Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

Energy Transition Minerals – the crazy Greenland micro-cap

At the start of the year, I published an extensive research report about Greenland.

The report featured a micro-cap stock that provides exposure to Donald Trump's idea of "buying" Greenland.

After Donald Trump Jr's surprise visit to Greenland, the stock rallied 56% in a single day.

It temporarily tripled, with massive trading volumes.

In my 34-year career, I've hardly ever come across a similarly unusual story.

Energy Transition Minerals.

The unexpected legal twist in the Greenland saga

My research report on Greenland is a 42-page humdinger that was shared exclusively with Undervalued-Shares.com Lifetime Members.

As it says at the outset, I am amazed there are still people who take Trump literally but not seriously.

When Trump announced that "buying" Greenland was an absolute priority for his presidency, much shrieking and wailing followed in the mainstream media. At least initially, there was hardly any real intellectual curiosity as to the reasoning behind Trump's initiative. Only The Independent asked how the purchase would actually work.

Over the past few weeks, the public discourse has already changed significantly.

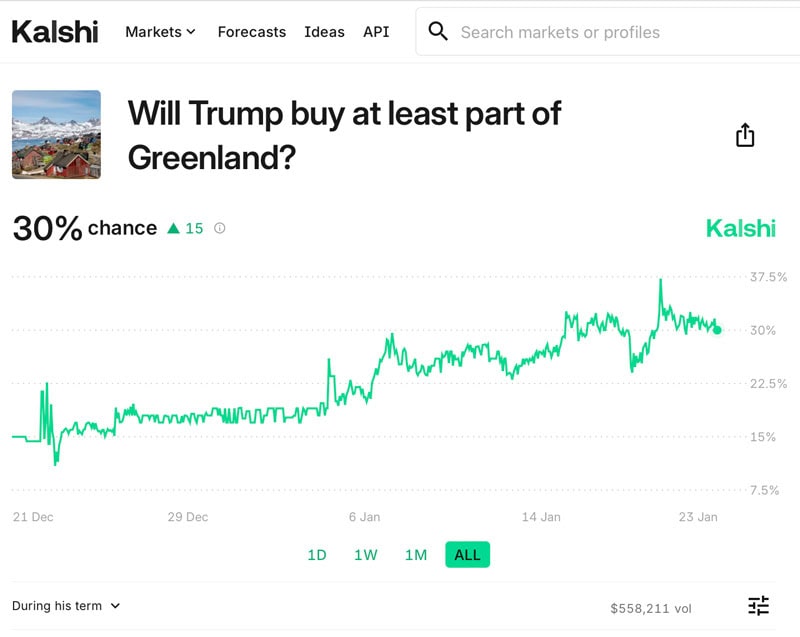

Currently, the online betting odds for the US buying Greenland are 32%, after briefly spiking to 37% on Inauguration Day. These odds are driven by small amounts of money, and some of these bets will be politically motivated. Still, after the greatest political comeback in the history of modern-day politics, only a fool would assume that the odds for some kind of deal to be struck are zero.

Source: Kalshi.

Indeed, even the mainstream media have changed their tone. There is now a widespread realisation that:

- Trump always starts off with a maximum demand to anchor his negotiating. "Buying" more likely means other forms of close association.

- The timing for this advance was ideal, given that Greenland was already working to redefine its legal status and governance.

- Denmark hasn't exactly been Greenland's greatest guardian. There are very dark chapters in how Denmark treated Greenlanders, and even after decades of trying, the Danes have not succeeded in turning Greenland into an economically viable entity.

Speaking of economics, Greenland may also be bankrupt.

That's the angle my research report covered in some depth, and which still hasn't received sufficient coverage elsewhere.

It is already widely known that Greenland relies on Danish welfare for half of its government budget. 15 years after Denmark allowed Greenland to further expand its "home rule", the large but sparsely populated island isn't anywhere near being able to govern itself – if you assume that being "independent" also means paying your own way.

Even worse, Greenland politicians have manoeuvred the territory into a very difficult situation financially.

Greenland's ruling party appears to have broken laws and investment regulations, which the government has now been taken to court for.

This is a serious legal case indeed, and the claimant is financially backed by the world's leading litigation financier. Their track record is a win or partial win in 92% of all cases they fund, and they are stumping up a double-digit million amount to make sure the case has its best shot at coming out favourably. The backing of this particular litigation funder gives this case against Greenland a significant amount of credibility.

If the claimant is successful, Greenland could face USD 11.5bn in damages – 4x the size of Greenland's GDP.

If Greenland faced such a high payout, would Danish tax payers step in? It'd be akin to Denmark having to pay 24 times its annual USD 500m subsidies to Greenland.

Maybe this is the door that Donald Trump spotted being slightly ajar.

In fact, markets are now betting that this door may open up further during 2025.

Here is the Australian micro-cap company that could indirectly shake up geopolitics.

The publicly listed company at the heart of it

Energy Transition Minerals (ISIN AU0000250250, AU:ETM) has since 2006 been working to develop the Kvanefjeld resource project in Greenland, the world's second-largest deposit of rare earth minerals, and the sixth-largest uranium deposit.

Previously named Greenland Minerals & Energy, by 2020 the Australian company readied itself for taking Kvanefjeld into production. A political storm ensued, prompting Greenland's new left-wing government toreverse legislation that had been in place since 2013. The government changed laws specifically to prevent Kvanefjeld from going ahead.

Kvanefjeld was supposed to be part of the solution for Greenland's financial challenges, but it could now become the territory's financial death knell instead. Energy Transition Minerals has initiated a legal case against the governments of Greenland and Denmark, claiming damages of USD 11.5bn (backed up by a report from a Canadian company that specialises in providing expert opinions on such legal claims). When it comes to the size of an arbitration claim relative to the entire economy of the host nation, this case is probably without equal.

The international "Investment Court System" is not something that many members of the public would take an active interest in, but it has created a niche that some investors have made billions of dollars from. It's the set of rules through which foreign investors can sue sovereign nations if they have been wronged in the context of their foreign direct investment. They can do so in the courts of the country where the investment took place, or they can take it through international arbitration mechanisms. They can also go to national courts first and then use arbitration mechanisms provided elsewhere.

The system is very complex, and in this complexity hides the occasional investment gem.

Statistics about this sector are difficult to obtain, because many such claims are resolved behind closed doors. Still, some statistics are available. Over the past 21 years, over USD 113bn have been paid from states to investors courtesy of cases that went into arbitration.

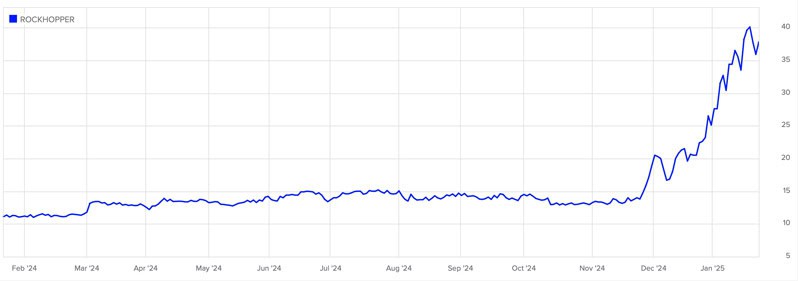

One such case will be familiar to Undervalued-Shares.com Lifetime Members: Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH), a London-listed oil explorer that originally started in the Falkland Islands but then temporarily invested in Italy. The Italian government did not deliver on its legal obligations to the company and closed down the exploration project. Rockhopper Exploration felt wronged and eventually got awarded EUR 160m in damages. This provided a major financial boost for its plans to get back into the Falklands oil business, now that this industry has woken up from its multi-year slumber. The stock recently went vertical, and tripled from 13 pence to 39 pence in just eight weeks. This happened in no small part because of the money received from the arbitration award.

Rockhopper Exploration.

A worthwhile series of articles about this entire subject was published by Inside Climate News, where a former commercial litigation specialist works as reporter.

Source: Inside Climate News, 14 January 2024.

Without a public register of such cases, it's difficult to assess how many of them prevail. One often-cited study from 2012 concluded that out of 244 cases analysed, 42% were decided in favour of the host state, 31% in favour of the investor, and 27% settled out of court. Given that in a settlement out of court, most investors get paid a percentage of the damages claimed, it suggests that about half of these cases end with at least a partial win for the investor.

Over the past 15 years, so-called litigation funders have discovered such claims as a highly profitable niche. Litigation funders finance legal cases on behalf of a claimant in exchange for a percentage of the claim if the case is won. The biggest such litigation funder is Guernsey-based Burford Capital (ISIN GG00BMGYLN96, UK:BUR), which claims to have delivered a win or partial win for 92% of its cases.

Burford Capital's biggest claim to fame is the so-called Petersen/YPF case. In 2015, the firm spent USD 18m on acquiring a legal claim against the government of Argentina, stemming from the country's effective expropriation of shareholders of NYSE-listed YPF (ISIN US9842451000, NYSE:YPF). This was a highly complex case, which required fronting legal bills in the hundreds of millions.

In 2023, Burford Capital won the case and was awarded USD 16bn in damages. That is 888x times what it had paid for the claim – not counting legal costs, though. Additional interest is now accumulating while the payment has not yet been made by Argentina, meaning another two million dollars are added each day. Along the way, Burford Capital sold parts of its claim at a higher valuation to financial investors, thereby recouping its investment and getting cash for the legal case while retaining the remainder of the claim.

How much money Burford Capital had invested in the case and what amount it will realise at what point remains unclear, not the least since Argentina is trying to context the ruling. However, it's probably fair to say that Burford Capital will have made at least over 100x on its investment.

Politicians don't like being held to account for not adhering to laws, and they can make it difficult to file claims against them. Still, if enough money is at stake, even sovereign nation-states can be brought to heel.

Inside Climate News recently covered this lucrative niche within public market investing in its long-form article "How to Buy a Piece of a Lawsuit and Impoverish a Country".

As the headline makes clear, these outsized returns attract public attention because of the impact they can have on nations where politicians or government bureaucrats cause such problems to arise.

The claim that Energy Transition Minerals has brought against Greenland could soon get yet more attention, and primarily for the fact that it could bankrupt the 56,000 Greenlanders.

An island of superlatives

Greenland is an unusual case of a "country".

Technically speaking, Greenland is an autonomous territory of the Kingdom of Denmark. Initially settled by indigenous people from Alaska and Canada as far back as 4,500 years, the island became associated with Europe in 986. In 1953, it became integrated into the Danish state under the constitution of Denmark. Somewhat counterintuitively, Denmark didn't actually "claim" Greenland – it was called upon by the United Nations to administer a territory that at the time had no governance structure in place and was inhabited by perceivedly "primitive" people.

In 1979, the Danes granted limited home rule to Greenland, i.e. Greenlanders were allowed to operate their own government for specific areas (while Greenland remained responsible for others). This was the first step towards becoming an independent nation eventually. In 2009, the freedom given to Greenland under home rule was extended. For now, though, Greenland is an Overseas Territory of Denmark rather than a country.

Within this complex set-up and history sits a rather unique treasure. Greenland is one of the most resource-rich territories on the planet. This is also owed to Greenland's size: it is the world's largest island that is not a continent. It's ten times the size of the UK. With just 56,000 residents, it's also the least populated self-governing territory on Earth.

Source: The Economist, 31 October 2024.

In 2006, an Australian mining entrepreur, Roderick McIllree, floated what was then "Greenland Minerals & Energy" on the Australian Stock Exchange. In 2007, the company secured an exploration for Kvanefjeld, even then already known as the world's second-largest deposit of rare earth minerals and the sixth-largest deposit of uranium.

However, Greenland Minerals & Energy faced one major hurdle, and one that was known by investors from the outset.

When the company surfaced with the idea of exploring the area again, it was done primarily with the idea of exploiting so-called rare earth elements (REE), also called rare earth metals. These are increasingly used in electrical and electronic components, lasers, glass, magnetic materials, and industrial processes.

By founding Greenland Minerals & Energy and acquiring the Kvanefjeld exploration license, McIllree created an entity that could single-handedly make a significant difference for securing the Western world's access to REEs.

His company did have to swallow a toad, though, at least initially. It was fully understood by everyone at the time that the REEs of the Kvanefjeld resource would come with a certain percentage of radioactive materials as by-product. This was relevant as Greenland had banned the production of radioactive materials at the time, even if they were only a by-product of extracting other resources. Greenland Minerals & Energy made a move on a potentially very worthwhile resource, but regulation concerning the inevitable by-product rendered it impossible to actually put these resources into production.

Until the developments of 2011-13, that is.

The local parliament of Greenland had received additional self-governing powers in 2009. Shortly thereafter, it voted to grant permission to produce radioactive materials under certain conditions. This legislation was specifically passed to give Greenland Minerals & Energy the green light to go ahead with the Kvanefjeld project, which Greenland saw as its get-out-of-jail card – quite literally, given that it remains tied to colonial rule.

The company subsequently had to struggle through a period of low commodity prices and difficult fundraising conditions, but in 2020 got ready to start preparing for production.

At that point, the winds of politics had changed again, and violently. A civic movement headed by a resident of the village near to the Kvanefjeld project started to lobby against the mine going ahead. The issue turned into a public firestorm. In April 2021, the green-leaning Inuit Ataqatigiit (Community for the People) party won the territory's elections with 37% of the votes and appointed a new prime minister.

The new administration moved on to change legislation, effectively barring the company from progressing to production.

Greenland Minerals & Energy claims that it was wronged by the government of Greenland. According to its interpretation of the legal situation, Greenland was not entitled to retroactively change the rules. In turn, it feels that it fulfilled all deliverables that entitled it to switch its exploration license to a production license.

The company has since not just filed a legal claim, but it has also rebranded as Energy Transition Minerals. The new name is also to underline its potential major role in enabling the policy goals of certain nations that plan to transform their energy sector. The company wants to get across that even though mining is always an extractive industry, it could do a world of good by producing in Kvanefjeld. Besides, it insists on its legal rights, as any individual or company would do.

Not just the legal team at Burford Capital, but also some legal experts in Denmark believe that Energy Transition Minerals has a case.

Did Greenland shoot itself in the foot?

The risk of Greenland losing the case was highlighted in a long-read article in Danwatch, an award-winning Danish independent media and research centre specialised in investigative journalism on global issues:

"Experts warn that Greenland is gambling with its own future

Poul Hauch Fenger is a lawyer with expertise in international law.

As a lawyer, he has had insight into several arbitration cases and believes that from the outside it seems as if Greenland has adopted the new uranium law in an attempt to stop the mining project in Kvanefjeld.

In his opinion, this creates a 'Gordian knot' for Energy Transmission Minerals, because the mining project has been organized according to an existing legislation and is now suddenly presented with a completely new and stricter legislation.

'With the proviso that I do not know the finer details of the case, I would say that the existing legislation must be stronger than the new legislation. Therefore, my immediate thought would be that mining company has a good case', he says, also issuing a warning to Greenland: 'When companies consider throwing millions or billions of dollars into a project, they do so based on the expectation that their investment will be returned. But if they can see that the political climate means that a new, blocking legislation can suddenly be adopted, they could find themselves on thin ice and become very reluctant to invest,' says Poul Hauch Fenger.

Former Deputy Director of the research institution GEUS (Geological Survey of Denmark and Greenland) Flemming Christiansen agrees. He believes the case presents Greenland with a 'credibility problem'.

'As a matter of principle, you don’t legislate retroactively, as I believe has happened here. Previously, it would have been the case that you would automatically get an exploitation license if you had first obtained an exploration license and at the same time met the requirements laid down,' says Flemming Christiansen."

Another valuable piece written about the case is an article by three legal experts led by Jacques Hartmann, Professor of International Law at Dundee Law School, Scotland. The article does not draw a clear conclusion but it shows how the case has similarities to favourable decisions made elsewhere while also facing a set of hurdles and unknowns.

Obviously, if the case was entirely clear-cut, the share price of Energy Transition Minerals would no longer be trading on its current level.

Overall, it appears that the case will be coming to a head soon, and it'll all be set within the much broader context of Greenland trying to chart out its future. It's also seemingly a case with a lot of merit. For Greenland, going into this legal case is a major risk, and one that could even kill its dream of eventual independence.

It's notable how the share price got moving exactly when Trump won the election. Is this the opportunity that Trump, author of "Trump: The Art of the Deal", has spotted?

Will the Greenlanders realise the tight spot they might be in, and proactively negotiate instead of waiting how things will pan out?

There is much to speculate about.

A reality check for Greenland – and negotiating leverage for the US

Interestingly, in principle all seven of Greenland's political parties back mining.

The territory of 56,000 people is wealthy in some ways, with an average GDP per capita of USD 57,000 – higher than that of Germany or Canada.

On the other hand, half (!) of Greenland's government budget consists of the annual handout from Denmark. Greenland's people are currently dependent on welfare for survival. Also, sustaining a decent lifestyle is extraordinarily expensive in such an extreme territory.

Greenland has barely any infrastructure, and any infrastructure development will come with a much higher price tag given the remoteness of the territory. In fact, historically these extreme conditions have long held back the development of resource extraction.

Source: Springer Nature Link (paywalled).

Even its government doesn't have enough resources. E.g., the government's planning department needs to oversee hundreds of licenses with just 16 staff members. In a territory that has zero unemployment and where educated young people have a high likelihood of leaving, it's not easy to build the necessary capacity to run a successful economy (or government).

Territories that are stuck in such a tight spot can easily enter a doom-loop. Demographics have already taken a turn for the worse. In the village that is located near Kvanefjeld, the population has shrunk from 2,000 to now 1,500 since 1991. At the going rate, Greenland could become a dying nation before it has even become one.

There is a strong consensus in Greenland that the territory should eventually achieve full independence. However, an island where half of the insufficient government budget is dependent on the former colonial power does not have that great a prospect for achieving independence.

Fishing can be part of the answer, given Greenland's vast territorial waters.

Tourism can also be part of the answer, but requires more infrastructure to be funded first.

Source: The Times, 12 December 2024.

Mining is widely recognised as the only industry that could bring in enough money to help Greenland become a viable sovereign entity.

Too bad, then, that one of Greenland's highest-profile and most advanced mining projects had its lights blown out by the government – and with a potential multi-billion dollar claim now coming the way of Greenland's treasury.

All the while, China has been trying to take a stake in Greenland, and Russia is close by.

It's one thing to make public statements about wanting independence; it's another thing entirely to pay for it. This includes having a military, which so far the Greenlanders didn't even need to put into their budget.

Would Denmark come to Greenland's rescue if the Kvanefjeld legal case brought the territory to its knees financially?

Greenland's politicians knowingly broke a contract with a mining investor. If they then asked to be bailed out, it would not likely to go down well with Danish voters.

It could well lead to a watershed moment and Denmark saying "enough is enough".

How exactly could a deal look like? This is what I investigated in my 2 January 2025 report on Energy Transition Minerals. It's a report that was exclusively published for Undervalued-Shares.com Lifetime Members, but given how much the share price has already moved (up from AUD 0.039 to AUD 0.079 currently), I am now making this report available as a free download.

If you found this case captivating until here, I recommend you read the entire report as it includes a lot more fascinating details.

There is one additional piece of reporting that I want to share with you – a brief conversation with David Mamadou, CEO of Energy Transition Minerals, a few days ago (on this note, I'd like to stress that the company never requested my reporting nor paid me for it).

The share leaps – and the company reacts

Following the election of Donald Trump, investor interest in Energy Transition Minerals increased immediately. The stock price started to get moving the day the election was decided.

Energy Transition Minerals.

Using this momentum, the company decided to carry out a small share placement to raise AUD 9.35m. It placed a combination of shares and warrants at a price of AUD 0.068. The placement was accompanied with the publication of an updated corporate presentation, which also refers to the new situation created by Trump. Clearly, Energy Transition Minerals is all too aware of its potentially unique position.

What does David Mamadou have to say about this? Here are our key talking points.

Swen Lorenz: Are you able to provide a bit more colour on what type of institutional investor was interested in this placement, and maybe even name one or two such investors who have now come onboard?

David Mamadou:While I can't comment on specific names, I am pleased to say that the private placement was strongly supported with wide participation from long-term strategic investors, hedge funds as well as high-net-worth individuals. The geographic spread covered Australia, New Zealand, Singapore, Hong Kong, UAE as well as USA.

Swen Lorenz: Are you planning to reach out to the US government as well? If so, what could be your objective in doing so?

David Mamadou: We are working at every level to resolve the issue. We are supported by experienced negotiators who are skilled in conflict resolution such as Julie Bishop, who was Australia's foreign minister from 2013 until 2018, a period which partly coincided with US President Donald Trump's first term in office. We have also strengthened and refreshed our board of directors with the addition of experienced mining executives Simon Kidston as non-executive Chair and Aris Stamoulis as a NED, and earlier this year we welcomed Svend Hardenberg in Greenland as General Manager. In our upcoming trip to Greenland, we plan to meet with the Greenland regulatory authorities and to deepen our connections with the community in Narsaq and the workers association of Greenland, and the business community at large. Our focus remains to find a path to the development of this project which is strategic, not just economically but also geopolitically for Greenland.

Swen Lorenz: How would you summarise the reaction of the investor community to the news of the past weeks?

David Mamadou: The investment community seems very positive at the moment on Greenland's future prospects given its vast mineral wealth and the current geopolitical climate; an investment in ETM is one way to secure exposure to this compelling thematic. In addition, our current depressed valuation, due to the ongoing legal proceedings, could be seen as providing an attractive risk-return investment proposition.

Following these developments, how could all this work out for shareholders?

Seizing up the upside for shareholders

The bad news first, it's currently almost impossible to establish a price target with any degree of precision:

- Energy Transition Minerals would have to share the damages awarded with its litigation funder, and the details of this agreement are not known.

- If the company regained control over the project, it would probably involve a degree of renegotiating the economics with the government of Greenland.

- The usual situation of the exploration company yet having to raise the funding for constructing the mine operation adds another layer of complexity.

It is, however, entire feasible to make a judgment on the order of magnitude of the stock's potential upside.

In 2020, when Energy Transition Minerals seemed near the end of its preparatory phase, the company had a market cap of around AUD 500m.

Following its IPO in 2006, it reached a market cap as high as AUD 2bn.

With now 1.54bn shares outstanding, the company currently has a market cap of AUD 120m (USD 75m).

Valuing such litigation claims is an art and a science. Energy Transition Minerals is currently valued at just 0.65% of its USD 11.5bn claim. Even at an early stage, claims of this type would typically trade at no less than 1% of the total. Once a case really gets rolling, it can trade at 2-5% of the claim.

The fact that USD 11.5bn translates to many times the current share price even when factoring in some dilution and splitting the proceeds with a litigation financier, has already gotten some investors interested. Even after sharing the spoils with Burford Capital, there is a HUGE arbitration claim that investors can currently buy into at a valuation that is lower than what comparable cases would trade for at this stage. It's the sort of opportunity where many investors will want to chuck in USD 1,000 or 5,000 just to be part of it, and with a potentially significant pay-off even in absolute terms if the investment case does come together in some shape or form.

However, one can also argue that Energy Transition Minerals' claim of USD 11.5bn is somewhat inflated. The case also remains at an early stage, e.g. there are still arguments about jurisdiction.

Besides, the company doesn't actually want to be paid off. It wants its license reinstated, so that it can continue to develop the actual resource.

How do you value such a case?

It's impossible to say at this stage.

The upside seems to be huge, though, no matter how you turn it.

Which is why Energy Transition Minerals is likely to continue waves of speculative interest, depending on the latest headlines about Greenland. Needless to say, this can also lead to momentous down-days when reporting is turning negative.

Strong retail following

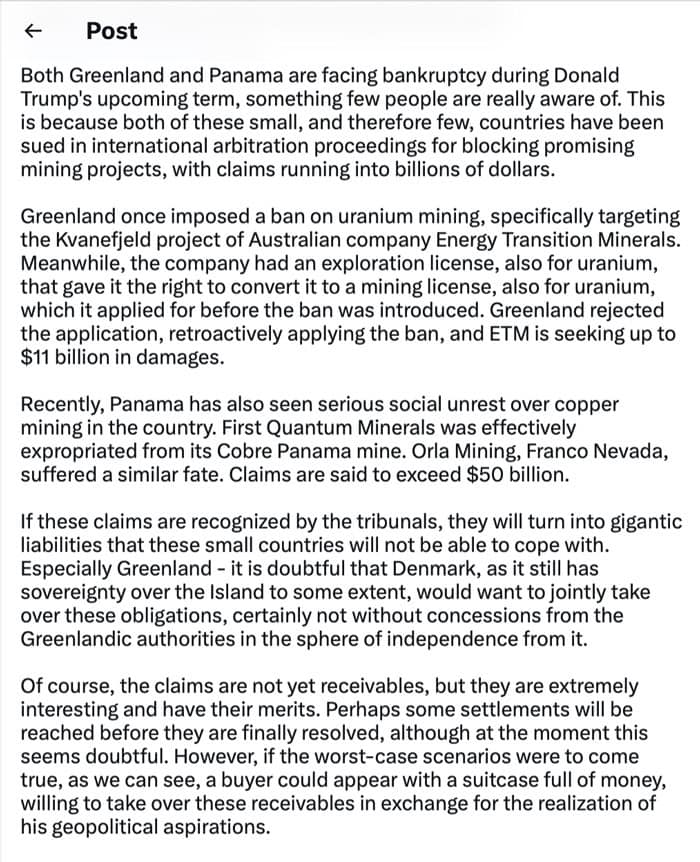

Even before the recent increase in interest, Energy Transition Minerals had over 6,500 shareholders. Interest among FinTwits is also seemingly growing. Polish FinTwit Marcin Michalek, who frequently comments on mining disputes around the world from an investment perspective, provided a brief summary of the same idea presented in my research report. His 24 December 2024 tweet about Energy Transition Minerals, Trump and Greenland got 110,000 views.

Source: Twitter account of Marcin Michalek (posted 24 December 2024, auto-translated from Polish).

The subject is also actively discussed on HotCopper, an Australian chat board for investors.

Will the interest continue to grow?

After a look through Greenland-related stocks, it appears that Energy Transition Minerals has the most interesting background story.

Since October 2024, it also involves one of Greenland's most respected businessmen and former political advisors, Svend Hardenberg, who joined Energy Transition Minerals as strategic advisor to the board.

It all makes you wonder, could Energy Transition Minerals even try to get close to the new US government? Could it eventually appear more visibly in the ongoing public discussions about Greenland?

I was eager to get a second opinion, and thus caught up with my friend Cody Shirk, a US-based geopolitics expert who often gets invited to speak at investor events about opportunities in remote, exotic and difficult parts of the world. Cody also recently wrote about Greenland on his website, and summarised his views in the brief 14-minute video below.

How does it all stack up from your perspective?

For the avoidance of doubt, this Weekly Dispatch (and the longer research report) does not predict that any of this will unfold. I leave it to you to judge if this is a case of adding two and two together, or not.

However, if Energy Transition Minerals did make international headlines eventually, be sure to remember where you read about it first!

Podcast: The Value Perspective with Swen Lorenz

What's Weird Shit Investing all about?

On The Value Perspective podcast, the Value Team at Schroders and I take a closer look at this conference, which had its inaugural edition in 2024. How did it come about, and what's in store for 2025?

We also reflect on the concept behind Undervalued-Shares.com, and what makes it stand out from other investment blogs.

Podcast: The Value Perspective with Swen Lorenz

What's Weird Shit Investing all about?

On The Value Perspective podcast, the Value Team at Schroders and I take a closer look at this conference, which had its inaugural edition in 2024. How did it come about, and what's in store for 2025?

We also reflect on the concept behind Undervalued-Shares.com, and what makes it stand out from other investment blogs.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: