The 3,600 residents of the remote Falkland Islands could soon experience an "economic boom" that has the potential to "transform the islands' entire economy".

So reported by the Daily Telegraph on 30 June 2024.

I had first reported about this possibility in 2004 – speak of being too early!

Why is this boom about to kick off, and what are the London-listed stocks to benefit from it?

The oil sheiks of the South Atlantic

The background story to the Falkland Islands is something that my older readers will be well familiar with.

Back in 2004, I published a 142-page investigative report about the islands' little-known oil resources. My research pointed to a century-old colonial company listed on the London Stock Exchange, which back then was the only way to get Falkland Islands exposure for your portfolio.

In the meantime, much has changed.

The islands have since seen an initial oil exploration boom, and exploitable oil reserves were found in 2010. Sadly, the oil price fell off a cliff in 2014, which killed the prospect of actually producing oil in the Falklands. The share prices of the fledgling Falkland oil companies all fell over 90%, many went under altogether and disappeared from public markets. One of them remained listed, though.

If you want to learn more about the entire background to this unusual set of self-governing islands, check out my Weekly Dispatch "A new oil boom in the Falkland Islands" from 7 October 2022.

The subject is now about to gain more relevance and immediacy because of a quasi-referendum the islands are about to hold.

As the Daily Telegraph just reported:

"The Falkland Islands has opened the door to oil exploration in its waters for the first time in history, in a move that could trigger an economic boom for locals.

The territory's ruling council has asked islanders if they will back the scheme to extract up to 500m barrels of oil from the Sea Lion field, 150 miles to the north.

Details of the scheme were released without fanfare in the Falkland Islands Gazette, an official government publication, signed off by Dr Andrea Clausen, director of natural resources for the Falkland Islands government.

'A statutory period of consultation will run from June 24, 2024 to August 5, 2024... regarding Navitas' proposals for the drilling of oil wells and offshore production from the Sea Lion field,' it said.

The territory's ruling council has asked islanders if they will back the scheme to extract up to 500m barrels of oil from the Sea Lion field, 150 miles to the north. .... The field is thought to contain 1.7bn barrels of oil, making it several times bigger than Rosebank, the largest development planned for the UK's own North Sea, estimated to hold 300m barrels."

Are we about to see the Falkland Islands hype 2.0?

Back in 2022, I was compelled to revisit the opportunity and point my readers towards two companies, in particular.

How to play the theme – idea #1

The oldie but goldie among Falkland Islands related stocks is FIH Group (ISIN GB00BD0CWJ91, UK:FIH).

When I first reported about this company two decades ago, it was called Falkland Islands Holdings (hence "FIH"). Among other assets, it owned 100% of The Falkland Islands Company, which was granted its Royal Charter in 1852 to settle, develop and exploit the Falkland Islands. The company has since broadened its portfolio to include some investments in the UK, and it also changed its name.

FIH Group's main areas of activity embrace:

- Retailing (including food, clothing, electrical goods, and home furnishings)

- Residential and commercial property

- The sale and hire of 4x4 vehicles

- Travel services including flight bookings

- Airport transfers and luxury coach and walking tours for tourists

- Insurance

- Agency services for cruise ships and fishing vessels

- Freight and shipping services to and from the islands.

In short, residents and tourists alike will struggle not to spend some money with FIH Group while on the Falklands.

Even though it now also owns some UK assets, it's still the only way to get broad exposure to the Falkland Islands economy through the stock market.

In a way, FIH Group is not too dissimilar from Société des Bains de Mer/SBM (ISIN MC0000031187, Euronext:BAIN), the company that controls large parts of the economy of Monaco and which I had last featured in my Weekly Dispatch on 21 July 2023. It's a bit less glamourous, though. Whereas Monaco is about Ferraris and Louboutins, the Falklands are about Land Rovers and Wellies.

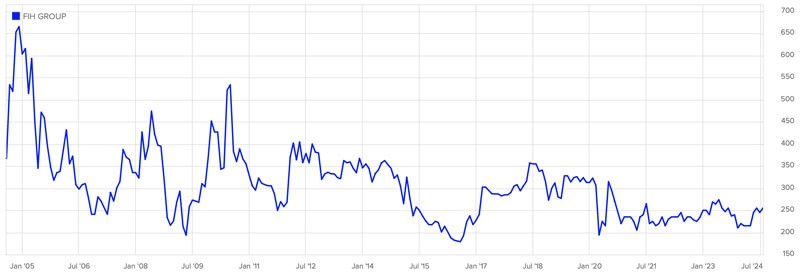

With a market cap of GBP 32m (USD 40m), FIH Group is a minnow of a company. However, it's profitable and stable. In 2023, it generated GBP 52.7m in turnover and profit before tax of GBP 4m, which translated into earnings per share of 20.1 pence compared to a current share price of 255 pence.

Its stock may yet get moving again, if or when there is a general economic boom in the Falkland Islands that comes with more media attention. The chart certainly looks like there is probably limited downside and a fair bit of upside, and all the more given FIH Group's low valuation.

FIH Group.

How to play the theme – idea #2

A more specialist, speculative play with much more upside is Rockhopper Exploration (ISIN GB00B0FVQX23, UK:RKH).

This is a GBP 90m (USD 114m) market cap company that discovered the Sea Lion oil field mentioned in the Daily Telegraph report. When I wrote about it in 2022, I described in more detail how it formed part of the alleged "stranded assets" that existed in the Falkland Islands. Few people knew the company even existed, and even fewer believed it was going to go anywhere. Similar to coal stocks a few years ago, most investors had completely written it off.

I analysed Rockhopper Exploration in an in-depth report for Undervalued-Shares.com Lifetime Members. In the report, I described an unusual set up:

"Oil exploration companies are usually risky, binary propositions. However, London-listed Rockhopper Exploration is trading at less than its likely cash reserves, following its recent winning of a EUR 190m compensation claim against the government of Italy."

All cash and the additional free upside of an oil field? What's not to like?

Rockhopper Exploration has since made major advances with its litigation against Italy. It teamed up with a litigation finance specialist to bring forward some of the cash payments while waiting for an appeal filed by the Italian government to run its course. The first EUR 15m have just ended up in the company's coffers. More should come its way before year-end 2024 because the appeal is now expected to be decided fairly soon.

The end of the legal case couldn't come at a better time. With everything that's now happening politically in the Falkland Islands, the market should soon focus back on the investment thesis of Rockhopper Exploration's oil rights.

As my report highlighted at the time:

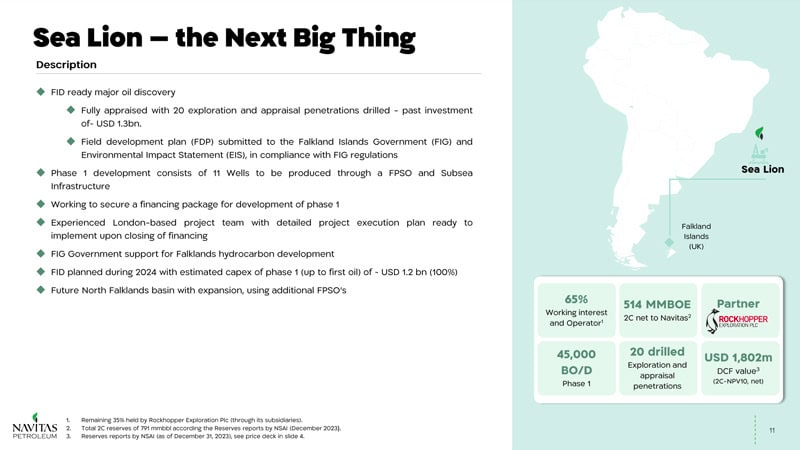

"On 23 September 2022, Rockhopper Exploration finalised a deal with Navitas Petroleum (ISIN IL0011419699, IL:NVPT), an Israel-based energy firm with a focus on the Americas. Navitas Petroleum has both the expertise and the necessary access to capital to make the Sea Lion oil field come into life. Navitas Petroleum will have a 65% stake in the oil field and act as its so-called 'operator' while Rockhopper Exploration retains a 35% stake and essentially gets taken along for the ride."

For anyone following this story, it's always worth checking the latest publications by Navitas Petroleum. In its just-released July 2024 investor presentation, the Israeli oil company calls its project in the Falkland Islands "the Next Big Thing".

The chart of Rockhopper Exploration does look like the stock may be about to break out soon. Which wouldn't be a surprise, given the concrete advances with both the legal case and the oil project.

Rockhopper Exploration.

As I concluded in my 2022 report: "This is an unusual, overlooked investment case with a potential multi-bagger return."

It's well worth getting this report back out. Even though it is now two years old, it still sets out all the baseline information of Rockhopper Exploration.

But what about the Labour government?

Now that Keir Starmer has wiped the floor with Rishi Sunak, will anything change?

It's unlikely.

As the Daily Telegraph put it:

"Labour … has made accelerating the net zero transition a key part of its pitch to the electorate. Sir Keir Starmer's party has promised to ban all new oil and gas exploration in British waters. This ban would not affect the Falklands, as it is the local administration there who have a say over drilling rights to surrounding waters.

Many within the Falklands government have wanted to make the islands a centre for oil production. John Birmingham, deputy portfolio holder for natural resources, MLA (Member of the Legislative Assembly), said: 'Offshore hydrocarbons have the potential to be a significant part of our economy over the coming decades.

In a statement, the Falklands Islands government said: 'We have the right to utilise our own natural resources. The Falkland Islands operates its own national system of petroleum licensing, including exploration, appraisal and production activities related to its offshore hydrocarbon resources."

It's all taken a long time, but the investment thesis behind the Falkland Islands oil discoveries could finally play out.

A multi-bagger from the Falkland Islands?

Looking for a more specialist, speculative way to play the Falkland Islands hype 2.0?

Check out Rockhopper Exploration, whose chart does look like the stock may be about to break out soon.

With everything that's now happening politically in the Falkland Islands, the market should soon focus back on the original investment thesis.

It's all spelled out in the Undervalued Shares Falkland Islands research report. Well worth getting it back out!

A multi-bagger from the Falkland Islands?

Looking for a more specialist, speculative way to play the Falkland Islands hype 2.0?

Check out Rockhopper Exploration, whose chart does look like the stock may be about to break out soon.

With everything that's now happening politically in the Falkland Islands, the market should soon focus back on the original investment thesis.

It's all spelled out in the Undervalued Shares Falkland Islands research report. Well worth getting it back out!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: