Just 7% of the company's shares are in free float. Given its market cap of EUR 233m (USD 250m), it's not a liquid stock that you could easily buy and sell. The daily trading volume is usually in the tens of thousands of euros.

Yet, it could be one of the most interesting stocks listed on the Paris stock exchange.

Not only does ZCCM sit on some incredible legacy assets, but it also appears that management has finally been tasked with turning the dusty old company into an attractive proposition for international investors.

This is the first instalment of a three-part series investigating obscure but fascinating microcaps. It starts with a company that has its roots in Africa's colonial days, and which may now be jolted into the 21st century.

Today's Weekly Dispatch is, I believe, an Undervalued-Shares.com exclusive.

A case for deep, off-piste research

ZCCM Investments Holdings started its existence as the Zambia Consolidated Copper Mine, and its roots go back to the late 19th century.

At the time, the British South Africa Company (BSAC) was set up with a Royal Charter and modelled on the famous East India Company. BSAC was part of the "Scramble for Africa" and designed to bring resources under control in the region that today consists of Zimbabwe, Zambia, Botswana, and South Africa. Cecil Rhodes, the infamous namesake of Rhodesia (later Zimbabwe) was a director of the BSAC.

In 1968, what had been the British Protectorate Barotziland-North-Western Rhodesia was reorganised, and the independent nation of Zambia emerged as a result. The newly created country took control of mining operations that hitherto had been run by foreign mining companies. Following several rounds of reorganising these assets under state leadership, Zambia decided in 1982 to merge everything into a single entity – the giant Zambia Consolidated Copper Mine.

Not unsurprisingly, having the government run the mining operations didn't do the country much good. By the mid-1980s, Zambia had become one of the world's most indebted countries, even though mother nature had gifted it tremendous natural resources. Over the course of a generation, state control of Zambian mining operations led to the nation's copper production falling by two thirds.

Following several further rounds of reorganisation, the Zambia Consolidated Copper Mine is today called ZCCM Investments Holdings. As its name indicates, it's primarily a holding for investments. The company owns stakes in many of the country's premier operations in mining and energy, as well as a few ancillary assets such as real estate.

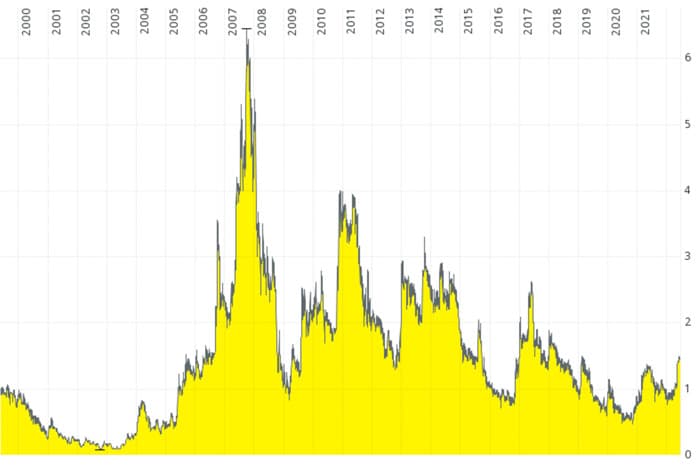

Since the turn of the millennium, ZCCM's stock price has seen quite some movements. After bottoming out at just 9 cents in 2002, it reached EUR 6.44 in 2007 – a 70-times gain in five years and a nice case study in what I once described in my three-part series about crisis investing. Subsequently, it fell back to as low as 62 cents in 2020.

During the past four weeks, the share price shot up from EUR 1 to around EUR 1.50. The long-term chart does make you wonder if the stock could be about to break out of its 15-year downward trend.

ZCCM Investments Holdings.

Has the market sensed that something is afoot?

It's not a question I could answer with absolute precision, simply because official information is still scarce. ZCCM's most recent investor presentation dates from 2018, and the last annual report made available to investors is from 2019. While an abridged version of the company's accounts exists for 2020, you'd need quite some Sherlock Holmes-style abilities to piece everything together to a coherent financial picture. ZCCM owns a vast range of assets, and some of them come with a complex history.

Still, it's entirely feasible to get a feeling for the company's direction of travel by looking at the evidence that is available on ZCCM's website.

Zambia's prime mining assets

Zambia has a wide range of natural resources including copper, cobalt, silver, uranium, lead, coal, zinc, gold, and emerald. Holding the equivalent of 6% of the world's copper reserves, the country ranks as Africa's second and the world's tenth largest copper producer.

When ZCCM was created in its current form, the Zambian government simply dumped its various mining and energy assets on the company. This broad-brush approach left ZCCM with some of the country's choiciest natural resources.

The stand-out asset in ZCCM's portfolio is a 20% stake in Kansanshi Mining Plc, Zambia's leading copper and gold producer. The other 80% are owned by First Quantum Minerals (ISIN CA3359341052, CA:FM), a Canadian mining corporation with a CAN 20bn market cap and a stock price that has risen seven-fold since early 2020.

Within First Quantum, Kansanshi is one of the biggest assets, representing the single largest contributor to First Quantum's profits in the fourth quarter of 2021 (see page 72 of First Quantum's 2021 annual report). However, it's also been a significant headache for the Canadians. The government of Zambia and First Quantum have spent years battling each other in court over issues such as value added taxes.

Earlier this year, the two warring parties settled and agreed on a major step forward. First Quantum is going to invest a hefty USD 1.25bn into expanding the Kansanshi mining operation and another USD 100m into a nickel mining operation elsewhere in Zambia. These are First Quantum's largest investments in Zambia since 2012. As a 20% shareholder in the Zambian assets of First Quantum, ZCCM stands to benefit from this development. When the news broke, the share price of ZCCM shot up by 50% almost overnight.

Indeed, ZCCM's stake in Kansanshi alone could be worth more than its current market cap. In 2021, Kansanshi achieved a gross profit over USD 968m. If you use First Quantum's current market cap to deduce what ZCCM's 20% stake in Kansanshi might be worth, you arrive at some stunning figures. This is a back-of-the-envelope calculation in the true sense of the word, but it gives a first sense for the kind of asset that may be hiding on ZCCM's balance sheet – long forgotten, but suddenly sought-after by some of the world's largest mining companies.

The vast Kansanshi mining operation in Zambia.

Someone who is well familiar with ZCCM is my old friend Axel Krohne of Krohne Capital in San Diego. Munich-born Axel is a world-travelling investment sleuth of the highest order and runs a fund that specialises in pioneer markets, besides publishing a free newsletter that outlines his research and features his fund's investments. During my research for this article, I noticed that this fund has managed to accumulate a position in ZCCM.

Did Axel see it all coming well in advance? I reached out to him, and this is what he said:

"I am currently in Zambia and met the management of ZCCM in March. I believe this is the most undervalued (copper) mine in the world. The country has a new president and the management of ZCCM is beginning to understand the tremendous values they have in their portfolio. ZCCM market cap is 20% covered by the value of Copperbelt Energy alone. Of course, they might never fully realize the values but with higher copper prices things for the country and the company are rather positive."

Indeed, ZCCM is a veritable potpourri of interesting holdings.

Another flagship asset of gargantuan size is the company's 100% stake in Mopani Copper Mines. This had been the country's first mining operation in 1929, but it needed investment to prop up its declining production. It was majority owned by Glencore (ISIN JE00B4T3BW64, UK:GLEN), the infamous Channel Islands-domiciled and London-listed trading house for natural resources. Besides Glencore, First Quantum and ZCCM held minority stakes in Mopani.

In early 2021, ZCCM orchestrated a complex transaction to buy out Glencore and First Quantum. ZCCM paid just USD 1 for 81% of the shares in Mopani; the mine's debt of USD 4.3bn was eliminated through an agreement with creditors, and ZCCM took on the role of guarantor of a new USD 1.5bn loan. Neither Zambia nor ZCCM actually had a spare USD 1.5bn laying around, which is why the loan was arranged to be repaid from revenue from the mine. Why would Glencore have agreed to such a deal? Among other factors, the company's resource traders get privileged, advantageous access to the copper produced by the mine.

ZCCM now wants to raise "billions" of investment to turn Mopani Copper Mines into a showcase project for the country's new ambitions. Under its newly elected president Hakainde Hichilema who took office in August 2021, Zambia wants to attract enough investment to have the nation produce USD 30bn worth of copper annually by 2030. For a country with an annual GDP of just USD 24bn currently, this is quite an ambitious plan. With its deal for Kansanshi, the new government seems to be off to a potentially good start.

There are many assets held by ZCCM that would be worthy of further investigation. Even just the surface uncovers some interesting nuggets of information. E.g., ZCCM also inherited a 24.1% stake in aforementioned Copperbelt Energy Corporation, a company that provides power to the mining industry. Because it's publicly listed on the Lusaka stock exchange in Zambia, it's possible to value the stake quite easily. As the investor relations website reveals, its stock price is up by a factor of three since early 2020 alone. ZCCM's stake, which long appeared to be just a mere footnote in the company's financials, is now worth USD 70m.

ZCCM holds a stake in 24 companies, only two of which have consistently paid a dividend in recent years. Copper is potentially in for a super-cycle, driven in no small part by investments in so-called renewable energy. Zambia's new leadership actively promotes new investment in the country, and the country's copper belt is one of the most attractive areas for copper exploitation besides the neighbouring Democratic Republic of Congo. This is definitely a good time to take a closer look at Zambia, and ZCCM is the proxy to buy a stake in mining assets across the nation.

The stock market in Lusaka is up 78% since January 2021.

I doubt anyone (but Axel!) has done the math recently on the value of ZCCM's underlying assets. This should change, at long last, following a little-noticed decision by the company's board of directors.

Utilising the European stock market listings

In December 2020, ZCCM's majority shareholder and its board agreed to pursue a new six-year plan. As part of the plan, the board promised to actively use ZCCM's stock market listing to create value for shareholders and make sure that the stock market gets wind of it.

The excerpt from the six-year plan sets out to "generate greater shareholder value by ensuring price discovery on stock exchanges where ZCCM-IH is listed. In 2020, ZCCM-IH revised its business model and positioned itself to deliver superior shareholder value. The revisions include taking steps to enhance value extraction from its current portfolio through diverse means other than dividend income."

The message is loud and clear: Zambia would like its stake in ZCCM to be worth more, and the stock's listing on the Paris stock exchange could come in extremely handy for that purpose.

In theory, at least, ZCCM could also tap the London market to generate more interest. Its stock is also listed in London, although not a single trade seems to have taken place of late according to the London Stock Exchange website. ZCCM still publishes announcements on the website, though, including the 6 January 2022 statement by its chairwoman, Dolika Banda:

"The combination of a conducive and enabling business environment set by the Zambian Government, an apposite ZCCM-IH 6-year strategic plan to 2026, and the augmentation of the ZCCM-IH board, leaves me feeling optimistic about the heights to which we can take this internationally owned Company."

Banda also just gave an interview to Mining for Zambia, which is very much worth reading.

And even though ZCCM is lagging behind with the publication of its latest annual report, it did manage to host a virtual gathering for shareholders in April 2022.

With these different components gradually falling into place, it's no wonder the stock price has started to move.

The question is, can ZCCM deliver on its new ambitions?

A case worth investigating

Zambia has a dire track record overall, which was recently confirmed when it became one of the first African nations to head for a sovereign debt default during the pandemic. It's now also been 16 months since ZCCM's six-year strategic plan was passed, and the company's website doesn't even include the most basic, up-to-date information.

Then again, the undervaluation of the stock and the potential of Zambia in the resource sector are potentially so vast that these factors could well outweigh everything else.

In the weeks leading up to this article, Zambia's president stated that the country was "very close to picking investor for Mopani copper mine". If this were to happen, ZCCM'S stock price could see the next boost. We may also approach the moment when the first equity analyst spends a week or two tracking down up-to-date corporate information in order to publish an in-depth analysis of the company. I also wouldn't be surprised to see the currently idle online forum for ZCCM shareholders soon spring back into life.

In summary, ZCCM is a long-forgotten company that may well be about to embark on an exciting new era. Its stock is still trading 75% off its 2007 high, and its chart looks like the decades-long downward trend could be broken. There is a lot for stock market sleuths to uncover, including a range of "legacy real estate assets" that the company also inherited along the way.

It's a difficult-to-analyse, difficult-to-trade microcap. Given its tiny free float, it wouldn't qualify for the kind of extensive research reports that I publish for Undervalued-Shares.com Members. Still, knowing my readers, I bet many will enjoy a series that takes a look at lesser-known entities, and some of them will even start to do their own research now.

Blog series: Forgotten microcaps

There's more to "Forgotten microcaps" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

The best "stimulant" company in the world?

Cigarette companies offer several factors that have become fashionable again: substantial earnings, high dividend yields, and reliable growth prospects.

With an entire choice of attractively valued companies in the tobacco sector, which one is the best?

I took a deep dive into the industry, and came up with a tobacco stock that is truly world-leading, offers a 5-8% dividend yield, and could rise 50% over the next 12-18 months even at times of inflation and rocky markets.

Which one is it? My latest report has all the details.

The best "stimulant" company in the world?

Cigarette companies offer several factors that have become fashionable again: substantial earnings, high dividend yields, and reliable growth prospects.

With an entire choice of attractively valued companies in the tobacco sector, which one is the best?

I took a deep dive into the industry, and came up with a tobacco stock that is truly world-leading, offers a 5-8% dividend yield, and could rise 50% over the next 12-18 months even at times of inflation and rocky markets.

Which one is it? My latest report has all the details.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: