My readers regularly ask me to recommend other investment blogs. Obviously, I wouldn't want to suggest just any random blogs to you. This new series will only feature blogs that, in my view, are truly outstanding in terms of quality and offer valuable content. Starting today, I'll feature one such blog every four to six weeks.

First up, Lyn Alden.

The US-based website, named after its 32-year old authoress, covers equity investing both in the States and internationally.

You'll learn why I have come to love her free e-letter, and why her blog is such a valuable addition to reading my Weekly Dispatches and investment reports.

Carefully choosing a mixture of publications

Before delving into Lyn's blog, here are a few words on how I will select the blogs that I highlight in my new series.

I have subscribed to about 300 publications, and I would like to think that I follow a few useful criteria for my reading habit:

- Authors and publications with similar viewpoints and methodologies as myself.

- Authors and publications that I very much disagree with.

- Authors and publications who cover topics and perspectives that I am eager to learn more about.

Lyn falls somewhere between the first and third points.

She writes about undervalued equity investments and looks at them from a mostly global perspective. So far, so similar.

However, there is a lot I learn from her writing. The approach and methodology that she applies are distinctively different to how I work. Besides giving me new investment ideas, her newsletter also challenges me to up my own game and incorporate additional aspects into my work.

You might also benefit from following her writing, and here is why.

1. Systematic approach to finding value

I regularly get asked by readers how I pick – or "find" – the stocks that I analyse in my in-depth reports. The truth is relatively simple and probably somewhat disappointing. Either I read something that randomly triggers a few existing wires in my brain and leads me to a particular company. Or I know someone who has had a good idea and shares it with me. There is nothing particularly systematic or methodological about it.

Lyn, who I recently had a chance to listen to at a conference in Philadelphia (her conference presentation is where the slides below are taken from), is way ahead of me in terms of casting her net.

"Every year, I publish a report where I look at 30 countries. I look at factors such as debt, interest rates, stability metrics, and foreign exchange rates. I do this to get a broad idea of where value lies. Then I look at the growth rates of individual companies in these countries."

With a systematic approach like this, it becomes much more viable to build a portfolio that is based on which regions of the world are most likely to do well over the next decade.

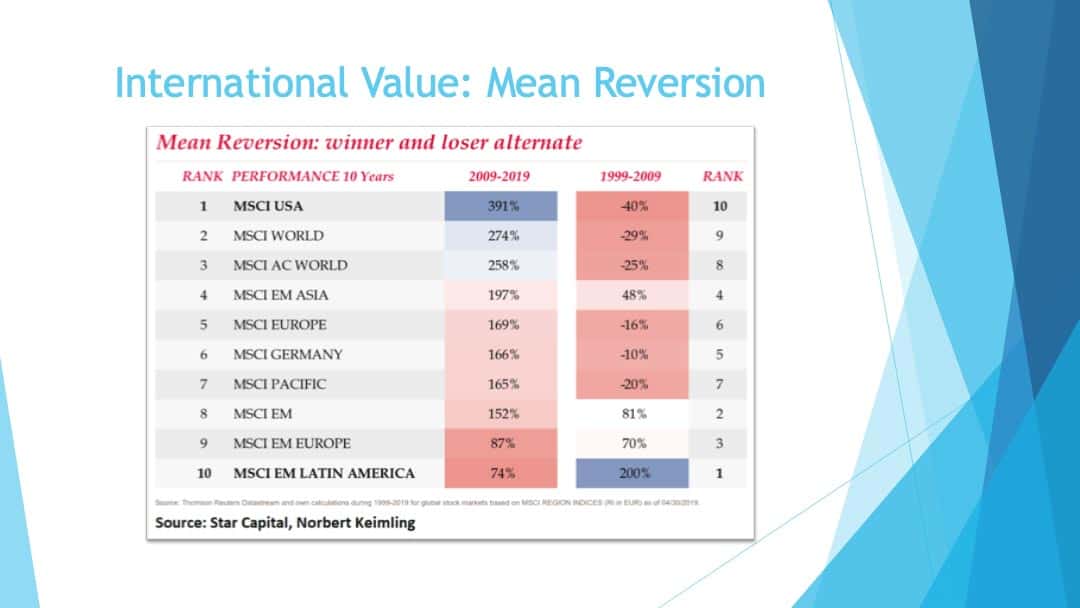

As Lyn's slide below shows, regions and sectors alternate between long periods of outperforming and underperforming. Or as Ray Dalio put it in a recent article that went viral, there are "relatively long periods (about 10 years) in which the markets and market relationships operate in a certain way (which I call 'paradigms') that most people adapt to and eventually extrapolate so they become overdone, which leads to shifts to new paradigms in which the markets operate more opposite than similar to how they operated during the prior paradigm."

Every decade or so, the world's top performers change (you can download the entire slide set here).

By adopting a systematic approach to filtering out the best regions and countries, Lyn can place some of her investments where the best returns are to be expected over the next years or decade. Doing this based on a deep-dive of key data about liquid markets and shifting it when the data suggests the next change is due, has a lot going for it.

This aspect of her writing would be sufficient for me to regularly take a peek at her free newsletter.

2. Using long-term data to inform your investment strategy

I loved Lyn's presentation in Philadelphia because it took the audience on a whirlwind tour of powerful data that is immediately relevant to your investment strategy.

E.g., I have always had a strong bias towards capital gains and tend to not pay enough attention to dividends.

Long-term statistics show that dividends have a powerful effect on your overall investment result. Just take a look at the following chart.

The blue line shows equity returns with dividends reinvested, and the red line is without reinvesting dividends.

The graph hardly needs any more explanation. To increase your long-term returns and build wealth, you should:

- Pick stocks that pay an attractive dividend while you wait for capital growth; AND

- Be disciplined about reinvesting your dividend payments.

Picking the right stocks is only half the work. You also need an informed long-term strategy for building and managing your portfolio. Spending a bit of time looking at long-term data and drawing manageable but powerful conclusions from it does pay dividends (no pun intended).

All the better if you have someone informing and inspiring you about it. I find it useful to regularly have one or two such data points and rules thrown my way.

FREE eBook: The world's best investing blogs

What are the best blogs to help you become a better investor and improve your returns?

Check out “The world’s best investing blogs” for my very own top 30.

3. The joy of following level-headed, meticulous long-format writers with a longer-term view

Much as I regularly rant about the mainstream media, I also feel a bit sorry for journalists who work at a daily newspaper or even a weekly publication. Legacy media has to struggle with a lot of in-built structural weaknesses that affect how much value and enjoyment media consumers get out of it:

- They continuously have to conjure up stories, even if there is little to say that day or week.

- When there is a lot to say, they may be restricted by the number of columns their editor has allocated to them or the amount of airtime their network can give them.

- Often, their headlines are written by clickbait-y headline writers whose work often feels like raping the spirit of the original article.

- Editorial boards or editors that give out a house view on certain political issues. E.g., for many publications, "Orange Man Bad" is currently the unshakable leitmotif that each piece of content has to adhere to no matter what the facts say.

- Never mind the power that advertisers have over how they select and present their content.

I have long believed that these are reasons why blogs, podcasts, and other forms of independent journalism have been on the rise. Most of these constraints don't apply to them, and it's a breath of fresh air.

E.g., to follow the US economy, Lyn's monthly e-letter has become one of my favourite reads:

- Email format allows to make it as extensive or as short as the news requires.

- Higher-level perspective instead of daily manufactured hype and hysteria. It's monthly, which automatically changes the nature of this reporting to a useful format.

- If Lyn has advertisers or political views influence her thinking, I haven't spotted that yet. Instead, I see reams of careful analysis of data and cool-headed conclusions.

I find her summary and analysis of the macro-situation easier to read, more convincing, and more useful than any number of reports I get from large investment banks.

Best of all, all of the parts of her writing that I have mentioned so far are available for free!

What Lyn likes right now

Just like my blog, LynAlden.com is geared towards investors who seek to build a portfolio of primarily long-term equity investments.

Her five quality criteria for picking companies are also very similar to mine:

- Benefits from long-term trends

- Strong returns on invested capital

- Durable economic moat

- Safe balance sheet

- Good management

And we both like the same one-sentence summary of value investing. All other details aside, value investing is simply about buying future cash flows at a low price. (And for as long as cash has any value, value investing will always come out as the superior investment strategy – albeit with periods of being "out").

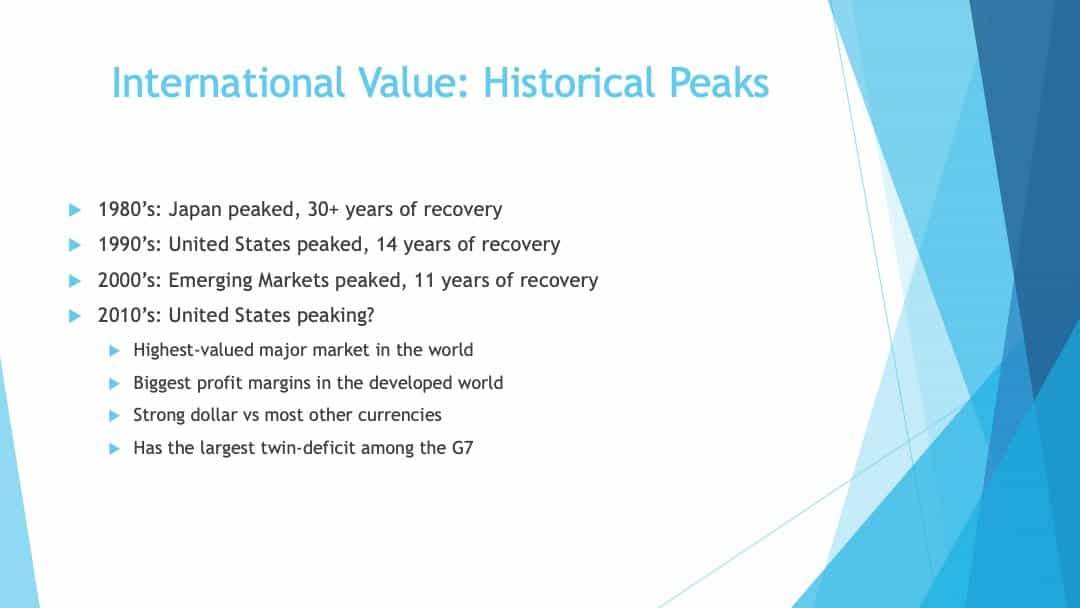

One of the cornerstones of Lyn's current thinking is that the US stock market will not continue to deliver the kind of superior returns that it has produced over the past decade.

Has the US peaked?

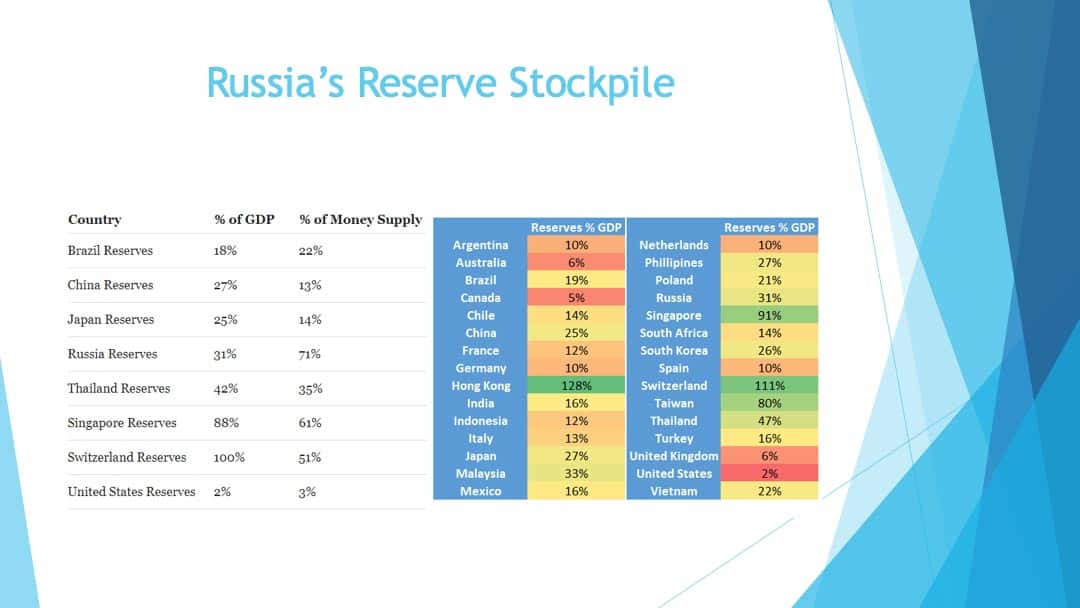

Lyn has identified Russia as a place with an extraordinarily unusual macro situation and value stocks to match. There are, of course, some political tail risks. But as one component of a globally diversified portfolio, Lyn believes Russia is worth looking at.

Russia is one of the world's paragons of keeping substantial currency reserves.

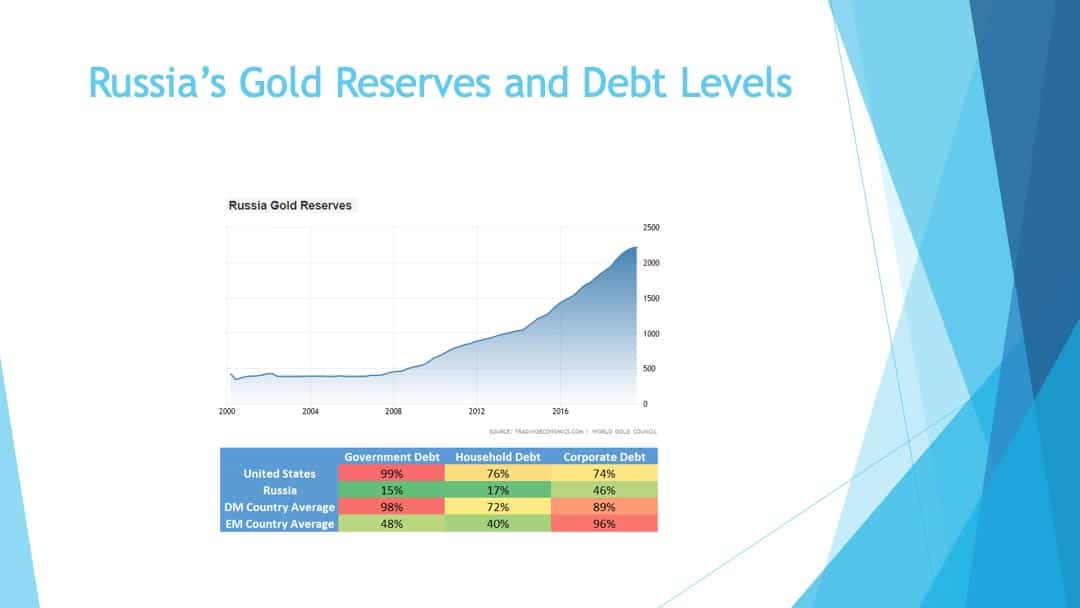

Comparing Russia's government, household and corporate debt to the comparative figures from the US is nothing short of mind-boggling.

If you believe debt is a bad thing, check out Russia as an investment destination.

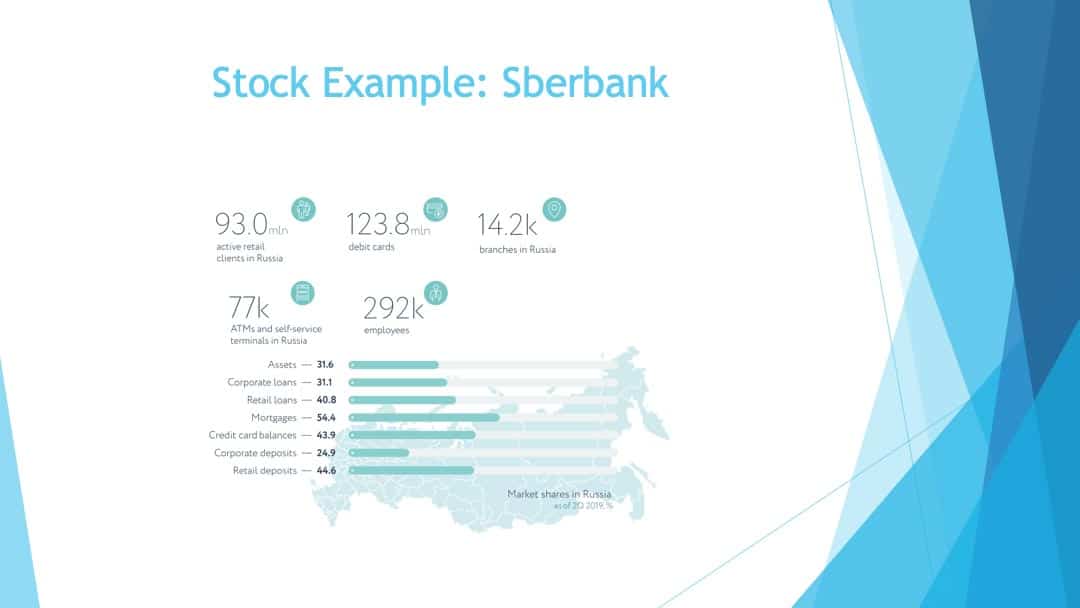

Lyn recommends Sberbank, Russia's leading bank and one of the largest companies on its stock market when measured by market capitalisation.

One of Lyn Alden's favourite plays on Russian value.

In between the company's growth, dividend yield, a gradual increase of the valuation, and currency gains, Lyn can see an annual return of about 19% for shareholders over the coming years. Assuming the valuation will gradually change from a p/e of 6 to a p/e of 8 isn't even particularly aggressive an assumption.

If this sort of analytical approach appeals to you, you should check out her blog.

Lyn also offers an eBook about stock analysis and an eBook about selling options (both USD 15). Her rolling commentary on Twitter is another way to follow her thinking.

Undervalued-Shares.com is your eyes and ears on the ground: Yours truly attending Lyn Alden's presentation in Philadelphia.

Blog series: Blogs to watch

There's more to "Blogs to watch" than this Weekly Dispatch. Check out my other articles of this 30-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year