If you are among my "Millennial" readers (or likewise, if you want to put your children or grandchildren onto the right track), this article will be for you.

I have a growing number of readers between 16 to 30, and some of them have asked me if they could pick my brain. They want to get help with learning about investing, making career decisions, and deciding where to go in life. Also, how do these separate strands all tie together to form a happy, successful life?

For whatever reason, they think I can offer a useful perspective.

Today, I'll cover all of that, though of course I won't be able to explain life and the universe in this single piece alone. But I can try and help people to get started on their journey.

My ten pieces of advice were selected after running an early draft of this article past half a dozen of my younger readers. Some of the points relate directly to investing, others indirectly. I added the latter because I don't think you can look at investing in isolation.

To the younger readers among you who have yet to carve out what course to take in life, I hope you will find the following useful.

Advice #1: Trade and invest your own money

I recently helped a fund management firm to hire a top-notch equity analyst.

What was the single most difficult-to-find, highly-priced skill we were looking for?

It wasn't the ability to create financial models in Excel, or pull reams of data out of a Bloomberg terminal.

There was one magic, must-have factor: the winning candidate had to have the kind of experience that would enable them to not just look at investments analytically, but also with a gut instinct.

I am entirely serious about it.

Some of the best investment analysts and fund managers I know concur that:

- You do need to exert tremendous energy to analyse a stock using conventional methods because that provides the baseline for a decision.

- At the end of the day, the decision to invest (or not) is down to your gut feeling. And it's on that level where a significant part of the outperformance is created.

Nine out of ten candidates we looked at would have easily scored on the first point.

But just one out of ten would even remotely qualify for the last point.

It's THAT rare a skillset in the investment industry.

It isn't difficult to figure out why this particular skill is in such short supply.

You will only get this particular gut sense for separating the wheat from the chaff if you have been active in the markets yourself – for years and, crucially, with your own money.

Only when you put your hard-earned dough on the line will you start to think about your investments and watch their intricate movements on a daily (if not hourly) basis. The experience that you will gather from obsessively watching your wealth go up and down will be invaluable.

As if this weren't difficult enough to pull off, you also have the system working against you. The finance industry nowadays makes it even more difficult for anyone to develop this particular qualification. We live in the day and age of excessive compliance regulation, and everyone obsessing about the most minute risks of a conflict of interest. It's not become easier to work in the investment industry AND operate your "PA" (industry jargon for "personal account") at the same time. However, you mustn't let that stop you.

What unites almost all of the young readers who have ever asked me for advice was their interest in working in investment analysis and portfolio management.

For all of them, this is my #1 piece of advice – by a mile. I even asked two well-placed colleagues if they felt the same. "Yep, spot on", they said.

You'd be surprised how few people tick this box nowadays. By implication, it means that this particular qualification will give you a lot of leverage in negotiating your salary and bonus scheme. I'd even go as far as saying that this will eventually enable you to pick your employer, rather than your employer picking you.

True, even for investors!

Advice #2: Learn about investment processes

The following is an inconvenient truth for me.

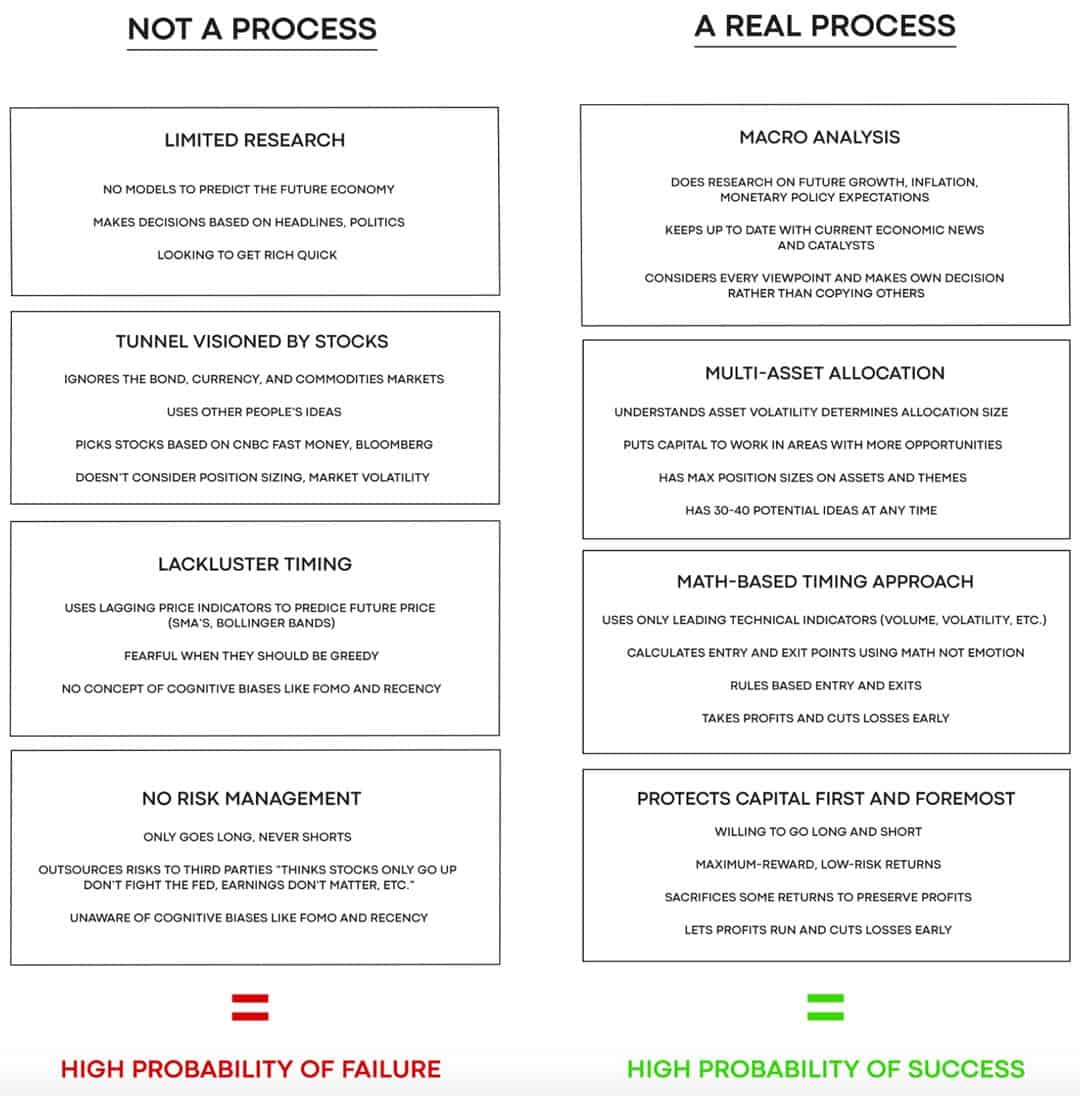

If you pursue a structured process to identify, analyse and manage investments, you almost inevitably become more successful.

What do I mean by "investment processes"?

An investment process is a series of repeatable steps that guide you through finding, analysing and managing investments. Within each step, you have a set of rules you must follow before moving on to the next step. At the end of the process, you will have a complete and coherent basis on which to make a decision, and manage investments on an ongoing basis.

It's a rule book or a system.

I didn't spot the value of this until later in life.

"I've got my own way of doing things."

"I sense a good investment when I see one."

"Because of my experience, I don't need any rules."

These are all sentences you could have heard me say when I was younger.

Today, I recognise the tremendous value created by building your own investment process and following it.

For a start, it forces you to add to your skills. Creating a robust investment process invariably involves a variety of analytical steps that you are not yet familiar with – because there are so many of them!

A process forces you not to cut corners but to look under every stone.

It also prevents you from making impulse decisions, thus reducing your number of bad decisions. (By the way, none of this rules out checking your gut instinct as part of the process – that's simply the last step of the process).

How does an investment process look like?

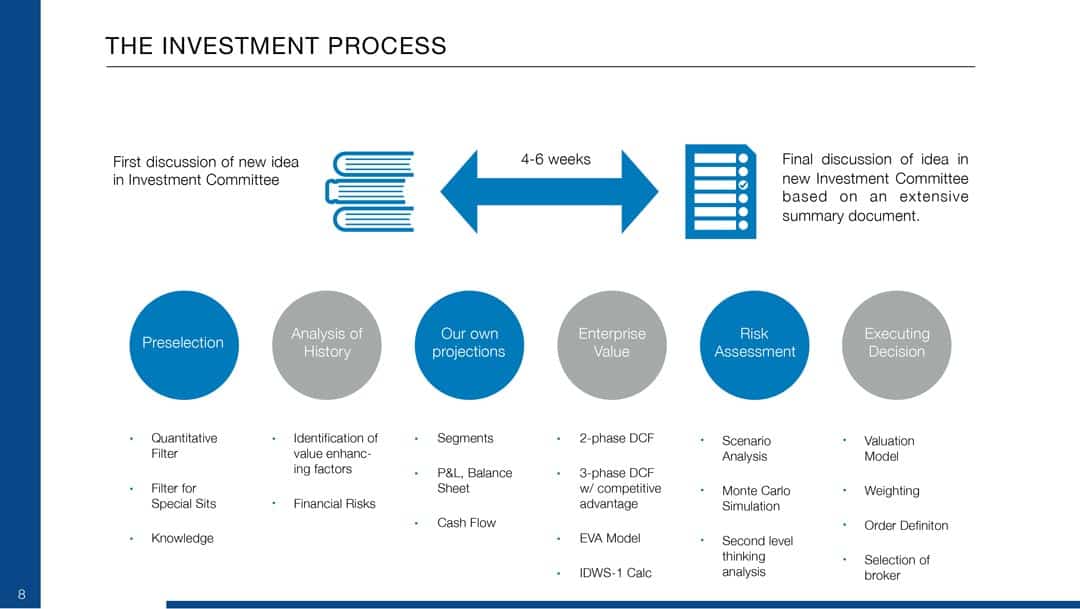

Here is an exemplary investment process, sourced from a fund management firm with an enviable track record and hit rate. It's included in a publicly available presentation of the Paladin ONE fund (ISIN DE000A1W1PH8), which my Members got to read about in this research report from November 2019.

It is just an example, and there are plenty more out there. I recently came across someone else's article that contained a useful juxtaposition.

Of course, if you are just starting out or manage your investments in your precious time off work, you cannot possibly pursue the same elaborate investment process as a fund management firm.

The point is, you need to be aware that over the years, you should strive to develop a broad enough toolkit to become comfortable with applying an investment process. It can be a much simpler process, and you can tailor it to your own needs and limitations. But you need to have one.

Successful, serious investors and fund management firms all use one.

As a starting point, you could simply latch onto the investment processes used by some bloggers. Lyn Alden, who I think is one of the best investment writers and bloggers in the world, runs her model portfolios based on a proven investment process that she has developed over the years. Every year, Lyn publishes an analysis of the most important economies worldwide, based on which she then hones in on the markets that she would like to invest in. If someone else has done the heavy lifting for you, you don't need to do it all yourself.

When you enter the job market, try to have as broad a set of tools for investment analysis as possible. Get comfortable with applying them to a process, and think through which methods make more sense in your view. It'll become another valuable skill for you to market yourself.

If you really want to impress prospective employers, create and present your own investment process. Alternatively, take their existing process apart and tell them what they got wrong. They'll love engaging with you about it!

Advice #3: Seek an autodidactic education in personal finance

There is hardly an area in life that isn't affected by money and finances:

- Should you buy or rent?

- How best to plan for your retirement?

- What do you need to understand about insurances?

- Prenuptial agreement – yes or no?

If you get one of these questions entirely wrong, it could damage your life. Yet, how much do they teach you about these things in school, or even at home? Your parents themselves were probably never taught by anyone. It's a persistent problem. I grew up in Germany, where talking about money was a taboo.

There is now an entire industry that has become extremely apt at separating you from your money. Anyone you deal with regarding your finances will have their own interest at heart first and foremost.

Caveat emptor ("buyer beware"), and always do your own due diligence.

The good news is, you live in the golden age of digital information. No generation before you had access to so much (and usually free) information, and you can fairly easily create a system of continually educating yourself about personal finance matters.

You'll have to create it yourself, though. No one else can determine your priorities at different stages in your life. If you don't make time for it, you will probably still get through life okay, but you'll have a lot of money snatched off you by prying hands along the way.

In amidst your likely fascination with stocks, don't forget about all the other personal finance areas that will affect how you live, what you can afford, and how safe you (and your loved ones) will be throughout your life. Not being able to afford good health insurance or not knowing how to spot the "right" one could turn into a life-or-death error at a later stage in your life.

Needless to say, I recognise that giving this advice is easier than to put it into action. Where to start?

Here is how I will help you get a head-start in life.

I had long planned to feature several blogs that are suitable for younger readers and anyone interested in personal finance (as opposed to stock investing). Sometime during August, I will therefore launch a special, extended "Blogs to watch" series that puts those blogs in the spotlight.

Armed with a few pointers to other useful blogs, you should get off to a good start, and without any costs. (This series should also be useful for older readers who want to put their children or grandchildren onto the right path of reading about the subject.)

#4: Read OLD books

It will seem counter-intuitive, but old books are often helpful in predicting the future for investments.

Why?

- Plenty of books predicted the right ideas, but they were published ten, twenty or more years too early. You have to dust them off just as they become relevant again!

- History doesn’t repeat itself, but it does rhyme. Knowing about stuff from the past long gone by will enable you to get a better understanding of the present and make more accurate predictions for the future. It will help you to at least get the overall direction of travel right, and that's as much as you need to do better than most other people.

I have generated outstanding investment ideas (and, sometimes at least, made heaps of money) by reading out-of-print books that others had long forgotten about.

You could even go as far as calling this approach one of my secret weapons – not just with regard to investing, but life generally. This strategy can help you outperform in your investments and your career.

My favourite story about using out-of-print, "published-too-early" books and utilising them to make money on the stock market is about the Falkland Islands and their massive oil reserves. It's also a story that those of my readers who have followed me for longer are likely to remember.

In 2004, I published a 142-page tome about the "secret" oil reserves of the Falkland Islands, and how one company listed on the London Stock Exchange was going to benefit from them. To this day, it ranks as the longest piece I have ever written, and one of the most impactful ones.

It also led to a fair amount of controversy. One Austrian newspaper accused me of fabricating lies and doubted there'd be any oil at all. In the end, the controversy only fuelled the public interest.

The story stood out because

- it was about a subject that everyone knew something about (the Falklands War)

- the potential pay-off to investors was huge (nothing else does more to get investors' attention)

- I was the first person to write about it from an investment perspective.

How had I come up with it? I had simply dug out books and other publications from the 1970s and 1980s, in which the islands' potential for gigantic oil reserves was analysed in detail by geologists. These old publications also set everything in the right political context (did you really think Thatcher was only interested in saving the 2,000-odd Brits living there?). However, the authors' work had been too early. The technology wasn't advanced enough yet to drill for oil in the deep, rough sea around the islands. Oil prices drifted lower for many years, which made these reserves commercially uninteresting. The books and their conclusions disappeared from public view.

During the early 2000s, the oil price rallied from USD 10 per barrel to over USD 100. The world was worried about "Peak Oil" – remember that one? Offshore drilling technology had made significant advances over the past two decades.

That's when the market was ready to once again take an interest in the subject. I managed to get onto it before anyone else - simply by digging out those old books. It was a perfect case study for taking an underappreciated, forgotten idea and connecting it to current investment opportunities. Subsequently, media the world over started to write about the story and several new Falkland-related companies IPO'ed on the London Stock Exchange.

On a more macro-level, you'll find that the world does move in (sometimes extremely long-term) cycles. Here's another opportunity for you to look at information from the past long gone by and base predictions on it.

It's a controversial book, but you could do worse than look at Neil Howe's and William Strauss' "The Fourth Turning". First published in 1997, it has become a cult book of sorts. It sets out how each new generation creates a particular new cycle, and how every four generations (80 to 90 years) a major reset takes place. It's based on a study of American society, but it's safe to assume that one can apply the same logic elsewhere.

The last fourth turning took place in the 1930s, leading into the 1940s (you can check the timings of all previous turnings in a table published on Wikipedia). Based on that, the late 2010s and early 2020s were going to be a time of another "fourth turning", i.e., a major upheaval of the existing system and a potential reset. Needless to say, such a turning point doesn't make for a smooth ride!

I moved to Sark in the Channel Islands a few years ago because (among other things) I had a gut feeling that we were indeed heading towards such a period of turbulent change. Back then, you were a conspiracy theorist if you told people that great storms laid ahead and you'd better retreat to somewhere slightly off the beaten path. Come June 2020, and that thesis doesn't look so outrageous anymore. It's also directly relevant for my investment success because being in a peaceful, stable place enables me to focus on my work.

The notion that everything is running in cycles seemed unbelievable to my younger self, but there is probably a lot to it. Based on that idea, it makes all the more sense to dig out older books to help predict what the future may hold. They won't ever offer you a blueprint, but there will be some useful guidance and inspiration.

As I like to say: "There is nothing new under the sun." Or, in the words of my late grandmother: "Things always come back."

That's why going through older books is so valuable on so many levels. I could give you a lot more examples, but the point should be clear. It's a combination of accessing information that gives you an edge, utilising recurring cycles, and learning from the past to make better sense of what's ahead.

I have benefitted repeatedly and strongly from this approach.

Old books can guide you to investment treasures – no kidding!

Advice #5: Get a job in the corporate world at least once

Parents will probably love me for this one, and it's one of the questions I get asked about a lot.

When I was young, I refused to pursue conventional employment. Because of that, I never saw a large organisation from the inside during my formative years.

That only changed when I was 36 and suddenly found myself become the CEO of an operation with 150 employees, 200 freelancers, and partner organisations around the world. It was the first time I was ever conventionally employed and had to work within a complex, sprawling organisational structure. The subsequent 3.5 years in this position have taught me a LOT about the workings of large entities.

Crucially, I've acquired skills that help me analyse publicly listed companies, and look at them from an inside perspective. This very different perspective is crucial to help you understand how these companies function (or, most of the time, *don't* function) – and you won't get it from reading books.

In retrospective, my investing career would have benefitted significantly had I had ANY experience of working in an organisation earlier in life. It's not so much about which position you have (even an internship will give you a glimpse of corporate life), but merely about being in the belly of the beast.

In this day and age of glorifying early-20s entrepreneurs, it's a point that is particularly worth mentioning.

First, be realistic about your chances of setting out on your own early in life. I once stated that you have a five times (!) higher chance of succeeding if you set up a business in your 40s. There is a lot of nonsense peddled by the media about young entrepreneurs.

Secondly, the skills and observations you gather when working in an organised setup will benefit you in many other walks of life, including analysing companies and judging their investment potential.

Do it at least once, if only for a few years.

Hanging out with these people (for a while) is not a bad idea at all.

Advice #6: Learn more languages

I once read a biography of Aristotle Onassis, the late Greek shipping billionaire and market speculator. One passage that I vividly remember described his ability to work a room by switching seamlessly from one language to another.

At age 16, his family lost their entire fortune during the destruction of Smyrna, the legendary Greek trading metropolis that fell into Turkish-Ottoman hands and which today is known as Izmir.

Luckily, even at that young age, Onassis was already fluent in four languages: Greek, English, Spanish, and Turkish.

His fluency in other languages gave him not just the practical skills, but also the mindset to set out into the world and seek his fortune. After emigrating to Argentina (he spoke Spanish!), he picked up a few more languages by working nightshifts in a telephone exchange and listening in to foreign conversations.

Onassis became a millionaire by age 22. He was able to do so because of his ability to engage with people in a way that is only possible if you speak their language. He also used it to pick up on emerging trends and predict the future.

His skill to socialise in different languages gave him access to an international, well-heeled audience in Buenos Aires, which in turn led him to spot his first opportunity. He invested his modest savings in buying Turkish tobacco and creating a cigarette brand that would appeal to well-to-do Argentinean women, who at the time obsessed about the exoticism of the Arab world. That made him his first million.

Onassis then moved to London where he became a member of the Baltic Shipping Exchange. Based on all the information he had gathered, he was so confident that prices for ships were about to bottom out, that he invested all his money in picking up six ships. The decision laid the groundwork for a global shipping empire.

The command of languages was just one aspect to his success, but without it, Onassis would probably have gotten stuck in Greece. Investing is all about increasing your chance to come across opportunities, and speaking more languages enables luck to find you. In a business where you need to gather information to look into the future, being able to collect information from local sources will inevitably prove a useful skill.

It matches my own experiences.

I could not have lived my career had I not gone to the US at age 16. I got my English up to scratch by attending a high school in New Jersey for six months.

It was all the more relevant for my career because English is the lingua franca for anything investment-related. At a time when most German investors stuck to German-language publications, I was able to trawl the planet for useful information. It helped me to find opportunities abroad, which in turn fascinated other German investors. Good command of English was jet fuel for my career in the investment industry.

You may say: "That was then, but what about now?"

There are STILL many markets in the world that are less transparent, and language barriers continue to play a significant role.

I am entirely convinced that by learning a reasonably common language, such as Spanish or Chinese, you'll put yourself ahead of other investors who cannot read local newspapers, engage with locals, and sift through local chat forums.

It's my plan for July to feature a well-known, decent-sized European country that is probably a treasure chest for investors because it has been challenging to access due to a language barrier. (Watch this space!)

I'm always envious of people who've grown up speaking three or four languages, as many people in Switzerland do, or some of my friends' kids. If you don't learn it early in life, it'll be very challenging to find the time later in life

If my memory serves me right, Onassis eventually mastered seven or eight languages. If I had children and had to decide how to best set them up for life, I'd make sure they learned as many languages as possible.

Being comfortable in English is merely the baseline today. The question is, what do you have on top of that?

A while back, I met a young Polish lady in her mid-20s who fluently spoke six languages, including Mandarin. As she described it: "Among my friends, speaking just two languages is simply unacceptable; three languages are the bare minimum to turn you into a credible person, and four or five is really the standard nowadays."

That's the competition you'll be up against!

And before you ask, besides German and English, I have some grasp of Spanish, Italian, and French. I could probably be semi-fluent in each of these three languages if only I could lock myself away for four weeks and build on what I've already learned. It's been my plan for years to make a start with Spanish. But such is busy adult life!

Deal with it when you are young, or regret it later. It's directly relevant to your success in finding and managing investments.

A sub-aspect of learning languages is to regularly get out of your current environment and experience the world. I wrote an article once that sort of explains this aspect a bit further: "10 ideas for dramatically changing your work environment (or moving country!)".

Onassis' life might inspire you – here is a free 55-minute documentary that I hugely enjoyed (despite the terrible image quality).

Advice #7: Build a unique talent stack

The moment I became a university drop-out was when I sat down in a lecture hall and took in the sight of 700 (!) other students who had all started their first semester at the same time.

I could not have formulated it in words back then, but I knew instinctively:

"If they all study the same stuff that I study, how will I ever manage to distinguish myself from them?"

That realisation was the end of my brief stint in the world of academia.

Becoming a university drop-out as someone with a German middle-class background in the mid-1990s was no picnic. Just about everyone told me I was throwing my life away.

However, I did something that simply turned out to be much more valuable, even if at the time, I wasn't consciously aware of what I was doing. I assembled a unique set of skills, which would set me apart from most other people.

Dropping out of university didn't mean I didn't want to study. I simply decided that I needed to explore other things than everyone else.

And study I did! During my 20s, in particular, I was a complete readaholic and devoured what must have been thousands of books.

Check back to point #9 in part 1 of this series, where I described Scott Adam's theory about so-called "talent stacks". Know as much as you can about a very diverse set of areas, and (crucially!) combined in such a way that you stand out. That's what my studies were all about.

Just to give you an example, very few people in the investment industry know much about websites, blogs, and alternative media. There are plenty of investment bloggers out there whose investment-related content is brilliant, but their websites simply aren't up to scratch in order to make money off them. I am not the world's leading expert on blogging, but I do know more about the subject than most people in the investment industry. Combine a few skills that few others have, and you are ahead of the game! It's not about being the best in the field, but about being good enough in several areas and having that come together to make you a stand-out person.

There are two books I was looking forward to recommending as part of this article, both of them by Scott Adams:

"How to fail at almost everything and still win big"

"Loserthink: how untrained brains are ruining America"

The young readers who fed back on my early draft of this article asked me to recommend lots of books. I find it challenging to offer reading lists because there are millions of books out there, and you can easily end up creating long lists for the sake of looking smart. How practical and useful such lists are is another matter.

Instead, I decided to focus on just two books, but with all the more emphasis on advising you to study them. If you found this article useful, then you'll also get a lot of mileage out of either one of these books. It's probably best if you read them in the above order. (As an aside, Scott Adams is also an avid stock market investor.)

Ask yourself: what is it that will set me apart from all the other dashing young people who want to pursue a similar career to the one I've got in mind?

You do need a baseline of skills that everyone needs to have (see point #2). But beyond that, what sets you apart? You don't want to be a normie that no one remembers the face of. In a world where everyone is one click away from being a self-declared expert, learning to think differently is more important than ever.

One of my test readers asked me how I ended up being offered a private jet to fly across Africa and research investments, and how I was able to co-manage a USD 300m property fund in Macau at age 31. The answer is simply this: I've always had an unusual talent stack, and that caused unusual offers, requests and opportunities come my way. If you are known for an unusual combination of skills, unusual jobs and opportunities will be offered to you. Whatever energy you send out into the universe comes back to you (eventually).

The question what sets you apart from everyone else is an inconvenient one because it does take real effort and the courage to get off your designated lane and do things your way. Also, it is not a question that you will find a definitive answer to. You'll have to develop your talent stack over the years, with lots of failure along the way. It never ends, at least not until you decide to call it quits on your career.

There is good news, though. Now that you have made a start (by reading media such as Undervalued-Shares.com), nothing will be able to stop you.

How will you stand out?

Advice #8: Choose your jurisdiction wisely

Right, I just cannot not mention this one, even if it's a seemingly tangential subject.

What if I told you that there is one easy, risk-free step that will double your investment returns?

There actually is such a step. Just minimise the amount of taxes you pay.

Throughout their lives, people give away between 30% and 70% of their income in taxes. For argument's sake, say it's usually about 50% if you live in one of the large Western economies.

If you reduced that down to 20%, you'd end up with a lot more money in your pockets.

If you cut it down to virtually zero (which is what I have done, and entirely legally), you double your income without taking any risks.

There are numerous examples of why this plays directly into your investment success:

Tax-free compounding: One of the reasons behind Berkshire Hathaway's success was its ability to postpone capital gains taxes simply by sitting on investments for decades (google to learn how this works). By pushing out capital gains taxes, Warren Buffett was able to compound his money faster than anyone else. Even if there is tax due at the end, a good tax strategy will have accelerated the investment success.

Taxes distorting investment decisions: I can't even begin to tell you how many cases I know where investors put off decisions because there were tax implications. If you live anywhere that has capital gains taxes of any kind (and I know that my German readers are having a particularly complicated time with the subject), then you'll have tax issues distort the clarity of your thinking about the buying, holding, and selling of investments.

Some countries charge more than others: Plain and simple, it makes a difference whether you pay 10% capital gains tax or 30%. It's even worse if you live in a country where the government simply decides to confiscate your pension savings – as Argentina did some years back. That wasn't called a capital gains tax, but it amounted to the same. You will almost inevitably experience similar government action at some point in your life if you don't choose carefully where you live.

I recently wrote a three-part series around "Your lifetime tax bill". The series sets out why your choice of jurisdiction is probably the single most significant financial decision you'll make in life. It's bigger than buying a house, by a multiple.

My series also presents some shocking figures about the extent to which most Western governments run their citizenry dry. Even if you "only" have the salary of a big-city professional, you'll probably end up paying several million in taxes over your lifetime. Would you have known?

What if instead, you could at least keep one of these millions? How would it affect your financial situation? Can you imagine your quality of life if you were able to create true financial freedom a great deal sooner than your fifties or sixties?

Advice #9: Try to save and invest early

How to decide on the split of saving and spending when you are young?

It is one of the questions one of my test readers threw me.

The apparent conundrum is this:

- When you are young, you need to spend a lot of money on kitting out your life. Clothes, car, furniture, etc. Never mind the peer pressure of being a good consumer (and showing off on Instagram).

- Unfortunately, during the period of your life when you will have the biggest need for consumption, your income will be the lowest.

How can you possibly save ANY money?

You won't like the answer.

The only way is to work double hard AND be super frugal.

The good news is that this strategy will give you a superpower.

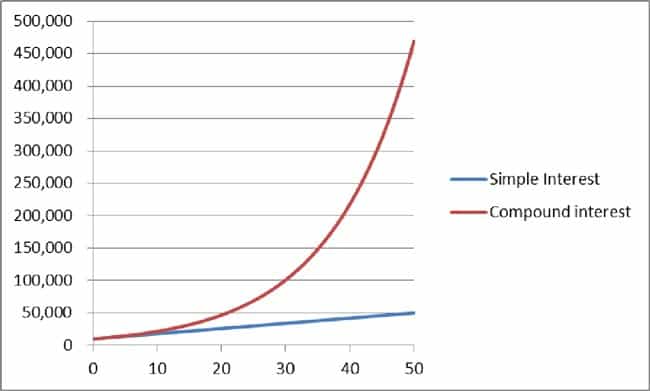

If you manage to put some money away early in life and invest, the incredible magic of compounding will make you better off much earlier in life than most of your peers.

The difference between starting to save and invest in your 20s, and leaving it until your 30s is incredible.

Compounding has been called the world's 8th wonder.

That's not a new realisation. Nowadays, you even have an entire movement preaching about it. It's the "FIRE" movement, "Financial Independence Retire Early". You'll find heaps of information about it on the web.

There is no easy way to take you there.

Get an additional job in the evening.

Pay a friend to sleep on their basement sofa instead of renting a studio apartment.

Don't eat out.

That's what it boils down to. I did as much when I was young, and it helped me build up my nest egg at the time. Even when I did start to spend a bit more, I kept some old habits. E.g., one of my first expensive holidays was to Mauritius, which involved having to catch a red-eye flight from an airport far from where I lived. I slept on a bench in Düsseldorf airport the previous night instead of booking myself into an airport hotel. I could have easily afforded the hotel, but having a three-hour snooze on a bench seemed like an easy way to earn some money.

Be brutal and maximise how much you can save. When you spend, spend your money on something that helps build your talent stack, such as buying books. Keep the consumerism spending for later, when you've got such a head-start already that it doesn't matter anymore.

Thriftiness will become fashionable again in the 2020s – just wait for it!

Advice #10: Don't be afraid of failure

No matter how much you study, plan and work in order to become a success, there'll be plenty of failure along the way. For you, too.

Don't let the fear of failure stop you from doing what you think you should be doing.

Throughout my entire career, I've always had people telling me that I can't do this and shouldn't do that.

Sometimes, they were right. At other times, they were wrong. But at no time did a mistake kill me. I can now laugh about most of my mistakes,– even the very serious ones that I truly didn't laugh about when they happened. Hardly anything that happens today will still matter to you in five years; you will probably have already forgotten most of it. This five-year rule is actually really useful to keep in mind.

Even more importantly, from each failure, there were useful lessons to be learned. And if you start collecting failures while you are young, you'll probably have several decades to put those lessons to good use. Put another way, when you are young, you can afford to make mistakes. Once you are old, it becomes much harder (if not impossible) to fix them. Try regaining your savings if you lose them at age 70! Fail early and then use the lessons for the rest of your life.

Failure always brings something valuable with it. Life is rich and you will often find surprising ways to extract value from your earlier failures. The trick is to get the good stuff out of failure.

Look at Warren Buffett, whose initial investment in Berkshire Hathaway was a disaster. He simply refused to let this monumental mistake stop him, though. When the textile business of Berkshire Hathaway didn't work out, he used the company as an acquisition vehicle for insurance business. The rest is history ("How Warren Buffett's 'mistake,' Berkshire Hathaway, became the foundation of his career").

Knowledge – and that includes failure – compounds. Check back to what I wrote about this under point #5 in part 1 of this series: "10 methods to my madness".

If you play your cards right, all the failure you suffer during your investment will eventually become an asset. Just stay in the game. Don't ever quit.

Debrief

I hope this article provided a bit of inspiration and guidance. Naturally, it can only touch briefly and somewhat generally on the many aspects involved.

You probably haven't come across www.swen-lorenz.com yet. If this article piqued your interest, you'll probably love this other website of mine, where I write about a wider range of subjects. It includes articles such as:

- 44 things I know because I am now 44 (one of my favourites!)

- How to write while you sleep (really!)

- 10 ideas for dramatically changing your work environment (or moving country!)

The content is currently for free, and you can get email alerts for new articles.

As always, I love to hear from you. What did you think? Was this useful for you?

This was the last part of my "How I work" series, and I wanted to thank all readers and colleagues for their input and feedback. I couldn't have done it without you!

Blog series: How I work

There's more to "How I work" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Set yourself up for life...

... with an Undervalued-Shares.com Lifetime Membership!

Admittedly, at USD 999, it's a step up from my unbeatably affordable Annual Membership, but I strongly believe it's worth every single penny. I'd have grabbed it with both hands when I started my investment career!

As a Lifetime Member, you not only enjoy all the benefits of an Annual Member (i.e. my 10 best investment ideas every year, 2 special reports, regular report updates, email alerts etc.), but you'll get a couple of extras on top:

- 4 additional investment opportunities each year, sourced from small- and mid-caps (i.e., less liquid markets).

- Priority booking of reader events and trips.

- Deeper engagement, e.g. involvement in the content of my next book.

Plus, you'll also be protected against a potential future Membership fee increase. Pay just once, and be sorted for life!