I turn 50 today. What have I learned about investing so far?

Hilton Worldwide – will ‘Spark’ spark the share in 2024?

Image by Ceri Breeze / Shutterstock.com

Hilton Worldwide needs no introduction. The name "Hilton" is literally a synonym for hotel.

Right now, the company runs 7,400 hotels with a staggering 1.2m rooms.

Despite its size, it aims to grow yet bigger – by a lot!

Current expansion plans include the construction of new Hilton hotels worth USD 50bn – with Hilton only putting up USD 350m of capital.

How is that even possible?

Hilton's historic roots explain today's success

For a solid understanding of Hilton, do spend a bit of time studying the company's eponymous founder.

As the son of a Norwegian/German family that grew affluent on the back of a grocery business in New Mexico, a 32-year-old Conrad Hilton set out on his own in 1919. Hilton used his entire savings of USD 5,000 to buy a small hotel in one of the bustling oil towns in Texas.

Within a few years, he had built a small chain of hotels, only to lose it all during the Great Depression. With a string of audacious manoeuvres, he eventually won back control of his hotel group. In 1942, Hilton expanded beyond the state of Texas.

During the post-war years, he innovated the industry by introducing:

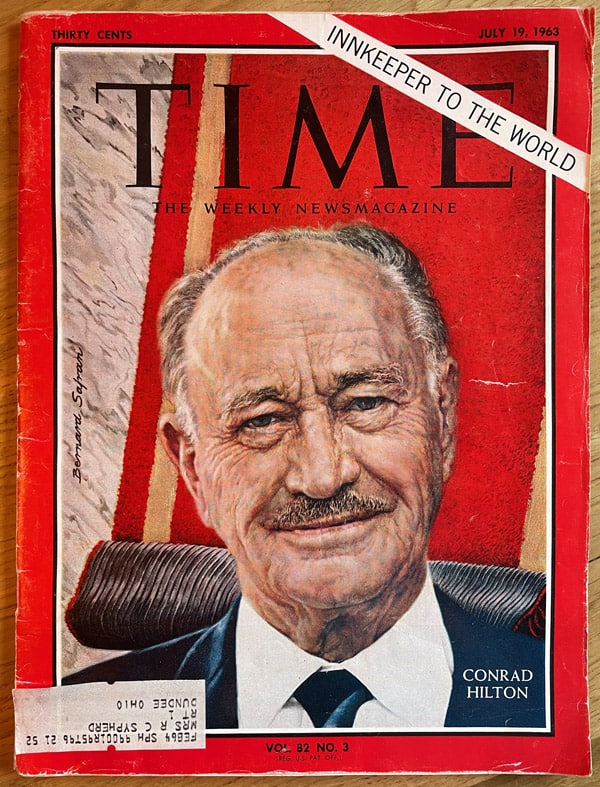

- The first global chain of hotels, which helped kick-start the global travel boom. As a 1963 TIME magazine cover story about Hilton put it: "Whether he is in Teheran or Trinidad, the American traveler can be sure that Hilton will offer him a clean bed, pleasant surroundings, plentiful ice water, and food he can safely eat. … Hilton is busy spotting the world with hotels where ever the US tourist and businessman alight, circling the globe in the longest hotel chain ever made."

Source: TIME, 19 July 1963.

- The first global reservation system, and a cost-control system to match: "The very spread of the chain helps to pull in the guests. Hilton operates a globe-circling reservation system of 126 sales offices. Each hotel keeps rigid watch on costs and sends daily reports to Hilton headquarters, which knows within 24h whether a banquet in Cairo or Hong Kong made money. To tighten costs, two teams of executives surveyed 15 Hilton hotels in the US last year, came up with findings that will save the chain nearly USD 2m. All this has helped to bring the Hilton chain's labor bill down to 40% of revenue, versus 45% for most other hotels."

- The first capital-light growth model of a hotel chain: "The usual Hilton arrangement is for local capital – either private or government – to supply the land, the building and the furnishings. Hilton only puts up the operating capital and runs the hotel. Two-thirds of the hotel's gross operating profits goes to the hotel owner, one-third to Hilton."

Hilton's career included several transactions that made history. E.g., his USD 111m purchase of the Statler Hotel chain was the largest transfer of real estate in America since the Louisiana Purchase in 1803.

Hilton died in 1979. Nowadays, his name is eclipsed by the fame of his granddaughter, Paris Hilton. However, for anyone eager to learn from successful entrepreneurs and investors, some of the long-forgotten literature about Conrad Hilton will still be useful, and fascinating:

- "The Hiltons – The True Story of an American Dynasty" is a 540-page humdinger that revolves around the family drama, the personalities of the main protagonists, and the assortment of stars and starlets drifting in and out of the family through marriage.

- "Be My Guest" is the 1957, 288-page autobiography of Conrad Hilton, which exudes the founder's ethos to dream big. The final (highly recommended!) chapter contains Hilton's advice on "The art of living", summed up in nine rules to live by.

- "Inspirations of an Innkeeper" was published by Conrad Hilton on the occasion of his 75th birthday, containing private clippings from his speeches, correspondence and experiences. Only 312 copies of the large-format book were printed and gifted to those who were closest to Hilton. I managed to find a copy, and made a scan for you to download for free (PDF, 62MB).

Hilton was involved with managing the company just before his death at 91. His New York Times obituary noted that "he was at his desk six days a week" well into his 80s and "it was not uncommon for him to dance until 3 A.M., to appear for coffee and orange juice at 8 A.M., then go on about a full day's schedule."

His son Barron wrestled control of the company through a protracted fight between heirs, and became Chairman of the Board and CEO. He managed the firm until 1996 and remained involved well into the 2000s.

The reign of the family officially ended in 2006, when private equity took control. Blackstone Group fielded a USD 7.5bn offer, which at the time was the largest transaction Blackstone had ever made.

It's been up further since.

The recent decade of compounding value

Controversial as the role of private equity in managing other companies often is, it did prove a winner for Hilton Worldwide Holdings (ISIN US43300A2033, NYSE:HLT). When Blackstone gained control of Hilton, the group had 4,000 hotels under management. Today, it's up at 7,400 hotels.

After an initial period as a privately held company, Hilton became a public company again in 2013. Its stock IPOed on the New York Stock Exchange.

December 2023 marked the tenth anniversary of the stock trading in New York. Anyone who bought into the IPO would have achieved a total return of 330%, outperforming the Dow Jones' and the S&P 500's returns of 185% and 210%, respectively. Along the way, Hilton also repeatedly got recognised as the best employer to work for in the US.

What's the magic sauce of this ongoing success in an industry that many see as rather boring?

Hilton Worldwide Holdings Inc.

Hotel operator as data miner

In stock market circles, Hilton is widely known as the showcase model for a hotel company that got rid of its real estate and instead focused on being an operator. Indeed, Blackstone did take this model further than the Hilton heirs had already done. Hilton today owns just 1.5% of its hotel rooms. The other 98.5% are operated on a franchise model or under a management contract. Under the franchise agreements, the company collects royalties amounting to circa 5-6% of room revenue, with no exposure to the hotel's profitability. Hilton is running one of the world's ultimate asset-light franchise models.

However, the factors that made the company such a success extend elsewhere.

Over the past ten years, Hilton has managed to more than quadruple the number of members of its Hilton Honors loyalty programme, from 40m to 173m today. This made Hilton Honors the fastest-growing major hotel loyalty programme, and one of the three largest such programmes overall.

The vast amount of data that Hilton Honors provides on guest preferences and spending patterns makes for a better, more personalised experience for its registered members, helps to optimise costs, and enables the company to drive incremental revenue through highly-targeted sales offers. Such a membership programme creates a network effect that only gets stronger as the membership base increases.

The size of such a data pool matters. Hilton allegedly has already spent the past few years working on how to best tap into the insane amount of client data it has accumulated. The new possibilities thrown up by AI will only make this data more valuable and useful, and in ways we probably can't even imagine yet.

AS Morgan Stanley summed it up in a year-end 2023 note: "AI offers the biggest opportunity to Hilton, given the company's scale and direct relationship with consumers."

Based on Hilton's growth plans, the flywheel effect that this membership programme creates will be applied to an ever-larger number of hotels. This could even involve an ambitious concept that the company unveiled last year, and which the market hasn't paid much attention to yet.

Will Spark spark another billion-dollar success?

Hilton's investor presentation is pleasantly short and comprehensible. On 14 pages, the company gets across why the next ten years may well be as successful for its shareholders as the past ten years.

Hilton and its franchise partners are planning additional hotels worth USD 50bn (in comparison, Hilton's current market cap is USD 48bn). 50% of these projects are already under construction. They are going to add another 457,000 rooms to the group, taking the company's total to over 1.5m rooms. Hilton will only need to contribute USD 350m of its own cash towards these growth plans. Over 90% of the additional hotels will require zero upfront investment by Hilton.

Speak of a capital-light operating model!

The strength of the Hilton brand, global booking system and loyalty programme is such that many owners of hotel real estate are gagging to be part of the group. Nowadays, this extends across 17 brands and categories. Besides the classical "Hilton Hotel & Resorts", there is a raft of other brands that cover different price points and service levels:

- Fancy boutique hotels? Look up "Curio Collection by Hilton".

- Need a timeshare? Check out "Hilton Grand Vacations".

- How about luxury? "Conrad Hotels & Resorts" will provide that.

All of this is centrally sold through to the company's 173m members and the entire global public.

The brand that few investors have on their radar yet but which could prove a game changer even for Hilton is "Spark". In fact, Hilton's CEO, Chris Nassetta, in early 2023 called it "the most disruptive thing we've done".

Nassetta believes his team has cracked the code for lower-market motels, a highly fragmented market with no sizeable international operator. The plan is for Spark to offer a higher-quality yet affordable product that will use cheap land outside of towns and eat into the market share of motel owners. Digital tools such as 24-hour digital check-in and mobile keys, as well as a basic breakfast will be among the hotels' features. Spark will be priced about 20% below its existing economy brand "Tru", and slightly above the traditional motel pricing.

The motel space is so big that a successful roll-out of Spark would represent an opportunity to bring millions of new customers into the Hilton ecosystem and "be worth billions of dollars" to the company's shareholders.

When Nassetta first discussed these plans in February 2023, his company had more than 200 deals in various stages of negotiation. Hilton has since opened several such properties. Media reporting about this new part of the Hilton empire has been scarce so far, and mostly limited to specialist publications such as Travel Weekly, Hospitality Net, and Hotel Business. Hilton's full-year results, to be announced in the second half of January, could provide a first update.

Source: Travel Weekly, 11 January 2023.

Will success beget more success?

Hilton isn't the world's largest hotel group, nor does it operate the world's largest loyalty programme. Marriott International operates over 8,000 hotels with 1.4m rooms in 2022, putting it a smidgeon ahead of Hilton. Jin Jiang in China has over 12,000 hotels with 1.2m rooms. Marriott's membership programme, Bonvoy, was already at 177m members in late 2022.

Still, the Hilton brand and company occupy a special place not just in the minds of the public, but also in the minds of investors.

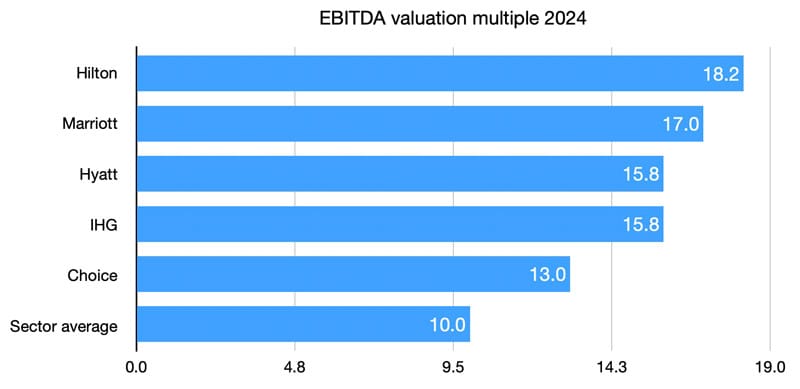

Relative to its publicly listed competitors, Hilton stock commands a premium.

Source: Seeking Alpha estimates.

Is the premium justified?

Hilton itself will say it is and point towards its above-average growth: from 2007-2022, Hilton grew its number of rooms by 127% while Hyatt, Marriott, and IHG came in at 96%, 92%, and 62%, respectively. While the timespan chosen by Hilton for this comparison may be somewhat arbitrary, it does show the company's relative strength.

Its success for shareholders was also driven by the strength of its financial model, which even the pandemic lockdowns slowed down only temporarily. Hilton has been able to buy back its own stock at a pace of 2-3% per year. Given its capital-light model, the company should be able to do the same over the coming years.

No doubt, this company is a high-quality business with a multi-year runway of accelerated earnings growth and an exceptional management team.

How much room is there for Hilton to grow further?

So far, 70% of the company's revenue is generated in the US. With an estimated 800,000 rooms across its various US brands, Hilton already controls about 16% of the US hotel room stock of 5.3m. There probably remains room to grow this share further, especially with an initiative such as Spark. On a global level, Hilton will have only scratched the surface of its long-term growth potential. Estimates of the global stock of hotel rooms run between 15-20m, and growing quite consistently.

Hilton's further growth is not going to come without bumps in the road. The hotel and hospitality industry has proven vulnerable to repeated shocks, as demonstrated by events such as 9/11, the Great Financial Crisis of 2008/09, and the pandemic lockdowns.

Still, the human urge to travel, explore, and connect probably makes for a strong underlying current. 80% of the world's population has not yet been on an airplane even once, which will change as the world's middle class continues to grow. Many will want to enjoy that "clean bed and pleasant surroundings" which Conrad Hilton provided when the burgeoning American middle class started to explore its country and the rest of the globe.

In a world where size is a strong advantage, it'd take a brave soul to bet against the continued long-term success of the Hilton chain and its stock. Hedge fund billionaire Bill Ackman is among those who believe in the company. His Pershing Square Holdings (ISIN GG00BPFJTF46, UK:PSH) at last count had about 11% of its money invested in Hilton. As Ackman summarised in his 2022 annual report:

"Despite Hilton's unique business model and attractive long-term earnings algorithm, the stock remains attractively priced at approximately 24 times forward earnings. We find Hilton's valuation to be compelling given its industry-leading competitive position, superb management team, attractive long-term net unit growth algorithm, and best-in-class capital return policy."

When's the best time to buy into such a company? Cost-averaging would probably be the right answer. Why not sign up to the Hilton Honors programme and buy a few more stock each time you stayed in a Hilton hotel? In terms of creating a small savings plan for yourself, you could probably do a lot worse.

Hot off the press: new in-depth research report

What do you call a publicly listed company where ALL large shareholders agree that the company should be sold?

A prime takeover target.

My latest research report – out this week exclusively for Lifetime Members – features one such target from the British Isles.

It is the market leader in its region, with a strong balance sheet and a valuable brand name.

A bid for this company will likely have to be at least 50-75% above the current share price.

Hot off the press: new in-depth research report

What do you call a publicly listed company where ALL large shareholders agree that the company should be sold?

A prime takeover target.

My latest research report – out this week exclusively for Lifetime Members – features one such target from the British Isles.

It is the market leader in its region, with a strong balance sheet and a valuable brand name.

A bid for this company will likely have to be at least 50-75% above the current share price.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: