Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

ASMALLWORLD – the social network for the migratory rich?

During the 2000s and early 2010s, ASMALLWORLD was the world's elite social network.

Think Facebook, but for millionaires and C-suite executives.

ASMALLWORLD's major shareholder was none other than Hollywood's now-disgraced film producer, Harvey Weinstein.

The company subsequently underwent a change in ownership and a partial change in business model. In 2018, it listed on the Zurich Stock Exchange.

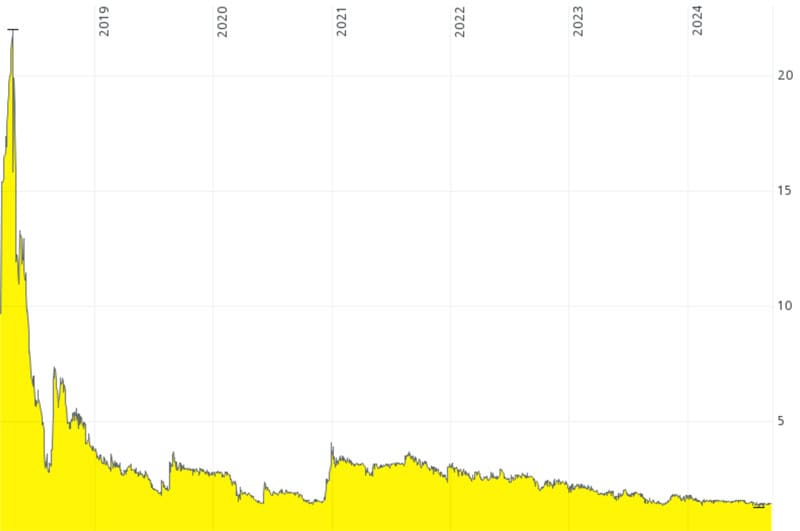

Its stock is currently down 94% and lingers with a market cap of just CHF 21m.

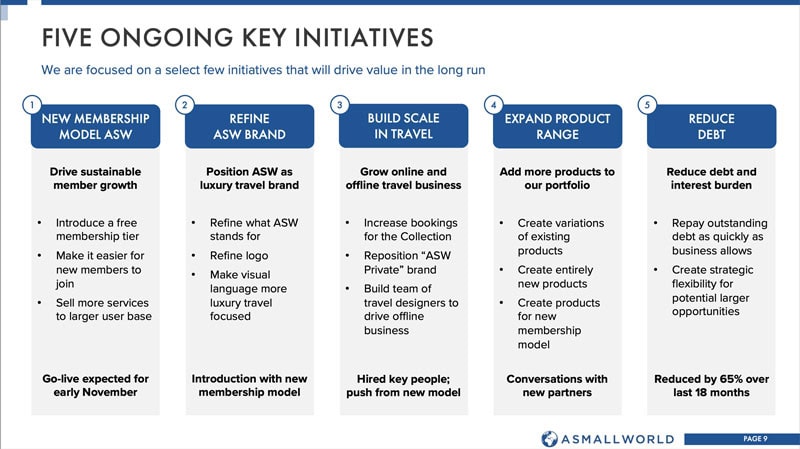

In November 2024, ASMALLWORLD is looking to launch a new membership programme. It could be the most significant change in strategy since 2013.

Is now the time to check in on the forgotten, beaten-down stock?

ASMALLWORLD.

The glory days of an "exclusive" network

In the quest for undiscovered gems and exciting turnarounds, it helps to have been a consumer of a broad range of services and products.

Sometime in the late 2000s, I joined the membership roster of what was then the "MySpace for millionaires".

In case you aren't old enough to remember, MySpace was the first global social network. It famously fizzled out and went bankrupt, but it did reach global relevance two years before Facebook even opened up its membership to anyone outside of Harvard University.

In a landmark article published in 2007, The Wall Street Journal described ASMALLWORLD as promising "safe havens for the affluent where they can flirt, swap advice, plan parties and find new pals without mixing with hoi polloi."

Joining required not just a credit card to pay the fees, but recommendations from existing members. "ASW", as it was dubbed, was a genuinely exclusive affair.

It caught the attention of Harvey Weinstein, then the world's most powerful film producer and a power broker in the world of celebrity. After Weinstein bought a stake, the likes of Tiger Woods, Paris Hilton, and Naomi Campbell joined ASW. Major advertisers and sponsors started to appear on the social network, including Jaguar, Diane von Furstenberg, Mercedes-Benz, Cartier, and Moët & Chandon.

ASW was the digital home-of-choice for "social connectors and the migratory rich, who may want to meet up in Scotland for golf or Paris for dinner."

However, the initial success didn't last long. The presence of the rich and famous attracted the inevitable hanger-on types, and the membership experience was quickly watered down. By April 2013, ASW had grown to over 850,000 members, up from a more exclusive 150,000 in 2007.

In 2010, Weinstein sold his stake to Patrick Liotard-Vogt, then a 25-year-old Swiss heir, socialite, and self-styled global financier. Liotard-Vogt appointed a glamorous female CEO, but the new leadership eventually had to close down the membership programme altogether and restructure the company. Tiger Woods was famously kicked off the membership roster, and ASW largely disappeared from the public eye. The company announced it was going to cap membership at 250,000 to "ensure the integrity of our community in a way that no social network has ever done before."

What exactly happened during the subsequent years isn't entirely clear from public sources. ASW reemerged in 2018, when Liotard-Vogt took it public on the Swiss stock exchange. The network had relaunched with a subscription model, and it was starting to yet again generate significant revenue. The placement was done at a share price of CHF 9.75, equivalent to a market cap of CHF 80m. The stock quickly rose to CHF 22, and the company was temporarily worth CHF 180m.

It traded at 12x its annual sales, which at the time compared to multiples of 14x for the German LinkedIn equivalent Xing and 24x for Facebook. ASW was aiming to quadruple its revenue to CHF 20m by 2022, which would have required sustained annual growth of 30%. The company was loss-making at the time, and somehow, ended up with 28,000 members, as can be seen from a 2018 investor presentation that is still available online.

Today, the stock is trading at just CHF 1.43, and the market cap has shrunk to CHF 21m.

What went wrong, and is there a chance of a turnaround – or a rebirth, even?

Where it's at now

The Swiss establishment media don't hold ASW in high regard. Finanz und Wirtschaft, the country's leading finance newspaper, once dubbed it "a joke stock".

The reputation of the major shareholder didn't help. In 2014, Liotard-Vogt left Switzerland for Saint Kitts and Nevis, a Caribbean island that is famous for its citizenship-by-investment programme and viewed by many as a jurisdiction for people who are running away from something.

According to Handelszeitung, another major Swiss finance publication, Liotard-Vogt had creditors chase him for CHF 4m. This included CHF 1.2m reportedly owed to Diners Club, the credit card company. Other Swiss publications followed suit with negative reporting. It was only in 2019 that Liotard-Vogt's lawyers made these publications add to their online articles that Liotard-Vogt had never intended to escape his creditors, never seen these financial claims as justified, and had resolved all outstanding matters.

Source: The Independent, 24 January 2014.

Just what exactly happened during this period will never be publicly known in detail. The entire situation surrounding ASW has become a lot clearer, though.

In March 2018, the company had raised CHF 18m from investors. It wanted to re-establish itself as a community, travel service, and social network for "citizens of the world". The website offered:

- Deals, discounts, and special access from hundreds of partners including airlines, hotels, salons, spas, and fashion designers.

- A membership card designed by designer and actor Waris Ahluwalia, providing access to more than 50 ASW events worldwide every month, including small parties, weekend getaways, and concerts.

- A customised website experience and mobile app.

- Complimentary services from a nightlife concierge of The World's Finest Clubs.

Members had to pay a small annual fee to remain in the network at all, or a fee of several thousand Swiss francs annually to enjoy an elite concierge service.

Today, ASW describes itself as "a global community united by a shared passion for the good life. We inspire you to meet great people, travel better and experience more."

The company can now carry out its mission with a significantly improved balance sheet. In autumn 2023, it raised CHF 4.1m in capital by placing shares at CHF 1.50 each. Liotard-Vogt's holding company, Pellegrino Capital AG, converted CHF 2.6m of its outstanding financial claims against ASW into shares. Liotard-Vogt now holds a 69% stake in a company that has net debt of just CHF 1.2m. Since stepping down from his board position in 2020, Liotard-Vogt is merely the largest shareholder.

In 2023, ASW recorded revenue of CHF 21.2m – not too far off the 2022 target that it had issued in 2018. The EBITDA margin of 9.8% came in below the 15% target set at the time of the IPO, but it's been enough to take the company to positive territory. ASW generates about half of its revenue from membership fees, and the other half from travel-related services.

The company has finally found its footing.

The question is, will the stock finally start to recover?

The beckoning of a new era?

Given its status as a micro-cap, it's no surprise that no investment bank analyst is covering the stock. ASW also has an issue with free float – or rather a lack thereof. Alongside Liotard-Vogt, there are three other shareholders with disclosed stakes, totalling over 14%. This means that less than 15% of the 14.5m outstanding shares are currently in free float, equalling a float worth just CHF 3m at current market prices.

Why is the stock worth being featured at all?

With its focus on the affluent and internationally mobile, ASW could reposition its stock as a play on a potentially powerful macrotrend. For all its faults, ASW remains a valuable niche brand, and it's always easier to improve and scale up an existing network than to build one from scratch. Much of what ASW offers is already well in tune with the needs and demands of the migratory rich.

The stock could also be cheap based on its existing business.

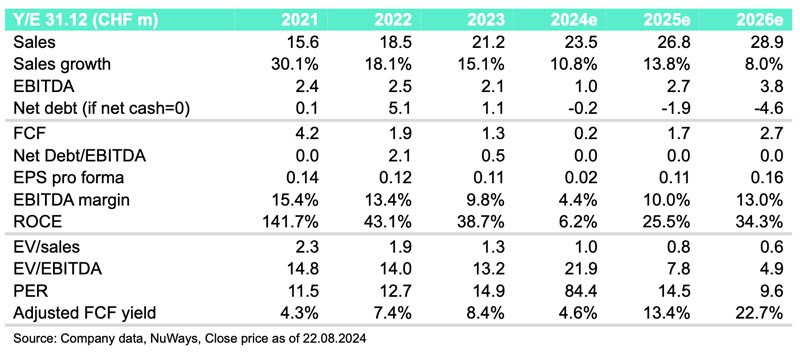

According to recent research from NuWays, ASW could achieve leapfrogging revenue and cash flow in 2025 and 2026 as a result of a new, free membership tier that the company is looking to launch in November 2024. The goal is to broaden the website's funnel, and upsell new members into higher tier services. Revenue is thus projected to grow to CHF 26.8m in 2025 and CHF 28.9m in 2026, while EBITDA could reach CHF 2.7m and CHF 3.8m, respectively. Based on 2026 estimates, ASW stock would be trading at just under 5x EBITDA and a 22% cash flow yield.

Source: NuWays, 26 August 2024 (metrics based on a share price of CHF 1.33).

None of this resolves the issue that there is very little free float for new investors who want to get in – but that doesn't make ASW any less interesting a company to keep an eye on.

After all, it could easily go back to some of its earlier, exciting plans, such as connecting its high-calibre audience to Swiss private banks and other premium financial services. Now that ASW has its house in order, could such plans open up significant new revenue sources?

Source: ASMALLWORLD, Investor Presentation H1/2024.

One way to look at this situation is that a CHF 21m market cap is low for a company with a global brand name and a globally scalable platform – the valuation could be a "joke", even.

Beauty is in the eye of the beholder, though.

If anything, ASW might also be a service that some of you might want to check out yourself. After well over a decade of non-membership, I just signed up again and already spent a few minutes trial-surfing the platform. It IS reminiscent of the old ASW that I once enjoyed.

ASW is the only surviving company from an era when "social networks for the rich" made ample headlines, with now-defunct companies such as Diamond Lounge or Squa.re. For now, ASW is a dinosaur of a website, but dinosaur bones sometimes make for good investments when they get rediscovered and dusted off.

Maybe there is still life left in this remnant of a different era?

Internet leader at a bargain price

The world's leading Internet companies tend to be hugely profitable, and their stocks valued at a premium.

Once in a while, though, you can buy into them at a bargain price – such as Meta and Spotify in 2022.

Who could follow in their footsteps?

The latest report from Undervalued Shares has identified another global Internet leader that is currently available at a bargain valuation.

If you missed buying Meta or Spotify in 2022, this one is for you.

Internet leader at a bargain price

The world's leading Internet companies tend to be hugely profitable, and their stocks valued at a premium.

Once in a while, though, you can buy into them at a bargain price – such as Meta and Spotify in 2022.

Who could follow in their footsteps?

The latest report from Undervalued Shares has identified another global Internet leader that is currently available at a bargain valuation.

If you missed buying Meta or Spotify in 2022, this one is for you.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: