Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

Falkland Islands – a star is born

Image by Vintagepix / Shutterstock.com

"Falkland Islands – the next big thing?", Undervalued Shares wondered in July 2024.

Over the past weeks, the share price of the best-known Falkland Islands play has gone vertical.

What exactly is going on?

Might there be another Falkland Islands stock that could soon head a lot higher?

The story that keeps following me

The Falkland Islands are a niche investment theme that I have been onto for many years.

In fact, it's probably one of my signature stories. The 142-page research report that I published in 2004 is something that I get asked about to this day. It's not often that equity investors remember a specific research report a full two decades after it was published.

At the time, I was the first to write about the archipelago's suspected oil reserves. I connected the islands' potential in hydrocarbons to a long-forgotten, colonial company listed in London. This company was a convenient way to get exposure to an exciting new investment theme.

I was proven right when the Falklands subsequently saw an initial boom in oil exploration. However, this boom fizzled out when the oil price fell off a cliff in 2014. The handful of Falklands-related oil plays that had IPO'ed during the boom collectively lost over 90%.

Subsequently, the whole matter went quiet. In 2020, Energy Voice doubted that anything would ever happen, using the term "stranded asset" to describe the situation.

I rather like forgotten, written-off assets! Most things come back eventually.

In October 2022, I got back onto the subject.

My Weekly Dispatch at the time headlined "A new oil boom in the Falkland Islands".

Undervalued-Shares.com Lifetime Members received a 35-page research report about the ONE Falkland Islands stock that I believed offered an "unusual, overlooked investment case with a potential multi-bagger return".

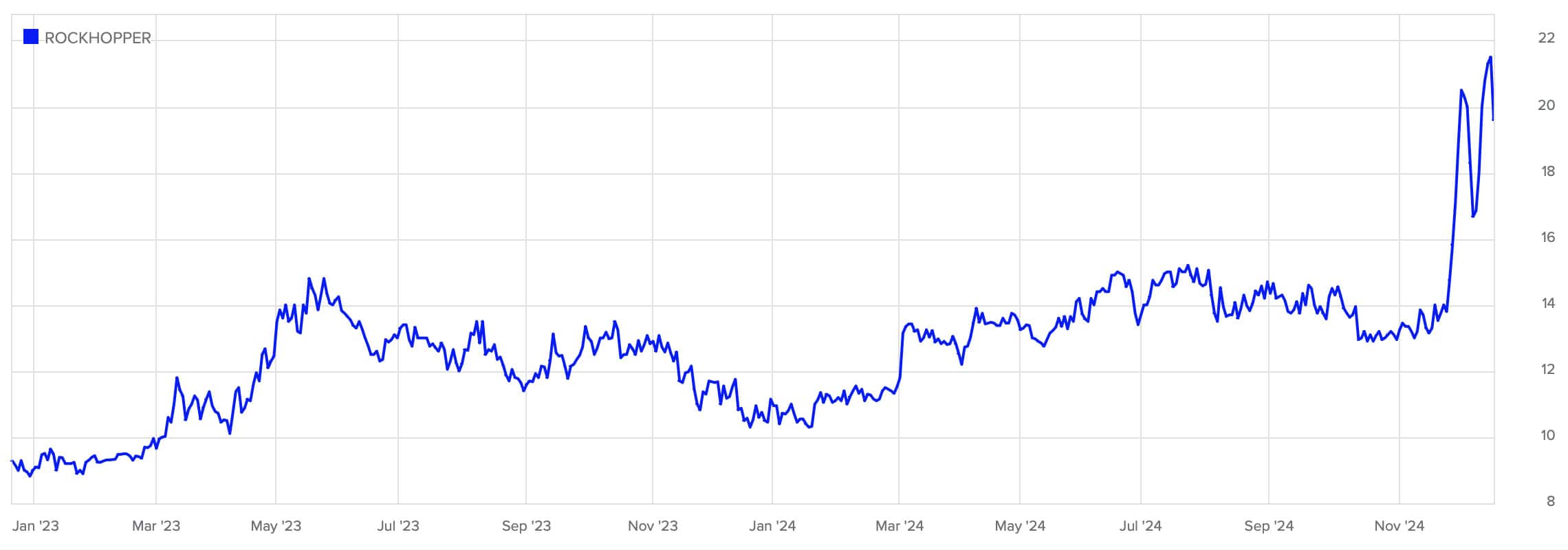

It's taken a while for the story to take off, but it finally has. After going sideways for the past two years, the stock has just risen 70% in the space of a week.

Rockhopper Exploration.

What happened?

The Falkland Islands oil story is back, and with a vengeance!

The blue-eyed sheiks of the South Atlantic

In case you didn't know, the Falkland Islands have a population of just 3,600. To put this in perspective, the islands' landmass makes it larger than Hawaii, which has 1.4m people.

To this day, the Falklands remain a so-called British Overseas Territory. They are internally self-governing, but the UK takes care of defence and foreign policy. Of course, this is the situation that led to the Falkland War of 1982, when Argentina invaded the islands to pursue its old territorial claim, only for a British task force to take the islands back militarily.

The Falklands have been doing well ever since. Besides keeping the islands safe, Britain's military presence also provides a significant influx of money. The islands also have abundant fish, especially squid. Exploiting the enormous amounts of squid that can be caught in the vast territorial waters has brought real affluence to the Falklands, and the locals are nowadays sometimes referred to as "squidionaires". The islands have even managed to build their own sovereign wealth fund, although they are keeping quiet about it for fear of upsetting the UK taxpayer. In any case, since the end of the war some 32 years ago, the islands have undergone an economic transformation, and the population has doubled.

Source: MercoPress, 5 July 2011.

How long the Falklanders will manage to keep their growing wealth out of the media remains to be seen. It's oil that will likely make the islanders truly rich. Potentially, it could turn them into one of the world's richest people. In my 2004 report, I had joked about "the blue-eyed sheiks of the South Atlantic", and the term could soon be justified.

The waters around the Falkland Islands are rough, deep, and far away from the rest of the world. As such, they didn't immediately lend themselves to exploring for oil and gas. Technology had to evolve for that to become possible, and higher energy prices also helped.

The Falklands' 776 islands and islets are surrounded by 4,700 square miles (12,000 square kilometres) of territorial waters, parts of which are easier to explore than others.

London-listed Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH) controls an area called Sea Lion, which lies at a relatively shallow depth of 450 metres (1,500 feet). Between 2012 and 2022, the company and its partners had spent over USD 300m on engineering and other non-drilling work relating to the Sea Lion project. This was a multiple of Rockhopper's market cap at the time and led to the discovery of 500m barrels of oil, 312m of which Rockhopper expected to exploit in an economic way.

Or so it thought…

The most recent wave of renewed interest in the islands' oil sector was kicked off when, on 25 November 2024, The Telegraph reported:

"Oil field under Falkland Islands even bigger than first thought

A giant oil discovery in the Falkland Islands is even bigger than originally thought, it has emerged.

An independent report into the North Falkland Basin has upgraded estimates of recoverable oil resources from 791m barrels to 917m – twice the annual output of the entire North Sea.

Rockhopper Exploration, the company planning to drill in the field, said it planned to extract 532m barrels, up from a previous estimate of 312m. Most of the remainder could be recovered under further plans.

The field, 136 miles north of the Islands, could have more than 1.2bn barrels of oil, according to Rockhopper, making it bigger than any left in the North Sea."

Better still, this is now finally ready to go.

The government of the Falkland Islands had to put certain measures in place before production could commence. One of the last remaining steps was to ensure that the local population was genuinely supportive of the undertaking. To this end, a public consultation was held.

From 2 July to 13 August 2024, a total of 25 representations were received from individuals, businesses and other organisations, including several departments of the Falkland Islands government. These representations were shared with Rockhopper and its partners, for them to respond to. The government has now given the green light to go ahead.

All of this can now be done without overt threats from neighbouring Argentina. Following Argentina's change in government, the country that once started a hot war with Britain over the disputed islands has adopted a more conciliatory tone. Under president Milei, we could even soon see the restart of direct flights from Argentina to "Las Malvinas", as the Argentineans call the island.

Source: Financial Times, 28 October 2024.

It's clear that the Falkland Islands will become an oil territory, and they will also get an infrastructure to match.

The coming deep sea port

Other significant developments have taken place.

On 7 November 2024, the Executive Council of the Falkland Islands government published a paper about setting aside land for building infrastructure to support the oil industry:

"The Sea Lion project will require onshore logistics and support facilities, for both the construction phase and throughout the life of the oilfield, currently estimated to have a 30-year production life

This will include both generic storage and laydown facilities, some specialist facilities such as a plant for generating drilling fluid (also known as the 'Liquid Mud and Bulk Facility'), a suite of workshops and engineering facilities, and some hazardous storage for bulk and hazardous chemicals."

The government set aside land for this purpose as long ago as 2014.

What's remarkable about it is that this port will be in addition to *another* port upgrade that the government had already signed off on separately.

In autumn 2018, the government had launched a tender for the construction of a new port in its capital Port Stanley, and with fairly ambitious capacity. This port project was officially launched to benefit fishing and tourism. With an estimated cost of USD 85m, it will cost about half of the Falklands' GDP.

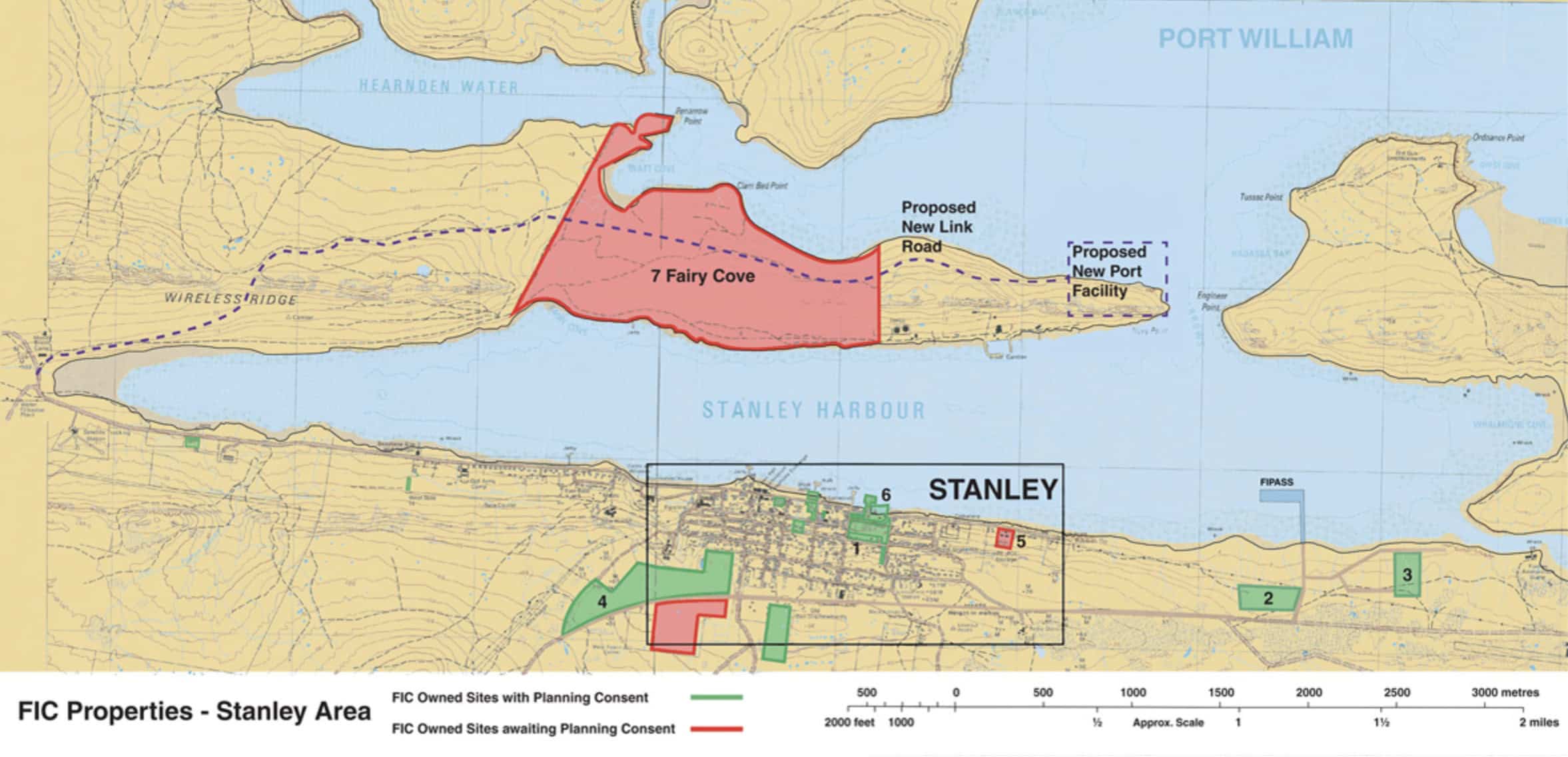

It speaks volumes that the Falkland Islands are now adding another harbour facility, and one that is specifically geared towards the hydrocarbon industry. This second port will be constructed in Port William, to the north of Stanley Harbour. The Falklands have started to beef up their level of ambition.

Click on image to enlarge.

Infrastructure investment on an unprecedented scale, different parts of the economy being beefed up to diversify beyond oil, and the build-out of facilities for the hydrocarbons industry – it all reeks of continued boom times for the Falkland Islands.

Which companies are going to benefit?

Besides Rockhopper, there is another interesting play.

In fact, sometime next year, this stock could also develop a dynamic all of its own. This is something that the company hinted at for the first time only on 19 December 2024, so you can take this Weekly Dispatch as a particularly timely report.

Falkland exposure with a twist

The oldie but goldie among Falkland Islands-related stocks is FIH Group (ISIN GB00BD0CWJ91, UK:FIH). When I first reported about this company two decades ago, it was called Falkland Islands Holding (hence "FIH") and represented the only way to invest into the islands through public markets.

Among other assets, it owned 100% of The Falkland Islands Company ("FIC"), which was granted its Royal Charter in 1852 to settle, develop, and exploit the Falkland Islands. Locally, FIC's main areas of activity embrace:

- Retailing (including food, clothing, electrical goods, and home furnishings)

- Residential and commercial property

- The sale and hire of 4x4 vehicles

- Travel services including flight bookings

- Airport transfers and luxury coach and walking tours for tourists

- Insurance agency services for cruise ships and fishing vessels

- Freight and shipping services to and from the islands.

In short, residents and tourists alike will struggle not to spend some money with FIH Group's subsidiary while on the Falklands.

The problem has been that FIH Group had become a strange hotchpotch of activities that extends beyond the shores of the Falkland Islands.

In 2004, the company spent GBP 7.5m to acquire the Portsmouth Harbour Ferry Company. This is a business that firmly controls its particular niche, but it lacks scale and growth prospects.

In 2008, FIH Group spent GBP 10.3m to acquire Momart, the world-famous art logistics and storage company. Momart is an interesting niche business with an excellent brand name and it resides in a valuable piece of London real estate, but it has nothing to do with the Falkland Islands.

Which investor ever woke up in the morning and thought: "Let me invest into a company that covers the Falkland Islands, specialist art transport, and a small British ferry company"?

The lack of focus is the key reason why this stock only went sideways for well over a decade. In fact, it hasn't moved an inch since 2006. What's more, the company just published a disappointing trading update, disclosing a drop in revenue of 32% during the six months ending 30 September 2024. The group's underlying profits swung from a positive GBP 0.6m during the same period in 2023 to a staggeringly negative GBP 5.9m in 2024.

What had happened during these first six months of the company's current fiscal year?

Momart and the ferry company performed in line with expectations, but the Falklands division got into major issues with a residential construction project that it had agreed to handle on behalf of Britain's Ministry of Defence.

The stock had already been under pressure, and it dropped a further 10% when this news hit the market. FIH Group now has a market cap of just GBP 27m. The stock has minimal trading liquidity, and its valuation multiples are a fraction of its break-up value. As such, it's quite representative of the UK market and its malaise in small-cap stocks.

FIH Group.

Throughout 2024, the situation of London-listed small-caps has become such that a growing number of them either sold out to private equity or decided to spin off or sell divisions. As it were, this is just what the doctor ordered. There is now an entire subset of interesting London-listed small-caps that make for an interesting investment because they are going to return capital to their investors. E.g., in early November 2024, Undervalued-Shares.com Lifetime Members received a report on a holding company that is heading for liquidation. Since that report came out, the stock rose from 59 to 80 pence.

Why is that relevant for FIH Group?

Structural change coming in 2025

Large shareholders of FIH Group have run out of patience. Instead, a consensus has started to form that management will have to act:

- The Portsmouth Harbour Ferry Company with its reliable income stream should be sold off to financial investors.

- Momart, together with its valuable real estate storage facility in East London, could be sold as well. It might also be suitable for being listed in its own right if it can be wrapped into a credible growth story. The more obvious solution, though, seems to be an outright sale.

- The resulting cash could then be distributed to FIH Group shareholders, and the company's name changed back to Falkland Islands Holding. The new/old Falkland Islands Holding would be a focused play on the Falkland Islands and bound to attract new attention given the developing story in its home jurisdiction.

Given the company's shareholder structure, it would take less than a handful of key shareholders to agree that the situation now needs acting upon.

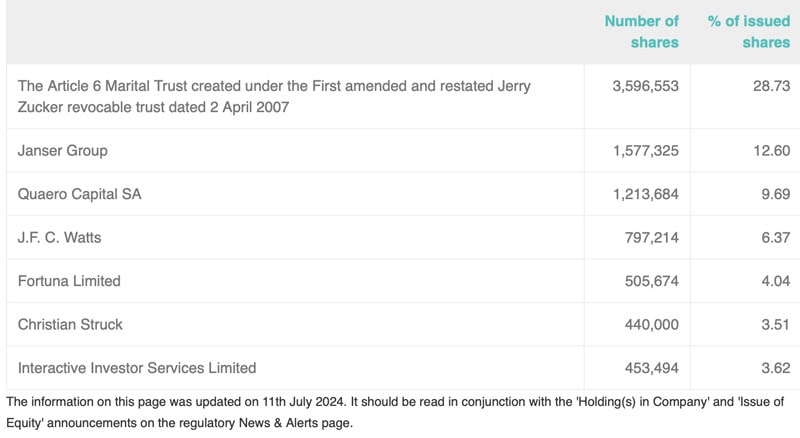

Source: FIH Group website.

A restructured company could then focus on its prospects in the Falklands Islands, which includes…

Land, land, and more land

FIH Group doesn't just own a bunch of operating businesses that will benefit from an increasing population of residents, workers, and visitors. It also owns the most interesting land bank of the Falkland Islands.

The company's legal predecessor once owned about half of the entire archipelago, but it sold most of the land to the Falklands government in 1991. Much of its was agricultural land and of very limited value. It did, however, retain land in and around the capital, and much of it with serious development potential now that the islands are coming into their own economically.

Most residents live in or near the capital, Port Stanley, where FIH Group owns much of its remaining land (see below map for details; the green areas already have planning consent, the red areas are awaiting planning consent.). The company holds residential, office, and industrial real estate that is rented out to third parties, but it can also develop its own land.

Click on image to enlarge.

FIH Group also owns one large parcel of land on a peninsula opposite the capital. This will be the location of a new harbour facility, which would significantly increase the value of the nearby land.

400 acres translates to 1,618,742 square metres. FIH Group currently has 12,519,900 shares outstanding. This makes for land reserves of about 0.1292 square metre of land per share. Looked at it another way, if you purchased 31,323 shares for GBP 75,500, you'd indirectly own an acre of land in the Falkland Islands.

What's the land worth at going prices?

God only knows, especially in the case of the large piece of land that will host the new harbour facility.

However, does it matter if you can get these land reserves for free?

A simplified sum-of-the-parts calculation for FIH Group shows that if the company sold Momart, the East London real estate, and the Portsmouth Harbour Ferry Company at a decent valuation, you'd end up getting the Falkland assets for free:

- Momart generated an operating profit of GBP 1.4m, and it has a very strong brand name. It could be valued at GBP 14-21m, i.e. a multiple of 10-15x. This would equate to 1x sales. The warehouses in Leyton, East London, that Momart is using are a separate asset and worth about GBP 20m, but there is a mortgage of GBP 11m to be paid off. All in, Momart and its real estate will be worth GBP 25-30m, which covers almost the company's entire market cap.

- The Portsmouth Harbour Ferry Company generates operating profit of GBP 0.9m and could be valued at 12-15 times earnings. That'd be GBP 10.8-13.5m.

FIH Group also has minimal net debt.

These are very rough figures, but it doesn't take much to imagine that FIH Group could liquidate its non-core portfolio and make at least its entire current market cap available to shareholders as capital returns. Investors who buy on the current level would then have all their capital returned and own the Falkland Islands businesses and land bank for free.

What's the long-term upside of the Falkland Islands businesses?

And what will a piece of land be worth in ten or 20 years in what seems set to become one of the world's most affluent communities?

That is anyone's guess.

What does it matter, though, if you are getting these assets for free?

Remarkably, the trading update published on 19 December 2024 even contained a first hint that such steps could be in the making. It ended with:

"The Group is also evaluating strategic options to maximise shareholder value for all divisions."

Have individual large shareholders started to exert pressure already?

If I was a large holder with an illiquid stake, I'd now be sure to pick up the phone and ask management how they see the company get out of its long-running malaise.

In fact, I'd also pick up the phone if I were part of Momart's management team. There may be an opportunity waiting for them to propose a management buy-out, and to suggest as much out of their own initiative before shareholders press for the company to potentially be put up for auction.

With FIH Group becoming a play on restructuring measures and capital returns, the stock is unlikely to remain on the current level for long. After all, it's also fair to say that there is growing investor interest in such outlier micro-jurisdictions.

For anyone looking to benefit from a renewed oil exploration boom in the Falkland Islands, buying stock in FIH Group may not be a bad long-term idea. You have to buy into it while it's still looking like a dead duck, though.

Alternatively, you can also consider Rockhopper Exploration.

A litigation claim turned oil play

When I first reported about Rockhopper, the company was a strange mixture between an unclear legal claim and a struggling exploration project.

How so?

After the end of the first oil exploration boom in the Falkland Islands, Rockhopper invested in a project in Italy, only to have the Italian government pull out the rug from underneath the project because of the country's "net zero" push. The British company took this issue to the International Court of Arbitration and won a EUR 190m compensation claim.

Incredibly, in late 2022 Rockhopper stock was trading for less than the likely payoff from the Italian compensation claim, and the value of the operation in the Falkland Islands was effectively thrown in for free. As I said when describing the opportunity: "All cash and the additional free upside of an oil field? What's not to like?"

In the meantime, the company has collected some of the money from the claim against Italy, and the remainder is secured through an agreement with a litigation finance firm.

Backed by cash and a strong balance sheet, Rockhopper's future valuation is now down to the success of the Sea Lion project.

This project has insofar been derisked as Rockhopper has sold a 65% stake to Navitas Petroleum (ISIN IL0011419699, IL:NVPT), an Israel-based energy firm with a focus on the Americas. The Israelis are going to cough up the USD 1.4bn investment that is necessary to get the field to production while Rockhopper retains a 35% stake and essentially gets taken along for the ride.

Now that Rockhopper's stock price has started to move, just how high could it go?

In September 2022, Canaccord Genuity estimated the value of the Sea Lion project alone as 21-116 pence per share (this represents the most recent credible estimate available).

Canaccord's figures were calculated at a time when the oil price was USD 80, compared to currently USD 71. However, the reserves of the Sea Lion field have since increased. Experience shows that additional reserves add disproportionately to value. Also, it's highly likely that Rockhopper will, before too long, explore further parts of the Falkland Islands.

If the Sea Lion field works out as projected and Rockhopper starts other oil-related activities in the Falkland Islands, its stock could turn into the multi-bagger that my initial report projected it to be. In any case, Rockhopper is a higher-octane option for anyone wanting to put a bet on the Falkland Islands. Indeed, that's what quite a few investors seem to have concluded lately, based on the price action and trading volume of the stock.

Now that Rockhopper is truly off to the races, it could still be a good play for anyone looking for exposure to the oil sector. That said, the days when buying Rockhopper stock was akin to buying a load of cash and getting the Falkland assets for free are over.

That same situation now only exists in the case of FIH Group.

In the Falkland Islands, like everywhere else, the early penguin bird catches the worm. If you invest when it's still ugly and foggy, you get the best price!

Dominant, fast-growing tech play in emerging markets

Looking to buy a fast-growing, world-class tech company at a fraction of US valuations?

The company featured in my latest research report hails from a small and exotic country, but it does not need to hide behind US tech firms such as Google, Apple or Amazon.

With a #1 market share in several sectors, off-the-charts financial metrics, and continuous high-paced growth, it offers 5x upside potential over the next 3-5 years.

Dominant, fast-growing tech play in emerging markets

Looking to buy a fast-growing, world-class tech company at a fraction of US valuations?

The company featured in my latest research report hails from a small and exotic country, but it does not need to hide behind US tech firms such as Google, Apple or Amazon.

With a #1 market share in several sectors, off-the-charts financial metrics, and continuous high-paced growth, it offers 5x upside potential over the next 3-5 years.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: