A week ago, a dozen Undervalued-Shares.com readers visited Budapest.

Thanks to a reader and friend who must remain unnamed, we had access to an outstanding array of publicly listed companies and experts for the region. The trip not only gave a broad insight into the state of play in Hungary, but also a sense for several opportunities that the international investment community is not yet aware of – but could become aware of as early as late November 2023.

Are Hungarian stocks a deep-value play with a potential catalyst on the horizon?

Here is what we've found.

Undervalued-Shares.com readers in the boardroom of OTP Bank, Hungary's largest bank.

Not all is as it seems

The value of on-the-ground research trip lies in tapping the brains of local experts and leaders. Quite often, you uncover facts and figures that run counter to the narrative spun by popular media.

Case in point, the widely-held belief that Hungary is a xenophobic place that doesn't let in foreigners. It'd be easy to believe this was the case when you see organisations such as Reuters referring to Hungary as an "anti-immigration" country.

A meeting with the Budapest team of international law firm Dentons gave a more nuanced picture. Ted Boone, a Hungary veteran, and his colleagues informed us that South Korean and Chinese companies, in particular, were increasing their investments in the country. Given Hungary's decreasing population and shortage of labour, these large-scale investment projects will bring with them their own labour force from countries such as the Philippines, Vietnam, and India.

Who knew?

To be clear, there is much to be criticised about Hungary, both politically and economically.

The country has been in a recession, and riding out the downturn has already taken longer than expected.

During the past 12 months, government spending that amounts to a redistribution of wealth accounted for 20% of GDP. This figure is off the scale.

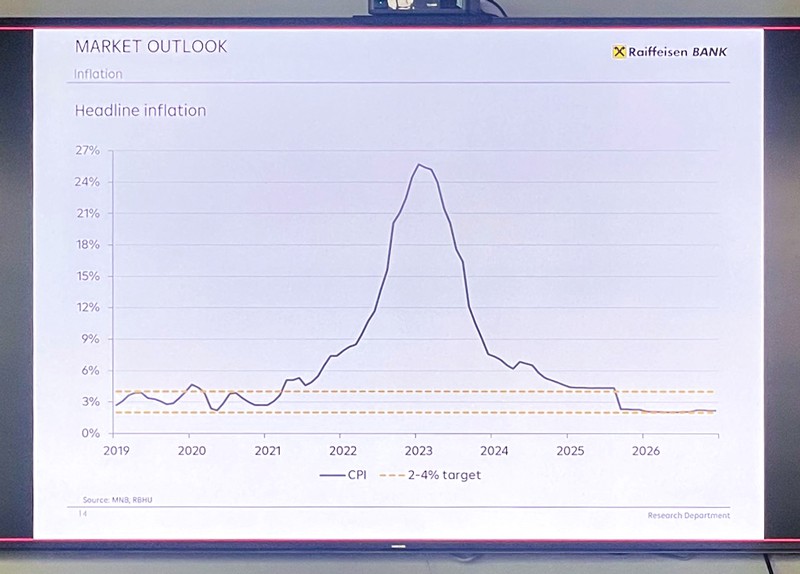

The Hungarian forint collapsed in October 2022, which made imports more expensive. Correspondingly, Hungary had to battle the highest inflation rate of Europe, peaking over 25%.

However, there are also positive developments and catalysts for change on the horizon.

Most notably, the EU might soon unblock its funding for Hungary, which it had frozen over the policies of Hungary's Prime Minister, Victor Orbán. The freeze significantly held back the country's funding for certain projects, such as infrastructure.

On 3 October 2023, the Financial Times exclusively reported: "Brussels to unfreeze Hungary funds as it seeks help for Ukraine:

The commission intends to unfreeze about €13bn in funding before the end of November, three officials briefed on the discussions told the Financial Times."

Why the change?

The EU wants to increase next year's budget by a staggering EUR 66bn, and aims to have the support of all 27 EU nations for this rather controversial decision. Countries that are net recipients, such as Hungary, will be promised extra handouts in exchange for their support. Net contributor countries such as Germany need to be given some kind of political justification for increasing their contribution – such as being able to declare victory over some of Orbán's policies. This is how politics works, always.

Earlier this year, the supposed hardliner Orbán gave in to some of the EU's demands for judicial reform, and the country is now actively speaking to Brussels to "clarify" a few issues.

What would the effect of that be?

In a conversation with the macro team from Raiffeisen Bank, my group had a chance to dig deeper into the subject.

Over seven years, Hungary is entitled to EUR 40bn in EU grants and a further EUR 10bn in EU loans. Over the same period, it will contribute EUR 12bn to the EU, resulting in a net balance of EUR 28bn in favour of Hungary, plus the EUR 10bn in financing.

In a country with a GDP of just EUR 150bn, this is a noticeable amount of money.

A successful outcome is not guaranteed, but it does look more likely than not that Hungary will manage to unblock EU funding. As the team of Raiffeisen Bank told us: "The current underlying intention of both sides should be to unfreeze the funds."

If the sources of the Financial Times are correct, this could happen as early as late November 2023. Without a doubt, it'd be major news the world over.

And it'd come at a time when the wider perception of certain subjects is in the process of changing anyway. As I wrote in my recent Weekly Dispatch on Hungary, when it comes to politics, much of Europe is currently moving the way of Hungary. Germany has since held two state elections, with the "right-wing" AfD coming out as the second largest party – even though the establishment threw everything and the kitchen sink at preventing their advance.

In other news, Henry Kissinger has come out saying that "Germany made a 'grave mistake' by letting in too many migrants".

Were Hungary and its leadership merely a few years ahead of the world in some aspects?

It's not an unreasonable question to ask, and the underlying trend may lead to a re-rating of some Hungarian stocks.

If my hunch is right, we might see further gains in one particular stock, which is also a bellwether of Hungary's economy.

Hungary's banking behemoth

The Budapest Stock Exchange has 151 listed companies. If you ask anyone about Hungarian stocks, OTP Bank (ISIN HU0000061726, BUD:OTP) is one of the two they are likely to mention first. Hungary's leading bank makes up 30% of the Hungarian market's entire market cap.

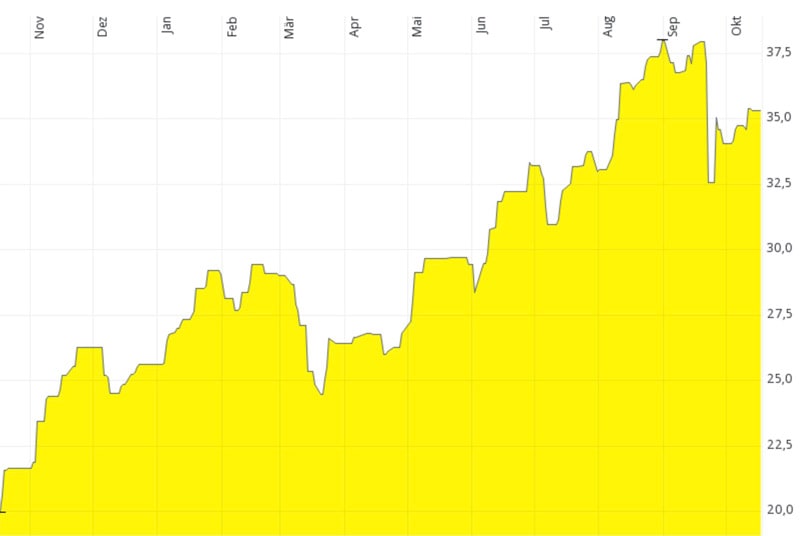

Over the past 12 months, the stock of OTP Bank is up 94%, after having risen from EUR 18 to now EUR 35.

OTP Bank.

There is never a single reason that explains the rise of a stock, and what may seem a logical explanation on the surface can easily turn out to be off target. E.g., it's widely assumed that bank stocks generally profit from the changing interest rate situation. In the case of OTP Bank, this wasn't true for its core business in Hungary. The bank has a lot more rate sensitive liabilities than assets, which made higher rates a drag on the Hungarian operation. (In other CEE markets, though, OTP Bank benefited from higher rates.)

Also, OTP Bank is generally not easy to categorise. MSCI classifies Hungary as an emerging market, and the bank itself does like to describe itself as an emerging market company. However, it's also true that 85-90% of the group's loans are in the EU, and >40% are in the Eurozone. The bank may be known for its presence in Russia, Ukraine and Uzbekistan, but these three countries jointly make up just 8% of the total. It's difficult to put OTP Bank into a box.

What's clear, though, is that the bank will likely continue to benefit from a combination of organic growth and further acquisitions.

As Orsolya Nyeste, macro economist at Erste Group told us during a brunch discussion: "The Central and Eastern European conversion story is still intact. There is room to grow, both organically and non-organically. Commercially, it's a very good market. Despite all the negative aspects of the Hungarian economy, it is still a very profitable market for OTP as the incumbent player. Customers still keep cash in their accounts, which allows for the bank to earn great margins."

Hungarian and other Eastern/Central European banking markets are underpenetrated relative to Western European markets. As described in the latest Weekly Dispatch on Georgia, being a bank in a relatively small market can be a godsend towards earning above-average margins.

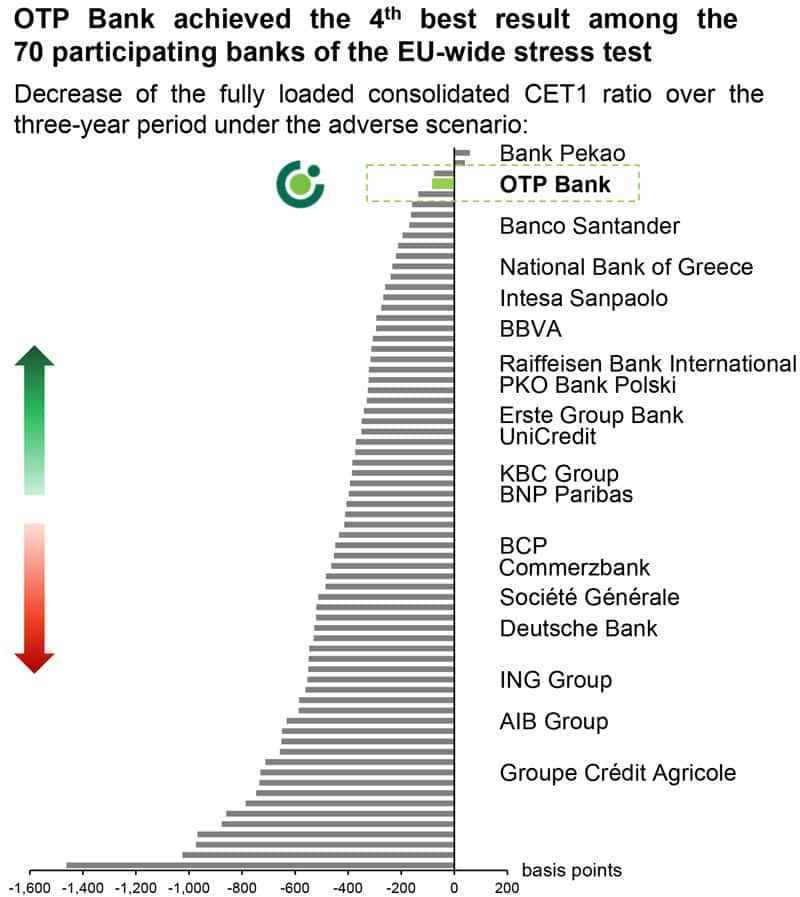

And it all comes with a surprising amount of stability. OTP Bank is exposed to a region that has its vagaries and issues, and it still does some business in Russia. However, it did score 4th out of 70 in a bank stress test conducted by the European Banking Authority in 2023. In Russia, the bank is only the 46th largest player with a minuscule 0.17% market share in Russia's overall banking assets. Stats like these make you wonder if the perceived risk of the region in general, and Hungary in particular, isn't blown out of proportion.

In fact, OTP Bank is a much higher-quality operation than most investors outside of the region would expect. Euromoney awarded OTP Bank the prizes for "Best Bank in CEE" in 2018 and 2021, as well as "Best Digital Bank in CEE" in 2022. The Banker crowned it "Bank of the Year in CEE" in 2021 and 2022, and Global Finance made it "Best Bank in CEE" in 2023.

With all that in mind, how does OTP Bank stack up as an investment for someone considering to buy now?

European banking stocks remain hated by financial markets, and the entire sector continues to trade at low valuations despite recent gains. OTP Bank is cheap at a price/earnings rate of less than 5, but there are also other European banks that trade at these multiples.

OTP Bank is one of Hungary's most liquid stocks. The stock could work for someone who likes the region's growth potential or wants to bet on Hungary coming in from the cold.

Those who are looking to invest in an industry other than banking, but with a similar combination of growth and value, should look at a small-cap stock that we found on the outskirts of Budapest's city centre. It may well have been one of the gems that we uncovered during the entire trip.

My intrepid group of readers visiting a small-cap Hungarian company.

A high-tech innovator "Made in Hungary"

Hungary's government does deserve some criticism for its strong focus on attracting old economy-type companies. However, Hungary has always had a high level of education and as a result, has more than one innovative high-tech company listed on the Budapest Stock Exchange.

ANY Security Printing Company / ANY Biztonsági Nyomda Nyrt. (ISIN HU0000093257, BUD:ANY) once was the "State Printing Company of Hungary". However, it was privatised a long time ago and has since transformed its product line from traditional printing products to secure identification documents on paper, out of plastic, and digitally. This includes passports, election forms, visa stickers, tax and revenue stamps, corporate loyalty cards, lottery forms, driving licenses, vaccine passports, bank cards, ministerial letters and similar.

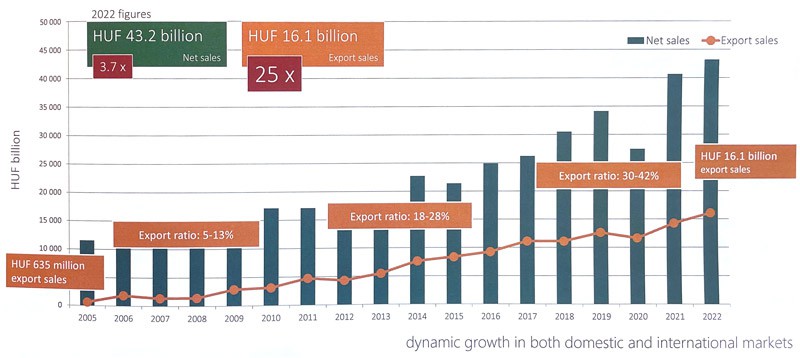

Since 2005, the company has grown its revenue by nearly 4x and its exports by 25x. These long-term statistics are somewhat tainted by the recent higher inflation rate of the forint, but they indicate a huge entrepreneurial success nonetheless. Exports now make up 50% of ANY's revenue, giving Hungary a former state-owned company that is succeeding in an innovative, competitive field at an international level. As I said before, who knew?

Source: ANY, investor presentation.

ANY has recently struggled with issues such as exceedingly high energy prices, difficulties in raw material markets, and rising transport costs.

Still, longer term, there seems to be plenty of growth potential for the company. Globally, there are 1.1bn people without any ID document. The ongoing digitisation of sectors such as government, healthcare and finance will also grow the need for secure documents. To tap into these opportunities, ANY has filed patents in 30 African countries. The company is hoping to emulate its success in providing secure documents to Angola, where it landed a hugely lucrative ten-year contract to deliver products worth EUR 130m of revenue, which equals one year's group revenue from a single client. Amazingly, as management told us when we questioned them about the risk of doing business in the region, not a single one of their African government clients has ever defaulted on a payment for a delivery.

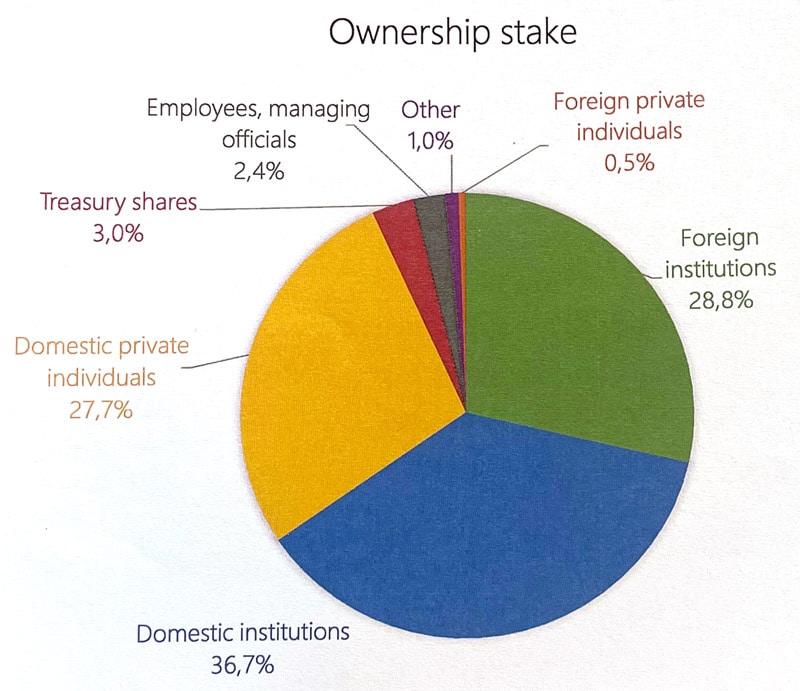

With a market cap of less than EUR 70m, ANY is a micro-cap stock with limited liquidity. However, its stock has long been traded on Germany's OTC markets, which makes it accessible through any broker that can execute trades in Germany. Over the past two years, ANY paid a dividend yield of 10%. Its market cap is a mere 0.6x annual revenue of EUR 110m, which is cheap by anyone's measure. Its debt is reasonable, at somewhere between 1-1.5x EBITDA. 72% of the share capital is in free float, which could even make ANY a takeover target for a foreign investor seeking to consolidate this specialist industry – though this has a low likelihood for as long as Hungary is perceived to protect national champions from foreign ownership.

ANY shareholder structure.

Gabor Bukta is the only Hungarian analyst who covers the stock, and his research is available for free from the Budapest Stock Exchange website. As he wrote in his 23 August 2023 research note:

"ANY is the only Hungarian stock, which could consistently beat even the S&P 500 index in HUF terms by 3% points per annum over the last 10 years, with an accumulated total return of more than 500% to date. In addition, we have a strong reason to believe that this trend may continue."

Our meeting with ANY overran, because we were fascinated by the company's first-hand explanation of security documents.

As it were, one of our group placed an order to buy stock when we were barely halfway into our meeting. Much as this is anecdotal evidence, it shows that once the investment thesis of ANY is communicated to a wider audience, it does convince. The difficulty is, of course, that Hungarian small-caps have barely received any attention for a long time – not even within Hungary. ANY's stock chart looks tantalising, though, and there may be a step up on the horizon. If the stock managed to move above EUR 5, it could have a lot further to run.

ANY Security Printing Company.

Or will ANY turn out a value trap, because no one else is ever going to notice the stock?

It's a fair question to ask, and those who do worry might want to look at a stock that is a proxy for investing in Hungary without having to buy a Hungarian stock.

The Austrian route to investing in Hungary

Erste Group Bank (ISIN AT0000652011, VIE:EBS) is the opposite to ANY, inasmuch as it's a highly liquid stock of a company that has huge brand name recognition. In Central and Eastern Europe, "Erste" is one of the top brand names in banking (despite the fact that only German speakers will realise the name stands for "First").

Erste Group has also previously won awards such as "Best Bank in Central and Eastern Europe". Outside its Austrian home market, it currently operates in Hungary, the Czech Republic, Slovakia, Croatia, Romania, Montenegro, Slovenia, and Poland.

Just like OTP Bank, buying into Erste Group is one way to benefit from the ongoing Central and Eastern European conversion story. However, quite unlike OTP Bank, it does not require putting your faith in a Hungarian company. Erste Group is an Austrian company with a listing on the Vienna Stock Exchange, and it comes with Austrian governance standards and other advantages. Whether it's right or wrong to view the governance standards of Austrian and Hungarian companies in such a way is up to debate, as OTP Bank's solid rating for governance standards shows. However, many investors will have the idea in mind.

The investment thesis underlying Erste Group's stock benefits from positives such as the 0.7x price-to-book ratio, and it has to contend with negatives such as next year's projected expense increase probably going to outrun revenue growth.

What could make the stock particularly interesting in the short run is the ongoing change to a new CEO, combined with the overdue increase in the bank's capital distribution to shareholders.

Erste Group's leadership change, planned for July 2024, is an organic change rather than anything contentious. The company's current CEO does not want to extend his mandate, and a replacement was sourced internally.

Still, such a leadership change inevitably holds up a number of other processes. E.g., if Erste Group wanted to increase its capital distribution to shareholders, it would wait for the new CEO to make that decision (and have him benefit from its announcement).

The company has been paying out 40-50% of its earnings through dividends and buy-backs, and it reportedly experienced pressure from investors to increase the amount of money it funnels back to shareholders.

Erste Group's results for the first three quarters of 2023 will be announced on 30 October 2023. Is this announcement going to include a first, cautious indication of the future of capital distribution under the new CEO? Given the overall constellation that we found during our visit, I wouldn't be surprised. It would take off some of the pressure that shareholders have been placing on the company recently, and allow the new CEO to get off to a good start.

This could be a short-term catalyst for the stock, and one that is set within the longer-term context of Erste Group as another proxy for investing in the region.

Take your pick – the choice is wide

The selection of Hungarian companies gives a taste of how surprisingly diverse the Budapest Stock Exchange is. Not only does it include 151 locally listed companies, but there are also international plays with exposure to Hungary.

Interestingly, even the Budapest Stock Exchange (ISIN HU0000063078, BUD:BET) itself is now a publicly listed company. This made virtually no headlines at all when it happened, due to the company's initial quiet listing, with plans to increase its free float. The exchange had come back under Hungarian control in 2015.

Hungary does not currently have a particularly developed capital market, with a culturally limited openness towards equities savings by private investors. As a presentation by Dentons put it: "The Hungarian capital market remains under-utilized, with companies heavily reliant on bank loans as their primary source of financing. …. The limited availability of securities and corporate bonds can be attributed to subdued demand, largely due to the limited presence of personal savings and pension plans in the market."

The Budapest Stock Exchange wants to improve on that and grow its own business while doing so. There seem to be some first signs of progress already: in 2022, the exchange's mid-cap platform, BSE Xtend, closed a year full of records, almost tripling the number of issuers in 2022 and reaching 18 companies. New entrants included companies from cybersecurity, proptech, and pharmaceuticals – hardly just old economy companies. The fact that many Hungarian companies have developed ties with neighbouring markets or countries that are further afield was also something that we've noticed throughout our meetings.

The Budapest Stock Exchange has a market cap of around EUR 37m, and currently less than 10% of the shares are in free float (with the company planning to increase its free float at a later stage). Since its listing in June 2023 at a price of HUF 3,220, the stock reached a record high of HUF 3,840, only to since fall back to HUF 2,545. The market capitalisation of all Hungarian companies is about EUR 33bn. For someone hunting for entirely undiscovered stocks that combine value and potentially growth, I'd keep an eye on this one.

Budapest Stock Exchange.

Other companies that we visited included Magyar Telekom (ISIN HU0000360128, BUD:MTELEKOM), the former national telecoms operator. Orbán's administration has previously been criticised for nudging large foreign investors to sell up, with beneficiaries often including local companies and entrepreneurs. Vodafone did sell its Hungarian operation, and Magyar Telekom nowadays dominates the fixed market together with just one other competitor, 4iG. Magyar Telekom is 63.5% owned by Deutsche Telekom (ISIN DE0005557508, DE:DTE). With a secondary listing in the US (as American Depository Shares, ISIN US5597761098), it could benefit from several of the trends mentioned in this article, provided they came to pass. The stock is trading at an EV/EBITDA multiple of less than 5.

MOL (ISIN HU0000153937, BUD:MOL) is the other obvious stock to pick when seeking exposure to the Hungarian market, given that it single-handedly contributes 20% of the market cap of Hungary's publicly listed company sector (see also my recent Weekly Dispatch on Hungary for a more extensive assessment of the gargantuan oil and gas company).

In our meeting with MOL's investor relations team, it became clear that even in a country like Hungary, issues such as windfall taxes decreed by the government include an element of negotiation. MOL has benefited significantly from continuing to buy Russian pipeline oil, which has long traded at a massive discount. The extra margin earned by MOL was taxed heavily by the state of Hungary – higher than similar taxes enacted in other countries. When we visited, we heard that MOL was in a conversation with the government where an offer to keep oil and gas production on the 2022 level will be used to negotiate a decrease in extra taxation. A few short days later, MOL announced that it struck just such a deal.

The company also continues reducing its dependency on oil from Russia; their investor relations team pointed out that they had already done so as part of a long-term reorientation since the Crimea conflict broke out in 2014. These are the kind of data points that Western media are unlikely to share with you.

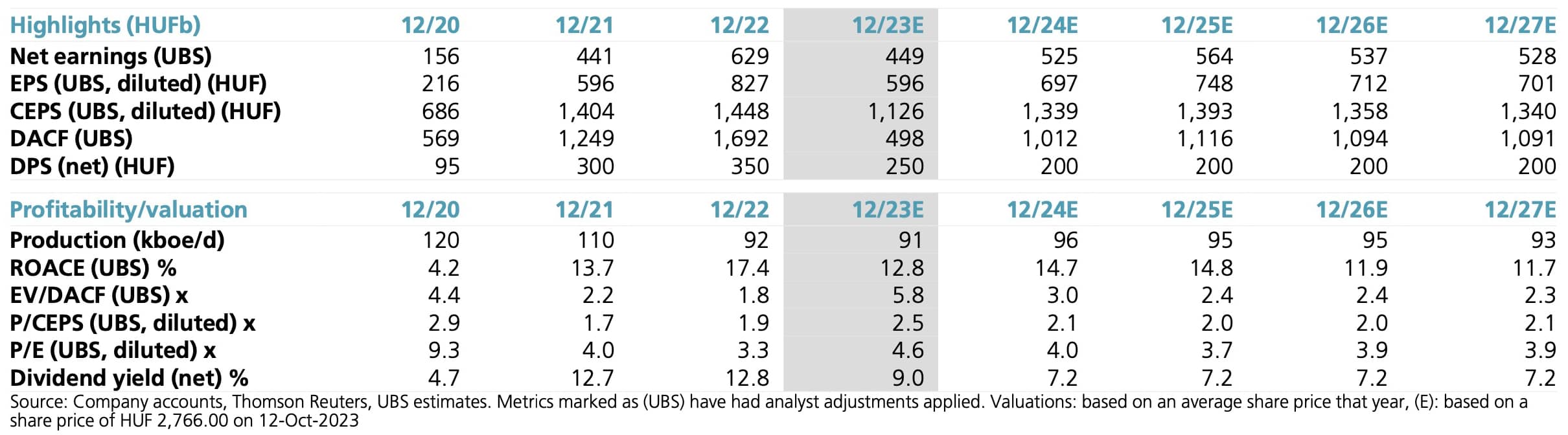

Below are the most up-to-date estimates for MOL. The stock continues to trade at emerging market valuations, even though it's a European company. While valuations of oil and gas stocks are a subject in itself, even within this sector, MOL stock is undoubtedly very cheap.

Source: UBS, 12 October 2023 (click on image to enlarge).

Hungary – a new cycle starting soon?

In the 1990s, Hungary was one of the most open economies in Eastern and Central Europe and widely regarded as a benchmark for the changes that took place across the region.

Right now, its reputation is mixed, at best. The country is admired by some, and despised by others. It has had real economic issues to deal with, and being known as the country with the highest inflation rate in Europe is not conducive to attract investors.

Equally, within the region, Hungary is cheaper even than its peers. All the bad factors that the country is known for should already be priced in – and then some. In addition, according to Raiffeisen Bank's analysts, inflation is seemingly on the way down.

Hungary's headline inflation.

Within Europe, Hungary's level of indebtedness is one of the lowest, with a projected continuing decrease from 73% of GDP in 2023 to 61% by 2028.

Between 2021 and 2023, foreign ownership of Hungarian stocks has decreased from 56% to now 44%. All the while, Hungarian financial investors and Hungarian households have increased their ownership of Hungarian stocks from 23% to 34%. Who said there wasn't any hope for Hungary to eventually develop a more pronounced equity culture?

What if there was a powerful catalyst such as a relaunch of EU funding of Hungarian projects?

Could the changing political landscape elsewhere in Europe lead to a broad re-rating of Hungarian stocks?

Are stocks like OTP Bank and Erste Group a low-risk way to latch onto a region where consumer markets show growth rates not achieved in Western Europe?

These are some of the questions that the investor trip to Budapest tried to answer.

Naturally, a two-day trip is limited in both scope and depth, and it won't turn you into an expert. Still, with the right line-up of meetings and an open-minded approach, you'll be able to develop a sense if an opportunity is worth keeping on your radar.

Speaking to the decision-makers and residents of another country almost always makes you learn a valuable new fact, or two. Or as my friend Mikkel Thorup of Expat Money said: "View the world through someone else's eyes. Perspective is one of the most undervalued skills in life."

Alongside all the fact-finding, we also simply did have great fun as a group, and all ended up making new friends.

Investing in the stock market in Hungary – good value or value trap?

Ladislas Maurice of The Wandering Investor and I reflect on our visit to Budapest.

Why should you consider investing in the Hungarian stock market? What are some potential catalysts for a re-rating of Hungarian stocks? Which companies are worth a closer look?

If you liked today's Weekly Dispatch, you'll certainly enjoy this additional summary!

Investing in the stock market in Hungary – good value or value trap?

Ladislas Maurice of The Wandering Investor and I reflect on our visit to Budapest.

Why should you consider investing in the Hungarian stock market? What are some potential catalysts for a re-rating of Hungarian stocks? Which companies are worth a closer look?

If you liked today's Weekly Dispatch, you'll certainly enjoy this additional summary!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: