Westminster is in chaos, and many "experts" continue to predict doomsday scenarios for the UK. Yet, the one company that is very closely associated with Britain's integration into the EU project continues to rally on the stock market.

Back in October, I pointed you towards Paris-listed Getlink SA (FR0010533075), the company that owns and operates the Eurotunnel under the British Channel. As I wrote back then, the share was significantly undervalued. Relative to its future earnings and the value of its assets, it was cheap.

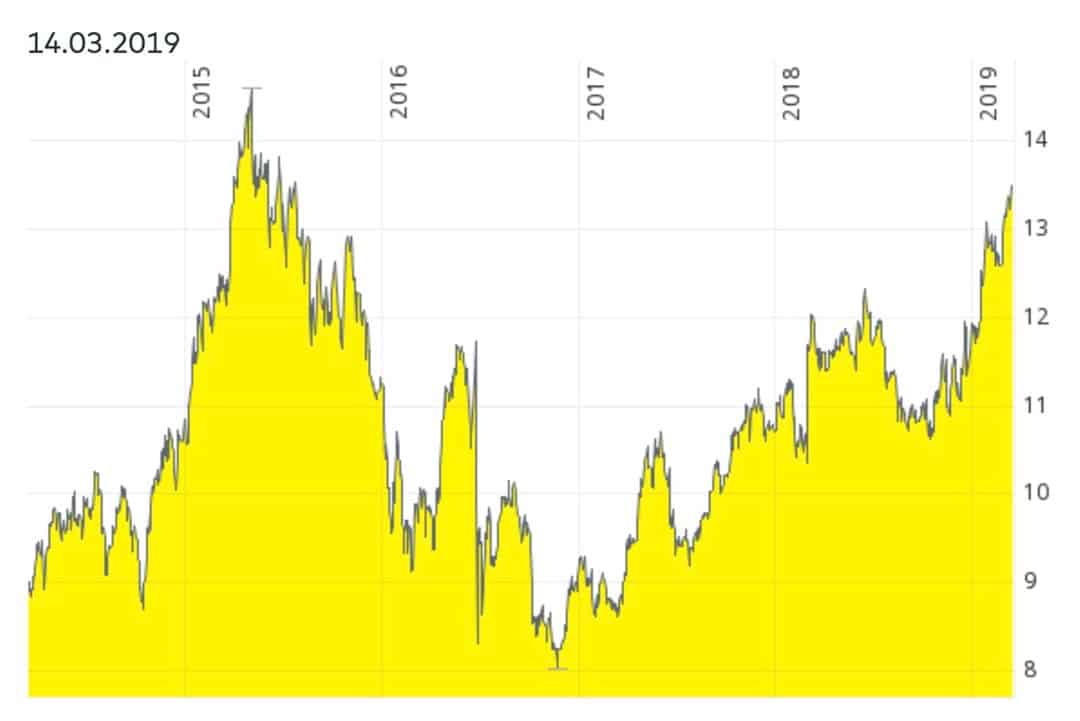

Since then, the share has risen from EUR 11.10 to now EUR 13.38, up 19% in four months. During the same period, Britain's FTSE 100 index rose only 3%, and France's CAC 40 index gained just 7%. The share is now within reach of its ten-year high of EUR 14.43, a level that it had last traded at in 2015. That's quite an outperformance of the broad market.

How is that even possible, given the uncertainty Britain faces?

One company's reality check about Brexit

In this particular case, it seems that the reality on the ground is quite different to what most politicians, pundits, and other interested parties would like you to believe.

All of this is nicely summed up in the recent investor presentation published by Getlink, which I recommend anyone with an interest in the subject spends some time reading.

Will there be complete chaos for Eurotunnel if a No Deal scenario unfolds? Getlink's management has held over 500 meetings with government representatives to analyse and plan the situation. It believes that annual passenger numbers would not change at all, and that friction during the transition period would be "minor." It also assumes that changes to border control processes could be made quite quickly.

The company does hope for a Withdrawal Agreement to be signed as the most desirable scenario. But it has come to some interesting conclusions during its analysis of the subject. E.g., historically, two-thirds of Eurotunnel traffic have zero correlation to the GBP/EUR exchange rate.

Getlink has also quantified the estimated costs caused by Brexit. If a deal for Britain leaving the EU was agreed, it'd expect expenses of approximately 1% of 2019 revenue. If no deal were agreed, the one-off costs would come out at an estimated 2% to 2.5% of 2019 revenue.

It's not zero, but both figures are a mere ripple in the current long-term growth of the company. Also, much of this has been provisioned for already.

The stock market as an early indicator of the future

The invisible forces of the market tend to have a reasonably good insight into what's lurking beyond the horizon.

Getlink's value has been rising because investors have recognised some powerful long-term trends, including:

- The ever-increasing demand for fast freight delivery, making Eurotunnel a winner in the age of e-commerce.

- Modern travellers prefer high-speed trains to other transport, leading to ongoing passenger growth.

- The 2020 launch of Getlink's new electricity cable through the tunnel, a EUR 453m investment that will enable trading energy between the UK and France and start to generate results from next year onwards.

- Ongoing debt repayment and decreasing interest expenses, which enables gradually rising dividends to shareholders. Just as expected, the company has recently raised its dividend payment. It even managed to up the dividend a bit more than expected.

Politics can temporarily interfere with such long-term trends, but it can hardly stop it.

In my October 2018 column, I pointed out that Getlink has a unique feature which makes it a much more valuable and safer investment than most other infrastructure investments. Because of agreements that were made during an earlier debt restructuring, the company has an unusually long concession for the tunnel. Its license to operate the tunnel expires in 2086, not in 2042 as had been planned initially.

Plus, as it turns out, the market just doesn't buy into the noise generated in Westminster and Brussels about flesh-eating bacteria raining down on Britain on 29 March. Instead, the market has refocussed on Getlink's projected long-term growth. Between now and 2022, the company is likely going to generate consistent, significant earnings growth. It's a veritable cash-cow, if ever there was one.

Watch out for my next research report

Getlink is also a lesson why stinginess can lead to missing investment opportunities.

Much as I wrote extensively about the share's low valuation, my original article also stated that I'd rather wait for potential market turbulence to get the share price down even further. With that in mind, I've missed the train leaving the station. No pun intended.

Though I would always generally be cautious when buying an investment, and think hard whether there'll be another opportunity to buy during a dip. This time, it didn't work out. But there'll be other times where it will.

Missing a good investment isn't too dramatic a mistake, because there'll always be other opportunities. After all, there are more than 50,000 publicly listed companies available to you worldwide.

One of them will be the subject of an extensive research report that I am going to send to my members soon. I am going to put the finishing touches to the report this coming weekend.

New opportunities beckon, and I am keen to get some of them in front of my readers soon. If you want to receive them the moment they are published, do sign up to my Membership Programme, which is a mere $49 per year. That's about 1/10 of what other such services charge, and probably is among the best value you can find among similar research services.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Want to receive my next research report on the day it is released?

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Updates on previous research reports

- 2 special publications per year

P.S.: I just released my latest in-depth report about what I consider to be the best equity opportunity in Germany - Porsche SE! Available for Members only so sign up now to get immediate access.