High valuations, low growth rates, interest rates hovering around zero, and a potential recession in sight… There is a long list of reasons why a growing number of investors has started to look beyond the Western European and American markets.

Just how many opportunities exist outside of the world's main markets becomes much clearer once you start to travel the world in search of interesting investments (as I do).

I have just been to a country that few people have been to because until very recently, it was politically isolated. It does, however, feature:

- 200 publicly listed companies, with possibly 50 more IPOs to come between now and 2022.

- A government that is hell-bent on reforming, modernizing and liberalizing its capital market and economy. As part of that it has just placed its first ever Eurobond issue, which attracted $8.5bn in subscriptions for an initially planned placement volume of $500m (which was then upped to $1bn).

- A large population eager to catch up economically with its neighbors (and the world); it actually has the largest population of its region!

Through long stretches of human history, this country has been known as an enlightened, successful world center for trade, science and the arts.

Even though it's seemingly off the beaten path from a European or American perspective, it lies at a strategic, central position. The major markets of China, India, Russia, Europe, the Middle East and Africa are all within relatively easy reach.

Meet Uzbekistan, one of the more unusual – but all the more interesting – markets to emerge as an investment destination.

Ignore "frontier markets" at your own peril

By revealing this country's name, I will have probably lost the attention of a significant percentage of this week's readers.

"Too exotic."

"Too politically risky."

"My broker can't trade there."

Much as these are valid points to some degree, ignoring the opportunities that arise in countries that are emerging from troubled times also leaves you at risk of missing out on some of the world's best investment opportunities.

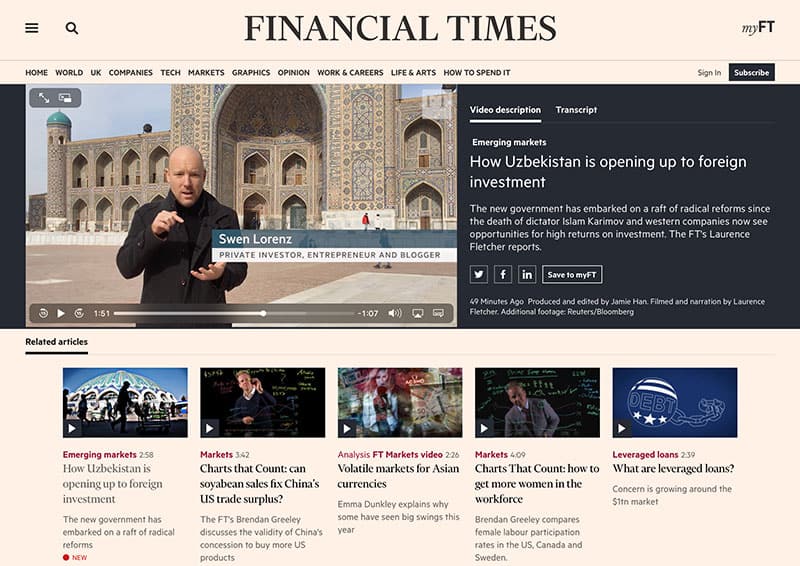

Last word on Uzbekistan: A fun 3-min video from the Financial Times

The Financial Times published this 3min video on 8 March 2019, and your author happens to be in it. Recommended watching for a first-hand impression of the country. You can also read a feature-article about the subject written by the FT’s @Laurence Fletcher.

E.g., if you want to make 10, 20 or 50 times your money or achieve an outsized dividend yield that you just couldn't achieve in more mature markets, these so-called "frontier markets" are a place that you should pay attention to.

Which is why I have decided to write a three-part series about my trip and the findings I brought back from it.

I will use the example of Uzbekistan to explain a few general points about investing in such countries, besides looking at specific investment opportunities that are open to anyone (no Uzbek brokerage account required).

Why Uzbekistan, why now?

In case you haven't got a clue what's been happening in Uzbekistan over the past two years, you are not alone.

The Chinese, the Russians and the South Koreans are already significant investors in the country. Foreign direct investment is growing rapidly, but Western countries generally have not been paying much attention to this corner of the world. Nor have there been overly many journalists visiting the country to report about its economy and businesses.

Uzbekistan lies at the center of the region known as Central Asia, which also comprises Kazakhstan, Kyrgyzstan, Tajikistan, and Turkmenistan.

Historically, these were the countries that made up the fabled Silk Road, i.e., the trading route that first connected Europe to Asia.

In more recent times, Kazakhstan became famous for its massive uranium reserves and the Borat movie, and Turkmenistan regularly made headlines because of its late dictator's extraordinary eccentricities.

Uzbekistan hardly ever got in the news at all. So far, it has only ever gotten any attention because of its historic sites. Some of the world's most outstanding cultural, historic and artistic sites are located in the city of Samarkand (the very center of the old Silk Road) and other parts of Uzbekistan.

These and other UNESCO-protected sites have started to attract large numbers of tourists. Germans and French are currently both vying for the no. 1 spot in the visitor statistics during Spring and Autumn, and during the hot summer months the Russians show up en masse.

Outside of that, hardly anyone is aware of the following:

- With 32m people, Uzbekistan has the largest population of the region's countries. That's nearly twice the 18m inhabitants of neighboring Kazakhstan, and almost half of the region's entire population of 69m.

- The country features what is probably the world's largest open-pit gold mine, the Muruntau gold deposit.

- Exact figures are hard to come by, but the country's current income per head is only about 25% that of neighboring Kazakhstan. This is a result of decades of political isolationism and socialist policies.

- It is the only one of the Central Asian countries that borders all the other Central Asian countries, making it the region's natural trading center. (Fun fact, it is also one of only two "double land-locked countries" in the world, i.e. you need to cross two other countries first before you get to the sea. The other one is Liechtenstein.)

Its former President of 26 years, the late dictator Islam Karimov, was famous for all the wrong reasons. He was known to throw political opponents into boiling water and lock up journalists; he carried out a massacre when demonstrators started to rise up in one of the country's regions in 2005, and he generally made every effort to keep the country isolated from the rest of the world. He also never reformed the highly subsidized, Soviet-era command economy.

All this started to change when Karimov died in 2016. Since then, Uzbekistan has been advancing rapidly. It is now probably at a tipping point towards achieving the most significant changes in the country since the fall of the Soviet Union in the early 1990s.

The last 24 months brought sweeping changes

The country's new President, Shavkat Mirziyoyev, had served as Prime Minister of Islam Karimov. Many observers saw it as a bad start when an establishment figure ascended to the Presidency. However, he decided to chart an entirely new course for the country and has made it his declared goal to leave the Karimov-era behind. Uzbekistan isn't conventionally democratic just yet, but it's already a far-cry from what the country was like under Karimov. E.g., all incarcerated journalists have been released.

For foreign visitors and investors, Mirziyoyev's most striking recent change was the relaxation of visa requirements. Just as I was planning my own trip, Uzbekistan dropped its visa requirement for 45 countries. Everyone with an EU passport can now travel to Uzbekistan visa-free. Citizens of Singapore, Japan, South Korea, Indonesia, Turkey, Brazil, Argentina, Switzerland, Norway, Iceland, Chile, Canada, and Australia can also visit without a permit. Evidently, this is not the visa policy you'd expect from a formerly isolationist country. Not surprisingly, during the first half of 2018, tourism numbers were up an astonishing 91%. Figures for the entire year are likely to be equally impressive once they are published, following a recent flurry of media reporting about the country's incredible visitor sites.

Foreign visitors are usually astonished to learn that for crossing much of the previously difficult-to-access country, they can now go online and book a Spanish-built high-speed train.The railway link connecting the capital, Tashkent, to the two tourism hotspots Samarkand and Bukhara can easily keep up with the railway systems of Germany, Japan, or Switzerland – and beats all of them in terms of service!

Indeed, the tourism industry of Samarkand has been brought to such a level in terms of both quality and quantity, that it is ready to scale up. Over the next coming years, a fast-growing tourism industry could have a transformative effect on the country. In a country as poor and under-developed as Uzbekistan, the spending power of a few hundred thousand foreign tourists – let alone a few million – can have a huge effect.

But these are just some of the more visible changes. What the tourists generally tend to be less aware of are the other changes going on in Uzbekistan's economy.

For example:

- Personal income tax was lowered from 22% to 12%, and the corporate tax rate was fixed at just 7.5%. By reducing the tax rates to such a low level, the government wants to officialize the grey and black economy. This will lead to massively increased tax revenue, because the low tax rates will be collected from a much bigger percentage of the overall economy. A similar strategy in Georgia, which is a model-case for a laggard ex-Soviet economy eventually getting modernized at a record pace, led to tax revenues increasing 12-fold in just four years.

- The system of currency control was abandoned, and the value of the national currency – the "Soum" or "Sum" – is now determined by the market. The currency is fully convertible.

- Private ownership of land was introduced, excluding only agricultural land (which the government leases out to farmers on 50-year contracts).

- Foreign Direct Investment (FDI) was virtually zero during the Karimov-era but reached $2.5bn in 2017 and $2.9bn in 2018, respectively. Projections for 2019 are $4.1bn.

Lots is going on behind the scenes:

- All laws relating to the country's capital market are currently under review, with the aim to attract more foreign capital. Continuing to drive FDI is a publicly-declared key priority for the President.

- Uzbekistan is considering to follow the example of Kazakhstan and set up arbitration courts that are based on English law and staffed with British judges. Foreign investors could then opt to use international-standard arbitration courts to try and resolve their problems, instead of having to rely solely on the Uzbek court system.

- The country is thinking about the introduction of private pension funds, similar to what Chile set up in the 1980s (to this day a model-case for creating a private pension system).

I came to Uzbekistan on a group trip organised by Sturgeon Capital, a London-based frontier market specialist that has had a foothold in Uzbekistan for a decade. Because of their network, I was able to meet with Ministers, bankers, and some of the leading entrepreneurs of the country.

After a week of meetings across its capital and in Samarkand, you cannot help but get the impression that significant changes are afoot in Uzbekistan.

The last major country to shake off the Soviet era?

Make no mistake, Uzbekistan is a country that has fallen far behind its neighbors. Islam Karimov's reign led to the country effectively missing out on one generation's worth of economic growth.

A lot of catching up is required before Uzbekistan can join the list of economically advanced nations. E.g., it recently ranked #140 in the Freedom House ranking of economic freedom. This is below countries such as Ethiopia (#137), Kenya (#131), and Pakistan (#130); neighboring Kazakhstan has already advanced to #59. However, even its current ranking is an improvement over last year's ranking (#152). Freedom House noted that Uzbekistan scored "robustly higher for investment freedom, labor freedom, and business freedom."

Central Asia's most populous nation is not without challenges and risks, and I'd be the last person to take politicians by their word until I have actually seen them deliver on their promises. However, without a doubt there are early signs that this could become one of the region's next success stories.

With its comparatively large and well-educated population (almost 100% literacy rate), an unusually high number of publicly listed companies, and plenty of investment opportunities outside of public markets, it is definitely a country to keep an eye on.

What's next

Why such situations are so attractive for investors, and how anyone with a brokerage account can easily get a stake in the country's future, is something I will look at in more detail during the next two parts of this frontier investing mini-series.

Uzbekistan is an interesting case study for anyone open-minded enough to invest outside of their home country, and an exciting prospect for anyone keen on making above-average returns on the back of undervalued investments in a fast-growing economy.

Stay tuned for more!

Blog series: Hunting for investment bargains on the Silk Road

There's more to "Hunting for investment bargains on the Silk Road" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Want to receive my next research report on the day it is released?

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Updates on previous research reports

- 2 special publications per year

P.S.: I just released my latest in-depth report about what I consider to be the best equity opportunity in Germany - Porsche SE! Available for Members only so sign up now to get immediate access.