For today's exclusive article, equity analyst Gwen Hofmeyr assiduously sifted through company records in 400 counties across six US states.

This original research yielded 10,000 datapoints about a company that is Nasdaq-listed and has a USD 1.4bn market cap, but which few would have ever taken a closer look at.

Anyone who ever said that markets are efficient may have to adjust their view after today's Weekly Dispatch about regional US supermarket chain Ingles Markets.

A typical Ingles Market (image by Chadarat Saibhut / Shutterstock.com).

Tracking down "Undervalued Land"

One of the historic treasures sitting on my hard drive is a 2003 research report dubbed "Undervalued Land". It was published by Porter Stansberry, a relatively new newsletter publisher then but one who has since gained an entirely different level of notoriety.

Stansberry's report looked into US companies that owned enormous land reserves. The idea was that buying these stocks would allow you to own "the world's most desirable land at a 99% discount".

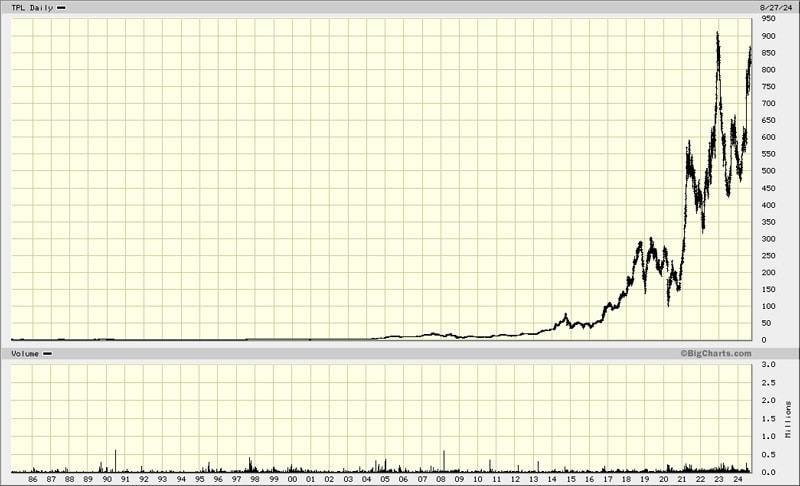

One of the stocks that caught my eye in the report at the time was Texas Pacific Land Corporation (ISIN US88262P1021, NYSE:TPL). This was a company that owned 1m acres of land, which made it the largest private landowner in Texas. As a so-called liquidation trust, it had an unusual legal structure that most investors weren't familiar with.

In 1888, when Texas and Pacific Railway went bankrupt, Texas Pacific Land was set up to gradually sell down the 3.5m acres of land owned by the defunct railway company. The structure was created to avoid flooding the market with too much land all at once. However, the liquidation of the trust took a lot longer than anyone ever imagined. Over 100 years later, it still had 1m of the initial 3.5m acres left. To give you an idea of just how much land this is: Manhattan is a mere 14,500 acres while the state of Rhode Island is barely 1m acres. Texas Pacific Land's initial land holding was the same size as the state of Connecticut.

Despite these incredible figures, the market was largely ignoring the quirky stock, mainly because it didn't fit into any category. Texas Pacific Land's market cap at the time equated to just USD 14 per acre, even though comparable land had already sold for as much as USD 9,900 per acre.

Back then, those who did know of the stock feared it was a value trap. I didn't, and I have to thank Porter Stansberry's work for putting this opportunity on my radar.

Fast-forward 21 years, and Texas Pacific Land's share price is up an astounding 252x. The stock has appreciated by 30% p.a. for 21 years running, beating most of the world's best hedge fund managers (without having to pay fees!).

Texas Pacific Land Corporation.

An element of luck was involved, though. Oil and gas reserves found on the land upped the value further and helped make Texas Pacific Land more widely known. It is now a USD 20bn market cap company, and some claim the stock has yet further to run. Besides oil and gas, there is also the increasingly valuable resource of water.

Having seen this stock's rise from obscurity to rock star status, I've long had the ambition to produce an updated, expanded version of the Undervalued Land report. I've never found the time to do it, though.

Gwen Hofmeyr to the rescue, an outstanding equity analyst who temporarily had a bit of time on her hands.

From Hingham Bank to Ingles Markets

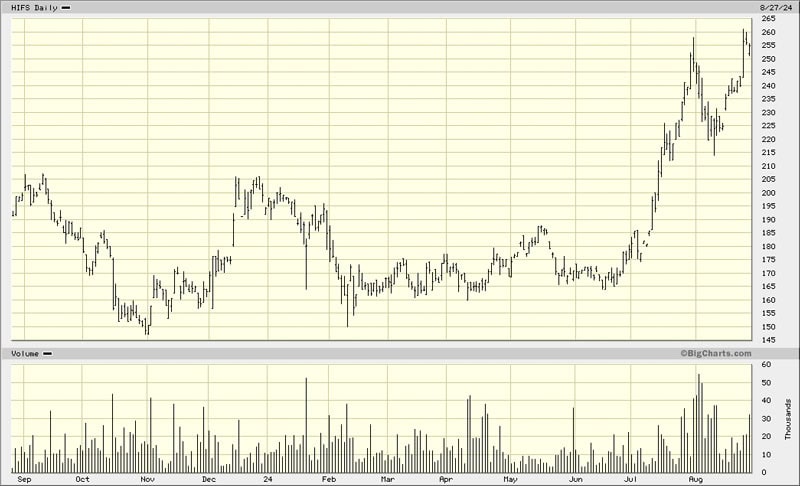

In May 2024, I highlighted Gwen's research report on Hingham Institution for Savings (ISIN US4333231029, Nasdaq:HIFS), one of the oldest banks in the US. Such regional banks were largely ignored by analysts and Wall Street, even though some of them offered a compelling investment case if you took the time to analyse the underlying details.

While working as equity analyst for a Canadian family office, Gwen had gone through the trouble of compiling an impressive 3,600 data points about 138 publicly listed regional US banks. Out of that compilation fell an in-depth analysis of Hingham Institution for Savings, which Gwen presented at the MOI Global "Best Ideas 2024" conference.

Her conclusion convinced me. The stock was trading at a valuation last seen during the Great Financial Crisis and the dot-com bust. Both times, it proved a good move to pile into the stock ahead of the good times returning and multiples expanding. Indeed, since I published my Weekly Dispatch on Hingham Institution for Savings, the price is up 41%.

Hingham Institution for Savings.

My Weekly Dispatch also showed how this was a model case for disproving the efficient market theory. By manually collecting vast amounts of data and analysing them in a way that no one else had bothered to do before, it was possible to derive some truly original insights – and beat the market!

Gwen and I got talking, and we decided to explore the idea of researching ideas for an Undervalued Land report.

Little did we know what a challenge we were up against.

Casting a wide net

2003 was a different era in capital markets. Finding Undervalued Land stocks with real potential for a re-rating was still a lot easier then. Since then, markets have become yet more transparent.

This time around, Gwen ran a filter that produced 112 names in industries such as farming, water utilities, vineyards and distilleries, as well as paper and forest products. Not only was this a relatively small list, but land ownership would be an expected feature in these companies and, therefore, was likely priced in already. That's why we decided this approach wasn't good enough.

We then pursued the idea of screening for European or Asian companies that own large amounts of land in North America. What was a great idea in theory yielded just a single candidate: T&G Global (ISIN NZTURE0002S5, NZ:TGG). The New Zealand-based apple grower had several thousand acres in Washington state, which was an interesting feature but didn't make for a compelling investment case.

In the next round, we screened for companies that had large amounts of land disclosed to their shareholders, hoping that our combined expertise and instinct would suffice to pick out a few interesting candidates. To avoid the issue of looking at companies where land values were already priced into the equation, we mostly stayed clear of REITs and other overly obvious sectors.

At that point it started to get interesting.

During her nightly research sessions involving a detailed analysis of disclosure documents, Gwen discovered that some companies owned a much bigger acreage of land than disclosed to shareholders.

How is that even possible?

Because disclosure regulations give companies a fair amount of leeway in what exactly they disclose to shareholders.

For example, TWC Enterprises (ISIN CA87310A1093, TSE:TWC) is a Canadian business that owns and manages golf courses in Ontario and Florida. In its reporting to shareholders, it only shows reserve land that is undeveloped but not land that had already seen some improvement. This is entirely legal and within disclosure rules.

In the case of TWC Enterprises, something was evidently hidden from plain view.

Digging deeper into TWC Enterprises required going through state-level company registers and county tax records in Canada and the US. This arduous work yielded some compelling initial results. Undervalued Shares readers can learn more about the potentially quite interesting case of TWC Enterprises in the full report that Gwen produced.

A couple of other companies also produced some interesting results.

However, none stood out more than a company that you are unlikely to have ever read about before, unless you happen to live in the area where its business is based.

The one that got away (so far)

North Carolina-based Ingles Markets (ISIN US4570301048, Nasdaq: IMKTA) is a family-owned, small-town operator of 198 supermarkets and 93 shopping centres. Outside of its home state, it also has supermarkets in South Carolina, Georgia, Tennessee, Alabama, and Virginia.

For the avoidance of misunderstandings, Ingles Markets' name isn't derived from "Inglés", Spanish for "English", but it goes back to Robert P. Ingle, who founded the company in 1963. Today, Ingle's son Robert P. Ingle II, known as "Bobby", is the company's chairman. He is the single-largest shareholder with a 22.1% stake of the overall equity, and he controls 72% of the votes.

Ingles Markets' primary business is the operation of supermarkets under the brands "Ingles Markets" and "Sav-Mor," with 189 and nine locations, respectively. The company likes to describe itself as providing high-quality, affordable grocery products in clean, thoughtfully laid-out stores, with convenient on-site amenities. It operates a number of such amenities, including fuel stations (108 locations), car washes (18 locations), pharmacies (114 locations), Starbucks pop-ups (108 locations), and curbside pick-ups (129 locations). Customers seems to like it: the average Google review of an Ingles Supermarket is 4.3 out of 5.

Ingles Supermarket in Spartanburg, South Carolina (image by Todd Kuhns / Shutterstock.com).

A single figure instantly gets across why Ingles Markets is worth a look if you are after real estate reserves. The company owns 84.3% of its supermarkets, the highest store ownership rate by far among publicly traded supermarkets in the US. In comparison, Kroger (ISIN US5010441013, NYSE:KR) owns 50% of its supermarkets, and Albertsons (ISIN US0130911037, NYSE:ACI) just 39%.

Sifting through the company's disclosure documents (100% credit to Gwen for doing that!), it quickly became apparent that something wasn't quite right. If Ingles Markets only owned as much land as it disclosed to shareholders, then each acre would be worth USD 2.2m. After making certain adjustments for leaseholds and buildings, each acre owned by Ingles Markets would have to be worth USD 9.2m even. Evidently, the figures disclosed to shareholders didn't add up. What did we miss?

Given the conservative nature of the business, it didn't seem like Ingles Markets was artificially inflating the value of its land. More likely, the company was understating the extent of its real estate holdings.

This extraordinary finding made us focus the entire research project on Ingles Markets rather than a selection of different stocks.

Using documents manually (!) sourced from 400 (!!) county tax offices across Georgia, North Carolina, South Carolina, and Tennessee as well as Google Maps and other public sources, Gwen eventually ended up with a dataset comprising 10,000 datapoints (!!!).

This dataset about Ingles Markets' real estate holdings is now available to anyone who likes to verify the research or dig deeper.

The most exciting finding is that the company owns a lot more land than its shareholders have been aware of. Based on this research, Ingles Markets owns 3,700 acres rather than the 160 acres disclosed in its reporting to shareholders – that's 21x a land reserve than Wall Street had been aware of so far!

Further research yielded other interesting insights and conclusions.

1. Shutting out competitors

Ingles Markets has a regional focus, and likes to limit competition in its operating regions.

In a fair few cases, the company purchased land with the intention of restricting competition.

As Gwen's full report shows:

"Ingles Markets owns the 10.46 acre plot of land directly beside their Ingles location at 100 Nathan Dean Bypass in Rockmart, GA, which otherwise could be used for commercial development by a competitor."

The "Master Property List" tab of the full dataset includes countless examples where Ingles has strategically bought land to limit competition.

The company's chairman and his CEO, James W. Lanning, have acquired deep regional expertise for real estate transactions. Its strategic approach to land ownership even allows the company to successfully compete with much bigger supermarket chains.

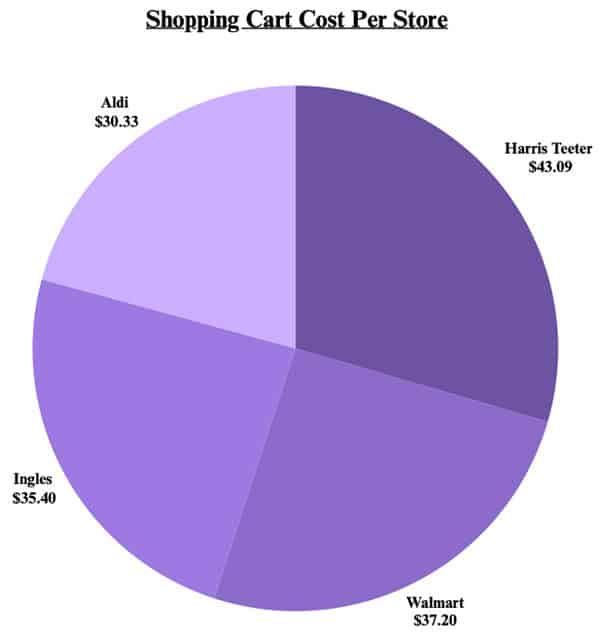

2. Competing successfully with Harris Teeter, Walmart, and Aldi

Naturally, this isn't the first-ever attempt of a deep-dive into Ingles Markets.

As far as we know, no institutional research coverage exists of Ingles Markets. In 2018, the company's management team effectively stopped taking calls from Wall Street – with a distinctively Buffett-esque attitude, as you can see if you make the effort of reading up on the history of the firm's relations with Wall Street. Check on Mario Gabelli's attempt to buy 5% and go activist on the company in 2017. He failed, but remains a shareholder.

A 2021 report published on Value Investors Club (VIC) did a good job looking at the firm, and it concluded that Ingles Markets was facing a concerning level of competition from Aldi and Trader Joe's. As the analyst put it, the intensity of the competition is "difficult to gauge".

Is it, though?

A genuine deep-dive needs to include an analysis of underlying efficiencies related to the proximity of distribution centres, competitors getting locked out of markets, and ancillary conveniences being offered. Once you take such factors into consideration, it shows that Ingles Markets has done much better than generally known in keeping competition at bay. It competes strongly on price, and where it's not the cheapest supermarket, it often wins on the basis of proximity, convenience, and brand loyalty.

Source: Gwen Hofmeyr.

On this, too, Gwen's report contains an entire section. If you are a budding analyst eager to learn how to do a very hands-on kind of research and come up with truly original, differentiated conclusions about an operative business, then these sections of the report will be a model case for you.

For everyone else, I suggest taking a view at the company's….

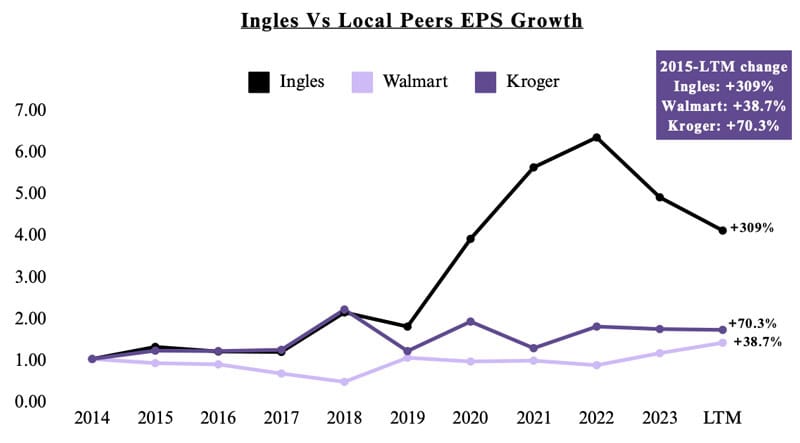

3. Superior metrics

Ingles Markets doesn't operate in isolation, and the US groceries market is highly competitive.

However, within these restrictions, the company has performed extraordinarily well.

If you analyse the supermarket business' operative figures for 2020-2022, you find an unusual ability to increase prices above the rate of inflation over direct competitors and the industry at large.

Source: Gwen Hofmeyr.

It appears that the company's low-cost offerings and strategic store positioning provides Ingles Supermarkets with a convenience factor on a scale not replicated by peers.

Much as there is some further research to be done, Ingles Markets' inflation resistance combined with its large real estate portfolio probably makes it an ideal asset for inflation-concerned investors.

Is the stock undervalued, though?

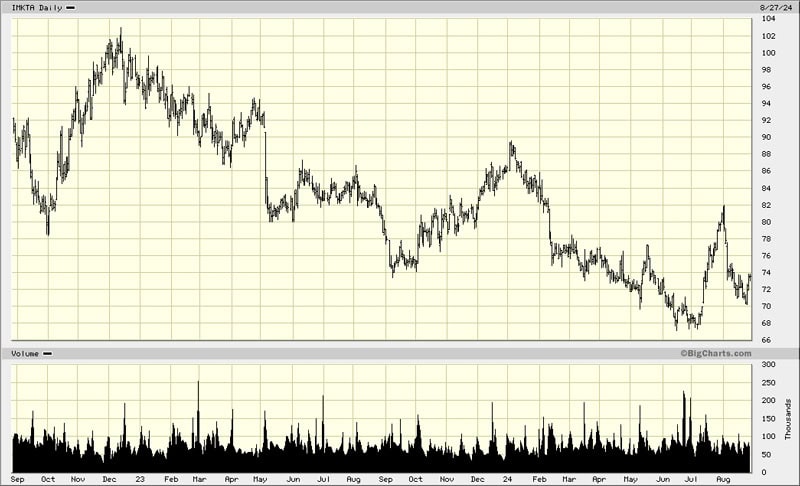

Ingles Markets.

An undervalued sleeper stock – for how much longer?

Since going public 37 years ago, Ingles Markets has never reported a loss.

It has paid down debt to a point where it has a better balance sheet than any of its competitors.

Over the past ten years, management has bought back over 20% of its stock.

A regional supermarket chain "down South" may be a bit of a snoozefest in the eyes of most investors, but as the case of Hingham Institution for Savings has shown, such stocks can deliver quite solidly when they get rediscovered.

If you adjust Ingles Markets' valuation for the additional real estate that Gwen's analysis has uncovered, the stock is currently trading at 0.61x book value, which is 52.3% lower than the company's historical average. It's trading at a multiple not seen since the 1990s.

As Gwen concludes in her 48-page report:

"Ingles is characterized by valuable assets that are not in a state of deterioration, but in a state of appreciation, and their quality is incrementally expanding. In other words, Ingles is no cigar butt, and yet it is priced like one."

As ever, there are risks that the business needs to face up to. Some investors will be worried about a governance structure with multiple voting rights for the founder's family (something that didn't stop Google from performing well for its investors), and the repeated land deals with related parties. Also, despite its enormous scope, the dataset now in existence about Ingles Markets' real estate needs building out further as well as double-checking.

For now, though, it seems that another veritable Undervalued Land play has been discovered, thanks to one person putting in a diligent, grinding effort. Such gems can stay undiscovered for a long time, and investors should never place too high a percentage of their investments in a single investment. However, as cases such as Texas Pacific Land or Hingham Institution for Savings show, it can pay off rather handsomely to invest into value and base decisions on original thinking, provided you have a bit of patience.

If you fancy digging yet deeper or would like to learn how such outstanding analyst work is produced, I recommend you download Gwen's full report on Ingles Markets. It's available for free and contains a link to the entire underlying dataset in Excel.

In a world (currently) dominated by passive and quantitative strategies, doing such original research work has become a rare skill. Quite possibly, it's all the more valuable for that reason.

Who ever said markets were efficient?

Also, what's not to like about doing the financial equivalent of an archaeological dig?

Both Gwen and myself hope that you enjoyed this excursion into the word of underanalysed companies, and how to find and dissect them.

The best unknown stocks: why you should buy these 3! (German-language video)

A deep-dive into three exciting investment opportunities outside the mainstream: oil in Kurdistan, Russian shares, and oil in the Falkland Islands.

What are the opportunities and risks of these investments, and how can you spot and take advantage of such rare cases?

Moritz Hessel of Total Return Finanzen and I take a closer look.

The best unknown stocks: why you should buy these 3! (German-language video)

A deep-dive into three exciting investment opportunities outside the mainstream: oil in Kurdistan, Russian shares, and oil in the Falkland Islands.

What are the opportunities and risks of these investments, and how can you spot and take advantage of such rare cases?

Moritz Hessel of Total Return Finanzen and I take a closer look.

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post: