Why all this interest, and why the high bid premia?

Join me for a whirlwind tour of London's stock exchange and a closer look at one specific investment opportunity, M&G plc.

This British large-cap company could receive a bid at a 45% premium to its current share price of 201 pence. While you wait, the stock will pay a 10% dividend yield for 2022 (gradually rising to 13% by 2026). Over the coming three years, M&G is likely to distribute a remarkable 40% of its current market cap to shareholders, through a combination of dividends and buybacks – the highest among its peers.

Lucrative bids galore

The takeover mania that has taken hold of Britain's stock market is remarkable for several reasons:

- The sheer number of bids.

- The large size of many of the targets.

- The bid premia offered.

As highlighted in my Weekly Dispatch on 4 March 2022, a new takeover offer for a British publicly listed company was placed every 79 hours.

Bid activity has remained robust during these past months:

- GBP 3.7bn bid for Mediclinic, 35% bid premium.

- GPB 1.4bn bid for Biffa, 37% bid premium.

- GBP 7.2bn bid attempt for Pearson, 45% bid premium.

- GBP 1.7bn bid for ContourGlobal, 60% bid premium.

- GBP 5.1bn bid for Micro Focus, 98% bid premium.

Multi-billion takeover bids usually come with a 20-30% bid premium. In Britain, the typical bid premium has been running at twice the usual rate.

There were also a few special situations, such as M&C Saatchi (ISIN GB00B01F7T14, UK:MNC) which I had pointed out as a potential target in my 1 January 2021 article "Brexit special: a list of potential takeover targets". In May 2022, the company did receive a GBP 310m bid that represented a premium of over 50%. However, the deal fell apart and the subsequent three (!) bids from another bidder were all turned down by M&C Saatchi's board because they were seen as undervalued.

Key parameters to be aware of

You'd normally expect someone to explain these events based on a narrative around "the British stock market".

However, there is no such thing as "the British stock market". Instead, there is a British market for stocks. It's impossible to lump together all British stocks.

On the one hand, Britain does have the largest collection of European tech unicorns, and it has seen many large tech IPOs during the past two years.

Source: Statista.

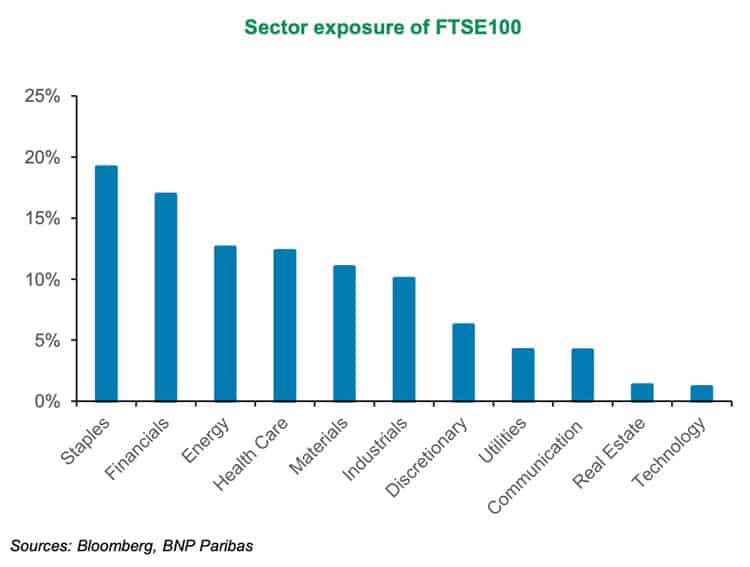

On the other hand, the FTSE 100 Index has a disproportionate number of companies in stodgy sectors such as mining, fossil fuels, and banking.

Source: BNP Paribas.

Given recent world events and the resulting shifts in financial markets, the FTSE 100 is currently one of the best performing national stock indices in the developed world. It's down just 1% since the start of the year, compared to the S&P 500 losing 17% and European indices dropping by about 20%.

On the other hand, you do have quite a list of major British IPOs that got torn to shreds:

- Deliveroo (ISIN GB00BNC5T391, UK:ROO) destroyed 79% of investors' capital.

- Alphawave IP Group (ISIN GB00BNDRMJ14, UK:AWE) is down 67%.

- Aston Martin Lagonda (ISIN GB00BN7CG237, UK:AML) wiped out 95%.

It's a mixed bag, and once you look closely, you'll realise that seemingly clear-cut factors sometimes pull into opposing directions. E.g., during the past three months, the pound sterling was the second worst performing major currency compared to the US dollar. However, since most large British companies earn revenues in dollars, the weak pound actually benefits them financially. A falling pound makes the country of Britain look weak on the outside, but it strengthens the investment case for many British blue-chip stocks.

As BNP Paribas summarised it in a 22 August 2022 research note:

"The FTSE100 has seen its 2022 earnings forecast revised up by 27% this year, yet trades flat in terms of price return YTD. ... A weak GBP tends to benefit FTSE100 stocks due to the index's high level of foreign revenue exposure... We expect this momentum to continue into 2023. … UK equities are 'most preferred' in Europe."

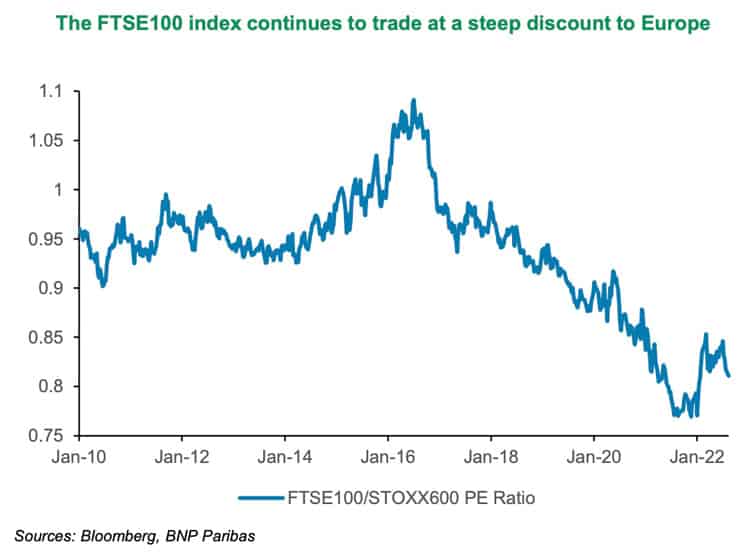

In terms of fundamentals, the UK market (when measured by the FTSE 100) is now relatively cheaper than Continental European stocks – by a mile! (It looks very different based on the FTSE 250 because that index is very much geared towards the domestic economy – a subject for another day.)

Source: Statista.

It doesn't take a math degree to figure out next steps. Just as Americans have discovered how cheap it's become to buy European real estate, they'll continue to use their strong dollars to gobble up British companies.

Compared to the dollar, the pound has just reached its lowest level since 1985!

As Bloomberg reported on 20 May 2022:

"UK companies are a lot more affordable for dollar-based funds… Morgan Stanley analysts reckon the UK market is extremely cheap on a historical basis. Last month, they looked at the multiple of earnings at which shares have traded at since 1980 (adjusting for the economic cycle): UK stocks were at roughly 1% below their average, US stocks 58% above."

What are such acquirers mostly interested in right now? Bloomberg had an answer for that question, too:

"Whatever the macro conditions, a buyout firm's primary focus will be on whether an individual asset generates sufficient cash to service the debt used to acquire it. That box looks to be easily ticked. Graham Simpson, analyst at Canaccord Genuity Quest, recently identified 255 London-listed stocks with a market capitalization under £1.5 billion that were generating extremely attractive levels of free cash flow relative to their market enterprise value."

Where can you find these companies with extremely attractive levels of free cash flow?

One place to look is Britain's insurance sector.

Value and takeover target wrapped into one

Insurance companies usually fall off the radar of most investors as their analysis requires a different methodology and terminology. Right now, the insurance industry could represent some of the best bargains among British stocks – but few have noticed yet.

One of the sector's most important metrics is the "solvency ratio": broadly speaking, a measure of a company's balance sheet strength. Notably, the solvency ratios of British insurance companies are currently at historically high levels. The British insurance sector has weak organic growth, but it combines strong cash flows with strong underlying balance sheets.

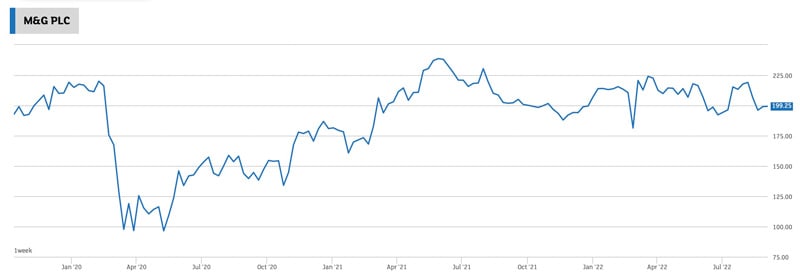

One company that sticks out is M&G plc (ISIN GB00BKFB1C65, UK:MNG), which sells a variety of products in insurance, retirement, and savings. It only went public in 2019, when it was spun off from another financial firm.

M&G plc.

One of M&G's strengths has been its high solvency rate and cash flow. Since its IPO, the company has already returned 35% of its share price through paying dividends and buying back stock. Despite its three-year track record, the market does not yet appreciate the inherent financial strengths of the business.

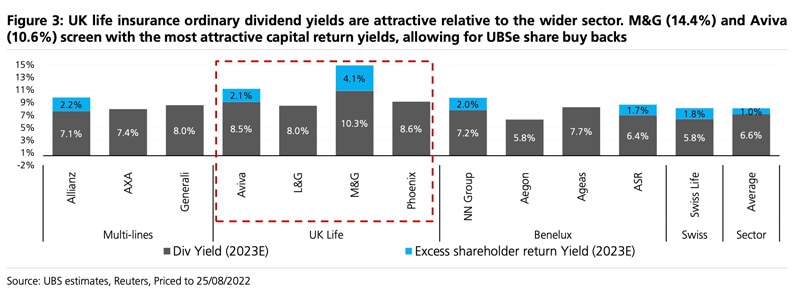

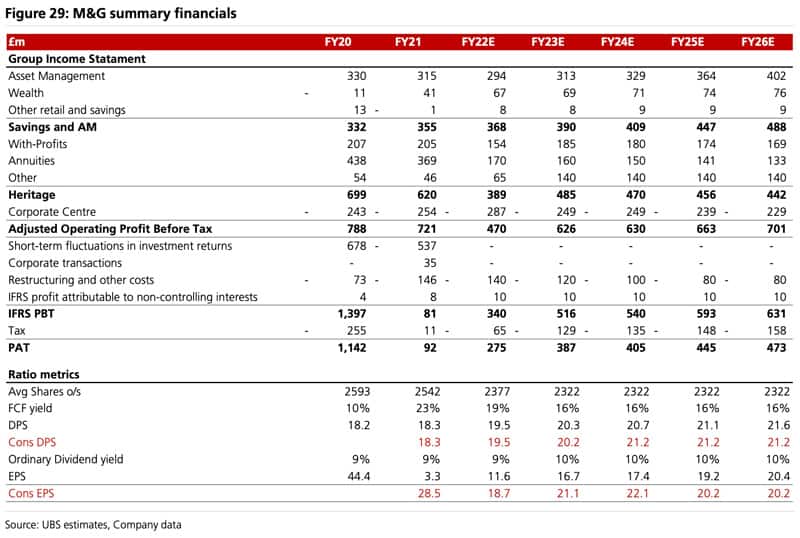

Based on an in-depth financial model published by UBS on 30 August 2022, M&G is likely to deliver a further ≈40% of its current market cap as capital returns over the next three years. The stock currently has a dividend yield of 10%, and the company is expected to carry out share buybacks equivalent to ≈4% of its stock price by the end of the year. The ≈14% combined dividend yield and share buybacks place M&G at the top of the industry's comparative metrics – in a sector with relatively substantial distributions to shareholders.

Source: UBS, 30 August 2022.

The general worldwide economic headwinds will of course have an effect at M&G, too. However, the ordinary dividend yield of ≈10% is something that UBS concludes is here to stay:

"M&G's solvency ratio is strong and we expect it to remain above the top-end of its target range (190%) over the next 3 years. … Allowing for UBSe shareholder capital returns, £300m of debt redemption and a £300m M&A budget over the next three years, we still expect M&G to retain >£1bn of holding company cash by FY24E. This is ahead of its ambition of holding >1 year of hold co. outgoings (c.£800m)."

Source: UBS, 30 August 2022.

M&G's strong cash is something that will make the company appear on the radar of potential acquirers. One of them has actually already taken a look at the situation: Schroders (ISIN GB0002405495, UK:SDR), one of the UK's leading asset managers.

As reported by Bloomberg in May 2021, Schroders had studied the idea of making a takeover offer for M&G, and considered to break up the company by selling its insurance operation and keeping the asset management business.

Schroders had run the numbers for a takeover bid priced at 270 pence. This came out at a time when the stock was trading between 210 and 240 pence, i.e. the bid would not have represented a particularly attractive premium. In the end, Schroders decided a takeover would be too expensive, and walked away from the idea.

M&G stock is now trading at just 201 pence, and it is likely that another bidder will eventually pick up where Schroders left off. Since 2019, the European insurance industry has been accumulating capital (by retaining earnings) at a faster rate than the industry needs to fund its growth. Organic growth is low, the coffers are filled with excess capital, and the valuations of publicly listed insurance companies are low – this all makes for the kind of environment where M&A is going to happen.

In fact, it has already started, in the form of two takeovers in August 2022. Britain's Phoenix Group (ISIN GB00BGXQNP29, UK:PHNX) acquired the UK operation of Canada's Sun Life Financial (ISIN CA8667961053, CA:SLF), whereas Aviva (ISIN GB00BPQY8M80, UK:AV), the London-based multinational insurance company, has announced the acquisition of Azur Underwriting.

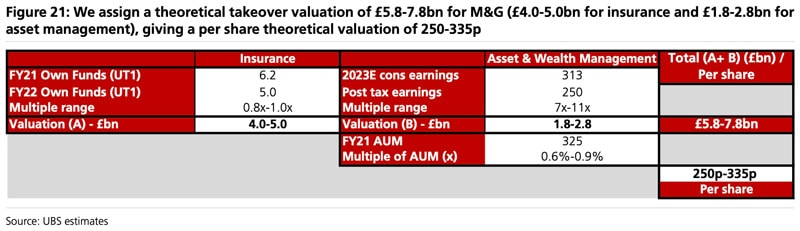

A breakup scenario for M&G would likely yield significantly higher value than today's share price. Even when taking the current macroeconomic headwinds into consideration, breaking the company into its individual components should lead to a value between 250 and 335 pence, depending on (among other things) the potential synergies with the acquirer. This valuation range is based on the current valuation of peers and the historical valuation of M&A transactions within the industry. The midpoint between the lower and upper value is 292.5 pence. Compared to its current share price of 201 pence, M&G stock has 45% upside.

Source: UBS, 30 August 2022.

How soon might M&G become the target of a bid?

It's anyone's guess. At a market cap of GBP 5bn (USD 5.7bn), this is a chunky target. As of now, no one in particular is known to be sniffing around. If they were, the stock would have already moved up a lot.

M&G is in an industry with low growth, and margins are under pressure. Then again, it's a takeover target for exactly that reason. With this kind of dividend yield and ongoing support from significant share buybacks, you could be very patient regarding the M&A upside.

It's just another example why it is worth keeping an eye on British stocks. Why look much further afield, when such good deals are available in a country with an easily accessible stock market?

More stock ideas from the British Isles

If you want to dig deeper into British stocks, you could do worse than check out the following:

British American Tobacco (ISIN US1104481072, UK:BATS) – a company that benefits from industry factors such as substantial earnings, high dividend yields, and reliable growth prospects. Plus, a hedge against inflation!

A British death care company – its name remains disclosed, but note that this is a company which has already attracted the interest of one of Britain's most prominent value investors.

John Menzies – this investment case has concluded with a lucrative takeover offer, but it remains a fascinating company to read up on nevertheless!

More stock ideas from the British Isles

If you want to dig deeper into British stocks, you could do worse than check out the following:

British American Tobacco (ISIN US1104481072, UK:BATS) – a company that benefits from industry factors such as substantial earnings, high dividend yields, and reliable growth prospects. Plus, a hedge against inflation!

A British death care company – its name remains disclosed, but note that this is a company which has already attracted the interest of one of Britain's most prominent value investors.

John Menzies – this investment case has concluded with a lucrative takeover offer, but it remains a fascinating company to read up on nevertheless!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: