Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

5 more British small-cap stocks worth digging into

My recent Weekly Dispatch about 3 British small-cap stocks proved a real crowd-pleaser – word is certainly spreading about Britain's irrationally low valuations!

Increasingly, takeover bids act as catalysts. Condor Gold, a long-time Undervalued-Shares.com favourite, just received a bid with a premium of up to 87% – far more than the usual 25-50%.

Here are another 5 British small-cap stocks that warrant further investigation.

A fallen e-commerce angel

Wine delivery company Naked Wines (ISIN GB00B021F836, UK:WINE) was one of the favourites during the coronavirus pandemic. Locked up at home, people took to the Internet to order wine, prompting the company's share price to rise by 4x during the first 1.5 years of the pandemic.

The subsequent downfall was painful. Consumers returned to brick-and-mortar stores, inventory turned out excessive, and margins fell. The stock is now 94% off its record high.

Naked Wines.

Not long ago, Naked Wines was a widely-followed stock that got featured at the Sohn Investment Conference in the US, and dubbed "the Netflix of wine" with a potential 1,000% return. It even made it onto CNBC, which is unusual for a UK-listed small-cap stock.

Once touted as the next great compounder, the company today has a market cap of just GBP 38m. It has gone from small-cap to micro-cap and largely fallen off investors' radar, with the exception of insiders, who have been loading up on the stock.

In October 2024, an investor associated with one of Naked Wines' non-executive directors bought 100,000 shares at an average price of 58.6 pence. The stock is now trading at 51 pence. You can find a variety of other insider purchases if you scroll down the list of last year's insider trading disclosures.

Naked Wines is now one of those stocks where news have started to become more favourable, but the share price hasn't reacted yet.

Earlier in 2024, the company hired a new CEO, Rodrigo Maza. Maza once worked for AB InBev – the drinks giant – where he scaled several online businesses. He works alongside Naked Wines' founder, Rowan Gormley, who is now in the position of chairman.

The most recent figures still look ugly. In the fiscal year ended 1 April 2024, total sales fell 18% to GBP 290m, and the company suffered a loss before tax of GBP 16.3m.

However, Maza believes Naked Wines had made "significant strides by strengthening financial foundations, embedding resilient management practices, and crystallising a robust customer proposition."

The low share price will still be driving the narrative, i.e. the stock is seen as a bit of a dog because of its low price. However, the repeated, significant insider buys since last year point to a different direction.

While I haven't done a deep-dive on the company (keep in mind that the Weekly Dispatches are merely my creative outlet), it appears that its inventory of wine alone is worth more than the market cap after you deduct all the liabilities. The board collectively owns a significant chunk of the shares.

For someone hunting for undervalued small-caps and with time to dig deeper, this is a stock I'd take a closer look at now.

A new British champion?

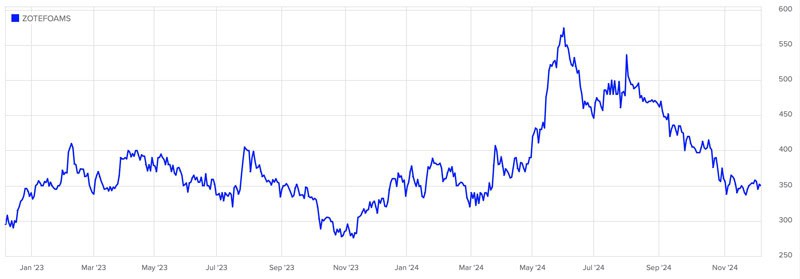

While Naked Wines is yesterday's darling, Zotefoams (ISIN GB0009896605, UK:ZTF) could well become tomorrow's hype.

Based out of London's famously unglamorous Croydon borough, Zotefoams specialises in producing lightweight foam materials with environmental, safety or other performance benefits. The company was founded in 1921, generates annual sales of GBP 127m, and has over 500 employees worldwide. Nike is one of its major customers.

Zotefoams.

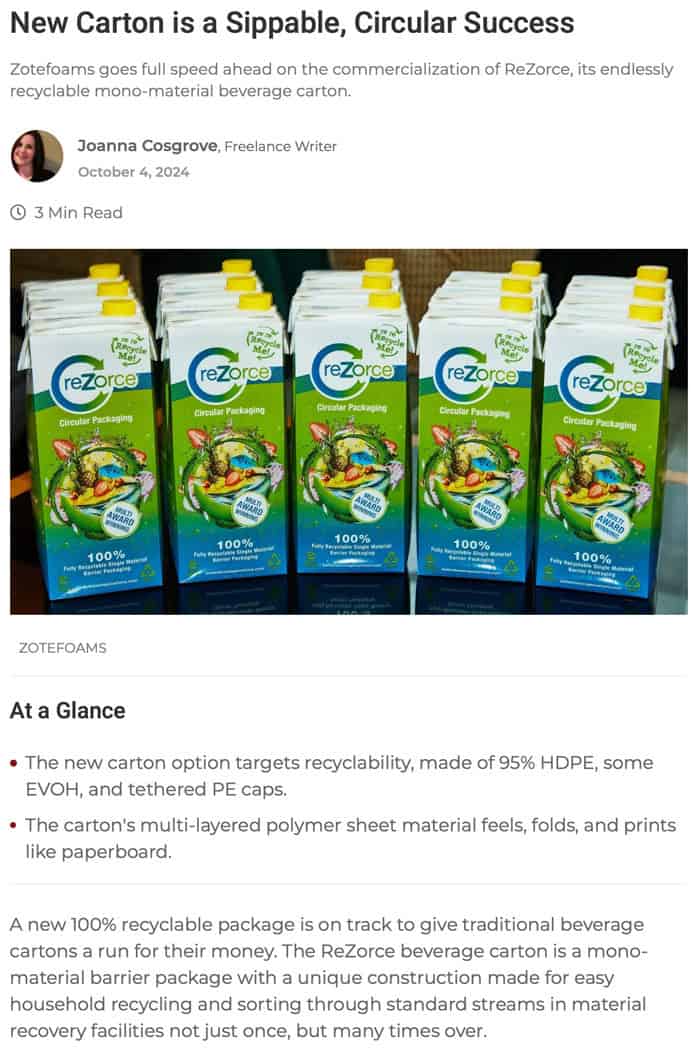

Zotefoams' products carry brand names like AZOTE, T-FIT and ZOTEK, and are complex to explain. One potentially game-changing product is ReZorce, which has been under development for years with significant capital expenditure along the way. The long wait may now be about to pay off.

ReZorce is a material that looks and feels like paperboard, and which could be used as an alternative to existing food and drink packaging. Existing package solutions for food and drink tend to be very difficult to recycle, and they tend to be "downcycled" (= recycled for lower-value products). If ReZorce works the way Zotefoams hopes it will, it can be recycled for the same type of packaging.

Who remembers the Rausing family and the many billions of wealth they created through their Tetra Pak technology? Zotefoams is trying to create a success on a similar scale.

ReZorce is currently undergoing market tests, and indications are looking promising. In October 2024, ReZorce won the Product Innovation category at the 2024 Reuters Sustainability Awards.

Source: Packaging Digest, 4 October 2024.

In the late 2010s, market expectations for Zotefoams' coming success with new materials saw the share price spike from 210 pence to 700 pence. It then lost much of that ground during the pandemic. Between November 2023 and May 2024, it doubled from 280 pence to 570 pence on expectations that ReZorce could become a global success. Right now, because of the general lack of interest in UK small- and mid-caps, the stock is back at 345 pence.

Zotefoams currently has a market cap of GBP 175m. Based on the most recent projections, the company is trading at around 5 the estimated 2026 EBITDA – or a lot less if ReZorce takes off!

What's the most likely catalyst to get the share price going again? If ReZorce continues to advance towards successful market entry, Zotefoams is likely to get a major strategic partner. This could be a global consumer goods company, or a strong financial investor. The success of Tetra Pak will make potential investors take this opportunity carefully.

In line with these developments, it's been interesting to note that BlackRock recently upped its stake from 2.7% to 5.08%, and then to 5.64%. Why is a such a fund management giant interested in a minuscule British small-cap?

Someone with the time to do a deep-dive should investigate. I have several analyst reports on Zotefoams, which I am happy to share.

A British brand going global?

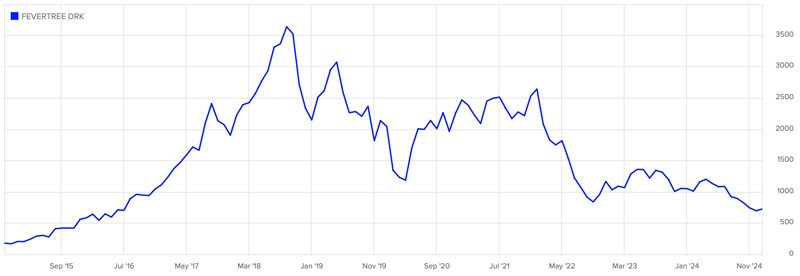

Fever-Tree Drinks (ISIN GB00BRJ9BJ26, UK:FEVR) is a success story that came out of nowhere. When Brits needed a tonic water to mix their gin with, they used to rely on Schweppes. Fever-Tree changed that, creating a lot of shareholder value along the way. Between 2015 and 2018, the stock rose 20x from 180 pence to 3,600 pence.

It has since come back to 715 pence, and the former hype about the company's rapid growth has disappeared.

Fever-Tree Drinks.

While Fever-Tree is primarily known as a British success story, it's the US that now makes up the company's largest revenue-generating region. Who knew? The growth in the US market is all the more important as it's a market with 12x the amount of revenue of the UK.

Fever-Tree's most recent investor presentation describes the company as having a "significant, growing global opportunity". As Insider Ideas concluded in its March 2023 analysis "Fever-Tree – is this a GLOBAL consumer blue-chip in the making?", this could be a company that is perceived to be British and valued at UK multiples, even though its outlook is that of a global, premium consumer brand with multi-decade growth potential.

Fevertree has been a bit of a forever takeover candidate:

- In 2018, The Telegraph reported that Unilever was about to snap up the company for 2,800 pence per share to gain a "unique asset that offers a leveraged play on premiumisation trends in spirits".

- In 2022, Berenberg Bank saw it as "an attractive target for three reasons: a market-leading position in a growing market, synergy opportunities available from scaling it up and making internal efficiencies, and its £131mln of net cash."

- In 2023, a dissertation written by Aaron Henzgen analysed "Pernod Ricard Buying Fever-Tree: An Acquisition Proposal Evaluation".

With the share price now at its lowest since 2016, will one of the global consumer brand giants finally step in?

The European market for bottling and soft drinks will likely see further M&A driven by the need for consolidation, diversification, and adaptation to consumer trends. For those among you wanting to dig deeper, I'd use the free report from Insider Ideas as a starting point to run a more in-depth analysis.

Undervalued liquidation play

Increasingly, publicly listed British companies are choosing to liquidate and return capital to shareholders – such are the dire times for London small-caps!

One company that seemingly offers a no-brainer upside is JZ Capital Partners (ISIN GG00BT3MVL31, UK:JZCP), a closed-ended private equity fund. It decided to go into liquidation, and will gradually return capital to shareholders.

Right now, the company has a remaining net asset value of USD 280m (GBP 220m) or USD 4.15 (GBP 3.27) per share. This compares to a current market capitalisation of GBP 135m and a share price of GBP 2.00.

JZ Capital Partners.

In July 2024, the company returned USD 40m to shareholders. It will next return USD 30m to shareholders during Q1/2025.

Interestingly, there isn't just the gap between the current net asset value and the share price. Investors who can hold this stock until all remaining capital is returned to shareholders will benefit from ongoing share buybacks at a discount to net asset value. JZ Capital is currently planning to return capital to shareholders by buying back shares. If these shares are bought back at a discount to net asset value, then those shareholders who do not sell benefit from the net asset value of the remaining shares going up.

The crucial question is, how long will this return of capital take to unfold? I spoke to Desmond Kingsford of Highwood Value Partners, whose fund holds a position in JZ Capital. According to Desmond, the current best estimate is that all remaining investments will have been sold in two years – which could also be 18 months or 2.5 years, given that JZ Capital does not have full control over all of its portfolio investments.

JZ Capital provides fairly detailed information about its remaining portfolio investments, and someone with some time on their hands could work out the potential return profile in more detail. You could also sign up to Desmond's investor letters, which may contain some information about JZ Capital in the future (as the most recent edition did).

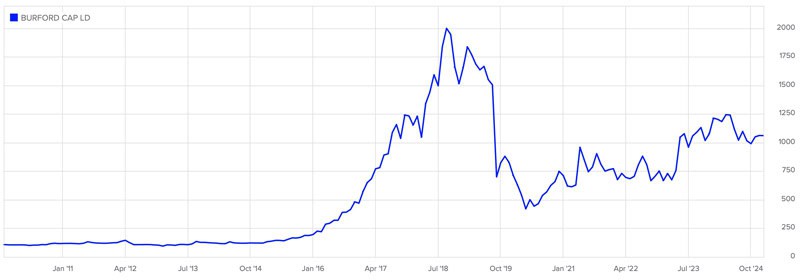

The world's #1 litigation play

If you prefer to invest in companies that are still alive and growing but whose valuation is about as bananas as that of JZ Capital, look no further than Burford Capital (ISIN GG00BT3MVL31, UK:BUR).

This is the world's market leader for litigation finance, i.e. Burford Capital funds the upfront costs of lawsuits in exchange for a share of the loot if the case is won. Based in Guernsey, the company invests both on its own behalf and several investment funds that it charges fees to.

Burford Capital famously purchased a claim against Argentina for just USD 28m, and has since turned it into a USD 16bn claim after winning a lawsuit in New York. Much as enforcing such a claim against the sovereign nation of Argentina will never be easy, it's true that Argentina has so far always paid foreign creditors a percentage of claims to make them go away. Burford Capital will likely eventually collect money from Argentina or sell its claim to someone else – or a combination of both. In a strange way, this stock is also a proxy for the reforms of Javier Milei. If Argentina's president manages to get his country back on its feet, paying off Burford Capital to clear away this issue could become more likely.

The claim against Argentina could yield more than Burford Capital's current market cap. The likely figures are hotly disputed, but the magnitude of the sums involved is staggering. Right now, buying into Burford Capital means you may only pay the price of the Argentinean claim, while the rest of the company is thrown in for free.

Burford Capital.

All the while, Burford Capital goes about its business with many other cases. If there is a large commercial litigation case that requires upfront capital, chances are that Burford Capital will win the mandate.

This is a business that's not easy to understand, and profits will be lumpy as a single lawsuit can provide a game-changing pay-off (or drag on forever and require investment to fight it through). I described all this in greater detail in "Burford Capital: profiting from disorder". Published in March 2022, this research report still provides one of the best summaries of the sector, and of the underlying opportunity.

I am amazed that Burford Capital's stock price hasn't moved up further given the positive developments that the case against Argentina has seen in the meantime.

As the examples above show, valuations in the UK market can be irrationally low. Eventually, Burford Capital stock will see another period of strong performance, similarly to 2015-2018. It will take some patience, but the odds are heavily stacked in favour of this investment.

My money-back guarantee returns

Earlier this year, I pointed Undervalued Shares Lifetime Members towards one of the best takeover targets in the UK.

One way or another, this stock will probably deliver next year – which is why I am offering a ONE-OFF money-back guarantee.

What's the deal?

Sign up for a USD 999 Lifetime Membership by 17 December 2024, and get access to all past reports about this particular company.

Expect at least one of the following to happen by 12 December 2025:

- a takeover bid

- a major shareholder starting an activist campaign to get the company sold

- management putting the company up for sale

- the share price rising at least 50% even without a bid.

If this case does not fulfil at least one of those criteria by 12 December 2025, you can cancel your Lifetime Membership and get your money back. (In that case, simply drop me an email by 31 January 2026.)

It's an unusual offer, and one that I won't make too often, so get on board *now*.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: