However, this mutual fund was a rare gem. Investing in it at that time was akin to getting extra money the day you invested – an extraordinary opportunity.

The fund is up 50% since then, and its managers are now limiting the number of new investors they accept. If you aren't invested yet, you have missed the boat in more ways than one.

As luck would have it, the fund's managers write a blog. Once a quarter, they let you in to one of their best investment ideas. E.g., the stock they highlighted extensively in late 2018 is up 120%. It was the perfect example for an investment with limited downside and massive upside - exactly the kind of constellation many of my readers are looking for.

"Blogs to watch" normally only features English-language blogs, but today, I am making a rare exception. This German-language blog is too good not to highlight, even if it means you have to use Google Translate to make sense of it.

A brief recap

The mutual fund that I'm referring to is Paladin ONE fund (ISIN DE000A1W1PH8), managed by Paladin Asset Management in Hannover, Germany. It is focussed on buying undervalued equities in the German-speaking area, and aims to deliver even during choppy years and with as little volatility as possible. Keep the term "risk-adjusted returns" in mind, as I will come back to it later.

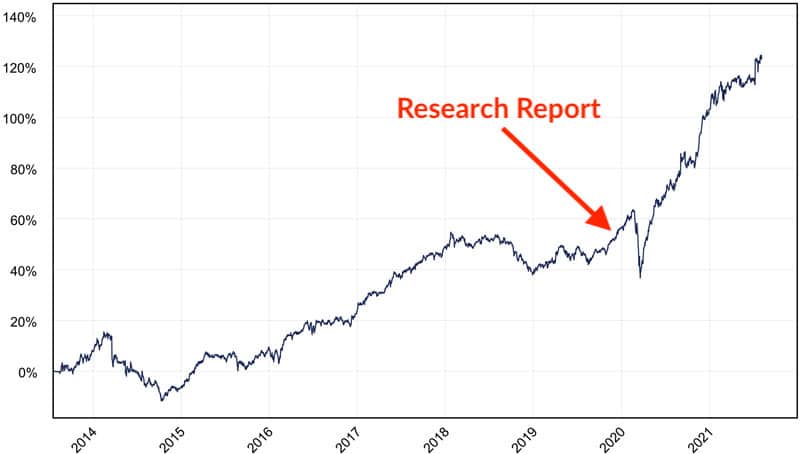

The research report that I published in late 2019 focussed on a then little-noticed investment in the fund's portfolio. Even though it usually only invested in publicly-listed equities, Paladine ONE had taken a stake in an unlisted renewable energy firm, Blue Elephant Energy AG.

As my behind-the-scenes research showed, the stake was likely already worth a lot more than what Paladin ONE had paid for it, but this valuation differential had not yet been included in the fund's valuation (out of caution). Investing in this mutual fund at that time was almost as good as getting extra money on the day you invested.

Here is what I wrote back then: "Once this position is valued on the basis of a publicly published stock price, the fund's net asset value will 'jump' by 7%."

How did it all end?

Paladin ONE has already twice revalued its stake. It added >3% to the fund's performance last year, a further 4.6% in 2021, and there is probably yet more to come. Things took a bit longer than expected due to the pandemic, but the eventual pay-off will likely be higher than what I predicted.

This worked out rather nicely and I could simply consider the case closed.

However, this fund's blog is a great example for the kind of investment publication that too few people have on their radar. Many specialist funds regularly publish missives about their investments, allowing you to pick the brains of some of the smartest people of the investment industry, at no cost and with no obligations. How amazing is that?

Here are three reasons why you might want to sign up to the quarterly blog posts of Paladin Asset Management.

FREE eBook: The world's best investing blogs

What are the best blogs to help you become a better investor and improve your returns?

Check out “The world’s best investing blogs” for my very own top 30.

1. Summaries of unusual, outstanding investment cases

The magic sauce of Paladin ONE is easy to locate: its team finds investment ideas that no one else finds. It's as simple as that – if you could describe it as simple. Generating original investment ideas is a rare skill nowadays, but it's also what Paladin ONE thrives on.

Unusually for a fund, the team shares some of its investment ideas freely and in great detail with anyone who signs up to the quarterly blog posts. In theory, this means that you don't have to invest in the fund at all but "simply" emulate some of these investments yourself.

E.g., had you picked up on the idea presented in blog issue Q3/2018, you could have bought into Medios (ISIN DE000A1MMCC8) at EUR 16. It's now just under EUR 36. Back then and today, it's one of the fund's largest positions – so you could have easily identified it as something worth checking out.

A lot of value, and all delivered for free!

2. An ongoing free masterclass in risk management

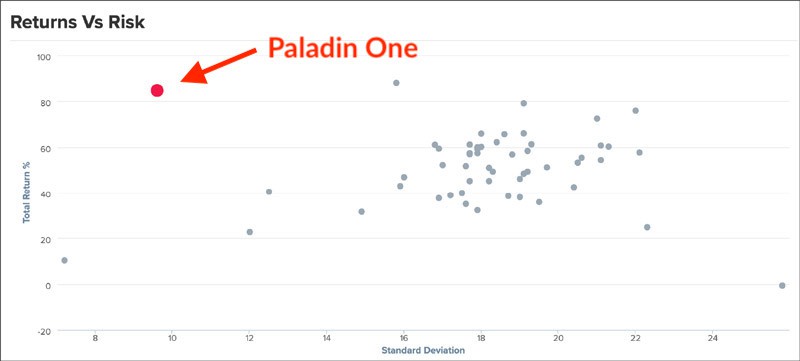

Few people appreciate what it means if a fund aims for so-called "risk-adjusted returns". During good times, no one cares about such details – the rising tide lifts all boats! However, stormy periods such as the March 2020 crash show why having clued-in fund managers who take care of risk is so valuable and justifies fund management fees.

When equity markets collapsed during the early phase of the pandemic, investors of the Paladin ONE fund continued to sleep relatively soundly. The fund's managers had taken out a portfolio insurance by investing 1% of their assets into a put option on Germany's DAX. The put gained around 700% throughout the crash, which helped to protect the rest of the fund.

Even at the height of the corona crash, Paladin ONE was the ONLY German small and midcap fund that showed a significant positive performance over the past five years.

Losing less than others during bad times means you have a better chance of getting ahead even faster during the subsequent recovery. In line with that, Paladin ONE is currently ranked #2 out of 54 comparable funds over the past five years (#1 is a mini-fund with EUR 9.7m in client assets so not directly comparable). You can check the up-to-date ranking using this link.

Does such a long-term performance get you interested in the concept of risk-adjusted returns?

Do these people sound like someone you could learn from in this regard?

The Paladin Asset Management blog articles spell out in great detail how the team finds its investment ideas, what the rationale is behind the investments, and how they are managed on a day-to-day basis. The two fund managers are Matthias Kurzrock and Marcel Maschmeyer, who have nearly 40 years of combined investment experience.

If you are an aspiring investor or portfolio manager eager to learn from the best, you'll find their blog akin to a tutorial. It'll be better than anything a university professor can teach you.

If this assessment of the fund's risk-adjusted return doesn't immediately make sense to you, you ought to educate yourself about risk management (source: CityWire – Factsheet Paladin ONE).

3. Just once a quarter

We all suffer under a glut of information. There are some newsletters and blogs that I dearly love, but if they send me an article every day then it is too much for me to keep up with. Websites that are driven by social media algorithms inevitably swamp you with content, which has become a problem for those blogs that rely on social media algorithms to reach their followers.

The Paladin Asset Management blog releases one new issue every quarter, and you receive it by email.

It's one of the highlights of the quarter. When it arrives in your inbox, you immediately make time to read it!

Fund newsletters as a valuable source of information

I had stopped reporting about Paladin ONE in May 2020, because I entered an investment project with the fund's two founders. Given the subsequent conflict of interest, I informed my readers that they'd have to follow the fund themselves. Still, the blog is another matter, and I wanted to have pointed it out to my readers.

Given the large influx of capital that came Paladin ONE's way thanks to its outstanding performance figures, it has recently slowed down the pace at which it accepts new investors. One of its two share classes (the one that is generally used by larger investors) is closed, at least for now. This goes to show the value of investing into funds when they are still young and undiscovered. The subject of "emerging managers" is one that I will cover on another occasion.

Outside of that, you can, at least, benefit from their expertise in idea origination, investment analysis, and portfolio management. Simply register for their quarterly letters, and find out how they do it.

I'll now make blogs published by fund managers a more regular feature of this series. Blogs come in all shapes and forms, and "Blogs to watch" will help you locate the best of them. Mostly, but not always, in English!

Blog series: Blogs to watch

There's more to "Blogs to watch" than this Weekly Dispatch. Check out my other articles of this 30-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Novavax: The "best" coronavirus vaccine and an undervalued stock?

Can coronavirus vaccine maker Novavax profit from the vast majority of unvaccinated people, and make vaccine sceptics fall in love with it?

My latest research report has all the details.

Give it a shot if you haven't already (no pun intended!).

As one reader put it: "You did it again. Fascinating report."