A young Canadian reader once sent me a hardcopy of "The Sleuth Investor", a 2007 book about uncovering the best stocks before they make their move.

Few would have come across it.

Its Author, Avner Mandelman, argues that "basing investment decisions on public information is like sending an army into battle based purely on public information gained from newspapers".

Instead, Mandelman suggests using principles from intelligence gathering to gather non-public information.

I recently met up with Christopher "Chris" Waller, fund manager at Plural Investing LLC and founder of the Hidden Gems Investing Substack.

Chris was the first person I've ever met who had read "The Sleuth Investor" book and brought it up in conversation.

I met him just when I put together my recent Weekly Dispatch about the litigation case of Panthera Resources, which was its own case of sleuth investing. Meeting a like-minded investor and analyst was refreshing.

What's more, Chris had really integrated its principles into his investing.

What exactly is sleuth investing, and how can you apply these principles yourself?

Chris explains it all.

One generous reader inspiring me to look into sleuth investing.

Swen Lorenz: Before we dive into sleuth investing, tell us about your career. How did you get into investing in the first place?

Chris Waller: Thanks for having me. I grew up in the UK and got into investing at the age of 16. I'm 32 today. That was September 2008, so an interesting time to get into investing! There was a mock stock portfolio competition in the UK and I was hooked straight away. Warren Buffett's biography The Snowball was also released in September 2008 and so I ended up reading that shortly afterwards. That was fortunate timing as I became a value investor from a young age, which I think has been an advantage.

After university I worked at Goldman Sachs Asset Management in London as a member of the investment team for their Global and International Small Cap funds, before doing my MBA at Columbia Business School where I was part of the Value Investing program. I launched my fund coming out of Columbia.

Photo: Chris Waller.

SL: What made you set up an investment fund, and why are you now also writing a Substack?

CW: I was very fortunate at Columbia to meet Joel Greenblatt, who was teaching there at the time. A lot of my approach to the fund today is inspired by what he did at Gotham Capital: focusing on finding 7-8 overlooked or small-cap companies that are undervalued and have insiders that are incentivized to unlock that value. If you're willing to do the work in these areas you can uncover 'hidden gems'.

A big part of my process to uncover these companies is primary research, or sleuth investing. A lot of that is speaking to experts in an industry who will be able to provide perspective on an industry and teach you because they have spent a career thinking about these topics in a way that most investors have not.

A major hurdle to this research is simply why would an industry expert talk to me? So I began writing 30-page reports on companies I was researching and sharing them with experts, which gave them a reason to talk to me because most of the industries I am doing work on are small and so have no serious research publicly available.

The Substack is the culmination of that. My goal is to systematise sleuth investing and have primary sources come to me. For instance, when I publish an article to my Substack or post it to LinkedIn I often get industry experts liking or commenting on the work. I then reach out to them and there is a much higher likelihood that they speak to me. Some experts even reach out to me directly now, which makes my life easier!

SL: In just a few words, what is sleuth investing, and why is it so valuable?

CW: Sleuth investing is about going beyond reading the easily available materials like a company's annual reports or earnings calls, and behaving like an investigative journalist who talks to people in the industry, visits locations, and tries the products themselves to gain a deeper understanding of an industry and company. Even most professional investors do not do this type of work and so if you do you should be a more educated investor with better insights. That should translate into better investment decisions.

SL: How can sleuth investing be legal?

CW: Sleuth investing is not about gaining non-public information or anything beyond or even near legal boundaries. Instead, everything a sleuth investor does should be achievable by any investor, it simply requires you to do the work.

For instance, a great source of sleuth investing is industry events like trade shows. These are accessible to anyone but typically involve you travelling in person to an event for several days and having conversations with 'ordinary' people in an industry about why they bought a product or what they think about industry trends. Most professional investors are not willing to put in that effort and get out of their comfort zone to talk to strangers.

There are other forms of sleuthing that are perfectly legal but take work. For example, the Freedom of Information Act allows anyone to request communications a government agencies has made to a company. This can reveal lots of interesting information and is accessible to anyone, but requires you to submit a request.

SL: Can you give us a rundown of Mandelman's sleuth investing principles?

CW: In my view, the overarching principle behind Mandelman's sleuth investing is that it is important for you to have your own human experience of a company, which is something many investigative journalists talk about, too. It is not enough to just be sat behind your desk looking at numbers.

Instead, having your own human experience talking to the people in the industry, experiencing the product, and visiting locations are essential to gaining qualitative insights. People, product, plant – it's called the three Ps.

When you have your own human experience it gives you a perspective that is often very different to if you were looking at a spreadsheet. There are also certain intangibles like the culture of a company that are critical to its future in the long run but hard to evaluate quantitatively.

SL: The term "gathering scuttlebutt" has become common parlance in the investment industry, and everyone knows how Peter Lynch gathered investment intel in everyday situations like shopping in supermarkets. Is the concept really that special, or is it just a bunch of common-sense principles wrapped into a catchy term?

CW: I don't think the term itself is that special, but very few investors do scuttlebutt or sleuth research even though it is valuable and so perhaps the term helps re-emphasise that.

SL: How do events such as trade shows play into sleuth investing?

CW: Trade shows are a great way to meet a lot of people in an industry in a couple days, and most industries have one or two big trade shows per year. Ideally, you can also build up a relationship with some of the people you meet and have follow-up conversations.

In some of the small-cap companies I invest in the industries themselves are small and the CEOs of many of the companies turn up to the show. I have been to shows where I have been able to speak to the key people across most of the companies in the industry, which has been enormously valuable in getting their perspective. It is also valuable to speak to less senior people, the customers, and try or see the products for yourself.

Since I'm usually the only investor at these shows I believe it allows me to understand an industry's dynamics better than most investors.

SL: Can you give us a concrete example of how visiting a trade show gave you an edge?

CW: The most recent industry event I went to was XPEL's installer day, which I wrote up on my Substack. XPEL (ISIN US98379L1008, Nasdaq:XPEL) is a supplier of paint protection film, which is a clear plastic film that wraps around your car and protects it from scratches and rock chips like the film protecting the surface of your phone. The installer day is an event attended by 600 of XPEL's installation shop customers.

At face value, XPEL appears to be a film supplier and not a good business. However, I learned several things in talking with the installers that helped me appreciate the competitive advantages XPEL has, the length of its growth runway, and the strength of its culture.

First, while XPEL makes the best film in the industry this is not actually the reason the installers choose to use its film. Instead, almost every installer told me they use XPEL because the company helps grow their business through leads from customers increasingly asking for XPEL specifically over other films, XPEL's online presence, and partnerships with car dealers and OEMs.

In other words, XPEL is the industry's leading brand and its true product is not really the film but the leads it drives towards installers. My estimate is that installers who switch to XPEL see a 20% jump in sales, which is a huge deal.

The second thing I learnt is that XPEL is so ingrained into its customers that it is more of a franchisor than a supply vendor. XPEL does not just supply film, but also the brand, leads, training, software, and service. That means switching costs are very high. I asked several installers at what price they would switch to an alternate film, and the replies were generally that there is no price.

Finally, the most striking moment for me was one where you had to be there to witness it. When I attended the same conference two years ago there was a moment when XPEL announced that they would be selling company-branded merch at the back of the ballroom. That immediately led to a stampede as installers ran to buy T-shirts, caps, and other merch before it sold out.

This year was similar. XPEL had a merch store next to the main ballroom and a huge queue of maybe 150 people formed waiting for it to open. This meant XPEL staff had to use a retractable barrier at the entrance like a nightclub to control the number of people going into the shop at any one time. Installers told me that XPEL's merch always sells out straight away but that the company occasionally does 'drops'.

Does this really matter? I would argue that there are very few businesses whose customers are this obsessed with the company. This along with XPEL's lead generation suggests to me the company will be hard to stop and has substantial pricing power. I don't think these are qualities that most investors appreciate, and I believe you have to show up in person to recognise them.

SL: What about speaking to employees of a company – both current and former employees? Do you ever put on a fake moustache to speak to the receptionist of a public company? Should we all start to watch Magnum PI to learn the tricks of private investigators?

CW: I have not found it to be helpful to pretend to be someone else, and almost always say upfront that I am an investor researching a company. People are (rightly) suspicious of strangers asking questions and so I have found that being as transparent as possible puts people at ease. While being an investor turns some people away, others are often curious to speak to an investor. And the big win is to build a relationship where you can continue having conversations on an ongoing basis. That is not sustainable if you are being deceptive.

SL: Platforms like X or Reddit are a useful resource for sleuths. Can you give us one or two real-life examples of how you used them to gain a valuable edge that you could not have gained otherwise?

CW: One of the companies I am invested in is called Watches of Switzerland (ISIN GB00BJDQQ870, UK:WOSG), which is a partner and authorised retailer of Rolex. Rolex does not sell watches themselves or online, only through authorised retailers. That means Watches of Switzerland's economics are very different to traditional retailers and more similar to the brands themselves. The company benefits from long customer waiting lists that sometimes run into years, no price competition from other retailers, no inventory risk, and no online competition. Half of the company's sales are in the UK, where it has 50% market share, and half are in the US, where it has 10% share and is also the largest.

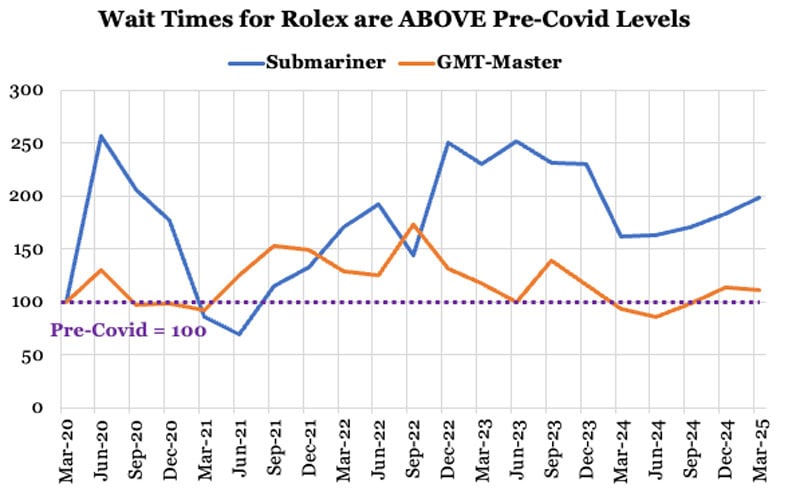

One thing that investors are concerned about is cyclicality. The luxury watch market was boosted after COVID, and that has reversed. Several data providers show that this has caused prices in the second-hand market to decline significantly, and a key question is to what extent that has a knock-on impact on the sale of new watches, which is what matters for Watches of Switzerland.

Watches of Switzerland and Rolex do not disclose the length of their waiting lists as it is a closely guarded secret, and so most investors are just extrapolating from the second-hand market decline that waiting lists must have shortened significantly.

However, sleuthing on Reddit and forums online show that waiting lists remain very healthy.

I have collected 3,728 reviews from customers online who purchased a Rolex over the last five years. Each of these comments contained the model of the watch purchased, the date it was purchased, how long the customer actually had to wait, rather than a theoretical wait time, and the country that they made the purchase in.

With this data, I was able to build out the waiting list for each Rolex model, compare that to pre-COVID levels, see what the impact of COVID was, and where it is trending today. The result is that instead of guessing what demand and supply for Rolex are doing, I can see that although waiting lists have reduced from their peak bubble levels post-Covid, they remain healthy and stable, particularly in Watches of Switzerland's key growth market of the US.

Platforms like X and Reddit are particularly useful for tracking customer comments. There have been instances in the past when I have seen a company's new products photographed or discussed by people online before they have been broadly released. In one instance, a freelance photographer posted images of the photoshoot for a new product to his LinkedIn.

But in general, I think there is a lot you can learn seeing customers and the people in an industry discussing things online.

SL: Your fund, Plural Investing LLC, is predominately invested in small- and mid-caps. Is that were sleuthing efforts should be focused, or could you also apply this kind of work to investing in large-caps, or even other asset classes such as bonds?

CW: I think sleuthing is something that should be applied at all market caps and asset classes. However, the biggest advantage will come when looking at small-caps because large-caps tend to attract larger funds that have more resources and so are more likely to be doing in-depth research.

SL: I took a look at the literature available on the subject. It struck me that the other truly interesting book to read (besides Mandelman's first book) is "We Are Bellingcat: An Intelligence Agency for the People" by Eliot Higgins. I know that you also read it. What's the Bellingcat approach, and how can private investors apply it in their work?

CW: Bellingcat is an open-source intelligence organisation founded by Eliot Higgins. Their approach relies on freely accessible information like photos and videos on social media, satellite imagery, and forums to piece together what truly happened in high-stakes events, generally wars. I would encourage anyone to read their report on who shot down Malaysian Airlines MH17 over Ukraine in 2014. This effectively takes techniques like analysing satellite images of car parks to understand customer demand to a new level.

While intelligence agencies like the CIA struggled to piece together who was responsible at the time, Bellingcat used tweets, YouTube videos, pictures of a missile launcher with unique markings, and geolocation tools matching these images to Google Maps to assemble a clear timeline of the launcher's journey from Russia into Ukraine and back. They verified time stamps by analysing shadows in photos, confirmed the launch spot through satellite imagery that showed a fresh burn mark in a field, and cross-referenced this with local chat room comments. There were even posts by Russian soldiers on social media that Bellingcat used to identify the exact Russian brigade that operated the launcher. All this evidence was presented publicly and the report above includes many of the key photos, videos, and techniques used.

I am not saying private investors need to go into this level of depth in their work, but I think there are some principles that are applicable. For each company that I am invested in, there are usually between 10-20 online sources I check each week across LinkedIn, X, Reddit, and YouTube. These include the accounts of the companies I am following but also the key executives, other employees, industry experts, and customers. Many of these are sharing useful information and insight that would be hard to find yourself.

SL: This already provides plenty of food for thought to get our readers started out with their own sleuthing. I have got to ask now, what's a current investment that you found through this method and is worth looking at?

CW: A current investment that has worked out well for me is TerraVest Industries (ISIN CA88105G1037, CA:TVK). Although the stock has appreciated a lot over the last 18 months, I still think it is worth keeping on your radar.

At first glance, the company appears to be a boring manufacturer of storage tanks in industries like propane storage that are barely growing or even declining. However, after speaking to some of the former founders of the companies they acquired, I realised that TerraVest has very significant advantages, an excellent and incentivised management team, and a long runway to continue making acquisitions.

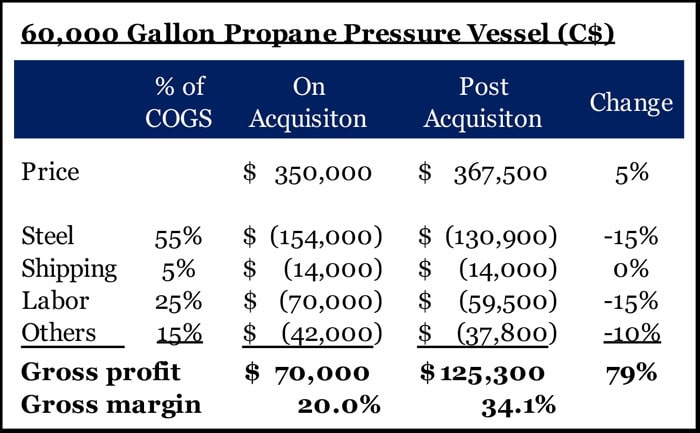

Many of the industries that TerraVest operates in are niche and local because it is expensive to transport a heavy storage tank. The founders told me that when TerraVest acquired their businesses, the company was able to get 10-20% discounts on steel input costs because of its size. TerraVest can group all its steel purchases and buy in bulk directly from the steel mill, whereas mom & pops simply do not have the scale to do that and often buy through a distributor. This is important because steel typically makes up half the cost of a storage tank.

TerraVest also makes other changes and as a result they can increase gross profits on a hypothetical 60,000 gallon tank from USD 70,000 to USD 125,000.

The founders also told me that many of the mom & pops in these niche industries will likely sell to TerraVest as it is one of few competitors with the scale and capital to make an acquisition.

For all these reasons, TerraVest generates an ROIC of 20% and has a long runway to keep compounding at those levels. The top five most senior members of management also each have the majority of the net worth in the stock, giving them a very strong incentive to keep compounding. The stock has returned 30% per annum for the last decade and is more fairly priced now than it used to be, but I think it should be in every investor's watch list.

SL: When Chris Waller is not sleuthing to find the next exciting stock pick, what else does he like to spend time on?

CW: I try to relax spending time with my family – my wife and I do not have kids yet so we still get time to go to restaurants and shows! Otherwise I'm a big football fan and try to play once a week.

SL: Your Hidden Gems Investing Substack is an incredible resource. Within just four months of starting to publish, you already have over 2,700 readers. What can readers find on your Substack?

CW: Thank you. My Substack includes 30-page reports on several of the companies I've discussed here, like Watches of Switzerland and TerraVest. I will be publishing one on XPEL in a couple of weeks. The reports begin with a 1-page summary, then go into detail based on discussions with roughly 20 industry experts and open-source analysis.

I also publish in-depth updates on each of these companies as well as analysis from trade shows. You can view my most recent trade show analysis, on XPEL, here.

SL: Thank you, Chris, for generously sharing your experience!

About Chris Waller and Plural Investing: Chris Waller is the Founder and Portfolio Manager of Plural Investing, LLC. Plural Partners Fund was launched in 2020 with the belief that in-depth primary research can uncover 'hidden gems' in the small-cap universe. The fund invests in 7-8 of these stocks over a 3-5-year time horizon. Some of our research is published in long-form reports and available at the Hidden Gems Investing Substack. Prior to founding Plural, Chris worked in London at Goldman Sachs Asset Management. Chris joined in 2013 and worked as a member of the investment team for the Global and International Small Cap equity funds. He has an MBA from the Value Investing program at Columbia Business School and a BA in Economics and Management from Oxford University. Chris lives in New York.

9% high-dividend stock and 13% interest with Swiss champion (German-language video)

British American Tobacco is a London-listed large-cap who is set to benefit from a likely revaluation of the entire tobacco sector.

With the ongoing growth of Next Generation Products such as vaping and heated tobacco, what makes British American the probably most interesting stock in its sector?

This talk with Anton Gneupel of D wie Dividende and fellow investor Norbert Schmidt gives an insight into some catalysts, and why now is a good time to take a closer look.

9% high-dividend stock and 13% interest with Swiss champion (German-language video)

British American Tobacco is a London-listed large-cap who is set to benefit from a likely revaluation of the entire tobacco sector.

With the ongoing growth of Next Generation Products such as vaping and heated tobacco, what makes British American the probably most interesting stock in its sector?

This talk with Anton Gneupel of D wie Dividende and fellow investor Norbert Schmidt gives an insight into some catalysts, and why now is a good time to take a closer look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: