Image by EQRoy / Shutterstock.com

Back in October, I wrote a snarky paragraph about Deutsche Bank potentially becoming the Eurozone's next Lehman Brothers.

This wasn't a particularly original foresight, given how widely known the problems of Deutschland's no. 1 bank were at the time. Equally, it wasn't an entirely stupid thing to point, considering that many a tipster recommended buying into the seemingly undervalued share (arguing that at 0.2 times its book value, Deutsche Bank shares had become ridiculously cheap and were quite simply oversold).

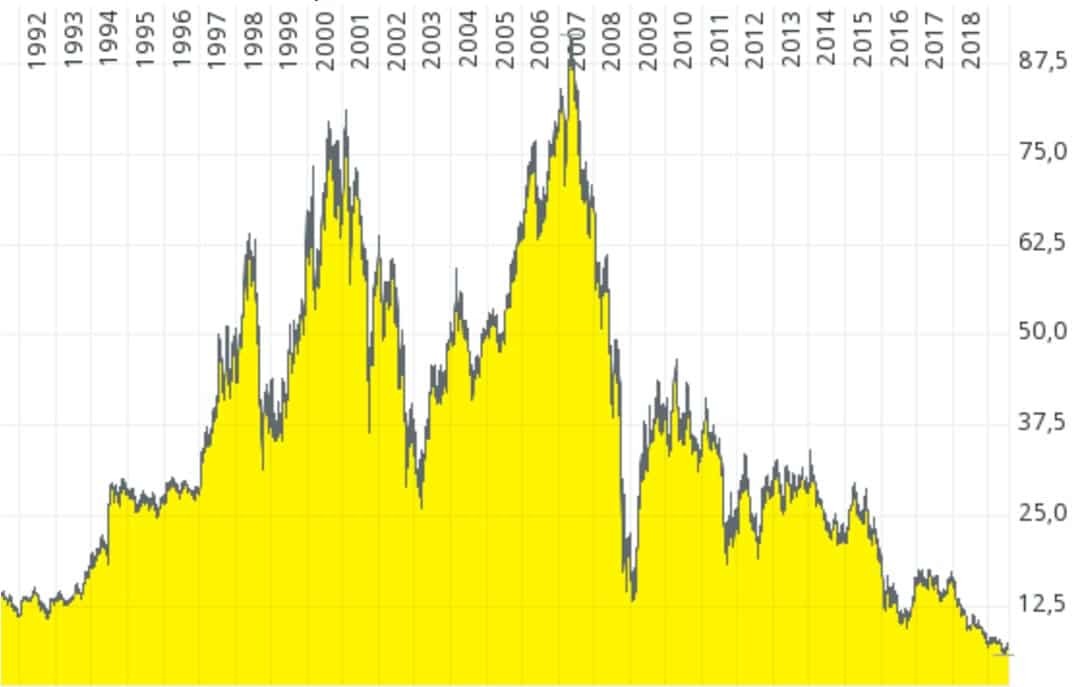

Since then, the share has fallen another 30%. It is now trading at EUR 6.60, down from EUR 9.35.

Given the past week's headlines about Deutsche Bank, it's worth taking another look - not the least as there is a general investment lesson to be taken from the entire debacle.

What next after this week's major headlines?

The bank announced its fifth (!) strategic change in direction in seven years, including the layoff of no less than 18,000 employees as part of closing down its equities trading division. According to some observers, this was the largest redundancy event within the banking industry since 2008. Given that it affects one-fifth of the bank's global workforce, it's a major development in any case.

I suspect the real situation regarding upcoming layoffs at Deutsche Bank is even worse. E.g., I just heard from a contact that many banks were "quietly" moving expensive back office functions from the City of London to Central and Eastern Europe. Purely for the sake of moving to a cheaper location, banks are laying off staff in one place, only to replace them with much less expensive staff – or IT systems! – in another one. Cheaper office space is a significant component of this, too.

During this tumultuous week for Deutsche Bank, some publications wrote of a Lehman-style mood inside the bank, most notably a Zero Hedge article that went viral. Others refuted that. Photos of laid-off bankers leaving buildings with moving boxes or the infamous white envelopes definitely brought back a few memories of 2008. It's also safe to suspect that there'll be quite a few rental properties coming onto the market in South West London.

That all aside, the critical question is, will this dramatic bloodletting now prove to be the turning point for Deutsche Bank?

It's a question I have spent a lot of time reading up on, and checking on the company's share price has long been a daily routine for myself. Deutsche Bank is a fascinating case, all the more since it used to be a bellwether of Europe's largest economy.

After months of reading, contemplating, and researching, I have a simple answer.

I still have no idea whether Deutsche Bank shares are a buy or a sell.

Unclear combat situation

If I wanted, I could find 101 crafty arguments why Deutsche Bank shares are Germany's hottest turnaround speculation:

- Drastic measures are finally underway, which were the missing part to get the bank back on track.

- Risks are more than compensated for through the bombed-out share price. Deutsche Bank's market capitalisation is now a mere EUR 13bn. Even after paying off about EUR 9bn in redundancy packages, it'll have a remaining book value of about EUR 54bn.

- From 2022 onwards, some EUR 5bn are supposed to be returned to shareholders through dividends and buybacks.

Just as well, I could convince anyone that the bank is about to go under:

- The zero-interest world has destroyed the business model of virtually all European banks, and Europe is quite simply over-banked.

- Deutsche Bank's balance sheet is a black hole with an unknown quantity of toxic assets inside.

- Its management has racked up a three-decade track record of continued failure, and "good people" are now even less likely to (continue to) work for Deutsche Bank.

The question is how to quantify these issues and how to weigh the positives against the negatives.

If anyone has managed to come up with a robust, verifiable way to analyse what's on this bank's balance sheet and how its remaining business is likely to perform over the coming years, then I'd love to see it. As yet, I have found no shortage of very smart people looking at individual aspects of this mess. But how it all hangs together seems to be anyone's guess still.

Which goes back to the point that not just one, but several former Deutschbankers who I am personally friends with have told me over the past few years: "Even the CEO won't know for sure what's on the bank's balance sheet." That's a pretty damning verdict, and it is not unreasonable to suspect that to some degree at least, this remains the situation.

Put another way, no one has much of an idea of how this is going to play out. I hate to admit it, but after way too many hours of following up on Deutsche Bank, it's all still as enigmatic as it has been years ago.

How low can it go?

Minimise risks, maximise the upside

When looking for investments, what you will ideally be looking for is an asymmetrical ratio of risk and reward. No investment comes without risk. But you can usually get a pretty good handle on how risky a business is, and how it might perform if unexpected adverse aspects turn up.

E.g.:

- If several of the largest customers jump ship, how will that affect earnings in the short term, and what is the chance of replacing them in the medium term?

- If the economy tanks and the company suffers through a two-year recession, does it have enough reserves to survive and come out the other end?

- If interest rates do something very unexpected, how will it affect the company's ability to serve its debt or refinance it?

Obviously, us humans are all ever so slightly deluded about our ability to judge risks. We tend to err on the side of optimism, and I am probably a particularly strong case of seeing most things through rose-tinted spectacles. But still, usually, with investments in publicly listed equities, you can get a handle on risks.

Here are some of the aspects that I've looked at for companies that I featured in some of my detailed research reports:

- TomTom has no bank debt and keeps a lot of spare cash in the bank. This takes away risks of not being able to make it through an unexpectedly bad year or not having the reserves needed to invest in its business.

- Gazprom would have a sufficient cash flow from its existing operations even if gas prices were considerably lower. Again, this lowers the risk of something majorly going wrong.

- Porsche SE also has no debt. It's the single biggest asset of the two families that control the company, and these families have already had a bad experience with excessive debt leverage. Chances are, them taking on too much debt again to do overly risky stuff is highly unlikely.

You get the idea. Based on experience in analysing shares and using a long checklist, you can get a reasonably good handle how risky (or not) a company is.

Though not so in the case of Deutsche Bank. Whereas I know of some other European banks that also used to be a "black box" but have since at least partially cleaned up their act, in the case of Deutsche Bank it is all still very opaque.

An equity story where there is too little of a chance to accurately assess risk is one that you should simply stay clear of.

Doing it any differently would be gambling, rather than value investing.

Value investing –a broad term, but roughly characterising the strategy of this website – is all about buying the dollar for 50 cents. We want to know what we are buying, and we want to buy it at a price that is objectively too cheap.

Even with this strategy, you suffer the occasional bad surprise and painful loss. But it's a lot less likely to involve too many of them, than if you gambled on a situation that might work out, but which could just as well explode in your hands.

A few added thoughts on the Fatherland

With this in mind, I'll continue to follow the curious case of Deutsche Bank from afar.

If you wanted a couple more general predictions and observations, these would be as follows:

- Where Deutsche Bank goes, so goes Germany. I have a strong gut feeling that Deutsche Bank will prove an early example of Germany – as a country – having over-extended itself financially and much economic suffering coming as a result.

- IF Deutsche Bank turns into a Lehman-style collapse for the German government to fix, the latter could find itself in the fiscal straightjacket that it had previously forced upon the likes of Greece and Italy. No doubt, much Schadenfreude would ensue elsewhere.

- Germany's balance sheet is currently as opaque and worrying as that of Deutsche Bank, if not worse. There is a good chance that in three or five years, the economic clean-up of the Merkel era and Deutsche Bank's crisis will both be mentioned in the same breath. Merkel will go down in history as a byword for trillions of euros of hidden debt, for which the day of reckoning is approaching.

These are observations that I might dig into in a bit more detail in future ramblings, not the least because they could have wider ramifications for investing in today's hyper-politicised and politically polarised world.

For now, I hope this has helped you understand how I view the need for assessing risks and finding investments that are clearly, objectively too cheap - to the degree that any human can ever make a definitive call in such a matter. Though for as long as I get it right in 60% or 70% of all cases (ideally: more), we should all come out making money off this.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year

P.S.: Check out my latest in-depth report about an investment opportunity you won’t get to read about elsewhere (yet!). Available for Members only so sign up now to get immediate access.