I turn 50 today. What have I learned about investing so far?

Forgotten microcaps (part 2): La Française de l’Energie – abandoned coal mines turned money machine

Until recently, few investors would have paid attention to abandoned coal mines in Northern France and Belgium. The public's perception was that they made for potential museums, at best.

Yet, a tiny company listed in Paris found a way to unlock massive wealth from those abandoned mines. Since late 2020, its stock is up three-fold. It might double or triple yet again.

Less than a year ago, this was a company with a market cap of EUR 70m, of which just 40% was in free float. A microcap by most standards, and one that was ignored by the market.

However, La Française de l'Energie (LFDE) is one of the most unusual investment cases you can find on Europe's stock exchanges. I bet you haven't heard yet of this particular idea for dealing with the energy crisis in Europe.

Here is what happened, and whether it's still worth hopping onboard.

La Française de l'Energie (LFDE).

Utilising gas that would go to waste

As far back as the 1980s, coal mines were considered a leftover from an era long past. In recent years, anything relating to coal has turned from merely outdated to outright toxic.

Yet, the abandoned coal mines of Europe harbour a valuable treasure, and it's not the coal.

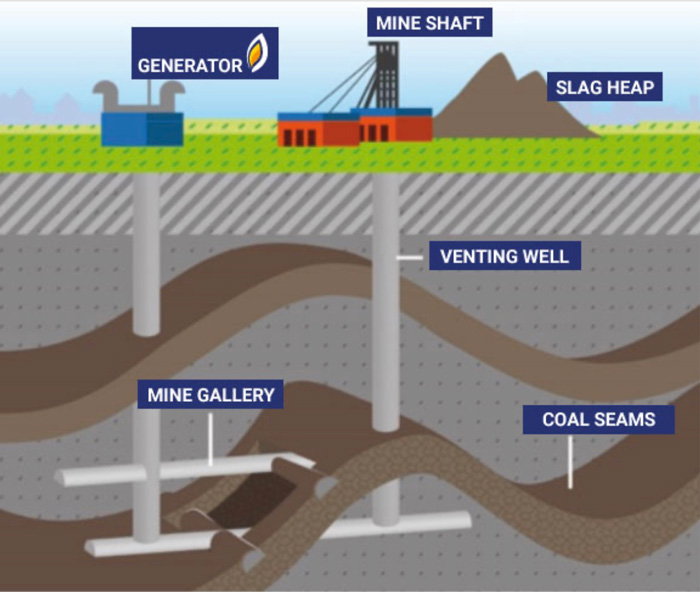

It's gas – or, to be more precise, so-called abandoned mine methane.

Coal naturally releases ("desorbs") methane gas. Methane keeps desorbing inside coal mines for many years – and often many decades – after the mining operation is stopped. First, the gas collects in the caverns and tunnels that comprise the mine. Eventually, the gas finds a way to the surface and into the atmosphere.

In 2007, a group of Australian entrepreneurs spotted an opportunity to turn abandoned mine methane into a business. Why let methane go to waste if there is a technology – Combined Heat and Power (CHP) – that allows you to cheaply convert it into electricity? CHP units fit into containers and can easily be transported to sites where it's possible to extract methane from abandoned coal mines. Using the CHPs to burn the methane generates electricity which can then be fed into the grid.

A mangled IPO

Originally incorporated as European Gas Limited with a listing on the Australian stock exchange, LFDE changed its set-up in 2010 and decided to redomicile to France where it also changed its name. In 2016, it went public in a little-noticed IPO. At the time, the idea of producing electricity from gas that seeps out of abandoned coal mines seemed quirky, but it hardly got investors excited.

LFDE had to content itself with an initial share price of EUR 27, the very bottom of its indicated price range of EUR 27-35.50. Instead of raising a hoped-for EUR 66m, the company only managed to mobilise EUR 37.5m. It used the additional funds to acquire Gazonor, a company created in 1991 by the French state-owned coal monopoly, Charbonnages de France. Gazonor was tasked with managing the evacuation of coal gas from abandoned mines.

Few saw the wisdom of it at the time. In late 2016, LFDE stock was trading as low as EUR 9.50, a hefty 65% loss months after going public. The stock wasn't going to surpass its IPO price until five years later. With a low market cap, limited free float, and an unusual business model, the investor community largely ignored it – until late 2021.

Exciting metrics

Much as I follow many oddball investments, I can't claim to have come across LFDE under my own steam.

It was first mentioned to me by the team of Paladin Asset Management, a boutique investment manager in Hannover, Germany, Their flagship fund, Paladin ONE (ISIN DE000A1W1PH8), had bought into the stock at prices around EUR 17 per share in late 2021. (Disclosure: the two founders of Paladin Asset Management, Matthias Kurzrock and Marcel Maschmeyer, are also shareholders of Sarnia Asset Management in Guernsey, of which I am CEO.)

Kurzrock and Maschmeyer are two of the best investment sleuths in my network. They had spotted that LFDE was facing not just one but several exciting developments that could lead to a re-rating of the stock.

During the years following its IPO, LFDE successfully:

- Established an initial ten CHPs with a combined output of 14.7 MW, which acted as proof of concept.

- Set an initial track record for the profitability of these units: internal rates of return of ≈40% in France and >60% in Belgium, according to analysts at Exane. Based on these extraordinarily high rates, LFDE could fund up to 90% of the investments in CHPs using debt.

- Raised financing for CHPs, including on a crowdfunding platform.

- Secured additional methane extraction rights, including in Belgium.

- Got the explicit backing of French politics, including president Macron himself.

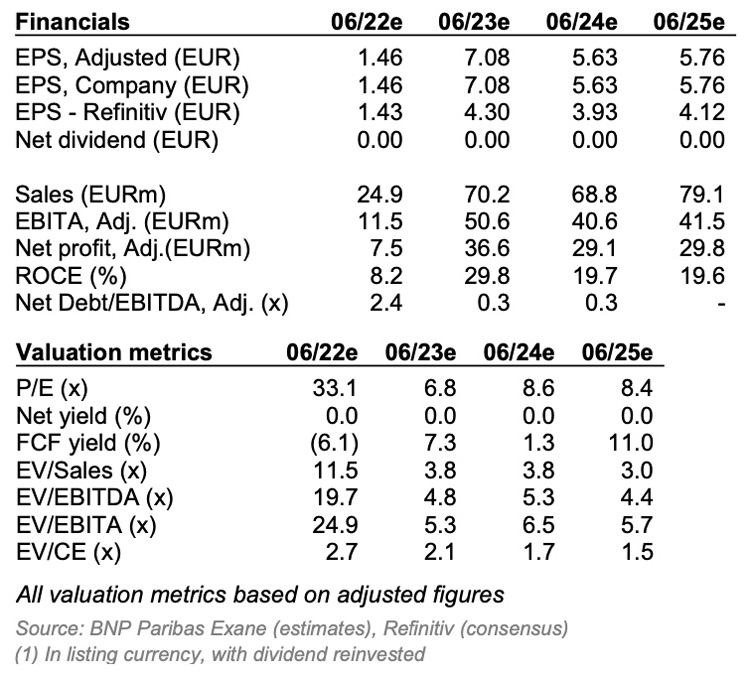

- Set a credible target of growing to 33 CHPs by mid-2023 and 60 CHPs by late 2024. This was estimated to drive a significant increase in EBITDA from EUR 3m in 2021 to around EUR 40m annually by 2025.

One of the mobile CHP units utilised by LFDE.

Additionally, LFDE stood to benefit from the significant rise in energy prices in Europe in 2021, allowing it to eventually charge higher feed-in tariffs.

Based on these developments, LFDE currently seems on track to become so profitable that even the increased share price equals a forward p/e ratio in the single digits. This strikes me as low for a company that – at least in theory – should have excellent visibility on its future earnings.

Source: Exane, 20 April 2022 (based on a share price of EUR 48).

The carbon certificate wildcard

Last but certainly not least, there is a chance for LFDE to benefit mightily from European policy decisions around so-called anthropogenic climate change.

In the current debate of the controversial subject, methane plays quite a prominent role. The methane molecule allegedly has a global warming potential that is nearly 30 times that of CO2 over a 100-year timeframe. Between 9-25% of global emissions that are deemed harmful for the planet's climate are based on methane. Preventing methane from rising to the atmosphere has become a policy priority. Cutting methane emissions is, according to the Executive Director of the UN Environment Programme (UNEP), the "strongest lever we have to slow climate change over the next 25 years".

As a company that captures and burns methane, LFDE may yet get issued so-called CO2 certificates. By preventing large amounts of methane from entering the atmosphere, the company could benefit from being a so-called negative carbon producer which get free CO2 certificates as a reward. Such certificates can be sold on the market or sold back to the regional government at a guaranteed price. Selling off the resulting rights under the emerging carbon emission trading scheme would generate highly profitable revenue on top of it all. It'd basically be a bonus of which the biggest part would go straight to the bottom line.

All of this was already becoming apparent to the market in late 2021. Then, Ukraine happened.

Strongly aligned with key European energy themes

Securing domestic energy resources was not a subject that European policymakers gave all that much thought to in recent years, unless it linked them to widely-loved forms of so-called renewable energies such as windmills or solar panels.

Following the events of 24 February 2022, the priorities have shifted.

European sources of power generation are now exceedingly important to reduce the reliance on Russian gas. Suddenly, the market has realised that LFDE's methane extraction rights in abandoned coal mines represent one of the largest undeveloped onshore gas resources in Western Europe. This is before fully accounting for the fact that Northern France and Belgium alone once had 350 coal mines in operation.

European gas and power prices are likely to remain elevated, domestic sources of power generation and gas reserves have increased in strategic value, and so-called green energy sources remain particularly prized. Given that LFDE never had anything to do with coal mining per se and merely processes a leftover product, the company ticks all the right boxes. Thanks to its green credentials, it barely has a risk of falling victim to any potential windfall tax proposals. 29 of France's 56 nuclear power plants are already out of operation, which is why the country (and its neighbours) need such alternative energy sources. LFDE has already started to expand into other forms of energy production as well.

It's no wonder the stock price has gone through the roof: since early February 2022 alone, it has almost doubled.

Where will it go from here? I called Paladin Asset Management for an assessment.

A potential triple – but with execution risks

Kurzrock tells me: "The division involving CO2 certificates is still under formation, but it's the most exciting part of the company and not yet reflected in the company's valuation. Management estimates that the sale of these certificates could generate an annual cash flow of EUR 30m – 60m. Discounting these payments with 8% p.a., this division could add a value of EUR 73 to EUR 145 per share compared to the current share price of EUR 48.

However, despite these prospects, for Paladin ONE this investment is probably near its end. We invest during a period of market ignorance and tend to take profits once a stock has gained some market attention and started to re-rate. This is the most attractive valuation gap for us to exploit, because it generates the kind of lower-risk returns that our investors like. Waiting for the eventual execution and delivery of management plans is something we usually leave to other investors."

What are these execution risks?

- The issuance of any kind of carbon certificates is not guaranteed, and hinges on political decisions.

- For some of its gas reserves, LFDE has yet to receive operating permits. Politicians may refuse them after all, because some of these gas fields have complex underlying structures and may require pumping water underground.

- Just as any fast-growing company, LFDE will face difficulties in managing the day-to-day challenges that arise when multiplying the size of a business within a few years.

You can make a credible case for a tripling of the share price from its current level, but you can also make a reasonable counter case that it's best to take profits off the table when the market is excited about a company.

If LFDE stock interests you sufficiently for you to do your own research, you can find some investment bank research on LFDE's website and more of it on the paywalled (but affordable) research platform Research Tree. The intricacies of utilising gas from old coal mines are a lot more complicated than I was able to describe for the purpose of this article, and it all makes for fascinating reading.

Treasure hunting in Europe's opaque markets

Today's second part of "Forgotten Microcaps" is a case study for the kind of asymmetric opportunity that you can find in niche corners of equity markets across Europe – including in off-radar countries such as Belgium, Norway, or Greece.

With its myriad of languages, legal systems, and economic quirks, Europe remains a fertile hunting ground for those who are looking for forgotten stocks that could be in for a re-rating. Until last year, LFDE was a microcap; it now gets covered not just by one but several bank analysts.

If turning discarded coal reserves is something you are interested in, GCM Resources (ISIN GB00B00KV284, UK:GCM) might be for you. The London-listed coal company has lost 99% of its value and could yet make a spectacular comeback.

Alternatively, you can wait until next Friday when I will feature the third and final "Forgotten Microcaps" stock. It'll come with very limited trading liquidity, you are unlikely to have heard of it, and it'll involve buying a world-class asset for a fraction of its value.

Blog series: Forgotten microcaps

There's more to "Forgotten microcaps" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Another coal opportunity for you

The past few months have led to a seismic shift in how nations think about energy. Coal has staged quite a comeback, as countries across the world suddenly realise that they might need coal for longer than they had planned.

With the new tailwinds for anything coal-related, mining company GCM Resources is a worthwhile punt. Its stock could remain at its current level for a long time, but just as much it could (at least) double overnight once the company gets more attention again.

A potential 100-bagger - if only a highly speculative one!

Another coal opportunity for you

The past few months have led to a seismic shift in how nations think about energy. Coal has staged quite a comeback, as countries across the world suddenly realise that they might need coal for longer than they had planned.

With the new tailwinds for anything coal-related, mining company GCM Resources is a worthwhile punt. Its stock could remain at its current level for a long time, but just as much it could (at least) double overnight once the company gets more attention again.

A potential 100-bagger - if only a highly speculative one!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: