Was it the Dutch who invented the joint stock corporation and share trading, or do the ancient Romans deserve this claim to fame?

British stocks – the lion is roaring again

Headline news from Britain seem pretty dire these days.

Energy crisis, cost of living crisis, three prime ministers in seven weeks... Britain looks more like a Banana Republic than the world's sixth largest economy.

Yet, the FTSE 100 Index has recently reached a new record level.

Will the rally continue, and what are some of the best sectors and opportunities to look at?

A short spin through the British market

Interpreting the macroeconomic news from Britain is anything but easy these days.

On 18 January 2023, the Confederation of British Industry (CBI) warned that "The world is giving up on Britain":

"Global investors are shunning Britain because the Government has no coherent economic plan and is failing to keep up with volcanic policy changes in the US and Europe. … Money is leaving the UK. Investors are freezing up."

Just two days prior, The Times had reported: "Chief executives bullish about Britain's prospects":

"Global chief executives rank the UK as the third most important country for investment, joint with Germany and behind only the US and China. Despite recent political turmoil, CEOs are increasingly bullish about the UK, according to PwC's 26th annual CEO Survey."

It's a contradicting and confusing situation – which is why it's important to keep in mind that even in 2023, almost all roads lead back to Brexit. The CBI had been almost fanatical in its support of remaining in the EU, and it has had an agenda of bashing the country ever since. The fact that the CBI paints a picture that is almost diametrically opposed to the findings of PwC in its annual CEO survey nicely illustrates today's polarised world.

In times like these, it's best to look at what the market says.

The key aspects to keep in mind are the following:

- The FTSE 100 Index is heavy on energy, commodities, banks, and consumer staples. This had been weighing on the index while tech stocks were all that investors were interested in, but it's now proven a boon. The companies included in the FTSE 100 also generate an average 80% of their sales abroad, meaning this index is much more an expression of Britain as a hub of global companies. Last but not least, the underlying companies have benefitted from the weak exchange rate of the pound sterling – the lower it goes, the more valuable their income in dollars and euros.

- The FTSE 250 Index is much more focussed on companies with a domestic business. The underlying companies generate 50% of their revenue in Britain, and there is a higher percentage of growth stocks.

- In amidst all this are manifold special situations. In particular, Britain has been a major target for takeover offers, which I wrote about repeatedly in the past (see here, here, and here). The British market is also quite simply incredibly diverse and offers many investment opportunities that you couldn't find anywhere else in this shape or form. Britain is renowned for its quirks, and its stock market is no exception when it comes to delivering eccentricities and unique characters.

Case in point, Aston Martin Lagonda Global Holdings (ISIN GB00BN7CG237, UK:AML). There are very few publicy listed niche luxury car companies anywhere in the world. Ferrari (ISIN NL0011585146, NYSE:RACE) is one, and it has produced fantastic returns for its early investors. Aston Martin has gone through a few difficult years, but it recently took major steps towards a turnaround. The company just released its annual report and outlook for the coming years, and the stock rallied more than 50% in a single week. (Undervalued-Shares.com Members were alerted to this opportunity the day before the news came out and when the stock was trading at GBP 1.94 – and it went as high as GBP 3.04 just eight days later.)

Aston Martin.

BP shows just how cheap British stocks are

Much has been made recently of the overall cheap valuation of British stocks.

However, what does this undervaluation look like in concrete terms?

The stock of British Petroleum (ISIN GB0007980591, UK:BP) is a prime example. BP is among the world's five largest oil companies and a so-called "super-major". It generates just 2% of its earnings in the UK – making it a truly global company. BP stock is currently trading at a price/earnings ratio of 5, compared to its US counterpart, Exxon Mobil (ISIN US30231G1022, NYSE:XOM) with a price/earnings ratio of 8.

There are of course manifold differences between BP and Exxon Mobil that could justify this valuation differential. Particularly in a sector like oil, however, one could also argue that both companies should be trading at fairly similar valuations.

Is it any wonder that quite a few British companies are considering to move their primary listing to the US? A primary listing in New York might help firms like BP increase their valuation, which is where one of the many opportunities lies.

Underlying dynamics going back to the 1990s

The root causes of Britain's low valuations are often connected to Brexit. The British market had been under pressure for years following the vote to leave the European Union, thanks also to organisations like the CBI talking down its own country's prospects. However, it's important to keep in mind that some of the factors playing into this run much deeper and go back much further.

Case in point, the incredible, long-standing neglecting of British stocks by British pension funds.

Britain has the world's fourth largest pension reserves. Among the world's 300 largest pension funds, the US ranks #1 with 148 funds while the UK comes in #2 with 23 funds, followed by Canada (18), Australia (15), the Netherlands (12) and Japan (11). Britain's pension savings are one of the world's biggest pools of money, but hardly anyone ever talks about them.

Back in the 1990s, British pension funds and insurance companies held over 50% of their money in British equities. Over the following two decades, this share plunged to just 4%. Some of the decline was due to changes to the accounting system following scandals such as the one caused by Robert Maxwell, as well as the seemingly never-ending bull run in bonds. By 2022, British pension funds held 72% of their assets in fixed income, up from 17% in 2000.

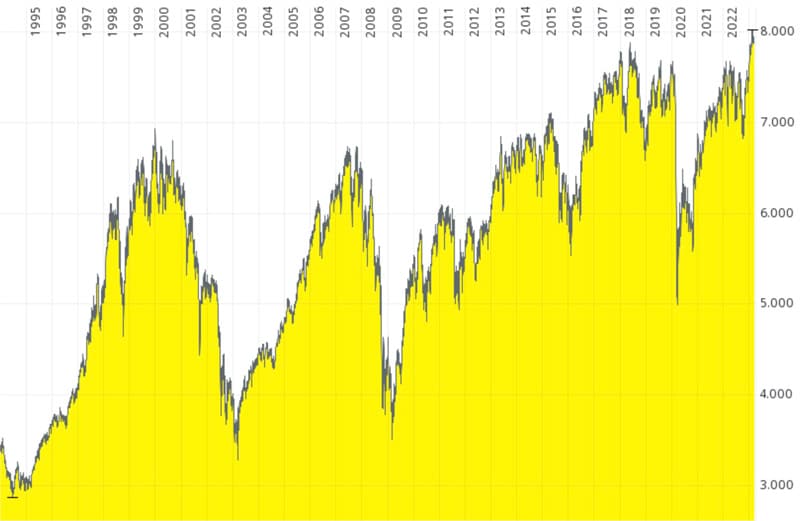

With domestic pension money shunning the local market, is it a surprise the FTSE 100 Index still trades just 15% above its level from 2000? The S&P 500 Index has since rallied by about 180%.

FTSE 100 Index.

On the other hand, what would happen to this market if British pension allocators started to put more money into UK equities?

They'd have quite a diverse market to choose from!

A deep, broad and diverse market full of opportunity

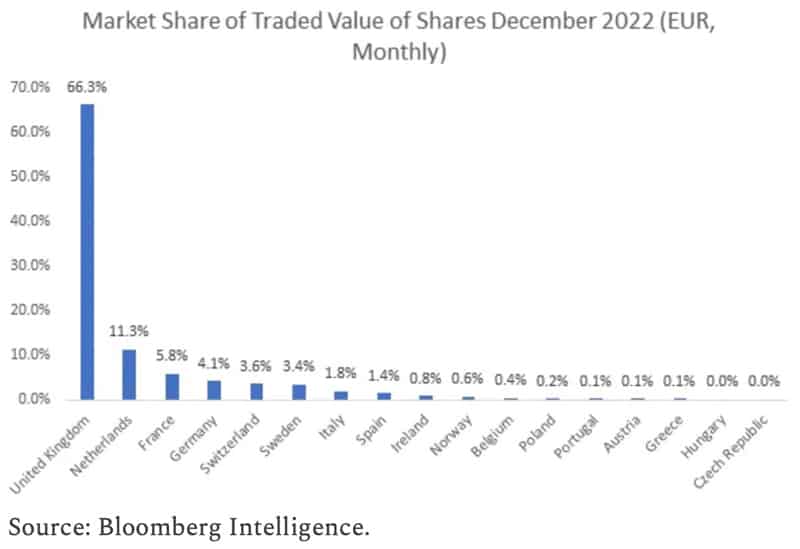

The size and breadth of the British stock market is often misinterpreted. "Paris overtakes London as Europe's most valuable stock market" or "Amsterdam ousts London as Europe's top share trading hub" are just some of the headlines floating around.

It's scary news for anyone considering to invest in British stocks, right? With Brexit, much business shifted to the likes of Frankfurt, Paris, Amsterdam – presumably leaving the City of London a ghost town?

Not quite. The first article left out all international listings in London as well as the AIM Growth Market. Had it included ALL stocks traded in London, the British market would have come out comfortably ahead of the Paris market. The comparison still would have been largely useless, though. Britain is quite simply a global financial market centre, whereas the French Bourse is much more of a national market. Due to its international orientation, London remains the world's #1 or #2 financial centre, sharing the top spot with New York. Paris made it back to #10, after temporarily falling as low as #25.

The second article referred to trading in EU shares – which is only of mild relevance to London as a global financial centre. When taking into account ALL shares traded in London, Britain takes the crown with 66% of all shares traded in Europe, while Amsterdam comes in a distant second with 11%.

Did I mention London's utter world dominance in foreign exchange trading? It's the world's largest financial market by volume, with daily trading amounting to USD 7.5tr. London has a 38% market share, which is up from 37% before the Brexit referendum and double the size of New York. The four biggest foreign exchange markets in the EU (Germany, France, Italy and Spain) just amount to a combined 4.7%.

As I like to say, "more people work in London's finance sector than Frankfurt has residents".

So, what opportunities should investors turn to in the British market?

A market for truffle hunters

My long-standing thesis is that the British stock market is a case for truffle hunters.

The British market lacks transparency and research, which is why those who carry out deep research can gain an edge.

Case in point, the recent movements of Aston Martin. Those who made an effort to dig around – such as yours truly – would have found that Aston Martin's major shareholder and chairman had effectively "leaked" considerable indications about the company's upcoming annual report and longer-term outlook in a TV interview with CNBC two weeks prior. Undervalued-Shares.com Members were pointed towards this opportunity ahead of the announcement, and pocketed a quick 50%.

It's not always that easy or quick, of course. In August 2019, John Menzies plc (now privately held), one of the world's leading ground handling companies at airports, was almost certain to receive a takeover bid over the following year. Then the pandemic hit, airport closures came in the way, and the stock temporarily collapsed. The takeover scenario did come true eventually, though, and the offer surpassed the initial investment price by far.

In the case of Dignity (ISIN GB00BRB37M78, UK:DTY), a market-leading funeral provider, things happened very quickly. Just a short six months after I proclaimed Dignity to become a takeover target, an offer was tabled. It yielded a 19% profit – not the world's most astounding ever investment but still a respectable gain, considering that this was a value investment with relatively limited downside. For value investors in search for undervalued stocks with a potential catalyst, Britain is a rich hunting ground.

Where to turn to next?

24 names to get you started

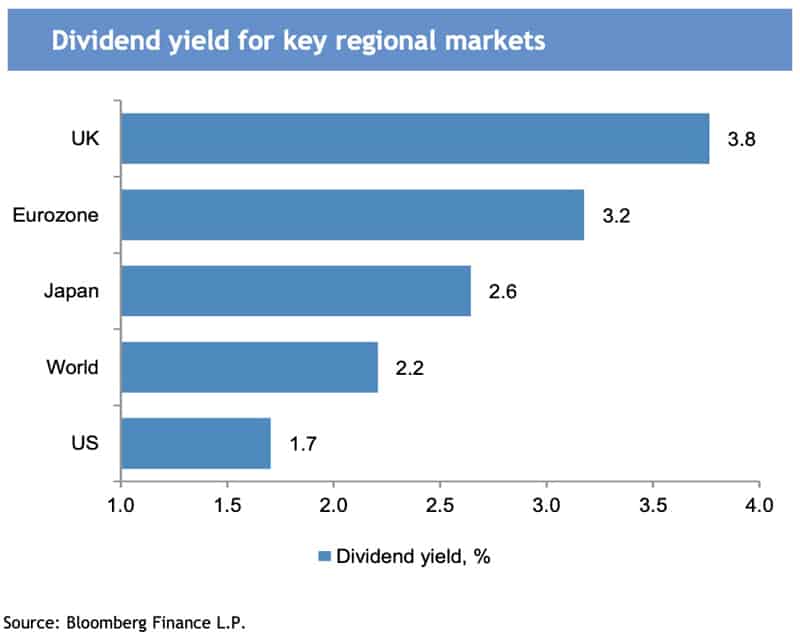

For someone wanting to do their own research, I'd recommend checking out dividend stocks. The British stock market currently offers some of the world's highest dividend yields.

Dividend yield for key regional markets.

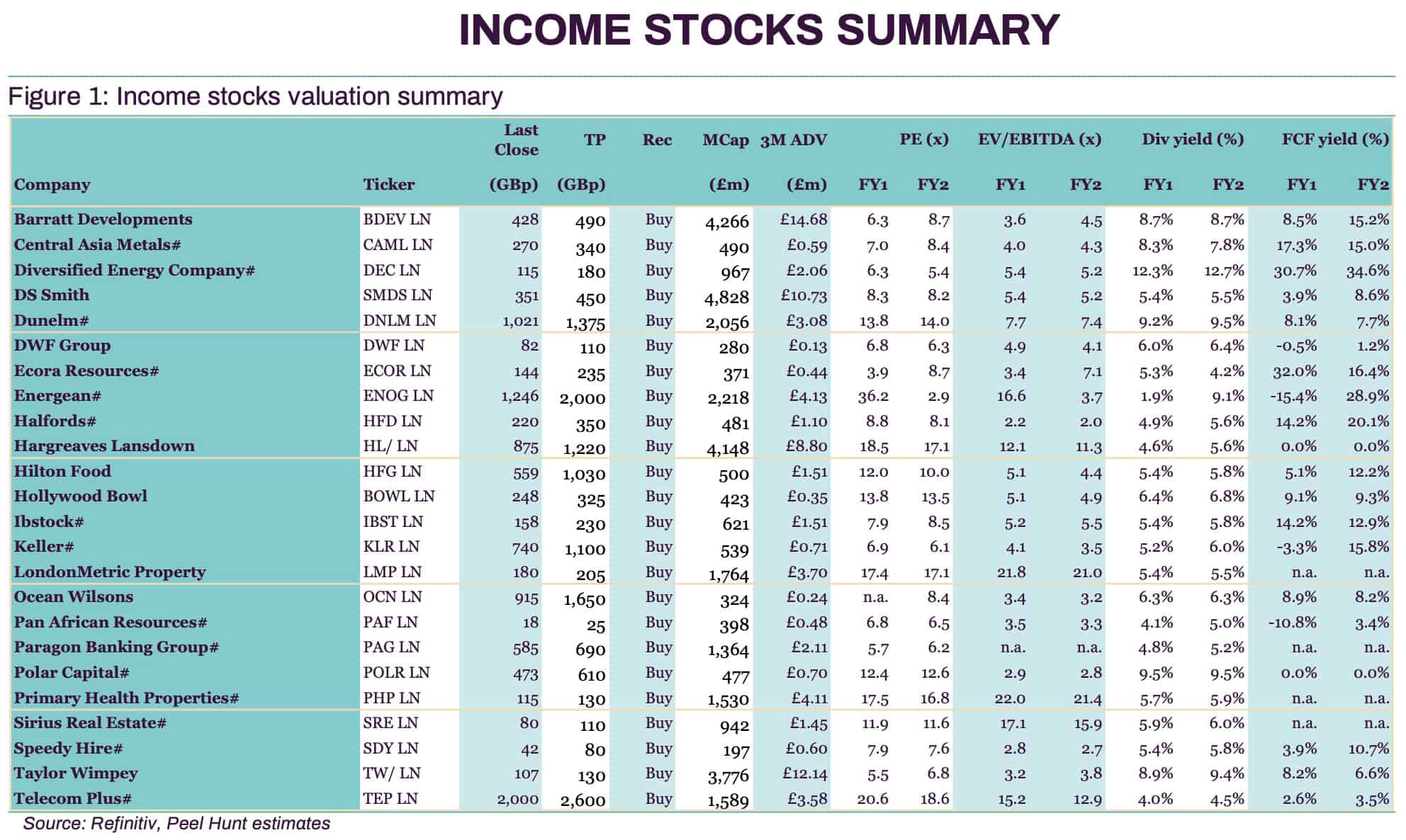

You could do worse than let your own research be inspired by the "24 Income Picks" that analysts of brokerage firm Peel Hunt released in January 2023:

"Our analysts have selected a variety of companies with attractive income characteristics across our coverage list. Diversified Energy Company is the highest yielder in the group with over 12% forecast, followed by Polar Capital at 9.5% and Dunelm at 9.2%. We expect 19 of the 24 companies to deliver dividend growth YoY, with three companies unchanged and two moderating slightly from high levels. … The 24 companies range in market cap from DS Smith at £4.8bn down to Speedy Hire at £197m. The median market capitalisation is £781m and the mean £1.44bn."

Here is their entire list with vital stats.

Click on image to enlarge.

There is an incredible array of diversity and opportunity in the British market. It's a market that's far from dead, which is also reflected by two excellent recent analyses by fund manager Redwheel and fellow blogger Konstantin Kisin, both of which I leaned on for the purpose of this Weekly Dispatch.

Latest stock pick: Aston Martin

The stock of Aston Martin rallied more than 50% in just one week after the company released its profitability forecast for 2023.

Is there more to come? What else does the future hold for the British carmaker?

The latest Undervalued Shares research report looks into the track record of the new lead investor, crunches the company's numbers for the years 2023-2025, and reveals why there may be a few surprises along the way.

If you missed investing in Ferrari in time (which went up fivefold), this report is a must-read.

Latest stock pick: Aston Martin

The stock of Aston Martin rallied more than 50% in just one week after the company released its profitability forecast for 2023.

Is there more to come? What else does the future hold for the British carmaker?

The latest Undervalued Shares research report looks into the track record of the new lead investor, crunches the company's numbers for the years 2023-2025, and reveals why there may be a few surprises along the way.

If you missed investing in Ferrari in time (which went up fivefold), this report is a must-read.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: