Image by travelview / Shutterstock.com

The company listed under the name Rolls Royce doesn't produce the eponymous cars.

Instead, it's one of the world's leaders for developing, producing, and servicing aircraft engines.

Rolls Royce is in an enviable position, at least on the surface of it:

- 51% global market share in its segment.

- Service contracts that last decades rather than years.

- An underlying market that benefits from secular growth.

Yet, over the past decade, the company's shareholders have gone through multiple crises. Even its CEO called Rolls Royce a "burning platform".

Over the past 12 months, however, the stock is up an impressive 260%.

What led to the turnaround, and could there be more to come?

Rolls-Royce.

Aircraft engines as subscription service

Created in 1904 by Charles Rolls and Henry Royce, the business now known as Rolls-Royce plc has gone through a turbulent history – most recently, a decade of deep losses, broken promises, repeated restructurings, and scandals relating to issues such as bribes.

In 2021, its then biggest shareholder called to "refresh" the company's board. You know a firm is in trouble when a 9% shareholder feels so frustrated that they question the company's leadership in public.

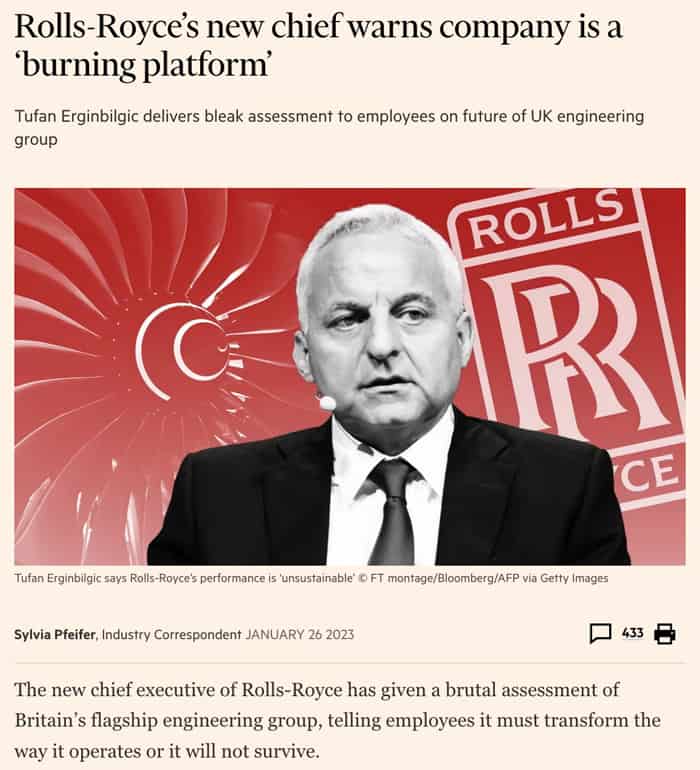

Since the beginning of this year, Rolls-Royce (ISIN GB00B63H8491, UK:RR) is headed by a new Chief Executive, Tufan Erginbilgic. Erginbilgic gained fame among investors – and infamy among stunned employees – by publicly calling Rolls-Royce a "burning platform" in an interview with the Financial Times.

Source: Financial Times, 26 January 2023.

How did a company that holds such a venerable name ever get into such a situation in the first place?

The pandemic certainly hadn't helped. While it affected all air travel-related businesses, it hit Rolls-Royce particularly hard, as the company produces over half of the world's engines for large, wide-body civil airplanes.

Rolls-Royce operates a business model whereby it actually sells these engines at a loss, only to make the money back from long-term service contracts. Airlines have to pay a fee which is based on flying hours during which the engines were used – essentially a subscription model with an extremely long cancellation period. Once an airline operates its fleet with Rolls-Royce engines, it's effectively locked into these service contracts for decades.

This business model made Rolls-Royce particularly vulnerable at a time when aircrafts weren't allowed to take off. In a know-how intense business such as aircraft engines, the company couldn't simply lay off staff to reduce costs, and the collapsing income pushed it deep into the red.

These external factors aside, it has also been clear for years that cost management across the company was atrocious, and that much of Rolls-Royce's crisis was a self-inflicted wound.

Tufan Erginbilgic had the good fortune of joining Rolls-Royce at a time when idle aircrafts were just getting back into the sky, but he also achieved quick success by bringing costs under control. During the first half of 2023, Rolls-Royce's underlying operating profits rallied to GBP 673m, up 438% from GBP 125m in the same period last year – quite the change for a company which the new CEO once described as being in the last chance saloon.

For many years, investors had stayed clear of Rolls-Royce – and rightly so.

Going forward, however, the stock could be good for doubling again, or even more than that.

The beginning of a new era?

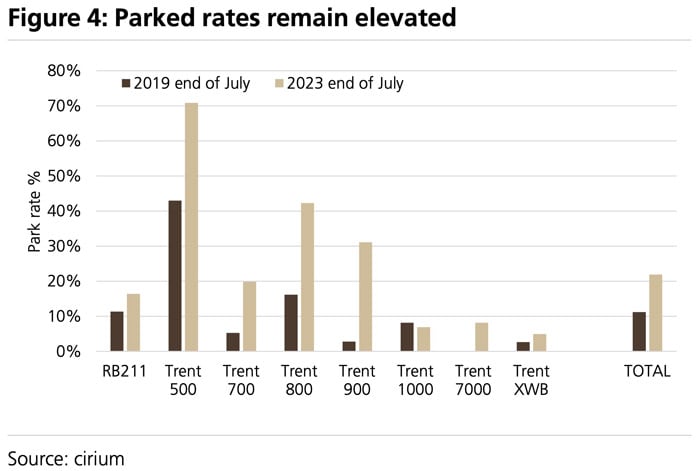

Post-pandemic, a remarkable 22% of operable commercial long-haul aircrafts in the world are still out of operation. These aircrafts are parked in locations such as the Arizona desert, waiting for their owners to put them back into service.

Even though only 78% of its jet engines are clocking up flying hours, Rolls-Royce has staged a stunning turnaround. For the other 22%, the company doesn't generate much revenue. What's more, those engines that are being used are seeing just nine hours of service a day, compared to ten hours before the pandemic.

International travel from Asia – where most long-haul flights are taking place – was still down 50% earlier this year, which weighed on Rolls-Royce. The question is, will Asian travellers get back to travelling quite as much as they used to before the pandemic?

Given the young population and increasing purchasing power of Asian consumers, will they also develop a growing appetite for travelling the world? I'd bet that an ever-growing number of Asian tourists will want to experience Paris, see Machu Picchu, and marvel at the Egyptian pyramids. Curiosity and a lust for travel are wired into the human DNA.

For all intents and purposes, Rolls-Royce operates in a secular growth market. Until the pandemic hit, global air traffic was growing at a reliable 2% p.a.

Crucially, it's a market where Rolls-Royce will likely benefit from one very important underlying dynamic. Privately, the company admitted in the past that it never made enough money from jet engines to even just fund that business' growth. For 50 years, Rolls-Royce had invested into gaining market share in the wide-bodied civil aviation market, and shareholders barely got any returns as a result.

Getting to half the market for wide-body engines has been incredibly expensive and taken decades, but Rolls-Royce could now stand on the threshold of a new era. Amazingly, the pandemic may even turn out to have been a long-term advantage.

Following the catastrophic collapse in air travel during 2020-2022, the airline industry has limited appetite for experimenting with new types of jets. For the first time, Rolls-Royce is not put under pressure from its partners and clients to invest in the design of a large new engine. Instead, it can now focus on improving costs, optimising existing service contracts, and enjoying the fact that it will likely retain a >50% global market share.

The new CEO already delivered on some of this by significantly raising prices for existing service contracts. Rolls-Royce could now benefit from a trifecta of factors providing wind under its wings (pun intended):

- Continuing to streamline operating costs.

- Increasing income from service contracts.

- Seeing idle planes put back into operation (and for more hours per day).

Another aspect that is little-understood but could have a powerful effect on the company's finances is the fact that putting idle jets back into operation is even more profitable than selling new engines. Each time Rolls-Royce sells an engine, it loses money at first. On the other hand, putting an existing engine back into operation leads to an immediate increase in lucrative servicing income. This counter-intuitive outcome of the pandemic is quite a remarkable fact that public markets will not yet have fully appreciated.

Add to that an eventual return to passenger numbers growing by 2% p.a. due to rising incomes around the world, and Rolls-Royce could become a very neat business indeed. It now has just a few remaining serious competitors, such as France's Safran SA (ISIN FR0000073272, PA:SAF), Germany's MTU Aero Engines (ISIN DE000A0D9PT0, DE:MTX), and the US' General Electric (ISIN US3696043013, NYSE:GE).

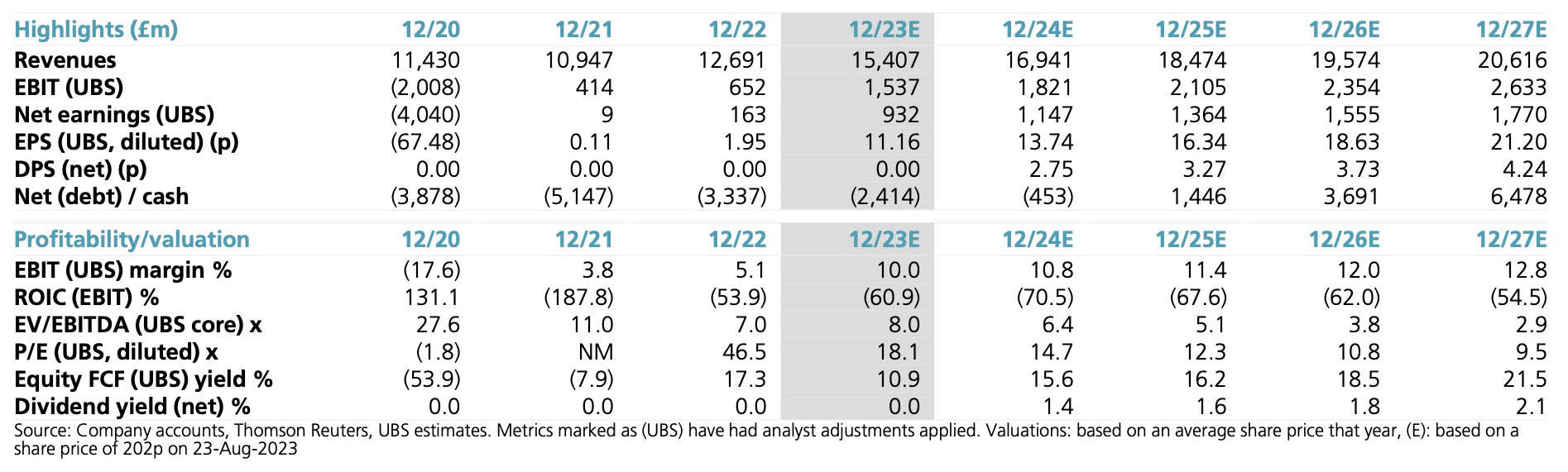

This constellation led analysts at UBS to issue revised forecasts. An extensive report published by the Swiss bank on 24 August 2023 concluded the following:

"We increase our price target 175%. We believe that 2023 guidance looks conservative, that Rolls Royce could achieve £2bn of Free Cash Flow as soon as 2024 and £2.8bn of underlying Free Cash Flow in 2026. … In our upside scenario, where Rolls can deliver Safran-style margins (fx adjusted) by 2026 we see fair value at £6."

Right now, the stock is trading at GBP 2.21.

Even if it rose to GBP 3.50, its cash flow yield would still be 8%, compared to peers MTU and Safran trading at a cash flow yield of 4-5%.

Source: UBS, 24 August 2023 (click on image to enlarge)

Where's the catch?

Rolls-Royce has become infamous for execution risks and under-delivering on its plans and promises. The company still has some way to go before investors will trust its forecasts again, and there are a number of macro risks, such as China potentially not delivering economically. It also doesn't just produce aircraft engines for commercial jets, but also products for the defence and energy industry.

UBS' downside scenario expects the share to drop back to GBP 1.

Overall, though, it seems that the odds are now significantly in favour of Rolls-Royce entering a new era – both as a company and investment.

This should become apparent to a wider audience at the company's upcoming Capital Markets Day on 28 November 2023. This will be an opportunity for the new CEO to reset the narrative, and the undervalued stock could experience multiple expansion as a result.

Leading up to this event, it wouldn't be surprising to see the stock catch up further with what seems to be a tantalising combination of fundamentals.

Hot off the press: new in-depth research report

My latest research report – published earlier this week – features one of the world's best (and cheapest) oil and gas stocks.

The company has a globally known brand and a highly liquid stock, some of the best metrics in the oil and gas industry, and a management which is returning its focus on the firm's core business.

It is one of the cheapest large-cap stocks in the world, and set to benefit from what could soon be a violent rally of undervalued oil and gas stocks.

Hot off the press: new in-depth research report

My latest research report – published earlier this week – features one of the world's best (and cheapest) oil and gas stocks.

The company has a globally known brand and a highly liquid stock, some of the best metrics in the oil and gas industry, and a management which is returning its focus on the firm's core business.

It is one of the cheapest large-cap stocks in the world, and set to benefit from what could soon be a violent rally of undervalued oil and gas stocks.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: