Gold stocks remain undervalued, with considerable upside potential. I picked the brain of Dominic Frisby, who has just released a new book on gold, to get his take.

How to invest in iconic New York real estate

New York hasn't had it easy recently.

Empty offices, horrific crime rates, and decaying infrastructure.

Could it all be just a blip in the fortunes of a city that forever thrives?

Some New York real estate comes as equity listed on the stock market.

The opportunity to invest in "woke cities"

It's all over the news, the entire concept of wokeness, DEI, and ESG is on the way out. Politics is shifting to the more conservative side of things, whether that with a capital "C" or a "c".

My July 2024 Weekly Dispatch "San Francisco real estate – a proxy for the death of woke?" proved timely.

When I visited San Francisco in January 2025, the city was already visibly improving. My friend Cody Shirk was also in town, and we shot a 17-minute video discussing what a bargain San Francisco real estate is.

Given the recent and ongoing political changes, my article about listed companies that give you exposure to San Francisco real estate is worth getting out again.

Can a similar case be made for New York, one wonders?

A city in crisis

To appreciate why now may be the time to look at buying into New York real estate, let's take a look at some of the media headlines from the past few years.

The following list represents a selection chosen to make a point, and it could be criticised for being one-sided. It still conveys an important overall message:

- "Leaving New York: High earners in finance and tech explain why they left the 'world's greatest city'" (CNBC, 1 November 2020)

- "How iconic Washington Square Park has become no-go zone for law-abiding locals after dark" (Daily Mail, 20 June 2021)

- "NYC odor complaints hit all-time high" (FOX 5 New York, 17 July 2022)

- "Another person pushed onto New York subway tracks" (yahoo!news / The Hill, 24 January 2022)

- "Central Park among NYC areas considered to house migrants" (NBC, 2 August 2023)

In line with such headlines, the decline of New York as a place to do business and spend money was palpable. It resulted in headlines such as the following:

- "New York City is dead forever" (New York Post, 17 August 2020)

- "Goldman Sachs chief warns New York City's future 'not guaranteed'" (Financial Times, 30 November 2021)

- "New York City has decided to destroy itself" (The Telegraph, 18 July 2023)

Outside of media headlines, you could find locals ranting about the situation. The X post below is a good example.

Source: Alex Finn on X, 23 December 2023.

It all led to some pretty stark headlines about the practical implications of the crisis:

- "NYC is now the worst place to do business, retailers say" (New York Post, 21 July 2020)

- "New York's 'zombie' office towers teeter as interest rates rise" (Financial Times, 3 December 2022)

- "New York property tycoon to give worn-out offices 'back to the bank'" (Financial Times, 2 February 2023)

New York Magazine summed it up with the following cover.

Source: New York Magazine, 17 July 2023.

In the second quarter of 2024, the office vacancy rate in New York stood at 24%, compared to 11% before the pandemic. Having one quarter of all office space stand empty is an extinction level event for the real estate market.

These headline figures are hiding some even harder truths. E.g., in some older, less attractive properties in need of renovations, office vacancy rates can run as high as 80%.

Given how bleak all this sounds, maybe now is the time to start looking at New York real estate?

After all, investing is all about being contrarian.

Change is in the air

There have been tentative signs of green shoots of late:

- "New York office market bolstered by sale valuing tower at $2bn" (Financial Times, 26 June 2023)

- "New York Landlord Vornado Bets $1 Billion That More Commuters Will Return" (The Wall Street Journal, 27 June 2023)

- "New York City's Biggest Office Landlord Offers a Glimpse of the Market's Comeback" (The Wall Street Journal, 9 December 2024)

- "NYC's 590 Madison Goes Up for Sale at Roughly $1.1 Billion" (Bloomberg, 18 February 2025)

There are increasing signs that New York will – once again – stage a comeback. Honestly, who'd be surprised? Cities like New York (or London) are what I have long called "forever cities". They go through crises, but they always emerge stronger. Whether it's London's Great Fire of 1666 or more recently New York's 9/11, throughout the ages London and New York have proven extremely resilient.

Check out the following for a counterview to the long-prevailing negative narrative:

- "The enduring attraction of cities" (Financial Times, 29 September 2020)

- "Jerry Seinfeld: So You Think New York Is 'Dead'" (The New York Times, 24 August 2020)

- "Some Thoughts on What Makes New York so Great" (Young Money, 17 October 2024) (MUST READ!)

New York is now finally pushing on with plans for reinventing or at least redeveloping "Penn Station", the western hemisphere's busiest transit hub and, quite possibly, its most despised. Originally designed for 200,000 daily riders, the station is today crowded with three times as many – more than LaGuardia, Newark and John F. Kennedy airports combined. It is a warren of cramped, crowded passageways with no place to sit and often described as "hellhole".

After decades of frustrated efforts, a genuine effort is now underway to redevelop the squalid, subterranean station buried beneath a sports arena. It's a slow process, and the most recent news involved spiralling costs and a decreased level of ambition, but any significant investment will go a long way towards improving the status quo.

What led to the determination to finally fix Penn Station?

The realisation that New York can no longer take for granted its ability to draw millions of workers each day from the wider region into its central business districts. Even New York occasionally has to make an effort, now that so many have chosen to move to Florida, Texas or North Carolina. A bit of competition is a wonderful thing to get things going, and the US' decentralised structure fosters competition.

Penn Station – part of New York's current third-world infrastructure (image by BrandonKleinPhoto / Shutterstock.com).

Large-scale redevelopment of troubled areas is something that New York has always been familiar with. Anyone who'd like to immerse themselves in a bit of history can pick up a copy of "Reconstructing Times Square", published in 1999 by Alexander J. Reichl. It traces how during the 1980s the troubled Times Square area was turned from a cheap drinking and porn district into the pricey Broadway theatre district that it is known for today. It also examines the role of the Walt Disney Company in the urban regeneration project and demonstrates the power that a single company can have to redefine a premier public space.

Of course, such large-scale change is difficult in a city with countless stakeholders and a powerful bureaucracy. In a New York of days long gone by, these issues were often overcome by a man called Robert Moses, an urban planner and public official who conceived and facilitated so many large projects in New York that he was once called "the greatest builder America has ever known". His controversial history is written up in the 1150-page (!) biography "The Power Broker", a Pulitzer Prize-winning humdinger published in 1975. Moses was the Lee Kuan Yew of New York, and even though he had a reputation as racist, in the words of former Governor Eliot Spitzer "at least he got shit built".

Could New York eventually give rise to another power broker of this type?

Even in the absence of a character like Moses, New York's decrepit John F. Kennedy airport is finally seeing a refurbishment. No less than USD 19bn are currently being sunk into the idea of taking JFK into the 21stcentury. As Engineering News-Record concluded, "the speed at which that $19-billion transformation of the roads and terminals is occurring could be called wild."

Imagine landing in JFK and not feeling that you arrived in a third-world airport circa 1982 – it'd be a game changer! At LaGuardia airport, the smaller but for a long time equally decrepit airport, an extensive refurbishment carried out during the pandemic has already led to a major improvement.

In any case, the Big Apple will come roaring back at some point.

Hudson Yards, the new neighbourhood built on Manhattan's West Side, made clear just how much a single successful mega-project can move the needle even in New York. Once slow and controversial, it has single-handedly made New York's office market value top the pre-pandemic level. All New York offices are now worth USD 205bn, compared to USD 196bn in 2020. How so, if 24% of the office space is vacant? The entire increase is due to the success of Hudson Yards.

More positive headlines are likely to come out of New York in the foreseeable future. Jamie Dimon's 'leaked' memo will probably be remembered as the point when going back to the office for at least a good amount of time became the norm.

Indeed, physical proximity to other people is what makes New York such a valuable piece of real estate. Smaller than Dallas / Fort Worth airport, Manhattan fosters a unique way of collaborating, competing, and doing business. Writing this article at the tail end of a seven-day trip of attending non-stop meetings in New York, I was myself reminded just how valuable that is. New York remains the best place in the world to be an ambitious capitalist – always has been, always will.

How can investors get in on the act?

NYSE-listed NYC real estate plays

New York City single-handedly contributes about 7% to the GDP of the US.

It's no surprise that a good number of New York-focused real estate plays are available on the stock market.

Empire State Realty Trust (ISIN US2921041065, NYSE:ESRT) is a real estate investment trust (REIT) that owns, manages, and operates modernised office and retail properties in Manhattan and the greater New York metropolitan area. Most famously, it owns the Empire State Building. The history-making building that also operates a world-famous viewing platform visited by 4m tourists a year makes up about one quarter of the business.

Empire State Realty Trust.

The overpriced cash cow atop the Empire State Building (image by starmaro / Shutterstock.com).

SL Green Realty Corp. (ISIN US78440X8873, NYSE:SLG) is a REIT that focuses on Manhattan commercial properties. It owns One Vanderbilt, arguably Midtown's most important commercial development in the 21st century. The company may also have some positive exposure to the growing trend of converting old office real estate into residential space.

SL Green Realty Corp.

One Vanderbilt in Midtown (image by Mariusz Lopusiewicz / Shutterstock.com).

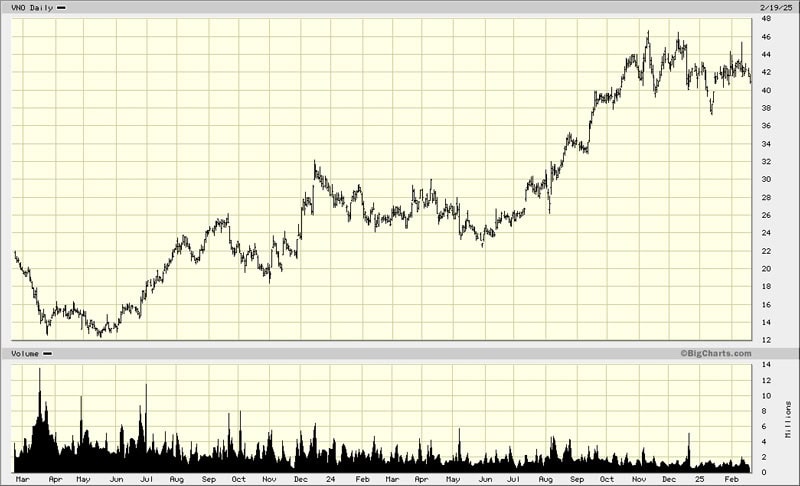

Vornado Realty Trust (ISIN US9290421091, NYSE:VNO) invests in office buildings and street retail in Manhattan. This REIT is a case study of how good management can put you ahead of the market. The company is on its way to achieve over 90% occupancy of its real estate in 2025. The stock is up 60% over the past 12 months, and nearly 200% over the last two years. Speak of having to pick up real estate when negative headlines abound, and benefiting from a good management team.

Vornado Realty Trust.

There are also less obvious plays that are primarily, but not purely about real estate. The best known example is Madison Square Garden Entertainment (ISIN US5582561032, NYSE:MSGE), which owns the entertainment facility of the same name. Located above Penn Station, the company has gone through changes that involved a splitting of its operations into separately listed firms. It also owns the equally famous Radio City Music Hall in New York. The company's real estate angle comes combined with a bet on growing demand for live events.

Madison Square Garden Entertainment Corp.

Madison Square Garden atop Penn Station (image by Photo Spirit / Shutterstock.com).

Which one to pick?

Each of these companies has its own idiosyncratic drivers, and anyone interested in them will have to analyse them in more depth.

Overall, though, this seems like a theme that is worth spending more time on.

Just as in the case of San Francisco, my most recent visit to New York made me conclude that the city is turning around.

Some of what I saw was also driven by the recent US election results. Much as president Trump isn't the Mayor of New York, his approach to the country is trickling down. E.g., finally, there is a heavier police presence on New York's metro system.

Source: New York Post, 16 January 2025.

Other aspects are improving as a result of time passing. During the past few years, property developers, landlords, and business owners have already had a lot of time to adjust to the new reality. Over time, these changes enacted by individual businesses add up.

A city like New York is a complex animal, and property companies are only ever exposed to some of these trends. New York entails many small sub-markets, and it's impossible to summarise them in a single article.

However, it is without a doubt that New York is at an inflection point. It certainly isn't dead, contrary to what some had predicted in 2020.

More likely, it will yet again pull itself out of its malaise.

If or when it does, having bought some New York real estate when things looked bleak should make you come out looking pretty.

Video: Bevvy Meets Swen Lorenz, Founder of Undervalued-Shares.com

What's the appeal of whisky as an alternative investment?

What are the potential risks and practicalities involved, and why are passion and expertise in alternative investing so important?

Some fascinating insights, delivered straight from the capital of Scotland.

Video: Bevvy Meets Swen Lorenz, Founder of Undervalued-Shares.com

What's the appeal of whisky as an alternative investment?

What are the potential risks and practicalities involved, and why are passion and expertise in alternative investing so important?

Some fascinating insights, delivered straight from the capital of Scotland.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: