Spoiler alert, this article won't try to change anyone's view on "climate change". It's also not going to look at any temperature statistics or scientific models.

It will focus solely on the changing perception of the subject, and the plethora of investment opportunities that arise from it.

What are three of the most interesting areas to look at?

It's the only article I have ever written about the subject – but it's also one that I was very much looking forward to publish!

Sharing my mental framework

The subject of so-called climate change isn't just controversial and polarising, it's also extremely complex and far-flung.

In public, the debate is dominated by three factors:

- "Man-made or not?" What is commonly referred to as "climate change" should really be referred to as "human-caused climate change". The climate has always changed, no one has any doubts about it. The core of the issue is whether mankind has accelerated climate change through carbon emissions or not.

- "How much is the climate changing?" Leaving aside the issue of who (or what) is causing the climate to change, there is the question of how much it is likely to change and what the subsequent changes will be in the world.

- "How to deal with it?" The third main issue is, how can mankind deal with climate change? Who should deal with it? What resources are required?

Whatever your view of these points, it's virtually impossible not to have regular exposure to the subject. The debate is simply everywhere nowadays, at least for now. Whether you like it or not, it influences the world we live in, including capital flows in financial markets.

That's why I have developed a mental framework of how I approach the subject.

The lens I apply is based around three notions that I have found reliable throughout my life.

1. Dealing with people who project certainty in the face of extreme complexity

Back in the 1990s, I followed the career of Jean-Pierre Van Rossem, a colourful Belgian. The heavily overweight, long-haired eccentric claimed to have developed a computer algorithm that allowed him to calculate where financial markets were going. His software was called "Moneytron", and he claimed that his supercomputer was able to make money in any part of the financial markets.

Well-heeled Europeans entrusted him with hundreds of millions, and Van Rossem ended up owning not just a whole collection of sports cars but even a Formula One team.

The man whose computer models predicted markets – or so he claimed.

It ended as these things inevitably ended. "Moneytron" wasn't able to predict markets after all, the investors lost all their money, and Van Rossem ended up in jail for fraud. In retrospective, it seems ludicrous that anyone ever gave him a single penny. Yet, even the Belgian Royal family had fallen for Van Rossem and given him some of the dynastic family wealth to manage.

Today, we have scientists telling us that they have computer models which can reliably predict one of the most complicated and variable-rich systems of the universe – the Earth's climate.

If that wasn't enough to make any rational person's ears perk, they also fit right into the next category.

2. Dealing with people who do not allow debate and dissent

Expressing doubt about climate change has become tantamount to treason. You'll have the term "climate change denier" attached to you, which was, of course, consciously chosen because it's so similar to the term "Holocaust denier" and therefore acts as a powerful tool for shutting up people.

Throughout human history, it has been a reliable rule of thumb that the censors are usually not the good guys.

As Katharine Graham, publisher of the Washington Post from 1963 to 1991, used to say: "News is what someone wants suppressed. Everything else is advertising."

Whenever I come across information that someone is keen to keep from the public domain, my next step is to…

3. Follow the money

The so-called fight against climate change has already sucked in resources amounting to about USD 5tr. No one has a precise figure, but it's in the trillions in any case.

What is being bandied about as the energy transition supposedly cost between USD 10- 100tr, depending on who you ask. In any case, that's more money than anyone can even begin to imagine. In comparison, the US government's annual budget is USD 6.2tr, and that of Germany is USD 1.6tr. One study put the current size of the climate change industry at USD 1.5tr per year, which would make it the world's 13th biggest economy and roughly on par with the GDPs of South Korea, Australia or Canada.

What's more, you are supposed to give these unprecedented amounts to entities that have a history of not even being able to reliably achieve basic measures of good governance, such as balancing their budgets (the US government last balanced its budget 22 years ago). However, you are not supposed to question the need to hand over these resources to them because… "climate change!".

Shamed be he who thinks evil of it.

Ignore the insanity – and focus on making money

For the purpose of this article, I purchased three dozen books that look at the subject from different angles:

- "The Case for the Green New Deal", and Bill Gates's advice on "How to Avoid A Climate Disaster" are the kind of books that your bookstore will have displayed in its entrance area in recent years.

- "Global Warming: A Case Study in Groupthink", and "Fossil Future: Why Global Human Florishing Requires More Oil, Coal, and Natural Gas – Not Less" are on the other side of the argument – to name just two examples.

- "The Cooling: Has the Next Ice Age Already Begun?" from 1976, and Paul Ehrlich's "How to be a Survivor: A Plan to Save Spaceship Earth" from 1971 are two particularly interesting books that dealt with the subject between the mid-1960s and 2000.

My tour de force of going through decades of literature on the changing climate and its predicted effects on humanity was intellectually interesting, and entertaining even. E.g., reading Ehrlich's plea for "global population control" made shivers run down my spine, in ways that no horror novel could have achieved.

However, what the books didn't provide me with was any degree of certainty (or even just clarity) of what is likely going to happen. Both sides operate using in-depth computer models created by world-leading scientists, and both sides are very convincing at making their case.

What's a normal person with limited time and other areas of interest to do in the face of such complexity?

In situations such as these, I find listening to my gut feeling the best indicator.

To recap, you have a group of people who project certainty in a complex situation, you are not allowed to question them, and they make a living out of it all. In any real-world, common-sense situation, how would your gut react to such a group demanding that you hand over resources and control to them?

Based on the above, I have a very simple approach to the entire debate.

I ignore it altogether.

And I am not even worried whether I am wrong to do so.

By now, there is a deeply entrenched, permanent industry that makes a living out of dealing with the subject. If there is an actual risk that the oceans will boil and our eyes will pop out from searing heat, I am sure the millions of employees that this sector directly and indirectly employs by now will eventually find a way to deal with it. There are many good, clever people working in that sector. Plus, they have trillions in resources to deal with the issue, even now. I happily leave it to them to deal with it, and while they do so, focus on the humour side that comes out of it, which is the only effective way for dealing with anyone who tries to suppress opinions and debate.

Funny memes – the best part of the climate change debate (click on images to enlarge)!

In day-to-day life, I have a very basic but effective rule of whether or not to participate in the debate. When someone speaks to me about "climate change" rather than "human-made climate change", I just nod politely and see how fast I can get them to move on to the next subject. It's simply not worth my time to speak to someone who can't even get the basic terminology right. That's before I even ask whether they are doing so because they are manipulative or just imprecise – neither one of which being to their favour.

Much as I ignore the political debate, I do follow it through the lens of investment research.

Without a doubt, you have come to Undervalued-Shares.com to read about investment ideas. That's where I do find this subject exceedingly interesting and relevant, because it does influence the course of your investments and provides a plethora of different options to invest in.

What are the three most interesting options to invest in?

After collecting material about the subject for years, I recently had the feeling that now was a good time to sit down and distil a few areas of interest within the subject of investing in the era of so-called climate change.

It'll include a few outliers, as you will see.

Idea #1: Bet on cracks in the narrative

For years, the narrative seemed like it only had one direction.

Climate change all the way. Renewable energy forever. Fossil fuels, bad.

Of late, we have seen this narrative crumble in front of our eyes.

Suddenly, a growing number of people realises that fossil fuels continue to contribute 80% of the world's energy needs. That's down just 2% over the past 20 years, despite trillions spent on so-called renewable energy. What did all those trillions gets us? A miniscule reduction in the use of fossil fuels.

Of late, it has become obvious that without fossil fuels, the world cannot function.

Suddenly, the Germans are back in the business of mining for coal. In order to deal with the fall-out of Angela Merkel's catastrophic energy policies, they are digging for lignite – the most environmentally damaging form of coal.

Natural gas was recently relabelled "green energy", to justify its continued use.

Drilling for oil and gas offshore is making a comeback, all of a sudden.

Even nuclear energy, that original nemesis of the Green movement, is suddenly being invited back in from the cold.

So much has changed recently.

It was a short six years ago that a video went viral in which Tony Seba predicted that by 2025, "all new cars sold will be electric". Seba's prediction was taken serious by many. After all, he is an academic who "has taught thousands of entrepreneurs and corporate leaders at Stanford University".

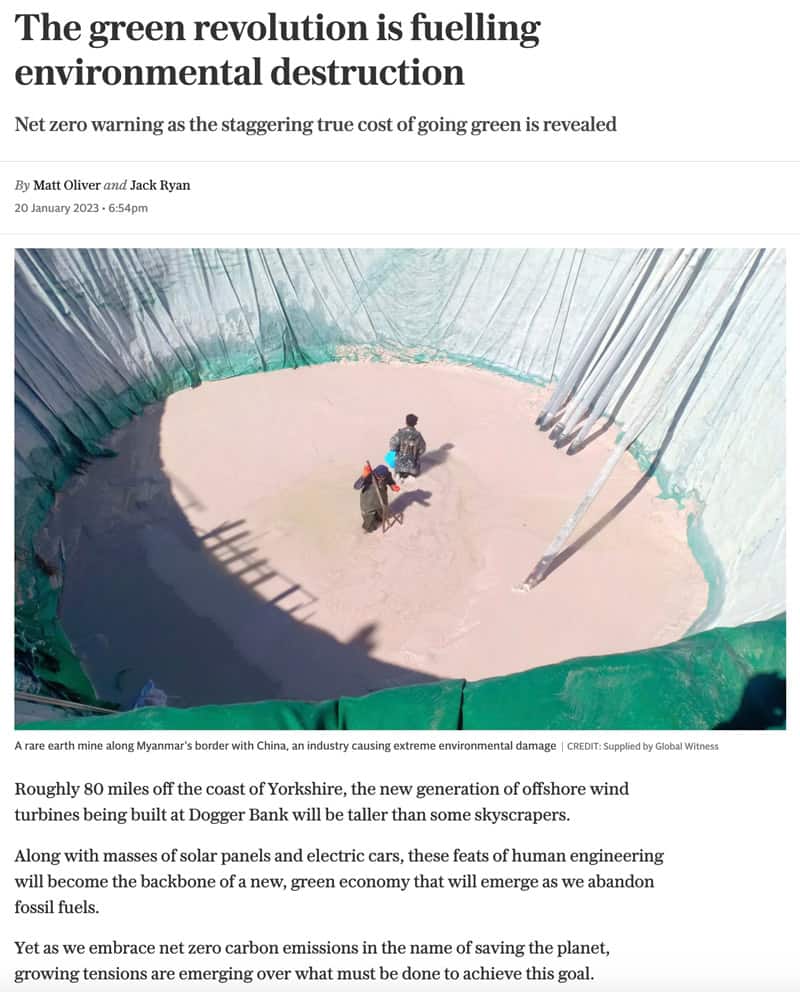

Fast forward to 2023, and what we are actually seeing is a marked slowdown in the sales of electric vehicles. Auto industry executives have recently started to publicly question the overall potential of electric vehicles, and there is a marked uptick in the mainstream media reporting critically about the damage done to the environment by digging for the massive resources needed for the electrification of the economy (see below).

Source: Daily Telegraph, 20 January 2023.

Whisper it, but we may well be past Peak Climate Change Hysteria.

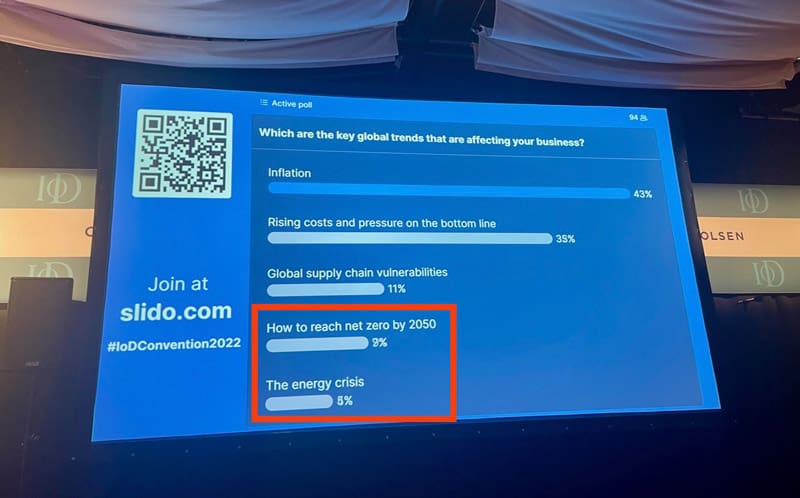

I live on a group of islands where subjects such as climate change and green energy have been pushed to a nauseating degree by politics, the media and special interest groups. Is the population still taking the bait? At a recent event of Guernsey's Institute of Directors, an anonymous survey taken among the large audience of business leaders and executives yielded that energy issues ranked at the bottom of their worries.

Poll at the Guernsey Institute of Directors, October 2022.

The climate change industry is working extra hard to push back. In June 2022, Joe Biden's national climate change advisor, Gina McCarthy, wanted to launch phase two of climate change censorship. She asked Big Tech to censor not just anyone who is a so-called climate change denier, but also those who "seed doubt about the costs associated with green energy and whether they work or not."

Their problem is, obviously, that trying to prevent information from flowing freely is like trying to hold on to a soaped-up pig by its tail. It'll slip out of your hands pretty quickly, and be all the madder for it.

One of the new investment themes that has not received enough attention and analysis yet is that we have entered an age of growing distrust of government and similar authorities.

If our politicians and self-described elite cannot even deal with growing homelessness and crime, how will they fare in managing the Earth's climate?

Never mind how the handling of the coronavirus pandemic has made many people question everything.

The Green movement's (in)ability to deliver operationally and stick to its values is now on full display for everyone to see. This movement will ask you not to believe your lying eyes, but it's simply hard not to notice how Germany had planned to switch off all nuclear reactors to go green, only to now bring back the most environmentally damaging form of coal to deal with its resulting energy shortage. One of the richest countries on Earth, with the most engineers and the highest level of political dedication, failed on most counts of its 12-year energy transition programme. Why would anyone believe that other countries will succeed?

What all of this will likely result in is a gradual return of energy realism.

Cars with internal combustion engines will be produced well beyond 2025 – we can now be sure of that, and no one needs to waste any more time listening to a breathless Tony Seba.

Just as much, it's now become clear that fossil fuels will remain the mainstay of the world's energy provision not just until 2035, but more likely until 2050 – or even well beyond that. The world does experience the occasional energy transition, but these are generally not pulled off within years but decades and generations. There are still 800m humans without access to electricity, and global energy consumption is likely to increase by a factor of 2-3 over the next quarter of a century. Fossil fuels will remain the workhorse of the global energy industry.

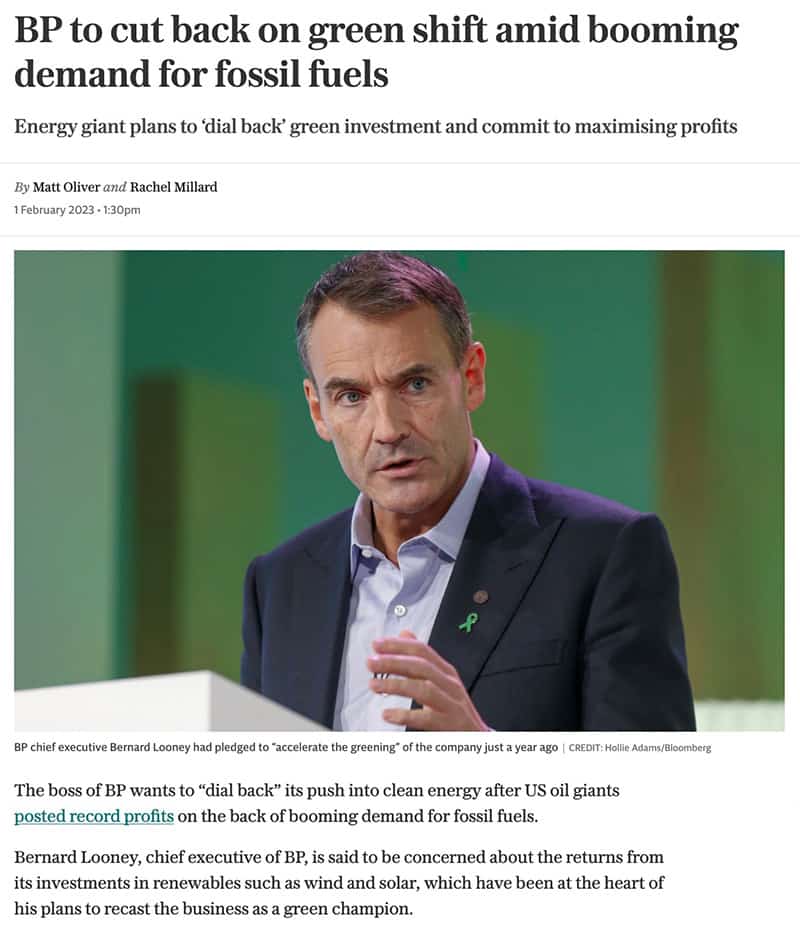

Growing signs of a return to sanity (source: Daily Telegraph, 1 February 2023).

