are located, as well as the large banks and hundreds of smaller financial services firms.

Still ranked the #1 financial centre in the world by several measures, the City has recently made headlines for all the wrong reasons.

The City going down the gurgle?

Of late, many of the headlines about the City of London have been about its decline. Even the most ardent fans of London's Square Mile will admit that not all is well.

Many would say the City's decline started with Brexit – which many feared would send a lot of business to competing financial centres such as Frankfurt, Paris, Amsterdam, Zurich, and Milan. Mind you, the City of London has more people working in the finance industry than Frankfurt has residents, which also provided quite a barrier to business migrating elsewhere.

Personally, I think the decline started in 2008 already. Following the Great Financial Crisis, London as a whole never quite regained the vigour and dynamism that it had in the early 2000s. Its financial district is very much part of it, given that it contributes 8% of the UK's GDP and a much larger share of Greater London's economy.

Assessing the City's current and future situation is complex. Most things aren't black and white, but grey.

In any case, there has been a lot of doom and gloom over the past few years.

- "London stock market is 'structurally broken', warns broker" (Daily Telegraph, 1 December 2023)

- "London Stock Exchange's Terrible Week Risks Sending It Into a Doom Loop" (Bloomberg, 8 December 2023)

- "'We are losing lots of companies – if we do nothing the UK market will fade away'", (Daily Telegraph, 3 January 2024)

One top banker of the Bank of England warned as recently as October 2024 that "excessive red tape on banks and insurers threatens to turn the City of London into a 'graveyard'". His concern was that today's culture of trying to make financial institutions safer to protect consumers ultimately threatens the sector's willingness to take risks. Taking risk is, of course, the very business the City was created for.

All the while, competitors elsewhere are trying to take a bite out of the City's business. Nowhere else is that desire bigger than in the EU headquarters in Brussels, where the idea of decrowning the City has been pursued with an almost religious zeal ever since the unruly Brits dared to stick their middle finger to the EU. Christine Lagarde, the president of the European Central Bank, once launched an ambitious plan for a Frankfurt-Paris-Amsterdam stock exchange to challenge London's role.

Amid these political tussles, those who are purely interested in business still come to London's defence. One of Wall Street's most feared short seller, Carson Block of Muddy Waters, once called for London to carry out reforms to establish itself as the world's "cleanest" stock market.

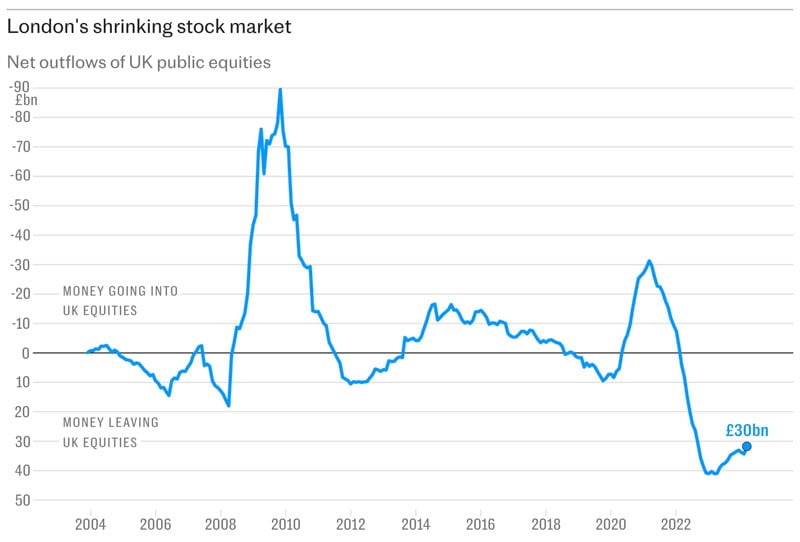

Block was not alone. In 2022, the CEO of the London Stock Exchange convened a group of City grandees to devise a plan for reforming London's stock market. Following a prolonged drought in new listings, the London Stock Exchange was fighting on several fronts, which included lagging valuations relative to American peers and a disinterested British pensions industry that forever reduced its exposure to domestic equities.

It's been challenging to remain on top of all the different initiatives that have aimed to get the dynamism back into London's equity market. One such initiative included "The Edinburgh Reforms", a package of 30 pro-City measures unveiled by Jeremy Hunt under the Tory government.

Did it succeed?

A year after they were passed, some Members of Parliament branded Hunt's post-Brexit shake-up a "damp squib". Many of the reforms either hadn't been completed or were so small in impact as to be irrelevant.

One aspect where the City did make progress with clearing out nonsensical rules was the unbundling of fees for investment bank research. MiFID II, the EU's post-2008 financial reforms package, had made it illegal for asset managers to pay for their investment research alongside fees for trading. While laudable in theory, the regulation led to decreasing coverage of stocks – and dramatically so in the case of small- and mid-caps. The UK's rollback of these rules was a sensible and overdue measure, and a sign that the City of London remains entirely able to rewrite the rules to make itself more attractive for business.

Source: Financial Times, 10 April 2024.

Such deregulation is never easy. Keep in mind, even the Americans needed 70 years to dismantle the Depression-era Glass-Steagall rules, which separated retail banking from investment banking. One of the City's distinct advantages is that it's somewhat independent from national politics. In the City, lobbyists that lobby for pro-business regulations are said to always win, simply because they are better-resourced, better-connected and single-mindedly focused on winning concessions. In a jurisdiction that is aimed at business, business being the driver for regulation (or the lack thereof) should be a good thing overall.

Of late, London has also been making progress again with winning listings. French media group Vivendi is planning to list Canal+ in Britain, while South Africa's Anglo American Platinum aims for a secondary listing in the UK.

Possibly of more immediate interest, though, is the ongoing wave of takeovers of publicly listed British companies. This subject has been a well-known pet obsession of Undervalued-Shares.com, with multiple articles published since 2019 (check here, here, here, here, and here).

Just a week ago, another takeover bid made headlines because of its outsized premium and the particular background of both bidder and target company.

Takeovers galore

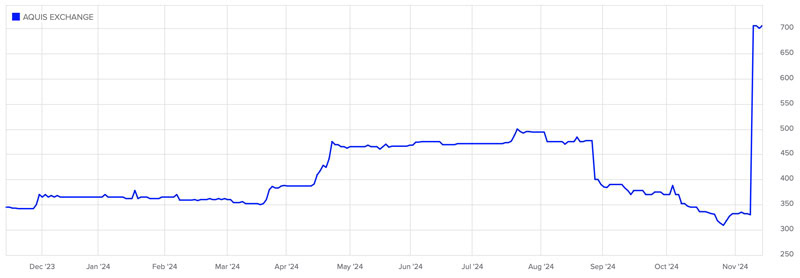

Aquis Exchange (ISIN GB00BD5JNK30, UK: AQX) is not a company that many outside Britain would be familiar with, but it's got special symbolic value. Formerly known as PlusMarkets, Aquis is an OTC-style stock exchange where small companies can list in a simple and relatively easy procedure. Like many other exchanges around the world, Aquis itself was a publicly listed company.

On 11 November 2024, Switzerland's exchange operator SIX Group launched a public offer for the company. Even though it was only for GBP 194m (USD 250m), this represents the largest acquisition by SIX since 2020. Notable was its premium – the bid came in 120% above the most recent share price! Undervalued-Shares.com had reported repeatedly how bid premia for British companies tend to be unusually high, simply because valuations of British small- and mid-caps are so low. Aquis became an extreme example, and a lucrative one at that (though outdone by 2023's bid for Hotel Chocolat, which came in at 170%).

Aquis Exchange.

Evidently, the Swiss seem to have faith in London keeping its position or else, they wouldn't pay such a top premium for an operation that depends on London's continued success as a place to list shares.

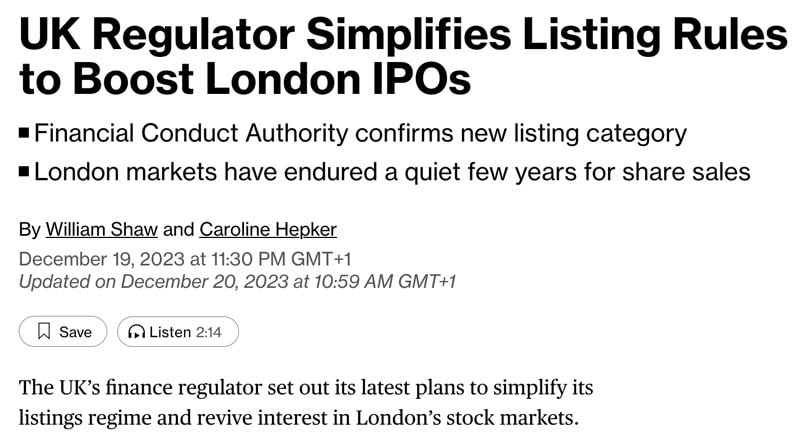

Source: Bloomberg, 19 December 2023.

The high premium offered for Aquis is also a result of the long-standing undervaluation of British stocks. As the Financial Times pointed out on 23 March 2023: "UK's 'staggeringly cheap' stocks trade at record discount to US

Forward price-to-earnings ratios – a commonly used valuation metric – of stocks on the MSCI UK index are 47 per cent lower than those on the US equivalent, according to asset manager Schroders. The 48 per cent discount in January was the largest in data going back to 1988."

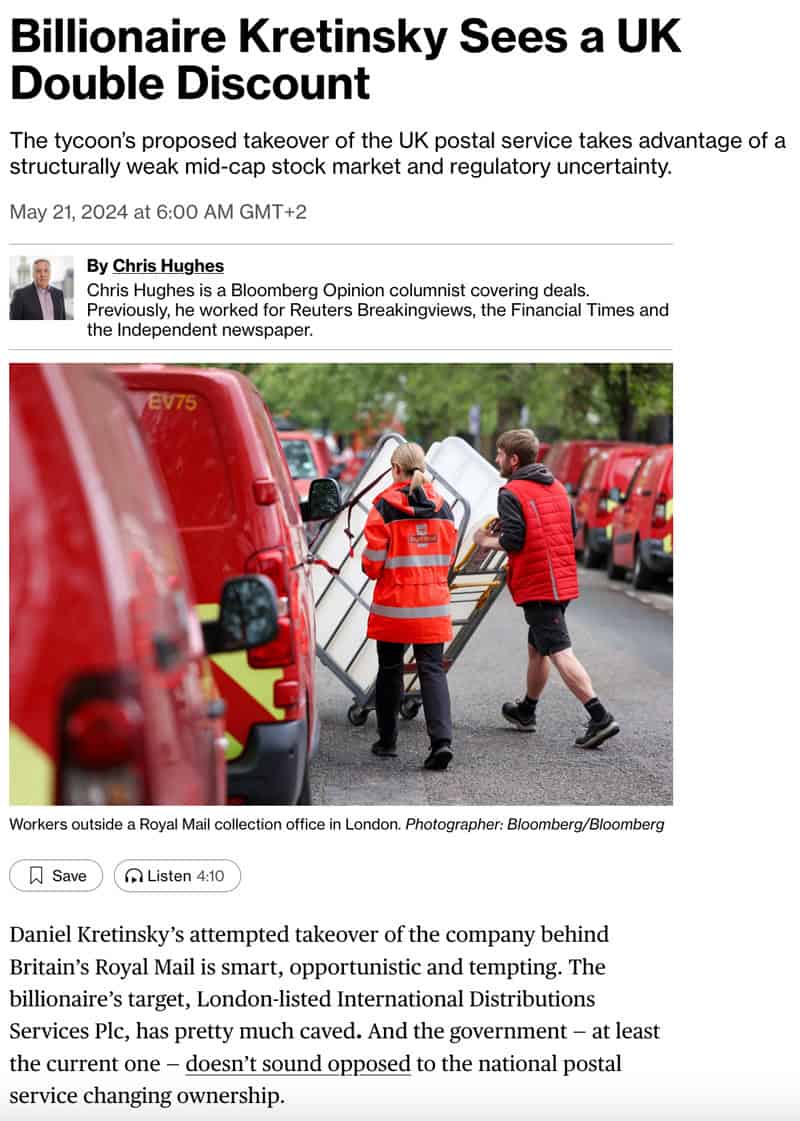

Source: Bloomberg, 21 May 2024.

Investors from the US and elsewhere have been flocking to the shores of the UK to take advantage of low valuations and frustrated shareholders. Indeed, 2024 is shaping up to be yet another year when shareholders of many publicly listed companies could receive a bid. So far this year, we have seen:

- "Tritax Offers to Buy UK REIT in $1.2 Billion All-Share Deal" (Bloomberg, 12 February 2024)

- "Currys rejects £700m Elliott takeover bid" (The Times, 17 February 2024)

- "Talks begin over Superdry sale" (The Times, 20 February 2024)

- "Wincanton bidding war kicks off" (Financial Times, 26 February 2024)

- "Spirent strikes £1bn takeover deal with Viavi" (The Times, 5 March 2024)

- "UK Bank M&A Heats Up With Nationwide's £2.9 Billion Bid for Virgin Money" (Bloomberg, 7 March 2024)

- "Mondi's £5bn bid for DS Smith set to create packaging giant" (The Times, 8 March 2024)

- "Pollen Street Capital makes £432m offer for Mattioli Woods" (The Times, 9 March 2024)

- "Direct Line boss beefs up defences after Ageas bid" (The Times, 10 March 2024)

- "BP draws takeover interest from UAE oil giant" (The Telegraph, 11 April 2024)

- "Royal Mail faces foreign ownership threat after Czech billionaire's takeover bid" (Daily Telegraph, 17 April 2024)

- "Concord to Buy Hipgnosis in $1.4 Billion Song Catalog Deal" (Bloomberg, 18 April 2024)

- "Darktrace agrees £4.4bn takeover by Thoma Bravo" (The Times, 26 April 2024)

- "John Wood Group rejects £1.4bn takeover bid" (The Times, 9 May 2024)

- "Keywords Studios set to recommend $2.48 bln takeover by EQT" (Reuters, 28 June 2024)

- "N Brown goes private to end Aim market woes" (The Times, 17 October 2024)

This list is far from complete. In fact, in April 2024, Goldman Sachs warned that the "UK stock market is shrinking at its fastest pace in history", not the least because of the ongoing wave of bids.

Source: Haver Capital, Goldman Sachs.

It looks like this takeover mania is set to continue for a bit longer:

- "Takeover interest in UK companies hits highest since 2018" (Financial Times, 12 May 2024)

- "The UK Stock Rally Has Legs This Time as Buybacks and M&A Surge" (Bloomberg, 14 May 2024)

- "Britain warms to Chinese takeovers" (The Telegraph, 15 September 2024)

However, we could now move beyond just conventional takeovers.

The CEOs, boards, and large shareholders of many British companies that have been languishing on the stock market are getting tired. Instead of waiting for public market investors to flock to their undervalued stocks, they are taking matters into their own hands. Stock buybacks, capital returns, and even outright liquidations of companies are on the rise. Throw in a dash of activism, as the article below shows.

Source: The Times, 14 November 2024.

As Clearway Capital, a small fund manager with a track record of finding value among UK small- and mid-cap stocks, recently wrote in its third quarter letter to clients:

"The U.K. markets, particularly small and mid-caps, suffer from structural undervaluation driven by a lack of liquidity. The Alternative Investment Market (AIM), a sub-market of the London Stock Exchange that caters to small businesses, for instance, has lost almost 60% of its companies since 2007, of which ~11% in the last twelve months. Many of these companies, who have struggled for years with low valuations now prefer to seek capital in private markets and to delist

…. While on one hand this will likely result in an increasing wave of public to private transactions from which we will benefit, on the other it raises concerns for companies who do remain listed. Unless such companies actively return capital to shareholders via share buybacks and outsized dividends, we cannot find any reason why cheap stocks won't stay cheap indefinitely which is why a hard catalyst is always part of our investment thesis when we invest in small-caps. We have positioned the fund accordingly. The majority of our directional exposure is to high quality, growing businesses with defensive and recurring revenues and each with a hard catalyst, while over one third of the portfolio was invested in event driven special situations whose short-term outcomes should not be correlated to broader market movements."

Clearway Capital had a sizeable position in Learning Technologies Group (ISIN GB00B4T7HX10, UK:LTG), which I featured in a Weekly Dispatch in August 2024 before it received a bid with a 29% premium just five weeks later.

To extract value from Britain's unloved stocks, it pays to do a bit of lateral thinking and look at companies that have truly fallen off the radar.

As it were, I have more such companies on my radar than I can feasibly write research reports about – which is why I've decided to feature some of them in today's Weekly Dispatch.

The Weekly Dispatches are my outlet for experimenting, and for reporting about cases that I have done only comparatively superficial research about. It's in the extensive research reports that I send to Undervalued-Shares.com Members that I dig into individual cases in great detail. In the Weekly Dispatches, I do free-style reporting in what ever way suits me best (sorry to be blunt – but anyone who doesn't want to pay the paltry USD 49 for an annual Membership only gets the crumbs).

Keen to clear my desk before year-end, I don't want to let some potentially valuable leads and ideas go to waste!

Here are three potential ideas that you might want to dig into in more detail.

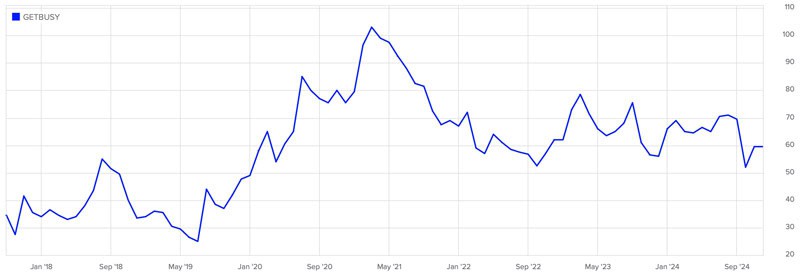

Idea #1: GetBusy PLC

GetBusy is a productivity software business that has a strong position in the tax and accountancy area. The business benefits from good economics and a net cash balance sheet. In a typical sign of the situation of the London market, the stock is trading at about 1.25x revenue at a time when private market transactions in the space were recorded with revenue multiples around 7x. In March 2024, Smart Space Software was taken off the London market after a bid that amounted to 3x annual revenue. GetBusy has a market cap of just GBP 30m, and thus is hardly followed by anyone.

Remarkably, management is highly incentivised to eventually sell the business and return cash to shareholders. As page 37 of the company's annual report spells out, management will receive GBP 6.75m in lieu of options if it returns GBP 70m of cash to shareholders. The team stands to get 9.5% rising to 25% of the increment above GBP 70m to GBP 120m. E.g., if they sell for GBP 120m, they get 25% of the GBP 50m incremental, which is GBP 12.5m. The shareholders would get GBP 70m less GBP 6.75m + GBP 37.5m = GBP 100.75m, which is 3.35x today's share price.

The CEO and his dad own 22% of the business, which saves having to issue the usual management options and could get another few million for shareholders.

They just need to sell the business and return capital to shareholders.

It's a stock with limited liquidity, but indicative of the type of valuations you can currently find among UK small- and mid-caps.

As Charlie Munger said: "Show me the incentive, and I'll show you the outcome."

Given the incentivisation, this should be a no-brainer, right?

GetBusy PLC.

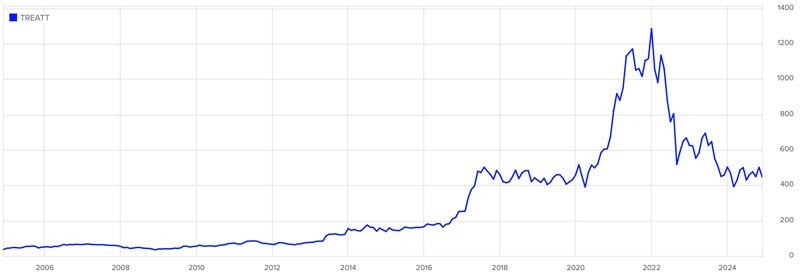

Idea #2: Treatt PLC

Treatt (ISIN GB00BKS7YK08, UK:TET) is a stock most are unlikely ever to have heard of, even though they will have used their product without even realising it. The 148-year old company with a market cap of GBP 270m is an independent manufacturer and supplier of natural extracts and ingredients used in consumer products that require flavour and fragrance. The company's particular strength lies in essential oils, citrus, and the beverage sector.

Treatt is a minnow compared to global industry giants like International Flavors & Fragrances (ISIN US4595061015, NYSE:IFF), and Givaudan (ISIN CH0010645932, CH:GIVN). Still, it benefits from secular tailwinds such as a trend towards sustainability and provenance, natural ingredients, and sugar reduction.

Following another period of clunky capex, Treatt is now set for 5-10 years of growth. After a dramatic collapse in share price since early 2022, the stock is trading at about 10x EBITDA, compared to its peers trading between 16x-24x. Outside of being smaller, there doesn't seem to be anything to justify such a discount.

Could a foreign competitor be tempted to swoop in and launch a bid? Probably, yes. This is a high-quality asset that would fit neatly into one of the larger groups. It's a situation that I believe warrants further research.

Treatt.

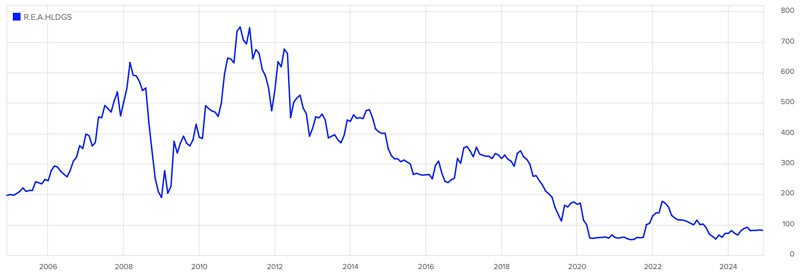

Idea #3: R.E.A. Holdings PLC

R.E.A. Holdings (ISIN GB0002349065, UK:RE) is a London-quoted Indonesian palm oil producer. The stock was well over 400 pence before the pandemic but now trades around 80 pence. The net asset value of the business is 250 pence, and the market cap a mere GBP 36m.

This is a stock that was pitched at the Weird Shit Investing conference in London in June 2024. As the presenter of the idea said in his one-page summary of the investment case in the Weird Shit Investing manual: "The Chairman is 80 and wants this sell. I believe MP Evans or a local player will acquire in the next 12-18 months."

His current assessment?

"Palm oil prices are pretty strong reflecting some concern over the forthcoming harvest but even if you account for lower tonnes produced there should be an upgrade given how firm the price has been. I estimate that debt could be lower by $20m to the last broker note – given this at its heart is a debt for equity swap that matters! Sand / Stone – multi decade resource – continues to ramp and adds to the scope for free cash flow upgrades in outer years. Company focuses on increasing the terminal value of the business by planting (investing) in new hectares. I suspect the industry will 'spot this' as the deleveraging story (circa $22m a year using palm prices from H1 – not spot) is augmented in H2 2027 by the reduction of replanting capex and incremental cash flow from the new hectares meaning free cash flow could / should be $50m that full financial year. It's entirely plausible that mid 2028 REA has a net cash position meaning the NAV at industry transaction values is closer to 500p."

As this example goes, with the addition of Weird Shit Investing to the events hosted by Undervalued-Shares.com, I have significantly improved my access to truly original investment ideas and the type of experts who come up with them.

R.E.A. Holdings.

Activism, liquidations, and capital returns

I could easily add more names, and I sent another highly interesting case of this type to Undervalued-Shares.com Lifetime Members just a few days ago.

In this latest research report, I introduce a British small-cap stock that seems on the way to selling all of its holding and returning the cash to its shareholders. This should yield well over 2x the current share price within the next 12-24 months. Thereafter, the company will likely become a cash shell, and it could be used to launch a new business altogether.

Earlier in 2024, I had already featured another undervalued liquidation case in a research report for Lifetime Members. This was also a British small-cap, and its stock is currently temporarily suspended from trading because of a technical issue. It should be readmitted next month. This case remains extremely interesting, too.

As ever, these are just some ideas and examples of what's out there.

Despite all the delistings and takeovers, there are still 2,000 listed companies in the UK – many of them underfollowed, as you can gather from what I set out above.

Undervalued stocks eventually revert to mean, even if that takes liquidating the entire company. It all ties in with the City's 2,000-year history of reinventing itself over and over again, and remaining one of the world's premier hubs for finance and trading.

Britain will remain an interesting stock market, and too interesting not to keep an eye on.

Hot off the press: new in-depth research report

The time to profit from undervalued AIM-listed companies is now.

Underresearched by investors, here is one opportunity that shouldn't even exist – but it does, because hardly anyone is even following AIM stocks anymore.

It's a small-cap whose outright liquidation will happen before too long. The return of all its capital to shareholders should yield 2-2.5x over the coming 12-24 months, with low downside risk.

My latest research report – out this week exclusively for Lifetime Members – has all the details.

Hot off the press: new in-depth research report

The time to profit from undervalued AIM-listed companies is now.

Underresearched by investors, here is one opportunity that shouldn't even exist – but it does, because hardly anyone is even following AIM stocks anymore.

It's a small-cap whose outright liquidation will happen before too long. The return of all its capital to shareholders should yield 2-2.5x over the coming 12-24 months, with low downside risk.

My latest research report – out this week exclusively for Lifetime Members – has all the details.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: