A new generation of flying vehicles was supposed to bring cheap, quiet, and safe air transport in dense urban areas.

Goodbye, traffic jams.

Hello, "electric vertical take-off and landing" (eVTOL) aircrafts.

The Paris 2024 Olympics were supposed to see the first commercial service of this nature. Announced with huge fanfare over a year before the games, the exercise eventually had to be cut down significantly. In the end, we only saw demonstration flights in limited areas with only the pilots onboard.

Unsurprisingly, eVTOL stocks are currently down between 66% and 95%.

Is now a good time to take a closer look at them?

Source: The Next Web, 8 August 2024.

A short primer on an exciting industry

eVTOL sounds like a buzzword invented in Silicon Valley, but it's actually a term coined by the European Union Aviation Safety Agency (EASA).

In 2016/17, a series of technological advances involving batteries and light materials converged with the era of cheap capital, which catalysed the emergence of a new sector within aviation. The idea of mass transport based on small, urban aircraft had been around for decades, often summarised under the idea of a "flying car". During the second half of the 2010s, 400 new start-ups tried to turn this dream into reality. Clearly, there are many geeks and tinkerers out there.

Jess Dixon's flying car idea in the 1940s (source: Wikipedia).

When this industry started to engage with EASA, it became clear that the latest generation of newly developed small aerial vehicles didn't fit into the existing regulatory categories. These were neither planes or helicopters, which is why the regulator created "vertical take-off and landing" (VTOL) as a new category. An "e" was added subsequently to reflect the fact that these aircraft are usually run with electrical power.

In 2020/21, several companies went public as special purpose acquisition companies (SPACs), supported by the general hype that fuelled tech stocks in general at the time.

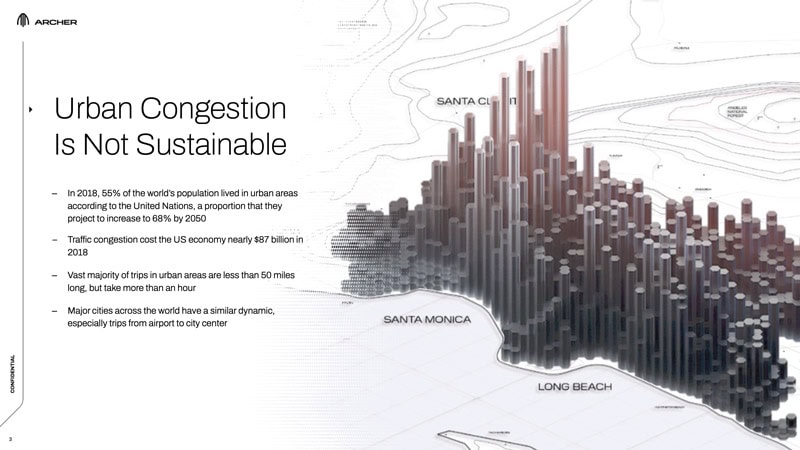

The economics seemed tempting. eVTOL aircraft were mostly planned to have a 20-50-mile range, ideally suited for airport transfers and other regional trips. Many niches exist for eVTOL operators to break into; e.g., to this day, there is no train that connects Britain's Cambridge with Oxford nor is there a direct motorway link.

Source: Archer Aviation, April 2023 Investor Presentation.

Estimates at the time assumed that 15% of all transfers to and from airports as well as 5% of longer-distance regional trips could eventually be replaced by a massive fleet of eVTOLs taking to the skies. This could create a market of USD 60bn annual revenue by the early 2030s. Given the seemingly large total addressable market, eVTOL companies raised several billions from investors.

It all sounded great, but for the investors who put money into the fashionable theme back then, it hasn't worked out yet. Rising interest rates, operational delays, and a cooling climate for pre-revenue tech companies made shareholder capital melt away. The following overview of major publicly listed eVTOL companies speaks for itself.

| Company | Market cap (USD) |

Loss since record high |

| Lilium | 466m | -95% |

| Vertical Aerospace | 182m | -94% |

| EHang | 744m | -90% |

| Eve Holding | 740m | -78% |

| Blade Air Mobility | 214m | -78% |

| Archer Aviation | 1.3bn | -75% |

| Joby Aviation | 3.5bn | -66% |

However, it did appear in late 2023 that 2024 might just be the year when these companies finally take flight:

- In its widely followed report "Travel Trends 2024", Amadeus IT Group, a global software specialist for the travel and tourism sector, highlighted eVTOLs as a "key emerging trend".

- In December 2023, "Transforming World: We saw the future", an extensive report by Bank of America Securities, concluded "Electric Aviation: Sooner than you think!"

- In September 2023, no lesser person than Sir Stephen Hillier, chairman of Britain's Civil Aviation Authority (CAA), predicted the "widespread adoption" of flying taxis as part of a "quiet revolution". Sir Hillier pointed towards "the first commercial flight in an electric vertical take-off and landing aircraft due at the Paris Olympics next year", and said the industry was at an "inflection point".

Notably, the stocks of the industry's two leading companies, Joby Aviation (ISIN KYG651631007, NYSE: JOBY) and Archer Aviation (ISIN US03945R1023, NYSE:ACHR), rallied towards the end of last year. 2024 looked so promising!

Joby Aviation.

Sadly, the much-awaited milestone and publicity stunt of seeing Emmanuel Macron fly around Paris in an eVTOL didn't materialise. Why not? One particular technical part for the eVTOLs produced by Germany's Volocopter (privately held) wasn't ready in time, which is why the regulator didn't allow it to go forward. Or so they say. Other reports spoke of the vehicle not meeting the promised noise limitation.

Once again, it's jam tomorrow for the backers of this industry. Cynics would say that this has been the ongoing summary of the entire industry ever since the concept of flying cars first came up decades ago.

Unsurprisingly, compared to the recovery experienced at the end of 2023, the stocks of these companies have yet again lost ground.

Have we reached true capitulation territory yet?

A tempting dream to back

eVTOLs are a fashionable subject, and I have to admit that I have my own non-investment reasons to investigate the subject.

As an avid traveller who likes to optimise his schedule down to the last minute, I'd love to have such a service in more locations.

In France's Nice, you can hop onto a helicopter to reach Monaco in seven minutes instead of an hour by taxi. A scenic ride past Cap Ferrat is thrown in for good measure.

In New York's JFK airport, you can fetch a heli ride with Blade Air Mobility (ISIN US0926671043, Nasdaq:BLDE) and save yourself from the ever-worsening traffic jams that are involved with getting into Manhattan these days.

In both places, the heli transfer is easily booked through the Internet and relatively affordable.

The concept sure beats the alternative of fetching a conventional taxi, provided you don't have heaps of luggage and place at least a bit of a premium on your time.

The problem is that helicopters have never proven a scalable business. Sexy as they are, helicopters are also notoriously:

- Loud.

- Unsafe.

- Expensive.

There is a lot of opposition everywhere against helicopters, and both safety issues and costs also limit their use.

eVTOLs could finally help the transport industry overcome the shortcomings that prevented helicopters from getting more widespread usage.

eVTOLs do promise a leap forward:

- 100x safer than helicopters.

- As quiet as a car driving at 30 miles per hour.

- Priced somewhere between cars and helicopters, depending on which estimate from a very broad range of estimates you choose to believe.

I have long followed eVTOL stocks from afar. My gut feeling had been that the publicity stunt planned for the Paris Olympics would fail amidst the all too frequent technical and operational delays that come with any such emerging industry. However, I also always believed that eventually, worthwhile technologies that are backed by billions of investor capital do succeed. Would now be the time to get my hopes up regarding improved urban mobility, potentially combined with a contrarian investment opportunity hiding among bombed-out eVTOL stocks?

Obstacles and challenges

The eVTOL sector has had such a wide following among investors because its products will be applicable to daily life. It's also quite simply a fascinating technology that you can spend hours and hours learning about in a playful and entertaining way. In this day and age when investing is a lot about themes and dreams, what's not to like?

For a start, eVTOLs come as distinct vehicle types: multicopters, lift plus cruise, tilt rotors, and ducted fans. To research this article, I could easily have set aside a few days to watch every single video published on the excellent YouTube channel eVTOL innovation.

Source: eVTOL innovation.

Tellingly, this particular channel added its last video over a year ago. After the massive hype that this industry experienced with millions of views for some of these videos, the public interest has waned of late. Observers have caught on to the mind-boggling number of challenges faced by companies across this industry.

While technical issues only play a minor part, companies have less control over issues such as:

- Politicians and the public disliking the idea of potential crashes in urban areas.

- Cities refusing to grant planning permission for "vertiports".

- Media and regulators playing up initial (inevitable) technical issues and deaths.

- A global lack of trained pilots even now, which will only be worsened if hundreds or thousands of new vehicles take to the sky.

- An initial lack of economies of scale, making public demand a difficult hurdle to overcome at a time when capital is no longer available at zero interest.

For each of these aspects, a complex sub-analysis needs to be done.

E.g., many marketing materials for eVTOLs reference the eventual "move to automated flights". What often gets lost in superficial discussion is the difference between automation and autonomy. The tech industry already had its moment of reckoning over driverless cars, which were promised for the early 2020s but are now once again estimated to be many years away – if they will ever come at all. One could argue that it will be easier to replace pilots in larger aircraft, as these aren't regularly operating around large buildings and densely populated areas. eVTOLs may end up adopting "automated flights" much later than commercial airliners.

To accurately predict the future course of this industry, one seemingly has to be an expert across multiple different aspects and sectors.

Now think of the challenge of being the CEO of such a firm and having to overcome all of these obstacles, while cash balances are melting fast. E.g., Joby Aviation has over USD 800m in the bank, but it's also burning through USD 100m a quarter.

Based on my initial sector analysis, I didn't get the impression that eVTOL technology was truly going to take off in 2024 – nor in 2025 or 2026, for that matter.

What I did conclude, however, is the following.

1. Consolidation and eventual winners

If there are two companies that appear best positioned to survive a wave of consolidation in the fragmented industry, it's Joby Aviation and Archer Aviation, with market caps of USD 3.5bn and USD 1.3bn, respectively.

The industry partnerships, track record, and order books make them stand out among the sector.

- Joby Aviation has received investment from Delta Air Lines (ISIN US2473617023, NYSE:DAL), and the company has the longest track record of advancing towards regulatory approval.

- Archer Aviation has a strong partnership and funding agreement with Stellantis (ISIN NL00150001Q9, Euronext:STLA), the EUR 40bn European carmaker. United Airlines (ISIN US9100471096, NYSE:UAL) has pre-ordered 100 of its eVTOL crafts.

Both of these companies are arguably in the lead for making the dream happen, and to catalyse a consolidation of the fragmented sector.

2. Different applications, jurisdictions, and asset classes

To judge the future of the sector, a new mindset might be needed about the applications and their geographical reach.

It's possible that firms will not so much operate a passenger service, but instead focus on lifting cargo from A to B.

Some parts of the world could find it easier to adopt a service for commercial use with passengers – such as the Middle East with its newly-planned cities, flat land, and relatively stable weather. China and other countries with absolute rulers could find it easier to certify such vehicles for flight, compared to Western nations where many stakeholders need to be satisfied beforehand. For a bet that is more geared towards the Chinese government really wanting such transport options, there is EHang Holdings (ISIN US26853E1029, Nasdaq:EH), which is now worth USD 750m after peaking at 10x that market cap in 2021.

Maybe our understanding about how these machines are powered needs to undergo a shift first. We may yet see technological innovation and disruption that changes the prospects of this industry. E.g., a few weeks ago, Joby Aviation pulled off a 561-mile flight with an air taxi powered by hydrogen.

Rather than a new means of mass transport, eVTOLs could emerge as a service to the wealthy in the type of limited enclaves that are springing up around the world. Think free cities, micro-nations, and large private estates introducing them. There may also be indirect plays to benefit from the scheme, such as buying up cheap land in places that are not currently easy to get to but where this type of technology could prove transformative for connectivity. Think buying deserted argricultural land in Monaco in the 1850s, when there was no easy land access to the principality, and visitors had to take a tedious boat trip from Nice – how that changed when a railway and roads were built. What could be a modern-day equivalent to investing in a landbank?

3. Value among rubble

The stocks of Joby Aviation and Archer Aviation may be down 66% and 75% since their highs, but other eVTOL stocks have lost even more.

Lilium (ISIN NL0015000F41, Nasdaq:LILM) was once dubbed the company that Elon Musk wished he had founded, but it's now down 95%, with a market cap below USD 500m.

Vertical Aerospace (ISIN KYG9471C1078, Nasdaq: EVTL) is down 94%, and its major industrial partner, Rolls Royce Holdings (ISIN GB00B63H8491, UK:RR) recently pulled out. The company is now valued at a mere USD 182m after once trading at nearly USD 3bn.

Both companies had many hundreds of millions poured into them, and their expertise as well as track record may yet have a value.

Vertical Aerospace has – at least in theory – an order book of USD 6bn. If the company's billionaire founder manages to turn around the situation, the upside of this bombed-out stock could be tremendous. How to tell if or when such a turnaround will happen? For now, the confidence of the billionaire owner, who keeps backing the company, is all you have to go by.

Source: The Times, 22 July 2024.

The dream will happen – one day

After spending a day looking at this sector, yours truly has concluded that his hope of quicker airport transfers is not going to happen quite as soon.

I just don't buy the promises – for now. Regulators and politicians having to be convinced. Lack of trained pilots. Small payload. Limited range. People not wanting to risk their life in oversized, experimental drones. Crowded skies.

It's more likely there'll be a few more years of missed promises and missed milestones. There won't be any quick scaling up to multi-billion operations that reinvent the very concept of urban air mobility. A few places may introduce them sooner, though, but that won't be enough to create an industry that generates the kind of predicted revenue.

Flying taxis are closer than ever – but likely still years away. Making these machines deal successfully and reliably with our complex world is a challenge far greater than may be apparent at first glance.

Given cash burn rates at the eVTOL companies, I'd expect more dilution rather than a massive, lasting turnaround. Even Joby Aviation and Archer Aviation are at risk of having to raise further funds at a valuation that existing shareholders may find contentious.

There could be exceptions, though. The share price of Vertical Aerospace could recover by a multiple if it managed to escape from its current crisis – it's very speculative, though and seems more like a wager. Joby Aviation or Archer Aviation may yet see a takeover bid from a larger firm that is eager to secure itself a strong position in the sector and add the promise of a generational shift in transportation to their own equity story. Stellantis already purchased Zipcar, the car-sharing company.

I love dreaming of this type of future, and it WILL happen at some point. Archer Aviation is promising to launch an air taxi service in 2025. As ever in such industries, the inflection point is only ever just around the corner.

However, all of these eVTOL companies have the grim reaper on their tail for now, given their cash burn rates and the market's lacklustre interest in supporting ever new funding rounds.

For now, I wouldn't bet my money on any of these companies even at today's much lower share price. The risk of dilution seems too high, relative to the potential pay-off.

For now, it'll still be taxis, trains, boats, and other conventional means of transport for me.

A niche play on a deal with Ukraine

A stock with more immediate upside if peace comes to Ukraine?

The latest report for Undervalued-Shares.com Lifetime Members features a stock that has 4x upside if a deal with Ukraine were made.

This investment depends on Russian equities becoming tradeable again in some shape or form – but if they do, this stock could move quite quickly.

In fact, it has already started to do so – but it's not too late yet to take a closer look.

A niche play on a deal with Ukraine

A stock with more immediate upside if peace comes to Ukraine?

The latest report for Undervalued-Shares.com Lifetime Members features a stock that has 4x upside if a deal with Ukraine were made.

This investment depends on Russian equities becoming tradeable again in some shape or form – but if they do, this stock could move quite quickly.

In fact, it has already started to do so – but it's not too late yet to take a closer look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: