In last week’s Weekly Dispatches, I gave you an overview of the exciting political and economic changes currently unfolding in Central Asia’s most populous nation, Uzbekistan.

As part of my trip to visit Ministers, bankers, and entrepreneurs in the country’s two leading economic hubs, Tashkent and Samarkand, I've come across several success stories. These reminded me just why anyone who is eager to achieve superior investment returns should pay attention to “frontier markets" in general, whether that’s Uzbekistan or similar countries in other parts of the world.

As a real-life example, meet Kamol Abdulloev, the man who’d deserve the title "Carpet King of Uzbekistan".

A global success story hiding in the regions of Uzbekistan

Once you have been to Kamol’s newly built carpet factory on the outskirts of Samarkand, your perspective of the Uzbek economy changes forever.

Rows and rows of German-built, state-of-the-art carpet weaving machines suck in colourful threads provided by thousands of reels. Well-dressed staff members keep an eye on the incredible line-up of machinery and courteously greet visitor – though it’s unlikely they will have seen many! The recently built facility is spotlessly clean, and it’s evident that its owner has already planned for further expansion.

Expansion is something that Kamol is well-familiar with. As recent as 2000, he employed just 40 staff members. Today, more than 10,000 (!) Uzbekis work for him across a range of industries. Carpets are Kamol's main business, and his company, SAG Gilamlari, has achieved a number of remarkable feats:

- SAG has risen out of nowhere to become the world’s 4th largest carpet manufacturer.

- The company sells carpets in Afghanistan, which sounds like selling snow to Eskimos and speaks to the level of product quality his company has achieved.

- Every day, the factory churns out 5,000 to 6,000 carpets, which are based on a database of 400,000 different designs to cater to any market around the world.

How did he do it?

When asked, Kamol cites honesty and frankness as the main reasons for his success.

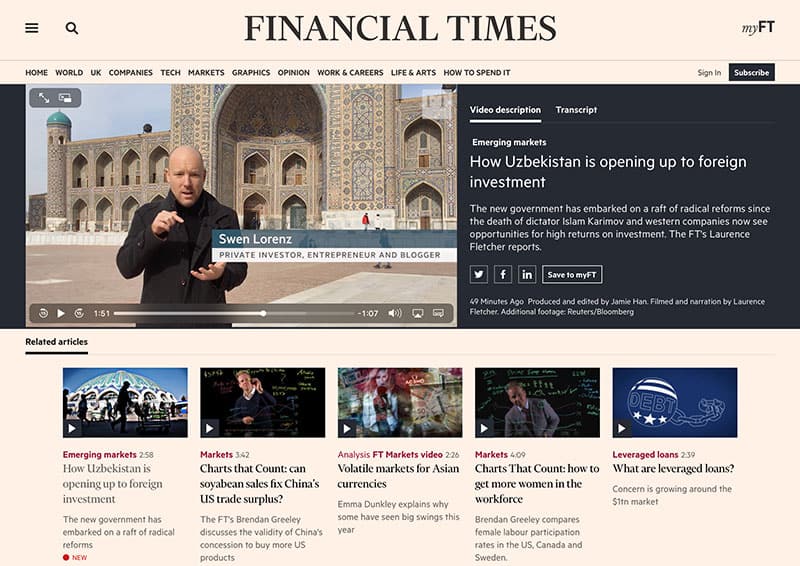

Last word on Uzbekistan: A fun 3-min video from the Financial Times

The Financial Times published this 3min video on 8 March 2019, and your author happens to be in it. Recommended watching for a first-hand impression of the country. You can also read a feature-article about the subject written by the FT’s @Laurence Fletcher.

- When he started, there was little competition because the economy was still stuck in Soviet-style thinking. Carpet-making wasn’t done using modern management and equipment, and this was a low-competition market.

- Because of the under-developed economy, labour costs were very low in Uzbekistan (and they remain low to this day; a taxi trip anywhere in central Tashkent is no more than EUR 1).

- No matter how under-developed a country’s economy may be, there are always some sectors where a country harbours special talent or tradition. In Uzbekistan, there was plenty of talent available in carpet making. Kamol recognised this opportunity and leveraged these assets to his advantage.

In less than 20 years, Kamol has gone from small-time entrepreneur to veritable business tycoon. He has become a very wealthy man in the process, but one who remains exceedingly humble and terrifically hospitable.

Could Kamol have pulled off a similar feat in developed countries like Germany, the UK or the US? Pretty unlikely, because he would have faced much steeper existing competition, high labour costs, and a variety of other hurdles.

For private investors seeking to improve the return in their portfolio, Kamol’s SAG is a useful case study why frontier markets are worth looking at. These countries offer you opportunities that in this shape or form, you just cannot find in developed markets.

10 reasons to invest in frontier markets

During this research trip, I met a number of other frontier market experts.

Picking their combined experience of decades of investing in up-and-coming markets, I compiled a list of reasons why anyone putting together a portfolio of long-term investments should add some frontier market exposure.

- Higher growth rates:Frontier markets usually experience a period of rapid "catching up." This is the period when previously suppressed consumer demand finally hits the market. The local population buys cars, gets credit cards, and takes its first ever holiday abroad. Financing enters the economy and helps successful companies make transformative leaps forward. These countries often grow at an annual rate of 5% to 8% for extended periods, and sometimes even achieve 10% or 12% growth in a single year. Uzbekistan’s growth is projected to be above 5% in 2019 and 2020, and rise to 6% in 2021. Successful reforms could lead to a few years with even higher growth rates. Why is this relevant for investors? Because it’s much easier to achieve high investment returns in fast-growing markets. High economic growth rates are like the tide lifting up all boats!

- Lower valuations:Frontier markets generally suffer under a scarcity of investment capital. The lack of competition among funders generally leads to lower prices for investments. You can buy investments on incredibly attractive conditions.

- Big opportunities in low-risk industries:In Western markets, you usually need to back high-risk ventures in sectors such as technology or pharma/healthcare to have a chance of making 10, 20 or 50 times your money. In frontier markets, you often only need to invest in proven, conventional and therefore relatively safe industries such as cement, consumer goods or retail banking to achieve superior returns. E.g., a friend of mine was CEO of Bank of Georgia in the 2000s, and under his leadership, the share price rose 180 times in just four (!) years because the bank achieved rapid growth in a fast-changing economy. Early investors who had bought shares on the fledgling Georgian stock exchange could subsequently use a newly arranged listing on the London Stock Exchange to cash out. Try earning such a return with a bank investment in Europe or the US!

- Favourable demographics:Western Europe’s demographics are a catastrophe and its rapidly aging population is hindering economic growth. In frontier markets, you usually have a young, growing population. In Uzbekistan, 55% of the population is younger than 30 years. Young people build houses, set up new companies, and buy more consumer products. With a large number of young, hungry consumers entering the economy, you are virtually guaranteed to achieve higher overall growth rates.

- No debt bubble:Not a day goes by without new headlines about Western Europe’s problems with out-of-control debt and desperate central bank measures to keep certain Southern European economies afloat. The US and most other Western industrial countries have similar issues. Countries that used to be too isolated to be considered by international creditors often have low levels of debt. E.g., Uzbekistan has a debt-to-GDP ratio of only 13%, compared to 65% for Germany, 87% for the UK and 131% for Italy (these figures all vary depending on which source you refer to and which manipulated statistic you believe in, but the orders of magnitude are clear). In some ways, countries with low debt levels are less risky, and they can certainly be more dynamic once other growth levers are pushed. If you want to see an example how high debt stifles growth, look no further than the Italian economy.

- Low correlation:If you choose a frontier market that has not yet experienced a massive influx of speculative foreign capital, then this country’s economy and capital market will be less prone to suffer when other large markets go through a period of declining asset prices. Even if Europe and the US went into recession now, Uzbekistan would likely continue its current phase of fast economic growth. Having a portion of your portfolio invested in frontier markets can reduce the portfolio’s overall volatility and give you something to sell out at a high price just when new bargains have become available in markets that haven’t done so well recently.

- Lack of transparency as an opportunity:Frontier markets are usually not yet transparent, e.g., it will be more difficult to analyse companies and draw a conclusion on their investment potential. This is a risk but also an opportunity. If you have access to the right kind of local information, you may be able to buy into an investment opportunity at an extraordinarily attractive valuation because others have not yet caught up with just how attractive that investment is. Once they do, the price shoots up, and you can cash out a multiple of your original investment (more about this in the third part of this article series when I speak about Uzbek shares).

- Urbanisation:In frontier markets, there is often a trend towards rapid urbanisation, which in turn creates investment opportunities. E.g., in Uzbekistan, only about 8% of the population live in the nation’s capital; a relatively low percentage by international standards. This was partially caused by restrictions on moving to the capital. These restrictions have recently been lifted and the country is now likely to see ongoing migration to its capital city. This will lift prices for real estate, increase demand for consumer goods, and generally provide an extra lift to any company that caters to the needs of the capital’s growing population. This is a relatively simple but powerful trend to take advantage of.

- "Hot money" flows:Once they get discovered, frontier markets have a tendency to "overshoot". These kind of markets usually go from being ignored for years, to attracting the first generation of pioneering investors who then make extraordinary profits, to eventually attracting large numbers of speculative investors who feel they have missed out and want to jump on the bandwagon. During this final period, markets often turn into bubbles and valuations overshoot, not the least because most of these countries are ultimately fairly small and can’t even take in all that much foreign capital. That’s great for anyone who has bought in early and can cash out at ridiculous valuations by selling to "buy-near-the-top" lemming investors who buy at the top. A crash inevitably ensues, but if you get your timing right, you will have already cashed out by then.

- Higher dividend yields:Local investors in frontier markets often have a strong bias towards companies paying out high dividends. You can regularly achieve much higher dividend yields in these markets than you’d be able to earn in Europe or the US. Depending on what your investment goals are, this can also become a useful building block in your portfolio, e.g. if you want to generate annual income from your investments.

For the sake of brevity and readability, these are all somewhat generalised points. Each country varies, and within each country you have multiple opportunities with different characteristics. Some of these points overlap to a certain extent, and there are undoubtedly yet more reasons you could add to this list.

I wanted to provide you with a quick initial overview of why, if you haven’t considered these kinds of opportunities yet, you could benefit from paying more attention to them in the future.

Frontier markets aren’t a focus of this blog, but they are indeed a subject that I will be covering from time to time. I’ll write about them whenever I come across specific opportunities that emerge out of my traveling, my network of contacts, and the voracious reading I do on behalf of my readers.

"Yes, sure, but how can I take advantage of this specific opportunity?"

Truth be told, you’d currently be hard-pressed to call up your bank or broker and ask them to buy shares of the leading Uzbek companies for you.

There are 200 companies already listed in Uzbekistan, and according to a government representative there are an estimated 50 other local companies ready for an IPO. But the Tashkent Stock Exchange is not yet easily accessible for foreign investors.

Though as always, there are smart ways how to deal with such difficulties.

In the next (and final) part of this series, I’ll provide you with an overview of:

- What sort of opportunities I found on the Tashkent Stock Exchange.

- Which Uzbekistan-related investment you can already buy into on the London Stock Exchange.

- Who you can speak to about an upcoming Uzbekistan investment fund, one that will be open to virtually anyone who has an interest in this investment theme.

Check back here next week (or subscribe to my automatic email alertsfor these Weekly Dispatches) to learn more.

You, too, could quickly get access to the investment opportunities currently appearing in Central Asia’s last and final major country to emerge from a Soviet-style command economy.

Provided, of course, you have the right information available to you!

More about all this in the 3rdand final part next week.

Blog series: Hunting for investment bargains on the Silk Road

There's more to "Hunting for investment bargains on the Silk Road" than this Weekly Dispatch. Check out my other articles of this three-part blog series.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Want to receive my next research report on the day it is released?

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Updates on previous research reports

- 2 special publications per year

P.S.: I just released my latest in-depth report about what I consider to be the best equity opportunity in Germany - Porsche SE! Available for Members only so sign up now to get immediate access.