Seaport Entertainment Group is a NYSE-listed play on the revival of New York’s southern tip. I visited the neighbourhood to evaluate the opportunity.

IPO of Virgin Galactic: 5 days until lift-off

From the end of next week, you are likely to read more often about Virgin Galactic, the company that aims to take large numbers of tourists into space. On 23 October, its shareholders are virtually certain to approve the final legal steps towards its planned "backdoor IPO".

A few weeks after the shareholder approval, Virgin Galactic should become the world's highest-profile space-related company listed on a stock market. If everything goes according to plan, the media could soon be awash with reports about this exciting new stock traded on the New York Stock Exchange.

In my blog's never-ending quest to beat the crowds and provide you, my readers, with an edge, I took a closer look at the company and its investment prospects.

That much I can divulge already: researching and writing this column made for one heck of an interesting day!

"Space Tech" is now a thing

Virgin Galactic is one of the better-known private companies that attempts to make its mark in the fledgling space economy, but it isn't the only one.

When Neil Armstrong and Edwin "Buzz" Aldrin first set foot on the moon in 1969, anything relating to space was the sole domain of government agencies. Over the past twenty years, the industry has changed significantly. There is now a burgeoning for-profit space industry, funded by private capital and sometimes with governments as paying customers.

When historians start writing books about the early phase of this industry, they will likely make prominent mention of the "X-Prize". Back in the 1990s, an American businessman offered USD 10m for the first project to succeed in sending a manned spacecraft into space, landing it safely back on earth, and repeating the same exercise within two weeks. Peter Diamandis, an entrepreneur and futurologist, wanted to provide a catalyst for finding a scalable, commercially viable form of space travel.

An engineer named Burt Rutan managed to raise funding from the late Microsoft billionaire, Paul Allen, to build a spacecraft specifically aimed at winning the X-Prize. The duo succeeded in 2004, which piqued the interest of another billionaire wild child. Richard Branson's Virgin Group acquired the rights from Allen but kept Rutan on its payroll as lead engineer. The newly formed Virgin Galactic enterprise set itself the goal of becoming the world's first commercial operation to take large numbers of tourists into space. Sir Richard had created a successful airline, now he wanted to do something similar further up in the sky.

Technically speaking, Sir Richard was only no. 3 among the world's space-obsessed billionaires. Jeff Bezos, the owner of Amazon, had already started his space venture – "Blue Origin" – in 2000. Elon Musk, then known as the successful former CEO of PayPal and today the driving force behind Tesla, had launched SpaceX in 2002. Though all three were aiming at different goals:

- Branson focussed on making space tourism available to the masses.

- Bezos hoped to colonise space and start an interstellar exodus from earth (no doubt with overnight Amazon Prime deliveries available on all populated planets).

- Musk wanted to colonise Mars, and along the way provide lucrative services to governments.

Speak of ambition and stretch goals!

Space geeks will argue which one of these companies has been more successful so far. What's beyond doubt, though, is that these three men have been the driving force behind an entirely new industry.

Private funding is looking to outer space for returns

In this day and age of negative interest rates, investors are looking beyond planet earth to generate superior returns. Who'd have thought? Even just ten years ago, this would have been ridiculed by most.

As recently as 2011, venture capital investment in space-related undertakings was virtually non-existent. That year, financial investors were recorded to have done nine funding deals totalling a minuscule USD 2.6m. (Not counting funding that the founders of the above-mentioned ventures provided to their own companies.)

In 2017, the venture capital industry provided USD 1.8bn across 74 investment deals. From its very low base, that's a 700-fold growth in just six years. There is now an aptly-named group of investors – the Space Angels – who provide funding for early-stage ventures in the sector. The ultimate space angel is, of course, Jeff Bezos. He has pledged to invest USD 1bn of his own money each year to further the cause of Space Tech and space colonisation. Think of it what you may, but space tech has become an industry in its own right.

The value of at least some companies has seen similarly steep rises. First among them is, of course, Elon Musk's SpaceX venture. In its 2002 funding round, the company was valued at just USD 27m. It did take a long eight years for the company's valuation to reach the magic milestone of USD 1bn. Since then, the sky has been the limit. During its most recent funding rounds, SpaceX was valued at USD 10bn (2015), USD 20bn (2017), and USD 33.4bn (2019).

Not least since the implosion of WeWork, we all know that valuation figures used for financing rounds that involve venture capital and private equity have to be taken with a grain of salt. WeWork was valued at USD 47bn one month, only to find itself in a form of soft bankruptcy the following month. Up to now, though, SpaceX deserves a lot of credit for becoming the third most valuable, privately held venture capital project in the US. The company has managed to achieve annual revenues of USD 2bn through projects such as supplying the International Space Station.

In comparison, Virgin Galactic's valuation of around USD 2bn makes the company look like a minnow. That's the value the company will likely have once the legal steps of the backdoor IPO have been carried out. The company's listing on the New York Stock Exchange is imminent, and you can already secure your own space in this exciting venture through buying shares of the shell company that Virgin Galactic will be merged into.

The passenger-carrying spacecraft developed by Virgin Galactic. (Image: Steve Mann / Shutterstock.com)

An unusual but safer way to public markets

Somewhat out of the ordinary, Virgin Galactic will go public through a merger with a listed "shell company".

Social Capital Hedosophia (NYSE:IPOA) is a publicly-listed entity created by Chamath Palihapitiya, a successful entrepreneur and serial investor from California. He had become wealthy through his involvement with Facebook but has now become a venture capitalist in his own right. The 43-year old has received praise from Peter Thiel, a rare and weighty endorsement.

In 2017, Palihapitiya created Social Capital Hedosophia with the sole purpose of providing another company easier, quicker access to the stock market. The company did not have a business of its own but merely kept a cash reserve to eventually acquire another business (or merge with one). Unusual for a firm with no other clearly-defined purpose, it managed to raise a staggering USD 690m from investors in 2017. With such a large cash reserve, Social Capital Hedosophia was in a strong position to look for the right target. The usual modus operandi in such situations would be to eventually change the name of Social Capital Hedosophia to the name of the target business – and presto, there is your newly-listed company!

In case you wonder why an entrepreneur would choose this route instead of a regular IPO, there is an element of increased speed and decreased uncertainty. Merging with or being acquired by a company that is already listed on a stock exchange tends to be a bit faster than going through the tedious listing process. Also, given that Social Capital Hedosophia already had massive cash reserves, the risk of having to go to potential investors and raise funds is eliminated. Once the board and the principal shareholders of Social Capital Hedosophia have decided to back a transaction, the funds contained in the listed shell company can be put to use by the target company.

Given that shell companies have a somewhat questionable reputation, vehicles like Social Capital Hedosophia are nowadays usually described as "Special Purpose Acquisition Company", or SPAC. On my books, it's still a shell company. Call a spade a spade. Although I don't agree with the widely-held notion that only second-rate companies go public through shell companies. Such backdoor IPOs can be done for a wide variety of technical and strategic reasons. Another company that successfully went down this route and which I recently featured on this website is Lindblad, the cruise ship operator. Since its backdoor IPO at USD 10 (which was when I first wrote about it), Lindblad's share price has increased to a record USD 19, and the underlying business performed very nicely.

For most of its first two years of existence, Social Capital Hedosophia struggled to find a suitable target. There was even talk of a management team break-up, and fears of the company's liquidation if no target was found within the statutorily required two-year period.

In July 2019, with two months to spare before the deadline, Palihapitiya and Sir Richard agreed to use this particular SPAC to bring Virgin Galactic to the public market.

The transaction was based on:

- Virgin Galactic shareholders receiving USD 300m cash from Social Capital Hedosophia (effectively a partial cash-out by Sir Richard's group).

- Virgin Galactic merging with Social Capital Hedosophia through USD 1.3bn worth of new shares of Social Capital Hedosophia (i.e., 130m shares valued at USD 10 each).

- Palihapitiya investing another USD 100m of his personal cash in Social Capital Hedosophia, for which he'd also get additional shares for USD 10 each.

- Boeing, the world's leading jet manufacturer, taking a 1% stake for a USD 20m consideration.

The result will be:

- The existing shareholders of Virgin Galactic hold 52.5% of the combined entity, while Social Capital Hedosophia shareholders own the other 46.5%. With a 13.2% stake, Palihapitiya is the single largest individual shareholder. The remaining 1% is the stake purchased by Boeing.

- The combined entity is debt-free and holds about USD 400m in cash reserves, which gives the loss-making company a two-year "cash runway" (a very suitable term in the particular case of this company!).

- Palihapitiya becomes Chairman of the company.

- The combined entity is named "Virgin Galactic Holdings". Usually, the ticker symbol of SPAC shares gets changed at the same time as the merger takes place. Sadly, the ticker symbols "STAR" and "LUNA" are already taken by other NYSE-listed companies. Also, it appears that SpaceX has secured itself the ticker symbol "SPACE" for future use.

For the data freaks among my readers: I spotted a variety of media outlets and websites reporting slight variations of these steps and figures. The ones I am listing here are based on the recently issued, mind-boggingly comprehensive SEC document. You will find these transactions outlined on pages xii and xiii.

The result will be that anyone who wants to become an investor in space tourism can easily do so by buying shares in Virgin Galactic on the New York Stock Exchange. Assuming a share price of USD 10 and 195,556,443 shares outstanding after the various transaction have taken place, the company will have a market cap of about USD 2bn. Given that it will sit on cash reserves of USD 400m, the company's enterprise value will be roughly USD 1.6bn. Over the past 15 years, Virgin Galactic has eaten up USD 1bn in funding. It will be valued at 5.5 times projected 2023 EBITDA and 2.5 times projected 2023 revenue. At first sight and given the scale of the ambition, the market cap of the new entity does not seem outrageous at all.

The question is, does this company deserve your money as an investment?

The business case for space tourism

Ahead of their proposed merger, Social Capital Hedosophia and Virgin Galactic have provided a lot of useful data about their future business ambitions.

The company has already received USD 80m in deposits from 600 eager customers who want to be among the first to fly to space. If it succeeds in launching regular tourist trips to space from June 2020 onwards, these deposits can lead to a total revenue of USD 150m. These deposits do serve as a proof of concept for the product and provide some visibility on the future revenue potential.

Even with its current price tag of USD 250,000 for each flight, Virgin Galactic aims at a surprisingly large group of customers. To put the price in comparison, renting a luxury island in the Caribbean or chartering a decent-size yacht can nowadays easily cost the same. At a time when everyone seems to be into experiences, this is a product that could probably sell a lot better than you'd expect. The number of people who can afford such a trip has become very large thanks to rising global wealth.

Of the existing 600 bookings, 70% are reportedly from clients with a net worth of less than USD 20m. A surprising 10% have a net worth of less than USD 1m, i.e., these people are willing to spend >25% of their savings on this one adventure of a lifetime.

Globally, some 37m people have a net worth between USD 1m and USD 5m. Over 3m are high-net-worth individuals with between USD 5m and USD 10m in liquid wealth. As Virgin Galactic grows and technology advances, the price for space flights is likely to come down. Longer-term, the company aims to reduce the price for flights to USD 50,000 (which is not too different from the prices charged by Concorde once you adjust for the difference in purchasing power of the dollar 20 years ago). Much as these are all estimates, the potential market for Virgin Galactic does seem sufficiently large. Assuming none of the first flights ends in disaster, there is likely to be a long queue of people eager to look at the blue planet from high-up. I myself took a peek from a height of 20km (13mi.) on a Concorde flight back in 2003. Quite a sight to behold, even though it pales in comparison to the 90km (56mi.) that Virgin Galactic will take passengers to!

During the initial phase, Virgin Galactic intends to operate one spacecraft that can accommodate up to six passengers. A second and third spacecraft are under construction and likely to enter service in 2020 and 2021, respectively. However, the company doesn't expect to operate at full capacity during the initial phase. It plans to gradually scale up until it reaches five monthly flights with six passengers each by 2022. It's not entirely clear yet how fast the additional spacecraft will enter service.

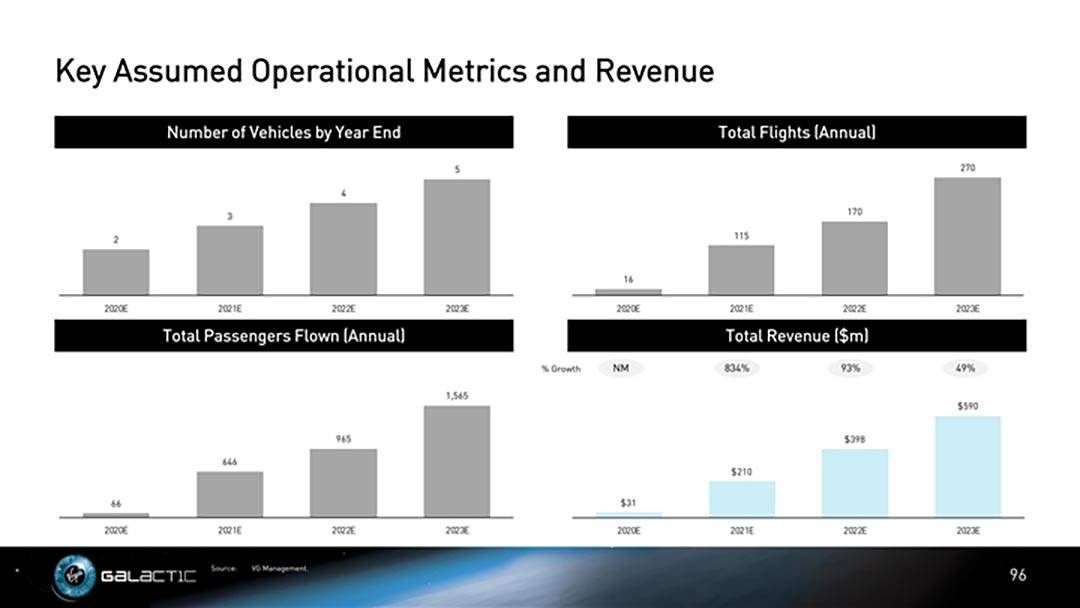

Once there is a handful of such spacecrafts in operation, you can see this becoming a sizable business. Virgin Galactic's management aims to generate USD 210m in revenue during 2021, which should be its first full year of service. By 2023, it wants to operate 270 flights annually and take 1,565 passengers to space, which would generate revenue of USD 530m based on projected pricing. It hopes to achieve an EBITDA of USD 273m in 2023, which would indicate solid upside for the share over the coming years. The company's projections are the typical hockey stick curve chart that virtually any start-up has in its pitch deck, and there isn't necessarily anything wrong with it per se (if you know how to interpret such projections). In a best-case scenario, this company can become a money-spinner indeed.

The company's projections up until 2023 (apologies for the low resolution, the company's slides are to be blamed).

There are a few exciting twists to the business model. E.g., if space tourism "takes off", Virgin Galactic might be able to build a long waiting list and take in huge amounts of deposits. Building additional spacecrafts will require capital expenditure, but that’s much easier to do if there is a long list of bookings and client money sitting in the bank. Financing becomes more easily available and cheaper under such circumstances.

You can even take the entire concept further and dream about Virgin Galactic eventually becoming a competitor in the aerospace industry. As one of its corporate slides sets out, the company might one day provide solutions for "hypersonic point-to-point travel". Put another way, Virgin Galactic might launch Concorde 2.0, but on steroids. Such a hypersonic jet could take passengers from Los Angeles to Tokyo in just two hours. If this vision ever came to fruition, Virgin Galactic could expand into the USD 600bn p.a. commercial air travel market.

Much as this prospect currently sounds like a pipe dream, it did lead Boeing to purchase a USD 20m stake in the company just two weeks ago. Granted, for a company the size of Boeing, this USD 20m is not much more than the equivalent of wanting to have a foot in the door. Boeing routinely does that with a lot of new ventures that may invade its traditional turf. Also, Virgin Galactic is indeed a lot less engineering-heavy than its two key rivals, and a lot more focussed on marketing. Pipedreams about hypersonic jets might remain just that. But for now, the investment by Boeing is a massive endorsement of the nearly 16 years of work and investment that have gone into Virgin Galactic.

Anyone with a positive overall inclination towards this company will also note Palihapitiya's additional personal investment. He is, after all, putting an additional USD 100m of his personal cash into the company by buying additional shares for USD 10 each. Right now, the share price is trading at USD 10.35. To give credit where credit is due, Palihapitiya is following on with a significant amount of money, and investors can currently get in at virtually the same price.

The board and executive team that will run Virgin Galactic under Palihapitiya's Chairmanship also come with a strong industry pedigree overall. It's entirely conceivable that institutional investors will find Virgin Galactic an attractive proposition, which could create significant demand for the stock.

So far, so good.

What could possibly go wrong?

Overall, the set of projections set out by the company seems achievable. No doubt, there is plenty of potential, if it all works out. If the company lives up to these expectations, buying into it at the current level could prove a good decision.

But there are a lot of "If's" that have to be mentioned alongside the undoubted potential.

- For a start, Virgin Galactic will effectively remain a zero-revenue company until it has safely flown the first batch of passengers to space and back. Projections for future revenue and earnings are even dicier in the case of such a pre-revenue company than for a more established company.

- Virgin Galactic's core product is still facing a lot of criticism and doubt. Whether the flight that is currently available for pre-booking really amounts to a genuine space tourism experience is hotly debated among enthusiasts. The rocket that fuels the Virgin Galactic spacecraft can reach an altitude of 90km (56 mi.) before passengers gently glide back to earth. This is only slightly beyond NASA's definition of space, and a bit below the 100km (62 mi.) demarcation used by the World Air Sports Federation. It remains to be seen if the initial passengers enjoy their experience enough to make others want to follow.

- Compared to the technologies that SpaceX and Blue Origin are using, Virgin Galactic is much more of a technological lightweight. Competitors would find it easier to invade Virgin Galactic's turf than to compete with the technology developed by SpaceX and Blue Origin.

After an initial hype, the stock price of Social Capital Hedosophia is back to where it started.

- It needs to be kept in mind that as far back as 2010, the company raised money at a valuation of USD 1bn. Since then, it has barely given its shareholders a worthwhile return for taking such tremendous risk. Palihapitiya's additional personal investment could be just another rich guy buying himself a hobby and a toy.

- There is a risk that one of the spacecrafts goes up in flames during the early period of operation. The equivalent initial phase of the jet plane era also involved a lot of crashes. If Virgin Galactic ends up incinerating a handful of celebrities and VIPs with live cameras and web feeds rolling, it could take years before the company recovers.

- There is also a threat that SpaceX and Blue Origin both aim to enter the same market, albeit neither one of these two companies are anywhere near doing so.

- Never mind more mundane problems such as delays to regulatory approvals or unexpected engineering issues.

Though none of this may play much of a role in the short term. The more appealing, dominant potential might lie in this company's particular appeal as a "narrative stock", and one that is backed by one of the world's most successful narrators of entrepreneurial enterprises. It could be a worthwhile investment to buy into before the anticipated hype sets in; and to sell in the period immediately before the actual first flights.

Here is how this could work.

Who wouldn't want to own a part of this?

Social Capital Hedosophia has published a 100-page presentation of the proposed merger on the Securities and Exchange Commission website.

Not surprisingly, the first 51 pages consist primarily of exciting photos and factoids aimed at space geeks. The business case is only discussed from page 52 onwards. The company is doing a great job of selling the sizzle, though.

Spaceport America in New Mexico: part-funded by the US government, it will be the location of Virgin Galactic's virgin flight. You can watch a 2-minute video about it here. (Image: Mia2you / Shutterstock.com)

Social Capital Hedosophia might become something similar to Tesla or Beyond Meat. Parts of the investing public might become so obsessed with the visionary, exciting business that the share gets bid up in a combination of media hype and co-ownership pride. Its free float of 33.3% will amount to 65.2m shares. This is much more than the sliver of shares that were listed by Beyond Meat, but a lot less than the number of Tesla shares floating around.

The company calls everyone who has made a deposit for a flight a "Future Astronaut". No doubt, they will come up with an equally flattering term for anyone who supports the company's mission by holding at least one share. There is a fairly unique opportunity to create a huge community of enthusiasts. E.g., nothing would stop Virgin Galactic from offering shareholders exclusive content and "live online participation" in events. Something along the lines of: "Have you got more than 10,000 shares? Come and visit the Spaceport America for an exclusive guided tour!"

It shouldn't be too difficult to attract the tens of thousands of private investors who will want to own a small part of this company. Fascination with space travel is, after all, universally shared across the globe. Tellingly, the existing 600 pre-bookings have come from 60 countries across six continents.

How many people are likely to watch a televised, first-ever commercial space tourism flight if it is marketed properly? Half a billion? If 100,000 private investors bought USD 6,500 worth of shares each, that'd take care of ownership of the entire free float. These are all mere examples, but you get the idea.

With media darling Richard Branson as the company's chief PR person and with a product that could capture the public's imagination like few other enterprises, this company's stock could go up significantly on the back of nothing else than media hype and public curiosity.

Not surprisingly, the company's SEC document lists "Potential public investor enthusiasm" in first position on its list of reasons for this transaction. You can find this list on pages 9/10/11 of the aforementioned SEC document.

Just watch this 5-minute video of Virgin Galactic's first flight, narrated by Branson. It's pretty awesome. Never mind the existing strength of his globally recognised Virgin brand.

If everything goes according to plan, it will only be another seven months before the company launches its first commercial, public flight. The June 2020 launch date is also confirmed in the SEC document. Imagine the potential public interest during the last two or three months leading up to the date. You probably won't be able to go a week without spotting Virgin Galactic somewhere in the media. The company could become a global phenomenon, and investors could re-rate the stock.

The combined entity will have global PR and investor relations firm Sard Verbinnen & Co work on its behalf. But it's safe to assume that for the most part, they can step aside and let Sir Richard do the talking. To begin with, he has a staggering 13m Twitter followers to speak to.

Given Sir Richard's global following, it's not hard to see a hype taking place. (Image: Prometheus72 / Shutterstock.com)

Plus, Branson is motivated. Ultimately, he will want to cash out a part (or all) of his stake. He is in the business of buying and selling companies, after all. He also sold control of Virgin Atlantic recently. I wouldn't be surprised if he went on to sell more shares in Virgin Galactic in a period of hype just before the first flights. The investment bankers and PR people behind such a move would always find the right terms to explain it: "providing more liquidity for the market", "broadening the circle of shareholders", and "giving other investors the opportunity to be part of the vision."

No doubt, Branson will have an interest in becoming the no. 1 hype master of the company. Here is an opportunity for him to talk up the prospects of a company and make hundreds of millions in the process (and there'd be nothing wrong with it at all). Who could resist?

The 100-page investor presentation issued by Virgin Galactic is worth a read (but comes in an atrocious file format).

A fun stock to watch (from afar)

As a narrative stock, Virgin Galactic doesn't fit the focus of my website, which is about value investing. I want to find secure future cash flow that is offered to me at too low a price. No disrespect, but Virgin Galactic is both a plan and a dream, rather than a secure future cash flow.

Just like with the other companies I look at in my Weekly Dispatches, I am not necessarily going to follow this company overly closely. To be clear, I might never report about it again. My Weekly Dispatches are the place for me to have a bit of fun and look at new ideas.

But one does have to say, for anyone looking for a stock that also makes for an interesting ride – no pun intended – Virgin Galactic is probably as good as it gets.

Even I am now wondering who will be the first few passengers to board such a flight. I'll be sure to tune in when the first flight takes off, no matter what time zone I will be in that day.

Heck, I might even buy a few shares to be a part of it…. It's all damn exciting, after all!

Did you find this article useful and enjoyable? If you want to read my next articles right when they come out, please sign up to my email list.

Share this post:

Get ahead of the crowd with my investment ideas!

Become a Member (just $49 a year!) and unlock:

- 10 extensive research reports per year

- Archive with all past research reports

- Updates on previous research reports

- 2 special publications per year