Was it the Dutch who invented the joint stock corporation and share trading, or do the ancient Romans deserve this claim to fame?

Ferrari – the company, the stock, and my car

Regrets, I have a few.

At least, thanks to my blog, other people can learn from my mistakes.

One such lesson drawn from mistakes, regrets, and human weakness is that of my investment in Ferrari.

It was an investment involving an undervalued asset, i.e., this anecdote is nicely in line with the broader idea of this website, even if it's not just about publicly traded shares. Also, it does tie in with one of the in-depth reports that are available to my website's Members.

On the surface of it, this Weekly Dispatch is about how I screwed up.

However, it is also about how you now have the opportunity to do better – both with your investments in general and one current investment idea in particular.

A cheap asset destined to appreciate in value

You may be surprised to hear that I've never had a driving license.

I've spent my entire adult either smack in the centre of large cities, or in remote, small island communities where walking or cycling was the way forward. Driving a car was never a necessity for me. To get around, I use taxis, airplanes, or girlfriends who like being behind the wheel.

Still, I once bought a Ferrari and put it into my garage.

The purchase had a clear investment angle. Back in 2003, the Ferrari Dino 246 of the late 1960s and early 1970s vintages were already a design icon. The car had been made famous through "The Persuaders" , a TV series starring the late Sir Roger Moore and Tony Curtis. I had watched that series in my parents' living room. (Obviously, I was later to side with Tony Curtis' choice of automobile, rather than Roger Moore's. Anyone who has watched the series will know why.)

Despite its previous TV fame, the Dino range had fallen out of favour on the vintage car market. At the time, it was extraordinarily cheap compared to cars with a similarly illustrious brand name, design status, and driving abilities. As I said back then, the shape of the Dino was almost as recognisable and iconic as that of Concorde.

I bought my 1974 model in pristine condition for GBP 50,000. Its chassis number of 07246 even incorporated the model number, which collectors love.

The value catalyst I speculated on was my generation of car enthusiasts getting a bit older and eventually having the spare cash to buy the cars of their childhood dreams. That's how, in essence, the entire vintage car market works. Cars go from being wet-dream posters in teenage boys' rooms to prized possessions in middle-aged guys' garages. Since I bought it at the age of 28, I felt that my investment was ahead of the curve – no pun intended.

My idea turned out to be spot on. Only, I didn't have the stamina to see through my own belief. E.g., there was the hassle of having to get the car moving regularly to keep the engine in good shape (difficult if you haven't got a driving license!). Never mind the constant temptation to chase other investments where you could watch a daily price movement. In 2007, I passed it on to its next lucky owner.

For a decade, the entire matter slipped my mind. Until early 2017, when a friend pointed out that he had spotted my name in an auction catalogue.

The coulda, shoulda, woulda investment

"My" old Ferrari investment turned up at an auction and sold for the princely sum of GBP 273,000. That was more than five times what I had paid. Not a bad return had I kept it for those 14 years.

Adding insult to injury, that specific car had now become a mini celebrity. It featured on a book cover page ("Dino Days"), and it had a write-up as well as a video dedicated to it on Drive Tribe.

What's worse for an investor, losing money or losing out to others?

On some days, I am not sure about the answer.

Though the lesson is clear. With some investments, it simply boils down to buy and hold. There is no need to continually chase the next shiny thing.

Essential criteria for finding such buy and hold assets are:

- A simple, timeless business model.

- Pricing power for the product, e.g., on the back of a strong brand name.

- Buying the asset when it's relatively speaking too cheap.

Come to think of it, you could have successfully applied the very same approach to Ferrari NV, the company.

Since 2015, the world's arguably most famous automobile brand is listed on the New York Stock Exchange. Buying its shares would have been so much easier than to keep and care for a vintage car in your garage.

Racy returns thanks to a strong moat

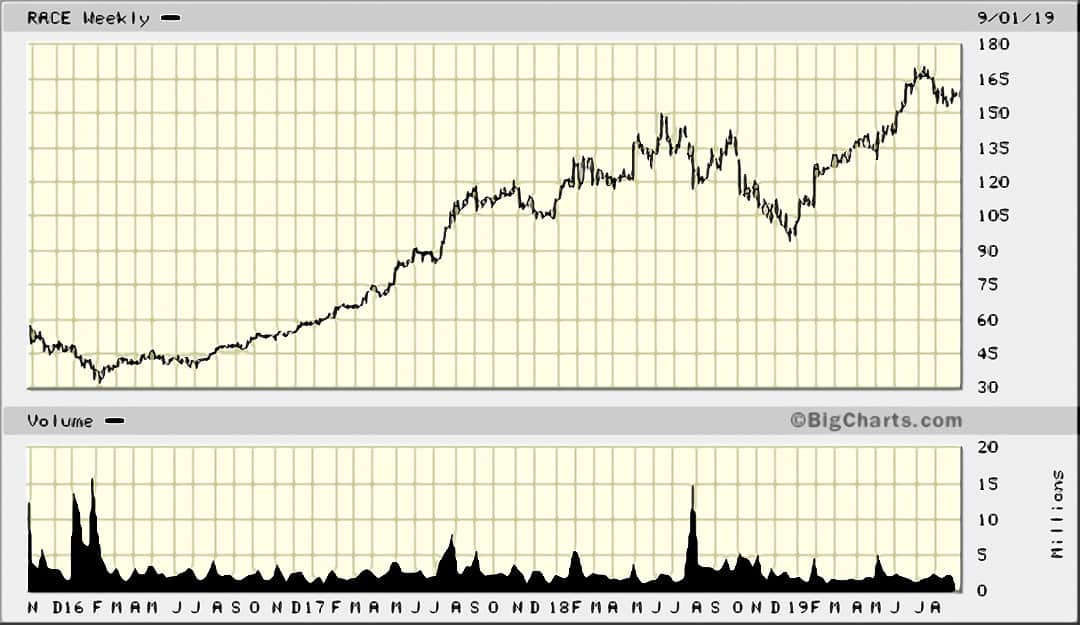

The stock trading under the ticker symbol "RACE" is up three times since it launched in late 2015.

Mind you, it wasn't an immediate success. When Fiat decided to reduce its then 90% stake in Ferrari by placing some of the shares with investors on the world's largest stock exchange, it asked for a price of USD 52 per share.

Anyone who bought at the time of the IPO quickly saw their investment shrink. A few months later, the stock was trading just above USD 30.

Ferrari, some joked, was a car crash IPO.

It turned out, though, that just when PR about the botched-up IPO was at its worst, you should have bought in. Since then, Ferrari's stock has ascended to now USD 157. Had you invested when Ferrari stock was out of favour, you'd now be up five times.

The Ferrari company's stock is up five times since its low four years ago.

Ferrari is a business to behold:

- It sells only 10,000 per year, but could easily double that if it wanted to maximise short-term revenue and cashflow.

- Customers have to apply for some of the models, giving the company extraordinary pricing power and insane margins.

- Few other assets in the world allow you to flaunt your wealth in quite the way as owning a Ferrari. Ferrari will always be Ferrari. Basta!

During the past 25 years, the sale of Ferrari sales decreased for only three years. Production of cars quadrupled over this period. Also, there still isn't any other car manufacturer that managed to become quite what Ferrari has managed to be. Porsche, Aston Martin (about which I once wrote a Weekly Dispatch), Lamborghini and others are all great brand names, but they do not compete 1:1 with the Ferrari brand.

The critical issue with such a high-quality business is, how do you buy a stake at an attractive price?

Usually, valuations for such a business will be sky-high. As Warren Buffett says, your return depends on the price you pay. So just how do you get in on such a great company at a reasonable price?

That's what you've got me for.

Because of the stock markets' vagaries and irrationalities, you can occasionally buy into a fantastic business at an insanely attractive price. Though just as was the case when Ferrari was trading at USD 30, it requires you to go against the grain and put money into a seemingly unattractive asset.

Also, you always have to keep your eyes open for these opportunities, so that you can spot them during the limited periods of time when they are available. Observing a large number of different companies takes time and effort. It also takes patience, because you sometimes have to wait for five, ten, or even twenty years before a world-class business happens to be available at a no-brainer price.

Then again, the stock market does regularly throw up these extraordinary opportunities. It's really just a case of effort and patience.

Case in point, the current opportunity to buy a stake in Porsche at rock-bottom valuations.

Today, life is giving you yet another opportunity

If you check the world's stock market for "Porsche", you'll find a "Porsche SE" listed on the German stock market (SE = société européenne, European Company).

Only, that isn't actually the Porsche car manufacturer.

Porsche, the car manufacturer, is nowadays 100% owned by Volkswagen. That company is called "Porsche AG" (AG = Aktiengesellschaft, German Company).

Volkswagen, in turn, has Porsche SE as its largest shareholder. Porsche SE is a publicly listed holding company that has invested over 90% of its equity in buying Volkswagen shares. It is controlled by heirs of the closely related Porsche and Piëch families, although it also has non-voting shares that are traded freely on the German stock market (as well as in the US as ADRs).

Can you still follow?

The complex corporate structure is one of the reasons why you can currently indirectly buy into Porsche AG, the car manufacturer, at a ridiculously low price.

Put in somewhat simplified terms, by buying shares of Porsche SE, you can currently buy an indirect stake in Porsche AG, the car manufacturer, at a fraction of its value. There are different analytical methods for looking at this, and valuations are always subjective. However, a good rule of thumb would be to say that you can currently indirectly buy a stake in Porsche AG, the car manufacturer, with a 60% discount to what it's really worth.

That's cheap if you ask me.

So cheap that I wrote a 72-page report about it back in January. I have drilled deep down into the details of this potential investment, so that you don't have to (and you might simply want to read the executive summary to get the essentials).

The crucial spark for this investment getting revalued has not yet happened. However, other developments have taken place since that have made the investment case even stronger. My January report is still valid today, and latecomers can still join the party.

Buy the stock, not the car (image credit: tishomir / Shutterstock.com)

Did you miss investing in Ferrari, the company, at rock-bottom prices?

Are you still waiting for a vintage Ferrari or Porsche to sit in your garage?

If the answer to both of these questions is "Yes", buying shares of Porsche SE might be the next best thing you can do with your money right now.

It's not a popular investment right now, and that's the entire point about it. Provided, of course, you agree that Porsche is another one of those heavily moated, timeless businesses that are likely to only ever grow as the decades pass.

In a few years' time, this will have likely become another story in a Weekly Dispatch, about an obvious bargain that most missed out on. After all, Porsche will remain Porsche…

You can download the entire Porsche/Volkswagen report, as well as two updates I have published since, on my website – provided you have invested a mere USD 49 for an annual Membership, that is!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year