The stocks of many fossil fuel companies experienced a great uplift in 2022, but many of them still trade at valuations that makes it look like they were going out of business in a few years. After a decade of neglect, the sector has a lot more catching up to do.

These companies won't go out of business anytime soon. Some of them will even return to growth, now that a decade of underinvestment in fossil fuel production is having the effect that it was always going to have in a world that is 80% dependent on fossil fuels. These companies' valuations are simply too cheap.

Over the coming years, the stocks of oil, gas, and coal companies should experience multiple expansion. If they experience a combination of growing earnings and multiple expansion, you'll have rocket fuel for stock prices – pun intended.

There'll be national and regional differences, because of factors such as windfall taxes. We'll also see massive fluctuations in energy prices along the way, because nothing ever develops in a straight line. This could be a temporary drop of the oil price to USD 50 per barrel or, just as much, it could be oil climbing to USD 200 per barrel if supplies hit a glitch.

The hype surrounding the climate change subject is likely to gradually subside, simply because it doesn't stack up and people are catching up with it.

There'll be large amounts of money to be made by investors when the valuations of fossil fuel companies return to a degree of sanity.

Which is not to say that we couldn't….

Idea #2: Profit from new inventions

Eventually, new and improved technologies will replace some or all of the fossil fuel industry. Just as the climate has always changed, so has the composition of the world's energy production.

Kudos to Europe, the region that has developed the world's most agile, innovative sector for generating and utilising energy in novel ways. Europeans are passionate about the subject of the energy transition, and they are an inventive bunch. There is a market, after all, for alternative ways of generating energy. This could be cheaper energy, or cleaner energy – and ideally, both.

Does that equate to investing in the latest generation of wind turbines?

I am generally sceptical about any industry that has a large base of investors who back them because it's fashionable and fits their political ideology. There has been a lot of hot, uninformed money chasing after the more obvious plays in this area. Just as fossil fuel companies offer high cash flow yields because they are out of fashion, so do conventional "renewable" energy companies suffer from lower cash flow yields.

What I'd be more interested in are innovative companies that solve problems to which no one has found a great solution yet, and which fewer have looked at recently.

E.g., I will be looking for companies that solve issues such as:

Cleaner energy from coal. For decades, the production of energy from coal has become ever cleaner, and companies in this industry are producing ever more energy per unit of coal. Who is to say that the answer to the world's problems doesn't lie, after all, in developing a much cleaner mechanism for producing energy from coal? A breakthrough technology could make those publicly listed energy companies that rely heavily on coal a great investment prospect, because it would allow these stocks to return to more normal valuation multiples.

Cleaner mining. Once an honest accounting is done for the resources that go into different industries, the so-called renewable energy sector is one of the world's worst polluters. Batteries are supposed to be clean and green, but having children mine for lithium in the Congo is neither clean nor socially responsible. The renewable energy industry has long understated its need for mineral resources and how it shifts real environmental burdens to poorer parts of the world where they are less visible. Of late, a growing number of observers have realised that the aimed-for energy transition cannot go ahead without sufficient commodities being mined. Anything that addresses this issue could be a truly outstanding investment, and help deal with the many moral issues that currently make pushing for so-called renewable energy such a questionable undertaking.

Source: Daily Mail, 30 January 2023.

Surprise winners: For years, we've been told that electric vehicles were going to be the solution. For many years, Toyota has been one of the few doubters. The Japanese car company long stated that it was going to largely ignore electric vehicles during the 2020s, and instead focus on getting hydrogen-powered cars ready for the 2030s. Suddenly, it looks like at least parts of Toyota's strategy are being vindicated. There may yet be surprise winners coming out of all this. Could biofuels turn out to be the solution for both aviation fuel and the production of plastics? If they were, investments in agriculture could become an exciting prospect.

Do I know which one of these areas will produce the biggest winner, or which companies are going to come out on top?

This is a vast, broad field for research with *thousands* of publicly listed companies. Within this set of investment possibilities, there'll be lots of different realities that depend on factors such as your geography and your investment priorities.

Just because I ignore the public debate about climate change and politely nod at climate people who put me to sleep lecture me about the subject over dinner, doesn't mean that I am not looking for investment opportunities in areas such as so-called cleantech or so-called renewable energies.

I urge you to take the same approach, if you aren't already doing so. Undervalued-Shares.com is on the lookout for stocks in this field.

Idea #3: Put emerging markets on your radar

Since the outbreak of the war in Ukraine, it has become widely accepted that the world is rearranging around different blocks.

This holds true for politics, economics and currencies, but also for the purpose of climate change-related policies.

There'll be real value in looking at the world from the perspective of where can you make money from distinctly different national approaches to the subject of climate change.

My current favourite is my bet that Saudi Arabia will soon see a boost in foreign investment and soaring stock prices.

Saudi Arabia is one of the world's most underestimated countries. I visited the reclusive kingdom extensively in 2018 (worming my way in at a time when they didn't have a tourist visa yet), and I have been following it closely ever since. I expect Saudi Arabia to be on the cusp of both a cultural revolution and an investment boom.

It helps that the country still sits atop one of the world's biggest oil reserves, which also happens to be one of the cheapest to produce. The Saudis are also about to ramp up their mineral exploration, which is virtually untapped and potentially another "last great frontier".

Saudi Arabia isn't going to stop producing oil because a few teenagers glue themselves to a street in Berlin or throw soup at paintings in London. In fact, during my travels to different parts of the world, I have long noticed that some of the recent societal trends seen in Europe and North America cause nothing but hearty belly laughs elsewhere in the world. In Asia and the Middle East, many realise that many of the West's misguided policies benefit their economies.

A significant percentage of the world's natural resources is found in emerging market countries. A good number of these countries have learned their lessons from past boom-and-bust cycles, and are now much wiser in their approach to exploiting their natural resources. For others, growing demand and higher prices will simply make for another financial boon.

Stock markets in emerging markets performed horribly during the 2010s, when Big Tech and other growth sectors of Western economies produced the best performance. During the 2020s, I expect emerging markets to stage a much better performance, not the least because they have all the stuff that the rest of the world needs to build, grow or just maintain their economies. This includes commodities such as lithium, cobalt, nickel, copper, manganese, iron, graphite, iridium, and terbium – which are needed for the energy transition envisioned by the climate change lobby.

Emerging markets were the underperformers of the 2010s.

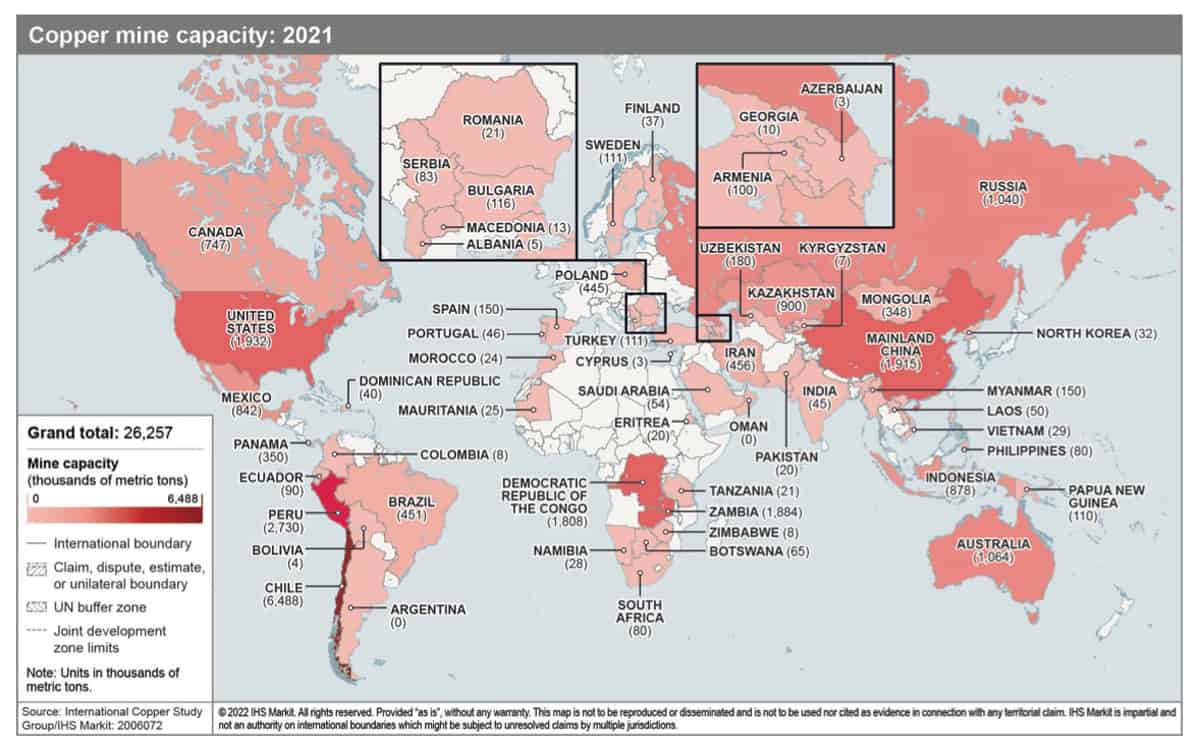

As an illustrative example, just look at the map where the most copper resources are found. Copper is the metal needed for the electrification of the economy, if only because its superior conductivity makes it virtually irreplaceable for the electricity grid.

Distribution of the world's copper resources (source: S&P Platts). Click on image to enlarge.

Plenty of emerging market countries and companies are going to have a field day when demand for mineral resources takes off because of the energy transition advancing in at least some countries. I don't expect demand for these materials to reach quite the level that some recently predicted, because many countries will slow down their energy transition programmes and/or because new technologies will be invented along the way (check back to last week's Weekly Dispatch about copper). However, there will be at least some additional demand, and it will hit a global commodities market that is bone dry following years of underinvestment in new production.

A problem is, how to pick the best investments in this sector and get access to the best opportunities?

After all, there are plenty of obstacles:

- Investing in Saudi Arabia remains anything but easy for now.

- Emerging markets are still quite untransparent, and risky to navigate.

- There is a plethora of mineral resources, but which one offers the best prospects?

I do have one specific idea ready for you.

Glencore as an option to play both sides

London-listed Glencore is a commodities company that:

- Produces fossil fuels.

- Produces commodities needed for "green" energy.

- Navigates emerging markets to find the best deals.

For an informative and refreshing take on the world's need for more commodities and the difficulty in delivering them, watch this short video where the former CEO of Glencore gives a journalist a dose of reality.

Watch from 6 min 19 sec onward.

I prefer investments in companies where management makes decisions based on reality instead of ideology. As such, Glencore is an outstanding company to look at. It is much maligned, because its management speaks truth to power and acts accordingly.

It's also the commodities company with the most attractive valuation metrics among large mining companies, such as the highest cash flow yield.

Glencore: the only commodities investment you need

Glencore already accounts for 4% of the world's copper consumption and owns mining assets that allow to more than double its production.

With global markets highly likely to face an unprecedented shortage of copper from 2025 onwards, Glencore is set to benefit mightily.

The company is expected to pay a ≈15% dividend yield for 2023, it is currently buying back stock at a rate of >10% the daily trading volume, and it has the highest free cash flow yield in its peer group.

Over the next three years, Glencore should return 50-60% of its current share price to shareholders.

Glencore: the only commodities investment you need

Glencore already accounts for 4% of the world's copper consumption and owns mining assets that allow to more than double its production.

With global markets highly likely to face an unprecedented shortage of copper from 2025 onwards, Glencore is set to benefit mightily.

The company is expected to pay a ≈15% dividend yield for 2023, it is currently buying back stock at a rate of >10% the daily trading volume, and it has the highest free cash flow yield in its peer group.

Over the next three years, Glencore should return 50-60% of its current share price to shareholders.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: