Not just in the form of today's Weekly Dispatch but also as a goodie that I've prepared for my Members (it'll be worth signing up if you haven't already!). It's high summer after all, and I think we can all do with a bit of diversion.

Chances are, you'll probably never have heard of the "Bawl Street Journal".

It isn't a blog, and it's not even in print anymore – so why feature it as one of my "Blogs to watch"?

Because it's simply too good not to!

A treasure discovered in an out-of-print bookshop

The Bawl Street Journal was a newspaper, and a very special one indeed.

I recently discovered a dozen historical issues of the paper tucked away in an archive.

The stack of papers covered the four decades spanning the Depression era 1930s, the post-war years of the late 1940s, the boom years of the 1950s, and the onset of the space age in the 1960s.

Usually, you need luck to find a single copy. I hit "buy" within minutes of spotting my treasure.

Having read all 12 issues, I can confirm…

They are fun.

They are insightful.

They are bound to be enjoyed by you.

Which is why I'm only too happy to share them with you. This Weekly Dispatch offers you a glimpse of the parody journal and its pearls of wisdom (which are still valid to this day). My Members get to enjoy all 12 issues = four decades worth of offensive historic material!

What on earth is this all about?

The Bawl Street Journal is an annual parody issue of the Wall Street Journal.

It was produced by the "Bond Club of New York", which, according to its statutes, was dedicated to "intellectual intercourse among men engaged and interested in the distribution of financial services." It was probably one of the coolest and best-connected finance-related clubs you could have been a member of during its heydays.

The Bawl Street Journal was launched in 1919 (mainly to fund the club's annual outing and other extravaganzas), and its yearly issue consisted of:

- Articles poking fun at current events and whatever insanity had befallen its era.

- Countless spoof ads taken out by the firms employing the club's members. Basically, anyone who was someone on Wall Street participated in the effort.

- Anything else the members of the club or the wider public would have found entertaining.

From its third issue onwards, the sale of the Bawl Street Journal produced enough profits to pay for the club's annual event. At its peak in the early 1960s, it sold over 60,000 copies for USD 1 each. This was ten times the price of its namesake at the time!

Evidently, the authors of the cheeky newspaper did something right.

I had the dozen old issues delivered to my lair in Sark and spent a weekend sifting through them.

Obviously, society's appreciation of humour has changed, and much of what was offensive back then would make readers yawn today. Also, many jokes required knowing about current events of the time, or even knowing the characters mentioned and what they had been up to during the year that had just passed.

However, other parts aged beautifully!

Even for today's investors, the dusty publication offers eternal grains of wisdom. As I always keep saying, knowing and understanding history is critical for anyone wanting to succeed in investing.

Is there ever anything new in the finance industry?

What sticks out the most when reading newspapers from decades long gone by is the fact that there is nothing new under the sun. It has all happened before.

(Legal disclaimer: all material featured in this article is Bawl Street Journal comedy, and does NOT speak for today's companies of the same name.)

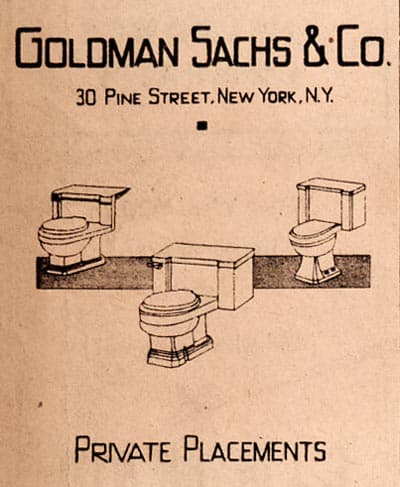

Investment banks bringing questionable companies to the market and issuing shares at inflated prices for a gullible public to subscribe to? Boom times produce a lot of cr** IPOs, which is what this 1948 ad for Goldman Sachs alluded to.

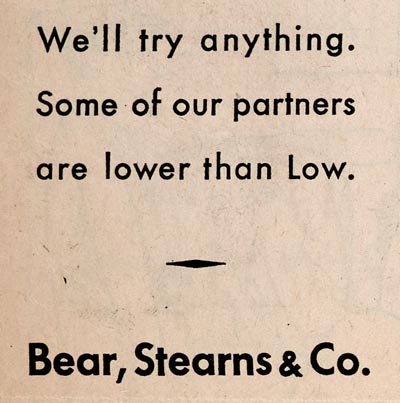

Does karma eventually catch up with you? The 1963 ad for Bear Stearns turned out prescient in ways its authors probably never expected. Or maybe they did?

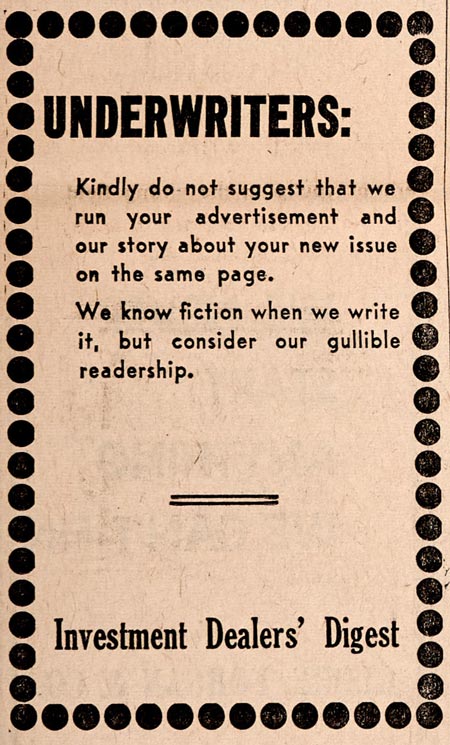

As ever, the ad-funded corporate media were an important accomplice in hyping overpriced IPOs. The Investment Dealer's Digest asked its members not to make it too obvious that purchasing ad space was one way of securing favourable editorial coverage. The business model of corporate media has remained the same to this day.

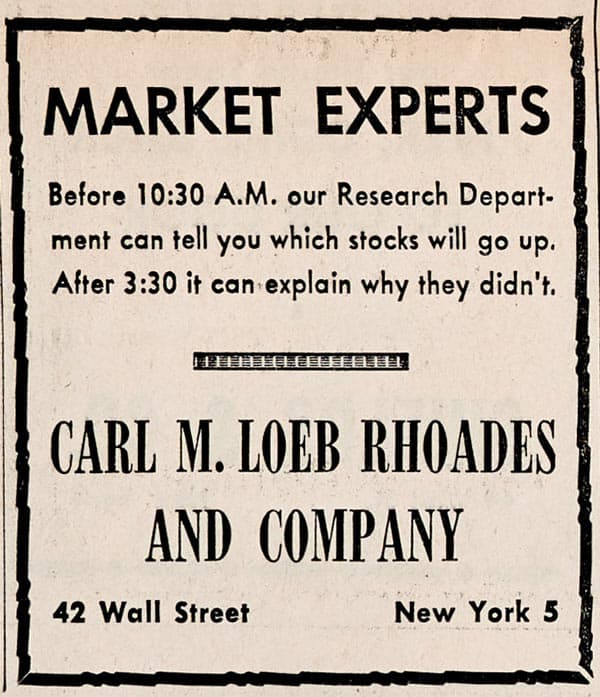

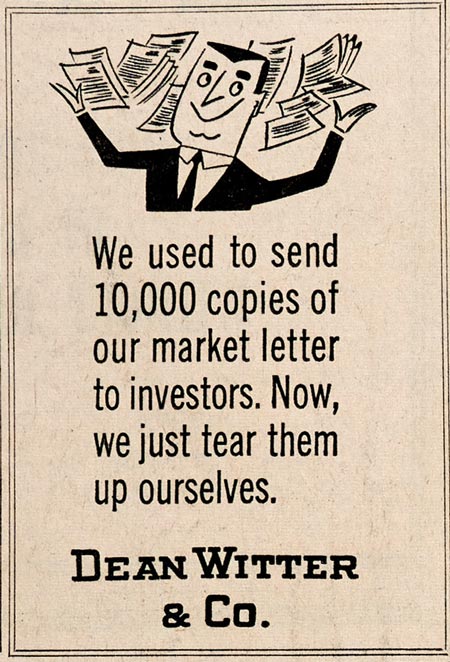

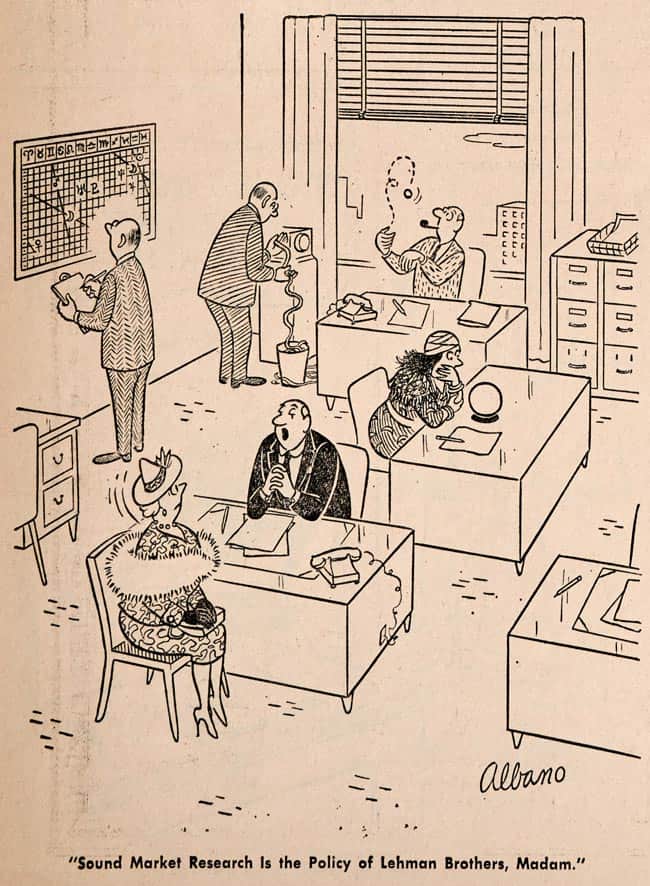

On that one day each year when the Bawl Street Journal came out, the major players on Wall Street were quite honest about their industry's faults and flaws. These advertisements made it clear what America's masters of finance thought of equity analysts and research reports – and of investors who ascribed any value to this drivel!

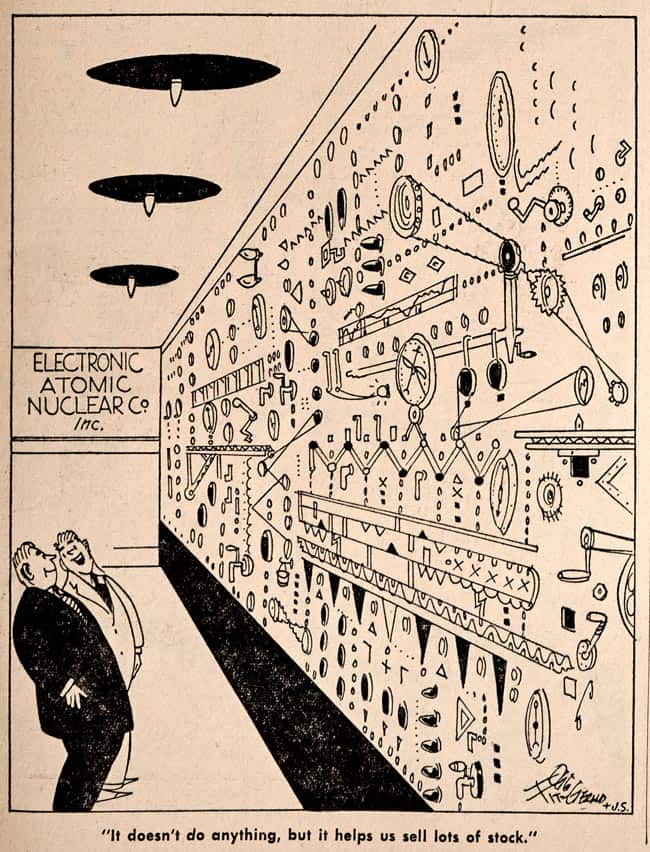

Every decade brings new technologies and bold bets on the future. It's surprising how many of them have already been played several times over by Wall Street. They usually end in busts, but that doesn't prevent them from coming back a decade (or two) later.

Elon Musk hyping life on Mars and Richard Branson floating an overpriced space travel company? It has all been seen before, during the space investments craze of the 1950s. Pay close attention to the spacesuit to see what Wall Street bankers thought of these IPOs. The ad was a homage to the quality of the investment theme.

The 1960s have also seen efforts to raise funds for a tunnel under the English Channel. Readers of my Weekly Dispatches will know what a disaster this turned out for private investors. The Bawl Street Journal had published an early warning about how ridiculous the enterprise was. 1980s investors who pumped money into the Eurotunnel IPO would have been well-served to read a two-decade-old issue of the Bawl Street Journal. As I never tire of repeating, reading out-of-print publications does make you a more astute investor!

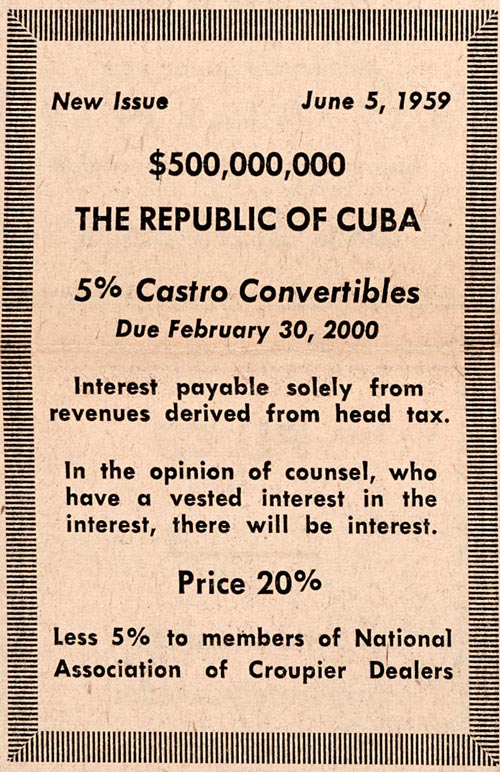

The parody newspaper also got it precisely right about Cuban debt. At a time when Wall Street was still flouting Cuban bonds, the writers of the Bond Club pointed out how ridiculous it was to expect getting paid back by the rulers of the sugar, rum and casino island. The ad also shows, though, how many of the Bawl Street Journal's jokes require some understanding of the circumstances at the time. Back in the late 1950s, a USD 500m issue volume was an outrageous fantasy number for a Cuban debt issue. Its pricing at 20% alluded to its eventual default, something readers of this website will know a lot more about since the publication of my Cuban debt report.

FREE eBook: The world's best investing blogs

What are the best blogs to help you become a better investor and improve your returns?

Check out “The world’s best investing blogs” for my very own top 30.

The US government and other important institutions also received their annual comeuppance. This 1932 article reported on the "Magic Rabbit Act", the US Congress' effort to reflate share prices and control every aspect of human life and the American economy. Seriously, what have we learned in the ensuing 88 years?

Wall Street bailouts are another theme that is repeated throughout the ages. The 1963 issue opened with a story about Washington reimbursing brokerage firms for losses. If farmers deserve it, why not Wall Street bankers? Native speakers will know what "S.O.B." stands for (or you can look it up here). Decades later, too-big-to-fail Wall Street firms again got their losses covered while Joe Public has to pay for it all.

Oh, and in case you wondered, presidential elections ending with recounts isn't anything new. Few people nowadays know that the most iconic of Democrat presidents, John F. Kennedy, only came into office on the back of a tight election, recounts, and suspicion of voter fraud. No doubt, we'll get to hear about all of this once again in November 2020.

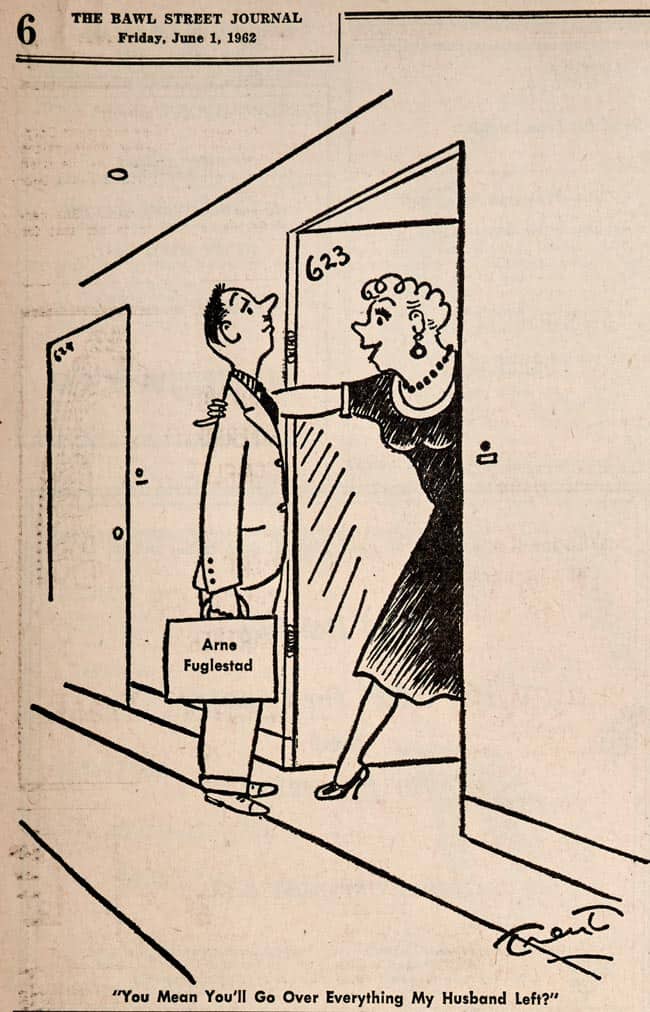

In between all these serious world affairs and financial dealings, the Bawl Street Journal was most infamous for its never-ending jokes about women. Secretaries, gold diggers, and female investors (mostly widows investing in bonds for "safe" income) were the primary targets. Many of these jokes seem tame (or even lame) by today's standards, but they will have set tongues wagging back in the days.

Just about everyone had it doled out to them, and in spades.

What was the truly worst thing about the Bawl Street Journal, though?

NOT being mentioned.

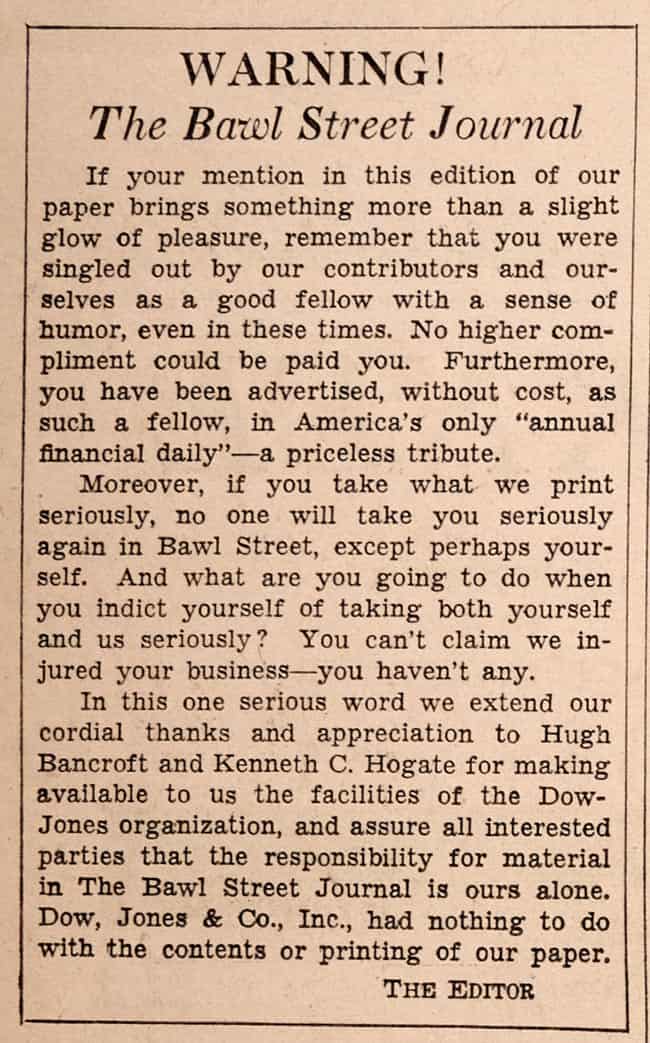

In each issue, the editors made it clear:

- Being poked fun about, insulted and derided, is just another form of flattery. Only the dull and irrelevant didn't get mentioned.

- Any PR is good PR. Even the stingiest of articles were akin to free advertising. After all, everyone who was someone DID read the Bawl Street Journal.

- If you took the Bawl Street Journal seriously, no one would take you seriously.

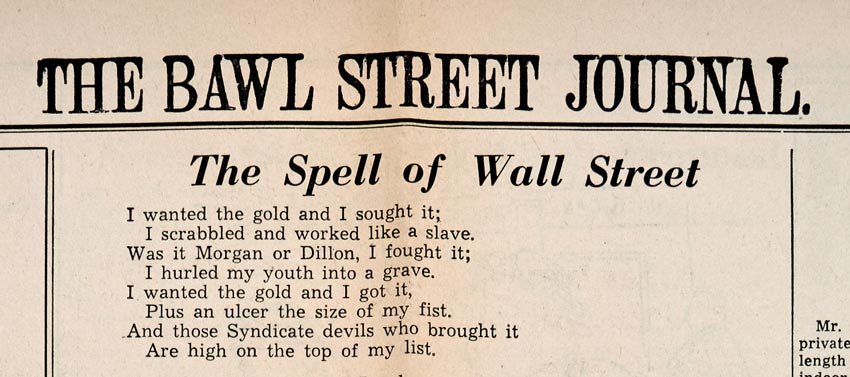

After all, Wall Street was never meant to be anything but a tank full of sharks. The opening lines of this 1963 poem captured it beautifully and timelessly.

What happened to it?

The Bawl Street Journal came to an end after publishing its 2009 issue, which was already its fifth issue that only appeared in digital format. The rising risk of potential lawsuits and the political ascent of the easily offended caused the editors to lay down their pencils.

Bereft of its main source of income, the Bond Club of New York was left with debt following its 2015 annual event. In 2017, some remaining members held a centennial celebration as the club's official last hurrah. No one stepped forward to cover the club's debt, and the legal entity was struck off shortly thereafter.

The former website www.thebondclub.com briefly carried a goodbye message and was then switched off altogether. Sadly, no one had the foresight to create a digital archive of all past editions of the Bawl Street Journal.

One of the few visible remnants is a 1999 article published in the members' magazine of New York's Museum of American Finance. The countryside club where the Bond Club hosted many of its early events made a grainy PDF copy of the article available on its website.

In 2017, a blog covering newspaper and magazine parody dedicated a commemorative article.

That was the last that was ever heard about the Bond Club of New York and its Bawl Street Journal, as far I was able to ascertain during my research.

Or was it?

It's all yours for the taking (a goodie for my Members)

Knowing how many of my readers love finance history, I've spared no expense to bring a dose of Bawl Street Journal to those who'd like to immerse themselves in the warm and fuzzy feeling of them olden days.

To give the parody journal something of a home and a place of worship, I have digitised all 12 issues that I've scooped up from the antique book vendor. Undervalued-Shares.com Members can download the following copies (high-resolution PDFs) for free in their Member accounts:

1932 issue

1948 issue

1952 issue

1955 issue

1958 issue

1959 issue

1956 issue

1954 issue

1960 issue

1961 issue

1962 issue

1963 issue

Occasionally, issues surface on eBay or AbeBooks. At the time I published this Weekly Dispatch, a 1965 issue was available on AbeBooks for USD 50 plus postage.

If you'd like to own an ORIGINAL hardcopy of the Bawl Street Journal, become a Member! The next 12 readers who purchase an Annual Membership will get one of the hardcopies thrown in for free (see my offer below for details). I'd love these marvels to find a suitable new home!

In the meantime, I hope you enjoyed this little summertime excursion to a publication that wasn't a blog, but which should be one if the right author was found today!

Blog series: Blogs to watch

There's more to "Blogs to watch" than this Weekly Dispatch. Check out my other articles of this 30-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get a Bawl Street Journal original

Be one of my next 12 readers to sign up for an Annual Membership (49 USD) and get one of my original copies thrown in for free (including postage to anywhere in the world)!

Simply use coupon code "BAWLSTREET" when signing up.

This is a first-come, first-served offer. My order system automatically counts down from 12. When all issues are gone, the order mask will stop accepting the discount code (and I'll add a red "sold out" comment at the top of the page).

I'll try to accommodate any requests for a particular publication year. Please note the 1932 and 1948 issues have some minor damage (in line with their age); all other issues are in nifty condition.

Don't forget: even if you miss out on the original hard copy, as a Member, you'll always be able to fully access all 12 digital copies in your Member account!