Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

Alico – a land giant hiding in plain sight

Nasdaq-listed Alico sprung from a pioneering railroad company.

It owns an unbelievably large amount of reserve land in Florida.

Is Alico a proxy to benefit from migration pushing into the Sunshine State?

Oldie but goldie

The Atlantic Coast Line Railroad was one of early America's railway companies. Set up in the late 1800s, it got to own swathes of land across Florida almost for free.

The railway operation eventually merged with a larger company, and the land was spun off as The Atlantic Land and Improvement Company. In 1974, it shortened its name to Alico (ISIN US0162301040, Nasdaq:ALCO).

The stock has been a "secret" value play ever since.

Yours truly first came across it in 2001, when Barron's published an investigative feature that outlined not just Alico's massive land reserves but also how some of it had gone from worthless swamp to prime real estate. Alico famously once donated land for the construction of the Florida Gulf Coast University. It subsequently was able to sell even tiny parcels in adjacent areas for premium prices, such as a plot of just 1.25 acres – which would have been on the company's books for a few thousand dollars – for USD 350,000 in 1997.

Following the detailed Barron's exposé, Alico's share price doubled from USD 16 to USD 32 in a matter of months.

The Barron's feature inspired me to research the Société des Bains de Mer (ISIN MC0000031187, BAIN.PA), the Monaco-based holding company that I (somewhat famously) published a report about in 2004.

Whereas the stock of SBM has since risen five-fold, the stock of Alico has not moved a penny. It's still trading at the same level as in the early 2000s. Indeed, the long-term chart shows a share that – aside from steadily paying dividends – hasn't made much money for its shareholders since the 1980s.

Alico.

Haven't land values in Florida exploded over the past 40 years?

Alico clearly intrigues successive generations of investors, and the stock regularly keeps rearing its head: it featured in the 2003 "Undervalued Land" report, a seminal piece of research referenced in my Weekly Dispatch "Ingles Markets – land reserves understated by 21x?", and was voted the most interesting investment pitch at the recent Cyprus Value Investor Conference (winning by a wide margin!).

Given how popular Alico's stock seems to be among value investors hunting for reserve land, I dug deep into my archive.

Worth 2x (or more)

The 2001 Barron's article is still available online.

While Alico doesn't get much attention from investment bank analysts, given its small market cap, it almost has a cult following among stock market sleuths.

The key to the company's attraction lies in the 54,000 acres of land that it owns throughout Florida. To put this in perspective, Alico's landbank is nearly four times the size of Manhattan. Even for the US, that's one heck of a large land holding.

Most of the land is currently used for growing oranges. Alico is one of the US' largest growers and delivers most of its crop to orange juice company Tropicana.

The possibility that Alico will gradually sell or repurpose land has drawn generations of value investors to the stock.

As Barron's noted over two decades ago:

"All that acreage is carried on the company's balance sheet at an average of less than $230 an acre. What's it really worth? Well, that depends, of course, on which acres you're talking about. …. In July 1995, for example, Alico sold 5,801 acres of undeveloped land to the Nature Conservancy for $8.3 million, or $1,430 an acre. Alico's cost: $68 an acre. In December 1996, another 21,700 acres were sold for preservation, this time to the South Florida Water Management District, for a mere $529 an acre -- Alico's cost, $9 an acre."

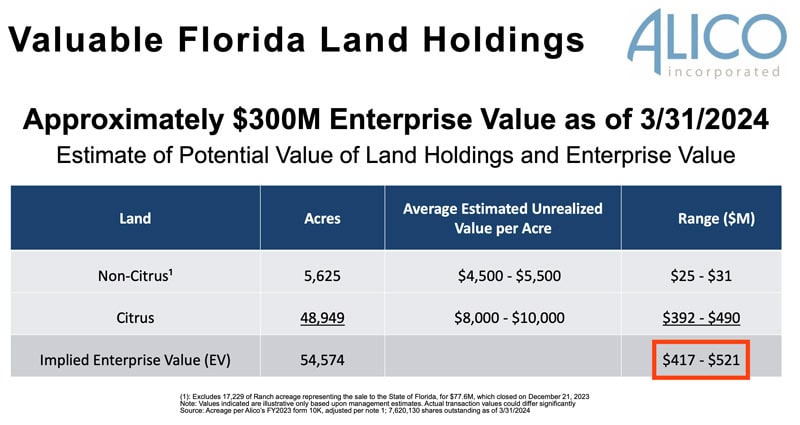

What are the massive land reserves worth today?

Estimates of this type are inherently tricky because they are location-specific and dependent on the land's use. In Florida, an acre of land can be worth a few hundred dollars or in the tens of millions.

Overall, it seems that Alico's land is undervalued at least by a factor of 2x, based on farmland values in the US in general and farmland for growing oranges in Florida specifically. It seems entirely credible that Alico would be worth USD 50-75 per share if all the land holdings were sold off alongside the company's equipment and other assets, and the net proceeds paid out to shareholders.

Source: Alico investor presentation.

With land values having exploded in Florida since the 1980s, you'd think this is a great stock to simply put away.

Why hasn't Alico's stock price appreciated during these past four decades?

The trials and tribulations of Florida's orange industry

Even though everyone always focuses on the land, Alico is primarily an agricultural operation.

Growing citrus fruits in Florida has been problematic for decades, with the industry hammered by a combination of hurricanes, freezing, and plant diseases. The sector is higly cyclical: while the state's orange crop yielded 41m boxes in 2021-22, it dropped to just 16m boxes the following season.

Orange growers have been giving up in droves, leaving the industry at its smallest in more than 75 years. Between 2003 and 2022, the acreage used for growing oranges in Florida decreased by 50%.

"Citrus greening", a bacterial infection transmitted by a tiny winged insect from China, has also played a major role in the ongoing struggles of Florida's orange industry. In 2016, the Obama administration allowed Florida farmers to use oxytetracycline, an antibiotic normally used to treat syphilis, tuberculosis, urinary tract infections and a number of other illnesses in humans. The use of this drug, which gets injected into an orange tree's trunk to spread from there, is controversial but entirely legal. Alico has successfully been treating its trees with the drug.

On a positive note, the industry's struggles have also made orange juice a more valuable commodity: over the past two years, the price for oranges from Florida has tripled.

Source: The Times, 29 September 2024.

Urh Krajnc, a Cyprus-based investor who is betting on a turnaround of Alico's fortunes in agriculture, presented the investment case at the recent Cyprus Value Investor Conference (if you'd like a copy of the presentation, please contact Krajnc on LinkedIn).

As he put it, there may be "light at the end of the tunnel" because of a combination of advantageous factors, including:

- New contracts with Tropicana at 30-50% better prices.

- Progress in fighting citrus greening.

- Recovery from the 2022 hurricanes.

Krajnc believes that Alico's "tree cycle acceleration" is not yet visible in the financials. Millions of trees planted in 2017 will now reach the eight-year milestone at which they get into full production. The company could soon get back to its 2015 production level, and shareholders would benefit from additional production producing outsized contributions to the P&L given that Alico is running a fixed cost-heavy operation.

It makes for a compelling argument.

Will these positive factors be enough, though, to get the share price moving?

Tough competition among undervalued small-caps

It's difficult to make a clear call on Alico's fortunes.

On the one hand, the company's land reserves have shrunk from 141,000 acres in 2001 to now only 54,000 acres. Given just how much land Alico has sold over the past two decades, why didn't shareholders benefit to a much higher degree? It's a case that can leave you sceptical, especially if have you already kept hearing about the story for decades.

On the other hand, the company has returned USD 196m of capital since 2015, in a combination of dividends (USD 40m), debt repayment (USD 121m), share buy-backs (USD 10m), and share tender offers (USD 26m). It is also undoubtedly true that the shrinking landbank is the result of Alico having sold off less productive land, smaller parcels, and land that isn't part of the core holdings – all the right moves to become more of a real estate play. The underlying numbers are compelling – else the well-informed, critical audience in Cyprus wouldn't have liked the case so much.

What's an investor to conclude?

Among small-caps, there are currently plenty of companies that are trading at 30-50% of their break-up value. The key question is, will there ever be a catalyst that prompts a stock to materially move higher?

Florida land values will continue to appreciate, and Alico has brought additional real estate expertise onboard to gradually maximise the value of the holdings. In citrus fruits, Alico is one of the most commercially successful operators in its industry.

Quite possibly, as one of the older generations, I have read about Alico for just a little too long and too often. Leaving that aside, the stock will appeal to some – and maybe enough to finally get its share price moving again. It's a lot of land, and Florida will undoubtedly remain on the up.

If you prefer Monaco over Florida...

… check out Société des Bains de Mer (SBM).

The Monaco-based holding company remains the only publicly listed vehicle to buy yourself a tiny slice in the Principality – one of the world's most expensive real estate locations.

Its stock is up five-fold since 2004.

It's never been analysed in as much detail as in this in-depth research report.

If you prefer Monaco over Florida...

… check out Société des Bains de Mer (SBM).

The Monaco-based holding company remains the only publicly listed vehicle to buy yourself a tiny slice in the Principality – one of the world's most expensive real estate locations.

Its stock is up five-fold since 2004.

It's never been analysed in as much detail as in this in-depth research report.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: