Image by Yingna Cai / Shutterstock.com

Helios Underwriting is an insurance play unlike any other. The company is rolling up the market of Lloyd's "names", a little-understood legacy sector nestled within the world's most famous insurance market.

The background story to this GBP 130m small-cap stock is unlike that of any other Lloyd's-related insurance company that you may have come across elsewhere.

I presented Helios Underwriting as an investment case at the Weird Shit Investing conference in June 2024. It proved popular with attendees, which is why I am now sharing it as a Weekly Dispatch for others to enjoy, too.

Buckle up!

The iconic Lloyd's of London building.

The world's most famous insurance market

Lloyd's of London is the century-old insurance market that once started in a coffee house. Back in the 1680s, this café in the City of London was a popular gathering place for sailors, merchants, and ship owners to negotiate insurance contracts.

Fast-forward 300 years, and Lloyd's is the insurance market that is housed in one of the most iconic buildings of London's financial districts. 5% of the world's insurance business is done through Lloyd's.

Importantly, Lloyd's is not a company but a market. The business is done through individual firms. In its iconic building, insurance brokers meet physically to negotiate insurance contracts. This includes contracts that would be seen as weird by most, such as insurance against UFOs landing on Earth. However, it's an entirely serious market and aimed at insuring niche, specialty risks. No risk is too unusual for someone at Lloyd's to take a serious risk at insuring it, though prices are naturally steep if your request is out of the ordinary.

The Lloyd's market suffered a catastrophic financial breakdown during the 1980s and 1990s. At the time, the majority of the insurance underwriting was backed by so-called names, private individuals that accepted unlimited liability for the insurance contracts they underwrote.

Why did they accept unlimited liability? They used their wealth to achieve a two-fold return. Backing insurance contracts means you only need to keep money in reserve in case a payout becomes due. In the meantime, you are free to invest the money elsewhere. As a result, you make money from receiving the insurance premiums *and* you can invest your money to achieve a return from stocks, bonds or other investments.

When Lloyd's was hit by payouts from the use of asbestos, many of these names lost everything. The market went through a period where it wasn't clear if it was even going to survive.

Survive it did, and it's thriving again.

The pandemic and resulting shift to working from home threw another curveball, given that the entire market is built around the idea of meeting in real life to negotiate contracts in person. During the bleak times of the lockdowns, Lloyd's discussed switching to a new operating model (described in more detail in the 2 December 2022 Weekly Dispatch "Lloyd's of London – a secular new theme?").

Today, Lloyd's is back to business as normal – and then some!

Lloyd's recently extended the rental contract for its building to 2035, with an option to even stay until 2040. Speak of commitment to people coming to the office.

The extension of its rental contract made the news, but outside of the world of insurance, few people follow other details or even understand how the market functions. It has many quirks and little-known aspects, e.g.:

- The individual "names" that back insurance contracts are widely believed to have been phased out following the crises of the 1980s and 1990s. Indeed, their numbers are down from 36,000 to just 2,000 – but they still exist.

- The right to invest with specific insurance syndicates is a property right in itself, and one that can even be bought and sold at auctions. This is the so-called capacity, a term this article will get back to.

- The Lloyd's market operates on a three-year accounting period. Not every company that participates in Lloyd's uses this accounting regime, though, which makes the sector hugely confusing to follow.

- Following its near-demise in the 1990s, Lloyd's is now protected against catastrophic losses through a triple safety mechanism:

- The underwriting capital.

- The "Central Fund" emergency reserve.

- Insurance contracts that are underwritten by private clients of J.P. Morgan.

- Lloyd's may be a very traditional market but it's also very innovative. Its recent launch of novel types of insurance for health care trials were launched made the headlines.

Source: Insurance Times, 13 February 2024.

Throw in the fact that insurance is not exactly the best-understood subject in general, and inherently complex.

It's within this complex, quirky set-up that an attractive long-term investment opportunity has been hiding for a long time.

A specialised investment vehicle for Lloyd's opportunities

Using the stock market to invest into Lloyd's-related insurance businesses isn't new. There are a number of well-known companies listed in London that offer this kind of exposure:

- Lancashire Holdings (ISIN BMG5361W1047, UK:LRE): GBP 1.5bn market cap.

- Hiscox Limited (ISIN BMG4593F1389, UK:HRX): GBP 4.2bn market cap.

- Beazley Limited (ISIN GB00BYQ0JC66, UK:BEZ): GBP 4.5bn market cap.

However, these are large firms with very broad businesses and followed by many analysts.

Something more focused and with a truly unique angle is Helios Underwriting (ISIN GB00B23XLS45, UK:HUW) – which is not to be mixed up with Helios Towers (ISIN GB00BJVQC708, UK:HTWS), an Africa-focused phone mast operator.

Put simply, Helios Underwriting is the equivalent of an investment fund that invests into parts of the Lloyd's insurance market.

The company has been outperforming the overall return of the Lloyd's market every year since 2013. The way Helios Underwriting has been managing risks and returns for its shareholders is remarkable, and a story that the investment industry has not yet woken up to.

How did it do that? Helios Underwriting owns "capacity" for some of the best insurance syndicates, i.e. it has a right to invest with these syndicates. Which syndicates are worth backing and under what conditions is part of the proprietary knowledge that Helios Underwriting has built up over the years. Owning capacity for the best syndicates is then a valuable right in itself, and it may also enable you to up your investment over time. The details of this are complex and go beyond the scope of this article, but Helios Underwriting could well be a very smart compounder.

The company describes itself as "offering exposure to a diversified insurance portfolio underwritten through top performing syndicates at Lloyd's of London".

The real story, though, is that Helios Underwriting has identified a niche within Lloyd's that it can exploit for its investors. It involves the 2,000 remaining "names", many of which are now in their 80s and 90s.

Consolidating the "names"

When Lloyd's suffered through its asbestos crisis, many wealthy, famous backers went bankrupt. Some committed suicide. The business model of letting individuals accept unlimited liability for insurance contracts proved a PR disaster, and a financial disaster as well as some of these risks then had to be paid through other means to keep the market from going under.

Since the mid-1990s, Lloyd's has been moving to a different model. No new names were accepted onboard; instead, the underwriting is backed by entities with limited liability.

The old names were grandfathered into the new regime, though, which is why of the original 36,000 names, 2,000 are still left.

Holding the status of such a name is a peculiar type of investment:

- It's complex to manage, and there are hardly any service providers left who can help you with it.

- Most of these names nowadays only have relatively small amounts invested in insurance underwriting, making them a sub-scale investment.

- Being a name is a property right you can leave to your kids, but it's so complicated and specialised an investment that it's not something that would be easy to leave to the next generation.

Right now, there remains a tax-efficient route for names to sell their rights – and this is where our protagonist enters the stage.

Helios Underwriting uses its capital to buy out these individual names. It can then use their capacity, i.e. their right to invest with certain syndicates.

On average, the rights held by these individual names are worth just GBP 1m. Their status is too small an asset for most insurance investors to bother with. However, for a tiny firm like Helios Underwriting, even the small number of remaining names represents a significant growth opportunity:

- The roughly 1,500 names that are attractive to acquire make up a combined GBP 1.5bn buyout opportunity – 10x the current market cap of Helios Underwriting.

- It's a buyer's market, because very few investors are following this sector.

- It's also an emotional asset, and one that the owners usually want to place with someone they like and trust.

Helios Underwriting has positioned itself as THE buyer for this specialty asset. It can even offer shares instead of cash, to give the seller the option of remaining invested but with someone else handling the complex part.

In effect, Helios Underwriting buys up valuable insurance capacity at value prices. It's also a real growth asset, because of the current success (and resurgence) of Lloyd's. After all, being a member of a syndicate gives you a kind of preferential right to up your investment when that syndicate takes on additional capacity.

This market has a lot of growth potential, which is becoming more apparent again now that the crisis of the 1990s has disappeared down the rear mirror. After spending the better part of a generation cleaning up the mess left behind by the crisis, Lloyd's is finally free again to focus on growth. In 2019, the company announced its aim to double the size of its market share in the global insurance market, from 5% to 10%. The pandemic threw a spanner in the works, but with the end of pandemic lockdowns, business is better than ever before:

- In 2023, underwriting profits jumped 127% to GBP 5.9bn (USD 7.5bn).

- The job market for positions within the Lloyd's market has also never been better.

- In spring 2024, Lloyds reconfirmed its aim to double the size of its market share.

Source: City A.M., 29 April 2024.

What's best about it all?

Because of the three-year accounting period of Lloyd's, there is a loophole that helps you to get more visibility on the future profitability of Helios Underwriting.

Hiscox, Lancashire and Beazley all report their performance based on a one-year accounting cycle (GAAP). Helios Underwriting, on the other hand, sticks to the same three-year accounting cycle of Lloyd's. Its results forever trail everyone else, whose reporting is two years behind.

By looking at the performance of Hiscox, Lancashire and Beazley, you can get a sense of how the next two years are likely going to play out for Helios Underwriting.

Massively undervalued stock – and a catalyst

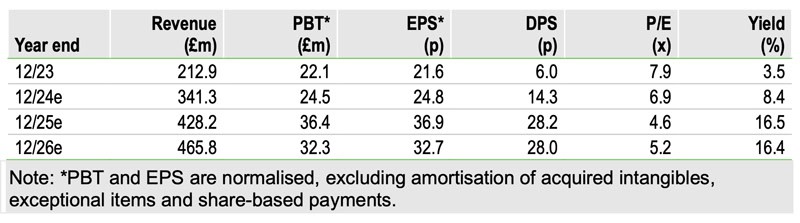

Given the current super-cycle of the insurance industry, results are likely going to be rather favourable for shareholders of Helios Underwriting. Based on the latest estimates provided by Edison Research in early July 2024, the company will show earnings per share of 36.9 pence in 2025 and 32.9 pence in 2026. With a stock price of 181 pence, this makes for an unusually low price/earnings ratio of 5.

Helios Underwriting is also predicted to pay a dividend of 14.3 pence for 2024, rising to 28.2 pence for 2025 and 28 pence for 2026. This makes for a current dividend yield of 7.9%, rising to over 15% p.a. for the two subsequent years.

Source: Edison, 5 July 2024.

Throw in Helios Underwriting's growth potential from buying out the ageing names, and you get quite an attractive investment proposition. After all, this is a company that has proven very apt at managing risks and making sure it only backs the very best syndicates, while gradually increasing the overall size of its portfolio.

Why is the stock so cheap, then?

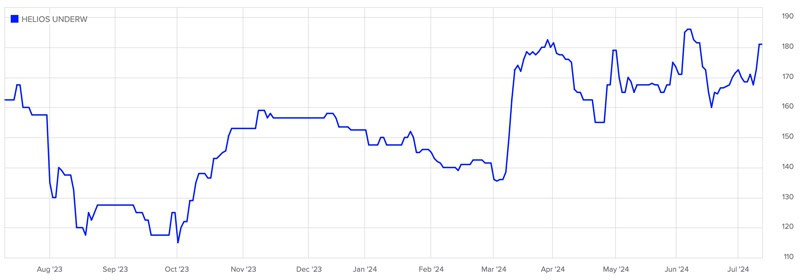

Two large shareholders had been under pressure of late. When the firm of British fund manager Crispin Odey went through large changes following a sexual harassment case, some of his stock hit the market. Another fund, Hudson Structured Capital Management, was also turned into a forced seller. Of late, Hudson Structured still had a 11% stake, i.e. there was a huge overhang of shares.

However, this may soon be resolved. Helios Underwriting recently had John Chambers join its board. Chambers is well-known through writing about Lloyd's-related opportunities in Britain's MoneyWeek, and he also plays an active role in the market. One of his roles has been to provide independent advice to institutional investors who were looking to deploy capital at the Lloyd’s market. His joining the board is remarkable. Is he going to help with placing the overhang from shareholders like Hudson Structured? Nothing was said in public, and I didn't ask Chambers (an Undervalued-Shares.com reader) for any input. But I can add one plus one. Since I featured this investment case at the Weird Shit Investing conference in June 2024, the stake held by Hudson Structured has already decreased from 15% to 11%.

If my hunch is right, Helios Underwriting is working to right its shareholder structure. Cleaning up the shareholder structure is the catalyst that I believe will lead to a re-rating of the stock. Given that this will entail speaking to potential investors, these developments are unlikely to remain secret for much longer. In fact, the stock price picking up during the past few days could be a sign that the market is waking up.

Helios Underwriting.

And even if it all does take longer, this is an investment fund type asset with an extraordinarily high prospective dividend yield over the coming years.

One of the key difficulties is getting in. The market cap is currently just GBP 140m, and 30% of the stock is held by management. Altogether, 60% of the shares are held by just a few shareholders (leaving aside the 11% held by Hudson Structured). Many shareholders are quite knowledgeable and in it for the long haul.

Investors interested in getting exposure should only place orders with a limit, and be patient if their order doesn't get filled right away. Though now is also the time to try and take a bite out of the shares that are seemingly for sale by Hudson Structured.

That said, Helios Underwriting stock will probably start to move higher as a result of what's been going on not just within the industry, but also at the level of the company and within its shareholder structure.

Hot off the press: new in-depth research report

Wind energy stocks are currently down-and-out, but they have previously proven resilient. Three cyclical downturns have occurred in this sector since 2000; each time, leading wind energy firms came back bigger and stronger.

The company featured in my latest research report – out this week – is better prepared than others to leave the current downturn behind, and tap into the continuing investments into wind energy.

It stands out as an investment because it combines i) low valuation, ii) clear progress towards the next growth cycle, iii) plenty of upside for investors who get in now.

Which stock is it?

Hot off the press: new in-depth research report

Wind energy stocks are currently down-and-out, but they have previously proven resilient. Three cyclical downturns have occurred in this sector since 2000; each time, leading wind energy firms came back bigger and stronger.

The company featured in my latest research report – out this week – is better prepared than others to leave the current downturn behind, and tap into the continuing investments into wind energy.

It stands out as an investment because it combines i) low valuation, ii) clear progress towards the next growth cycle, iii) plenty of upside for investors who get in now.

Which stock is it?

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: